Sales Tax Templates Instructions

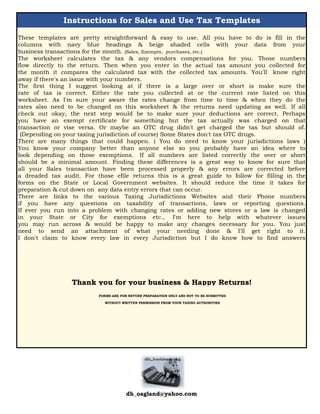

- 1. Instructions for Sales and Use Tax Templates These templates are pretty straightforward & easy to use. All you have to do is fill in the columns with navy blue headings & beige shaded cells with your data from your business transactions for the month. (Sales, Exempts, purchases, etc.) The worksheet calculates the tax & any vendors compensations for you. Those numbers flow directly to the return. Then when you enter in the actual tax amount you collected for the month it compares the calculated tax with the collected tax amounts. You'll know right away if there's an issue with your numbers. The first thing I suggest looking at if there is a large over or short is make sure the rate of tax is correct. Either the rate you collected at or the current rate listed on this worksheet. As I'm sure your aware the rates change from time to time & when they do the rates also need to be changed on this worksheet & the returns need updating as well. If all check out okay, the next step would be to make sure your deductions are correct. Perhaps you have an exempt certificate for something but the tax actually was charged on that transaction or vise versa. Or maybe an OTC drug didn't get charged the tax but should of. (Depending on your taxing jurisdiction of course) Some States don't tax OTC drugs. There are many things that could happen. ( You do need to know your jurisdictions laws ) You know your company better than anyone else so you probably have an idea where to look depending on those exemptions. If all numbers are listed correctly the over or short should be a minimal amount. Finding these differences is a great way to know for sure that all your Sales transaction have been processed properly & any errors are corrected before a dreaded tax audit. For those efile returns this is a great guide to follow for filling in the forms on the State or Local Government websites. It should reduce the time it takes for preparation & cut down on any data entry errors that can occur. There are links to the various Taxing Jurisdictions Websites and their Phone numbers if you have any questions on taxability of transactions, laws or reporting questions. If ever you run into a problem with changing rates or adding new stores or a law is changed in your State or City for exemptions etc., I'm here to help with whatever issues you may run across & would be happy to make any changes necessary for you. You just need to send an attachment of what your needing done & I'll get right to it. I don't claim to know every law in every Jurisdiction but I do know how to find answers Thank you for your business & Happy Returns! FORMS ARE FOR RETURN PREPARATION ONLY AND NOT TO BE SUBMITTED WITHOUT WRITTEN PERMISSION FROM YOUR TAXING AUTHORITIES dh_oagland@yahoo.com

- 2. STORE # Month End Date CITY COUNTY 1 7/30/2016 Raymond PACIFIC 7/30/2016 Mountlake Terrace SNOHOMISH 7/30/2016 Monroe TBD** SNOHOMISH 7/30/2016 Marysville TBD** SNOHOMISH 7/30/2016 Lynnwood SNOHOMISH 7/30/2016 Long Beach PACIFIC 7/30/2016 Granite Falls SNOHOMISH 7/30/2016 Centralia TBD** LEWIS 7/30/2016 Unincorp PTBA* Non-RTA SNOHOMISH 7/30/2016 Unincorp PTBA* SNOHOMISH 7/30/2016 Unincorp Areas CLALLAM 7/30/2016 Tacoma TBD** PIERCE TOTAL 7/30/2016 B & O TAX Gross Sales (includes Nexus Sales) Resale Certificate shipped out of State Government/ Non Profit RX and Medical Devices FOOD AND OR (WIC) OTHER/ newspapers/ exempt certificates Qualified Non Residents Total Exemptions Net Taxable Sales STATE OF WAHSINGTON ONLY ENTER DATA IN THE NAVY BLUE COLUMNS (other columns are calculated) SALES AND USE TAX for Period 0.00471 101,000.00 300.00 600.00 250.00 25,000.00 5,000.00 500.00 1,000.00 32,650.00 68,350.00 0.00471 - - 0.00471 - - 0.00471 - - 0.00471 - - 0.00471 - - 0.00471 - - 0.00471 - - 0.00471 - - 0.00471 - - 0.00471 - - 0.00471 - - TOTAL 101,000.00 300.00 600.00 250.00 25,000.00 5,000.00 500.00 1,000.00 32,650.00 68,350.00 Page 2 of 13

