Let's Toke Business June 2018

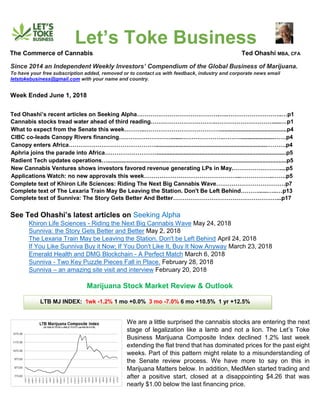

- 1. Let’s Toke Business The Commerce of Cannabis Ted Ohashi MBA, CFA Since 2014 an Independent Weekly Investors’ Compendium of the Global Business of Marijuana. To have your free subscription added, removed or to contact us with feedback, industry and corporate news email letstokebusiness@gmail.com with your name and country. Week Ended June 1, 2018 Ted Ohashi’s recent articles on Seeking Alpha…………………………………….….………………………..…p1 Cannabis stocks tread water ahead of third reading…………………………….………………………….....…p1 What to expect from the Senate this week………..…………………………………..........................................p4 CIBC co-leads Canopy Rivers financing……………………….......………………….……….....................……p4 Canopy enters Africa………………………………………......................................................................……….p4 Aphria joins the parade into Africa……………………….................................................................................p5 Radient Tech updates operations…................................................................................................................p5 New Cannabis Ventures shows investors favored revenue generating LPs in May.……………………....p5 Applications Watch: no new approvals this week…………………………………………...……………..…….p5 Complete text of Khiron Life Sciences: Riding The Next Big Cannabis Wave………………………………p7 Complete text of The Lexaria Train May Be Leaving the Station. Don't Be Left Behind………......…..…p13 Complete text of Sunniva: The Story Gets Better And Better………………………………………………...p17 See Ted Ohashi’s latest articles on Seeking Alpha Khiron Life Sciences - Riding the Next Big Cannabis Wave May 24, 2018 Sunniva: the Story Gets Better and Better May 2, 2018 The Lexaria Train May be Leaving the Station. Don't be Left Behind April 24, 2018 If You Like Sunniva Buy it Now; If You Don't Like It, Buy It Now Anyway March 23, 2018 Emerald Health and DMG Blockchain - A Perfect Match March 6, 2018 Sunniva - Two Key Puzzle Pieces Fall in Place. February 28, 2018 Sunniva – an amazing site visit and interview February 20, 2018 Marijuana Stock Market Review & Outlook LTB MJ INDEX: 1wk -1.2% 1 mo +0.0% 3 mo -7.0% 6 mo +10.5% 1 yr +12.5% We are a little surprised the cannabis stocks are entering the next stage of legalization like a lamb and not a lion. The Let’s Toke Business Marijuana Composite Index declined 1.2% last week extending the flat trend that has dominated prices for the past eight weeks. Part of this pattern might relate to a misunderstanding of the Senate review process. We have more to say on this in Marijuana Matters below. In addition, MedMen started trading and after a positive start, closed at a disappointing $4.26 that was nearly $1.00 below the last financing price.

- 2. The LTB Licensed Producer Index eased 0.4% last week outperforming the average. The results were dominated by The Green Organic Dutchman that hit the market with a strong opening. Without TGOD, the LP Index would have been very much in line with the average. The group had lobbied to have outdoor growing of cannabis banned in the regulations but the Senate approved allowing outdoor growing. This is not the final word on the matter but it was a minor setback. We think the Licensed Producers will generally benefit from passage of Bill C-45. The Canadian Cannabis Composite Index, published by Davis and Associates Capital Corp. advanced 4.5% last week. This index is heavily weighted toward the licensed producers and larger market cap companies and has been generally outperforming the other major indexes in the past couple of months. As we have said in the past, this shows the benefit of following more than one index. (access the 3Cindex here) LTB Low-Priced Composite backtracked 2.1% last week reflecting the nervousness inherent in the market. All three of the LTB stock price indexes are showing a similar pattern. Prices have adjusted down prior to the legalization legislation in Canada and more recently it is as if investors are biding their time to see what emerges from the Senate next week. We continue to believe the Low-Priced cannabis stocks to lead the charge before this cycle is over. Right now ware focussed on Khiron, Lexaria and Sunniva as aggressive buys for the months ahead. We thought prior to Senate third reading on The Cannabis Act, it might be worthwhile taking a look back to see just how uncertain investor psychology has been. In the last 21 weeks, the market has changed direction 13 times. This is the type of market in which momentum players and trend jumpers get whipsawed. But it is a time during which value investors establish positions that server them well over the medium term. Recently we have reiterated our positive position on Khiron, Lexaria and Sunniva. This week we add reminders on Canopy, Organigram and Radient as opportunities not to overlook in this market. Conclusion: an old mentor, frustrated by a market that continued to languish, once said, “The only thing wrong with the market last week is it didn’t go up.” That’s exactly how we feel now. Marijuana Matters

- 3. As Thursday June 7, 2018 is the scheduled date for third reading of The Cannabis Act Bill C-45, we thought it would be appropriate to review the process ahead. We have done this several times as the Bill has gone through its various stages. (See for example, Let’s Toke Business April 29, 2016). For a Bill to be enacted, it must receive first, second and third readings in the House and Senate followed by Royal Assent. We are now at the stage where Bill C-45 needs third reading in both the House and Senate and Royal Assent. Of these, third reading in the House and Royal Assent are largely routine. So third reading in the Senate is the only real hurdle remaining and that will happen in less than a week. Amendments made by the Senate are largely administrative and typically involve correcting spelling and grammar and translation changes in the Bill. Generally, the Senate does not block bills but can slow down the approval process. There have been rare instances in the past where a bill has been delayed with an election intervening resulting in an effective blockage of a bill. We have never found the Senate to be able to stop a bill when the Prime Minister and his majority government have the will to see it passed. A case of illustrating how a problem can be dealt with is Bill C-14 referred to as Medically Assisted Suicide or the Right to Die Legislation. This bill was proposed by the current Liberal government, it was highly controversial and there was a disagreement between the House and the Senate. The Bill required that a patient’s death must be “reasonably foreseeable” and many Senators felt, for example, in the case of Amyotrophic Lateral Sclerosis (ALS) also known as Lou Gehrig's disease, “reasonably foreseeable” death was not a consideration. The Senate sent an amended bill to the House and, in less than a day, the House sent it back to the Senate excluding the change to the “reasonably foreseeable” clause while accepting the administrative changes. The Senate voted with the House when the government’s representative in the Senate, Peter Harder, moved that the Senate agree with the House on the basis that “They are the representatives of the people and they will be held accountable, the government will be held accountable, for the implementation of this bill.” The Senate then voted 44-28 to go along with the House. Bill C-14 had First Reading on April 14, 2016 and received Royal Assent on June 17, 2016. The fact that the appointed Senators decided to yield to the elected Members was an important outcome. The government that passed Medically Assisted Suicide is essentially the same government we have today. With The Cannabis Act, the Senate Committee has identified 40 amendments to bring forward to the Senate. As indicated above, many of these, 29 in fact, are administrative in nature and will have little effect on Bill C- 45. These changes were put forward by Senator Tony Dean, the government representative in the Senate. Among the remaining items, there were some more substantive issues that were dealt with: An amendment proposed banning cannabis promotion through telecommunications. This did not pass. The Cannabis Canada Council that represents the regulated cannabis industry lobbied against outdoor growing. This did not pass and outdoor growing remains. An amendment will require regulators to set maximum THC content limits on cannabis products. Depending on limits set, this could favor black market products which might be more potent. An amendment to allow provinces to ban personal or home growing was passed. This will allow Quebec and Manitoba to prohibit home growing instead of setting the number of plants that can be grown at home at zero. This was positive because one alternative was to totally ban home growing. It might also halt court proceedings against provinces that don’t want home growing. An amendment requiring new products such as vapes, edibles and extracts to pass an application procedure involving both the House and Senate was passed. This will delay such approvals.

