More Related Content

Similar to Three statements model on BX

Similar to Three statements model on BX (20)

Three statements model on BX

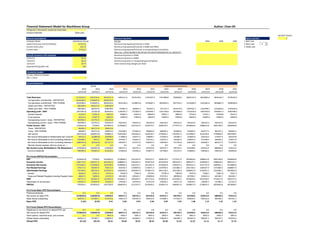

- 1. Financial Statement Model for BlackStone Group Author: Chan Oh

All figures in thousands, except per share data

Scenario selected: Base case

DO NOT TOUCH

General assuamptions Select scenario 2

Company Name BlackStone Group Pre-tax 2004 2005 2006 1 Best case

Latest Fiscal year end (mm/dd/yy) 12/31/12 Nonrecurring expense/(income) in COGS 2 Base case

Current share price $22.23 Nonrecurring expense/(income) in SG&A and Other 3 Weak case

Current date 9/16/13 Nonrecurring expense/(income) in nonoperating (income)/loss

After-tax - LEAVE BLANK IF NO AFTER-TAX DATA PROVIDED BY CO. EXPLICITLY

Firstcall Consensus EPS estimates Nonrecurring items in COGS

12/31/12 $0.41 Nonrecurring items in SG&A

12/31/13 $0.59 Nonrecurring items in nonoperating (income)/loss

12/31/14 $0.74 Total nonrecurring charges per share

Expected EPS growth rate 16%

Circularity breaker

Circular reference breaker

Off=1, On=0 1

Income Statement

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

12/31/10 12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21

Total Revenues 3119342.0 3252576.0 4019441.0 5295211.6 6370139.5 6752347.9 7157488.8 7586938.1 8042154.4 8524683.6 9036164.7 9578334.5

Compensation and Benefits - REPORTED 3610189.0 2738425.0 2605244.0

Compensation and Benefits - PRO FORMA 3610189.0 2738425.0 2605244.0 3432148.4 4128874.6 4376607.1 4639203.5 4917555.7 5212609.0 5525365.6 5856887.5 6208300.8

SG&A and Other - REPORTED 466358.0 566313.0 548738.0

SG&A and Other - PRO FORMA 466358.0 566313.0 548738.0 722907.4 869657.7 921837.1 977147.3 1035776.2 1097922.7 1163798.1 1233626.0 1307643.6

Operating profit - EBIT (957205.0) (52162.0) 865459.0 1140155.7 1371607.3 1453903.7 1541138.0 1633606.2 1731622.6 1835520.0 1945651.2 2062390.2

Interest expense 41229.0 57824.0 72870.0 83805.5 81815.4 80845.0 79874.7 78904.3 77934.0 77222.1 76768.8 76315.5

Fund expense 26214.0 25507.0 33829.0 33829.0 33829.0 33829.0 33829.0 33829.0 33829.0 33829.0 33829.0 33829.0

Nonoperating income / (loss) - REPORTED 501994.0 212751.0 256145.0

Nonoperating income / (loss) - PRO FORMA 501994.0 212751.0 256145.0 256145.0 256145.0 256145.0 256145.0 256145.0 256145.0 256145.0 256145.0 256145.0

Pretax income - EBT (522654.0) 77258.0 1014905.0 1278666.2 1512107.9 1595374.7 1683579.3 1777017.9 1876004.6 1980613.8 2091198.4 2208390.8

Taxes - REPORTED 84669.0 345711.0 185023.0

Taxes - PRO FORMA 84669.0 345711.0 185023.0 233108.2 275665.9 290846.0 306926.2 323960.6 342006.4 361077.3 381237.5 402602.3

Net Income (607323.0) (268453.0) 829882.0 1045558.0 1236442.0 1304528.7 1376653.1 1453057.4 1533998.2 1619536.6 1709960.9 1805788.5

Net Income Attributable to Redeemable Non-Controlling Interests in Consolidated Entities87651.0 (24869.0) 103598.0 111885.8 120277.3 128696.7 137062.0 145285.7 154002.8 163243.0 173037.6 183419.8

Net Income Attributable to Non-Controlling Interests in Consolidated Entities343498.0 7953.0 99959.0 107955.7 116052.4 124176.1 132247.5 140182.4 148593.3 157508.9 166959.4 176977.0