- 3. STORE # Month End Date CITY COUNTY 1 7/30/2016 Raymond PACIFIC 7/30/2016 Mountlake Terrace SNOHOMISH 7/30/2016 Monroe TBD** SNOHOMISH 7/30/2016 Marysville TBD** SNOHOMISH 7/30/2016 Lynnwood SNOHOMISH 7/30/2016 Long Beach PACIFIC 7/30/2016 Granite Falls SNOHOMISH 7/30/2016 Centralia TBD** LEWIS 7/30/2016 Unincorp PTBA* Non-RTA SNOHOMISH 7/30/2016 Unincorp PTBA* SNOHOMISH 7/30/2016 Unincorp Areas CLALLAM 7/30/2016 Tacoma TBD** PIERCE TOTAL PURCHASES FOR USE TAX TAXABLE ITEM FOR LITTER TAX STATE TAX LOCAL TAX LITTER TAX STATE USE TAX LOCAL USE TAX B & O TAX (taxed @ gross less out of state and rx) TOTAL TAX DUE STATE Sales Tax Calculated Sales Tax Collected Nexus Tax FOR RECONCILIATION INFO 250.00 15,000.00 4,442.75 1,025.25 2.25 16.25 3.75 355.13 5,845.38 5,468.00 5,385.28 80.00 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 250.00 15,000.00 4,442.75 1,025.25 2.25 16.25 3.75 355.13 5,845.38 5,468.00 5,385.28 80.00 Page 3 of 13

- 4. STORE # Month End Date CITY COUNTY 1 7/30/2016 Raymond PACIFIC 7/30/2016 Mountlake Terrace SNOHOMISH 7/30/2016 Monroe TBD** SNOHOMISH 7/30/2016 Marysville TBD** SNOHOMISH 7/30/2016 Lynnwood SNOHOMISH 7/30/2016 Long Beach PACIFIC 7/30/2016 Granite Falls SNOHOMISH 7/30/2016 Centralia TBD** LEWIS 7/30/2016 Unincorp PTBA* Non-RTA SNOHOMISH 7/30/2016 Unincorp PTBA* SNOHOMISH 7/30/2016 Unincorp Areas CLALLAM 7/30/2016 Tacoma TBD** PIERCE TOTAL Tax Over or (Short) If O(S) is large number then probably have a wrong rate or wrong deductions FOR RECONCILIATION INFO (2.72) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 (2.72) - Page 4 of 13