- 4. One of the most problematic proposals was to require the government to first report to indigenous (aboriginal) people how their concerns will be addressed. This amendment was not passed. This was one item that could have created a serious delay in passing the bill. These amendments are recommendations to the Senate. The next step is for the committee to submit its report to the Senate which can adopt, reject, alter or propose entirely new amendments ahead of third reading scheduled for June 7 at the latest. You can be sure the Conservative senators will try to make as much noise as possible in the week ahead. Assuming all goes according to plan, Bill C-45 with Senate amendments will pass and be referred back to the House. If the Medically Assisted Suicide approval process can be used as an example, the Liberal majority House will deal with any issues immediately. If the bill needs to be returned to the Senate and the Senate resists, the majority elected Liberals will probably play the “elected v. appointed” card to force the matter. In the case of Medically Assisted Suicide case, remaining disputes were resolved in one or two days. The House of Commons is scheduled to start its summer recess on June 23rd and is not scheduled to sit again until September 17th so there is ample time to deal with matters beforehand. The government has promised legalization “this summer” that would be before the end of August. Our guess is that Bill C-45 will receive Royal Assent before June 23rd at which point it will be law but it seems there is some intention to provide additional time for the provinces to “get ready.” As we saw with California recently, enacting a law can be done with the stroke of a pen but putting a law into effect requires the strokes of many pens. It has been our position all along that the winners out of legalization will be the Licensed Producers. From a business perspective, there was no good news here for the edibles industry and the one year time line following approval of recreational cannabis is probably not much changed. Those focussed on items such as vapes and extracts fall into the same category as edibles. The political noise will likely build as the week progresses and especially if the Senate tries to pull off a political stunt. As we also said before, if this results in a nervous market it will be an opportunity for longer term investors to establish positions at attractive levels. Breaking & Corporate News Canopy Rivers Corporation and AIM2 Ventures Inc. (TSXV: AIMB.P) have entered a binding letter of intent in to complete a transaction that will result in a reverse take-over of AIM2 by Canopy Rivers. Just as important to investors is that Canopy Rivers has entered into an engagement letter with CIBC Capital Markets and GMP Securities L.P. as joint book runners and together with Eight Capital as co-lead agents on behalf of a syndicate that will see Canopy Rivers to issue and sell, on a private placement basis, Subscription Receipts at a price of $3.50 for aggregate gross proceeds of up to $60,000,000. When this offering closes, CIBC will be the second of the big five Canadian chartered banks to participate in providing investment banking services to the Canadian cannabis industry. Canopy Growth (TSX: WEED) (NYSE: CGC) has acquired Daddy Cann Lesotho PTY. Based in the Kingdom of Lesotho, Highlands holds a license to cultivate, manufacture, supply, hold, import, export and transport cannabis and its resin. Lesotho is a high altitude mountainous kingdom that boasts over 300 days of sunshine per year and was the first African nation to legalize medical cannabis in 2017. With very low operating and resource costs, WEED will be able to produce large quantities of high quality medical cannabis at a low cost. Lesotho is also strategically positioned for the future medical cannabis economy of Southern Africa. This is WEED’s first step into Africa and we look forward to working with the strong local team at Highlands

- 5. to establish production and distribution capabilities consistent with Canopy’s global standard for high-quality, regulated medical cannabis products. We think this is yet another positive step in WEED’s move internationally. We also note the similarities between WEED’s expectations from Lesotho and our expectations for Khiron (TSXV: KHRN) from Colombia that is looking to be a low cost producer of pharmaceutical grade cannabis while taking advantage of upstream and downstream benefits related to cannabis production. We think this provides an outstanding example of our view of the future of cannabis. Aphria (TSX: APH) has entered into agreements to form Cannivest Africa Ltd., a joint venture with South African company Verve Group of Companies. As part of this transaction CannInvest will acquire an interest in Verve Dynamics Inc. (“Verve”), a licensed producer of medical cannabis extracts in Lesotho. The transaction is valued at C$4.05 million and will result in Aphria having a 50% ownership in Cannivest that will have a 60% ownership in Verve. This is another example of a Canadian Licensed Producer expanding into Africa. APH’s goal appears to be the same as expressed by Canopy and Khiron, that is, to become one of the lowest-cost producers of medical cannabis and extracts in the world. Radient Technologies Inc. (TSXV: RTI) reports it is in the final review stages of its application to Health Canada’s Office of Medical Cannabis for a production license under the Access to Cannabis for Medical Purposes Regulations (ACMPR). It anticipates receiving the license early in the fourth quarter of this year. The company also has an application to the Office of Controlled Substances for a Dealer’s License is under review and RTI anticipates receiving this license early in the fourth quarter as well. The RTI report provides updated information on the expansion of its manufacturing capacity, cannabis extraction operations included additional extraction business subsequent to Aphria's acquisition of MedReeaf, and expansion in Europe. (read full report here) In an exclusive report in New Cannabis Ventures, Alan Brochstein noted Canadian cannabis stock performance in an article Canadian Cannabis Producer Stocks See Extreme Variances in Performance in May. Brochstein compared the results from the three tiers of companies his indexes measure. Tier 1 includes the Licensed Producers (LP) with sales of at least C$4 million per quarter. This group rallied strongly in May with an advance of 15.5% and is now up 6.6% this year. Tier 2 companies are the other LPs with sales. This group declined 1.1% in May and is down 11.9% year to date. Tier 3 are LPs that are licensed to grow but not to sell. This group declined 3.8% in May and is down 18.7% in 2018. The data suggests that investors focussed on sales in May which may be part of the shift in investor psychology favoring fundamentals. (see full report here) Applications Watch No new Licensed Producers approved this week. The number of LPs is 105. There have been twenty-one LPs approved this year. In the past 53 weeks there have been 63 new Licensed Producer approvals. Of the 105 LPs: 35 are Cultivation & Sale, 65 are Cultivation and 5 are Sale Only. On the list of Fresh Marijuana & Oil producers, there are 30 LPs approved: 19 as Production & Sale, 7 approved for Production and 3 approved as Sale Only. In the category “Sale of Starting Materials,” 10 LPs are approved to sell starting materials: 8 approved to sell plants and 2 approved to sell seeds. There are now 31 public companies that are LPs or own an interest in one or more LPs.

