How Credit Departments Can Build Relationships and Drive Growth

•

0 likes•273 views

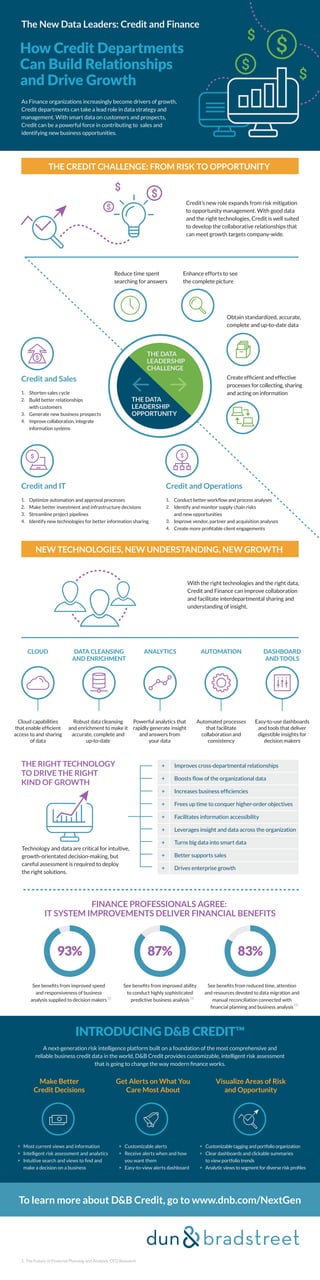

As Finance organizations increasingly become drivers of growth, Credit departments can take a lead role in data strategy and management. With smart data on customers and prospects, Credit can be a powerful force in contributing to sales and identifying new business opportunities.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Taking an Analytical Approach to Sales Acceleration

Taking an Analytical Approach to Sales Acceleration

Marketing Data Renovators Guide: 10 Steps to Prime Your B2B Database for Anal...

Marketing Data Renovators Guide: 10 Steps to Prime Your B2B Database for Anal...

Anti-Bribery and Corruption Compliance for Third Parties

Anti-Bribery and Corruption Compliance for Third Parties

The Changing Role of Information to Drive Competitive Intelligence

The Changing Role of Information to Drive Competitive Intelligence

How to Leverage the Power of Data Analytics in Sales?

How to Leverage the Power of Data Analytics in Sales?

Get accurate personality assessment of your employees with p maps

Get accurate personality assessment of your employees with p maps

Viewers also liked

Viewers also liked (20)

Customer Hunters Data-Savvy Marketing Tips for Finding Your Dream Buyers

Customer Hunters Data-Savvy Marketing Tips for Finding Your Dream Buyers

Netsuite Webinar: Easy Data and Credit Management with Dun & Bradstreet

Netsuite Webinar: Easy Data and Credit Management with Dun & Bradstreet

Marketing Data Renovators Guide: 10 Steps to Prime Your B2B Database for Anal...

Marketing Data Renovators Guide: 10 Steps to Prime Your B2B Database for Anal...

Integrating Offline & Online Channels for B2B Marketing

Integrating Offline & Online Channels for B2B Marketing

D&B Analysis | Flat Spot in US Economic Recovery (Fall 2012)

D&B Analysis | Flat Spot in US Economic Recovery (Fall 2012)

D&B's Global Economic Outlook to 2018 (2013 Update)

D&B's Global Economic Outlook to 2018 (2013 Update)

Similar to How Credit Departments Can Build Relationships and Drive Growth

Published in 2013, this White Paper discusses how the finance function would evolve with the combined forces of Big Data and Analytics and the levers that could help catalyze the change and has drawn upon the Global Trend Study conducted by Tata Consultancy Services (TCS) on how companies were investing in Big Data and deriving returns from it.The new ‘A and B’ of the Finance Function: Analytics and Big Data - -Evolutio...

The new ‘A and B’ of the Finance Function: Analytics and Big Data - -Evolutio...Balaji Venkat Chellam Iyer

The Future Of Underwriting Transformation by Talent & Technology - Sanda Cagalj EY Advisory (2015)The Future Of Underwriting Transformation by Talent & Technology - Sanda Caga...

The Future Of Underwriting Transformation by Talent & Technology - Sanda Caga...SigortaTatbikatcilariDernegi

Similar to How Credit Departments Can Build Relationships and Drive Growth (20)

The new ‘A and B’ of the Finance Function: Analytics and Big Data - -Evolutio...

The new ‘A and B’ of the Finance Function: Analytics and Big Data - -Evolutio...

Cognizant Analytics for Banking & Financial Services Firms

Cognizant Analytics for Banking & Financial Services Firms

Bridging the Gap Between Business Objectives and Data Strategy

Bridging the Gap Between Business Objectives and Data Strategy

How Are Data Analytics Used In The Banking And Finance Industries.pdf

How Are Data Analytics Used In The Banking And Finance Industries.pdf

The Future Of Underwriting Transformation by Talent & Technology - Sanda Caga...

The Future Of Underwriting Transformation by Talent & Technology - Sanda Caga...

More from Dun & Bradstreet

More from Dun & Bradstreet (12)

D&B Optimizer – Dun & Bradstreet Account and Lead Data for Salesforce

D&B Optimizer – Dun & Bradstreet Account and Lead Data for Salesforce

Seeing Beneath The Surface - Understand Supply Chain Disruption

Seeing Beneath The Surface - Understand Supply Chain Disruption

The 4C’s of Master Data - The Fundamental Elements of Commercial Relationships

The 4C’s of Master Data - The Fundamental Elements of Commercial Relationships

Scaling Account-Based Marketing in the Digital Age

Scaling Account-Based Marketing in the Digital Age

A Look Inside Modern & Energized Family | Dun & Bradstreet

A Look Inside Modern & Energized Family | Dun & Bradstreet

Recently uploaded

Recently uploaded (20)

Malegaon Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Malegaon Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Call Girls Kengeri Satellite Town Just Call 👗 7737669865 👗 Top Class Call Gir...

