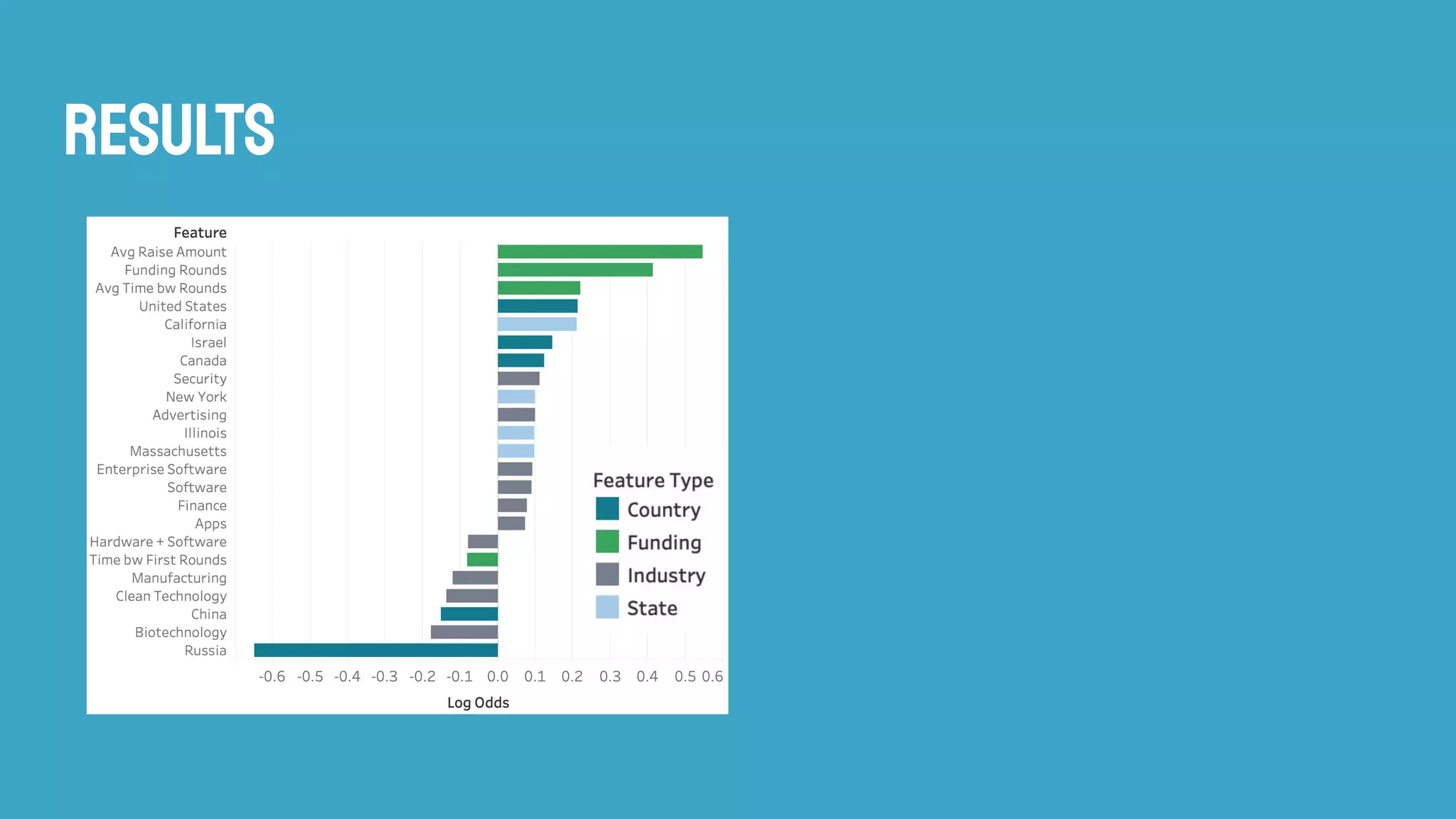

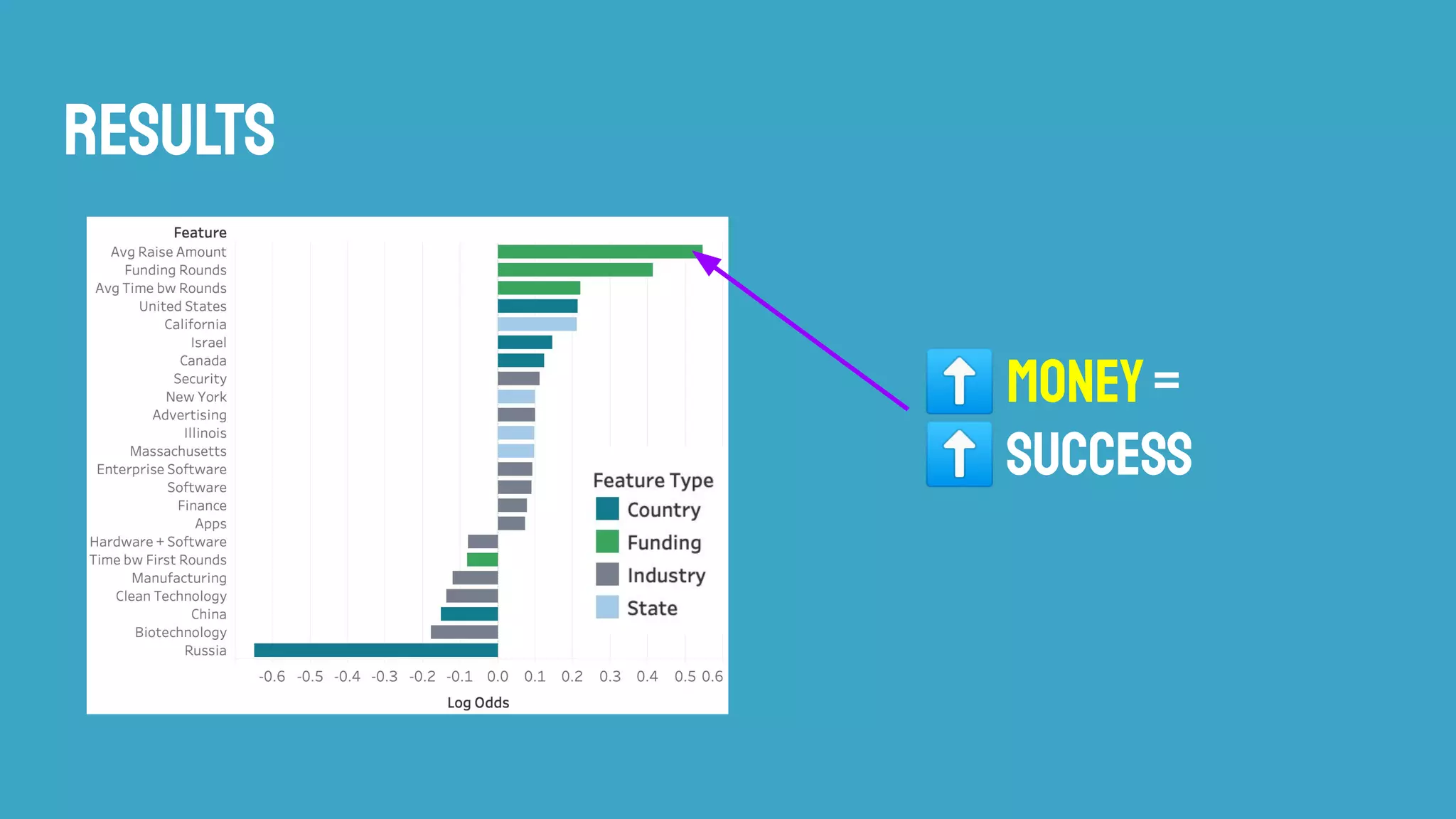

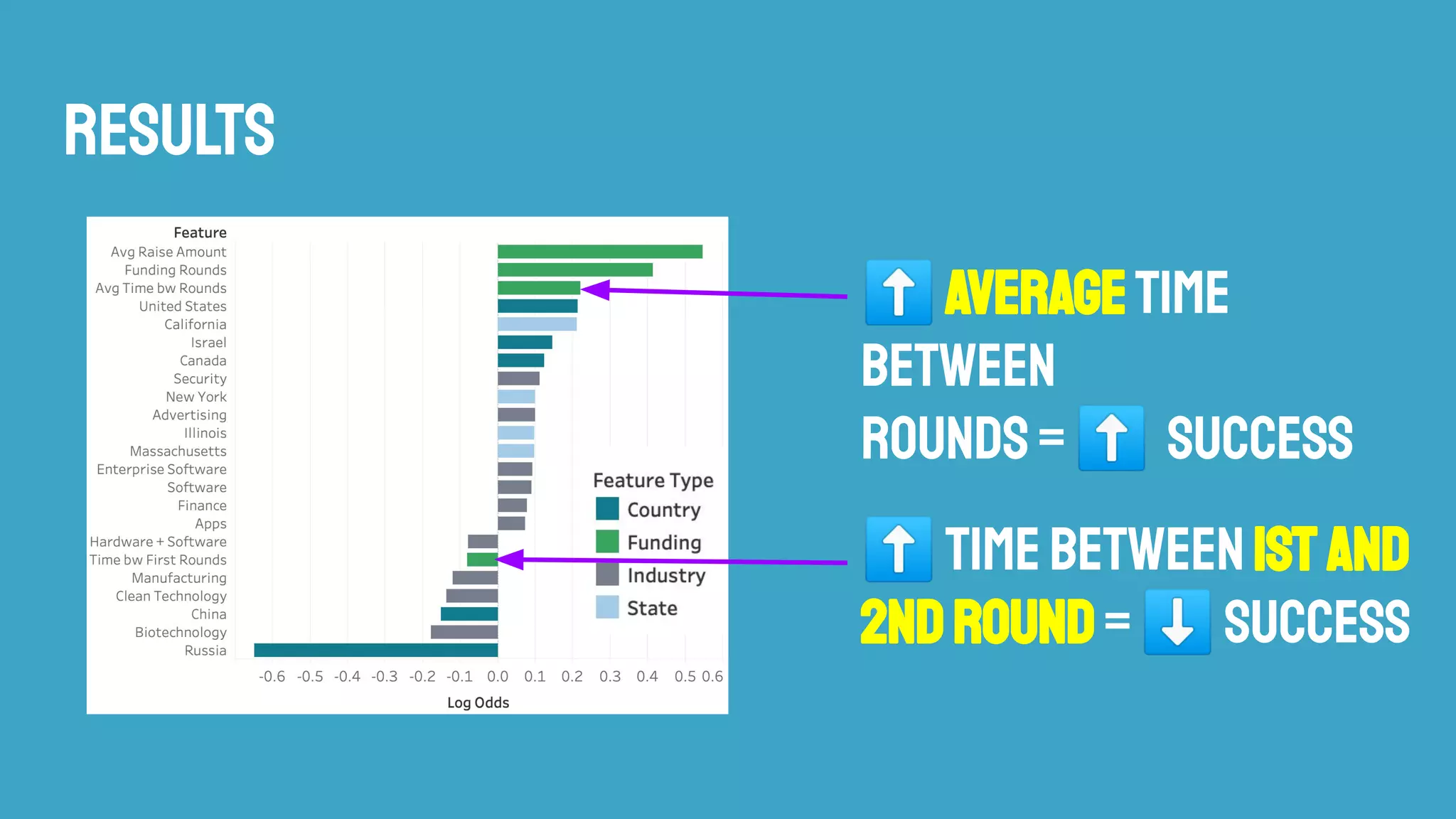