- 6. Licensed producers by province are Ontario (55 or 52%), British Columbia (21 or 20%), Quebec (7 or 7%) Alberta (4 or 4%), Saskatchewan (4 or 4%), New Brunswick (3 or 3%), Nova Scotia (3 or 3%), Manitoba (2 or 2%) and Prince Edward Island (1 or 1%). Percent totals may not add up to 100% due to rounding. Producer Prov Dried Marijuana Fresh Mari & Oil Sale Start Materials 1. 7 Acres ON Cultivation & Sale 2. Abba Medix ON Cultivation 3. ABcann Medicinals ON Cultivation & Sale 4. A.B. Laboratories ON Cultivation 5. Acreage Pharms AB Cultivation 6. Aero Farms ON Cultivation 7. AgMedica Bioscience ON Cultivation 8. Agrima Botanicals BC Cultivation Production 9. Agri-Médic ASP. QC Cultivation 10. Agripharm Corp. ON Cultivation & Sale Production & Sale 11. Agro-Biotech QC Cultivation 12. Agro-Greens Natural Prod SK Cultivation Production 13. Aphria ON Cultivation & Sale Production & Sale 14. Aqualitis NS Cultivation 15. Aurora Cannabis AB Cultivation & Sale Production & Sale 16. Aurora 2nd site QC Cultivation 17. Aurora 3rd site AB Cultivation 18. BC Tweed Joint Venture BC Cultivation 19. BC Tweed JV 2nd site BC Cultivation 20. Bedrocan Canada ON Sale 21. Bedrocan Canada 2nd site ON Cultivation & Sale Production & Sale 22. Beleave Kannabis ON Cultivation Production 23. Bliss Co Holding BC Cultivation 24. Bloom Cultivation AB Cultivation 25. Bloomera ON Cultivation 26. Bonify MB Cultivation 27. Breathing Green Solutions NS Cultivation 28. Broken Coast Cannabis BC Cultivation & Sale Production & Sale 29. Canada’s Island Garden PEI Cultivation & Sale 30. Canna Farms Ltd BC Cultivation & Sale Production & Sale Plants 31. Cannatech Plant Systems BC Cultivation 32. CannMart ON Cultivation 33. CanniMed Ltd SK Sale Sale 34. CannTrust ON Cultivation & Sale Production & Sale Seeds 35. CannTrust 2nd site ON Cultivation Production 36. Canveda ON Cultivation 37. DelShen Therapeutics ON Cultivation 38. Delta 9 Bio-Tech MB Cultivation & Sale 39. Emblem Cannabis ON Cultivation & Sale Production & Sale 40. Emerald Health Botanicals BC Cultivation & Sale Production & Sale 41. Emerald Health 2nd site BC Sale Sale 42. Emerald Health Farms BC Cultivation 43. Evergreen Medicinal BC Cultivation Production 44. Experion Biotechnologies BC Cultivation 45. FV Pharma ON Cultivation 46. Green Relief ON Cultivation & Sale 47. Greenseal Cannabis ON Cultivation 48. GrenEx Pharms AB Cultivation 49. High Park Farms ON Cultivation 50. Hydropothecary QC Cultivation & Sale Production & Sale 51. HydRx Farms ON Cultivation 52. Indiva ON Cultivation 53. IsoCanMed QC Cultivation 54. International Herbs BC Cultivation 55. Int’l Herbs 2nd site NB Cultivation 56. James E. Wagner Cultivation ON Cultivation 57. Maricann ON Cultivation & Sale Production & Sale Plants

- 7. 58. Maricann 2nd site ON Cultivation Sale Plants 59. Maricann 3rd site ON Cultivation 60. Medical Marijuana Group ON Cultivation 61. Medical Saints ON Cultivation 62. MediPharm Labs ON Cultivation 63. MEDIWANNA ON Cultivation 64. MedReleaf ON Cultivation & Sale Production & Sale 65. MedReleaf 2nd site ON Cultivation & Sale 66. Mettrum Bennett North ON Cultivation & Sale Production & Sale 67. Muskoka Growth ON Cultivation 68. Natural Med ON Cultivation 69. Natura Naturals ON Cultivation 70. Northern Green Canada ON Cultivation Production 71. Northern Lights BC Cultivation 72. Original B.C. BC Cultivation & Sale 73. Organigram NB Cultivation & Sale Production & Sale 74. Peace Naturals Project ON Cultivation & Sale Production & Sale Plants 75. Potanicals Green Grow BC Cultivation 76. Prairie Plant Systems SK Cultivation Production 77. PureSinse ON Cultivation 78. Quality Green ON Cultivation 79. Radicle Medical Marijuana ON Cultivation 80. RedeCan Pharm ON Cultivation & Sale 81. RedeCan Pharm 2nd site ON Cultivation Production 82. Rock Garden Medicinals ON Cultivation 83. Solace Health ON Cultivation 84. Spectrum Cannabis ON Cultivation & Sale Cultivation & Sale 85. Sundial Growers AB Cultivation 86. Tantalus Labs BC Cultivation 87. THC Biomedical BC Cultivation & Sale Production & Sale Plants 88. THC Inc NS Cultivation & Sale Production & Sale 89. Tidal Health Solutions NB Cultivation 90. Green Organic Dutchman ON Cultivation & Sale 91. Thrive Cannabis ON Cultivation 92. Tilray BC Cultivation & Sale Production & Sale 93. Tweed Grasslands ON Cultivation 94. Tweed Farms ON Cultivation & Sale 95. Tweed Inc. ON Cultivation & Sale Production & Sales Seeds 96. United Greeneries BC Cultivation & Sale 97. UP Cannabis ON Cultivation Production 98. UP Cannabis 2nd Site ON Cultivation 99. Vert Cannabis QC Cultivation 100. We Grow B.C. BC Cultivation 101. WeedMD ON Cultivation & Sale Production & Sale Plants 102. Weed Me ON Cultivation 103. Whistler Medical Marijuana BC Cultivation & Sale Production & Sale Plants 104. WILL Cannabis Group ON Cultivation To have your name removed from our distribution list, please send your request to letstokebusiness@gmail.com Your name will normally be removed within 24 hours of the receipt of your request. Khiron Life Sciences: Riding The Next Big Cannabis Wave Summary I believe the next wave of superior cannabis investments will be companies in developing countries that will produce pharmaceutical grade cannabis at a very low cost gram. Khiron will be one of those companies. It is operating in Colombia employing many production disciplines to enable it to produce a high quality medical product with consistency.