- 5. July-16 BUSINESS NAME & ADDRESS _____________________________________ _______________________________________ _______________________________________ FOR TAX PERIOD BEGINNING DATE______________ ENDING DATE______________ FOR MORE INFORMATION: FORMS ARE FOR RETURN PREPARATION ONLY AND NOT TO BE SUBMITTED STATE OF WA DEPARTMENT OF REVENUE WITHOUT WRITTEN PERMISSION FROM YOUR TAXING AUTHORITIES WEB ADDRESS: www.wa.dor.gov LINE NO CODE COL. 1 GROSS AMOUNT COL. 2 DEDUCTIONS COL. 3 TAXABLE AMOUNT COL. 4 RATE COL. 5 TAX DUE 1 16 0.00484 2 30 0.00138 3 28 0.00275 4 14 0.00484 5 21 0.00138 6 10 0.00484 7 07 0.00484 8 80 0.01500 9 03 0.00484 10 11 0.00484 11 55 0.01500 12 83 0.04710 13 04 0.01500 14 192 0.01630 15 135 0.01500 16 19 0.00484 17 02 101,000.00 25,600.00 75,400.00 0.00471 355.13 TOTAL B & O TAX 355.13 18 01 101,000.00 32,650.00 68,350.00 0.06500 4,442.75 19 05 250.00 0 250.00 0.06500 16.25 GROSS AMOUNTS FOR RETAILING AND RETAIL SALES MUST BE THE SAME STATE OF WASHINGTON COMBINED EXCISE TAX RETURN STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ II STATE SALES AND USE TAX Wholesaling Warehousing; Radio & TV Broadcasting; Public Rd Const; Gov Contracting; Chem Dependency Ctr; Canned Salmon Labelers Public or Nonprofit Hospitals; Qualified Food Co-ops Cleanup of Radioactive Waste for US Gov Service & Other Activities and/or Gambling Contests of Chance (less than $50,000 a year) Gambling Contests of Chance ($50,000 a year or greater) For Profit Hospitals; Scientific R&D Retailing of Interstate Transportation Equip Retailing Tax Classification Retail Sales Use Tax/Deferred Sales Tax (also complete local use Travel Agent Com/Tour Operators; Intl Charter Freight Brokers; Stevedoring; Assisted Living Facilities Extracting, Extracting for Hire Slaughter, Break Proc, Perish Meat-Whlse; Mfg Wheatinto Flour; Soybean & Canola Proc Insurance Producers; Title Insurance Agents;Surplus Line Broker Commissions; Child Care Prescription Drug Warehousing; Mfg: Wood Biomass Fuel; Split/Proc Dried Peas Processing for Hire; Printing and Publishing Manufacturing Royalties Page 5 of 13

- 6. July-16 STATE OF WASHINGTON COMBINED EXCISE TAX RETURN STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ TOTAL STATE SALES & USE TAX 4,459.00 LINE NO LOC CODE TAXABLE AMOUNT LOCAL RATE TAX DUE CITY OR CO 20 21 SEE ADDENDUM 22 23 TOTAL TAXABLE 68,600.00 TOTAL 1,029.00 LINE NO VII TOTALS 28 Total All Tax Due from page 1 4,816.38 29 Total All Tax Due from page 2 0 30 Total All Addendums 1,029.00 LINE NO LOC CODE VALUE OF ARTICLES LOCAL RATE TAX DUE CITY OR CO 31 Subtotal 5,845.38 24 32 Credit from page 2 sec vi 0 25 33 Subtotl 5,845.38 TOTAL 34 Add Penalty TOTAL AMOUNT DUE 5,845.38 LINE NO TAX CLASS CODE TAXABLE AMOUNT LOCAL RATE TAX DUE CITY OR CO 26 MOTOR VEHICLES 120 0.003 27 LITTER TAX 36 15,000.00 0.00015 2.25 LINE NO LOC CODE LINE NO LOC CODE Number of Unit/Days Unit/Day Rate Charged 35 39 36 40 37 41 38 42 TOTAL TOURISM PROMOTION AREA LODGING CHARGE LINE NO LOC CODE TAXABLE AMOUNT LOCAL RATE TAX DUE LINE NO LOC CODE TAXABLE AMOUNT LOCAL RATE 43 46 44 47 45 48 (enter location code and income only) CONVENTION AND TRADE CENTER TAX Code 48 TAX DUE IV LODGING TAXES SPECIAL HOTEL/MOTEL TAX Code 70 TRANSIENT RENTAL INCOME INFORMATION Code 47 INCOME TOURISM PROMOTION AREA LODGING CHARGE Code 170 Total Charges Due ITEM III LOCAL CITY & OR COUNTY SALES & USE TAX Local Use Tax/Deferred Sales Tax (Enter applicable rate of tax.) Code 46 TOTAL VALUE OF ARTICLES Local Sales Tax (Enter applicable rate of tax.) Code 45 Page 6 of 13