Net Income Attributable to Non-Controlling Interests in Blackstone Holdings(668444.0) (83234.0) 407727.0 440345.2 473371.0 506507.0 539430.0 571795.8 606103.5 642469.7 681017.9 721879.0

Minority interest expense, after tax (enter as - ) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Net Income (Loss) Attributable to The Blackstone Group L.P.(370028.0) (168303.0) 218598.0 385371.3 526741.2 545149.0 567913.7 595793.5 625298.6 656314.9 688946.0 723512.6

Common dividends 599390.0 702832.0 614530.0 513854.8 519343.6 523877.5 527786.0 531155.5 534060.2 536564.2 538722.9 540583.8

Pro Forma EBITDA Reconciliation

EBT (522654.0) 77258.0 1014905.0 1278666.2 1512107.9 1595374.7 1683579.3 1777017.9 1876004.6 1980613.8 2091198.4 2208390.8

Economic Income 1580770.0 1584971.0 2041007.0 2688822.6 3234653.6 3428732.8 3634456.8 3852524.2 4083675.7 4328696.2 4588418.0 4863723.1

Economic Net Income 1551838.0 1539208.0 1995299.0 2628606.9 3162214.1 3351947.0 3553063.8 3766247.6 3992222.4 4231755.8 4485661.1 4754800.8

Fee Related Earnings 478171.0 546493.0 700313.0 922592.3 1109878.6 1176471.3 1247059.6 1321883.2 1401196.2 1485267.9 1574384.0 1668847.0

Distributable Earnings 701784.0 696724.0 1033925.0 1362092.8 1638597.6 1736913.5 1841128.3 1951596.0 2068691.8 2192813.3 2324382.1 2463845.0

Interest 36666.0 53201.0 69152.0 79529.5 77641.0 76720.1 75799.3 74878.4 73957.6 73282.1 72851.9 72421.7

Taxes and Related Payables Including Payable Under Tax Receivable Agreement48867.0 74696.0 132325.0 183198.9 229432.1 258090.8 273576.2 289990.8 307390.2 325833.6 345383.7 366106.7

EBIT 787317.0 824621.0 1235402.0 1624821.2 1945670.7 2071724.4 2190503.8 2316465.2 2450039.6 2591929.0 2742617.6 2902373.3

Depreciation & amortization 192007.0 253629.0 192383.0 179249.2 167076.6 157515.8 150024.2 144171.8 139618.3 136094.3 133386.2 131325.2

EBITDA 979324.0 1078250.0 1427785.0 1804070.4 2112747.2 2229240.2 2340527.9 2460637.0 2589657.9 2728023.2 2876003.8 3033698.5

Pro Forma Basic EPS Reconcilliation

Preferred dividends 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Net income for basic EPS (370028.0) (168303.0) 218598.0 385371.3 526741.2 545149.0 567913.7 595793.5 625298.6 656314.9 688946.0 723512.6

Basic shares outstanding 364021.4 475582.7 533703.6 558537.8 564503.9 569432.0 573680.5 577342.9 580500.2 583222.0 585568.3 587591.1

Basic EPS (1.02) (0.35) 0.41 0.69 0.93 0.96 0.99 1.03 1.08 1.13 1.18 1.23

Pro Forma Diluted EPS Reconciliation

Adjustment to net income for diluted EPS calc. 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Net income for diluted EPS (370028.0) (168303.0) 218598.0 385371.3 526741.2 545149.0 567913.7 595793.5 625298.6 656314.9 688946.0 723512.6

Stock options, restricted stock, and converts 0.0 0.0 4965.4 4965.4 4965.4 4965.4 4965.4 4965.4 4965.4 4965.4 4965.4 4965.4

Diluted shares outstanding 364021.4 475582.7 538669.0 563503.2 569469.3 574397.4 578645.9 582308.3 585465.6 588187.3 590533.7 592556.4

Diluted EPS ($1.02) ($0.35) $0.41 $0.68 $0.92 $0.95 $0.98 $1.02 $1.07 $1.12 $1.17 $1.22