- 8. Khiron has assembled a top notch Colombian management team led by CEO Alvaro Torres with the support of two Canadian investment bankers that helped finance the company to this point. The Company has just begun to trade as KHRN on the Toronto Stock Exchange Venture Exchange. Depending on early trading progresses, I think the stock is very attractive up to $2.00 per share. In this cannabis market, it is prudent not to chase stocks on major rallies. Should KHRN reach the $2 mark, investors would be well advised to wait for it to trade back. Under $2, however, the stock can be accumulated aggressively. Overview: For some time, I have espoused the theme that the future of Canadian cannabis and cannabis, in general, is international. Less expensive and high quality cannabis will come from: 1. Locations where the combination of climate and resources such as labor, water, and power are ideal for growing cannabis. 2. Developing countries where the costs of production are significantly lower. 3. Companies that recognize the need to adopt the highest standards of production to ensure consistently high-quality product. 4. Management that understands these characteristics and has a sincere desire to produce the highest quality medical cannabis products possible. This is where Khiron Life Sciences (TSXV: KHRN) comes in. KHRN has commenced growing legal, high- grade cannabis in Colombia. I believe KHRN will produce pharmaceutical grade cannabis at a cost that cannot be approached in Canada, the United States or other developed countries. As a result, I believe KHRN embodies the characteristics that will shape the world cannabis industry for years to come. Everyone is familiar with Juan Valdez and Colombian coffee that regularly wins top international awards for its quality. Colombia is the world’s third-largest grower of coffee. If you are an American and buy cut flowers, chances are they were grown in Colombia that produces three out of four cut flowers imported into the U.S. Unfortunately, many people think of other less reputable products grown and shipped from Colombia. As I explain below, we cannot ignore the problem of drugs and narcoterrorism but most attitudes about this illicit activity are at least 25 years out of date. The Colombia of Pablo Escobar and the Medellin Drug Cartel is not the Colombia of today. Colombia has an ideal combination of the stage of economic evolution, social development, geographical conditions and political governance to become an international leader in the production of low cost, pharmaceutical grade medical cannabis. As a result, I think in the very near future we will be talking about KHRN as a leader in the Colombian and world medical cannabis industry. They have all the required Colombian licenses to grow, sell and import and export cannabis and their first crop should be harvested before the end of 2018. I expect in three to five years, we will be talking about Colombian grown, top quality medical cannabis and derivatives in the same way we talk about Colombian coffee and cut flowers. I also forecast Colombia will become the center of the Latin America/South America cannabis world and KHRN has already taken steps to position itself to be the leader in this region. Colombia: The Republic of Colombia is located in northwest South America and is bordered by Panama, Venezuela, Brazil, Ecuador and Peru. It is the fourth largest country in South America and has a population of 49.46 million with a population density of 41 people per square kilometer. The capital is Bogota which has a population of 7.6 million making it much larger than other major Colombian cities such as Cali (2.4 million) and Medellin (2.0 million). Spanish is the official language and is spoken by over 99% of the people. Colombia is ranked second in world biodiversity. The country includes Pacific Ocean and Caribbean Sea coasts to the northwest and northeast, the Andean mountains and the Amazon natural region to the south.

- 9. In considering Colombia in terms of stage of development, the United Nations’ Human Development Index (HDI) ranks a country as a combination of life expectancy, education, knowledge and standard of living. Colombia has an HDI of .727 that is better than the world average of .710. This ranks Colombia slightly better than China at .720 but well behind the United States and Canada at .920. Colombia is in an economic growth mode and is considered a developing country. The World Bank describes it as an ‘upper middle-income economy’ while most others rate it an emerging market economy. Colombia remains heavily dependent on resources including energy and mining but the export of agricultural products such as coffee, cut flowers and bananas are important economic contributors. According to the United States Central Intelligence Agency World Factbook, the Colombian economy ranks 32ndlargest in the world just behind the Philippines and South Africa and just ahead of United Arab Emirates and Bangladesh. Colombia is a democratically governed nation. The President is both head of state and head of government and is elected for one, four-year term through a multi-party system. Executive power rests with the government whereas legislative power is vested in an elected senate and house. The judiciary is independent. The Democracy Index compiled by the Economist Intelligence Unit rates Colombia as a ‘flawed democracy,’ a nation where elections are fair and free and basic civil liberties are honored but with other issues. In 2016, the government approved a peace accord with the Revolutionary Armed Forces of Colombia (FARC) allowing it to form a political party and integrate former fighters into society. FARC’s objective had been to create a Marxist-Leninist regime in Colombia through violent revolution. Integration is a delicate process that is being managed by the government. In the meantime, organized crime (narcotics), guerrilla and paramilitary groups still exist but primarily in the jungle regions and near neighboring borders. As a result, issues associated with drugs are there but Colombia today is not the country of two or three decades ago dominated by images of Pablo Escobar and the Medellin cartel as vividly depicted in films such as “Blow” starring Johnny Depp and Penelope Cruz. Cartels and narcoterrorism are still a fact of life but vast improvements have occurred in recent decades. The Colombians with the help of the Americans have reduced illegal drug production by an estimated 60% in the past decade. The Colombian homicide rate is still too high but has been improving and is now well below new drug centers such as Honduras and by this measure, life in Colombia is significantly more secure than American cities such as St. Louis, Baltimore, New Orleans and Detroit. This is an ideal time to be in business in Colombia as the country is, in my opinion, in the early stages of a secular economic growth cycle on the world stage but costs of production have not yet caught up. For example, based on a 2017 magazine survey of 7,000 people in Colombia: 50% said they make less than US $410 per month. 29% said they make between US $411 and US $800 monthly 21% said they make over US $801 per month. The minimum wage is US $260 per month. The labor force is reasonably well educated, averaging 13.6 years of schooling compared to 16.3 years in Canada and 16.5 years in the U.S. In Colombia, 61.7% of the population is employed compared with 61.0% in Canada and 58.8% in the U.S., In addition, there is an ample supply of laborers with experience in growing in open greenhouses and under controlled conditions. In summary, the CIA that is traditionally very cautious with international assessments says, “Despite decades of internal conflict and drug related security challenges, Colombia maintains relatively strong democratic institutions characterized by peaceful, transparent elections and the protection of civil liberties.”

