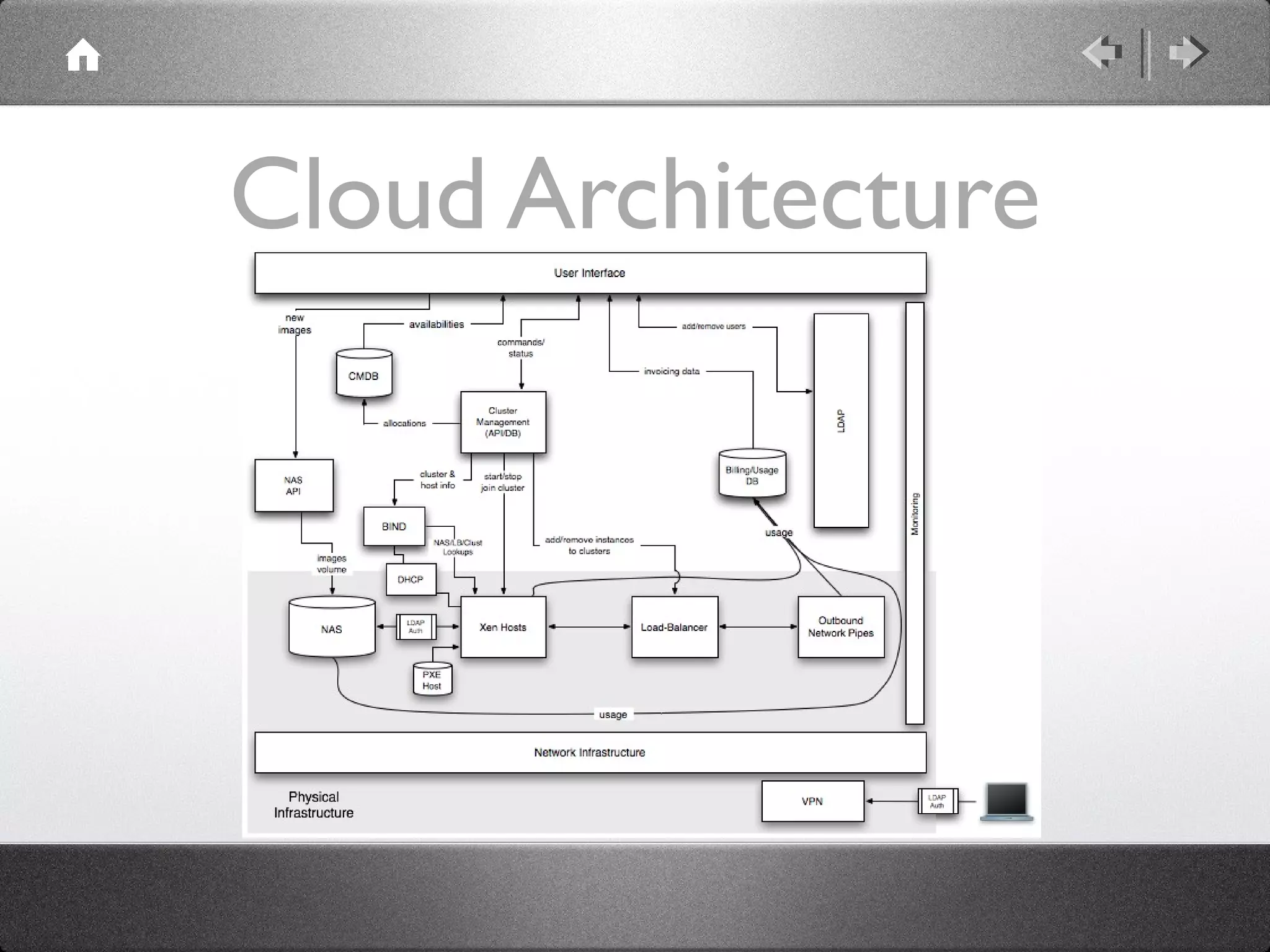

AppNexus is a cloud computing infrastructure company founded by Brian O'Kelley and Michiel Nolet. It aims to solve scaling, globalization, and integration challenges faced by Right Media through a global cloud architecture with multiple "Nexuses" providing services. Its revenue sources include renting servers, storage, bandwidth and profit-sharing with service providers. It plans to grow through recruiting applications and software providers in a self-reinforcing network effect. The company aims to launch its first location in January 2008 and expand globally over three phases to become the high-end leader in the cloud computing market.