Actual Projected Annual Forecast

Nonrecurring items

2

- 2. Firstcall consensus EPS $0.41 $0.59 $0.74 $0.86 $1.00 $1.16 $1.34 $1.55 $1.80 $2.09

Model variance from consensus ($0.00) $0.09 $0.18 $0.09 ($0.01) ($0.13) ($0.27) ($0.44) ($0.64) ($0.87)

Income statement assumptions

Revenue growth (%) 4.3% 23.6% 31.7% 20.3% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0%

Gross profit margin (%) (15.7%) 15.8% 35.2% 35.2% 35.2% 35.2% 35.2% 35.2% 35.2% 35.2% 35.2% 35.2%

SG&A and Other margin 15.0% 17.4% 13.7% 13.7% 13.7% 13.7% 13.7% 13.7% 13.7% 13.7% 13.7% 13.7%

EBIT margin (%) (30.7%) (1.6%) 21.5% 21.5% 21.5% 21.5% 21.5% 21.5% 21.5% 21.5% 21.5% 21.5%

Effective tax rate (%) (16.2%) 447.5% 18.2% 18.2% 18.2% 18.2% 18.2% 18.2% 18.2% 18.2% 18.2% 18.2%

D&A a % of depreciable assets (default) 20.8% 20.8% 20.8% 20.8% 20.8% 20.8% 20.8% 20.8% 20.8% 20.8%

Income in equity affiliates growth (%) (128.4%) (516.6%) 8.0% 7.5% 7.0% 6.5% 6.0% 6.0% 6.0% 6.0% 6.0%

Minority interest growth (%) 0.0% 0.0% 8.0% 7.5% 7.0% 6.5% 6.0% 6.0% 6.0% 6.0% 6.0%

Dividend payout ratio (162.0%) (417.6%) 281.1% 133.3% 98.6% 96.1% 92.9% 89.2% 85.4% 81.8% 78.2% 74.7%

Select a case (1=best, 2=base, 3=weak)

Balance Sheet

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21

Cash and equivalents (inc. investment securities) 7,785,330 10,888,590 9,862,481.9 9,263,018.5 8,618,547.9 7,935,717.3 7,222,652.8 6,479,829.1 5,800,884.7 5,091,850.0 4,351,820.4

Accounts receivable 406,140 638,164 840,717.3 1,011,382.9 1,072,065.8 1,136,389.8 1,204,573.2 1,276,847.6 1,353,458.4 1,434,665.9 1,520,745.9

Deferred income taxes 1,258,699 1,285,611 1,619,725.4 1,915,433.0 2,020,909.6 2,132,641.0 2,251,002.6 2,376,392.1 2,508,903.7 2,648,984.5 2,797,435.7

Prepaid expenses 81,701.0 81,498.0 107,365.5 129,160.7 136,910.3 145,124.9 153,832.4 163,062.4 172,846.1 183,216.9 194,209.9

Other current assets 106,005 152,484 152,484.0 152,484.0 152,484.0 152,484.0 152,484.0 152,484.0 152,484.0 152,484.0 152,484.0

Equity in affiliates 8,961,960 12,320,611 12,980,797.7 13,690,498.4 14,449,878.2 15,258,617.7 16,115,881.5 17,024,581.2 17,987,802.8 19,008,817.7 20,091,093.6

Furniture, Equipment and Leasehold Improvements, net 149,690.0 142,390.0 98,481.5 71,870.1 58,547.6 58,448.7 47,838.0 51,820.3 69,370.1 99,675.4 138,232.9

Goodwill 1,703,602 1,703,602 1,703,602.0 1,703,602.0 1,703,602.0 1,703,602.0 1,703,602.0 1,703,602.0 1,703,602.0 1,703,602.0 1,703,602.0

Intangibles 595,488 598,535 583,579.0 563,872.4 540,815.4 512,407.8 500,749.7 479,441.0 448,481.8 407,872.2 361,472.2

Other non-current assets 860,514.0 1,120,067.0 1,120,067.0 1,120,067.0 1,120,067.0 1,120,067.0 1,120,067.0 1,120,067.0 1,120,067.0 1,120,067.0 1,120,067.0

Total Assets 21,909,129.0 28,931,552.0 29,069,301.2 29,621,389.0 29,873,827.8 30,155,500.2 30,472,683.1 30,828,126.5 31,317,900.7 31,851,235.5 32,431,163.5

