Utah sales and use tax

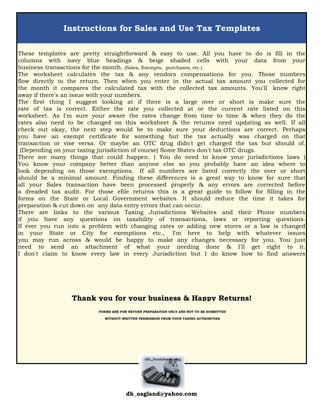

- 1. Instructions for Sales and Use Tax Templates These templates are pretty straightforward & easy to use. All you have to do is fill in the columns with navy blue headings & beige shaded cells with your data from your business transactions for the month. (Sales, Exempts, purchases, etc.) The worksheet calculates the tax & any vendors compensations for you. Those numbers flow directly to the return. Then when you enter in the actual tax amount you collected for the month it compares the calculated tax with the collected tax amounts. You'll know right away if there's an issue with your numbers. The first thing I suggest looking at if there is a large over or short is make sure the rate of tax is correct. Either the rate you collected at or the current rate listed on this worksheet. As I'm sure your aware the rates change from time to time & when they do the rates also need to be changed on this worksheet & the returns need updating as well. If all check out okay, the next step would be to make sure your deductions are correct. Perhaps you have an exempt certificate for something but the tax actually was charged on that transaction or vise versa. Or maybe an OTC drug didn't get charged the tax but should of. (Depending on your taxing jurisdiction of course) Some States don't tax OTC drugs. There are many things that could happen. ( You do need to know your jurisdictions laws ) You know your company better than anyone else so you probably have an idea where to look depending on those exemptions. If all numbers are listed correctly the over or short should be a minimal amount. Finding these differences is a great way to know for sure that all your Sales transaction have been processed properly & any errors are corrected before a dreaded tax audit. For those efile returns this is a great guide to follow for filling in the forms on the State or Local Government websites. It should reduce the time it takes for preparation & cut down on any data entry errors that can occur. There are links to the various Taxing Jurisdictions Websites and their Phone numbers if you have any questions on taxability of transactions, laws or reporting questions. If ever you run into a problem with changing rates or adding new stores or a law is changed in your State or City for exemptions etc., I'm here to help with whatever issues you may run across & would be happy to make any changes necessary for you. You just need to send an attachment of what your needing done & I'll get right to it. I don't claim to know every law in every Jurisdiction but I do know how to find answers Thank you for your business & Happy Returns! FORMS ARE FOR RETURN PREPARATION ONLY AND NOT TO BE SUBMITTED WITHOUT WRITTEN PERMISSION FROM YOUR TAXING AUTHORITIES dh_oagland@yahoo.com

