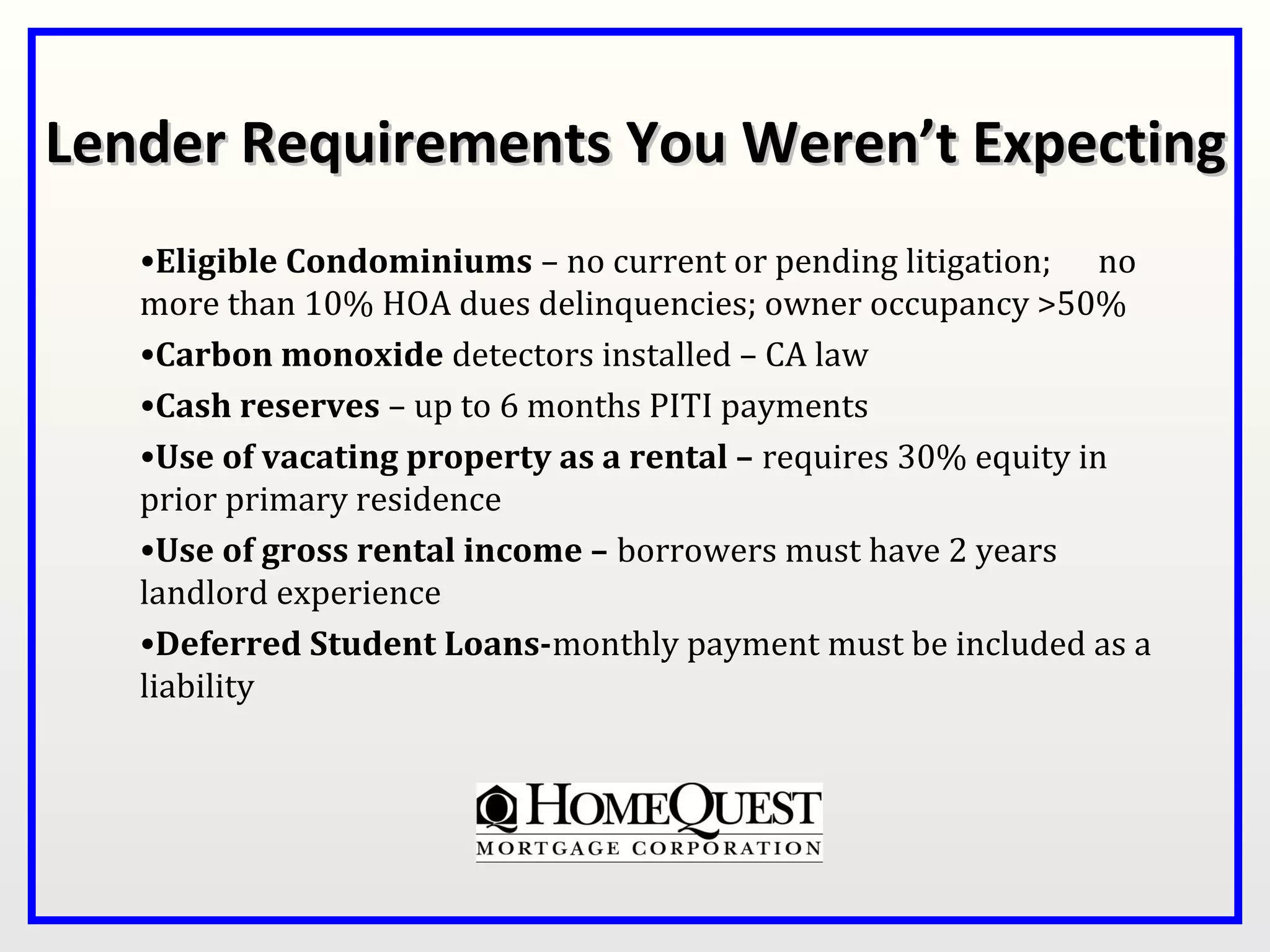

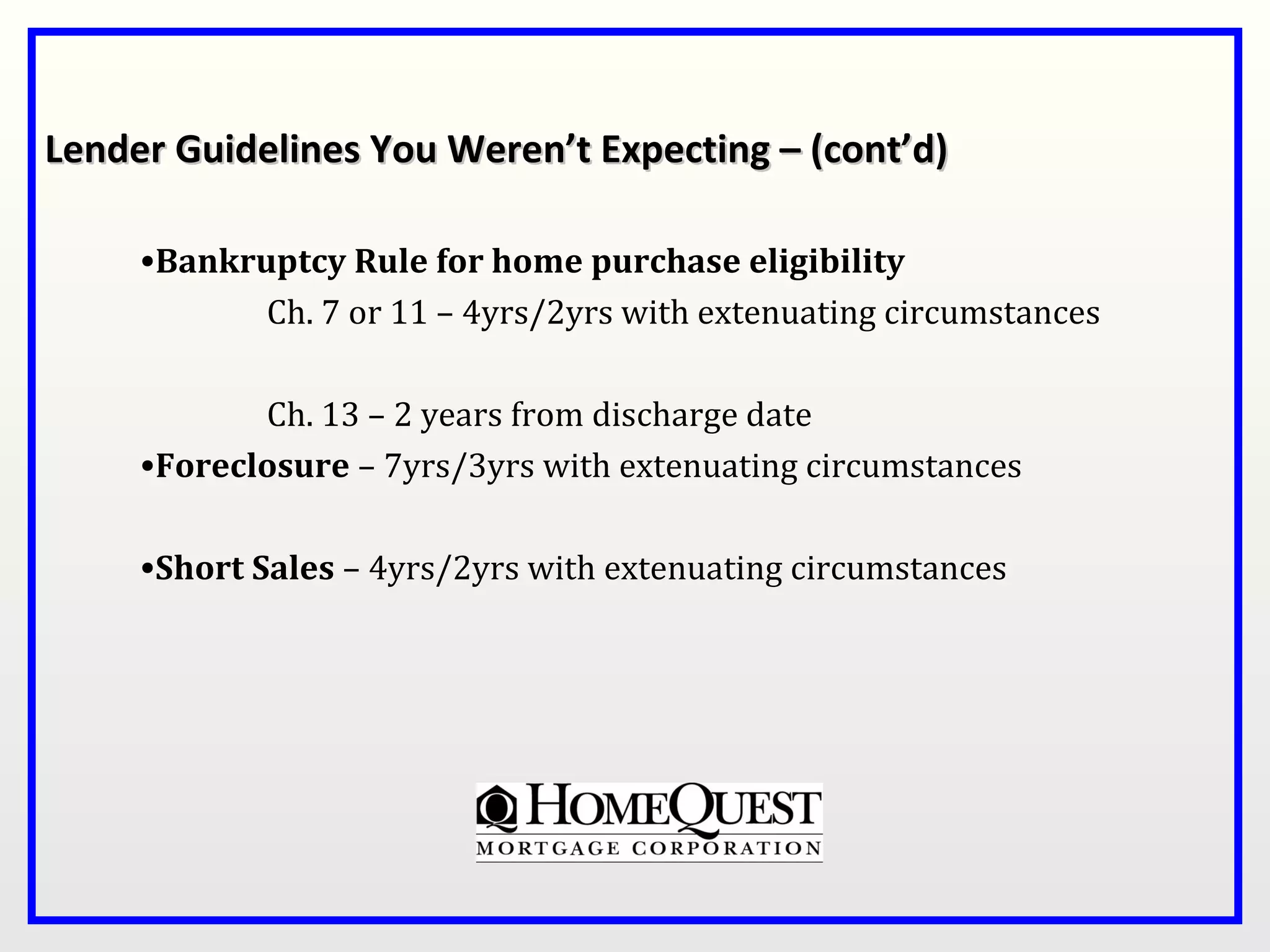

The document discusses the documentation requirements for obtaining a home mortgage loan. It notes that documentation is key, then lists the types of documentation needed, including income documentation like tax returns and pay stubs, asset documentation like bank statements, and other information like a driver's license and homeowner's insurance policy. It also outlines some lender guidelines around bankruptcies, foreclosures, and short sales. Finally, it recommends selecting a professional realtor to help navigate the home buying process.