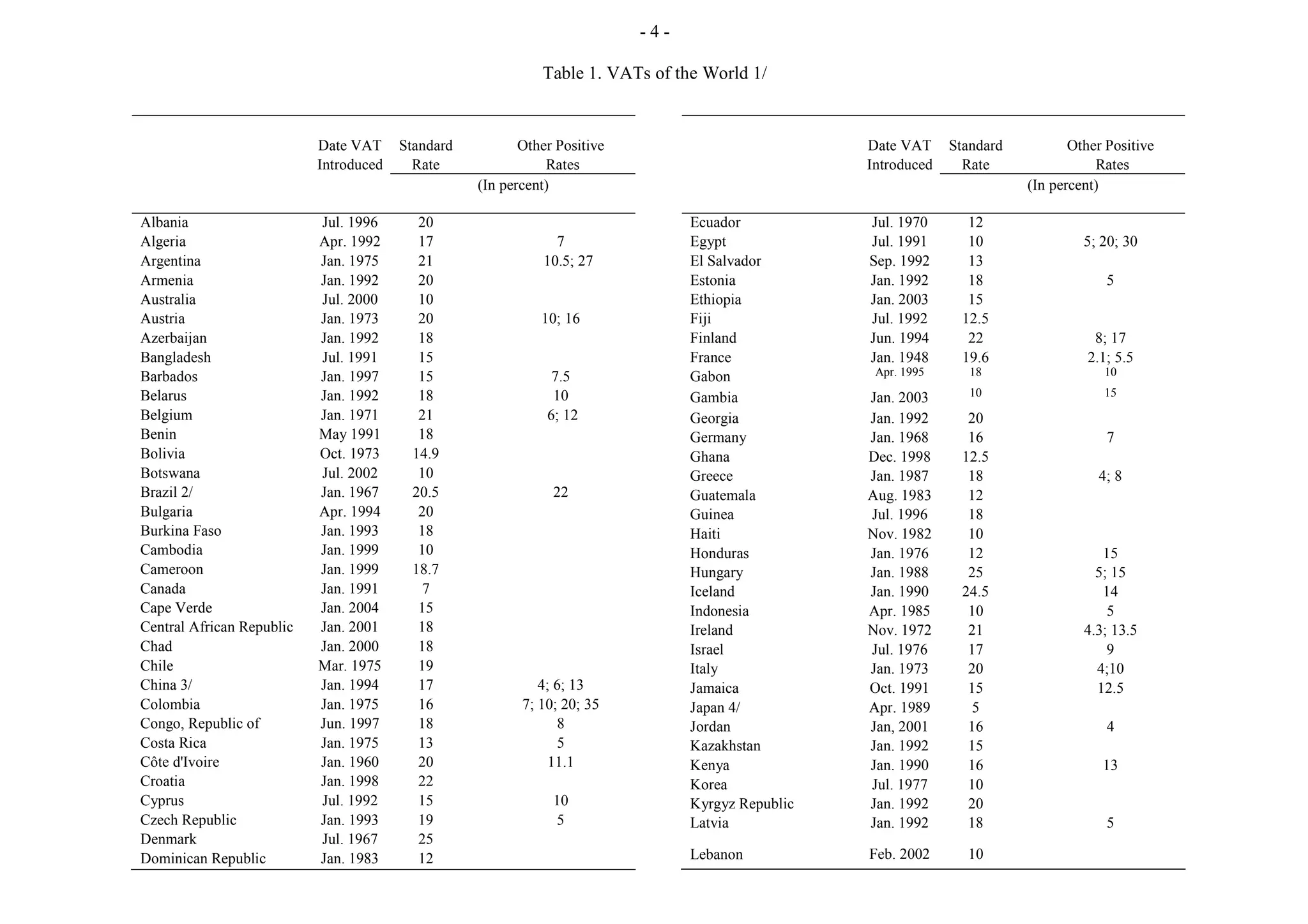

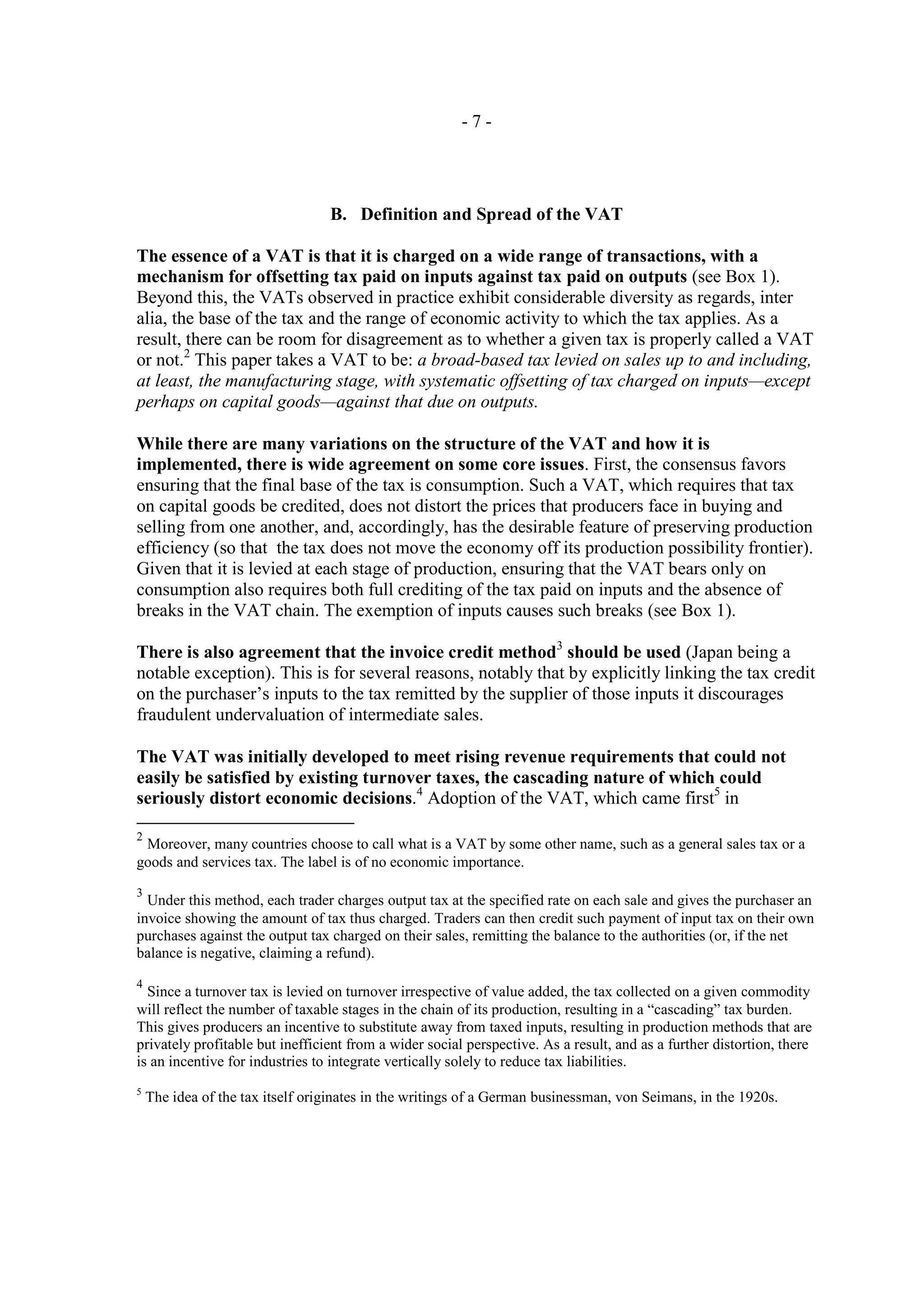

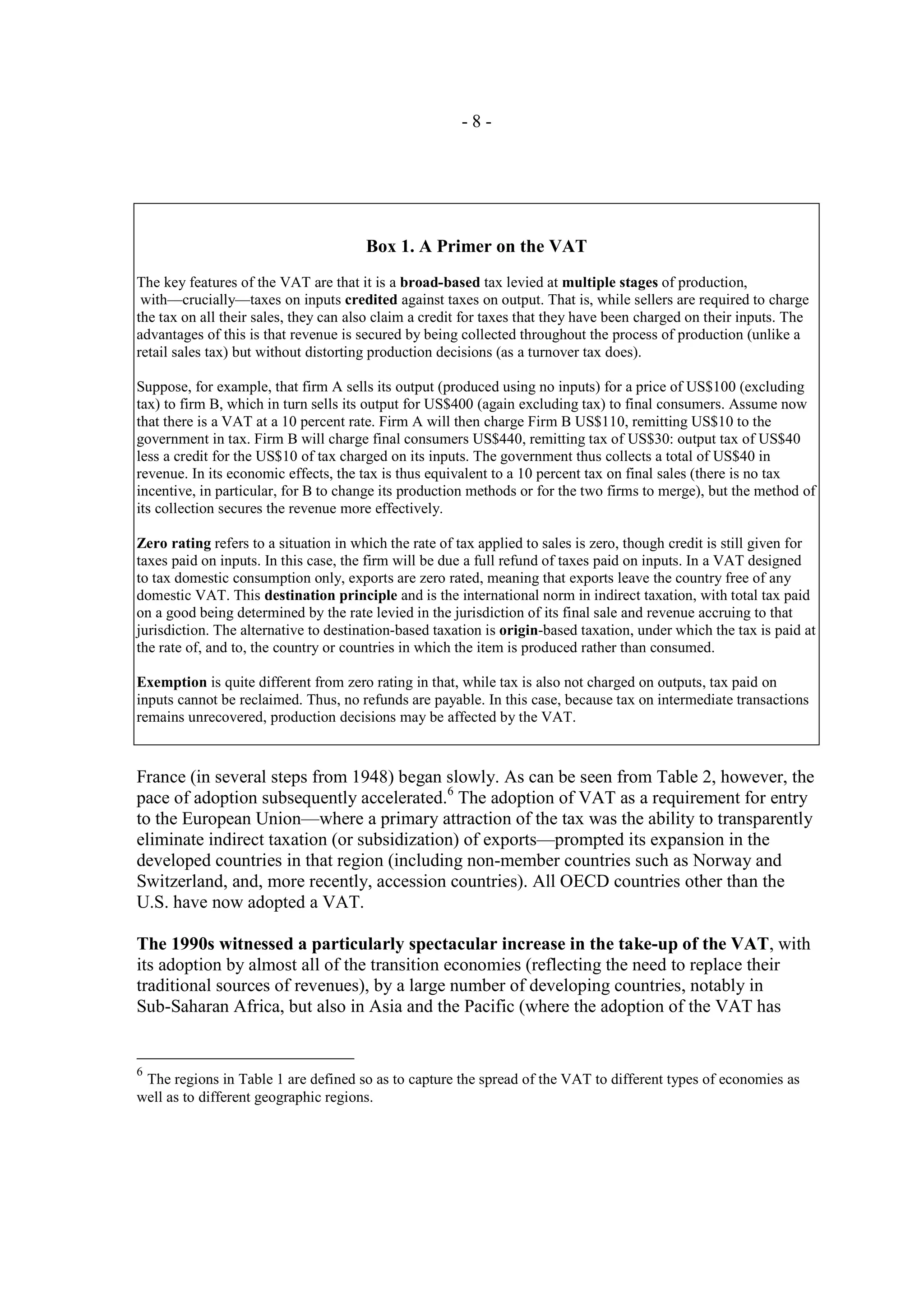