- 2. Jul-2016 STORE # Month End Date CITY CNTY CODES COUNTY CITY TOTAL RATE NON FOOD 2ND qtr FOOD TAX ST/CTY/ CNTY Gross Sales (high tax ) Nexus Sales FOOD Sales (low tax) Resale Certificate shipped out of State GVRNMNT/ RELGS/ CHRTY RX and Medical Devices Food Stamps WIC minus from food OTHER LOW TAX EXEMPTIONS HI TAX EXEMPTIONS UT-1 7/30/16 29-040 Weber South Ogden 0.071 0.03 100,000.00 1,000.00 50,000.00 300.00 600.00 250.00 25,000.00 5,000.00 5,000.00 26,150.00 7/30/16 06-300 Davis Falcon Hill Davis0.0675 0.03 - - 7/30/16 29-016 Weber Harrisville 0.071 0.03 - - 7/30/16 19-000 San Juan San Juan 0.062 0.03 - - 7/30/16 07-017 Duchesne Myton 0.062 0.03 - - 7/30/16 06-049 Davis Syracuse 0.0675 0.03 - - 7/30/16 17-000 Rich Rich 0.062 0.03 - - 7/30/16 21-031 Sevier Monroe 0.062 0.03 - - 7/30/16 19-002 San Juan Blanding 0.066 0.03 - - 7/30/16 24-024 Uintah Vernal 0.0655 0.03 - - 7/30/16 17-002 Rich Laketown 0.062 0.03 - - 7/30/16 29-012 Weber Farr West 0.071 0.03 - - 7/30/16 21-034 Sevier Richfield 0.066 0.03 - - 7/30/16 10-011 Grand Moab 0.081 0.03 - - 7/30/16 06-004 Davis Bountiful 0.0685 0.03 - - 7/30/16 06-302 Davis Falcon Hill Sunset0.0675 0.03 - - 7/30/16 29-018 Weber Hooper 0.071 0.03 - - 7/30/16 29-000 Weber Weber 0.071 0.03 - - 7/30/16 29-037 Weber Roy 0.071 0.03 - - 7/30/16 07-000 Duchesne Duchesne 0.062 0.03 - - 7/30/16 06-061 Davis West Bountiful0.0685 0.03 - - 7/30/16 01-000 Beaver Beaver 0.0595 0.03 - - 7/30/16 11-019 Iron Parowan 0.0595 0.03 - - 7/30/16 12-030 Juab Rocky Ridge Town0.0595 0.03 - - 7/30/16 14-010 Millard Delta 0.0595 0.03 - - 7/30/16 14-014 Millard Fillmore 0.0595 0.03 - - 7/30/16 15-000 Morgan Morgan 0.0595 0.03 - - 7/30/16 15-007 Morgan Morgan City 0.0595 0.03 - - 7/30/16 18-000 Salt Lake Salt Lake 0.0685 0.03 - - STATE OF UTAH ONLY ENTER DATA IN THE NAVY BLUE COLUMNS (other columns are calculated) SALES AND USE TAX for Period Page 2 of 13

- 3. Jul-2016 STORE # Month End Date CITY CNTY CODES COUNTY CITY TOTAL RATE NON FOOD 2ND qtr FOOD TAX ST/CTY/ CNTY Gross Sales (high tax ) Nexus Sales FOOD Sales (low tax) Resale Certificate shipped out of State GVRNMNT/ RELGS/ CHRTY RX and Medical Devices Food Stamps WIC minus from food OTHER LOW TAX EXEMPTIONS HI TAX EXEMPTIONS STATE OF UTAH ONLY ENTER DATA IN THE NAVY BLUE COLUMNS (other columns are calculated) SALES AND USE TAX for Period 7/30/16 18-019 Salt Lake Bluffdale 0.0685 0.03 - - 7/30/16 18-039 Salt Lake Draper 0.0685 0.03 - - 7/30/16 18-060 Salt Lake Herriman 0.0685 0.03 - - 7/30/16 18-065 Salt Lake Holladay 0.0685 0.03 - - 7/30/16 18-093 Salt Lake Midvale 0.0685 0.03 - - 7/30/16 18-118 Salt Lake Riverton 0.0685 0.03 - - 7/30/16 18-122 Salt Lake Salt Lake