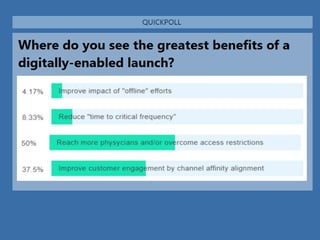

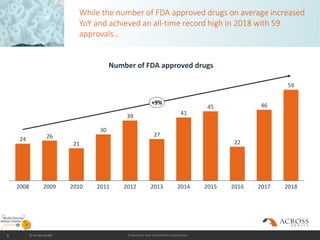

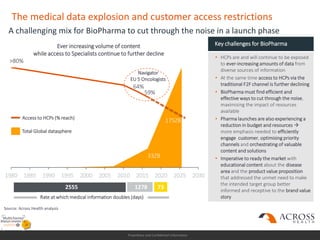

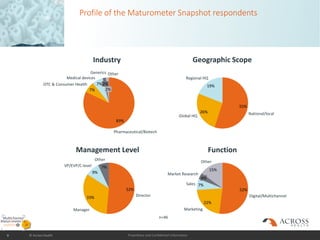

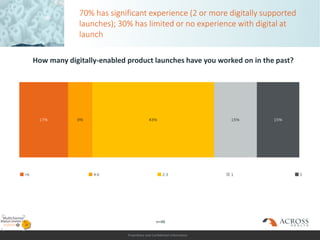

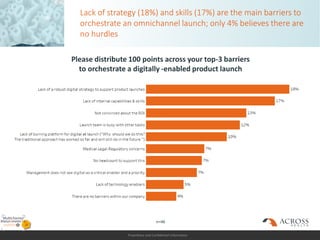

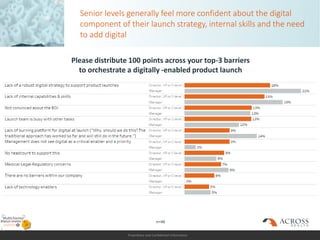

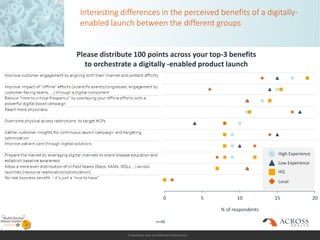

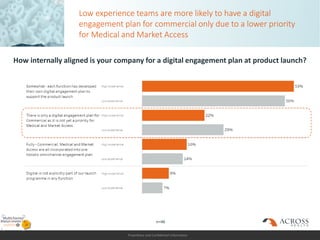

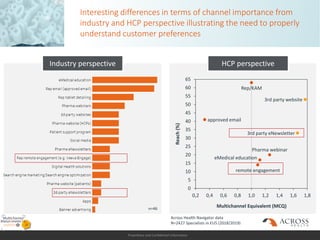

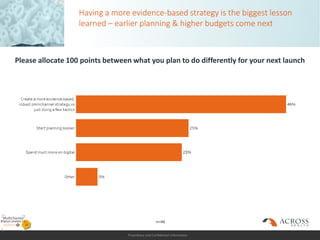

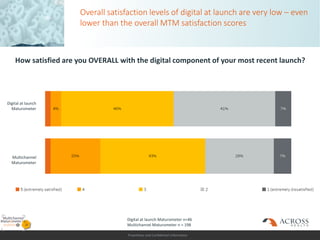

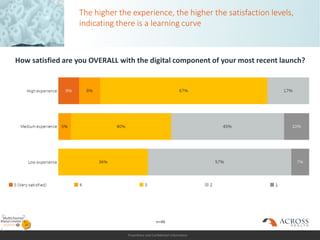

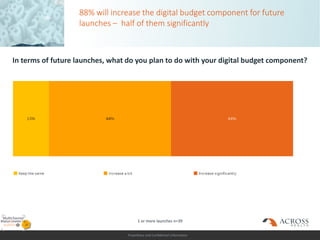

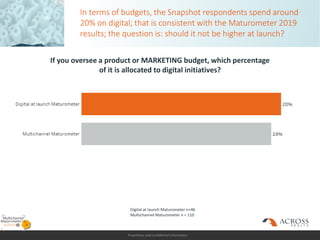

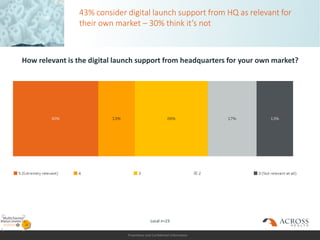

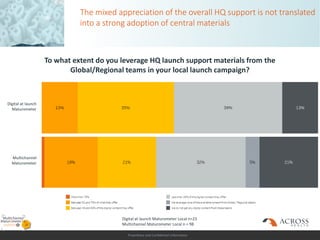

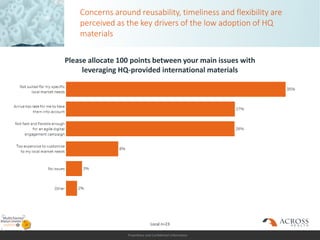

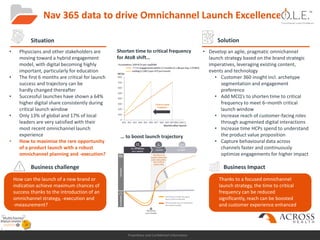

The document discusses the challenges and opportunities for digitally-enabled product launches in the biopharmaceutical industry, highlighting a current lack of strategy and skills as barriers to effective omnichannel engagement. It presents findings from a snapshot survey focused on the importance of digital channels, the perceived benefits of a digitally-enabled launch, and the overall dissatisfaction with digital components in recent launches. The document emphasizes the need for a robust digital strategy and greater internal alignment to optimize product launch effectiveness and enhance customer engagement.