Job Description

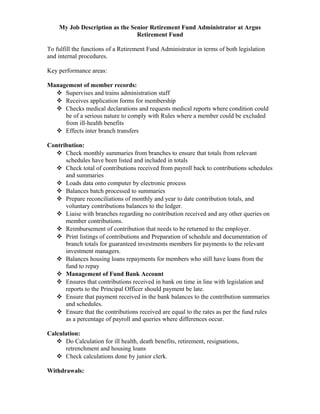

- 1. My Job Description as the Senior Retirement Fund Administrator at Argus Retirement Fund To fulfill the functions of a Retirement Fund Administrator in terms of both legislation and internal procedures. Key performance areas: Management of member records: Supervises and trains administration staff Receives application forms for membership Checks medical declarations and requests medical reports where condition could be of a serious nature to comply with Rules where a member could be excluded from ill-health benefits Effects inter branch transfers Contribution: Check monthly summaries from branches to ensure that totals from relevant schedules have been listed and included in totals Check total of contributions received from payroll back to contributions schedules and summaries Loads data onto computer by electronic process Balances batch processed to summaries Prepare reconciliations of monthly and year to date contribution totals, and voluntary contributions balances to the ledger. Liaise with branches regarding no contribution received and any other queries on member contributions. Reimbursement of contribution that needs to be returned to the employer. Print listings of contributions and Preparation of schedule and documentation of branch totals for guaranteed investments members for payments to the relevant investment managers. Balances housing loans repayments for members who still have loans from the fund to repay Management of Fund Bank Account Ensures that contributions received in bank on time in line with legislation and reports to the Principal Officer should payment be late. Ensure that payment received in the bank balances to the contribution summaries and schedules. Ensure that the contributions received are equal to the rates as per the fund rules as a percentage of payroll and queries where differences occur. Calculation: Do Calculation for ill health, death benefits, retirement, resignations, retrenchment and housing loans Check calculations done by junior clerk. Withdrawals:

- 2. Claims, including but not limited to collating the information based on the type of claim to be processed and process as required, submit tax directive, update register, and liaise with employer regarding process, etc. Check applications for tax directive prepares by junior clerk for members who takes lump sum cash benefits. Check applications received from members and their brokers where members wish to transfer to other funds or insurers to ensure compliance with legal requirement. Ensure that withdrawing members are processed on the system and recorded in the withdrawal register for compliance with FSB audit requirement. Preparation of cheques vouchers and payment of benefit. Provide withdrawal details for cash flow purposes. Reconcile the withdrawal register by category to the General Ledger Request transfer of funds from investment managers to the fund’s bank account. Prepare journals for PAYE from benefits accounts to PAYE Control account Loan Repayments: Check monthly summaries from payroll against schedule. Balances batch to summary and schedule totals Reconcile monthly and year to date payments to General Ledger Query with payroll/employer for non payments of loans Prepare journals for the interest rates and administration fees. Check computer report for any loans where final payments will be received and advise payroll to stop deductions at a specific time. General Work: Typing of correspondence and Filing of documentation, both electronic and physical paperwork Assisting with secretarial duties. Ordering of stationery Provide assistance to employers regarding any queries they may have etc. Records membership statistic Record housing loans statistics Assists Principal Officer with valuations and audit requirements Apply for tax directives SARS reconciliation (Reconciliation and submitting of both Employees’ tax monthly EMP201 and yearly EMP501). Handle queries regarding IRP5 Certificates from members or SARS. Member Relations: Interprets rules when dealing with queries from members. Ensure that members are made aware of the requirements to be met when withdrawing. Sends new members communication file when accepted. Prepare benefit statements and housing loan statements. Handle queries from brokers and members regarding transfer of benefits to insurer’s retirement products.