City 0.0685 0.03 - - 7/30/16 18-131 Salt Lake Sandy 0.0685 0.03 - - 7/30/16 18-139 Salt Lake South Salt Lake0.0705 0.03 - - 7/30/16 18-142 Salt Lake Taylorsville 0.0685 0.03 - - 7/30/16 18-155 Salt Lake West Jordan 0.0685 0.03 - - 7/30/16 20-014 Sanpete Gunnison 0.0635 0.03 - - 7/30/16 20-023 Sanpete Moroni 0.0595 0.03 - - 7/30/16 20-024 Sanpete Mt. Pleasant 0.0625 0.03 - - 7/30/16 02-120 Box Elder Willard 0.065 0.03 - - 7/30/16 22-030 Summit Park City 0.0795 0.03 - - 7/30/16 23-050 Tooele Vernon 0.0595 0.03 - - 7/30/16 23-056 Tooele Rush Valley 0.0595 0.03 - - 7/30/16 25-030 Utah Eagle Mountain0.0675 0.03 - - 7/30/16 25-083 Utah Orem 0.0685 0.03 - - 7/30/16 25-085 Utah Payson 0.0675 0.03 - - 7/30/16 25-103 Utah Spanish Fork 0.0675 0.03 - - 7/30/16 25-106 Utah Springville 0.0675 0.03 - - 7/30/16 26-014 Wasatch Wallsburg 0.0595 0.03 - - 7/30/16 27-000 Washington Washington 0.0605 0.03 - - 7/30/16 27-012 Washington Leeds 0.0605 0.03 - - 7/30/16 27-027 Washington Washington City0.0635 0.03 - - 7/30/16 28-001 Wayne Bicknell 0.0595 0.03 - - 7/30/16 01-009 Beaver Minersville 0.0595 0.03 - - 7/30/16 03-076 Cache Wellsville 0.063 0.03 - - 7/30/16 03-081 Cache Trenton 0.063 0.03 - - 7/30/16 05-006 Daggett Manila 0.0695 0.03 - - 7/30/16 02-004 Box Elder Bear River 0.0595 0.03 - - 7/30/16 08-012 Emery Huntington 0.0595 0.03 - - TOTAL 100,000.00 1,000.00 50,000.00 300.00 600.00 250.00 25,000.00 5,000.00 - 5,000.00 26,150.00 Page 3 of 13

- 4. STORE # Month End Date CITY CNTY CODES COUNTY CITY TOTAL RATE NON FOOD 2ND qtr FOOD TAX ST/CTY/ CNTY UT-1 7/30/16 29-040 Weber South Ogden 0.071 0.03 7/30/16 06-300 Davis Falcon Hill Davis0.0675 0.03 7/30/16 29-016 Weber Harrisville 0.071 0.03 7/30/16 19-000 San Juan San Juan 0.062 0.03 7/30/16 07-017 Duchesne Myton 0.062 0.03 7/30/16 06-049 Davis Syracuse 0.0675 0.03 7/30/16 17-000 Rich Rich 0.062 0.03 7/30/16 21-031 Sevier Monroe 0.062 0.03 7/30/16 19-002 San Juan Blanding 0.066 0.03 7/30/16 24-024 Uintah Vernal 0.0655 0.03 7/30/16 17-002 Rich Laketown 0.062 0.03 7/30/16 29-012 Weber Farr West 0.071 0.03 7/30/16 21-034 Sevier Richfield 0.066 0.03 7/30/16 10-011 Grand Moab 0.081 0.03 7/30/16 06-004 Davis Bountiful 0.0685 0.03 7/30/16 06-302 Davis Falcon Hill Sunset0.0675 0.03 7/30/16 29-018 Weber Hooper 0.071 0.03 7/30/16 29-000 Weber Weber 0.071 0.03 7/30/16 29-037 Weber Roy 0.071 0.03 7/30/16 07-000 Duchesne Duchesne 0.062 0.03 7/30/16 06-061 Davis West Bountiful0.0685 0.03 7/30/16 01-000 Beaver Beaver 0.0595 0.03 7/30/16 11-019 Iron Parowan 0.0595 0.03 7/30/16 12-030 Juab Rocky Ridge Town0.0595 0.03 7/30/16 14-010 Millard Delta 0.0595 0.03 7/30/16 14-014 Millard Fillmore 0.0595 0.03 7/30/16 15-000 Morgan Morgan 0.0595 0.03 7/30/16 15-007 Morgan Morgan City 0.0595 0.03 7/30/16 18-000 Salt Lake Salt Lake 0.0685 0.03 Net Taxable Sales (high tax) Net Taxable Sales ( low tax) PURCHASE FOOD TAX DUE (low tax) TAX DUE (high tax) USE TAX DUE TOTAL TAX DUE FOOD VENDORS COMP @ .0127 VENDORS COMP @ .0131 NET PAID TO STATE 74,850.00 45,000.00 500.00 1,350.00 5,314.35 35.50 6,699.85 17.15 87.77 6,594.94 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Page 4 of 13