Accounts payable 584,385 520,232 685,353.6 824,480.4 873,949.3 926,386.2 981,969.4 1,040,887.5 1,103,340.8 1,169,541.2 1,239,713.7

Accrued expenses 903,260 1,254,978 1,653,308.0 1,988,929.5 2,108,265.3 2,234,761.2 2,368,846.9 2,510,977.7 2,661,636.4 2,821,334.6 2,990,614.6

Other current liabilities (non-debt) 244,345.0 467,435.0 467,435.0 467,435.0 467,435.0 467,435.0 467,435.0 467,435.0 467,435.0 467,435.0 467,435.0

Current portion of long-term debt 125,380.0 175,425.7 175,425.7 175,425.7 175,425.7 175,425.7 175,425.7 81,954.0 81,954.0 81,954.0 41,954.0

Short term debt (Revolving credit facility) 245,674.0 368,691.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Long term debt 10,553,656.0 14,878,622.3 14,703,196.6 14,527,770.9 14,352,345.2 14,176,919.5 14,001,493.8 13,919,539.8 13,837,585.8 13,755,631.8 13,713,677.8

Convertible debt 0 0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Deferred income taxes 143.0 51,221.0 64,532.7 76,314.2 80,516.6 84,968.2 89,683.9 94,679.6 99,959.1 105,540.2 111,454.8

Other non-current liabilities 0 0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Total Liabilities 12,656,843.0 17,716,605.0 17,749,251.7 18,060,355.8 18,057,937.1 18,065,895.8 18,084,854.7 18,115,473.7 18,251,911.1 18,401,436.8 18,564,849.9

Redeemable Non-Controlling Interests in Consolidated Entities 1,091,833.0 1,556,185.0 1,556,185.0 1,556,185.0 1,556,185.0 1,556,185.0 1,556,185.0 1,556,185.0 1,556,185.0 1,556,185.0 1,556,185.0

Minority interest 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Convertible Preferred Stock 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Common Stock and APIC 4,668,705.0 5,464,677.0 5,699,463.0 5,934,249.0 6,169,035.0 6,403,821.0 6,638,607.0 6,873,393.0 7,108,179.0 7,342,965.0 7,577,751.0

Treasury stock (contra account) 0.0 0.0 (1,200.0) (2,400.0) (3,600.0) (4,800.0) (6,000.0) (7,200.0) (8,400.0) (9,600.0) (10,800.0)

Comprehensive (accumulated) loss 1,958.0 2,170.0 2,170.0 2,170.0 2,170.0 2,170.0 2,170.0 2,170.0 2,170.0 2,170.0 2,170.0

Non-Controlling Interests in Consolidated Entities 1,029,270.0 1,443,559.0 1,443,559.0 1,443,559.0 1,443,559.0 1,443,559.0 1,443,559.0 1,443,559.0 1,443,559.0 1,443,559.0 1,443,559.0

Non-Controlling Interests in Blackstone Holdings 2,460,520.0 2,748,356.0 2,748,356.0 2,748,356.0 2,748,356.0 2,748,356.0 2,748,356.0 2,748,356.0 2,748,356.0 2,748,356.0 2,748,356.0

Retained earnings 0.0 0.0 (128,483.4) (121,085.8) (99,814.3) (59,686.6) 4,951.4 96,189.8 215,940.6 366,163.7 549,092.6

Total Shareholders' Equity 8,160,453.0 9,658,762.0 9,763,864.6 10,004,848.2 10,259,705.7 10,533,419.4 10,831,643.4 11,156,467.8 11,509,804.6 11,893,613.7 12,310,128.6

Total Liabilities + Shareholders' Equity 21,909,129.0 28,931,552.0 29,069,301.2 29,621,389.0 29,873,827.8 30,155,500.2 30,472,683.1 30,828,126.5 31,317,900.7 31,851,235.5 32,431,163.5

Balance check 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Supporting Schedules

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21

Working Capital

1. Grow with revenues (default)

2. Override i: Days of revenues (Avg. collection period) 45.6 58.1

3. Overide ii: Absolute projection

Accounts receivable 406,140.0 638,164.0 840,717.3 1,011,382.9 1,072,065.8 1,136,389.8 1,204,573.2 1,276,847.6 1,353,458.4 1,434,665.9 1,520,745.9