- 7. July-16 STATE OF WASHINGTON COMBINED EXCISE TAX RETURN STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ TOTAL CONVENTION & TRADE CENTER TAX TOTAL SPECIAL HOTEL/MOTEL TAX LINE NO CODE COL. 1 GROSS AMOUNT COL. 2 DEDUCTIONS COL. 3 TAXABLE AMOUNT COL. 4 RATE COL. 5 TAX DUE 49 20 0.95000 50 64 0.03600 51 57 0.00300 52 65 0.00700 53 79 0.06000 LINE NO CODE QUANTITY RATE TAX DUE 54 59 Number of Stoves, Fireplaces, & Solid Fuel Burning Devices Sold: 30.00 55 54 Number of Gallons (whole numbers only) Sold: 1.00 56 73 Number of Tires Sold: 0.90 57 194 Number of Cigars ($0.69 or more): 0.65 58 198 Number of Little Cigars: 0.15125 59 162 Number of Units: 2.526 60 163 Number of Ounces (including partial ounces): 2.105 TOTAL OTHER TAXES LINE NO Credit I.D. AMOUNT 61 Multiple Activities Tax Credit (attach Schedule C) 800 62 International Services Credit 855 63 Small Business B&O Tax Credit (go to dor.wa.gov) 815 64 Renewable Energy System Cost Recovery Credit 925 65 Bad Debt Tax Credit (attach Schedule B) 801 66 Hazardous Substance 805 67 880 68 Tobacco Products Tax Credit 930 69 B&O Credit for Syrup Tax Paid 945 70 Destination Sourcing Tax Credit 602 71 Other Credits (attach appropriate documents) 810 TOTAL CREDIT (transfer to page 1, line 32) ITEM VI CREDITS Credit Classification Public Utility Tax Credit for Billing Discounts/Qualif Contributions to a Low Income Home Energy Assistance Fund Tire Fee Cigar Tax ($0.69 or more) Little Cigar Tax (acetate integrated filters) Moist Snuff (1.2 oz. or less) Moist Snuff (more than 1.2 oz.) Hazardous Substance Intermediate Care Facilities Tax Classification Solid Fuel Burning Device Fee Syrup Tax V OTHER TAXES Tax Classification Tobacco Products/Cigars (less than $0.69) Refuse Collection Petroleum Products Tax Page 7 of 13