- 5. STORE # Month End Date CITY CNTY CODES COUNTY CITY TOTAL RATE NON FOOD 2ND qtr FOOD TAX ST/CTY/ CNTY 7/30/16 18-019 Salt Lake Bluffdale 0.0685 0.03 7/30/16 18-039 Salt Lake Draper 0.0685 0.03 7/30/16 18-060 Salt Lake Herriman 0.0685 0.03 7/30/16 18-065 Salt Lake Holladay 0.0685 0.03 7/30/16 18-093 Salt Lake Midvale 0.0685 0.03 7/30/16 18-118 Salt Lake Riverton 0.0685 0.03 7/30/16 18-122 Salt Lake Salt Lake City 0.0685 0.03 7/30/16 18-131 Salt Lake Sandy 0.0685 0.03 7/30/16 18-139 Salt Lake South Salt Lake0.0705 0.03 7/30/16 18-142 Salt Lake Taylorsville 0.0685 0.03 7/30/16 18-155 Salt Lake West Jordan 0.0685 0.03 7/30/16 20-014 Sanpete Gunnison 0.0635 0.03 7/30/16 20-023 Sanpete Moroni 0.0595 0.03 7/30/16 20-024 Sanpete Mt. Pleasant 0.0625 0.03 7/30/16 02-120 Box Elder Willard 0.065 0.03 7/30/16 22-030 Summit Park City 0.0795 0.03 7/30/16 23-050 Tooele Vernon 0.0595 0.03 7/30/16 23-056 Tooele Rush Valley 0.0595 0.03 7/30/16 25-030 Utah Eagle Mountain0.0675 0.03 7/30/16 25-083 Utah Orem 0.0685 0.03 7/30/16 25-085 Utah Payson 0.0675 0.03 7/30/16 25-103 Utah Spanish Fork 0.0675 0.03 7/30/16 25-106 Utah Springville 0.0675 0.03 7/30/16 26-014 Wasatch Wallsburg 0.0595 0.03 7/30/16 27-000 Washington Washington 0.0605 0.03 7/30/16 27-012 Washington Leeds 0.0605 0.03 7/30/16 27-027 Washington Washington City0.0635 0.03 7/30/16 28-001 Wayne Bicknell 0.0595 0.03 7/30/16 01-009 Beaver Minersville 0.0595 0.03 7/30/16 03-076 Cache Wellsville 0.063 0.03 7/30/16 03-081 Cache Trenton 0.063 0.03 7/30/16 05-006 Daggett Manila 0.0695 0.03 7/30/16 02-004 Box Elder Bear River 0.0595 0.03 7/30/16 08-012 Emery Huntington 0.0595 0.03 TOTAL Net Taxable Sales (high tax) Net Taxable Sales ( low tax) PURCHASE FOOD TAX DUE (low tax) TAX DUE (high tax) USE TAX DUE TOTAL TAX DUE FOOD VENDORS COMP @ .0127 VENDORS COMP @ .0131 NET PAID TO STATE - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 74,850.00 45,000.00 500.00 1,350.00 5,314.35 35.50 6,699.85 17.15 87.77 6,594.94 Page 5 of 13

