Property Developments - Queensland State Budget 2019- 2020

•

0 likes•22 views

The document summarizes recent changes to property taxes in Queensland's 2019-2020 state budget that are aimed to increase tax revenue but may undermine the state's competitiveness. Specifically: 1. Land tax rates were increased by 0.25-0.75% for commercial landholdings over $5 million. 2. The absentee land tax surcharge was increased from 1.5% to 2% for foreign owners who don't reside in Australia. 3. A new 2% foreign surcharge on land tax was introduced for foreign companies and trusts owning land valued over $350,000. However, industry groups warn that nine increased property taxes since 2016 are cooling investment in Queensland and impacting

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

Changes to the foreign resident capital gains withholding tax regime - 1 Augu...

Changes to the foreign resident capital gains withholding tax regime - 1 Augu...Property Developments

More Related Content

What's hot

Changes to the foreign resident capital gains withholding tax regime - 1 Augu...

Changes to the foreign resident capital gains withholding tax regime - 1 Augu...Property Developments

What's hot (20)

2017 Town of Parry Sound Budget - Budget Overview #3 (Jan 13 2017)

2017 Town of Parry Sound Budget - Budget Overview #3 (Jan 13 2017)

Building good relations between IFIs & Finance ministries - Richard Hughes, H...

Building good relations between IFIs & Finance ministries - Richard Hughes, H...

Changes to the foreign resident capital gains withholding tax regime - 1 Augu...

Changes to the foreign resident capital gains withholding tax regime - 1 Augu...

Alamo Heights CCM 09.23.19 Item #9 Proposed Budget FY 2019-20

Alamo Heights CCM 09.23.19 Item #9 Proposed Budget FY 2019-20

Alamo Heights CCM 08.12.19 Item #7 Proposed Budget FY 2019-20

Alamo Heights CCM 08.12.19 Item #7 Proposed Budget FY 2019-20

GAMABrief: Preparing for the Capital Gains Tax Hike

GAMABrief: Preparing for the Capital Gains Tax Hike

Proactive Year-end Financial and Tax Planning Strategies

Proactive Year-end Financial and Tax Planning Strategies

Alamo Heights CCM 08.12.19 Item #8 Proposed 2019 Tax Rate

Alamo Heights CCM 08.12.19 Item #8 Proposed 2019 Tax Rate

News Flash October 27 2014 - IRS Inflation Adjustments for 2015

News Flash October 27 2014 - IRS Inflation Adjustments for 2015

Similar to Property Developments - Queensland State Budget 2019- 2020

Similar to Property Developments - Queensland State Budget 2019- 2020 (20)

Laurentian Bank Securities - Economic Research and Strategy

Laurentian Bank Securities - Economic Research and Strategy

Safyr Utilis Mauritius Budget 2016/17 Tax highlights

Safyr Utilis Mauritius Budget 2016/17 Tax highlights

SAFYR UTILIS Mauritius Budget 2016-17 Tax Highlights

SAFYR UTILIS Mauritius Budget 2016-17 Tax Highlights

The Financial Planners Guide to the Summer Budget 2015

The Financial Planners Guide to the Summer Budget 2015

Federal budget guide 2018 mazars australia_9th may

Federal budget guide 2018 mazars australia_9th may

Recently uploaded

Recently uploaded (20)

Common Legal Risks in Hiring and Firing Practices.pdf

Common Legal Risks in Hiring and Firing Practices.pdf

CASE STYDY Lalman Shukla v Gauri Dutt BY MUKUL TYAGI.pptx

CASE STYDY Lalman Shukla v Gauri Dutt BY MUKUL TYAGI.pptx

judicial remedies against administrative actions.pptx

judicial remedies against administrative actions.pptx

Understanding the Role of Labor Unions and Collective Bargaining

Understanding the Role of Labor Unions and Collective Bargaining

Who is Spencer McDaniel? And Does He Actually Exist?

Who is Spencer McDaniel? And Does He Actually Exist?

