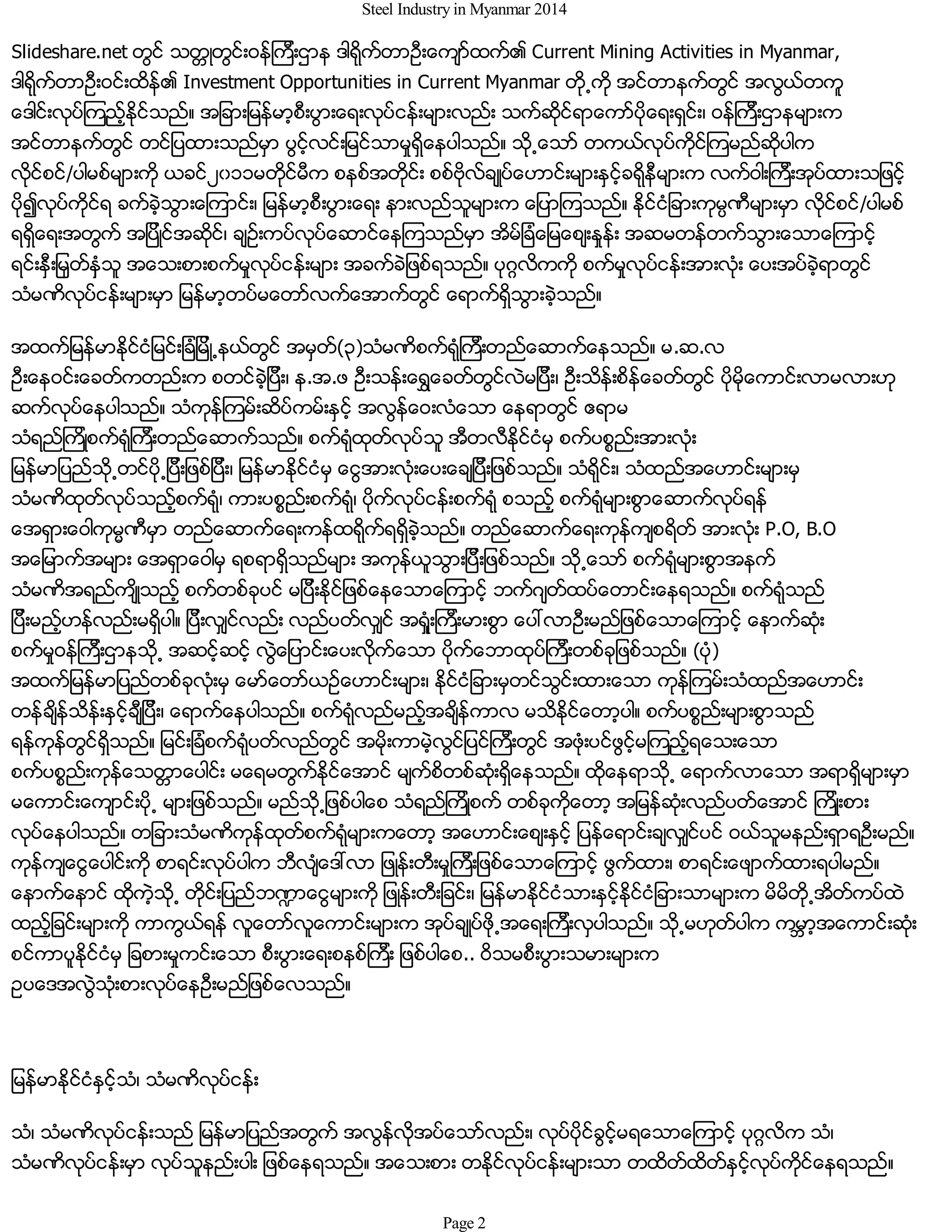

The steel industry is important for developing countries and steel production has increased significantly in countries like Europe, America, and Japan. China produces around 40% of the world's steel and has many steel mills to support its large-scale construction industry. However, China's construction industry and steel production are declining due to the slowing global economy. Steel prices in China have fallen substantially from 2007 to their lowest level in 2014. In 2013, China produced the most steel at 779 million tons, followed by Europe-CIS countries, Japan, the US, and India. Southeast Asian countries produce much less steel, with Malaysia the largest producer at 5.9 million tons. Many Southeast Asian countries import steel to support industrialization. China imports steel sheets

![57

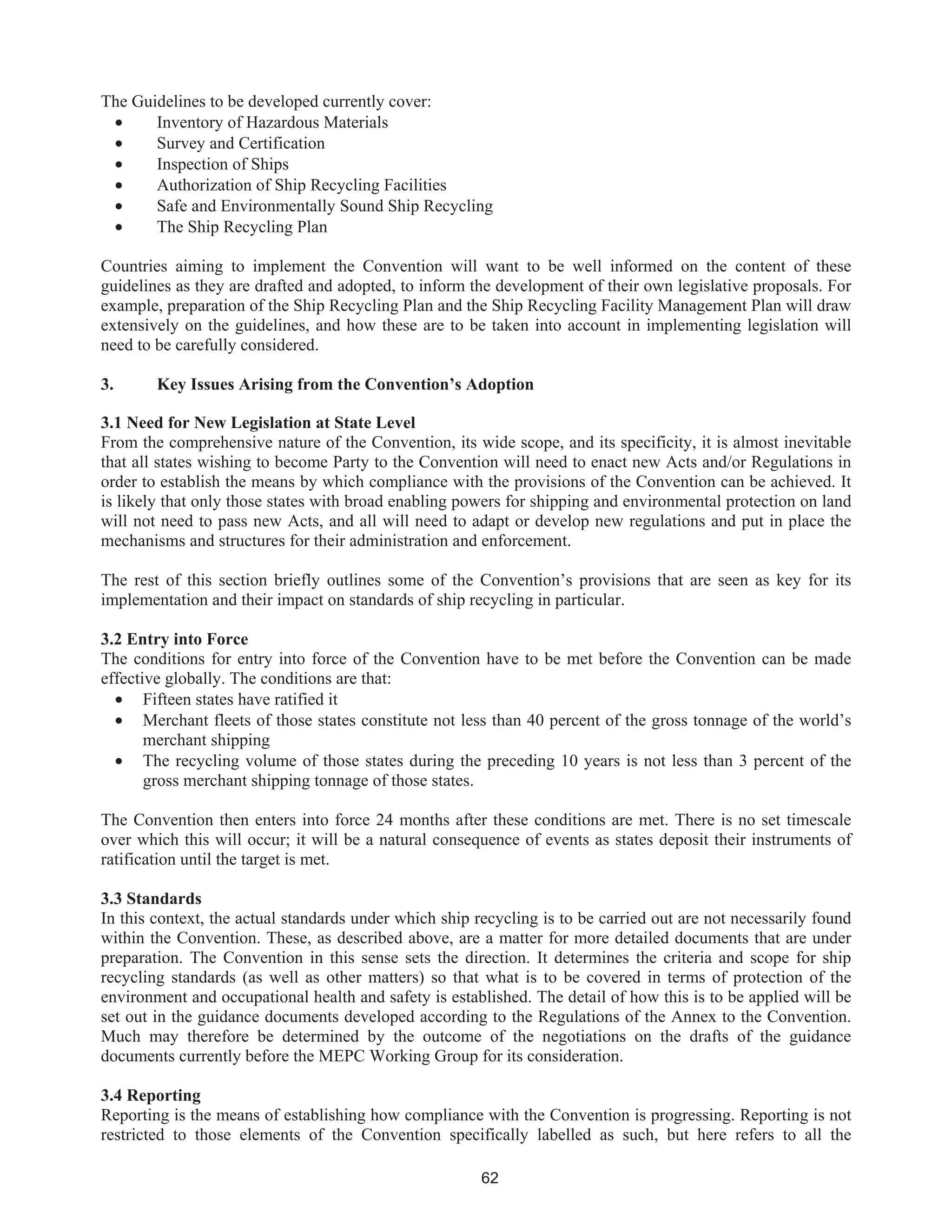

APPENDIX 2: BIBLIOGRAPHY

Basak, G. K. 2007. “Changing Dynamics of the Secondary Steel Sector.” Mimeo. Kolkata: Joint Plant

Committee.

Basel Convention. 2003. “Technical Guidelines for the Environmentally Sound Management of the Full and

Partial Dismantling of Ships.” Basel Convention Series/SBC No 2003/2. Geneva.

Bastiansen, E. 2006. “Recycling of Ships 2006–2021.” BIMCO Bulletin 101 (6): 110–15.

Beriwala, Shyam Sunder. 2002. “The Status of Re-rolling industry–Its Problems and Future Prospects.”

Mimeo. Kolkata: Joint Plant Committee.

Buerk, Roland. 2006. Breaking Ships: How Supertankers and Cargo Ships Are Dismantled on the Beaches of

Bangladesh. New York: Chamberlain Bros.

Buncombe, Andrew. 2009. “Alang: The Place Where Ships Go to Die.” The Independent (UK). 31 August.

China–Netherlands Environmental Protection Cooperation Project. 2005. Report on Environmental Sound

Management of Waste Ship Dismantling.

Clarkson. 2006. “Breaking News.” Feature by Martin Macleod.

Clarkson, Perter. 2009. “Huge Investment in Pakistan Shipbreaking.” GlobMaritime Social Network, 15

June.

Commission of the European Communities. 2007. Better Ship Dismantling. Green Paper. Brussels.

CONCAWE. 1998. Heavy Fuel Oils. Petroleum Products and Health Management Groups, Brussels.

Cotzias. 2009. “Cotzias Market Economic Outlook.” Maritime Econometrics, October. Pireaus-Hellas,

Greece: N. Cotzias Shipping Co. Ltd.

COWI/Litehauz. 2008. Certification of Ship Recycling Facilities, prepared for European Maritime Safety

Agency. Copenhagen.

Danish EPA (Environmental Protection Agency). 2003. Ship Breaking in OECD. Working Report No. 17,

Copenhagen.

———. 2007a. Pocket Book Manual. Draft 2006 submitted to Basel Convention Secretariat. Copenhagen.

———. 2007b. “Project Identification Note – Options for Demonstration Projects on Green Ship

Recycling,” February–September. By DHI/COWI. Copenhagen.

Das, P. K. et al. 2006. Proceedings of the First International Conference on Dismantling of Obsolete Vessels,

11–12 September 2006, Glasgow, U.K.

Dear, I. C. B., and P. Kemp. 2006. Oxford Companion to Ships and the Sea. Oxford: Oxford University

Press.

DEFRA (Department for Environment, Food and Rural Affairs). 2002. [[Ref missing; from chap 2]] London.

———. 2006. Partial Regulatory Impact Assessment: UK Ship Recycling Strategy. London.

———. 2007. Overview of the Ship Recycling Process in the UK. London.

Department of Environment, Ministry of Environment and Forests, Government of the People’s Republic of

Bangladesh in collaboration with IUCN Bangladesh Country Office and Bangladesh Centre for Advance

Studies, 2006. National Programme of Action for Protection of the Coastal and Marine Environment from

Land-Based Activities.

DNV (Det Norske Veritas). 2000. Decommissioning of Ships – Environmental Standards; Ship-Breaking

Practices/ On-Site Assessment; Bangladesh – Chittagong. Report 2000-3158. Oslo.

DNV/Appeldore. 2001. Technological and Economic Feasibility Study of Ship Scrapping in Europe.

Brussels: Commission of the European Communities.

Esso. 2003. Product Data Sheet, ESSO Hydraulic Oil AW, Anti-wear Hydraulic. Calgary: Esso Imperial Oil.

European Commission. 2004. Oil Tanker Phase Out and the Ship Scrapping Industry. Brussels.

———. 2007. Ship Dismantling and Pre-cleaning of Ships. Study by COWI/DHI. Brussels.

———. Forthcoming. Dismantling of Vessels with Enhanced Safety and Technology. Research foreseen

under the 7th European Research Framework Programme. Brussels: European Union.

———. Undated. Cost-effective and Environmentally Sound Dismantling of Obsolete Vessels. Project

funded under 6th Research Framework Programme.

———. Undated. Ship repair to Maintain Transport Which is Environmentally Sustainable. Project funded

under 6th Research Framework Programme.

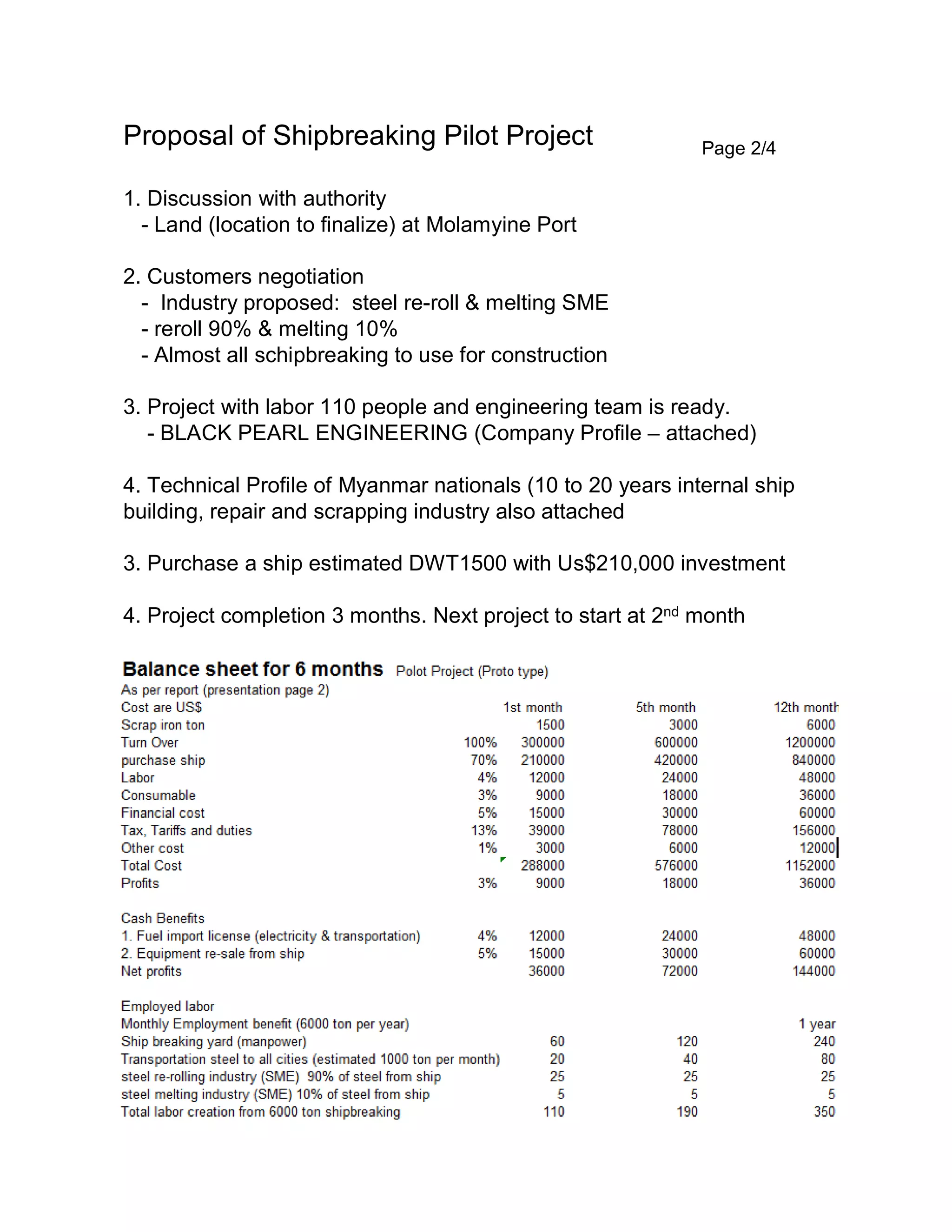

Feringa, G. 2005. “Ship Recycling in Bangladesh – Findings of Baseline Survey.” Draft Report to the ILO.

Geneva.](https://image.slidesharecdn.com/shipbreaking-myanmar-2014-140611041422-phpapp02/75/Shipbreaking-myanmar-2014-83-2048.jpg)