- 6. STORE # Month End Date CITY CNTY CODES COUNTY CITY TOTAL RATE NON FOOD 2ND qtr FOOD TAX ST/CTY/ CNTY UT-1 7/30/16 29-040 Weber South Ogden 0.071 0.03 7/30/16 06-300 Davis Falcon Hill Davis0.0675 0.03 7/30/16 29-016 Weber Harrisville 0.071 0.03 7/30/16 19-000 San Juan San Juan 0.062 0.03 7/30/16 07-017 Duchesne Myton 0.062 0.03 7/30/16 06-049 Davis Syracuse 0.0675 0.03 7/30/16 17-000 Rich Rich 0.062 0.03 7/30/16 21-031 Sevier Monroe 0.062 0.03 7/30/16 19-002 San Juan Blanding 0.066 0.03 7/30/16 24-024 Uintah Vernal 0.0655 0.03 7/30/16 17-002 Rich Laketown 0.062 0.03 7/30/16 29-012 Weber Farr West 0.071 0.03 7/30/16 21-034 Sevier Richfield 0.066 0.03 7/30/16 10-011 Grand Moab 0.081 0.03 7/30/16 06-004 Davis Bountiful 0.0685 0.03 7/30/16 06-302 Davis Falcon Hill Sunset0.0675 0.03 7/30/16 29-018 Weber Hooper 0.071 0.03 7/30/16 29-000 Weber Weber 0.071 0.03 7/30/16 29-037 Weber Roy 0.071 0.03 7/30/16 07-000 Duchesne Duchesne 0.062 0.03 7/30/16 06-061 Davis West Bountiful0.0685 0.03 7/30/16 01-000 Beaver Beaver 0.0595 0.03 7/30/16 11-019 Iron Parowan 0.0595 0.03 7/30/16 12-030 Juab Rocky Ridge Town0.0595 0.03 7/30/16 14-010 Millard Delta 0.0595 0.03 7/30/16 14-014 Millard Fillmore 0.0595 0.03 7/30/16 15-000 Morgan Morgan 0.0595 0.03 7/30/16 15-007 Morgan Morgan City 0.0595 0.03 7/30/16 18-000 Salt Lake Salt Lake 0.0685 0.03 Sales Tax Calculated less Sales Tax Collected less Nexus tax paid Tax Over or (Short) 6,664.35 6,590.00 71.00 (3.35) - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 FOR RECONCILIATION INFO Page 6 of 13

- 7. STORE # Month End Date CITY CNTY CODES COUNTY CITY TOTAL RATE NON FOOD 2ND qtr FOOD TAX ST/CTY/ CNTY 7/30/16 18-019 Salt Lake Bluffdale 0.0685 0.03 7/30/16 18-039 Salt Lake Draper 0.0685 0.03 7/30/16 18-060 Salt Lake Herriman 0.0685 0.03 7/30/16 18-065 Salt Lake Holladay 0.0685 0.03 7/30/16 18-093 Salt Lake Midvale 0.0685 0.03 7/30/16 18-118 Salt Lake Riverton 0.0685 0.03 7/30/16 18-122 Salt Lake Salt Lake City 0.0685 0.03 7/30/16 18-131 Salt Lake Sandy 0.0685 0.03 7/30/16 18-139 Salt Lake South Salt Lake0.0705 0.03 7/30/16 18-142 Salt Lake Taylorsville 0.0685 0.03 7/30/16 18-155 Salt Lake West Jordan 0.0685 0.03 7/30/16 20-014 Sanpete Gunnison 0.0635 0.03 7/30/16 20-023 Sanpete Moroni 0.0595 0.03 7/30/16 20-024 Sanpete Mt. Pleasant 0.0625 0.03 7/30/16 02-120 Box Elder Willard 0.065 0.03 7/30/16 22-030 Summit Park City 0.0795 0.03 7/30/16 23-050 Tooele Vernon 0.0595 0.03 7/30/16 23-056 Tooele Rush Valley 0.0595 0.03 7/30/16 25-030 Utah Eagle Mountain0.0675 0.03 7/30/16 25-083 Utah Orem 0.0685 0.03 7/30/16 25-085 Utah Payson 0.0675 0.03 7/30/16 25-103 Utah Spanish Fork 0.0675 0.03 7/30/16 25-106 Utah Springville 0.0675 0.03 7/30/16 26-014 Wasatch Wallsburg 0.0595 0.03 7/30/16 27-000 Washington Washington 0.0605 0.03 7/30/16 27-012 Washington Leeds 0.0605 0.03 7/30/16 27-027 Washington Washington City0.0635 0.03 7/30/16 28-001 Wayne Bicknell 0.0595 0.03 7/30/16 01-009 Beaver Minersville 0.0595 0.03 7/30/16 03-076 Cache Wellsville 0.063 0.03 7/30/16 03-081 Cache Trenton 0.063 0.03 7/30/16 05-006 Daggett Manila 0.0695 0.03 7/30/16 02-004 Box Elder Bear River 0.0595 0.03 7/30/16 08-012 Emery Huntington 0.0595 0.03 TOTAL Sales Tax Calculated less Sales Tax Collected less Nexus tax paid Tax Over or (Short) FOR RECONCILIATION INFO - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 - 0.00 6,664.35 6,590.00 71.00 (3.35) Page 7 of 13

