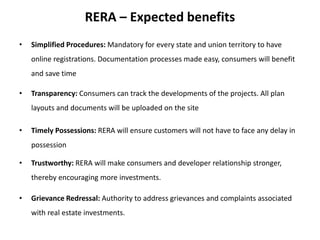

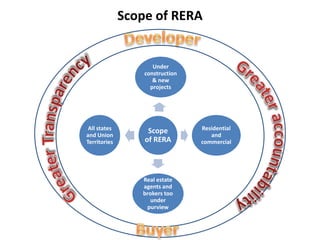

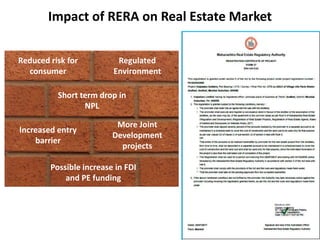

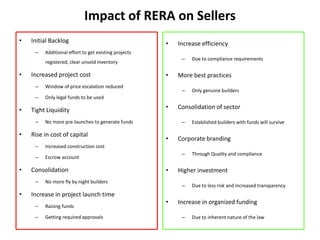

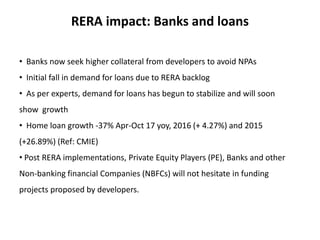

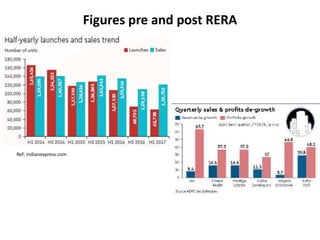

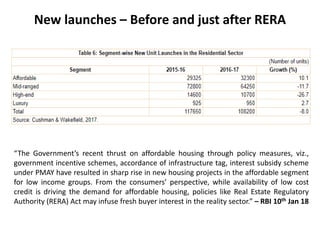

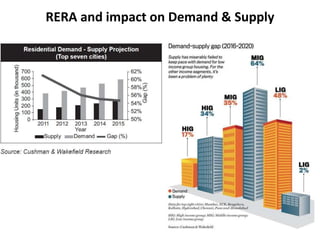

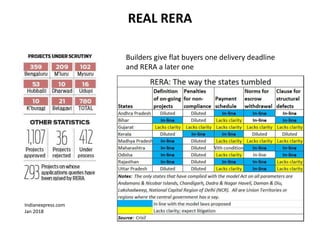

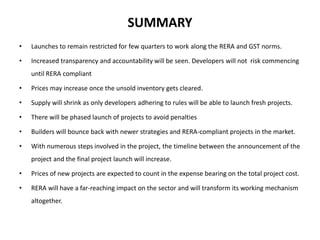

RERA will transform the real estate sector by increasing transparency and accountability. In the short term, real estate launches may decline as developers work to comply with new RERA and GST regulations. Prices may initially rise as unsold inventory is cleared, and supply will shrink as only compliant developers launch new projects. However, builders will adapt over time by launching projects in phases to avoid penalties and incorporating additional costs into prices. Overall, RERA will establish standards that improve consumer protection and confidence in the industry.