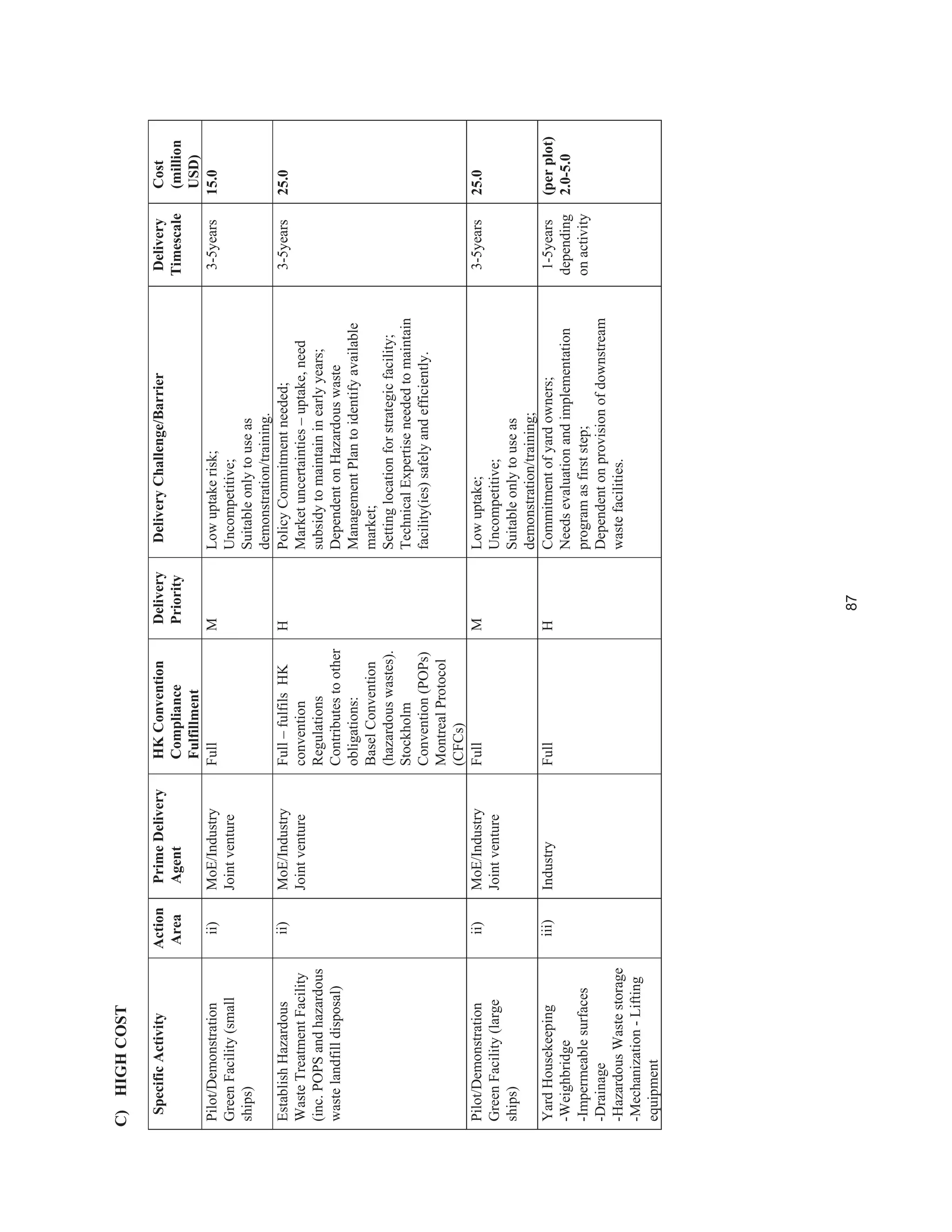

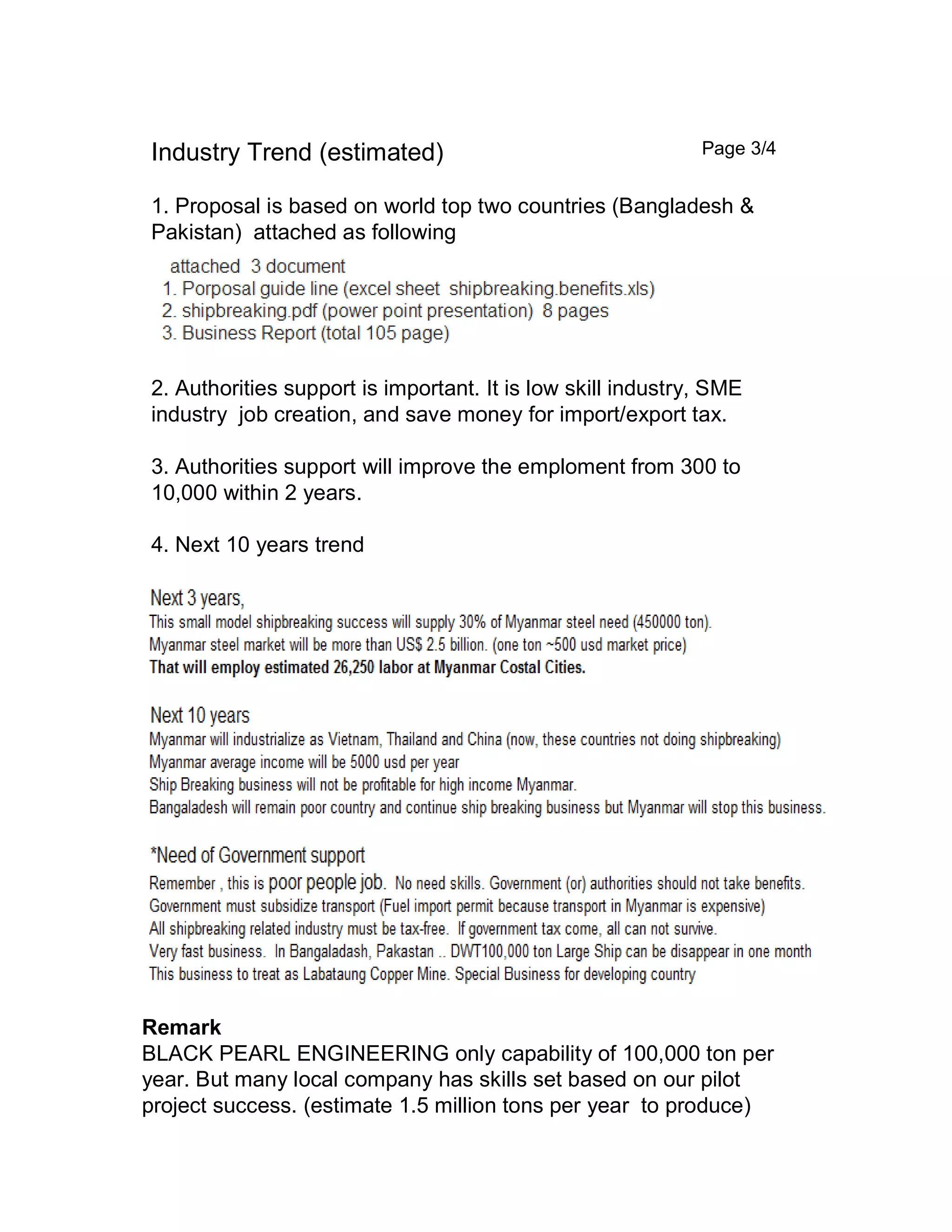

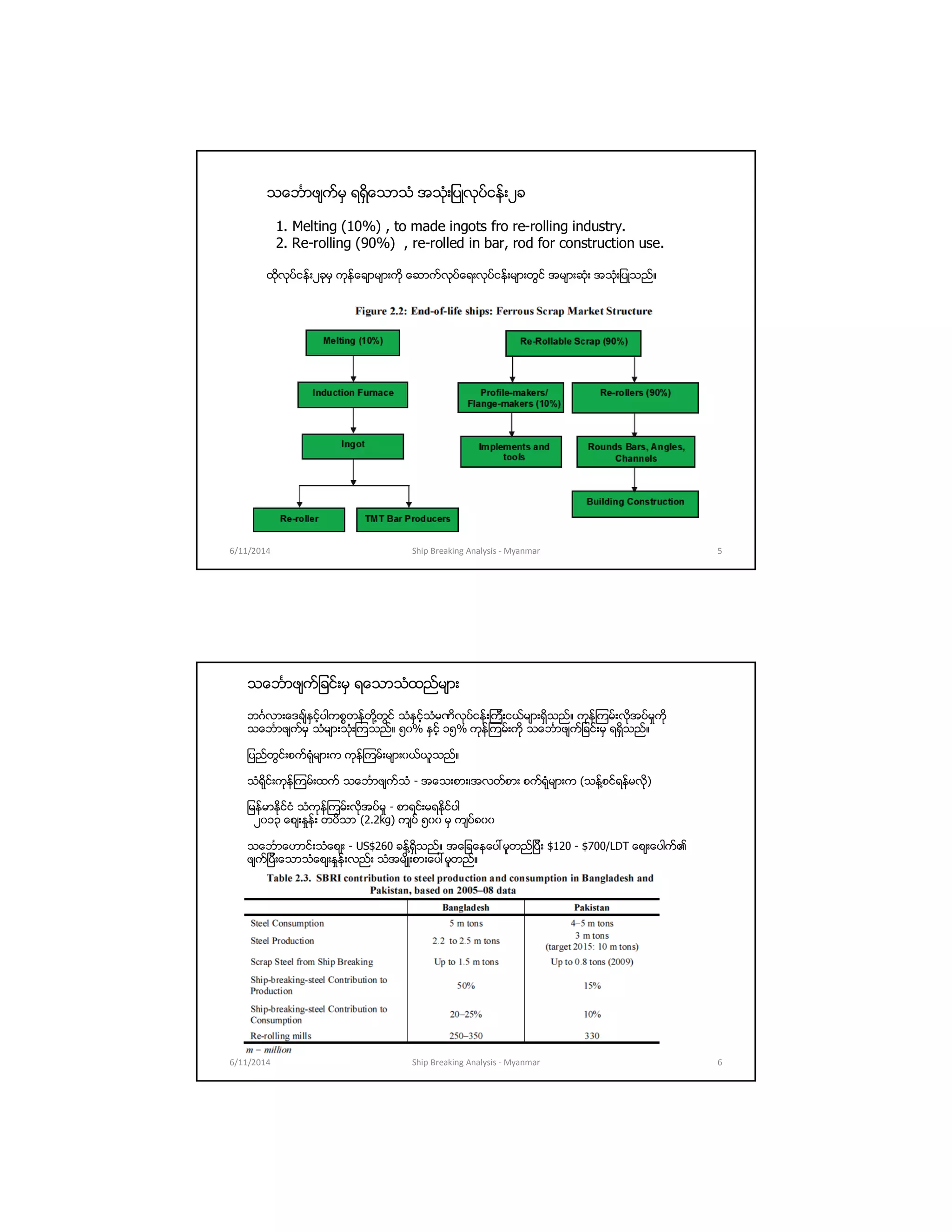

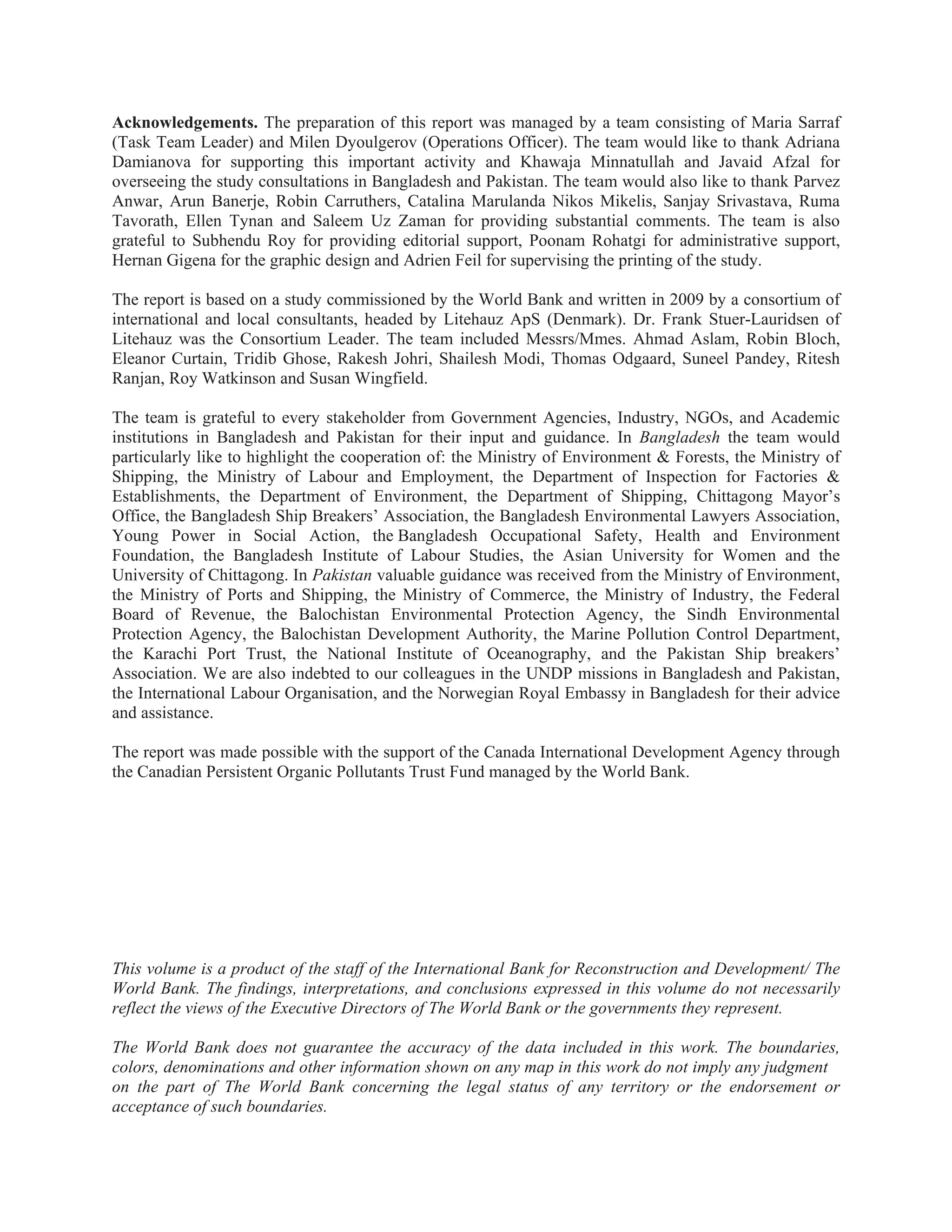

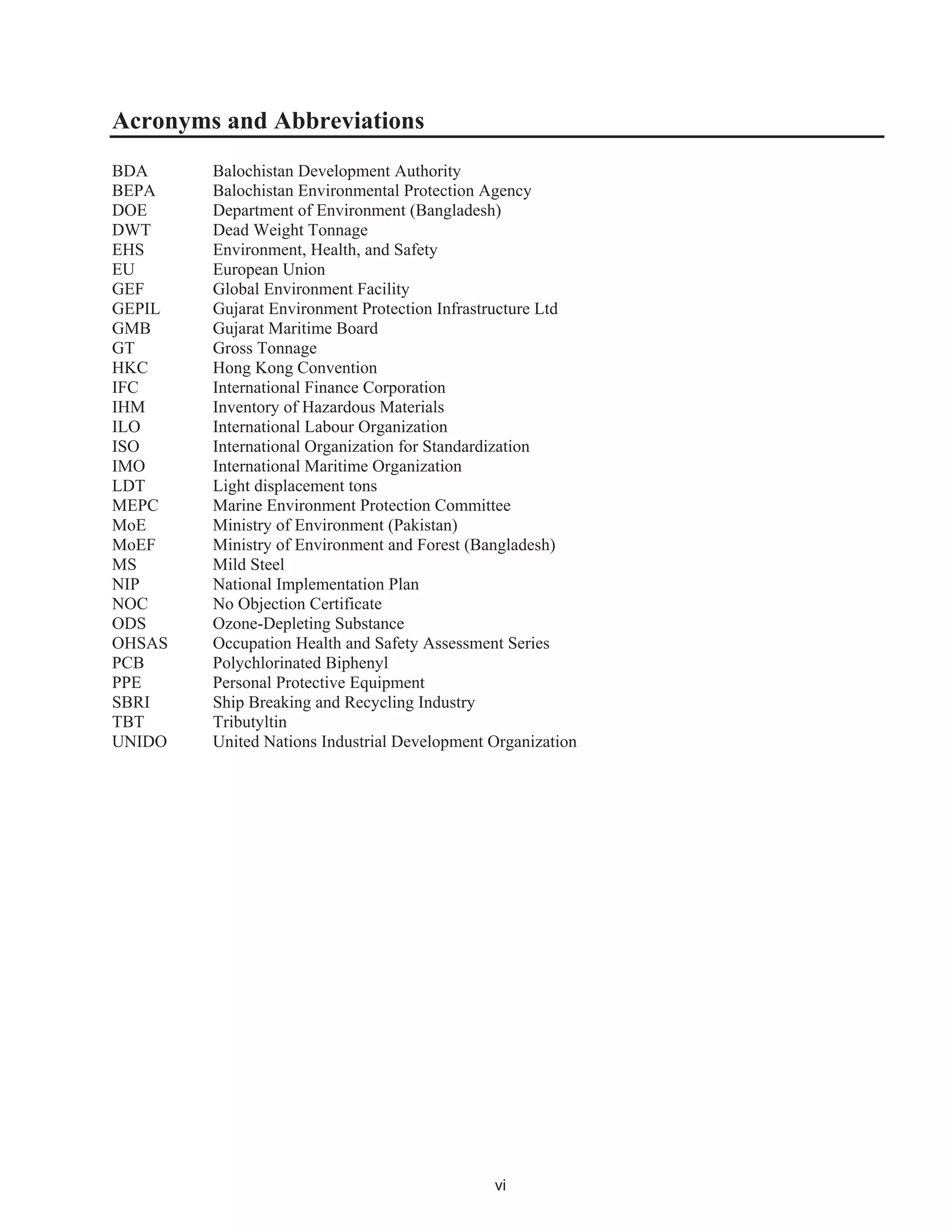

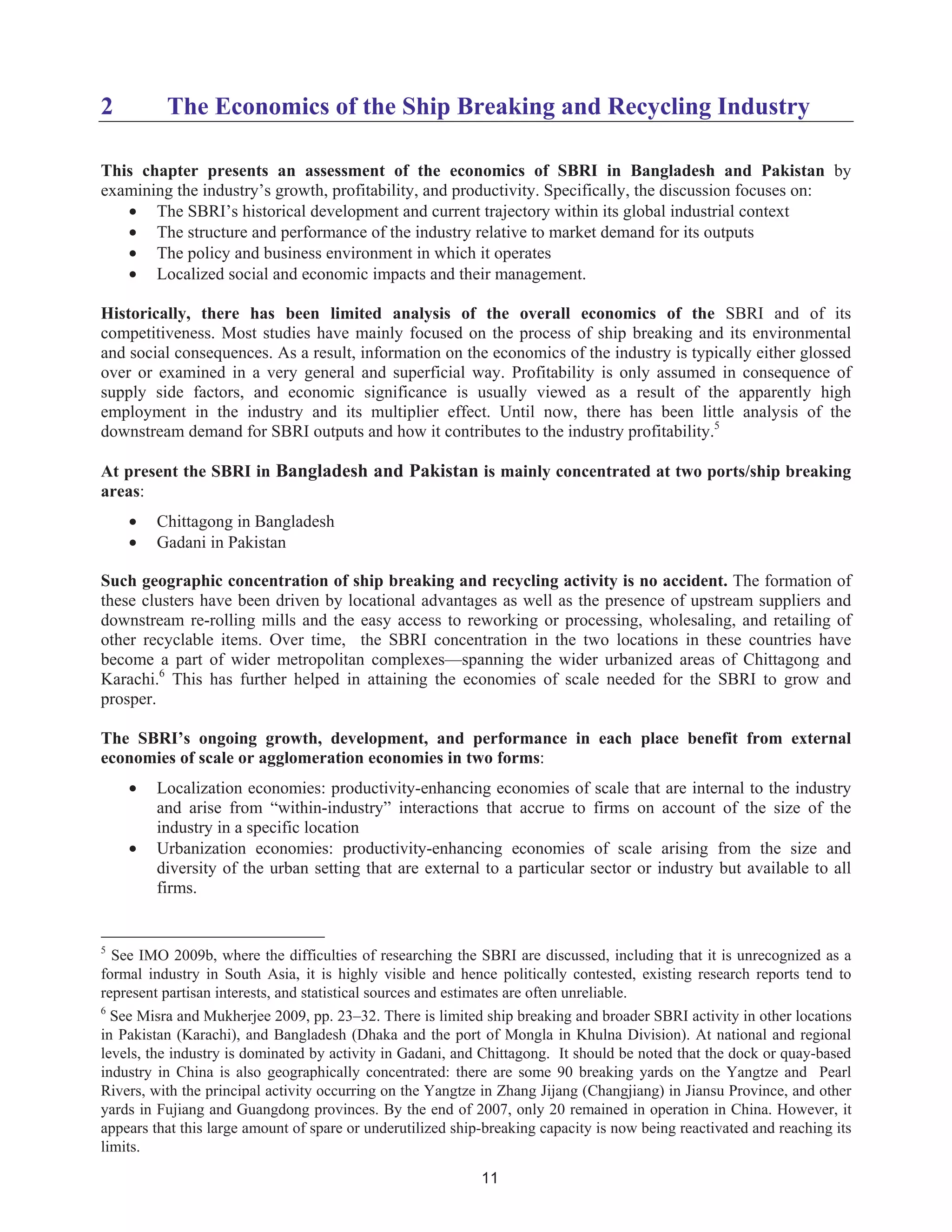

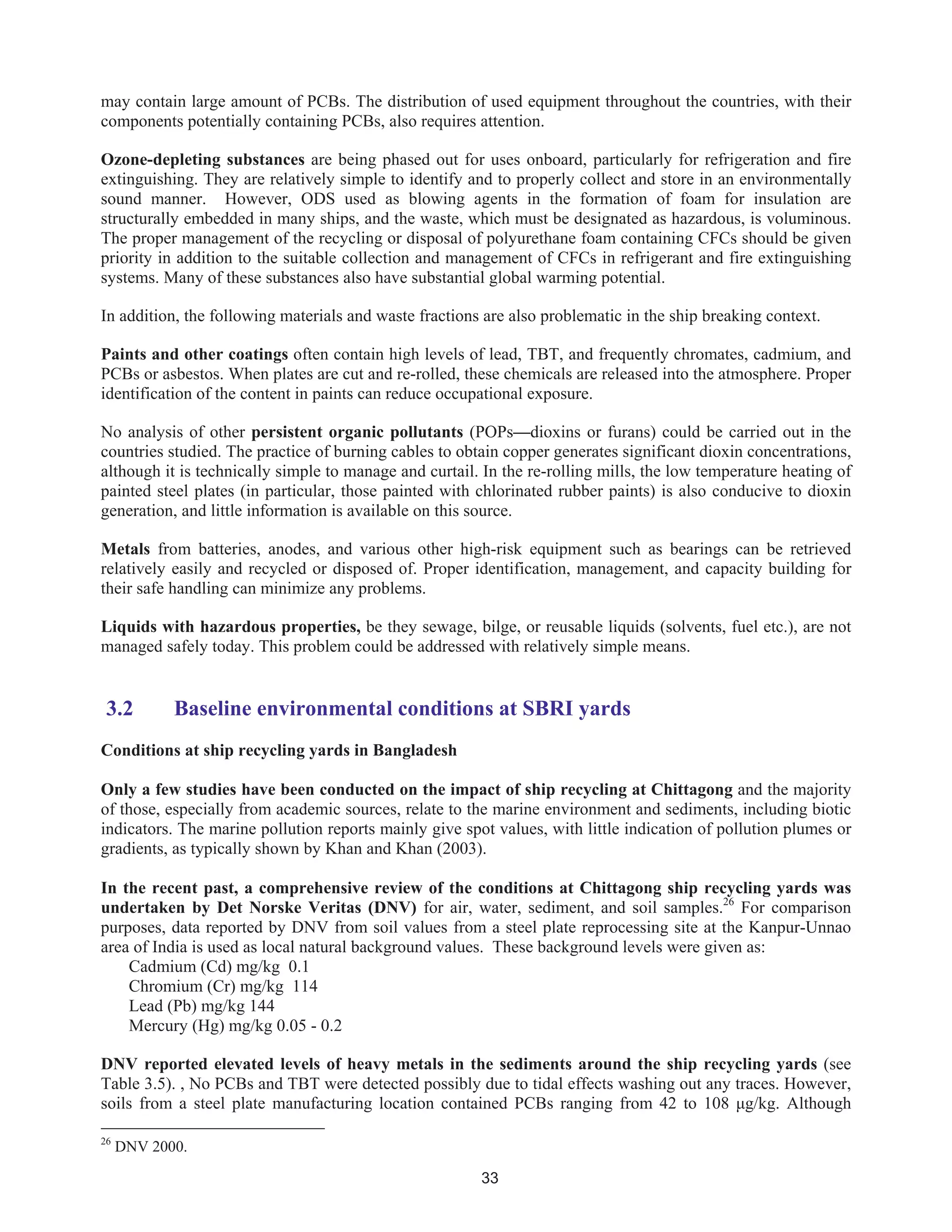

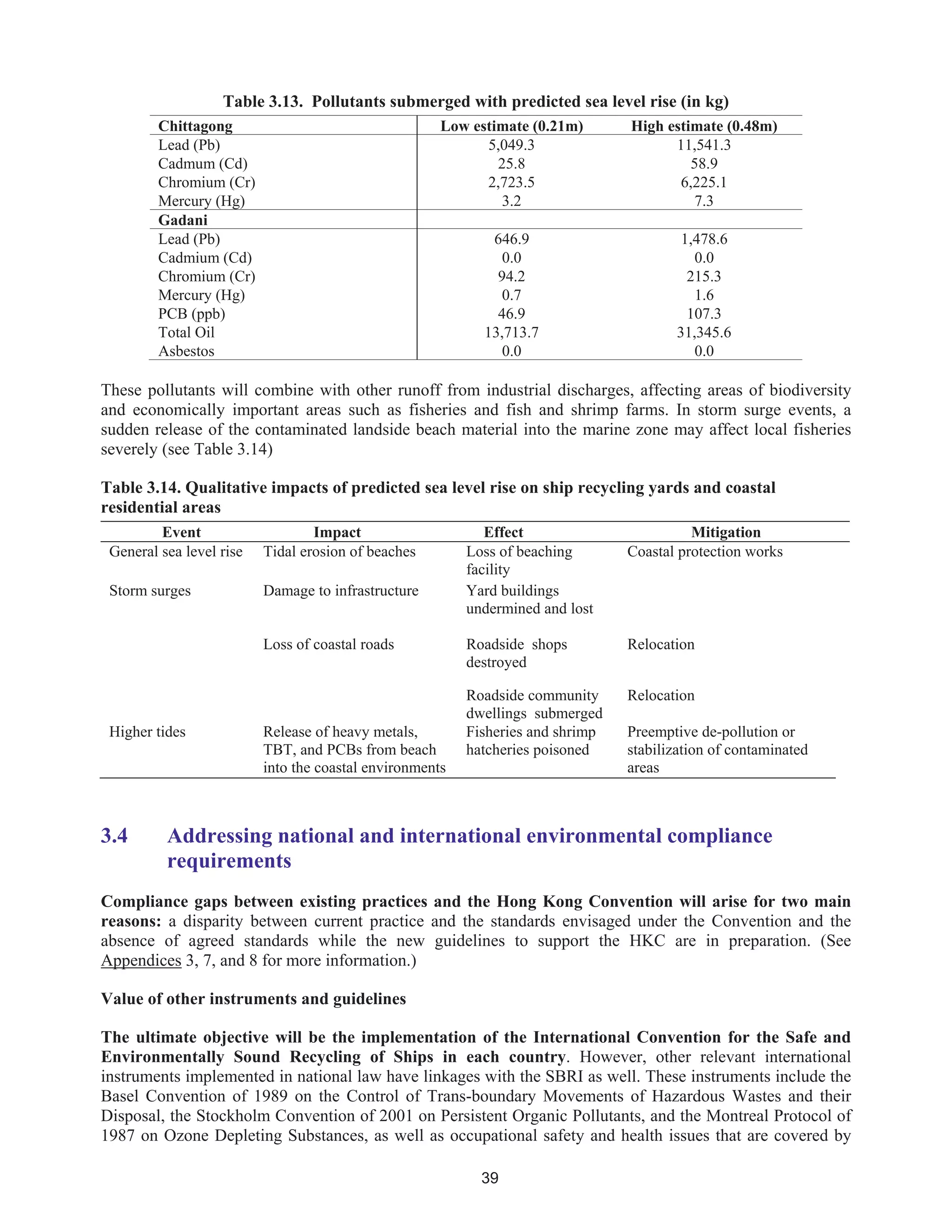

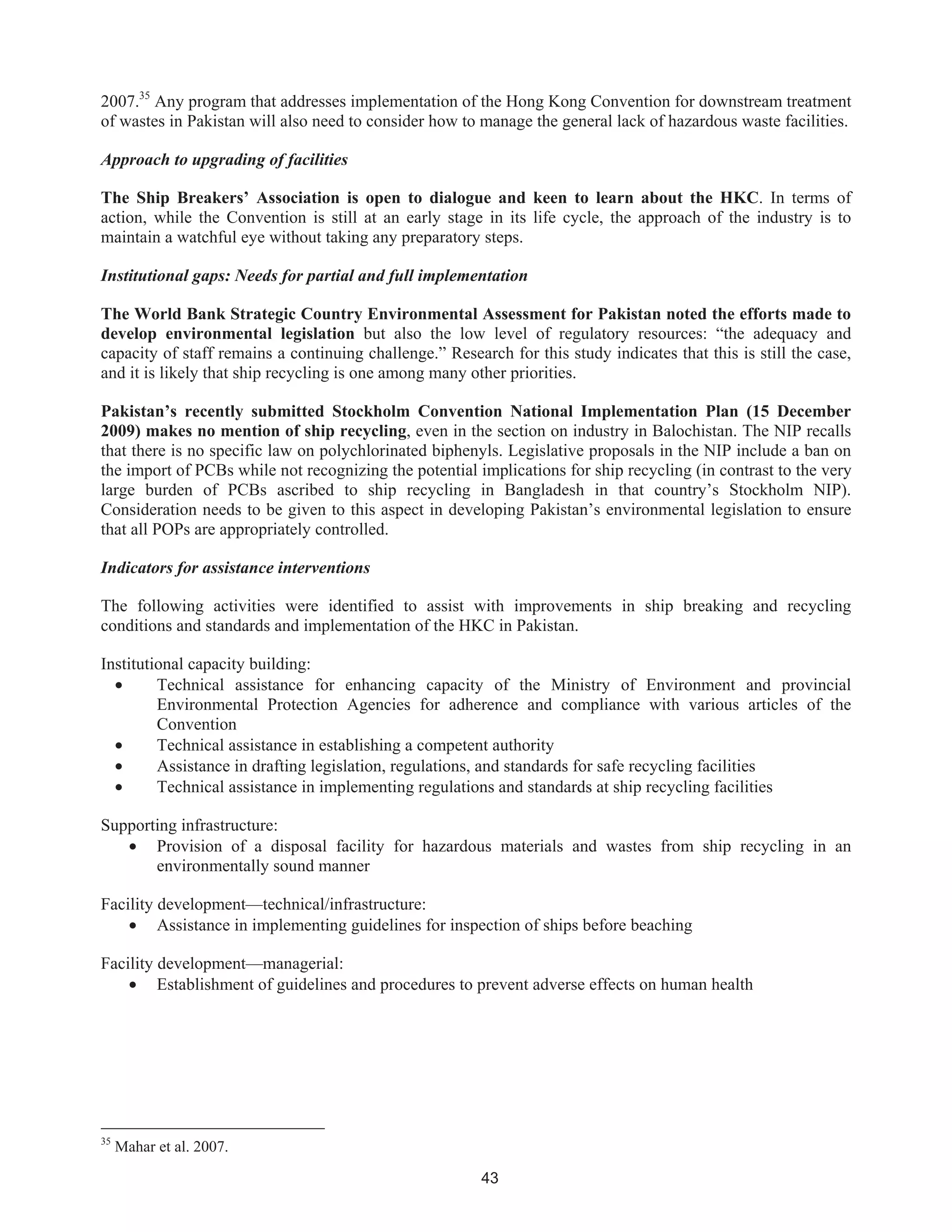

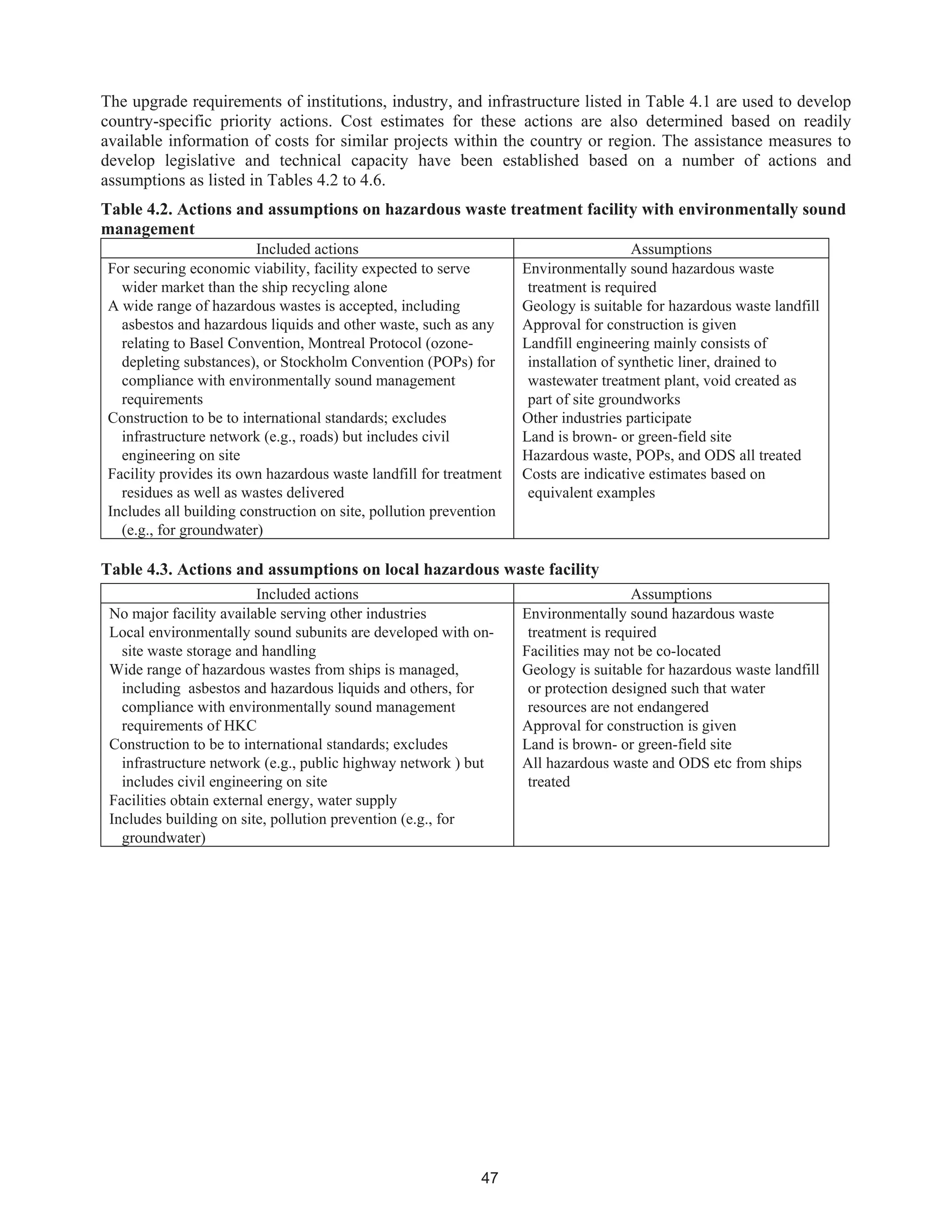

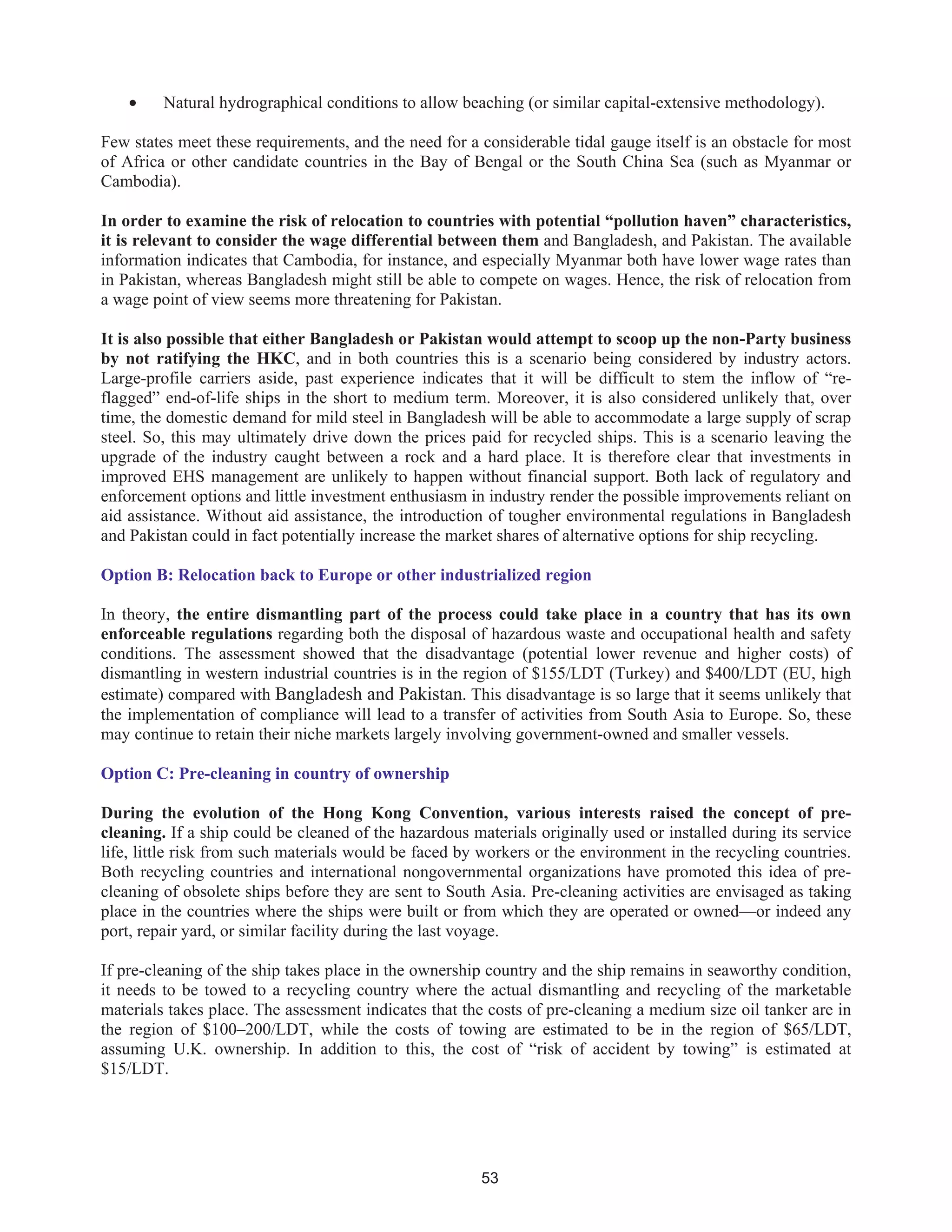

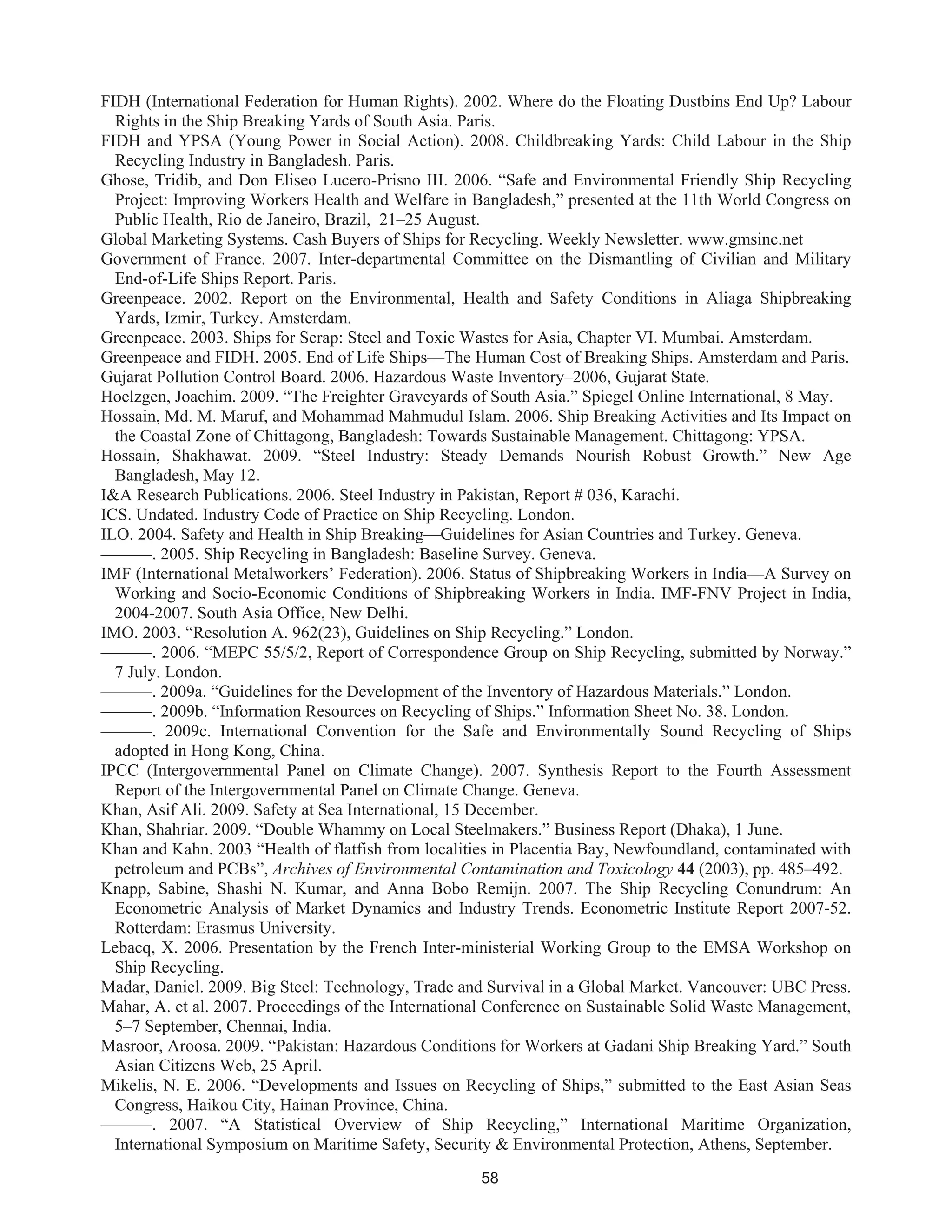

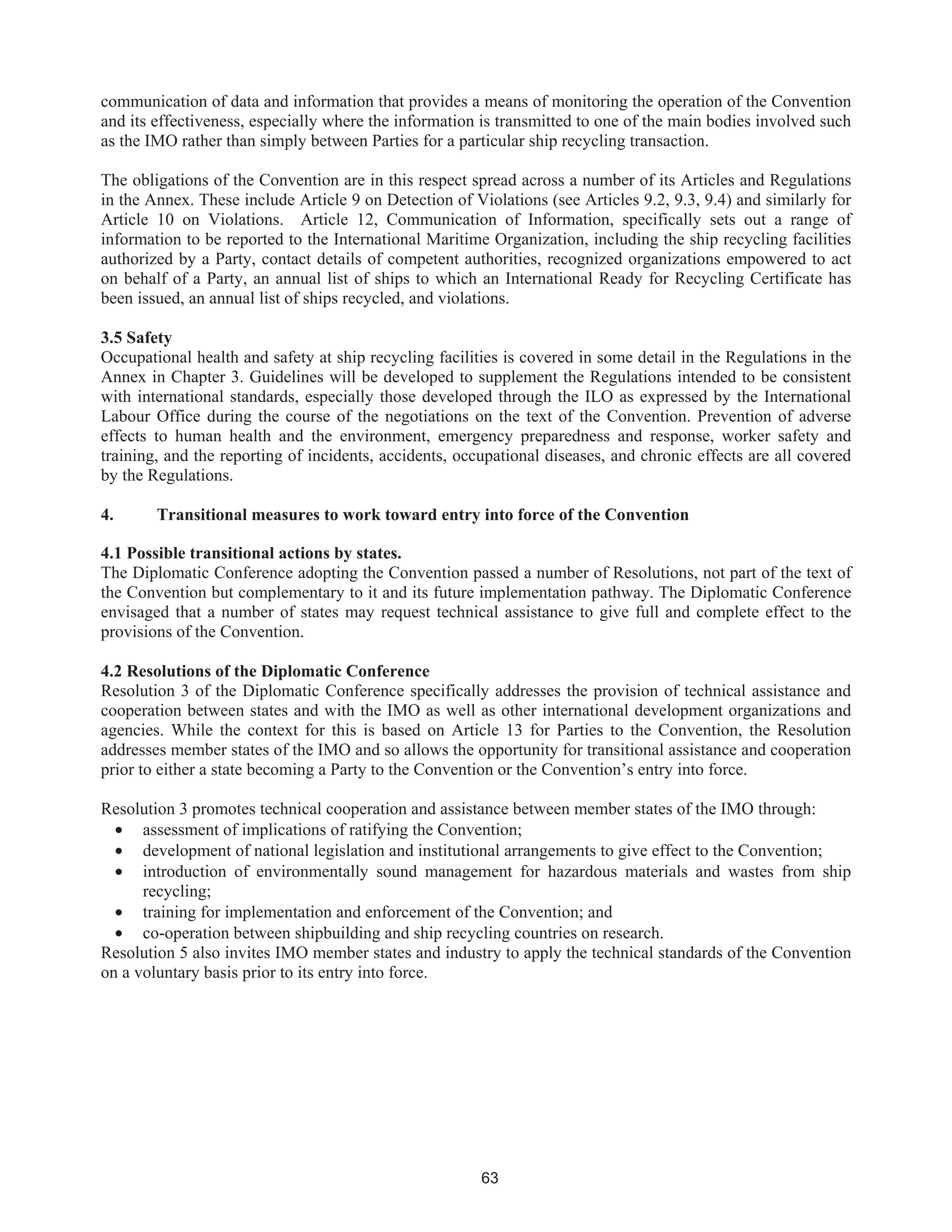

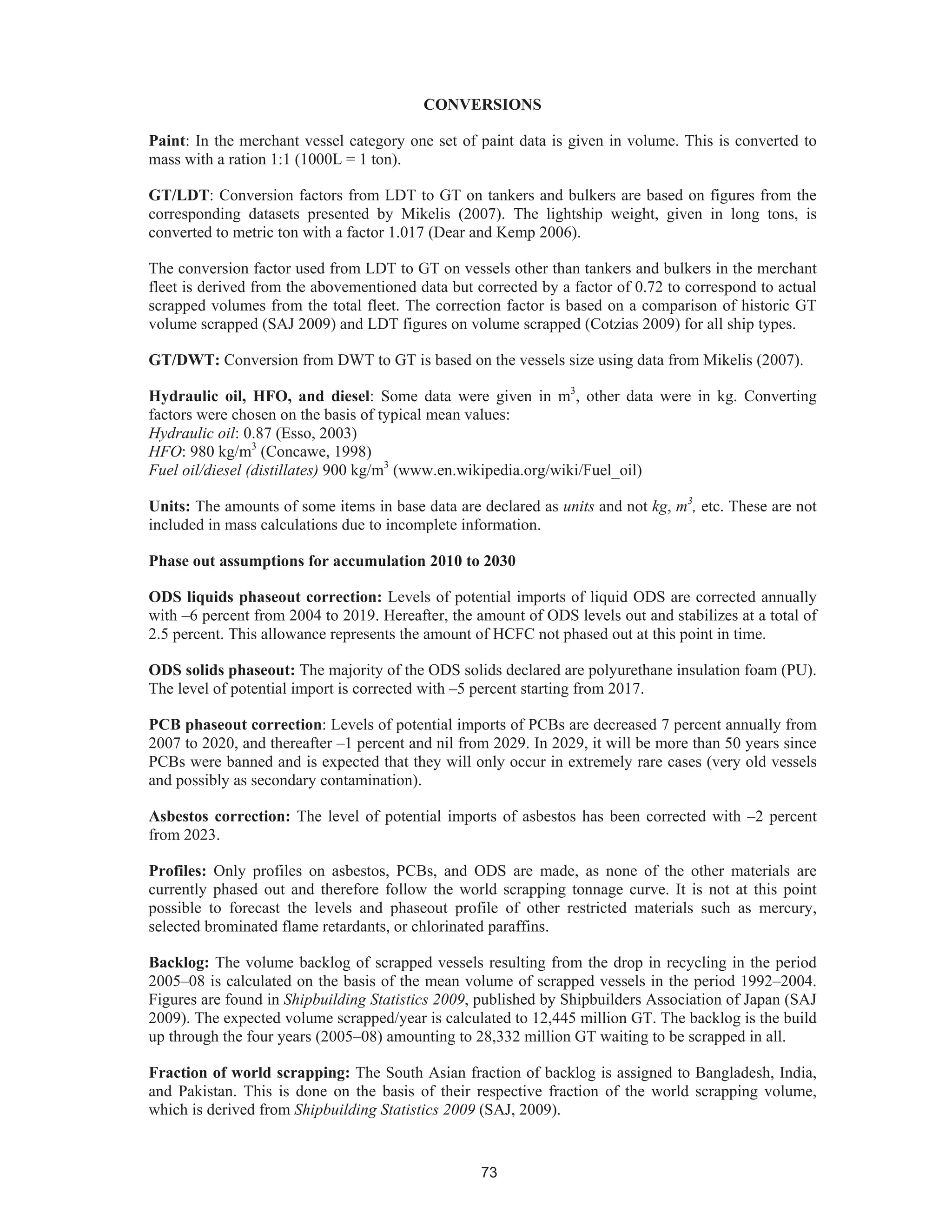

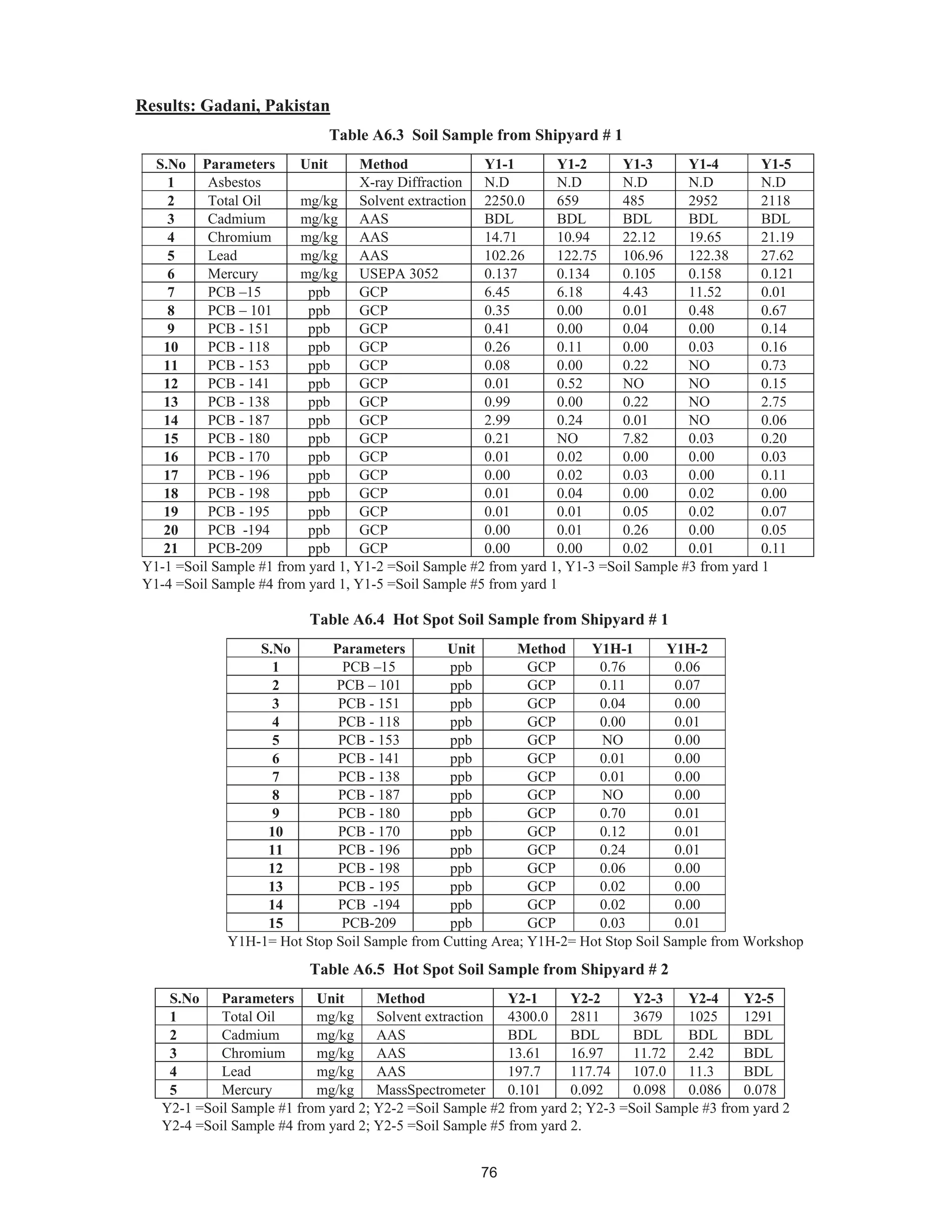

![69

APPENDIX5:SHIPAUDITS

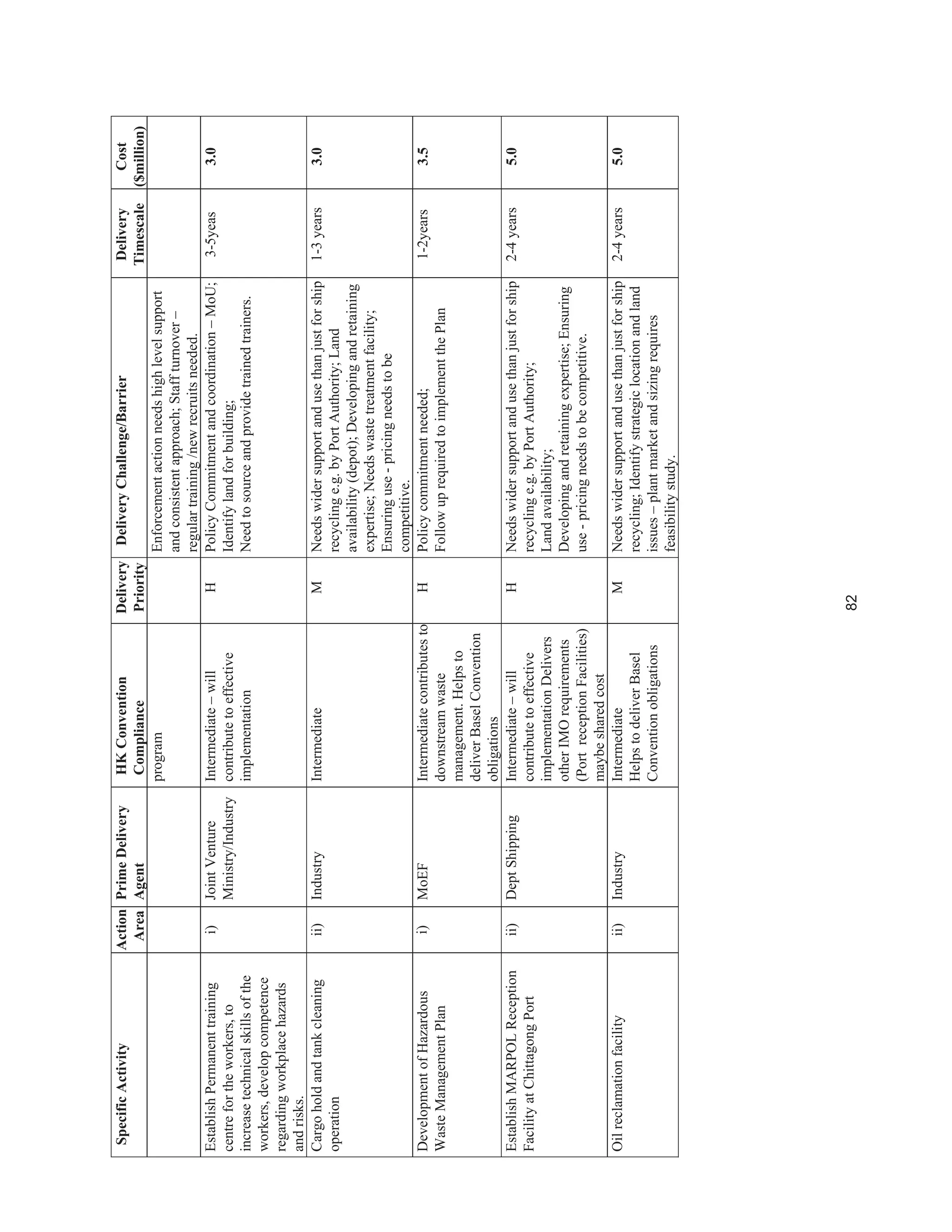