- 8. July-16 STATE OF WASHINGTON COMBINED EXCISE TAX RETURN STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ Combined Excise Tax Return Deduction Detail Line 1 - Extracting, Extracting for Hire I.D Line 7 - Manufacturing I.D AMOUNT Bad Debts 1601 Bad Debts 0701 Cash & Trade Discounts 1602 Cash & Trade Discounts 0702 Other (Explain): 1699 Freight on Out-of-State Deliveries 0703 TOTAL Advances Reimbursements; Rtrns & Allowances 0707 Other (Explain): 0799 TOTAL Line 2 - Slaughter, Break Processing I.D Bad Debts 3001 Line 8 – Royalties I.D. Amount I.D AMOUNT Cash & Trade Discounts 3002 Bad Debts 8001 Other (Explain): 3099 Cash & Trade Discounts 8002 TOTAL Advances Reimbursements; Rtrns & Allowances 8007 Other (Explain): 8099 Line 3 – Travel Agent Com; Intl Charter I.D TOTAL Bad Debts 2801 Cash & Trade Discounts 2802 Line 9 – Wholesaling I.D. Amount I.D AMOUNT Other (Explain): 2899 Bad Debts 0301 TOTAL Cash & Trade Discounts 0302 Interstate & Foreign Sales 0304 Line 4 - Insurance Producers; Title I.D Motor Vehicle Fuel Tax 0305 1401 1401 Casual Sales; Accommodation Sales 0306 Other (Explain): 1499 Advances Reimbursements; Rtrns & Allowances 0307 TOTAL No Local Activity 0308 Dairy, Fruit/Veg, & Seafood Mfd Products (see below*) 0367 Line 5 – Prescription Drug Warehousing I.D Dairy Products Used in Mfg of Dairy Products 0375 Bad Debts 2101 Other (Explain): 0399 Cash & Trade Discounts 2102 *Local sales for transport out-of-state TOTAL Freight on Out-of-State Deliveries 2103 Intrst. & Foreign sls use for RX & Warehsing Only 2104 Line 10 – Warehousing; Radio & TV I.D AMOUNT Advances Reimbursements; Rtrns & Allowances 2107 Bad Debts 1101 Manufactured Dairy Products 2174 Cash & Trade Discounts 1102 Other (Explain): 2199 Interstate & Foreign Sales 1104 TOTAL Advances Reimbursements; Rtrns & Allowances 1107 Radio/TV Advertising 1109 Line 6 – Processing for Hire; Printing and I.D Other (Explain): 1199 Bad Debts 1001 TOTAL Cash & Trade Discounts 1002 Freight on Out-of-State Deliveries 1003 Line 11 – Public or Nonprofit Hospitals; Qualified Food Co-ops I.D AMOUNT Advances Reimbursements; Rtrns & Allowances 1007 Bad Debts 5501 Other (Explain): 1099 Cash & Trade Discounts 5502 TOTAL Advances Reimbursements; Rtrns & Allowances 5507 Other (Explain): 5599 AMOUNT AMOUNT AMOUNT AMOUNT AMOUNT AMOUNT Page 8 of 13

- 9. July-16 STATE OF WASHINGTON COMBINED EXCISE TAX RETURN STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ TOTAL Line 12 – Cleanup of Radioactive Waste… I.D Line 18 – Retail Sales Tax I.D AMOUNT Bad Debts 8301 Bad Debts 0101 Cash & Trade Discounts 8302 Cash & Trade Discounts 0102 Interstate & Foreign Sales 8304 Interstate & Foreign Sales 0104 600.00 Advances Reimbursements; Rtrns & Allowances 8307 Tax in Gross 0114 Other (Explain): 8399 Sales to U.S. Government 0118 250.00 TOTAL Motor Vehicle Fuel Sales 0119 Prescription Drugs/Hearing Aids/Lenses/etc 0121 25,000.00 I.D Exempt Food Sales 0122 5,000.00 Bad Debts 0401 Qualified Nonresident Sales 0123 1,000.00 Cash & Trade Discounts 0402 Trade-in Allowance 0124 Apportionment (Interstate & Foreign Sales) 0404 Newspapers 0125 500.00 Advances Reimbursements; Rtrns & Allowances 0407 Sales to Indians with Delivery on the Reservation 0128 Gambling Prizes & Cash Pay-Outs 0410 Sales of Feed to Fish Farmers 0129 Qualified Initiation Fees; Dues; Contrbtns Rcvd 0411 Taxable Amount for Tax Paid at Source 0130 Interest on Certain Invest/Loan Obligations 0412 Returns & Allowances 0131 Artistic/Cultural Activities 0416 Sales to Nonprofit Orgs. of Art/Cltrl Art Obj for Displays 0132 Qualifying Blood Banks 0448 Ride-Sharing Vans 0134 Other (Explain): 0499 Purebred Livestock for Breeding 0135 TOTAL Tax Deferral/Investment Certificate No. 0136 Sale of Manufacturing Mach/Equip; Install Labor 0156 I.D Retail Sales Tax Exempt Purchases by Farmers 0159 Gambling Prizes & Cash Pay-Outs 19210 Direct Pay Permits 0170 Other (Explain): 19299 Retail Sales Tax Reported on SER 0179 TOTAL Other (Explain): Resale Certificates, sales for resale 0199 300.00 TOTAL 32,650.00 I.D Bad Debts 13501 Line 50 - Refuse Collection I.D AMOUNT Cash & Trade Discounts 13502 Bad Debts 6401 Apportionment (Interstate & Foreign Sales) 13504 Sales to U.S. Government 6418 Advances Reimbursements; Rtrns & Allowances 13507 Sales to Other Refuse/Solid Waste Collectors 6445 Qualified Initiation Fees; Dues; Contrib Rcvd 13511 Other (Explain): 6499 Artistic/Cultural Activities 13516 TOTAL Other (Explain): 13599 TOTAL I.D Line 51 - Petroleum Tax I.D AMOUNT Bad Debts 1901 1901 Petroleum Products Exported Out of State 5746 Not all deductions are allowable from both Retailing (B&O) and Retail Sales Tax. Line 14 – Gambling Contests of Chance ($50,000 a year or greater) AMOUNT AMOUNT AMOUNT Line 15 – For Profit Hospitals; Scientific R&D Line 16 - Retailing of Interstate Transport AMOUNT Line 13 – Service & Other Activities and/or Gambling Contests of Chance (less than $50,000 a year) AMOUNT Page 9 of 13