- 10. The Company: in December 2015, Colombian President Juan Manuel Santos signed a decree that made it legal to grow, process, import and export cannabis and derivatives for medical use. This seemed a little ironic in light of the country’s decades-old struggle against drugs but I think it will prove to be a brilliant move. KHRN was an early adopter and Alvaro Torres, Chief Executive Officer, was the first person to apply for licensing under the new regulations. In September 2017, KHRN became the first company to receive a license from the Ministry of Justice to cultivate cannabis. Since then KHRN has rounded out its license portfolio so it is now permitted to cultivate both high and low THC medical cannabis, produce extracts and sell domestically as well as export. I have analyzed the situation and conclude developing a medical cannabis industry is the right thing at the right time for Colombia and KHRN is my choice for success. Management: As regular readers understand, management is the most important factor in my investment decision-making process and I have had the opportunity to speak directly with many of KHRN’s team. For this report, I have limited my comments to a smaller group of people but they are representative of the entire team. For more information on the management team, please visit the Khiron website here Alvaro Torres, Chief Executive Officer and Director: Alvaro is a Colombian with extensive business experience as an engineer working with major companies. Having spoken to him and having heard him speak in public, he is clearly a builder and motivator. Alvaro was the person who initially had the idea of starting a cannabis business and was able to secure commitments from certain key individuals when KHRN was still a dream. I have seen Alvaro network and interact with employees, investors, and others and I believe he is an outstanding Chief Executive. I also believe he has the vision to grow KHRN into a major international company and to find and attract the best people to join him on the journey. In addition, although Alvaro has great pride in what has been accomplished to date and what he sees ahead, he remains humble, honest and avoids excessive hype. These are qualities I think are very important for a person in his position. He is quietly confident about Khiron’s past and future without being unnecessarily promotional. Juan Diego Alvarez is Chief Regulatory Officer: he is a Columbian and the recognized authority in medical cannabis regulations having been appointed by the Minister of Health to create and draft regulations for the legalization of medical cannabis. It is clear that other authorities in countries in the region look to him as the “resident expert” on all things relating to the regulation of cannabis and call on him from time to time for information. This is a significant asset because it fits very well with KHRN’s plan to expand into Latin and South America. He has rapidly developed expertise on the regulations within neighboring countries and KHRN is developing plans for future international expansion. He is an ideal person to guide KHRN through the complex and sometimes treacherous regulatory processes at home and in neighboring countries. Andrés Galofre is Chief Commercial Officer: Andrés is a Colombian and a co-founder of KHRN. He has 15 years of leadership experience in pharmaceutical marketing, brand management, and distribution of ethical drugs and consumer products in Latin America. Andrés led the launch of Pfizer’s Advil in Colombia that attained a 28% domestic market share. He is an energetic young man that I saw actively and enthusiastically providing information and perspective on KHRN during meetings. His family owns the land that has been leased for the first site. I think Andrés is an excellent choice to market and develop KHRN’s line of products based on what I perceive as a strong work ethic combined with the experience the position demands. Darren Collins Mark Monaghan

- 11. To hear Alvaro Torres describe his initial fundraising experiences, the early stage capital necessary to get KHRN launched was simply not readily available in Colombia. After knocking on many doors, he soon realized something else had to be done. Enter Canadians Darren Collins, now Chief Financial Officer and Mark Monaghan, Director. I have a historical link to both Collins and Monaghan as they were involved at a very early stage in financing Namaste Technologies (TSXV: N), one of my earlier recommendations. So KHRN is an example of the expertise Canada and Canadians have developed in the cannabis industry aside from growing the plant, in this case, investment banking. Monaghan and Collins worked closely with Torres, explaining what investors wanted to see and Torres worked hard to provide it. This developed into a symbiotic relationship as Collins and Monaghan were able to bring in $11.2 million of early-stage capital in a private issue that closed in January 2018. Ultimately, this led to KHRN going public on the TSX Venture Exchange. The message is simple. KHRN has a management team fully capable of taking the company to a leading position in the world cannabis industry while based in Colombia. I expect KHRN to be offering high quality, pharmaceutical grade cannabis and derivatives grown at a fraction of the cost of North American producers. I expect sales to begin in late 2018 and to grow very rapidly moving ahead based on additional facilities in Colombia and in other countries in Latin America and South America. KHRN might become recognized as a model for this type of transaction: development of an international cannabis operation, in this case in Colombia, managed by a strong team led by and comprised mainly of Colombians in a Canadian company traded on a Canadian exchange financed by Canadians. What I also like about KHRN’s Business Plan: The initial property is located near Ibagué, about three hours drive from Bogota. It is 4.5 hectares (over 11 acres) property with a pesticide-free history, flat layout, with electricity, water produced from wells, leased for $1,000 per month and located at the end of a two-lane, mostly paved road approximately 40 miles from the highway. Large sections of the approach are bordered by rice paddies. KHRN has an option to lease a further 15.5 adjacent hectares. The operating facility is much cheaper to build than North American greenhouse or indoor facilities and can be erected in a matter of weeks. The facility uses methodology incorporating many features from structures used in Israel and incorporating their good agricultural practices. Primary extraction and storage facilities are located onsite. The construction of Phase I, to be completed and yielding its first crop in 2018, is expected to produce ten tonnes of flower equivalent to 1,425 kilograms of extracts and will have a capital construction cost of approximately $420,000. In North America, this would usually not be sufficient for a down payment to purchase the land. KHRN is designing best-in-class Standard Operating Procedures covering site design, growing practices, appropriate extraction and formulation processing and adoption of ISO/IEC 17025 that is the standard generally required for testing and calibration laboratories to be deemed technically competent. The property is relatively secure as there is a military base and two police stations nearby. KHRN has implemented the highest standards in global controlled pharmaceutical compliance, including cannabis security, by adopting the U.S. Drug Enforcement Administration (DEA) standard pharmaceutical compliance protocols in security and safety. KHRN intends to expand into Latin America, a region made up of Belize, Costa Rica, El Salvadore, Guatemala, Honduras, Mexico, Nicaragua and Panama that has a population of 640 million and South America made up of Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Guyana, Paraguay, Peru, Suriname, Uruguay and Venezuela that has a population of 423 million. This is a very large prospective market in which Colombia has the advantages of proximity and cultural familiarity.

- 12. In summary, KHRN is a company that is focussed on producing pharmaceutical grade cannabis and derivatives for domestic and international sales. Management has taken several important steps to ensure this will happen. As an early adopter, they are fully licensed and funded to carry out their plans. They have acquired an outstanding first property and the initial harvest is now just months away. To ensure quality, they are designing best-in-class Standard Operating Procedures. To ensure security, they have adopted U.S. DEA standard pharmaceutical compliance protocols in security and safety. In short, they have taken the necessary steps to ensure success. Why is the stock attractive? Background: KHRN is going public on a non-Initial Public Offering (IPO) basis, that is, they are not raising money out of the gate. This is a positive thing. In many cases, a cannabis company will go public and raise money at the same time which dilutes shareholders immediately. But the advantage of an IPO is it sets a benchmark price for the new shares. In KHRN’s case, we do not have a benchmark for trading on day one. The company will begin trading with buy and sell orders matched by the Toronto Stock Exchange Venture Exchange. On January 16, 2018, KHRN completed a private placement offering for a Subscription Receipt at $1.00 per share that effectively means the investor purchased one share and one 24-month warrant exercisable at $1.20 per share. I expect the stock will open higher than this given the significant progress the company has made so far this year including nearly completing Phase 1 of construction and being in a position to reap its first harvest before the end of 2018. KHRN has approximately 45 million shares outstanding and 63 million fully diluted. Even adjusting for the risks of operating in a developing country, at a price of $2 or a market cap of around $100 million, I conclude the stock will still be undervalued. So I think the stock can be purchased in a range of up to $2 per share. Once we get a reading on how the initial crop is developing and other expansion plans KHRN might be getting ready to proceed with, I think the stock can easily trade significantly higher. Given the current state of the cannabis stock market, we do not advise chasing the price above $2. Should it go there, we think investors can wait for a pullback. As a low cost, pharmaceutical grade international cannabis derivatives producer, I think the initial enthusiasm for KHRN might be high so investors should maintain objectivity. Risk Factors: in an instance like Khiron, there are risk factors to be taken into account. At the same time, these matters can create superior returns if investor assessments are borne out. 1. Khiron is a relatively new company with little operating history. Of course, all companies in the cannabis industry are relatively young. If a Business Plan can be successfully carried out, investors will benefit from above average risk-adjusted returns. 2. The acceptance of cannabis as a legal product is a relatively new phenomenon and a historically illegal activity is moving above ground. This favorable trend might reverse but, in my opinion, it is more likely to accelerate toward legalization. 3. Colombia is a developing country that has had a history of problems with the illegal drug trade and narcoterrorism. On the other hand, the underground production of drugs has been reduced by an estimated 60% in the past decade. It is also worth noting that the legal medical cannabis trade does not threaten the illegal production of marijuana as it targets an entirely different demographic. 4. KHRN shares have just started to trade and have little history. At the same time, this can produce above average capital appreciation for investors who convert that risk into opportunity.