TABLEA5.1MERCHANTFLEET(calculationsareonthebasisofdeclaredhazardousmaterialsfromthefollowingnumberandtypesofships:

onecontainership,fourro-ros,fiveoiltankers,threechemicaltankers,andonenon-cargoship)

MerchantFleet-MeanTotal

HazardousMaterialUnit

Material

Total

1000

GT

total

Material/

millionGT

Rangeof

Shipsize

[GT]

Rangeof

material

Rangeof

material/

millionGT

No.

observations

Compiled

fromentry

no.

1

Asbestoston335659509

960-

156,8150.05-150

0.76-

3666.9413/14

2PCB

2.1

PCBliquids(transformers,etc)kg0.004520.00

960-

156,815NorangeNorange8/14

2.2

PCBssolids(capacitors,ballasts,

etc)kg0.352081.66

51,071-

156,8150.300-0.0450.29-5.872/14

3

Hydraulicoilton18158113

960-

156,8152.22-16.0

99.86-

2312.52/14

4ODS

4.1

ODSliquids(CFC,Halons,etc)ton2.523507

960-

156,8150.16-0.915.29-167.086/14

4.2

ODSsolids(e.gPU)ton3031731753

35,431-

51,0710.03-300

0.75-

8467.064/14

5Paints

5.1Paintsnoinfoton65157415norangenorangenorange1/14

5.2

Paintscont.TBTton430514

960-

156,8150.00-2.987.65-66.255/14

5.3Paintscont.PCBtonNoinformationavailable

5.4Paintscont.MetalstonNoinformationavailable

6Heavymetals

6.2Cadmiumton

0.301581.90

960-

156,8150.0002-0.30.21-1.912/14

6.4Mercurykg

16.2337143.75

960-

156,8150-50-146.066/14

7RadioactivesubstanceskgNoinformationavailable

8

Wasteliquidsorganicm319233405654

960-

156,8150.056-1820

1.25-

11,606.057/288.1-8.2](https://image.slidesharecdn.com/shipbreaking-myanmar-2014-140611041422-phpapp02/75/Shipbreaking-myanmar-2014-95-2048.jpg)

