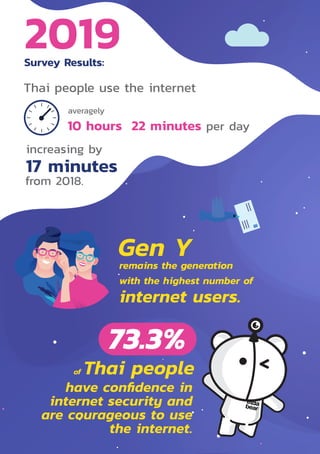

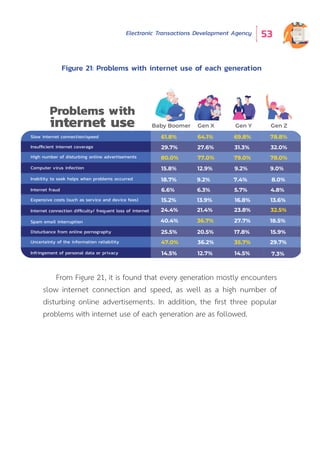

The Thailand Internet User Behavior 2019 report reveals that Thai individuals are spending an average of 10 hours and 22 minutes daily online, an increase from the previous year, with Gen Y showing the highest usage. Key online activities include social media engagement, streaming, and shopping, while concerns about internet security are prevalent, with 73% expressing confidence in online security. The report also highlights evolving trends in digital identity usage and the growing reliance on online services due to increased internet access and affordability.

![Electronic Transactions Development Agency 29

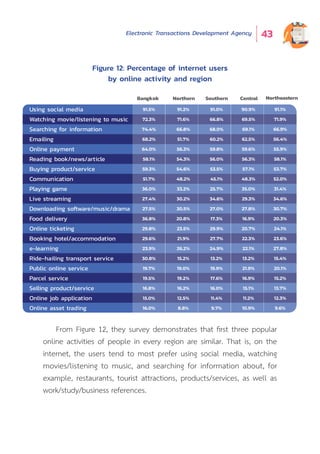

Internet User Behavior

Nowadays we are completely living in the digital society which

everything changes by leaps and bounds, more people can easily access

to the internet, and the internet user behaviors alter through time. In 2018,

there are 47.5 million internet users in Thailand4

, accounting for 71.5% of

the entire population in Thailand (66.4 million)5

. This shows the high growth

of internet users comparing to that number of 2013 (26.1 million). We can

see that from previous five years the number of internet users in Thailand

has been increasing averagely6

81.5% per year.

4

Number of internet users in Thailand during 2017-2018: http://webstats.nbtc.go.th/netnbtc/INTERNETUSERS.php

5

Number of populations in Thailand in 2018 is referred from Statistical Registration System, Department of

Provincial Administration, http://stat.dopa.go.th/stat/statnew/upstat_age_disp. php

6

CAGR (Compound Annual Growth Rate) has the formula as followed:

CAGR = [ (End year/ First year) ^1/(n-1)] – 1

When End year = data from the latest year, First year = data from the first year, ^ = the exponentiation

operator, n = number of years

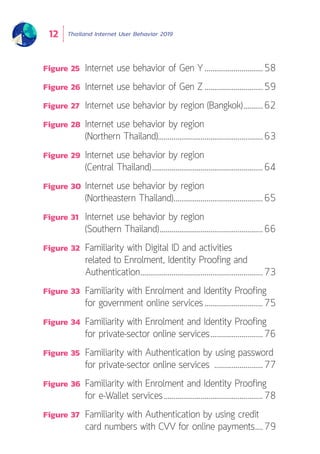

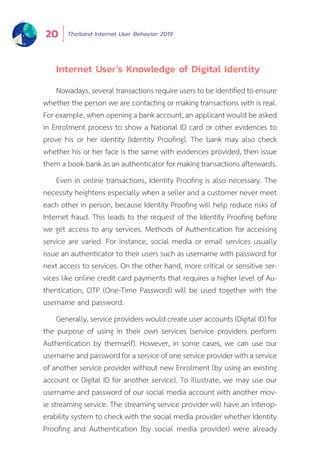

Figure 1: Number of internet users in Thailand during 2013 – 2018

0

10

20

30

40

50

Number of internet users (million)