- 13. Conclusion: I believe investors in Khiron will benefit from riding the next great wave in cannabis stocks. It may take some time for investors to become accustomed to this new reality. Again, we see that as something that will evolve as superior returns for early adopters. The Lexaria Train May Be Leaving The Station. Don't Be Left Behind Lexaria has been a favorite for some time. The DehydraTECH™ technology delivers THC and CBD faster and better when ingested. We have also known DehydraTECH™ has applications in vitamins, non-steroidal anti-inflammatory pain medications and nicotine. Lexaria published impressive in vivo test results for nicotine. When using DehydraTECH™ to deliver nicotine. more was delivered, faster, less was excreted and there was evidence the liver was bypassed. Tobacco companies have been desperately searching for a healthier delivery of nicotine to consumers without combustion. I believe these test results will attract attention from "big" tobacco. This is no time to delay. Get Lexaria into your portfolio immediately. Lexaria Bioscience Corp. (OTCQX: LXRP) has been a personal favorite for over a year. The shares were trading in the $.25 per share range when I first recommended it, moved up to peak at a high of $2.35 per share early this year and has settled back to a recent low of $.82 per share. Recently it recovered to the $1.25 range. LXRP has developed and out-licenses a disruptive and cost-effective DehydraTECH™ technology that promotes healthier administration methods, lower overall dosing and higher effectiveness of ingestible drugs and other beneficial molecules. Many vitamins, drugs, supplements and other beneficial molecules are lipophilic (i.e. fat soluble) and difficult for the human gastrointestinal system to efficiently and effectively absorb. DehydraTECH™ greatly improves the body’s ability to absorb these substances so their benefits can be received more quickly and pleasantly. I initially recommended LXRP as a cannabis edibles play. DehydraTECH™ would potentially: 1. neutralize the "marijuana" taste of CBD; 2. protect CBD from stomach acids so less source material is required to deliver the same dosage to the bloodstream.

- 14. 3. allow more CBD to pass directly from the upper intestine to the bloodstream. This delivers more source material to the bloodstream sooner, and, 4. result in more CBD bypassing liver filtration to be absorbed instead through the lymphatic system, speeding and increasing overall delivery. At the same time, however, we were aware of the potential in other areas, for example, fat soluble vitamins such as A, D, E, K; non-steroidal anti-inflammatory drugs (NSAID) such as aspirin or Tylenol; and nicotine. (see my original Seeking Alpha report: ‘Lexaria - the Best Cannabis Technology You Can Eat’ November 3, 2016) But when LXRP received a Notice of Allowance from the United States Patent and Trademark Office (USPTO) for the use of its DehydraTECH™ technology as a delivery platform for all cannabinoids including THC; fat soluble vitamins; non-steroidal anti-inflammatory pain medications (NSAIDs); and nicotine, the message finally resonated with the investment community and this was the trigger that moved the stock sharply higher. Subsequently, LXRP filed a new patent application with the USPTO utilizing the technology for delivery of phosphodiesterase type 5 (PDE5) inhibitors – trade names of existing well-known products include ViagraTM(sildenafil) and CialisTM (tadalafil). What got investors so excited was the realization that while cannabis was a great new market for the technology, it was by far the smallest: the vitamin market is almost four times larger, the NSAIDs market is just under eight times larger and the tobacco industry is almost one hundred times larger. This implies the potential for DehydraTECH™ is greater by some double or possibly triple digit multiple. That is why the Press Release of April 17, 2018 caught my immediate attention. In that release, LXRP announced positive topline results upon completion of its first ingestible nicotine in vivo (animal) absorption study. LXRP is scientifically testing the use of its patented DehydraTECH™ technology as a possible new nicotine delivery method. The Company says, “Nicotine was administered in a nicotine polacrilex derivative format as is widely commercialized today in nicotine replacement therapy products such as chewing gums.” The study results show the technology resulted in: • 1,160% faster delivery of equivalent peak quantities of nicotine to the bloodstream than achieved with controls; • 148% gain in the quantity of peak nicotine delivery to the bloodstream relative to controls; • 560% higher brain levels of nicotine where nicotine effects are focused, compared to controls; • Lower urine levels of nicotine excreted than controls, for enhanced nicotine activity and bioavailability over the course of the study;

- 15. • Lower quantities of key liver metabolites in the bloodstream as hypothesized, suggesting bypass of first pass liver metabolism. As the Company said, “The LXRP formulations generally achieved faster absorption, higher peak absorption and higher overall quantities of nicotine, on average, in the blood than the concentration-matched control formulations at both the 1mg and 10 mg/Kg doses tested. Furthermore, as previously reported, there were no obvious signs of gastrointestinal distress indicating that the animals (rats) appeared to tolerate the treatment well.” According to the World Health Organization (WHO), cigarette smoking is the leading cause of preventable death in the world. There were an estimated 5.5 trillion cigarettes sold to over 1 billion customers with a value of $699 billion worldwide in 2015. Current trends show tobacco use will cause more than 8 million annual deaths by 2030. (Centers for Disease Control and Prevention) But here is what we know about nicotine. In the amounts that enter a smoker’s bloodstream, nicotine is not dangerous. As an article by Sally Satel in Forbes said, “[nicotine] isn’t the stuff that can cause serious illness and death from cancer, lung and heart disease. Those culprits are the tar and toxic gases that are released from burning tobacco when you smoke.” Michael Russell who developed nicotine gum said, “People smoke for nicotine but they die from the tar.” Finally, as Mitchell Zeller, director of the Center of Tobacco Products (a division of the Federal Drug Administration) said, “…vaping – as puffing on an e-cigarette is called – doesn’t burn tobacco and release those carcinogens. Unfortunately, many Americans don’t understand that nicotine itself isn’t the villain.” Because of this, tobacco use has been suffering serious declines for many years. As WHO reports in 2010 there were 3.9 billion non-smokers aged 15 or older in Member States. This was 78% of the population in the age group meaning only 22% were smokers, WHO projects this will rise to 81% or only 19% smokers by 2025. But if nicotine can be delivered without combustion, it could be much safer and less intrusive to persons nearby which means the tobacco producers would benefit. In the meantime, tobacco has been assailed on many fronts including addiction rate studies that show nicotine is more addictive than heroin, cocaine, alcohol or cannabis. Not only that data shows that nicotine causes more deaths other commonly used drugs. It causes four times more deaths than alcohol; twenty times more deaths than legal drugs; over twenty-five times more loss of life