1. Grow with SG&A (default)

2. Overide: Absolute projection

Prepaid expenses 81,701.0 81,498.0 107,365.5 129,160.7 136,910.3 145,124.9 153,832.4 163,062.4 172,846.1 183,216.9 194,209.9

1. Straight-line (default)

2. Overide: Absolute projection

Other current assets 106,005.0 152,484.0 152,484.0 152,484.0 152,484.0 152,484.0 152,484.0 152,484.0 152,484.0 152,484.0 152,484.0

- 3. 1. Grow with COGS (default)

2. Override i. Payables Payment Period 77.9 73.1

3. Overide ii: Absolute projection

Accounts payable 584,385.0 520,232.0 685,353.6 824,480.4 873,949.3 926,386.2 981,969.4 1,040,887.5 1,103,340.8 1,169,541.2 1,239,713.7

1. Grow with SG&A (default)

2. Overide: Absolute projection

Accrued expenses 903,260.0 1,254,978.0 1,653,308.0 1,988,929.5 2,108,265.3 2,234,761.2 2,368,846.9 2,510,977.7 2,661,636.4 2,821,334.6 2,990,614.6

1. Straight-line (default)

2. Overide: Absolute projection

Other current liabilities (non-debt) 244,345.0 467,435.0 467,435.0 467,435.0 467,435.0 467,435.0 467,435.0 467,435.0 467,435.0 467,435.0 467,435.0

Intangible assets

Purchase of intangible assets 23,768.0 142,221.0 82,994.5 82,994.5 82,994.5 82,994.5 82,994.5 82,994.5 82,994.5 82,994.5 82,994.5

Amortization (enter as -) (207,591.0) (139,174.0) (97,950.5) (102,701.0) (106,051.6) (111,402.1) (94,652.6) (104,303.1) (113,953.7) (123,604.2) (129,394.5)

Intangibles 595,488.0 598,535.0 583,579.0 563,872.4 540,815.4 512,407.8 500,749.7 479,441.0 448,481.8 407,872.2 361,472.2

Furniture, Equipment and Leasehold Improvements

Capital expenditures 36,484.0 37,020.0 37,390.2 37,764.1 38,141.7 38,523.2 38,908.4 39,297.5 39,690.5 40,087.4 40,488.2

Recurring asset sales (enter as -) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Depreciation (46,038.0) (53,209.0) (81,298.7) (64,375.5) (51,464.2) (38,622.1) (49,519.2) (35,315.2) (22,140.6) (9,782.0) (1,930.7)

PP&E 149,690.0 142,390.0 98,481.5 71,870.1 58,547.6 58,448.7 47,838.0 51,820.3 69,370.1 99,675.4 138,232.9

Diluted Shares outstanding

Treasury share $ repurchases (2,100.0) 0.0 (1,200.0) (1,200.0) (1,200.0) (1,200.0) (1,200.0) (1,200.0) (1,200.0) (1,200.0) (1,200.0)

Value of shares issued 238,632.0 234,786.0 234,786.0 234,786.0 234,786.0 234,786.0 234,786.0 234,786.0 234,786.0 234,786.0 234,786.0

Expected average share price $24.45 $35.18 $44.13 $51.19 $59.38 $68.88 $79.90 $92.69 $107.52 $124.72

Consensus EPS growth 43.9% 25.4% 16.0% 16.0% 16.0% 16.0% 16.0% 16.0% 16.0%

Shares repurchased (34.1) (27.2) (23.4) (20.2) (17.4) (15.0) (12.9) (11.2) (9.6)

Shares issued 6,673.1 5,320.4 4,586.6 3,953.9 3,408.6 2,938.4 2,533.1 2,183.7 1,882.5

End of period basic shares outstanding 555,218.3 561,857.3 567,150.5 571,713.6 575,647.3 579,038.5 581,961.9 584,482.0 586,654.6 588,527.5

Weighted average basic shares outstanding 475,582.7 533,703.6 558,537.8 564,503.9 569,432.0 573,680.5 577,342.9 580,500.2 583,222.0 585,568.3 587,591.1