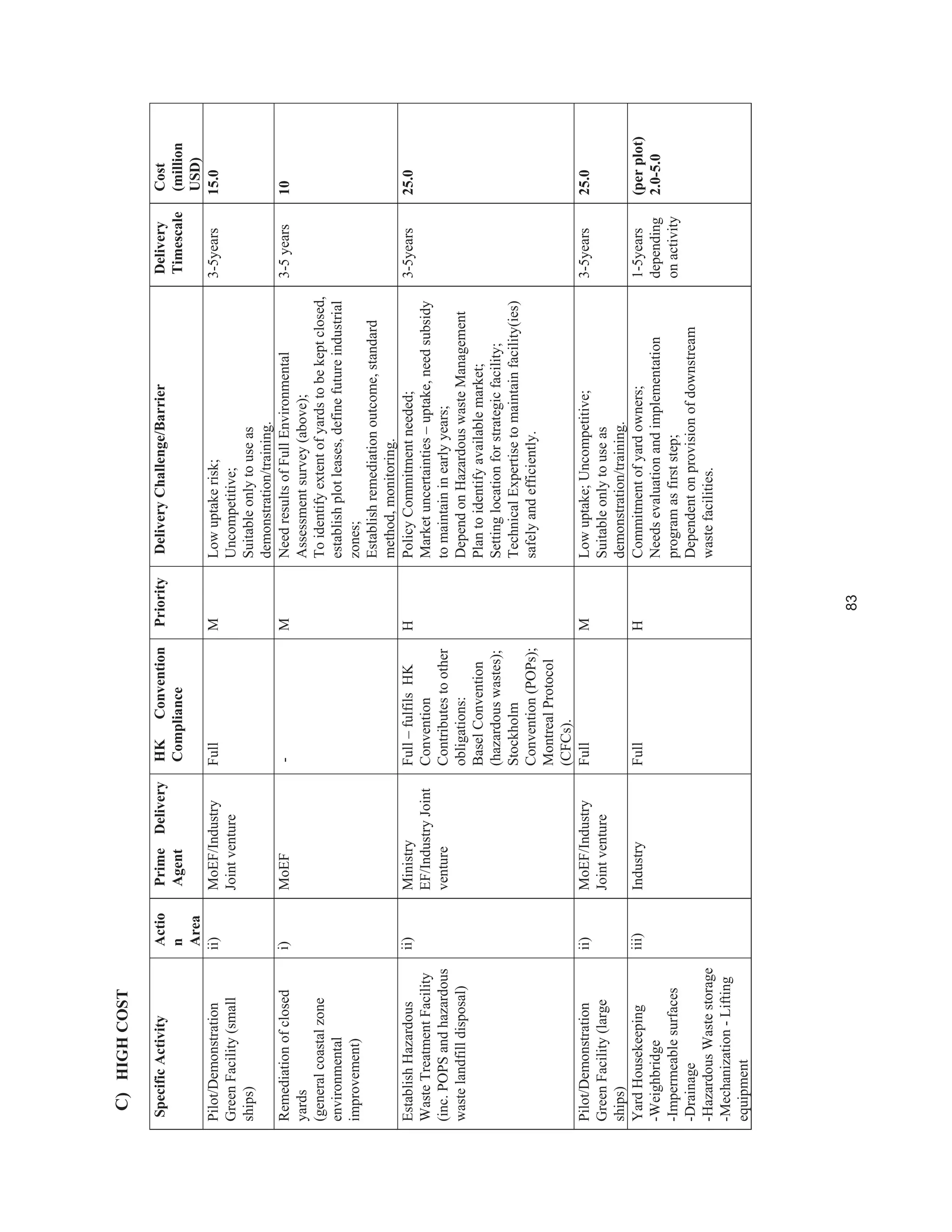

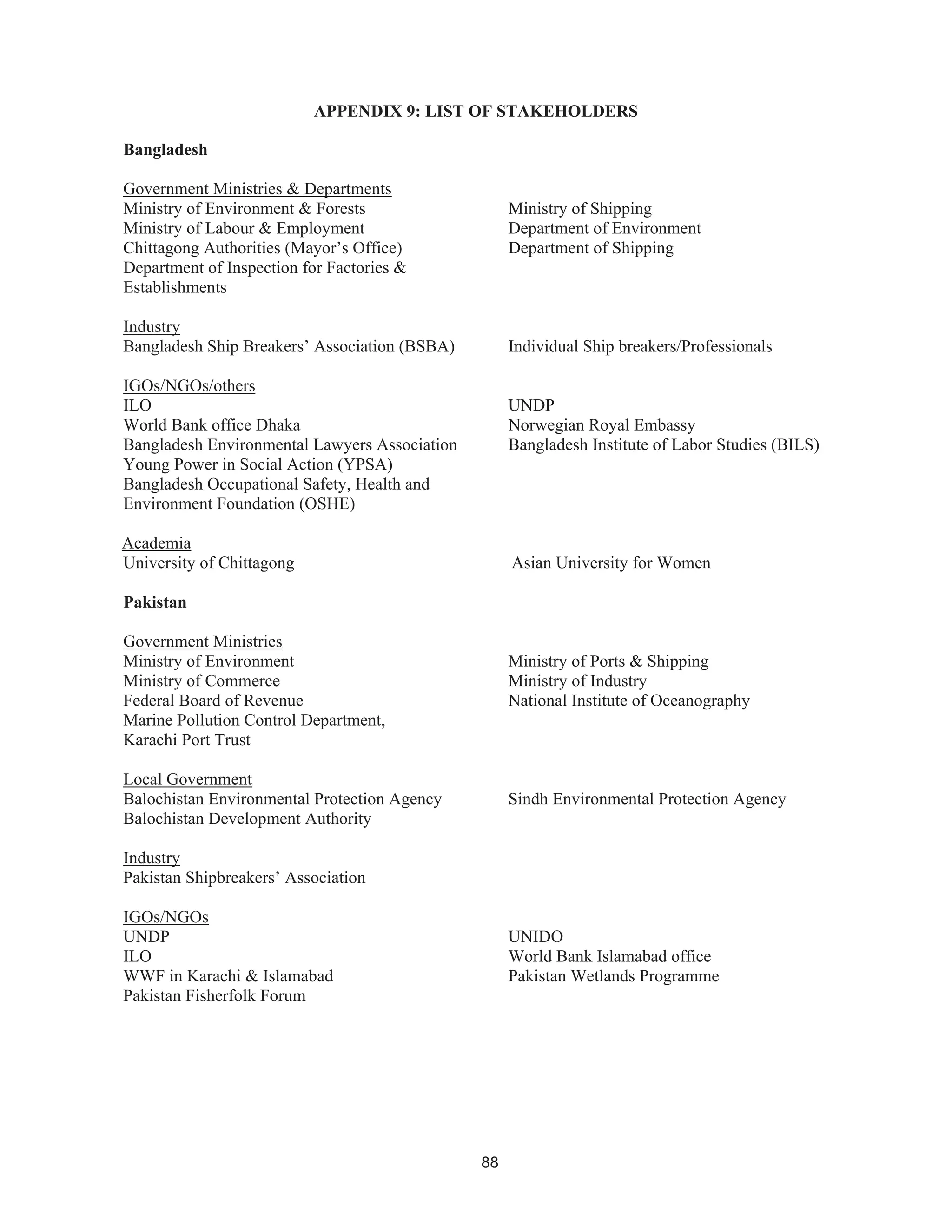

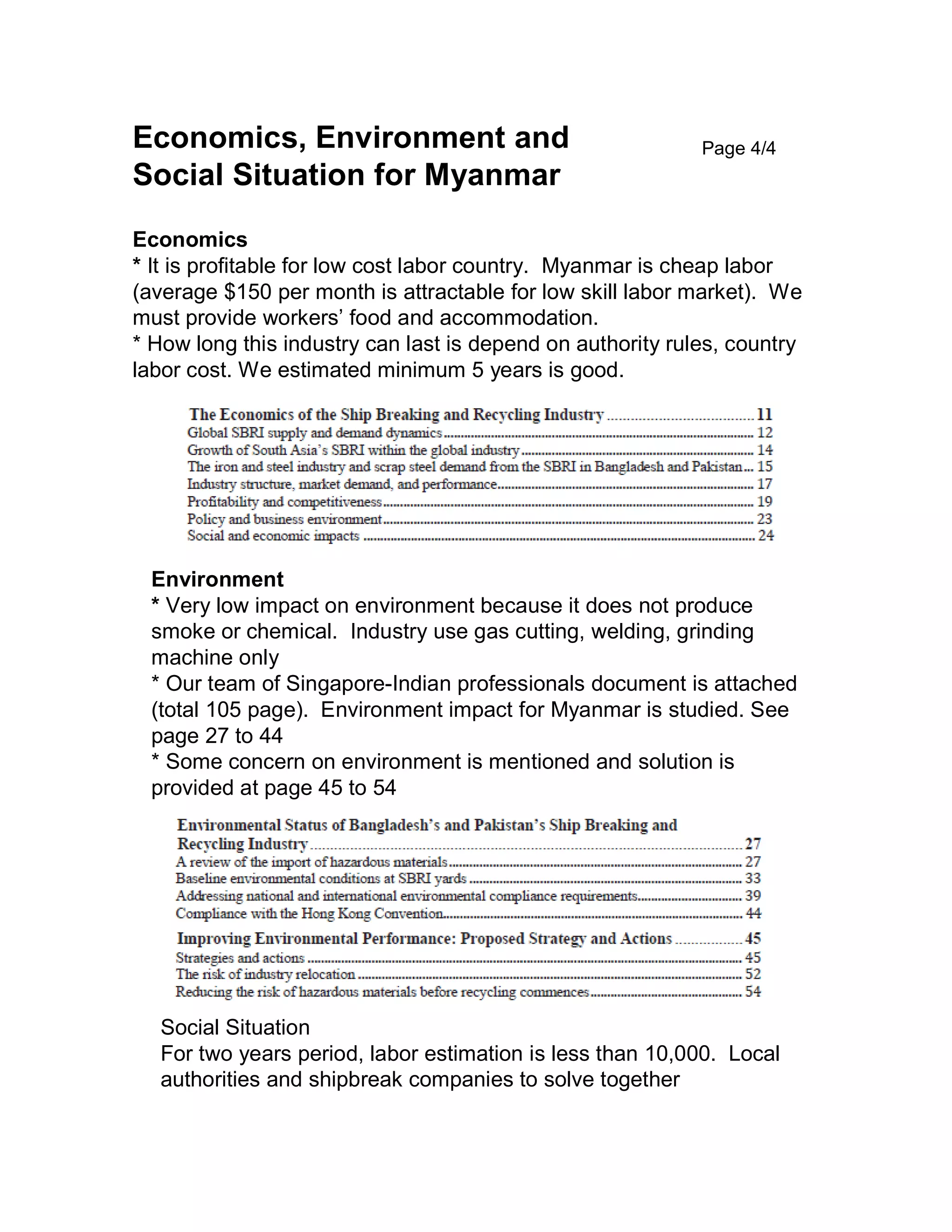

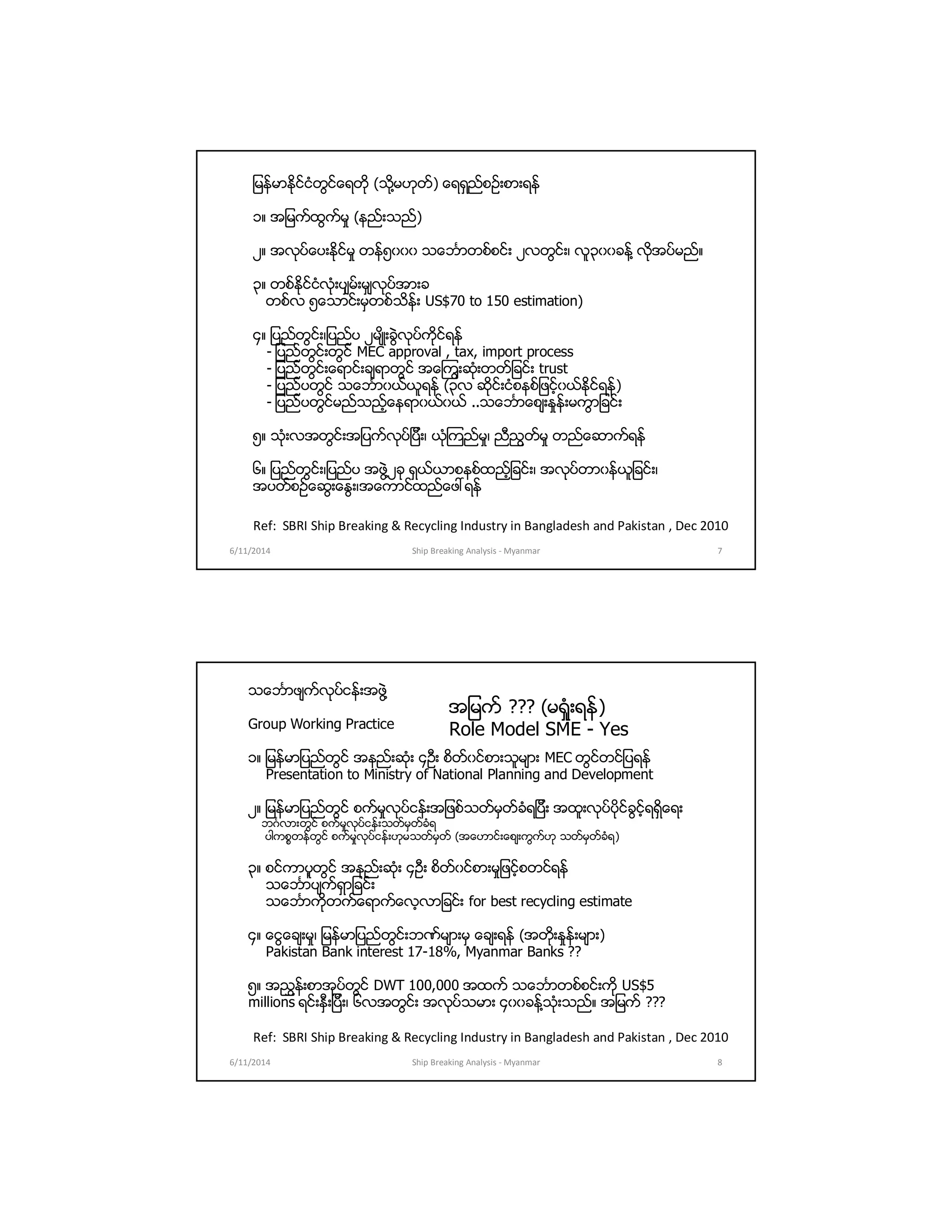

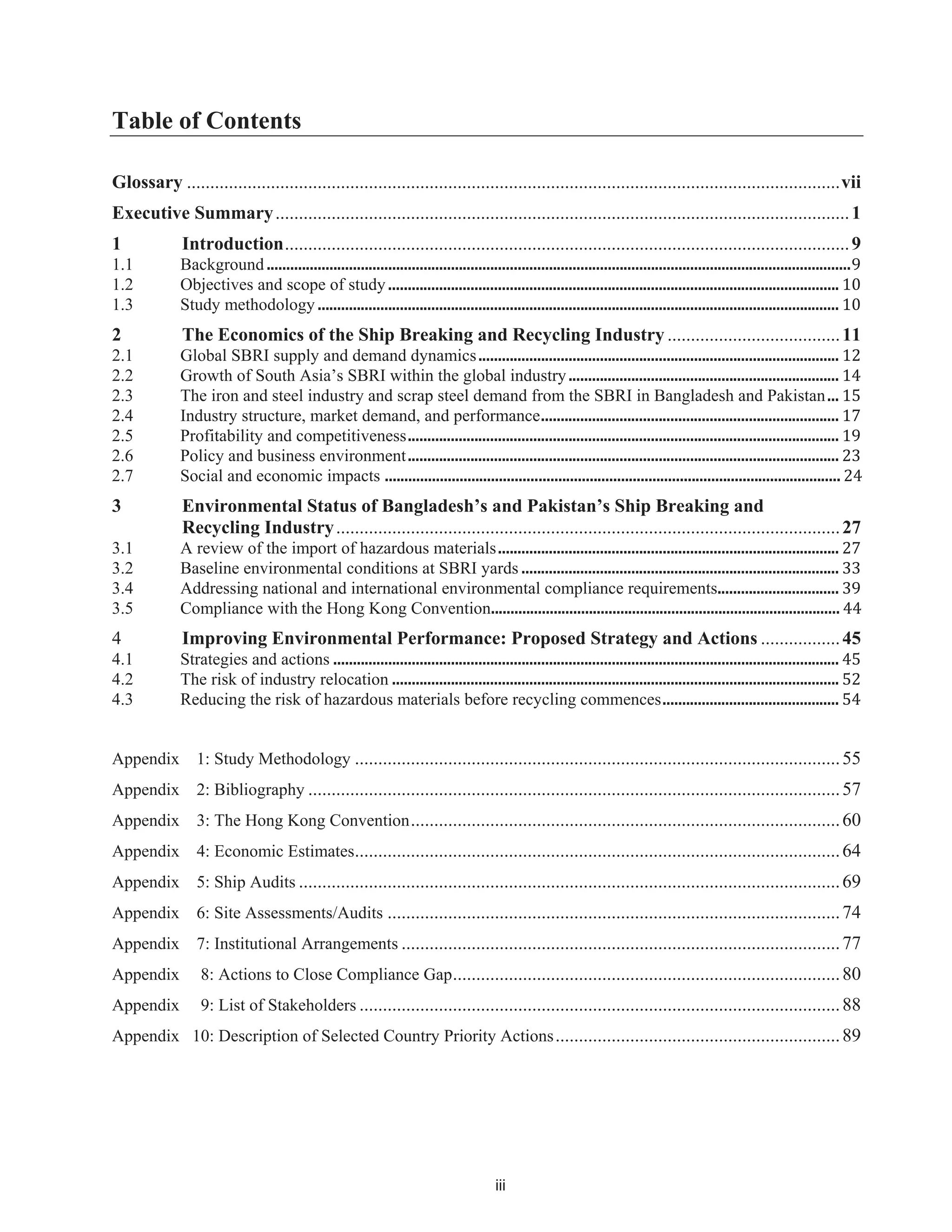

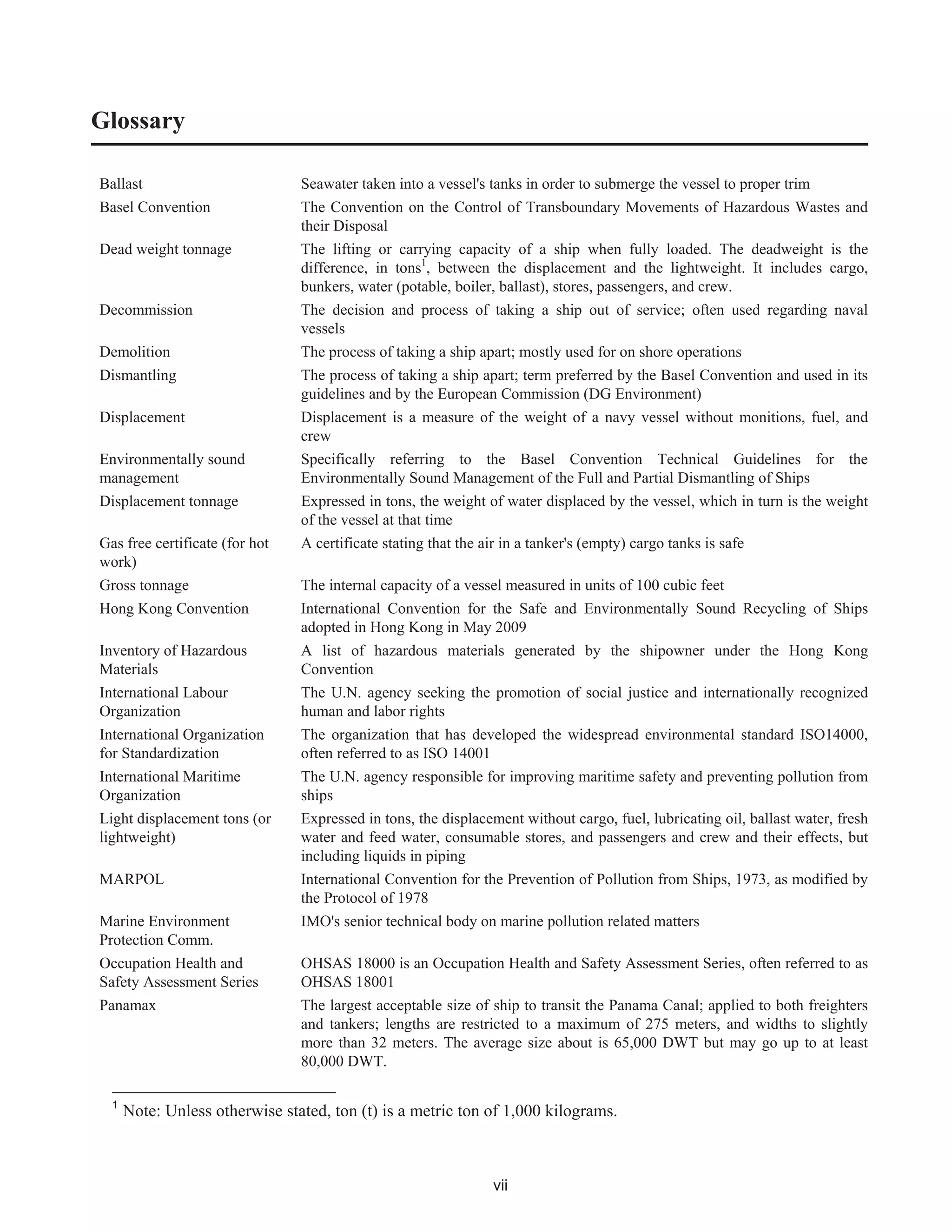

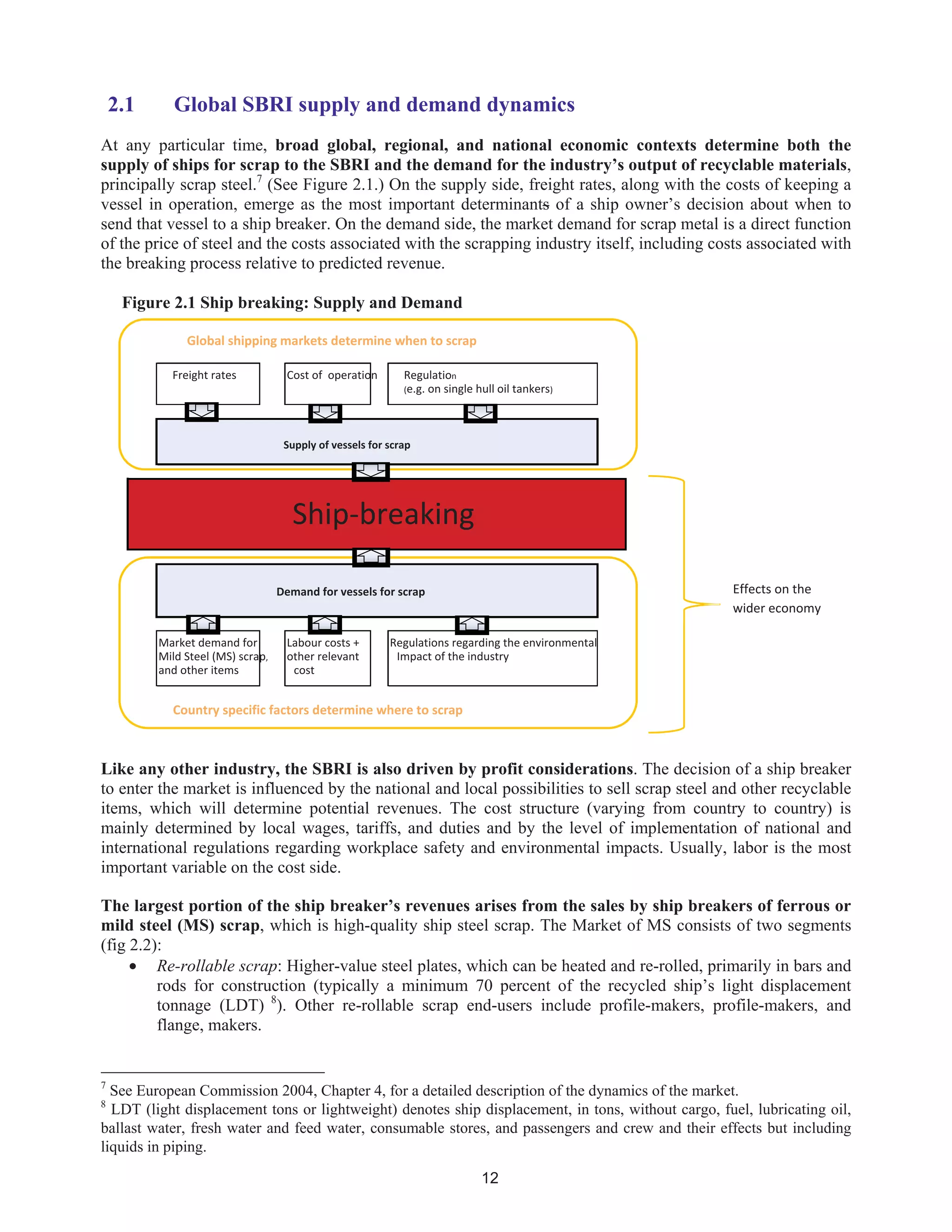

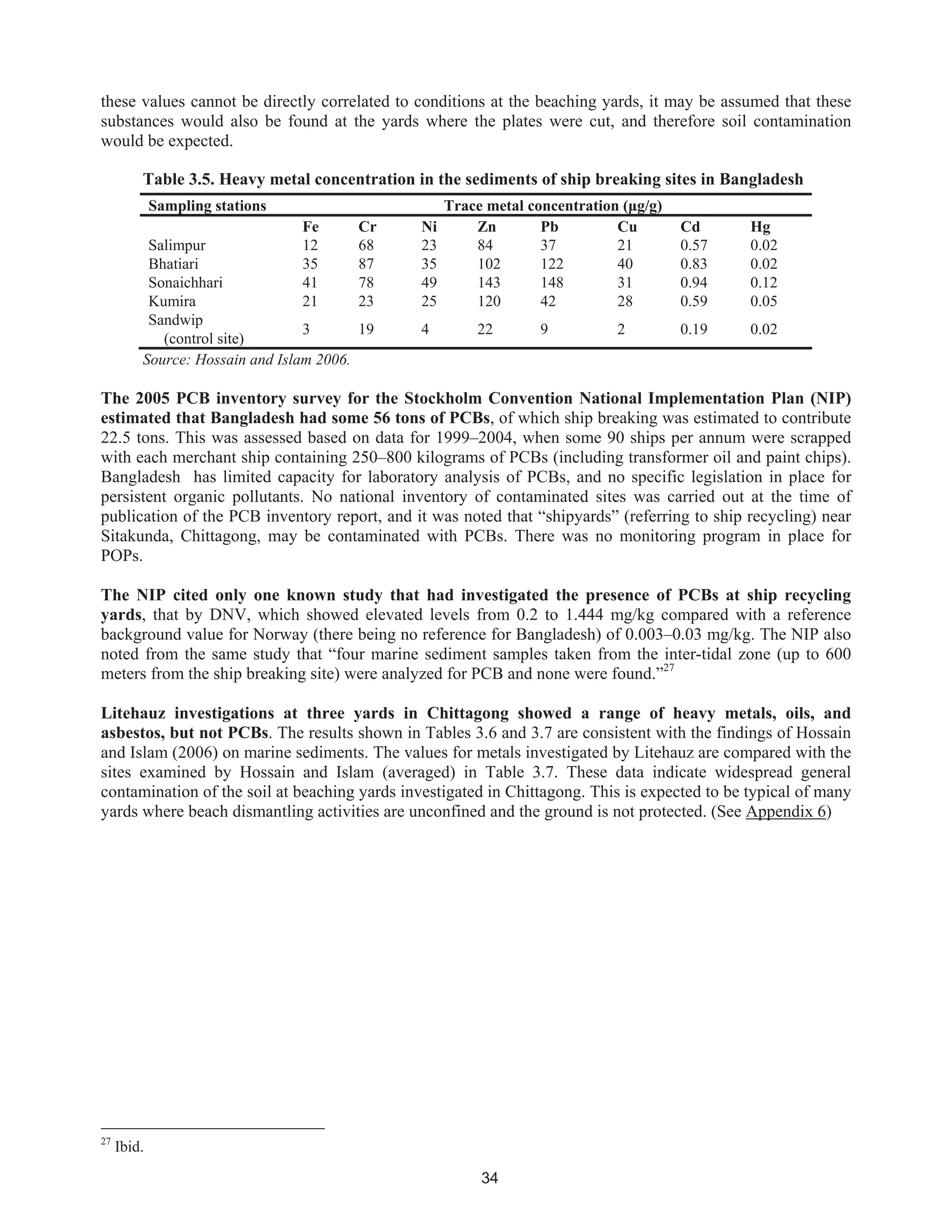

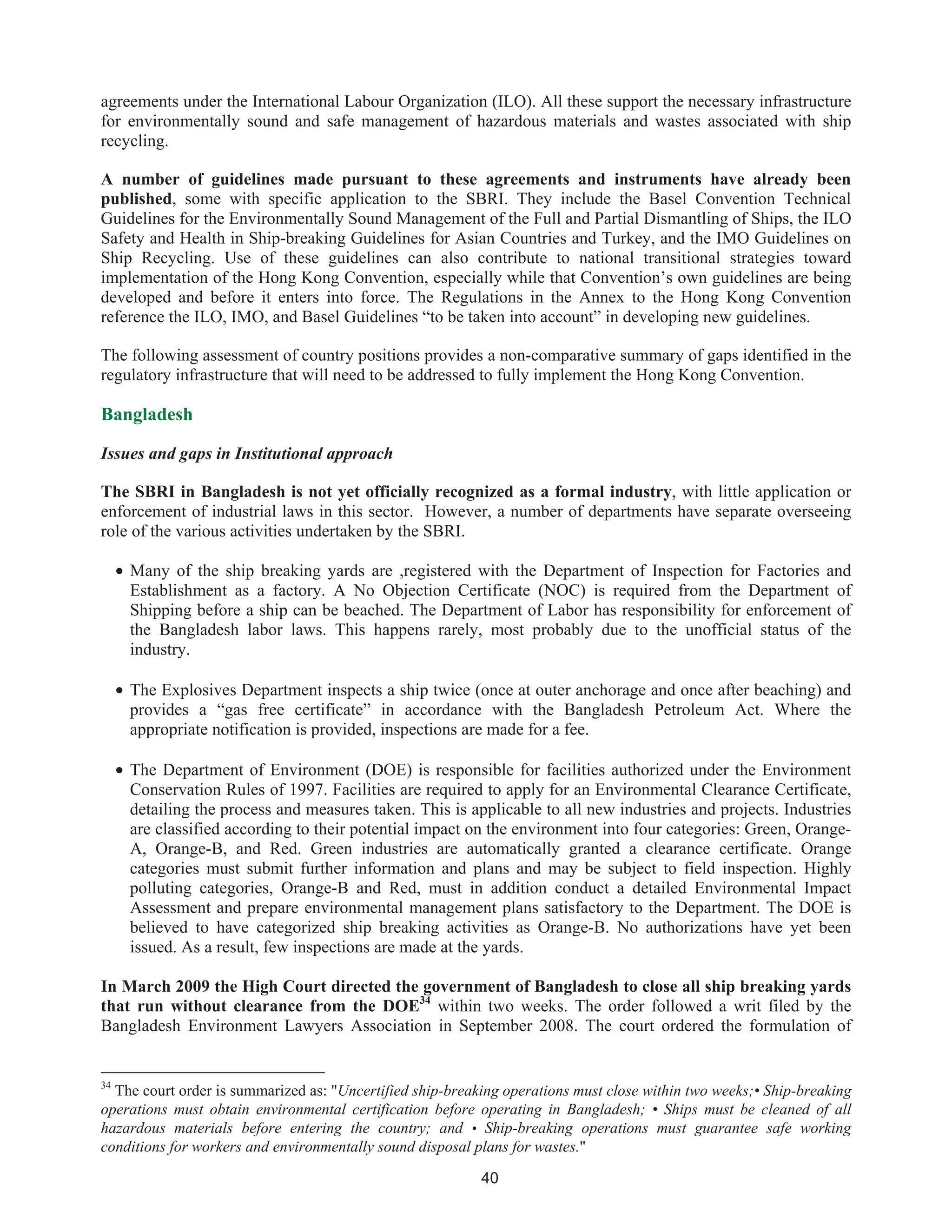

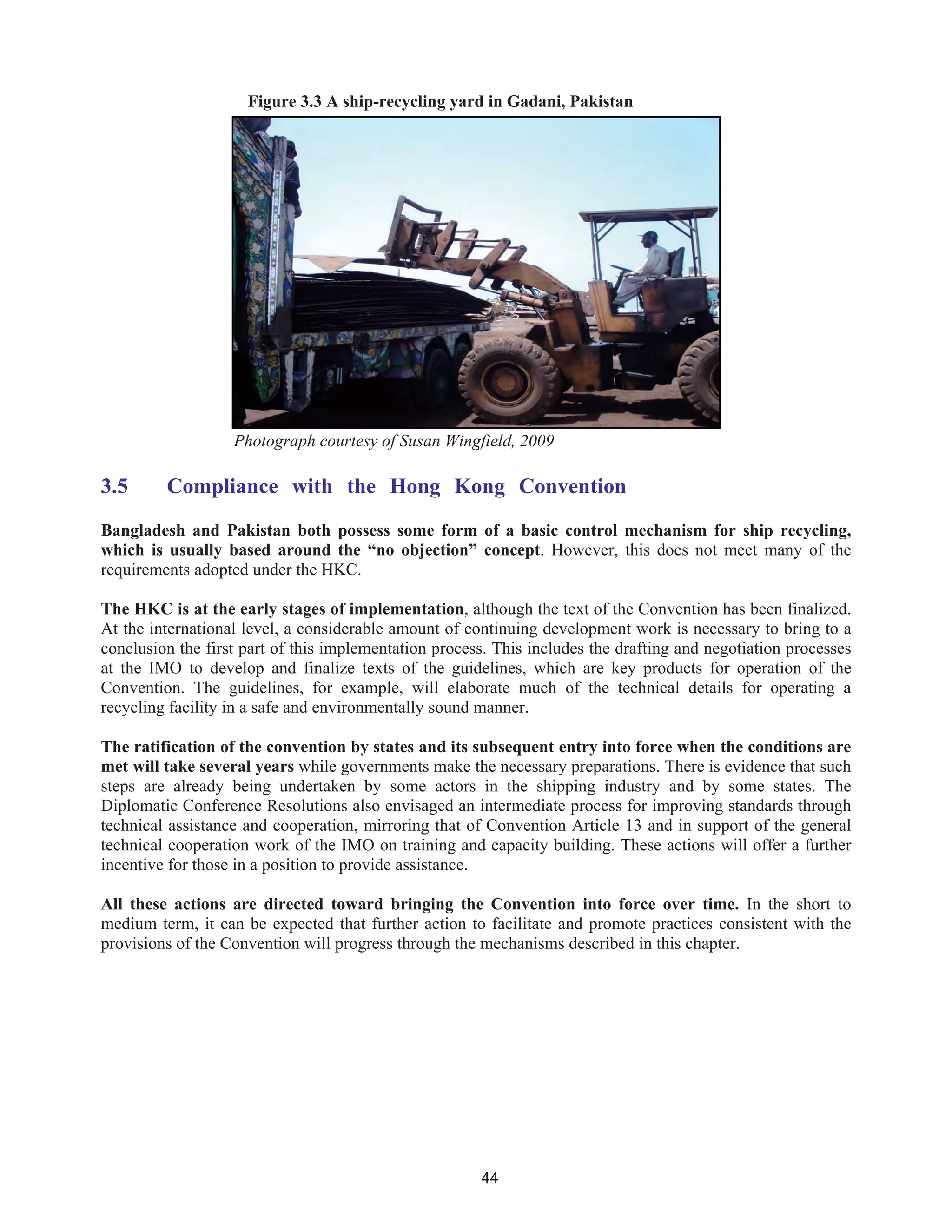

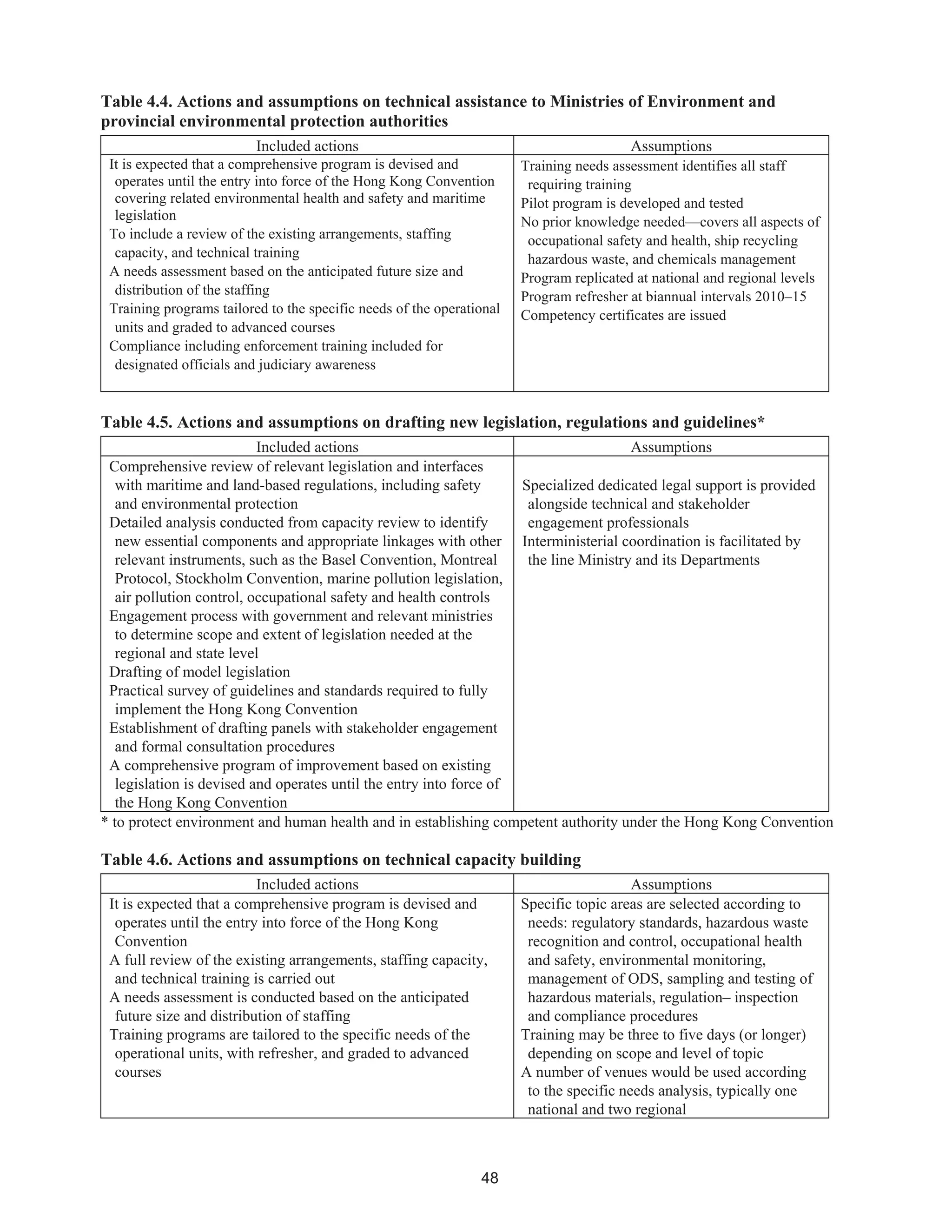

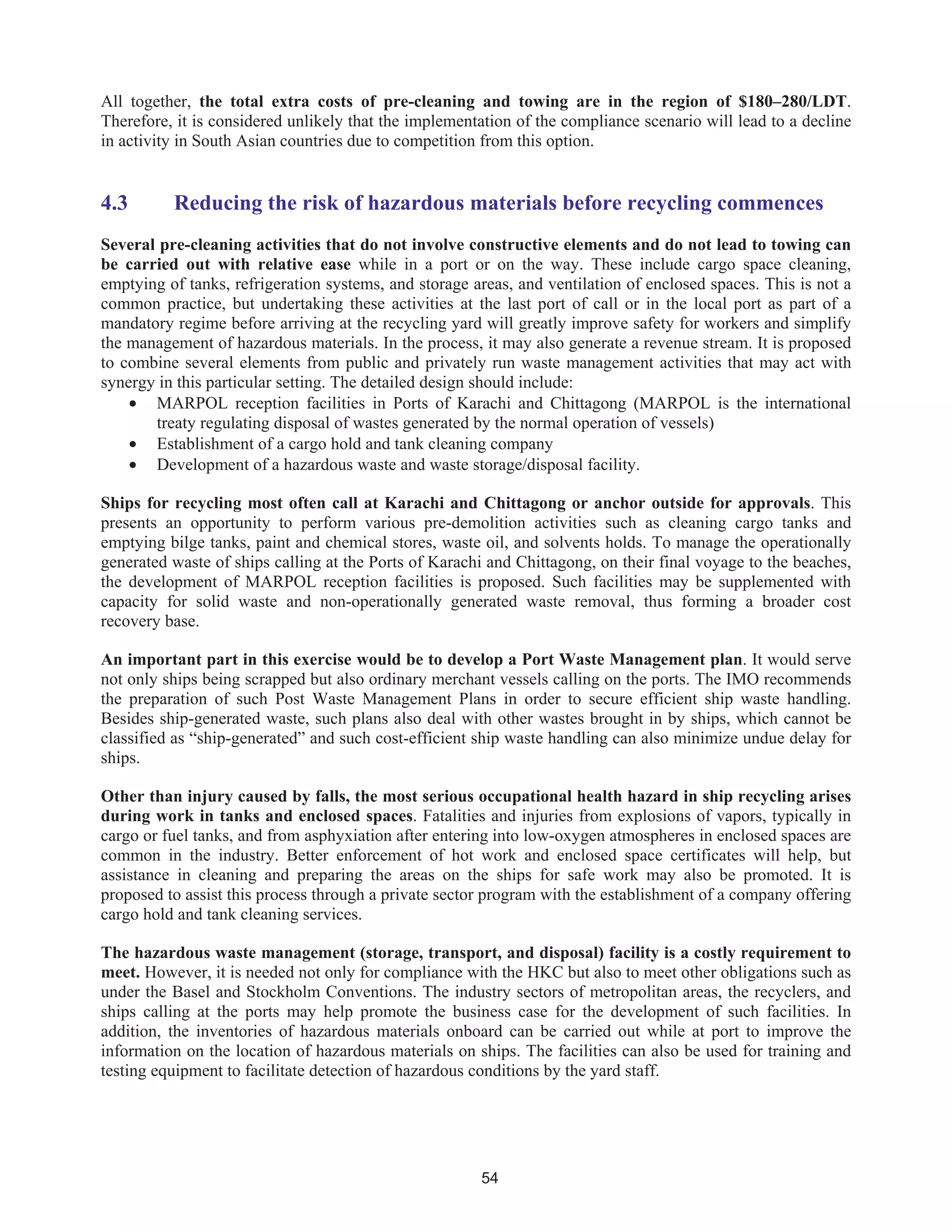

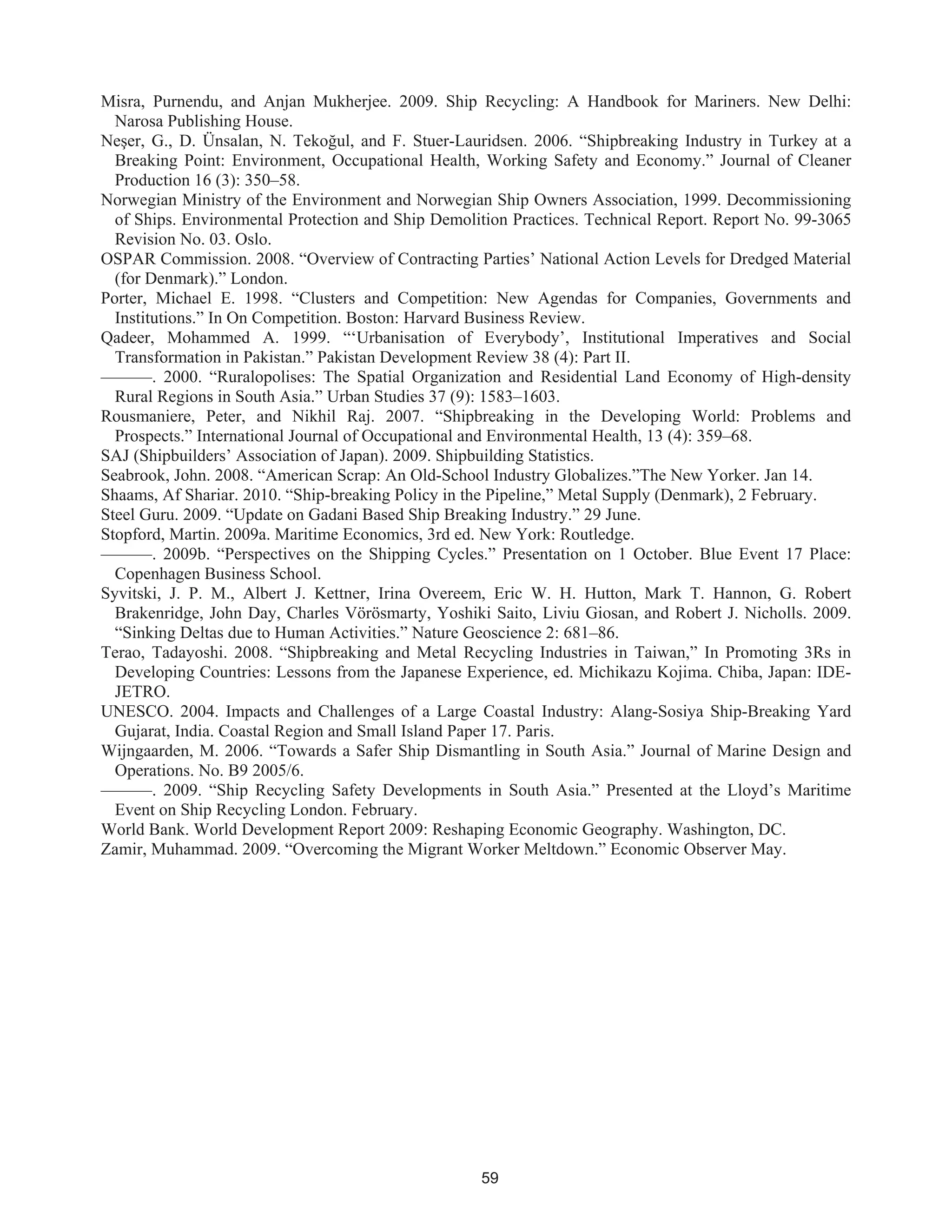

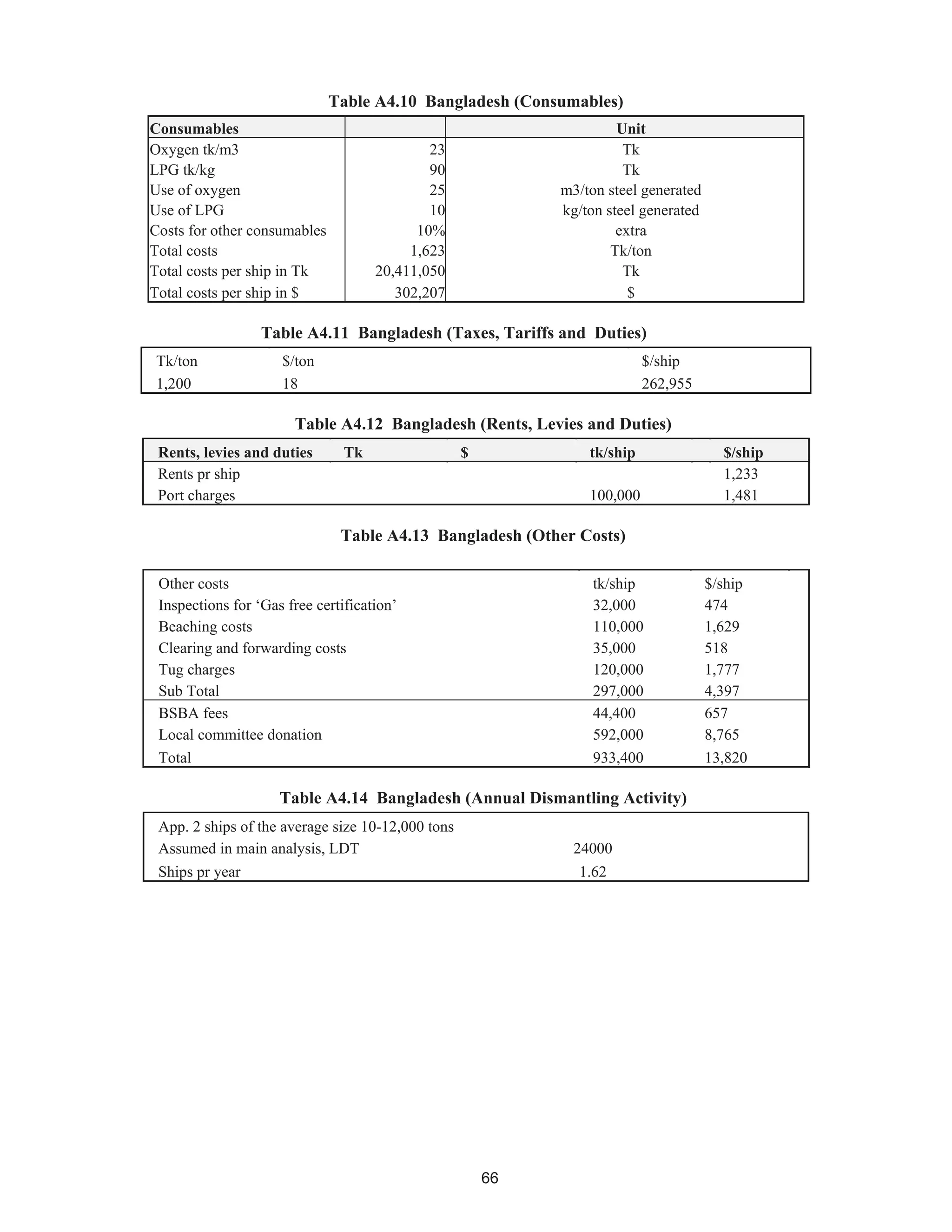