Smarp Snapshot 210 -- Google's Social Media Ad Fraud & Disinformation Strategy

Smarp Snapshot 210 -- Google's Social Media Ad Fraud & Disinformation Strategy

Property Developments - Queensland State Budget 2019- 2020

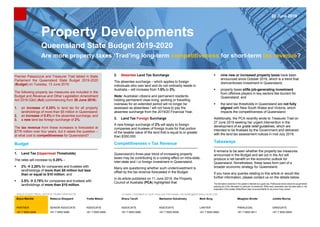

- 1. GOLD COAST REAL ESTATE TEAM CONTACTS TO EMAIL A MEMBER OF OUR TEAM USE FIRSTNAME.LASTNAME@MINTERELLISON.COM Bryce Melville Rebecca Sheppard Yvette Mason Shona Tarulli Marieanne Golubinsky Mark Borg Meaghan Brodie Juliette Murray PARTNER SENIOR ASSOCIATE ASSOCIATE ASSOCIATE ASSOCIATE LAWYER PARALEGAL GRADUATE +61 7 5553 9424 +61 7 5553 9490 +61 7 5553 9400 +61 7 5553 9400 +61 7 5553 9539 +61 7 5553 9552 +61 7 5553 9411 +61 7 5553 9455 28 June 2019 Property Developments Queensland State Budget 2019-2020 Are more property taxes ‘Trad’ing long-term competitiveness for short-term tax revenue? Premier Palaszczuk and Treasurer Trad tabled in State Parliament the Queensland State Budget 2019-2020 (Budget) on Tuesday, 13 June 2019. The following property tax measures are included in the Budget and Revenue and Other Legislation Amendment Act 2019 (Qld) (Act) (commencing from 30 June 2019): 1. an increase of 0.25% to land tax for all property landholdings of more than $5 million in Queensland; 2. an increase of 0.5% in the absentee surcharge; and 3. a new land tax foreign surcharge of 2%. The tax revenue from these increases is forecasted at $778 million over four years, but it raises the question – at what cost to competitiveness for Queensland? Budget 1. Land Tax (Uppermost Thresholds) The rates will increase by 0.25% – ▪ 2% → 2.25% for companies and trustees with landholdings of more than $5 million but less than or equal to $10 million; and ▪ 2.5% → 2.75% for companies and trustees with landholdings of more than $10 million. 2. Absentee Land Tax Surcharge The absentee surcharge – which applies to foreign individuals who own land and do not ordinarily reside in Australia – will increase from 1.5% to 2%. Note: Australian citizens and permanent residents holding permanent visas living, working or travelling overseas for an extended period will no longer be assessed as absentees / will not have to pay the absentee surcharge from the 2019/20 Financial Year. 3. Land Tax Foreign Surcharge A new foreign surcharge of 2% will apply to foreign companies and trustees of foreign trusts for that portion of the taxable value of the land that is equal to or greater than $350,000. Competitiveness v Tax Revenue Queensland’s three-year trend of increasing property taxes may be contributing to a cooling effect on intra-state, inter-state and / or foreign investment in Queensland. Many are questioning whether such underinvestment is offset by the tax revenue forecasted in the Budget. In its article published on 11 June 2019, the Property Council of Australia (PCA) highlighted that: ▪ nine new or increased property taxes have been announced since October 2016, which is a trend that disincentivises investment in Queensland; ▪ property taxes stifle job-generating investment from offshore players in key sectors like tourism for Queensland; and ▪ the land tax thresholds in Queensland are not fully aligned with New South Wales and Victoria, which impacts the competitiveness of Queensland. Additionally, the PCA recently wrote to Treasurer Trad on 27 June 2019 seeking her urgent intervention in the development of ex gratia relief guidelines, which are intended to be finalised by the Government and delivered with the land tax assessment notices in mid-July 2019. Takeaways It remains to be seen whether the property tax measures announced in the Budget and set out in the Act will produce a net benefit on the economic outlook for Queensland. Nonetheless, these taxes form part of a broader economic strategy for Queensland. If you have any queries relating to this article or would like further information, please contact us on the details below. The information contained in this update is intended as a guide only. Professional advice should be sought before applying any of the information to particular circumstances. While every reasonable care has been taken in the preparation of this update, MinterEllison does not accept liability for any errors it may contain.