Call Girls Kengeri Satellite Town Just Call 👗 7737669865 👗 Top Class Call Gir...

Call Girls in Delhi, Escort Service Available 24x7 in Delhi 959961-/-3876

Call Girls in Delhi, Escort Service Available 24x7 in Delhi 959961-/-3876

Call Now ☎️🔝 9332606886🔝 Call Girls ❤ Service In Bhilwara Female Escorts Serv...

Call Now ☎️🔝 9332606886🔝 Call Girls ❤ Service In Bhilwara Female Escorts Serv...

Marel Q1 2024 Investor Presentation from May 8, 2024

Marel Q1 2024 Investor Presentation from May 8, 2024

Falcon Invoice Discounting: Empowering Your Business Growth

Falcon Invoice Discounting: Empowering Your Business Growth

Russian Call Girls In Rajiv Chowk Gurgaon ❤️8448577510 ⊹Best Escorts Service ...

Russian Call Girls In Rajiv Chowk Gurgaon ❤️8448577510 ⊹Best Escorts Service ...

Business Model Canvas (BMC)- A new venture concept

Business Model Canvas (BMC)- A new venture concept

Falcon Invoice Discounting: Unlock Your Business Potential

Falcon Invoice Discounting: Unlock Your Business Potential

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Falcon's Invoice Discounting: Your Path to Prosperity

Falcon's Invoice Discounting: Your Path to Prosperity

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

How Credit Departments Can Build Relationships and Drive Growth

- 1. THE RIGHT TECHNOLOGY TO DRIVE THE RIGHT KIND OF GROWTH Technology and data are critical for intuitive, growth-orientated decision-making, but careful assessment is required to deploy the right solutions. See benefits from improved speed and responsiveness of business analysis supplied to decision makers See benefits from improved ability to conduct highly sophisticated predictive business analysis A next-generation risk intelligence platform built on a foundation of the most comprehensive and reliable business credit data in the world, D&B Credit provides customizable, intelligent risk assessment that is going to change the way modern finance works. See benefits from reduced time, attention and resources devoted to data migration and manual reconciliation connected with financial planning and business analysis 1 Make Better Credit Decisions Customizabletaggingandportfolioorganization Clear dashboards and clickable summaries to view portfolio trends Analytic views to segment for diverse risk profiles + + + To learn more about D&B Credit, go to www.dnb.com/NextGen Visualize Areas of Risk and Opportunity Improves cross-departmental relationships Boosts flow of the organizational data Increases business efficiencies Frees up time to conquer higher-order objectives Facilitates information accessibility Leverages insight and data across the organization Turns big data into smart data Better supports sales Drives enterprise growth FINANCE PROFESSIONALS AGREE: IT SYSTEM IMPROVEMENTS DELIVER FINANCIAL BENEFITS INTRODUCING D&B CREDIT™ + + + + + + + + + 93% 87% 83% Most current views and information Intelligent risk assessment and analytics Intuitive search and views to find and make a decision on a business 1. The Future of Financial Planning and Analysis, CFO Research + + + Cloud capabilities that enable efficient access to and sharing of data Robust data cleansing and enrichment to make it accurate, complete and up-to-date Easy-to-use dashboards and tools that deliver digestible insights for decision makers Automated processes that facilitate collaboration and consistency Powerful analytics that rapidly generate insight and answers from your data CLOUD DATA CLEANSING AND ENRICHMENT ANALYTICS AUTOMATION DASHBOARD AND TOOLS With the right technologies and the right data, Credit and Finance can improve collaboration and facilitate interdepartmental sharing and understanding of insight. The New Data Leaders: Credit and Finance THE CREDIT CHALLENGE: FROM RISK TO OPPORTUNITY NEW TECHNOLOGIES, NEW UNDERSTANDING, NEW GROWTH How Credit Departments Can Build Relationships and Drive Growth As Finance organizations increasingly become drivers of growth, Credit departments can take a lead role in data strategy and management. With smart data on customers and prospects, Credit can be a powerful force in contributing to sales and identifying new business opportunities. Credit’s new role expands from risk mitigation to opportunity management. With good data and the right technologies, Credit is well suited to develop the collaborative relationships that can meet growth targets company-wide. Credit and Operations Conduct better workflow and process analyses Identify and monitor supply chain risks and new opportunities Improve vendor, partner and acquisition analyses Create more profitable client engagements 1. 2. 3. 4. Credit and Sales Shorten sales cycle Build better relationships with customers Generate new business prospects Improve collaboration, integrate information systems 1. 2. 3. 4. Credit and IT Optimize automation and approval processes Make better investment and infrastructure decisions Streamline project pipelines Identify new technologies for better information sharing 1. 2. 3. 4. Reduce time spent searching for answers Enhance efforts to see the complete picture Obtain standardized, accurate, complete and up-to-date data Create efficient and effective processes for collecting, sharing and acting on information THE DATA LEADERSHIP OPPORTUNITY THE DATA LEADERSHIP CHALLENGE Get Alerts on What You Care Most About Customizable alerts Receive alerts when and how you want them Easy-to-view alerts dashboard + + + (1) (1) (1)