- 16. than illegal drugs; two hundred times as many deaths as caffeine; and eight hundred times as many deaths as aspirin. Of course, to date there is not one documented death resulting from an overdose of cannabis. As a result, tobacco companies are spending hundreds of millions of dollars in an attempt to save an industry that generates estimated sales of $700 to $750 billion a year excluding China. In addition, in many countries smoking is now socially unacceptable - no longer permitted in businesses such as offices and restaurants and in a growing number of societies it is no longer allowed public areas such as parks and beaches. Sadly, people smoke tobacco for the same reason they smoke cannabis – it delivers the nicotine into the user’s bloodstream far more quickly than ingestion. In addition, when you ingest nicotine or cannabis, the human digestive tract reduces the amount that enters the bloodstream. Third, it has an unpleasant taste and can cause upset stomachs. In effect, you get less of it, it tastes bad, can make you feel ill and it takes longer to be effective. That is where the recently disclosed results from DehydraTECHTM comes in. The published results suggest: 1. The nicotine is delivered to the bloodstream within 15 minutes compared with 2.9 hours; 2. There was a 148% increase in the delivery of quantities of nicotine delivered to the bloodstream; 3. There was 560% higher brain levels of nicotine where nicotine effects are focused; 4. There were lower levels of nicotine excreted in the urine for enhanced nicotine activity and bioavailability; and, 5. Lower quantities of key liver metabolites in the bloodstream as expected suggesting bypass of first pass liver metabolism. I believe this is the type of scientific information that will attract the attention of large tobacco companies that have been working on many alternative nicotine delivery systems trying to eliminate the negative impact of smoking. LXRP management has always intended to license different applications of its technology separately, for example, cannabis to cannabis companies, vitamins to vitamin companies, non-steroidal anti- inflammatory drugs to drug companies and nicotine to tobacco companies. I conclude this data will position LXRP in the crosshairs of one or more large tobacco companies. No one can say when such a licensing or acquisition event will happen. But if the world tobacco industry was a country, it would rank around 25th largest in the world or approximately the size of Poland. So to the top five

- 17. tobacco companies (1. China National Tobacco 2. Philip Morris (NYSE: PM) 3. Japan Tobacco (TYO: JPY) 4. British American Tobacco (LON: BATS) 5. Imperial Tobacco (LON: IMB)), the acquisition of the entire Canadian cannabis industry would not be a major financial decision to buy, not build. A transaction could even come from a smaller company as was the case when Constellation Brands (NYSE: STZ) took an interest in Canopy Growth (USOTC: TWMJF) I conclude the Lexaria train may be leaving the station. Make sure you’re onboard. Sunniva: The Story Gets Better And Better | Summary I had a chance to meet one-on-one with Dr. Anthony Holler, co-founder, Chairman and Chief Executive Officer and David Negus, Chief Financial Officer of Sunniva Inc. The California campus is coming along well. Plants should be in by June/July and the first harvest should commence by September/October. The initial oil conversion testing has had excellent reviews. The Canadian Federal Government arm representing the Oliver Indian Band is six months late in delivering a contract. To mitigate risk, Sunniva is doing due diligence on an alternative location. National Health Services has 95,000 active patients suggesting market penetration of around 35%. NHS growth continues and made a significant contribution to revenue last year. With the shifting political winds blowing in favor of cannabis recently, Sunniva sees a major opportunity in California, which it plans to go after in an aggressive manner. On April 27, 2018, it was my good fortune to interview Dr. Anthony Holler, Chief Executive Officer, Chairman and Co-founder of Sunniva and David Negus, Chief Financial Officer of Sunniva (CSE: SNN) or (OTCQX:SNNVF). Here are the highlights from that meeting: An Update on California Operations: The structural construction at the California campus at Cathedral City is virtually complete. Work has commenced on the internal infrastructure. Propagation is expected to begin in June/July. Since crops take approximately three months, the first harvest should be ready in September/October. The background is California was the wild, wild, west of cannabis in the United States. They are where Canada was around five to seven years ago. In the catch up process, some odd things have resulted. California approved medical marijuana many years ago and never required product testing. It was medicine but they didn’t require testing. Now that adult use cannabis is underway, they require testing. Random testing by various parties in years past have shown that around 85% of the cannabis is contaminated. That’s a major advantage to Sunniva. We are going to have clean, pharmaceutical grade product, which explains why people want to distribute our product and others want us to provide white label product for them. So we are going to focus on supplying these people and building our brand as a trusted source of clean product. With respect to the way we have structured out business, you must begin with the knowledge that the California regulations were set up to protect the small growers for five years. So the maximum size of a grow area, for example, is 22,000 square feet. Sunniva has made “convenience arrangements” with a group of

- 18. tenants that will employ Sunniva to operate their grow rooms and sell us back their output. We identified the individuals, did the paperwork, we will provide all the services and buy the product when it is grown. We supply them with a propagated plant of a certain strain and we take back a mature, fully grown plant. Each room has a different address, different license, its own power supply, water, and so on to comply with all the regulations. The fact is our structure complies fully with the California regulations and at the same time enables us to operate virtually as if we owned it all. At the end of the day, the difference to us is insignificant. We announced recently we received all our temporary state licenses, which is actually a major accomplishment. We have worked very closely with the California regulators at each step along the way and our attention to communication resulted in a positive outcome. This is a strong indication that our business model is fully compliant and acceptable to the regulators. Next we have to do the filings for our annual state licenses and each one of those is very complex. But once they are done, as long as there are no unexpected operating problems, it becomes a routine renewal year after year. We have heard the State of California has started sending out letters to those who haven’t filed for interim licenses and the threat is they can be shut down. The licensing is really a competitive advantage for an operator like Sunniva because we have the financial and human resources to deal with it. The transactional flows in our business model that make it all work for us are complex and hard to duplicate. We suspect many smaller operators will either not be able to complete their applications or it will take them a long time. We’re really excited by the prospect of being the first major grower to get underway and we think this gives us an important advantage over the competition. Sunniva’s other operation in Cathedral City is the oil conversion facility. We have two conversion licenses that are all for our own account: volatile (butane) and non-volatile (CO2). The licenses are for addresses that are beside each other in a small commercial mall. We have purchased some cannabis from others so we can test the operation. We are running the butane system now and our people are extremely pleased with the results. Prospective customers are also very happy. Our CO2conversions will be up and running in a month. We have third parties that have seen the output and the feedback is very positive. We have potential customers that want us to do their extraction for them. Income should start shortly. Just to clarify one thing, the zoning from Cathedral City didn’t allow extraction on our grow site. As a result, we rented a facility for an oil extraction operation nearby. But state regulations had no objection to combining the two so the city is thinking if the state doesn’t care, maybe we shouldn’t either. So they are considering a zoning change. Down the road, we may have both facilities in the one location. An Update on Canada: In Canada we looked at several sites for our location and the industrial park owned by the Osoyoos Indian band in Oliver, B.C., is a very good one. For us, though, timing is critical. We have to get going. We’re ready to start. The Osoyoos band is represented by the Federal Government through Indigenous and Northern Affairs Canada (INAC) and this has resulted in delays. INAC won’t let us break ground until the contract was signed and our contract was supposed to be ready six months ago - in November 2017. As the delay continued, we concluded it was in the interest of our shareholders to look for an alternative site to mitigate risk. We looked at a few alternatives and settled on the former Weyerhaeuser site in nearby Okanagan Falls. We are doing due diligence and will announce a decision when we are satisfied. We should be ready within a few weeks.