Investments in affiliates (Equity method)

Equity in income of affiliates 660,186.7 709,700.7 759,379.8 808,739.5 857,263.8 908,699.7 963,221.6 1,021,014.9 1,082,275.8

Dividends (enter as -)

Equity in affiliates (from balance sheet) 8,961,960.0 12,320,611.0 12,980,797.7 13,690,498.4 14,449,878.2 15,258,617.7 16,115,881.5 17,024,581.2 17,987,802.8 19,008,817.7 20,091,093.6

Minority interest (Consolidation method)

Minority interest expense 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Dividends (enter as -)

Minority interest (from balance sheet) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Cash Flow Statement

12/31/13 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21

Net Income 385,371.3 526,741.2 545,149.0 567,913.7 595,793.5 625,298.6 656,314.9 688,946.0 723,512.6

Depreciation & amortization 179,249.2 167,076.6 157,515.8 150,024.2 144,171.8 139,618.3 136,094.3 133,386.2 131,325.2

Changes in working capital

Accounts receivable (202,553.3) (170,665.6) (60,683.0) (64,323.9) (68,183.4) (72,274.4) (76,610.9) (81,207.5) (86,080.0)

Deferred tax assets (334,114.4) (295,707.7) (105,476.6) (111,731.4) (118,361.6) (125,389.5) (132,511.7) (140,080.8) (148,451.2)

Prepaid expenses (25,867.5) (21,795.2) (7,749.6) (8,214.6) (8,707.5) (9,229.9) (9,783.7) (10,370.8) (10,993.0)

Other current assets 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Accounts payable 165,121.6 139,126.8 49,468.8 52,437.0 55,583.2 58,918.2 62,453.3 66,200.4 70,172.5

Accrued expenses 398,330.0 335,621.5 119,335.8 126,495.9 134,085.7 142,130.8 150,658.7 159,698.2 169,280.1

Other current liabilities 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Deferred tax liabilities 13,311.7 11,781.5 4,202.4 4,451.6 4,715.7 4,995.7 5,279.5 5,581.1 5,914.6

Equity income in affiliates (660,186.7) (709,700.7) (759,379.8) (808,739.5) (857,263.8) (908,699.7) (963,221.6) (1,021,014.9) (1,082,275.8)

Dividends received from affiliates 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Minority interest expense 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Cash from operations (81,337.9) (17,521.5) (57,617.2) (91,687.2) (118,166.4) (144,631.9) (171,327.2) (198,862.1) (227,595.0)

Purchase of fixed assets (capital expenditures) (37,390.2) (37,764.1) (38,141.7) (38,523.2) (38,908.4) (39,297.5) (39,690.5) (40,087.4) (40,488.2)

Proceeds from sale of fixed assets 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Purchases of intangible assets (82,994.5) (82,994.5) (82,994.5) (82,994.5) (82,994.5) (82,994.5) (82,994.5) (82,994.5) (82,994.5)

Purchases/Proceeds from other long-term assets 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Cash from investing (120,384.7) (120,758.6) (121,136.2) (121,517.7) (121,902.9) (122,292.0) (122,685.0) (123,081.9) (123,482.7)

Convertible preferred stock 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Common stock and APIC 234,786.0 234,786.0 234,786.0 234,786.0 234,786.0 234,786.0 234,786.0 234,786.0 234,786.0

- 4. Treasury stock repurchases (1,200.0) (1,200.0) (1,200.0) (1,200.0) (1,200.0) (1,200.0) (1,200.0) (1,200.0) (1,200.0)

Comprehensive accumulated loss 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Other equity account 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Common and preferred dividends (513,854.8) (519,343.6) (523,877.5) (527,786.0) (531,155.5) (534,060.2) (536,564.2) (538,722.9) (540,583.8)

Dividends to minority interests 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Increases / (decreases) in debt (544,116.7) (175,425.7) (175,425.7) (175,425.7) (175,425.7) (175,425.7) (81,954.0) (81,954.0) (81,954.0)

Cash from financing (824,385.5) (461,183.3) (465,717.2) (469,625.7) (472,995.2) (475,899.9) (384,932.2) (387,090.9) (388,951.8)

