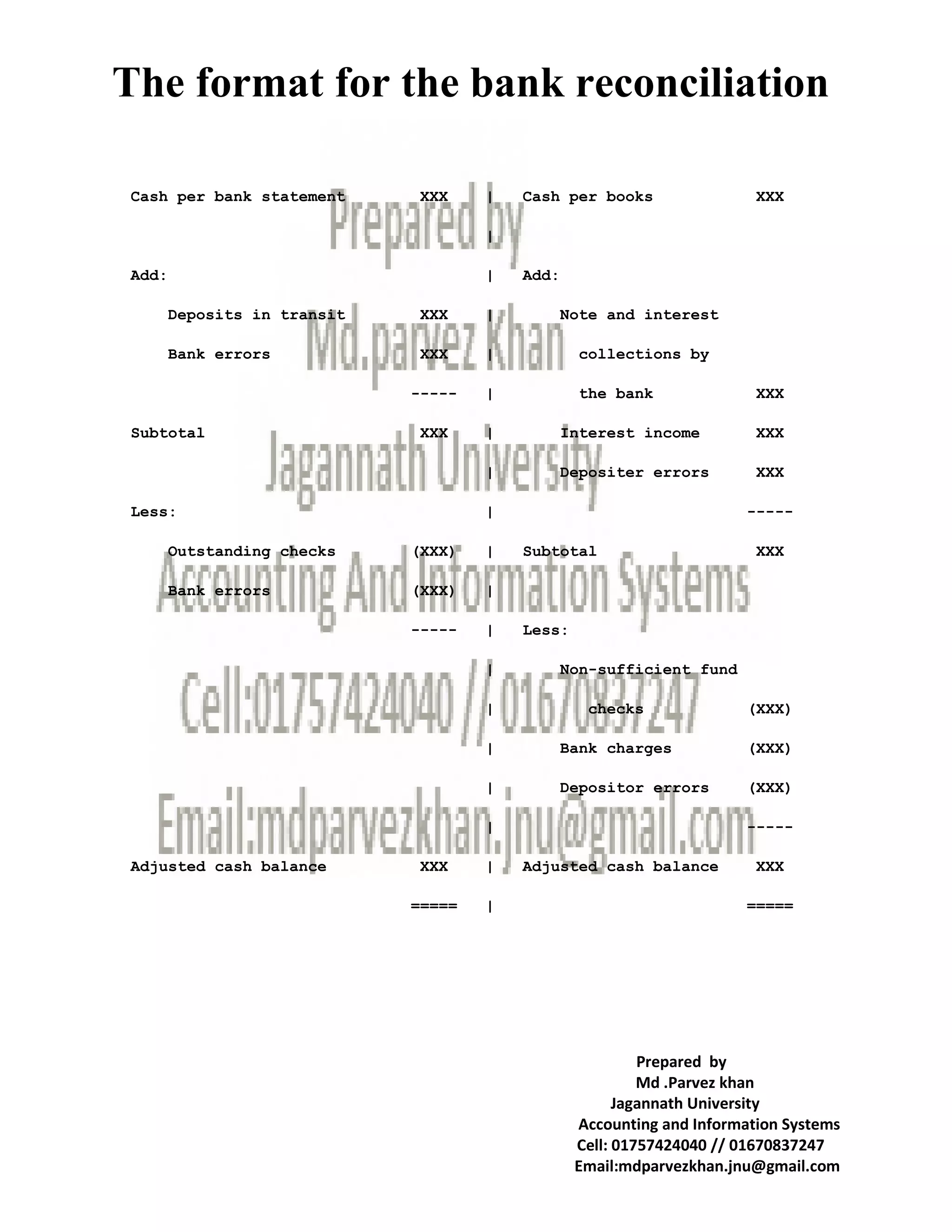

A bank reconciliation is a process that accounts for the difference between a company's bank balance and its cash balance according to accounting records. This is necessary because checks and deposits may be outstanding or errors may occur. The reconciliation statement lists additions such as deposits in transit and subtractions such as outstanding checks to calculate an adjusted balance for both the bank and accounting records.