- 8. for period Jul-2016 BUSINESS NAME & ADDRESS _____________________________________ _____________________________________ _____________________________________ FOR TAX PERIOD BEGINNING DATE______________ ENDING DATE______________ FOR MORE INFORMATION: Utah State Tax Commission FORMS ARE FOR RETURN PREPARATION ONLY AND NOT TO BE SUBMITTED 210 N 1950 W SLC, UT WITHOUT WRITTEN PERMISSION FROM YOUR TAXING AUTHORITIES Phone 801.297.3811 WEB ADDRESS: www.tax.ut.gov 1. Total sales of goods and services .......................................................................................... 1 151,000.00$ 2. Exempt sales included in line 1 ............................................................................................ 2 31,150.00$ 3. Taxable sales (line 1 minus line 2) ....................................................................................... 3 119,850.00$ 4. Goods purchased tax free and used by you .......................................................................... 4 500.00$ 5. Total taxable amounts (add lines 3 and 4) .................................................................................................................... 5 120,350.00$ 6. Adjustments (attach explanation showing figures) ...................................................................................................... 6 7. Net taxable sales and purchases (line 5 plus or minus line 6) ....................................................................................... 7 120,350.00$ 8. Tax Calculation a. Non food and prepated food sales (from sch a, j, & x ) ............................................................................................... 8a 5,349.85$ b. Grocery food sales, not including prepared food (sch ag & jg) ………………….……………………….………………………...………………… 8b 1,350.00$ 9. Total Tax 8a + 8b………………………………………………………………………………………………………...…………………………………..……...………… 9 6,699.85$ 10. Residential fuels included in line 7 $______________ x .0270 ……………………………………………………………………………………….. 10 11. Total state and local taxes due (line 9 minus line 1) .................................................................................................. 11 6,699.85$ 12. Seller discount, for monthly filers only (line 11 x .0131) ............................................................................................ 12 87.77$ 13. Additional grocery food seller discount, for monthly filers only (8b x .0127)………………….……….……………………………………. 13 17.15$ 14. NET TAX DUE……………………………………………………………………………...……...…………………...………………………………………………….…… 14 6,594.94$ STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ STATE OF UTAH SALES AND USE TAX RETURN for TC-62M

