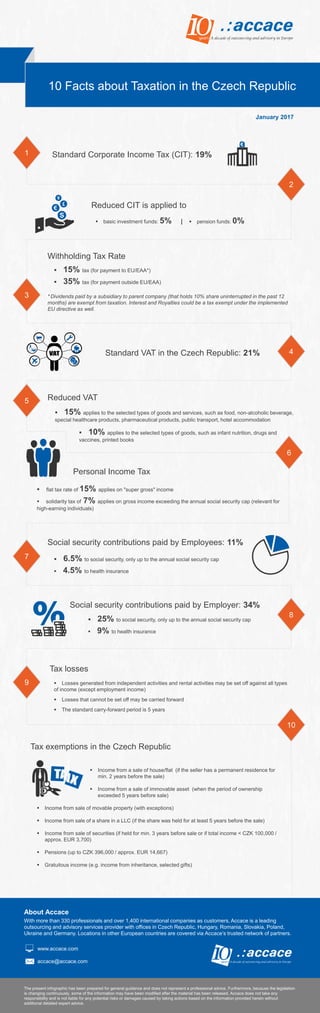

10 facts about taxation in the Czech Republic | Infographic

•

0 likes•66 views

Accace´s 10 facts about taxation in the Czech Republic is an overview that must not be missed if you own or intend to open a business in the Czech Republic.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (11)

International Indirect Tax - Global VAT/GST update (March 2018)

International Indirect Tax - Global VAT/GST update (March 2018)

Brexit Broadcast: What we know so far and where is the momentum heading

Brexit Broadcast: What we know so far and where is the momentum heading

Cyprus VAT Alert - Obligation for Submission of VAT Returns Electronically

Cyprus VAT Alert - Obligation for Submission of VAT Returns Electronically

Viewers also liked

Viewers also liked (14)

141369904 chirurgie-si-specialitati-inrudite-dr-d-vasile-dr-m-grigoriu-transf...

141369904 chirurgie-si-specialitati-inrudite-dr-d-vasile-dr-m-grigoriu-transf...

Similar to 10 facts about taxation in the Czech Republic | Infographic

Similar to 10 facts about taxation in the Czech Republic | Infographic (20)

Baker & McKenzie's Doing Business in Poland - Chapter 5 (Tax System)

Baker & McKenzie's Doing Business in Poland - Chapter 5 (Tax System)

The most important changes foreseen by the new 2018 Tax Code in Romania

The most important changes foreseen by the new 2018 Tax Code in Romania

Taxation of individuals & corporates chamcham presentation 2012 - bw update

Taxation of individuals & corporates chamcham presentation 2012 - bw update

Recently uploaded

Saudi Arabia [ Abortion pills) Jeddah/riaydh/dammam/++918133066128☎️] cytotec tablets uses abortion pills 💊💊 How effective is the abortion pill? 💊💊 +918133066128) "Abortion pills in Jeddah" how to get cytotec tablets in Riyadh " Abortion pills in dammam*💊💊 The abortion pill is very effective. If you’re taking mifepristone and misoprostol, it depends on how far along the pregnancy is, and how many doses of medicine you take:💊💊 +918133066128) how to buy cytotec pills

At 8 weeks pregnant or less, it works about 94-98% of the time. +918133066128[ 💊💊💊 At 8-9 weeks pregnant, it works about 94-96% of the time. +918133066128) At 9-10 weeks pregnant, it works about 91-93% of the time. +918133066128)💊💊 If you take an extra dose of misoprostol, it works about 99% of the time. At 10-11 weeks pregnant, it works about 87% of the time. +918133066128) If you take an extra dose of misoprostol, it works about 98% of the time. In general, taking both mifepristone and+918133066128 misoprostol works a bit better than taking misoprostol only. +918133066128 Taking misoprostol alone works to end the+918133066128 pregnancy about 85-95% of the time — depending on how far along the+918133066128 pregnancy is and how you take the medicine. +918133066128 The abortion pill usually works, but if it doesn’t, you can take more medicine or have an in-clinic abortion. +918133066128 When can I take the abortion pill?+918133066128 In general, you can have a medication abortion up to 77 days (11 weeks)+918133066128 after the first day of your last period. If it’s been 78 days or more since the first day of your last+918133066128 period, you can have an in-clinic abortion to end your pregnancy.+918133066128