Total increase/decrease of cash (1,026,108.1) (599,463.4) (644,470.6) (682,830.6) (713,064.4) (742,823.7) (678,944.4) (709,034.8) (740,029.5)

Debt

Current portion of LTD 125,380.0 175,425.7 175,425.7 175,425.7 175,425.7 175,425.7 175,425.7 81954.0 81954.0 81954.0 41954.0

Reclassification of LTD to CP of LTD (175,425.7) (175,425.7) (175,425.7) (175,425.7) (175,425.7) (81,954.0) (81,954.0) (81,954.0) (41,954.0)

Discretionary (paydown)/borrowing of long term debt

Long term debt 10,553,656.0 14,878,622.3 14,703,196.6 14,527,770.9 14,352,345.2 14,176,919.5 14,001,493.8 13,919,539.8 13,837,585.8 13,755,631.8 13,713,677.8

Discretionary (paydown)/borrowing of convertible debt

Convertible debt 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Calculation of short term debt

Cash @ beginning of the year (end of last year) 10,888,590.0 9,862,481.9 9,263,018.5 8,618,547.9 7,935,717.3 7,222,652.8 6,479,829.1 5,800,884.7 5,091,850.0

Plus: Free cash flows prior to debt during year avg. of (revenue / cash) (481,991.4) (424,037.7) (469,044.9) (507,404.9) (537,638.7) (567,398.0) (596,990.4) (627,080.8) (658,075.5)

Less: Minimum cash balance 20.0% 1,059,042.3 1,274,027.9 1,350,469.6 1,431,497.8 1,517,387.6 1,608,430.9 1,704,936.7 1,807,232.9 1,915,666.9

Total cash available / (debt required) for short term debt paydown 9,172,130.6 7,988,990.6 7,268,078.3 6,504,219.5 5,705,265.2 4,871,398.3 4,095,948.0 3,284,617.0 2,436,153.5

Short term debt 245,674.0 368,691.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Interest expense

Current portion of long-term debt 125,380.0 175,425.7 175,425.7 175,425.7 175,425.7 175,425.7 175,425.7 81,954.0 81,954.0 81,954.0 41,954.0

Short term debt 245,674.0 368,691.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Long term debt 10,553,656.0 14,878,622.3 14,703,196.6 14,527,770.9 14,352,345.2 14,176,919.5 14,001,493.8 13,919,539.8 13,837,585.8 13,755,631.8 13,713,677.8

Convertible debt 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Total debt 10,924,710.0 15,422,739.0 14,878,622.3 14,703,196.6 14,527,770.9 14,352,345.2 14,176,919.5 14,001,493.8 13,919,539.8 13,837,585.8 13,755,631.8

Interest expense 57,824.0 72,870.0 83,805.5 81,815.4 80,845.0 79,874.7 78,904.3 77,934.0 77,222.1 76,768.8 76,315.5

Average interest rate 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6%

Ratio analysis

12/31/13 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21

Capital Structure

Market Debt / Equity 75.0% 58.5% 49.4% 41.8% 35.3% 29.9% 25.5% 21.8% 18.6%

Financial Risk Ratios

EBITDA / Total Interest 21.5x 25.8x 27.6x 29.3x 31.2x 33.2x 35.3x 37.5x 39.8x

(EBITDA - Capex) / Total Interest 21.1x 25.4x 27.1x 28.8x 30.7x 32.7x 34.8x 36.9x 39.2x

Total Debt / EBITDA 8.2x 7.0x 6.5x 6.1x 5.8x 5.4x 5.1x 4.8x 4.5x

Total Debt / Total Capitalization (Bk. Equity) 60.4% 59.5% 58.6% 57.7% 56.7% 55.7% 54.7% 53.8% 52.8%

Net Debt / EBITDA 2.8x 2.6x 2.7x 2.7x 2.8x 2.9x 3.0x 3.0x 3.1x

Interest Coverage (EBIT/Interest expense) 13.6x 16.8x 18.0x 19.3x 20.7x 22.2x 23.8x 25.3x 27.0x

Internal Liquidity

Current Ratio (Curr. Assets / Curr. Liab.) 4.5x 3.8x 3.5x 3.2x 2.9x 2.6x 2.4x 2.1x 1.9x