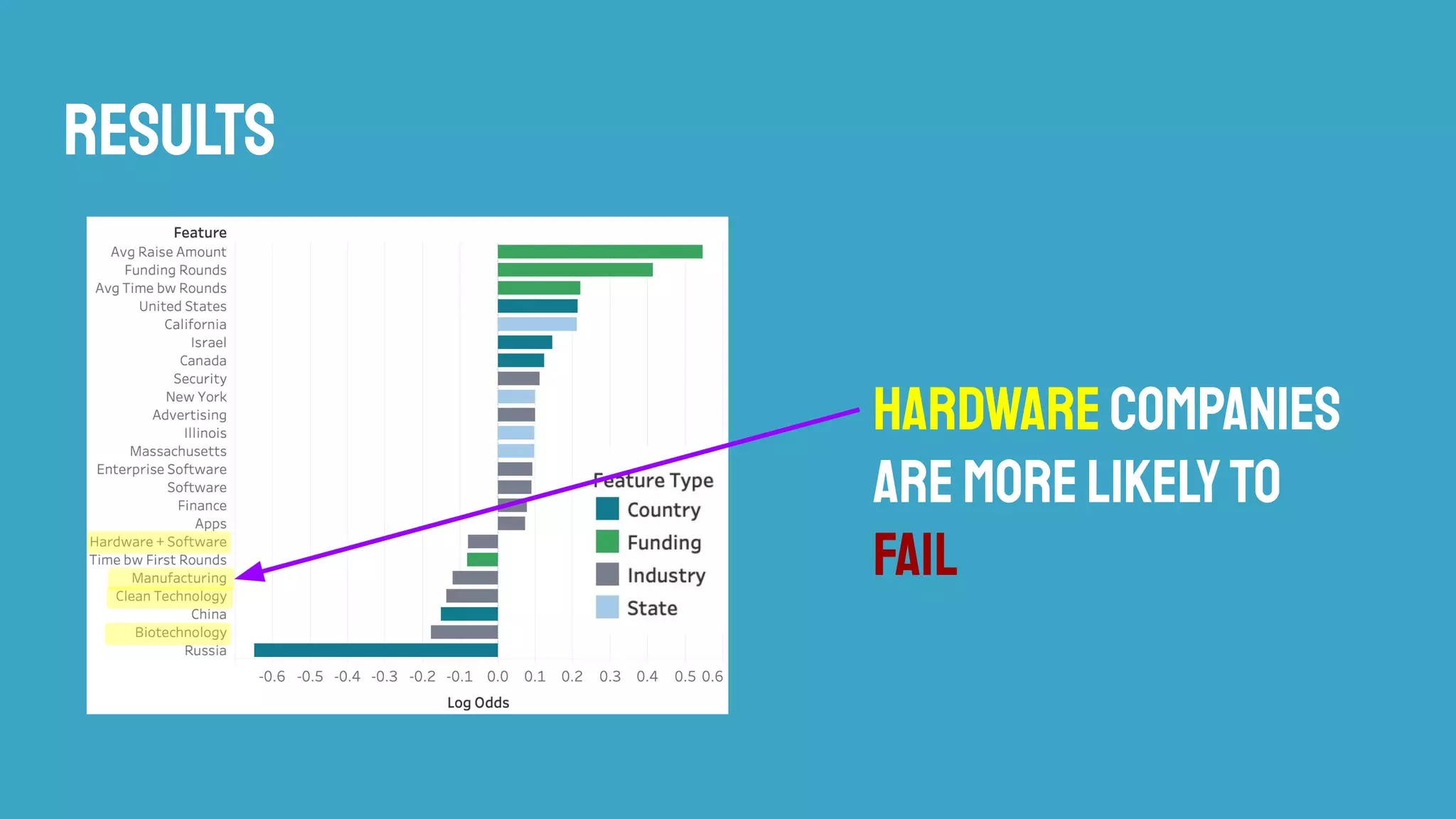

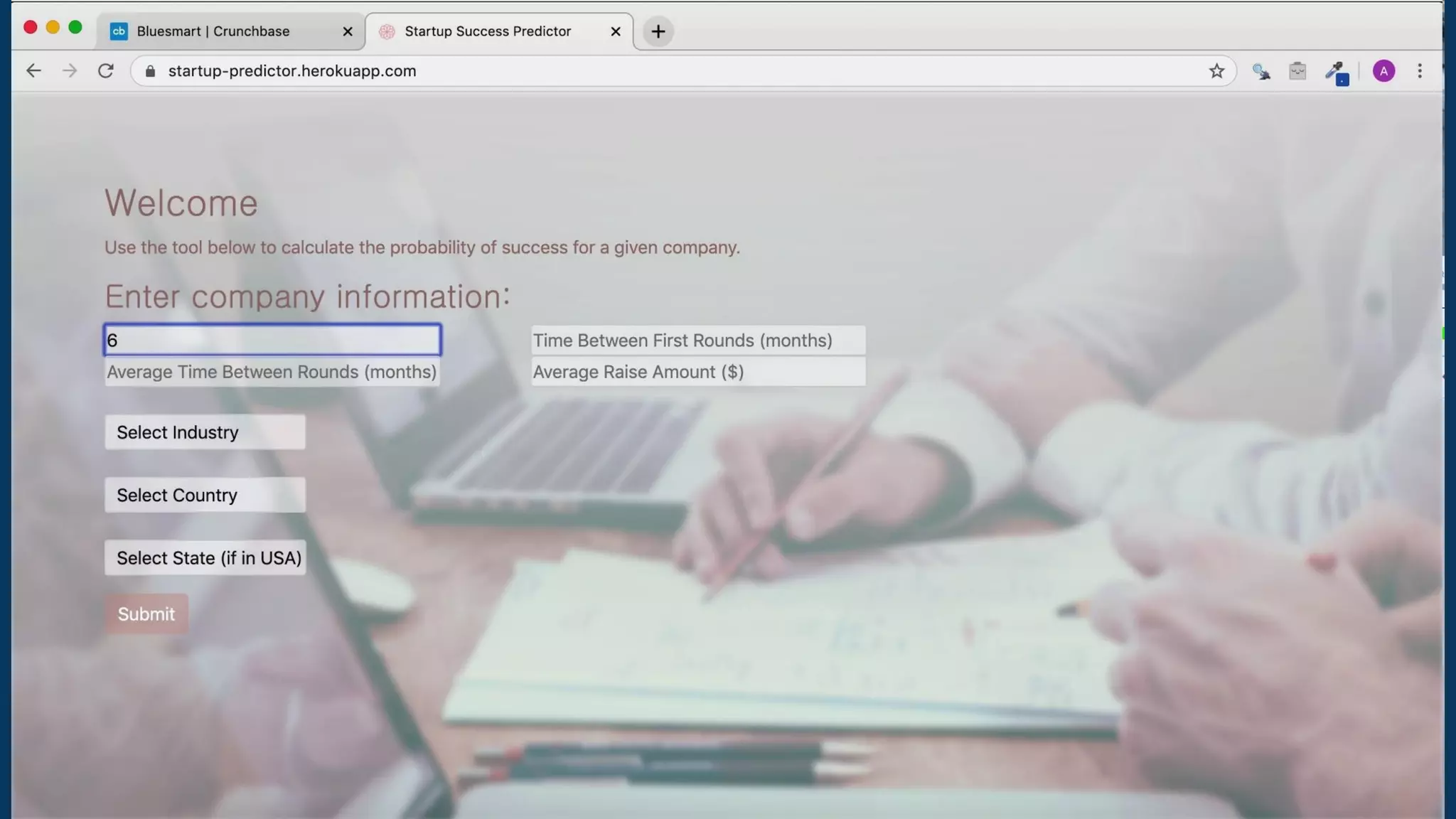

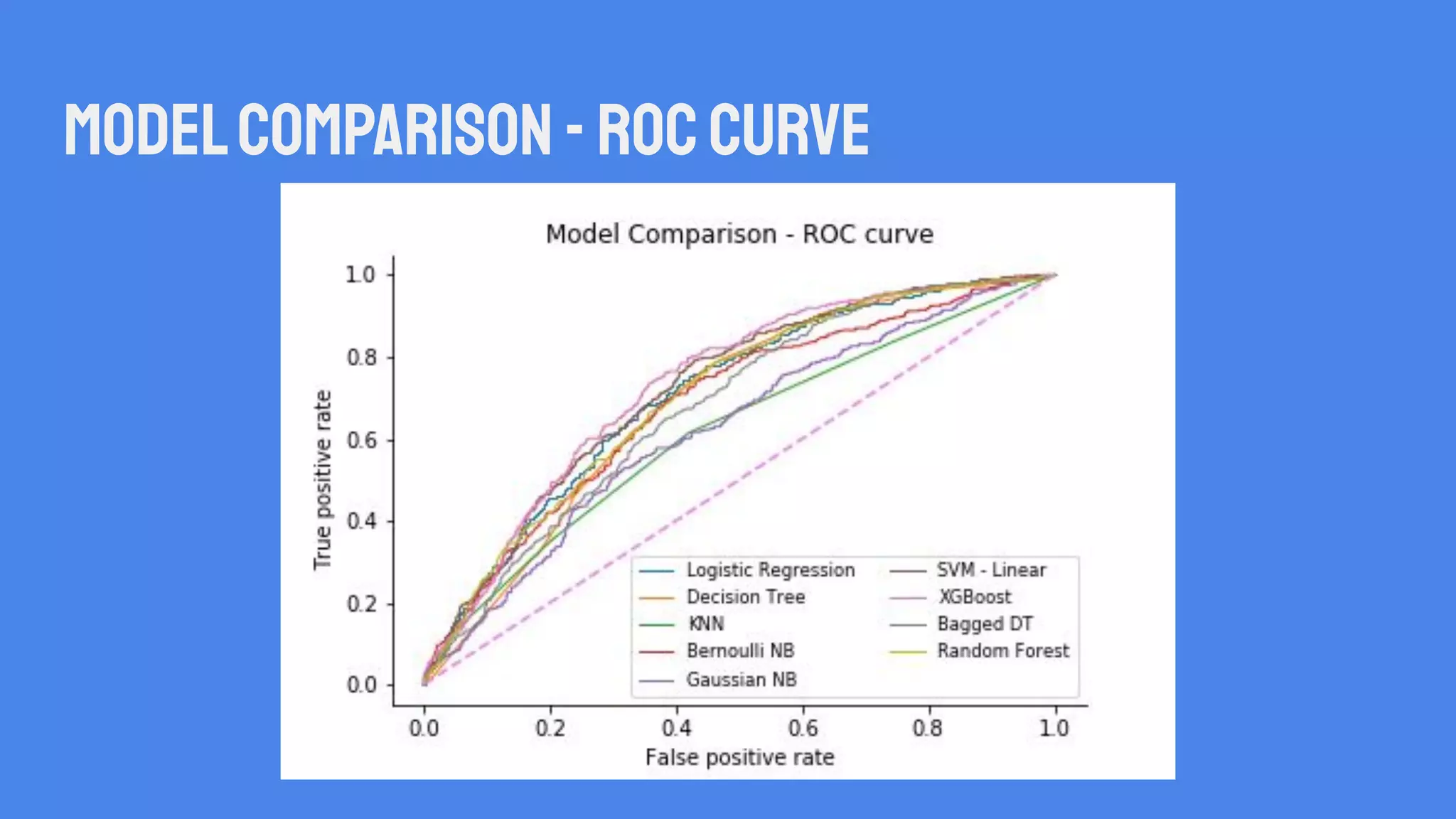