26.1

2013 2014 2015 2016 2017 2018

27.7

39.5

43.9

45.2

47.5](https://image.slidesharecdn.com/thailandiub2019byetdaen-200529093806/85/Thailand-Internet-User-Behavior-2019-30-320.jpg)

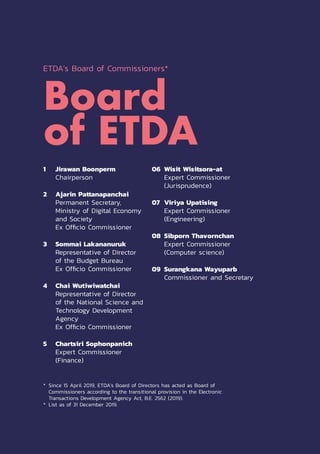

![Electronic Transactions Development Agency 31

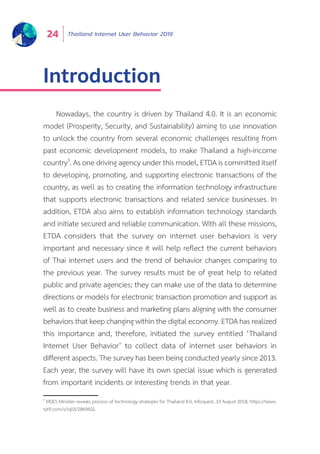

2013 2014 2015 2016 2017 2018 2019

4 hours

36 minutes

7 hours

12 minutes

6 hours

54 minutes 6 hours

24 minutes

6 hours

35 minutes

10 hours

5 minutes

10 hours

22 minutes

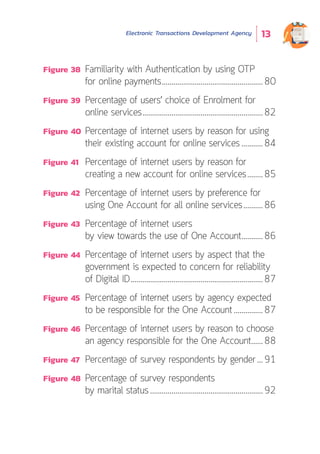

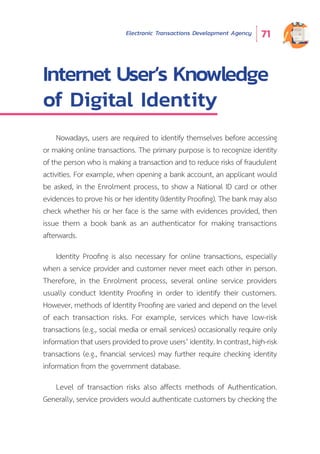

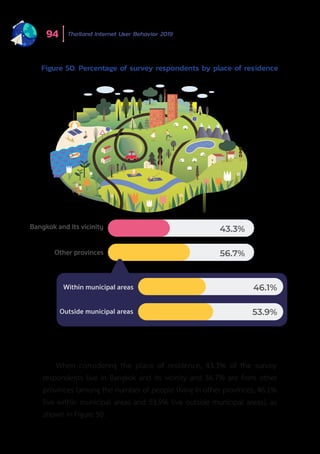

From Figure 2, the number of hours spent on the internet in Thailand

generally tends to increase with the average growth8

of 14.5% per year.

This rate is considerably high, and partly due to the expanding use of the

internet in every aspect of daily life.

8

CAGR (Compound Annual Growth Rate) has the formula as followed:

CAGR = [ (End year/ First year) ^1/(n-1)] – 1

When End year = data from the latest year, First year = data from the first year, ^ = the exponentiation

operator, n = number of years

Furthermore, Different devices for the internet access are currently

availableinthemarketincludingmobilephones,notebooks,andcomputers,

and their price tends to be lower due to the increase of businesses and

services, high level of industry competition, and the lower cost to manufac-

ture the technological devices. Another factor, in addition, enabling more

peopletoaccesstheinternetisthatmanynetworkprovidershavelaunched

tempting internet promotions which attract more internet users.