- 9. STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ Jul-2016 FORMS ARE FOR RETURN PREPARATION ONLY AND NOT TO BE SUBMITTED WITHOUT WRITTEN PERMISSION FROM YOUR TAXING AUTHORITIES 1. Business Location Address 2. Outlet # 3. Net Taxable Sales & Purchases (including prepared food) 4. Tax Rate 5. Sales and Use Tax (col. 3 x col. 4) South Ogden UT-1 75,350.00$ 0.0710 5,349.85$ Falcon Hill Davis -$ 0.0675 -$ Harrisville -$ 0.0710 -$ San Juan -$ 0.0620 -$ Myton -$ 0.0620 -$ Syracuse -$ 0.0675 -$ Rich -$ 0.0620 -$ Monroe -$ 0.0620 -$ Blanding -$ 0.0660 -$ Vernal -$ 0.0655 -$ Laketown -$ 0.0620 -$ Farr West -$ 0.0710 -$ Richfield -$ 0.0660 -$ Moab -$ 0.0810 -$ Bountiful -$ 0.0685 -$ Falcon Hill Sunset -$ 0.0675 -$ Hooper -$ 0.0710 -$ Weber -$ 0.0710 -$ Roy -$ 0.0710 -$ Duchesne -$ 0.0620 -$ West Bountiful -$ 0.0685 -$ Beaver -$ 0.0595 -$ Parowan -$ 0.0595 -$ Rocky Ridge Town -$ 0.0595 -$ Delta -$ 0.0595 -$ Fillmore -$ 0.0595 -$ STATE OF UTAH Schedule A for TC-62M

- 10. STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ Jul-2016 FORMS ARE FOR RETURN PREPARATION ONLY AND NOT TO BE SUBMITTED WITHOUT WRITTEN PERMISSION FROM YOUR TAXING AUTHORITIES 1. Business Location Address 2. Outlet # 3. Net Taxable Sales & Purchases (including prepared food) 4. Tax Rate 5. Sales and Use Tax (col. 3 x col. 4) STATE OF UTAH Schedule A for TC-62M Morgan -$ 0.0595 -$ Morgan City -$ 0.0595 -$ Salt Lake -$ 0.0685 -$ Bluffdale -$ 0.0685 -$ Draper -$ 0.0685 -$ Herriman -$ 0.0685 -$ Holladay -$ 0.0685 -$ Midvale -$ 0.0685 -$ Riverton -$ 0.0685 -$ Salt Lake City -$ 0.0685 -$ Sandy -$ 0.0685 -$ South Salt Lake -$ 0.0705 -$ Taylorsville -$ 0.0685 -$ West Jordan -$ 0.0685 -$ Gunnison -$ 0.0635 -$ Moroni -$ 0.0595 -$ Mt. Pleasant -$ 0.0625 -$ Willard -$ 0.0650 -$ Park City -$ 0.0795 -$ Vernon -$ 0.0595 -$ Rush Valley -$ 0.0595 -$ Eagle Mountain -$ 0.0675 -$ Orem -$ 0.0685 -$ Payson -$ 0.0675 -$ Spanish Fork -$ 0.0675 -$ Springville -$ 0.0675 -$

- 11. STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ Jul-2016 FORMS ARE FOR RETURN PREPARATION ONLY AND NOT TO BE SUBMITTED WITHOUT WRITTEN PERMISSION FROM YOUR TAXING AUTHORITIES 1. Business Location Address 2. Outlet # 3. Net Taxable Sales & Purchases (including prepared food) 4. Tax Rate 5. Sales and Use Tax (col. 3 x col. 4) STATE OF UTAH Schedule A for TC-62M Wallsburg -$ 0.0595 -$ Washington -$ 0.0605 -$ Leeds -$ 0.0605 -$ Washington City -$ 0.0635 -$ Bicknell -$ 0.0595 -$ Minersville -$ 0.0595 -$ Wellsville -$ 0.0630 -$ Trenton -$ 0.0630 -$ Manila -$ 0.0695 -$ Bear River -$ 0.0595 -$ Huntington -$ 0.0595 -$ Total 75,350.00$ 5,349.85$