Why do people choose the abortion pill? Which kind of abortion you choose all depends on your personal+918133066128 preference and situation. With+918133066128 medication+918133066128 abortion, some people like that you don’t need to have a procedure in a doctor’s office. You can have your medication abortion on your own+918133066128 schedule, at home or in another comfortable place that you choose.+918133066128 You get to decide who you want to be with during your abortion, or you can go it alone. Because+918133066128 medication abortion is similar to a miscarriage, many people feel like it’s more “natural” and less invasive. And some+918133066128 people may not have an in-clinic abortion provider close by, so abortion pills are more available to+918133066128 them. +918133066128 Your doctor, nurse, or health center staff can help you decide which kind of abortion is best for you. +918133066128 More questions from patients: Saudi Arabia+918133066128 CYTOTEC Misoprostol Tablets. Misoprostol is a medication that can prevent stomach ulcers if you also take NSAID medications. It reduces the amount of acid in your stomach, which protects your stomach lining. The brand name of this medication is Cytotec®.+918133066128) Unwanted Kit is a combination of two medicines, ounwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE AbudhabiAbortion pills in Kuwait Cytotec pills in Kuwait

Recently uploaded (20)

Call Girls Kengeri Satellite Town Just Call 👗 7737669865 👗 Top Class Call Gir...

Call Girls Kengeri Satellite Town Just Call 👗 7737669865 👗 Top Class Call Gir...

How to Get Started in Social Media for Art League City

How to Get Started in Social Media for Art League City

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

Falcon's Invoice Discounting: Your Path to Prosperity

Falcon's Invoice Discounting: Your Path to Prosperity

Insurers' journeys to build a mastery in the IoT usage

Insurers' journeys to build a mastery in the IoT usage

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

Chandigarh Escorts Service 📞8868886958📞 Just📲 Call Nihal Chandigarh Call Girl...

Chandigarh Escorts Service 📞8868886958📞 Just📲 Call Nihal Chandigarh Call Girl...

FULL ENJOY Call Girls In Majnu Ka Tilla, Delhi Contact Us 8377877756

FULL ENJOY Call Girls In Majnu Ka Tilla, Delhi Contact Us 8377877756

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

B.COM Unit – 4 ( CORPORATE SOCIAL RESPONSIBILITY ( CSR ).pptx

B.COM Unit – 4 ( CORPORATE SOCIAL RESPONSIBILITY ( CSR ).pptx

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

MONA 98765-12871 CALL GIRLS IN LUDHIANA LUDHIANA CALL GIRL

MONA 98765-12871 CALL GIRLS IN LUDHIANA LUDHIANA CALL GIRL

10 facts about taxation in the Czech Republic | Infographic

- 1. Standard Corporate Income Tax (CIT): 19% basic investment funds: 5% | Withholding Tax Rate 15% tax (for payment to EU/EAA*) 35% tax (for payment outside EU/EAA) * Dividends paid by a subsidiary to parent company (that holds 10% share uninterrupted in the past 12 months) are exempt from taxation. Interest and Royalties could be a tax exempt under the implemented EU directive as well. Reduced CIT is applied to Standard VAT in the Czech Republic: 21% Reduced VAT 10 Facts about Taxation in the Czech Republic 1 2 3 4 8 9 10 15% applies to the selected types of goods and services, such as food, non-alcoholic beverage, special healthcare products, pharmaceutical products, public transport, hotel accommodation 10% applies to the selected types of goods, such as infant nutrition, drugs and vaccines, printed books Personal Income Tax Social security contributions paid by Employees: 11% Social security contributions paid by Employer: 34% Tax losses Losses generated from independent activities and rental activities may be set off against all types of income (except employment income) Losses that cannot be set off may be carried forward The standard carry-forward period is 5 years Income from a sale of house/flat (if the seller has a permanent residence for min. 2 years before the sale) Income from a sale of immovable asset (when the period of ownership exceeded 5 years before sale) Income from sale of movable property (with exceptions) Income from sale of a share in a LLC (if the share was held for at least 5 years before the sale) Income from sale of securities (if held for min. 3 years before sale or if total income < CZK 100,000 / approx. EUR 3,700) Pensions (up to CZK 396,000 / approx. EUR 14,667) Gratuitous income (e.g. income from inheritance, selected gifts) Tax exemptions in the Czech Republic About Accace With more than 330 professionals and over 1,400 international companies as customers, Accace is a leading outsourcing and advisory services provider with offices in Czech Republic, Hungary, Romania, Slovakia, Poland, Ukraine and Germany. Locations in other European countries are covered via Accace’s trusted network of partners. www.accace.com accace@accace.com The present infographic has been prepared for general guidance and does not represent a professional advice. Furthermore, because the legislation is changing continuously, some of the information may have been modified after the material has been released. Accace does not take any responsibility and is not liable for any potential risks or damages caused by taking actions based on the information provided herein without additional detailed expert advice. 6 7 5 pension funds: 0% flat tax rate of 15% applies on "super gross" income solidarity tax of 7% applies on gross income exceeding the annual social security cap (relevant for high-earning individuals) 6.5% to social security, only up to the annual social security cap 4.5% to health insurance 25% to social security, only up to the annual social security cap 9% to health insurance January 2017