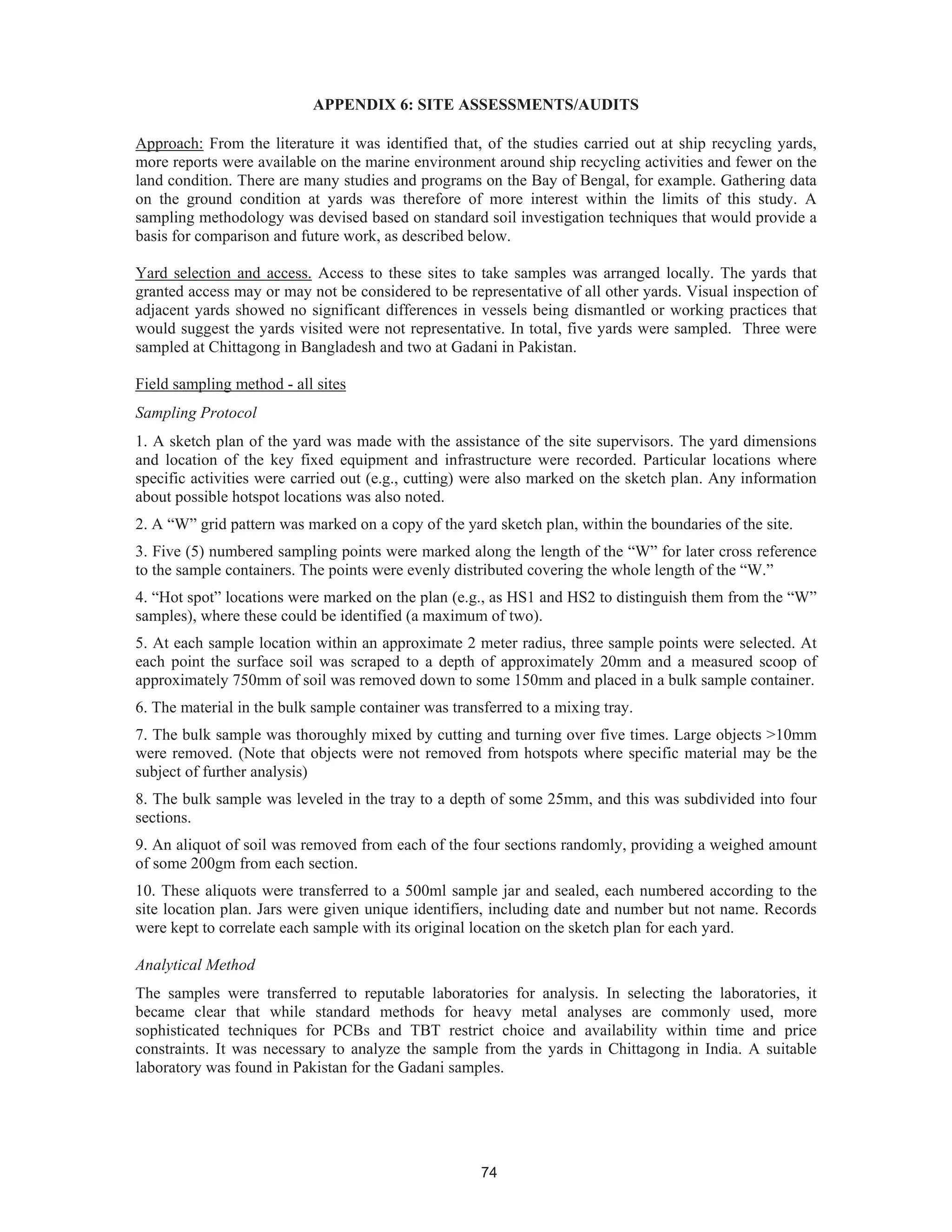

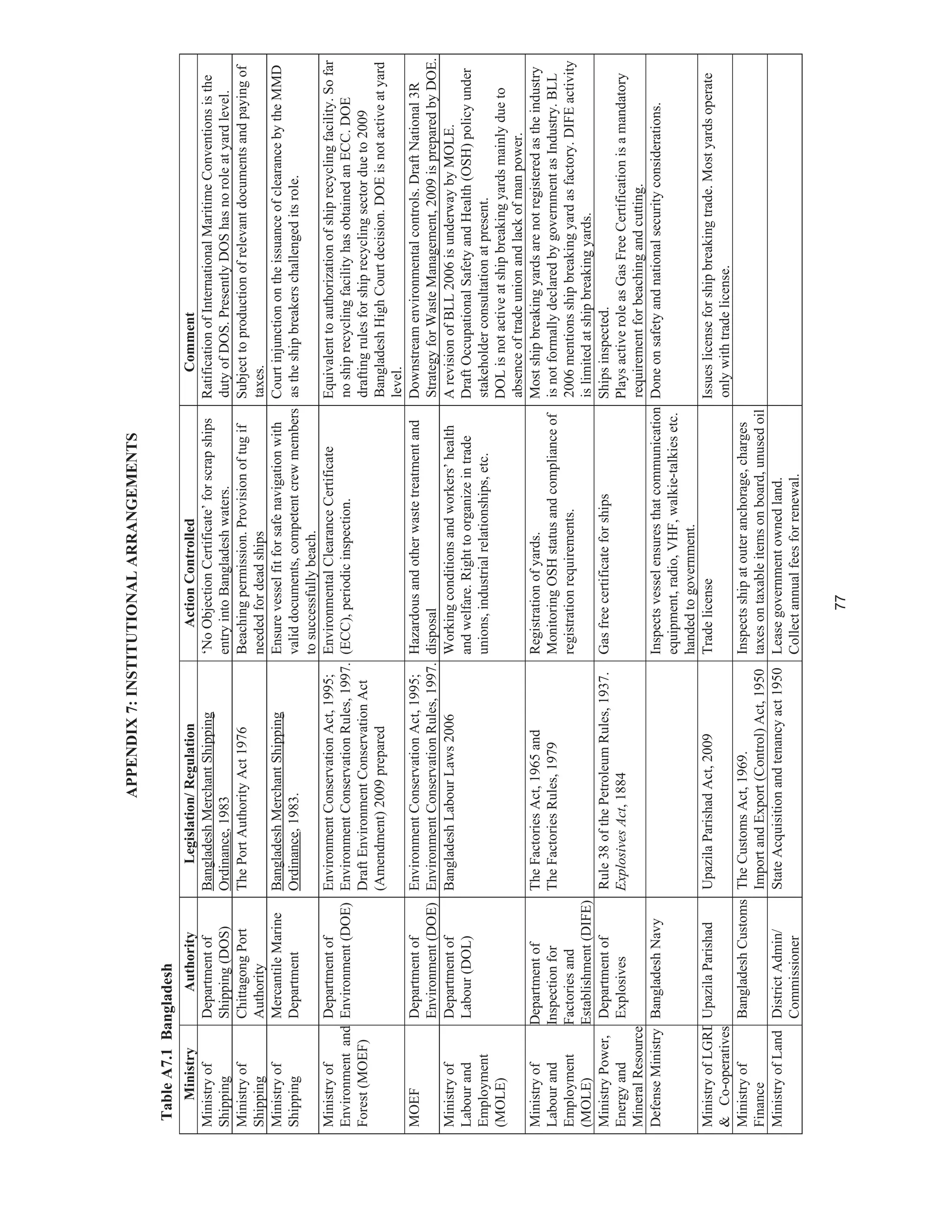

![70

MerchantFleet-MeanTotal-cont’d

HazardousMaterialUnit

Material

Total

1000

GT

total

Material/

millionGT

Rangeof

Shipsize

[GT]

Rangeof

material

Rangeof

material/

millionGT

No.

observations

Compiled

fromentry

no.

9

Reusableliquidsorganic(HFO,

diesel)ton15504833208

960-

156,8155.21-567

907.18-

12,802.199/14

10Misc

10.1BallastWater(C-34)ton25184259485Norangenorangenorange1/14

10.2sewage(C-35)m32842661Norangenorangenorange1/14

10.3Garbage(C-42)ton0.10442.3Norangenorangenorange1/14

10.4Incineratorash(C-41)ton0.05261.9Norangenorangenorange1/14

10.5

Oilyrags(C-45)ton0.22703.1

35,431-

44,2890.02-0.20.0006-0.004522/1410.5

10.7

Batteriesnickel/cadmium

unit

s742165Norangenorangenorange1/14

11Wasteliquidsinorganic(acids)m30.041570.28NorangeNorangeNorange1/14

12

Reusableliquidsorganic(other)m3151246615

960-

156,8150.24-86.0250-23,177.086/42

12.1,12.2,

12.4

13Misc

13.4Batterieslead(C46)ton0.351572.23156,815norangenorange1/14](https://image.slidesharecdn.com/shipbreaking-myanmar-2014-140611041422-phpapp02/75/Shipbreaking-myanmar-2014-96-2048.jpg)