- 10. July-16 STATE OF WASHINGTON COMBINED EXCISE TAX RETURN STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ Cash & Trade Discounts 1902 1902 Other (Explain): 5799 Interstate & Foreign Sales 1904 1904 TOTAL Advances Reimbursements; Rtrns & Allowances 1907 1907 Consignment Sales 1915 1915 Other (Explain): 1999 1999 TOTAL Line 52 - Hazardous Substance I.D. Amount I.D AMOUNT Other (Explain): 6599 Line 17 – Retailing (B&O) I.D TOTAL Bad Debts 0201 Cash & Trade Discounts 0202 Interstate & Foreign Sales 0204 Motor Vehicle Fuel Tax 0205 Advances Reimbursements; Rtrns & Allowances 0207 No Local Activity 0208 Casual Sales; Accommodation Sales 0213 Tax in Gross 0214 Consignment Sales 0215 Artistic/Cultural Activities 0216 Presc. Drugs Sold by Pub. Oper/Nonprofit Hospitals 0217 Dairy and Seafood Mfd Products (see below*) 0267 Other (Explain): 0299 TOTAL 25,600.00 25,000.00 600.00 AMOUNT Page 10 of 13

- 11. STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ FORMS ARE FOR RETURN PREPARATION ONLY AND NOT TO BE SUBMITTED WITHOUT WRITTEN PERMISSION FROM YOUR TAXING AUTHORITIES Location Code Sales and Use Taxable Amount Local Sales & Use Tax Rates TAX DUE CITY OR CO 2503 68,600.00 0.01500 1,029.00 3113 - 0.03300 - 3112 - 0.02700 - 3111 - 0.02600 - 3110 - 0.03300 - 2502 - 0.01500 - 3107 - 0.02400 - 2101 - 0.01700 - 4231 - 0.02400 - 3131 - 0.03300 - 500 - 0.01900 - 2717 - 0.03100 - 2301 - 0.02300 - 100 - 0.01200 - 102 - 0.01200 - 200 - 0.01200 - 201 - 0.01200 - 300 - 0.01500 - 303 - 0.02100 - 304 - 0.02100 - 305 - 0.02100 - 333 - 0.02100 - 400 - 0.01700 - 402 - 0.01700 - 501 - 0.01900 - 502 - 0.01900 - 503 - 0.02200 - 604 - 0.01900 - 605 - 0.01900 - 607 - 0.01900 - 666 - 0.01900 - 700 - 0.01600 - 702 - 0.01600 - 800 - 0.01200 - 802 - 0.01200 - 804 - 0.01500 - 900 - 0.01300 - 904 - 0.01700 - 909 - 0.01700 - 1000 - 0.01200 - 1001 - 0.01200 - 1101 - 0.01500 - 1102 - 0.01500 - 1104 - 0.02100 - 1200 - 0.01000 - 1201 - 0.01000 - 1300 - 0.01400 - 1301 - 0.01400 - 1303 - 0.01500 - 1307 - 0.01400 - 1308 - 0.01400 - 1312 - 0.01400 - 1401 - 0.02130 - 1405 - 0.02000 - 1406 - 0.02000 - 1502 - 0.02200 - 1503 - 0.02200 - 1600 - 0.02500 - 1704 - 0.03000 - 1712 - 0.02100 - 1716 - 0.03000 - WASHINGTON- III ADDENDUM LOCAL CITY & OR COUNTY SALES & USE TAX Page 11 of 13