- 12. STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ Jul-2016 FORMS ARE FOR RETURN PREPARATION ONLY AND NOT TO BE SUBMITTED WITHOUT WRITTEN PERMISSION FROM YOUR TAXING AUTHORITIES 1. Location of transaction CITY CNTY CODES 3. Net Taxable Sales & Purchases of Grocery Food Only (less WIC food) 4. Food Tax Rate 5. Sales and Use Tax (col. 3 x col. 4) 1 South Ogden 29-040 45,000.00$ 0.03 1,350.00$ 2 Falcon Hill Davis 06-300 -$ 0.03 -$ 3 Harrisville 29-016 -$ 0.03 -$ 4 San Juan 19-000 -$ 0.03 -$ 5 Myton 07-017 -$ 0.03 -$ 6 Syracuse 06-049 -$ 0.03 -$ 7 Rich 17-000 -$ 0.03 -$ 8 Monroe 21-031 -$ 0.03 -$ 9 Blanding 19-002 -$ 0.03 -$ # Vernal 24-024 -$ 0.03 -$ # Laketown 17-002 -$ 0.03 -$ # Farr West 29-012 -$ 0.03 -$ # Richfield 21-034 -$ 0.03 -$ # Moab 10-011 -$ 0.03 -$ # Bountiful 06-004 -$ 0.03 -$ # Falcon Hill Sunset 06-302 -$ 0.03 -$ # Hooper 29-018 -$ 0.03 -$ # Weber 29-000 -$ 0.03 -$ # Roy 29-037 -$ 0.03 -$ # Duchesne 07-000 -$ 0.03 -$ # West Bountiful 06-061 -$ 0.03 -$ # Beaver 01-000 -$ 0.03 -$ # Parowan 11-019 -$ 0.03 -$ # Rocky Ridge Town 12-030 -$ 0.03 -$ # Delta 14-010 -$ 0.03 -$ # Fillmore 14-014 -$ 0.03 -$ # Morgan 15-000 -$ 0.03 -$ # Morgan City 15-007 -$ 0.03 -$ # Salt Lake 18-000 -$ 0.03 -$ # Bluffdale 18-019 -$ 0.03 -$ # Draper 18-039 -$ 0.03 -$ # Herriman 18-060 -$ 0.03 -$ # Holladay 18-065 -$ 0.03 -$ # Midvale 18-093 -$ 0.03 -$ # Riverton 18-118 -$ 0.03 -$ # Salt Lake City 18-122 -$ 0.03 -$ # Sandy 18-131 -$ 0.03 -$ # South Salt Lake 18-139 -$ 0.03 -$ # Taylorsville 18-142 -$ 0.03 -$ # West Jordan 18-155 -$ 0.03 -$ # Gunnison 20-014 -$ 0.03 -$ STATE OF UTAH Schedule GJ for TC-62M

- 13. STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ Jul-2016 FORMS ARE FOR RETURN PREPARATION ONLY AND NOT TO BE SUBMITTED WITHOUT WRITTEN PERMISSION FROM YOUR TAXING AUTHORITIES 1. Location of transaction CITY CNTY CODES 3. Net Taxable Sales & Purchases of Grocery Food Only (less WIC food) 4. Food Tax Rate 5. Sales and Use Tax (col. 3 x col. 4) STATE OF UTAH Schedule GJ for TC-62M # Moroni 20-023 -$ 0.03 -$ # Mt. Pleasant 20-024 -$ 0.03 -$ # Willard 02-120 -$ 0.03 -$ # Park City 22-030 -$ 0.03 -$ # Vernon 23-050 -$ 0.03 -$ # Rush Valley 23-056 -$ 0.03 -$ # Eagle Mountain 25-030 -$ 0.03 -$ # Orem 25-083 -$ 0.03 -$ # Payson 25-085 -$ 0.03 -$ # Spanish Fork 25-103 -$ 0.03 -$ # Springville 25-106 -$ 0.03 -$ # Wallsburg 26-014 -$ 0.03 -$ # Washington 27-000 -$ 0.03 -$ # Leeds 27-012 -$ 0.03 -$ # Washington City 27-027 -$ 0.03 -$ # Bicknell 28-001 -$ 0.03 -$ # Minersville 01-009 -$ 0.03 -$ # Wellsville 03-076 -$ 0.03 -$ # Trenton 03-081 -$ 0.03 -$ # Manila 05-006 -$ 0.03 -$ # Bear River 02-004 -$ 0.03 -$ # Huntington 08-012 -$ 0.03 -$ TOTAL SCH GJ 45,000.00$ 1,350.00$