- 19. If we decide to change the location, nothing else changes. The physical facility will remain exactly the same. In fact, the new opportunity is to purchase the land. So at OK Falls, we can own the property and that makes it a little easier to finance. The finance plan that we have talked about – bank financing and unsecured debt – is very much intact for either location. We expect to complete our due diligence by the middle of May. So far we have not uncovered any serious issues but we haven’t made a decision yet. We deal with Health Canada regularly and we understand we are close to getting our letter. So that will be the next step. Update on Natural Health Services: Then there is Natural Health Services (NHS). The updated figures will be released in a couple of days with our financial statements so we can’t talk about specifics until then. (That report on April 30, 2018 showed 150,000 active patient files and 95,000 patients). The latest Health Canada figures reported around 270,000 registered patients so you can see how well NHS is doing. That’s about a 35% market share. We are pretty much the acknowledged leader in Canada by all the Licensed Producers. In addition, our patient retention rate is very good. What I can say is you will see NHS has continued to grow. Our clients receive a full service. They are educated about cannabis. They spend time with a doctor and that doesn’t happen with all our competitors. Patients learn about different strains and choose a Licensed Producer. When all that is done, we push the button on the computer and all the necessary data goes to the LP and patients can get their cannabis as soon as the next day. Our patients have to go through all of these steps before we give them a recommendation. Then they come back to be seen again in three months for a reassessment. We offer a real medical experience. Many doctors are reluctant to provide cannabis assessments for their patients because of the onerous paperwork that is required. Doctors with active private practices have told us they would go broke under the avalanche of paper. Of course, we have software that addresses this problem. Right now, our patient flow exceeds the ability of our doctors to process. It’s a wonderful business problem to deal with. Currently, we’re in a hiring mode with respect to doctors. We have a very good doctor training package. We are set up to engage doctors for one day a week or more. We’re very flexible. Also with our software, we think we can expand outside our own clinics to other settings such as doctors' offices and pharmacies. This is one of the opportunities we are working on. In a nutshell, NHS is doing very well. Growth in the California market: We think the biggest change in our thinking of late is the Trump administration seems to have decided to leave the states alone and there is a lot of political pressure in support of that idea from both Democrats and Republicans. Up to now, the market was concerned about the possibility that Attorney General Jeff Sessions would do something negative out of the blue. We always had confidence in California and feel the prospective returns outweigh the risks. Recent developments make us even more confident. California is huge, it’s fragmented and many operators are short of capital. We see this as an ideal opportunity for Sunniva to more aggressively pursue our strategy of growing rapidly to become a major entity in the market. Acquisitions will certainly be a part of that when the opportunity arises. We think all of a sudden, it’s a different world in California and perhaps the U.S. Other people don’t have as much to offer as they aren’t as developed as we are. So we happen to be in an ideal situation to take advantage of the changes and we plan to. Shareholders in a difficult Market: It has been a tough market but our share price today is above where it was when we opened for trading in early January. Not many cannabis companies can say that. We have

- 20. quite a loyal and experienced shareholder base. Many have invested with us in ID Biomedical, CRH Medical, Corriente, and so on. So they know it takes time to build a company. Many important investors were with us previously and they’re with us now. Management is also committed to the long term at Sunniva. We have a voluntary escrow agreement. Our total focus is on the big picture. The long term. Building a great business. We believe we’re doing that and so do most of our shareholders. Other: We would like to explain our delay in releasing our financial statements. We had our audit meeting and informed the auditor of our release date and everything was fine. Then at the last minute they came back and said they needed a few more days. Auditors are under a lot of pressure these days so if they’re not ready, they’ll delay you. So it wasn’t a big deal but we just want people to know how it came about. For newer readers who are not familiar with Sunniva, please see my original Seeking Alpha report on the Company (here) and my Seeking Alpha updates (here), (here) and (here). For a brief background on the participants: Dr. Anthony Holler is a co-founder, chief executive officer (CEO), chairman and director. Holler, who is leading the SNN team, is the former CEO and founder of ID Biomedical, which was a leader in high quality, low-cost manufacturer of flu vaccines and was sold to GlaxoSmithKline (NYSE:GSK) in 2005 for $1.7 billion. Dr. Holler invests in and takes an active role in every company he works with. He is engaged full time with a focus on increasing shareholder value. Dave Negus joined SNN in December 2017 as chief financial officer (CFO). Negus has over 20 years of financial leadership most recently as CFO of Luvo, Inc., a forward-thinking food company. Previously, Negus was vice president, corporate controller at Lululemon Athletica (NASDAQ:LULU) and led the finance team through their initial public offering. Mr. Negus received his Chartered Professional Accountant designation at Deloitte. Conclusion: Here are my takeaways from the meeting: 1. This was my first “in person” contact with Tony and Dave. They are both very well informed, strong leadership personalities. They are well suited for their respective jobs and I believe they will add substantial value in the years ahead. 2. The California campus is well underway and we should see revenue start to flow in the second half of 2018. 3. We can expect a strong flow of news from SNN in the near term. They made it clear that they are going after California aggressively and I think we will see reports as that happens. 4. I like the National Health Services business and it continues to grow and contribute revenue. Of course, we can look forward to Canadian product being offered to patients along with the strains of other Licenses Producers. 5. Subsequent to the interview, Sunniva reported revenue of $5.86 million for the quarter and $16.10 million for the year ended December 31, 2017. Although financial results at this point are not critical to my positive assessment of Sunniva as an investment, to provide some perspective Sunniva ranked seventh among Canadian public cannabis companies based on its recent quarter. My favorite genre of investment is the one that looks more and more attractive each time I talk to management. That is the case with Sunniva. I think this stock belongs in every cannabis portfolio. My favorite characteristic for an investment is one that looks more and more attractive each time I talk to management. That is the case with Sunniva. I think this stock belongs in every cannabis portfolio.