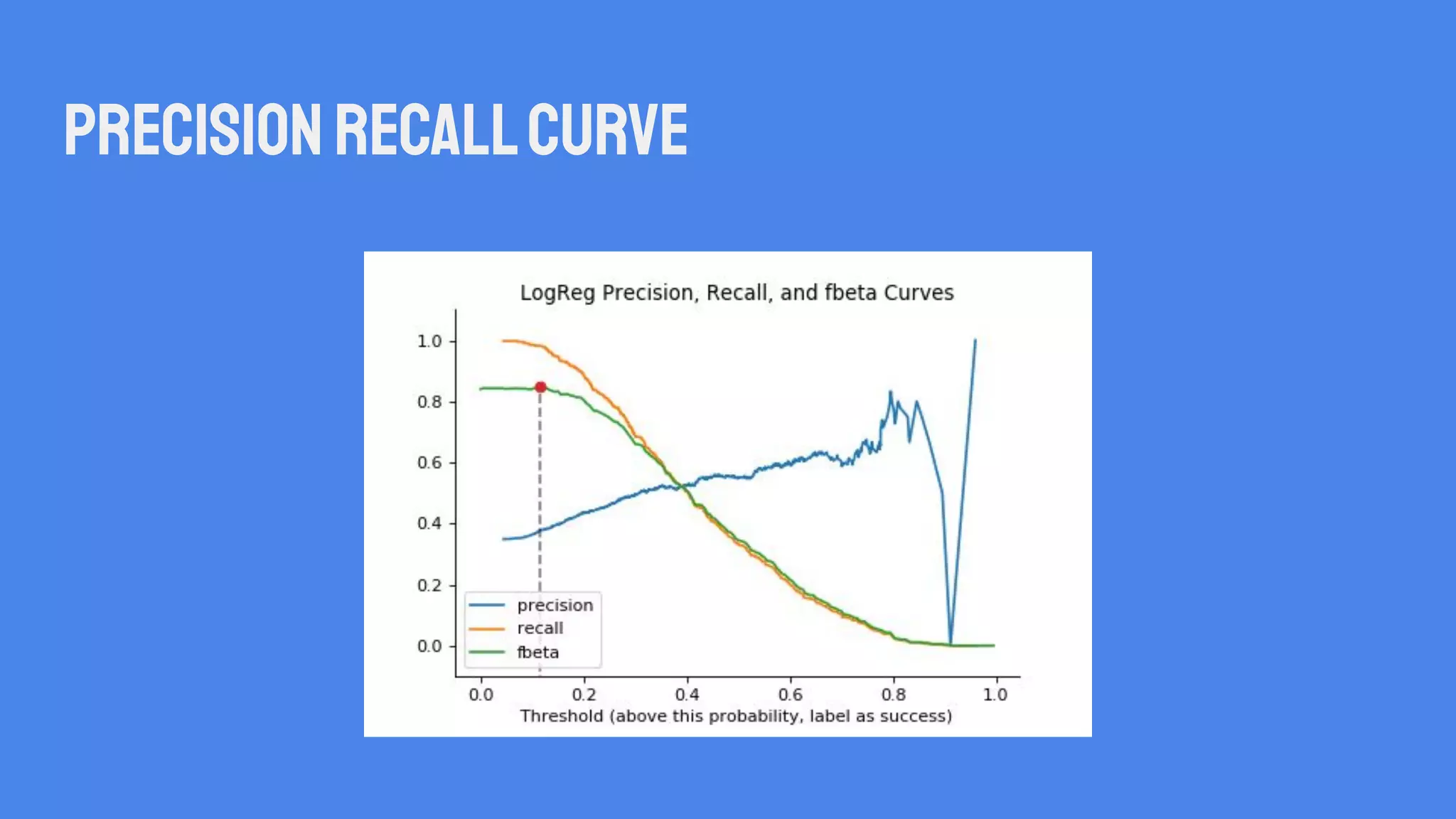

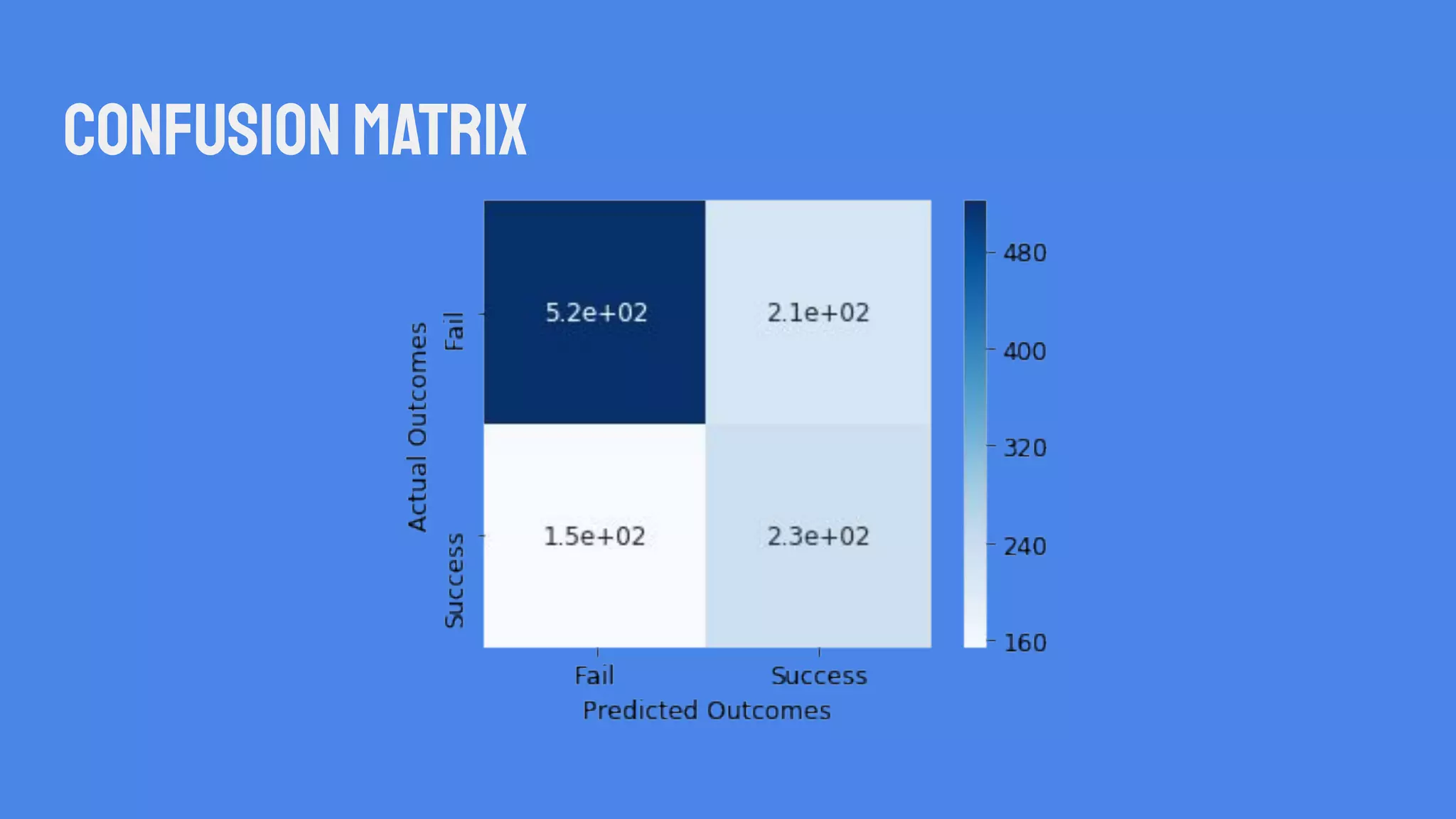

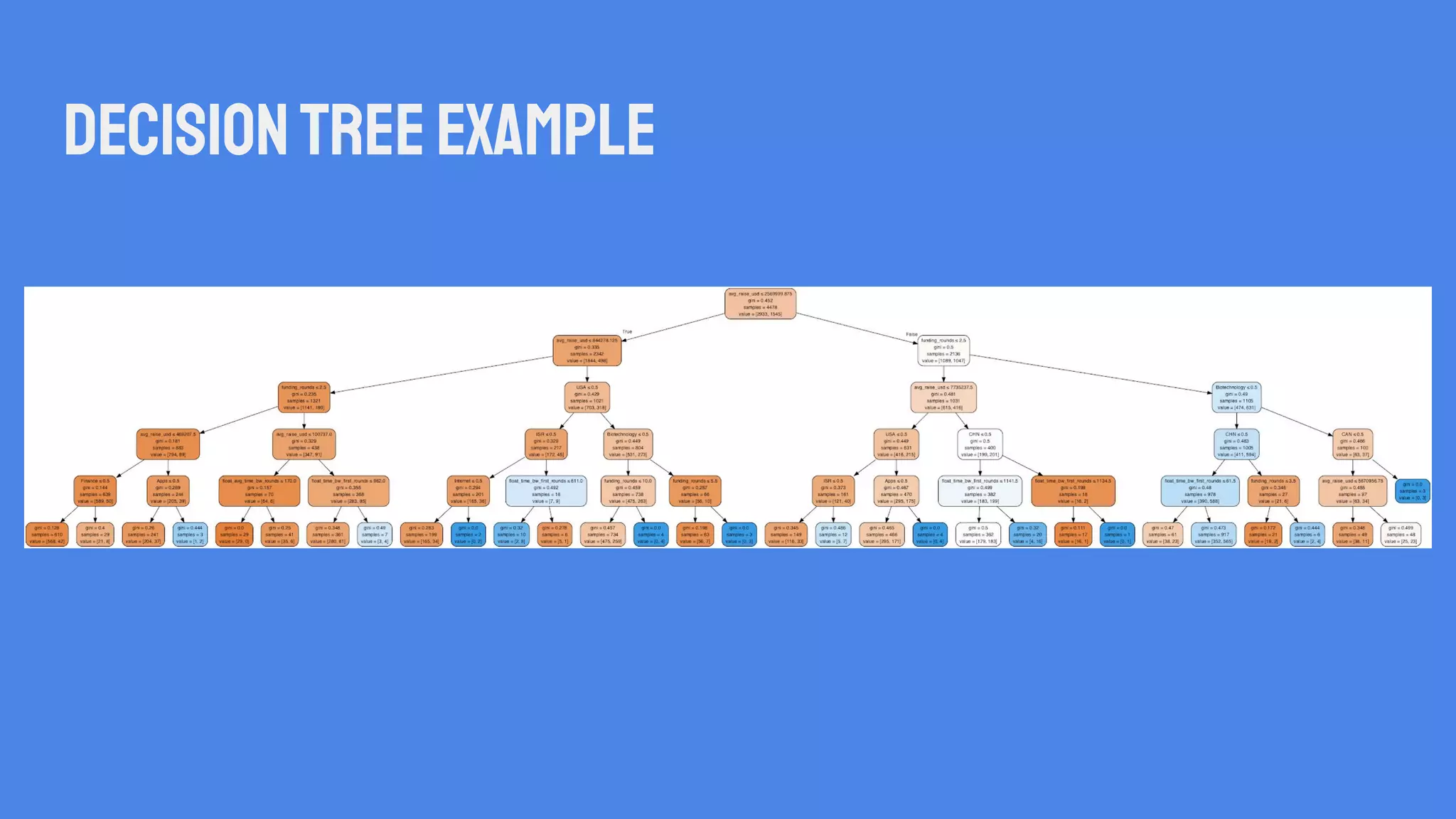

The document describes a methodology used by Crunchbase Enterprise to predict startup failures using early performance data. Classification algorithms and logistic regression were used to analyze features like funding amounts, timing, industry, and location from companies that received 2+ funding rounds. The models found that receiving more money and shorter times between funding rounds increased success rates, while longer times between the first two rounds and being a hardware company decreased success. The logistic regression model had a beta score of 0.85, correctly predicting outcomes 85% of the time.