Number of Hours Spent on the Internet

Figure 2 : Comparison of the average number of hours spent

on the internet during 2013 - 2019](https://image.slidesharecdn.com/thailandiub2019byetdaen-200529093806/85/Thailand-Internet-User-Behavior-2019-32-320.jpg)

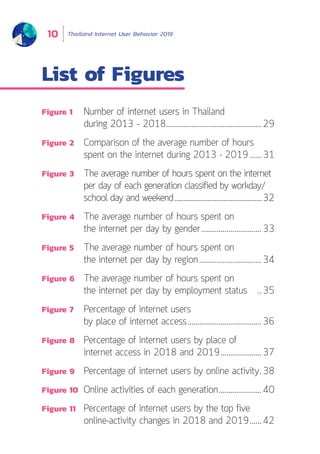

![Thailand Internet User Behavior 201932

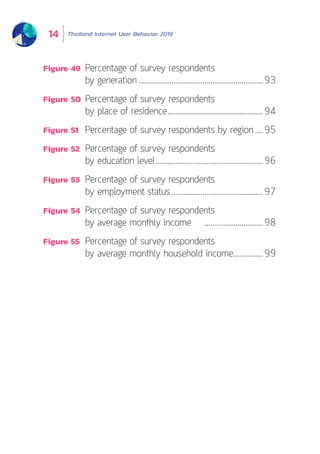

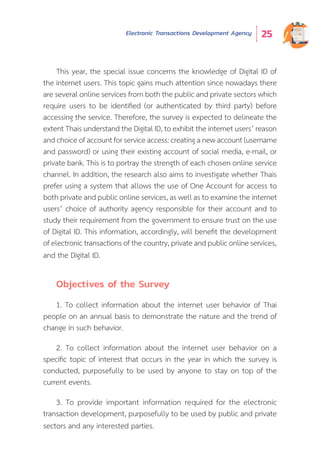

Figure 3: The average number of hours spent on

the internet per day of each generation classified

tvby workday/school day and weekend

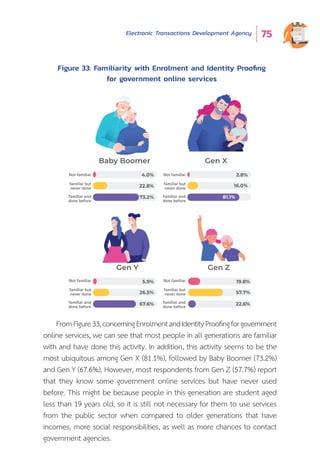

From Figure 3, it is found that Thai internet users averagely spend 10

hours 22 minutes per day on the internet9

, increasing by 17 minutes

from 2018. They spend 9 hours 52 minutes on the internet on workdays/

school days, and 11 hours 35 minutes on weekends. Looking into each

generation, the survey shows that the number of hours spent on the

internet of Gen Y (10 hours 36 minutes) outnumbers that of other

generations. Second to Gen Y is Gen Z (10 hours 35 minutes), followed by

Baby Boomer (10 hours) and Gen X (9 hours 49 minutes).

9

The average number of hours spent on the internet is the weighted average from the number of days on

workdays/school days (5 days) and weekends (2 days).The average number of hours spent on the internet =

[(hours on workdays/school days * 5) + (hours on weekends * 2)] / 7

HOURS MINUTES

9 52

HOURS MINUTES

11 35Weekend /

day

HOURS MINUTES

10 22

Average use

of the internet

per day in

2019Workday

School day day

Overview

of the internet use

Baby Boomer Gen X Gen Y Gen Z

HOURS MINUTES

9 35

HOURS MINUTES

11 3

HOURS MINUTES

9 20

HOURS MINUTES

10 58

HOURS MINUTES

10 7

HOURS MINUTES

11 50

HOURS MINUTES

10 00

HOURS MINUTES

12 1

Workday

School day Day

Day

HOURS MINUTES

10 00

HOURS MINUTES

9 49

HOURS MINUTES

10 36

HOURS MINUTES

10 35Average per Day

(increasing 17 minutes from 2018)