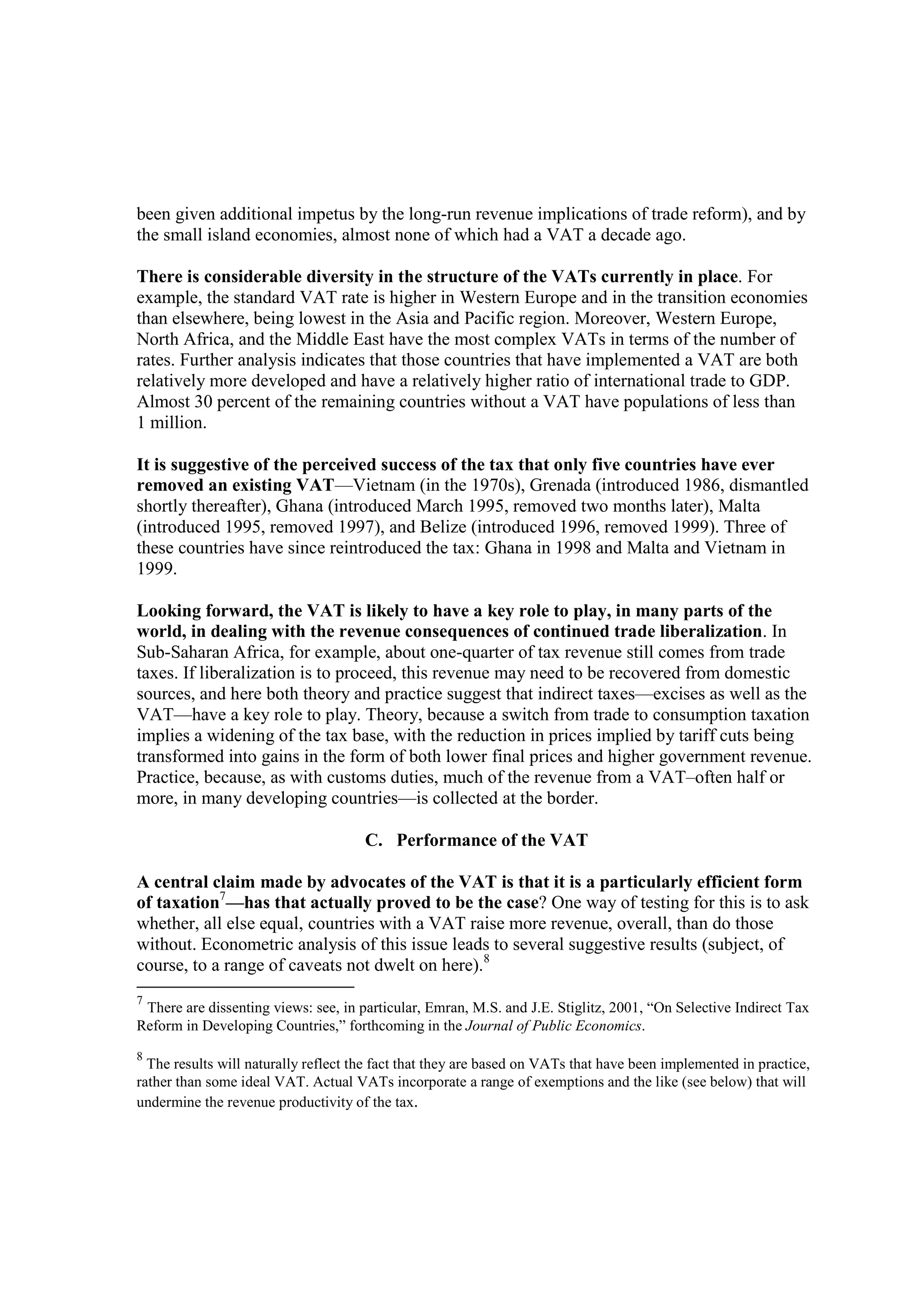

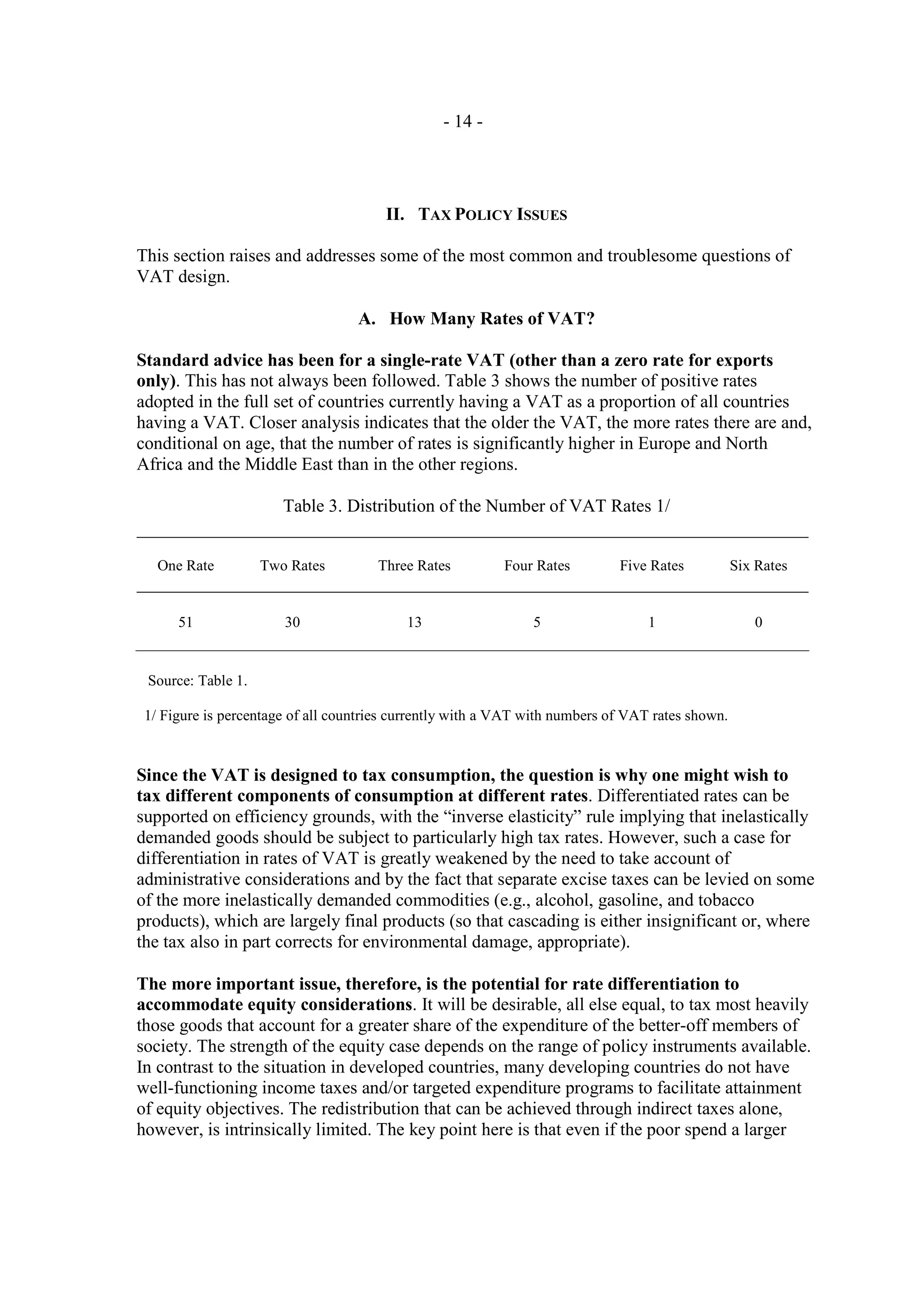

The document discusses the value added tax (VAT), providing background and context. It notes that the VAT has spread to over 130 countries and typically accounts for about a quarter of tax revenue. Key issues discussed include determining the appropriate number of VAT rates, what goods and services should be exempted, and challenges of cross-border administration and collection. The document aims to inform an international conference on experiences with the VAT and ongoing policy and administrative issues.