- 12. STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ FORMS ARE FOR RETURN PREPARATION ONLY AND NOT TO BE SUBMITTED WITHOUT WRITTEN PERMISSION FROM YOUR TAXING AUTHORITIES WASHINGTON- III ADDENDUM LOCAL CITY & OR COUNTY SALES & USE TAX 1720 - 0.02100 - 1723 - 0.03000 - 1724 - 0.03000 - 1726 - 0.03100 - 1727 - 0.02100 - 1730 - 0.03000 - 1731 - 0.03000 - 1733 - 0.03000 - 1737 - 0.03000 - 1800 - 0.02200 - 1801 - 0.02200 - 1900 - 0.01500 - 1903 - 0.01500 - 2000 - 0.00500 - 2100 - 0.01300 - 2108 - 0.01300 - 2200 - 0.01200 - 2205 - 0.01200 - 2206 - 0.01200 - 2207 - 0.01200 - 2300 - 0.02000 - 2400 - 0.01200 - 2401 - 0.01600 - 2403 - 0.01200 - 2405 - 0.01200 - 2406 - 0.01700 - 2424 - 0.01600 - 2600 - 0.01100 - 2601 - 0.01100 - 2605 - 0.01100 - 2700 - 0.02300 - 2705 - 0.01400 - 2709 - 0.02900 - 2716 - 0.02300 - 2721 - 0.02900 - 2800 - 0.01600 - 2801 - 0.01800 - 2904 - 0.02000 - 2906 - 0.02000 - 2907 - 0.02000 - 3105 - 0.02700 - 3200 - 0.01600 - 3208 - 0.01600 - 3209 - 0.01600 - 3210 - 0.02200 - 3212 - 0.02200 - 3213 - 0.02200 - 3232 - 0.02200 - 3300 - 0.01100 - 3402 - 0.02200 - 3403 - 0.02300 - 3404 - 0.01400 - 3500 - 0.01100 - 3603 - 0.01700 - 3604 - 0.02400 - 3701 - 0.02200 - 3705 - 0.02200 - 3737 - 0.02000 - 3803 - 0.01300 - 3804 - 0.01300 - 3806 - 0.01300 - 3807 - 0.01300 - 3809 - 0.01300 - 3816 - 0.01300 -Page 12 of 13

- 13. STATE LICENSE NUMBER (EIN) OR (SSN)_____________________________________________ FORMS ARE FOR RETURN PREPARATION ONLY AND NOT TO BE SUBMITTED WITHOUT WRITTEN PERMISSION FROM YOUR TAXING AUTHORITIES WASHINGTON- III ADDENDUM LOCAL CITY & OR COUNTY SALES & USE TAX 3902 - 0.01400 - 3903 - 0.01400 - 3908 - 0.01400 - 3909 - 0.01400 - 3912 - 0.01400 - 3913 - 0.01700 - 4000 - 0.02100 - 4004 - 0.02100 - 4014 - 0.02100 - 4024 - 0.02100 - 4039 - 0.02100 - 4100 - 0.01400 - 4205 - 0.01800 - TOTAL 68,600.00 1,029.00 Page 13 of 13