Gen Y is the group with the highest number

of hours on the internet for consecutive 5 years

Weekend](https://image.slidesharecdn.com/thailandiub2019byetdaen-200529093806/85/Thailand-Internet-User-Behavior-2019-33-320.jpg)

![Thailand Internet User Behavior 2019114

Statistical Tables

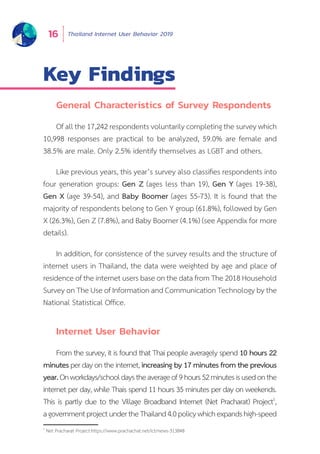

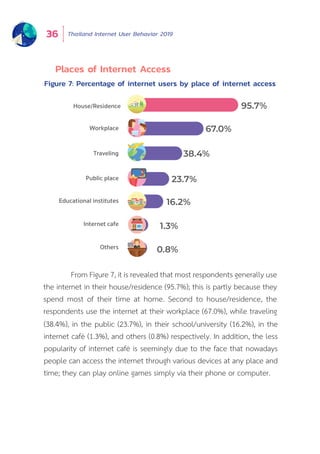

Table 1

The average number of hours spent on the internet per day of each

generation classified by workday/school day and weekend

Table 2

Percentage of internet users by online activity

1 The average number of hours spent on the internet is the weighted average from the number of days on workdays/school days (5 days) and weekends (2 days).

The average number of hours spent on the internet = [(hours on workdays/school days * 5) + (hours on weekends * 2)] / 7

Overall internet use 10 hours 22 minutes

Workday/school day 9 hours 52 minutes

Weekend 11 hours 35 minutes

The amount of time

used on the internet

of each generation

Baby boomer Gen X Gen Y Gen Z

Workday/school day 9 hours 35 minutes 9 hours 20 minutes 10 hours 7 minutes 10 hours

Weekend 11 hours 3 minutes 10 hours 58 minutes 11 hours 50 minutes 12 hours 1 minutes

Average per day 1 10 hours 9 hours 49 minutes 10 hours 36 minutes 10 hours 35 minutes

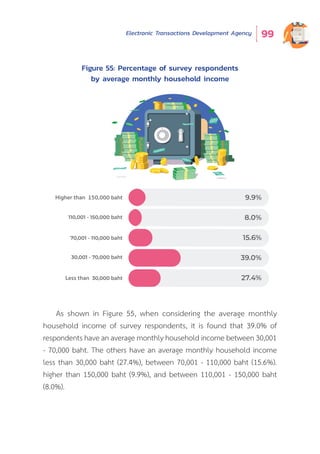

Details %

Using social media (such as Facebook, Twitter, Instagram) 91.2%

Watching movie/listening to music 71.2%

Searching for information 70.7%

Emailing 62.5%

Online payment 60.6%

Reading book/news/article 57.1%

Buying product/service 57.0%

Communication 50.0%

Playing game 34.1%

Live streaming (such as Facebook live, YouTube Live) 29.6%

Downloading software/music/drama/movie/game/in-game item 28.4%

Food delivery 26.5%

Online ticketing (such as movie, concert ticket) 26.1%

Booking hotel/accommodation 25.9%

E-learning 24.4%

Ride-hailing transport service (such as Grab Taxi, LINE Man Taxi) 21.4%

Government online service 20.1%

Parcel service 18.2%

Selling product/service 15.9%

Online job application 13.2%

Online asset trading 12.6%](https://image.slidesharecdn.com/thailandiub2019byetdaen-200529093806/85/Thailand-Internet-User-Behavior-2019-115-320.jpg)