Cash Ratio (Cash / Current Liab.) 3.5x 2.8x 2.5x 2.2x 1.9x 1.6x 1.4x 1.1x 0.9x

Operating Efficiency

Return on Capital (ROIC) 4.2% 5.0% 5.3% 5.5% 5.8% 6.1% 6.4% 6.7% 7.0%

Dupont Analysis

Operating Profit Margin 21.5% 21.5% 21.5% 21.5% 21.5% 21.5% 21.5% 21.5% 21.5%

Asset Turnover (Sales/ Assets) 0.2x 0.2x 0.2x 0.2x 0.2x 0.3x 0.3x 0.3x 0.3x

Interest (inc. interest income)/ Sales 1.6% 1.3% 1.2% 1.1% 1.0% 1.0% 0.9% 0.8% 0.8%

Equity multiplier (Assets / Equity) 3.0x 3.0x 2.9x 2.9x 2.8x 2.8x 2.7x 2.7x 2.6x

Tax Retention Rate 81.8% 81.8% 81.8% 81.8% 81.8% 81.8% 81.8% 81.8% 81.8%

ROE 5.7% 8.1% 8.7% 9.4% 9.9% 10.5% 11.0% 11.5% 12.0%

Operating scenarios - sensitivity analysis

Revenue growth (%)

Strong case 1 32.7% 21.3% 7.0% 7.0% 7.0% 7.0% 7.0% 7.0% 7.0%

Base case 2 31.7% 20.3% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0%

Weak case 3 30.7% 19.3% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0%

- 5. Gross Profit margin (%)

Strong case 1 35.7% 35.7% 35.7% 35.7% 35.7% 35.7% 35.7% 35.7% 35.7%

Base case 2 35.2% 35.2% 35.2% 35.2% 35.2% 35.2% 35.2% 35.2% 35.2%

Weak case 3 34.7% 34.7% 34.7% 34.7% 34.7% 34.7% 34.7% 34.7% 34.7%

SG&A and Other margin (%)

Strong case 1 12.7% 12.7% 12.7% 12.7% 12.7% 12.7% 12.7% 12.7% 12.7%

Base case 2 13.7% 13.7% 13.7% 13.7% 13.7% 13.7% 13.7% 13.7% 13.7%

Weak case 3 14.7% 14.7% 14.7% 14.7% 14.7% 14.7% 14.7% 14.7% 14.7%

Taxes

1. Straight line (default) 18.2% 18.2% 18.2% 18.2% 18.2% 18.2% 18.2% 18.2% 18.2%

2. Override i. Use marginal tax rate

3. Overide ii: Absolute projection

Capex as a % of revenues

Strong case 1 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5%

Base case 2 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0%

Weak case 3 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5%

Income in equity affiliates growth (%)

Strong case 1 10.0% 9.5% 9.0% 8.5% 8.0% 8.0% 8.0% 8.0% 8.0%

Base case 2 8.0% 7.5% 7.0% 6.5% 6.0% 6.0% 6.0% 6.0% 6.0%

Weak case 3 6.0% 5.5% 5.0% 4.5% 4.0% 4.0% 4.0% 4.0% 4.0%

Minority interest growth (%)

Strong case 1 10.0% 9.5% 9.0% 8.5% 8.0% 8.0% 8.0% 8.0% 8.0%

Base case 2 8.0% 7.5% 7.0% 6.5% 6.0% 6.0% 6.0% 6.0% 6.0%

Weak case 3 6.0% 5.5% 5.0% 4.5% 4.0% 4.0% 4.0% 4.0% 4.0%

Data tables

Display 2013 EPS based on various revenue growth assumptions (column) and gross profit margin assumptions (row)

2013 gross profit margin

$0.68 33.2% 34.2% 35.2% 36.2% 37.2%

33.7% 0.68 0.68 0.68 0.68 0.68

32.7% 0.68 0.68 0.68 0.68 0.68

2013 Revenue growth range 31.7% 0.68 0.68 0.68 0.68 0.68

30.7% 0.68 0.68 0.68 0.68 0.68

29.7% 0.68 0.68 0.68 0.68 0.68

28.7% 0.68 0.68 0.68 0.68 0.68