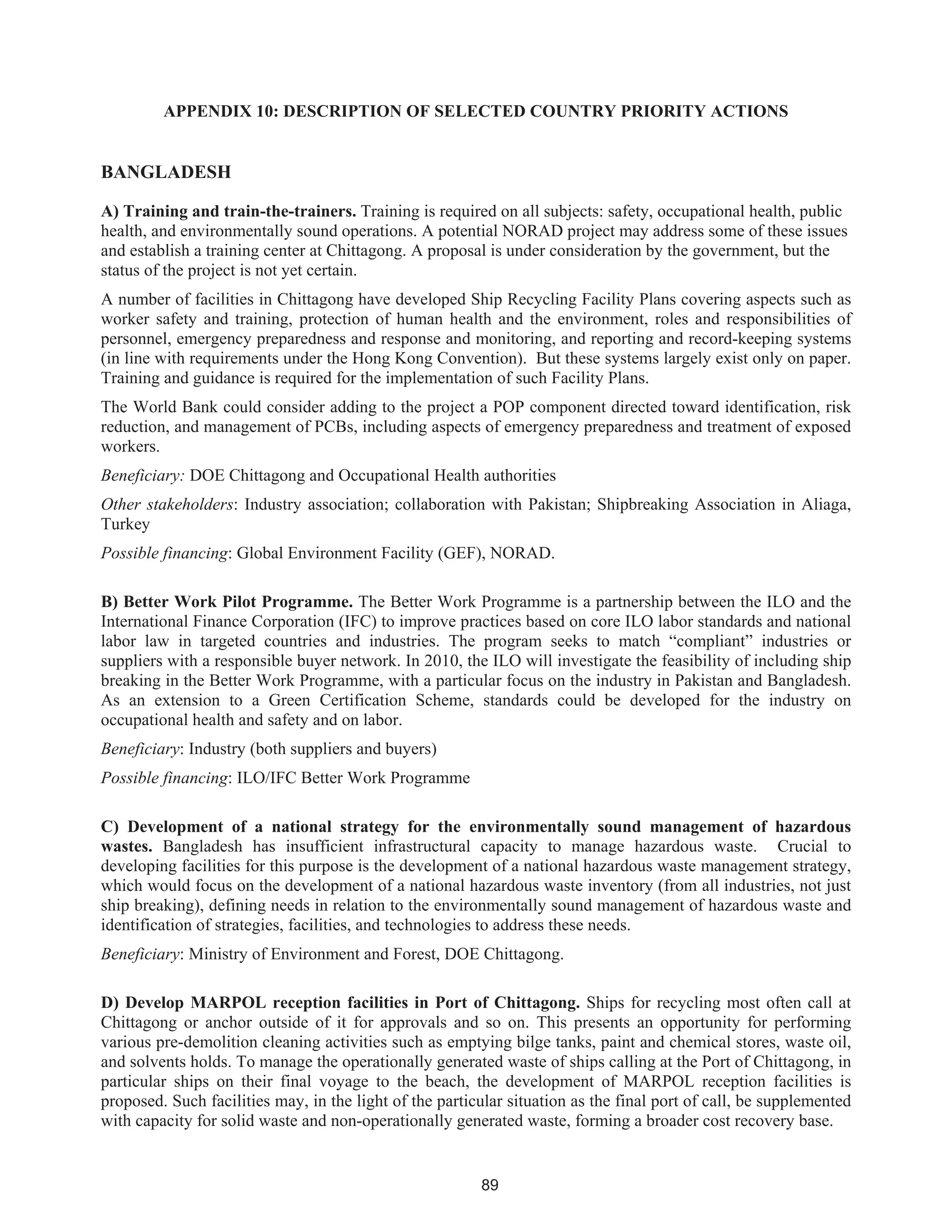

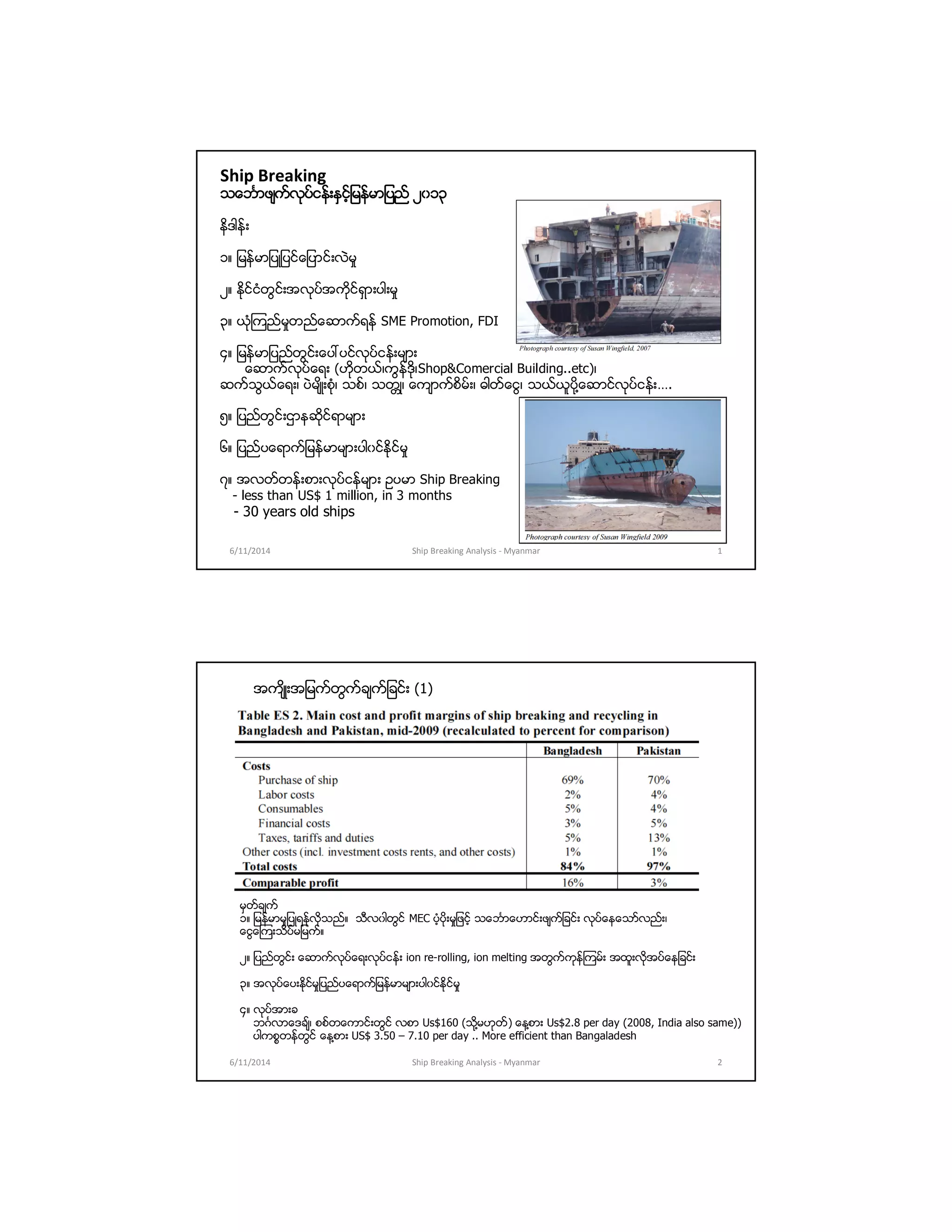

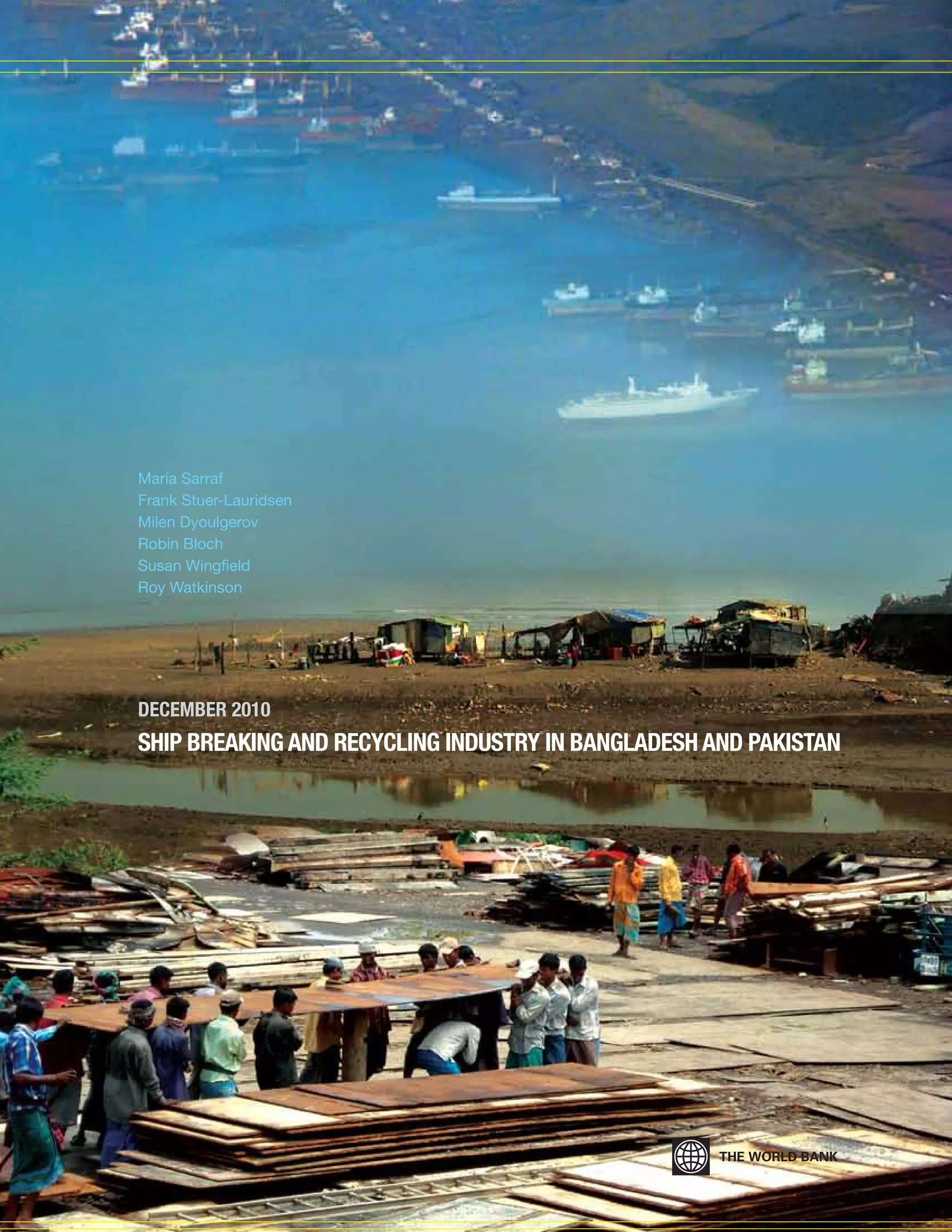

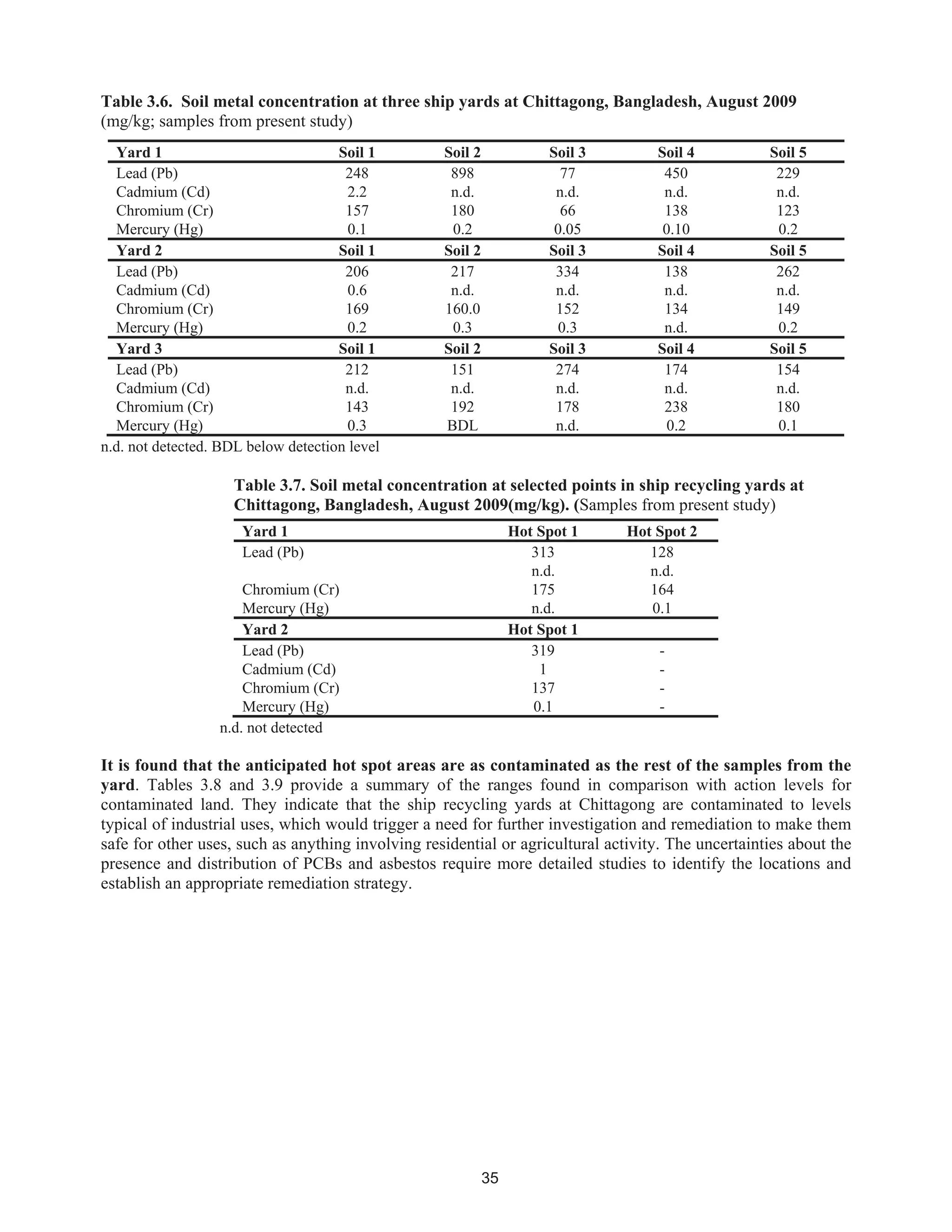

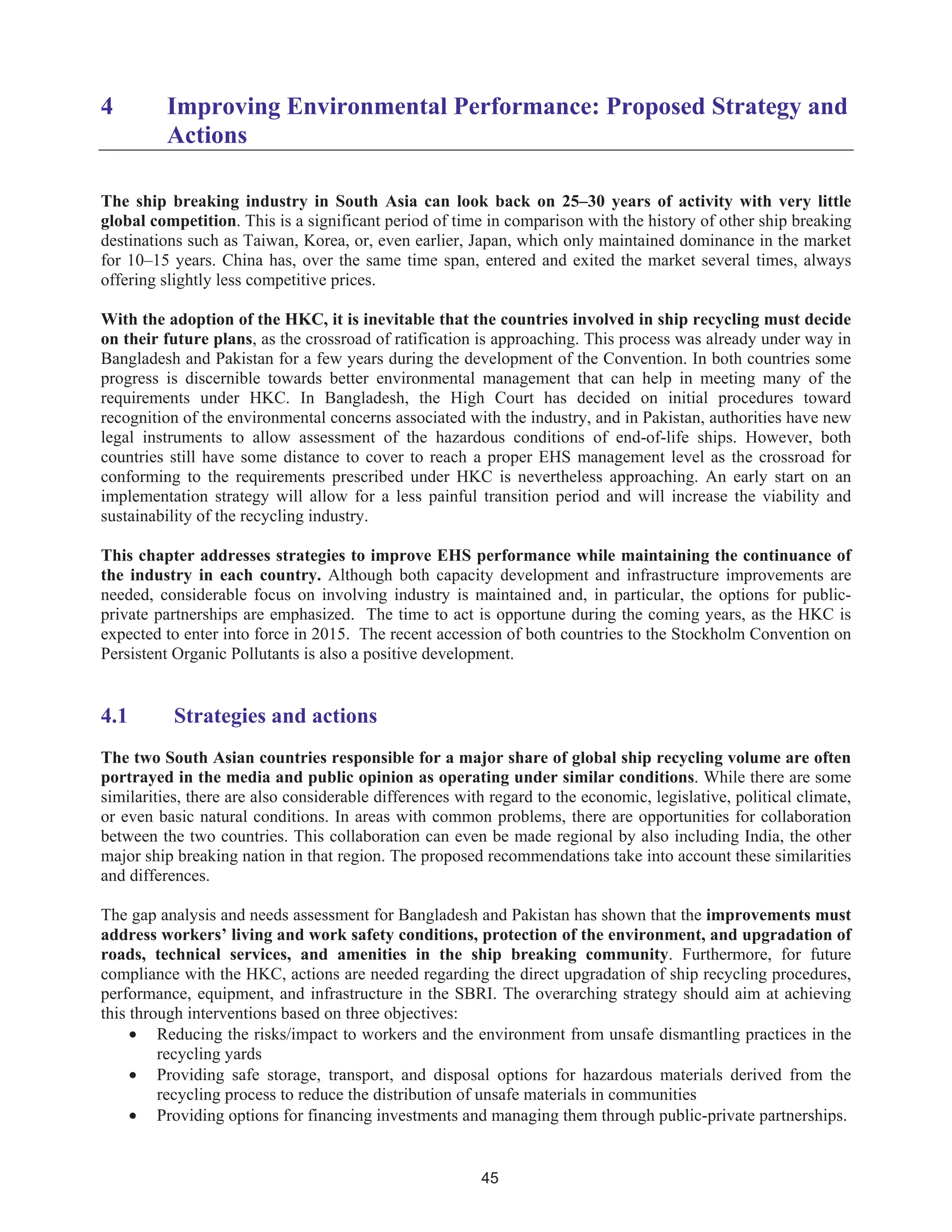

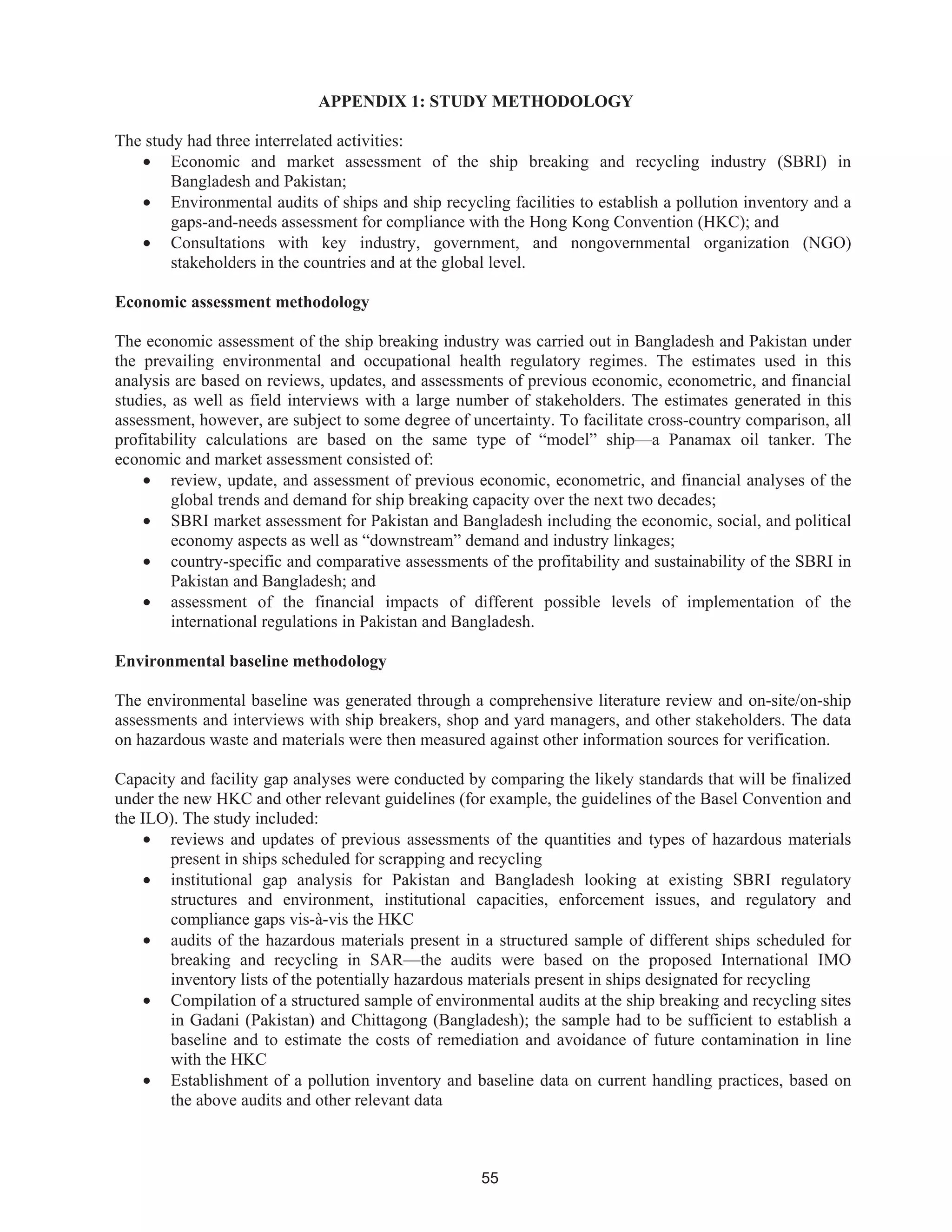

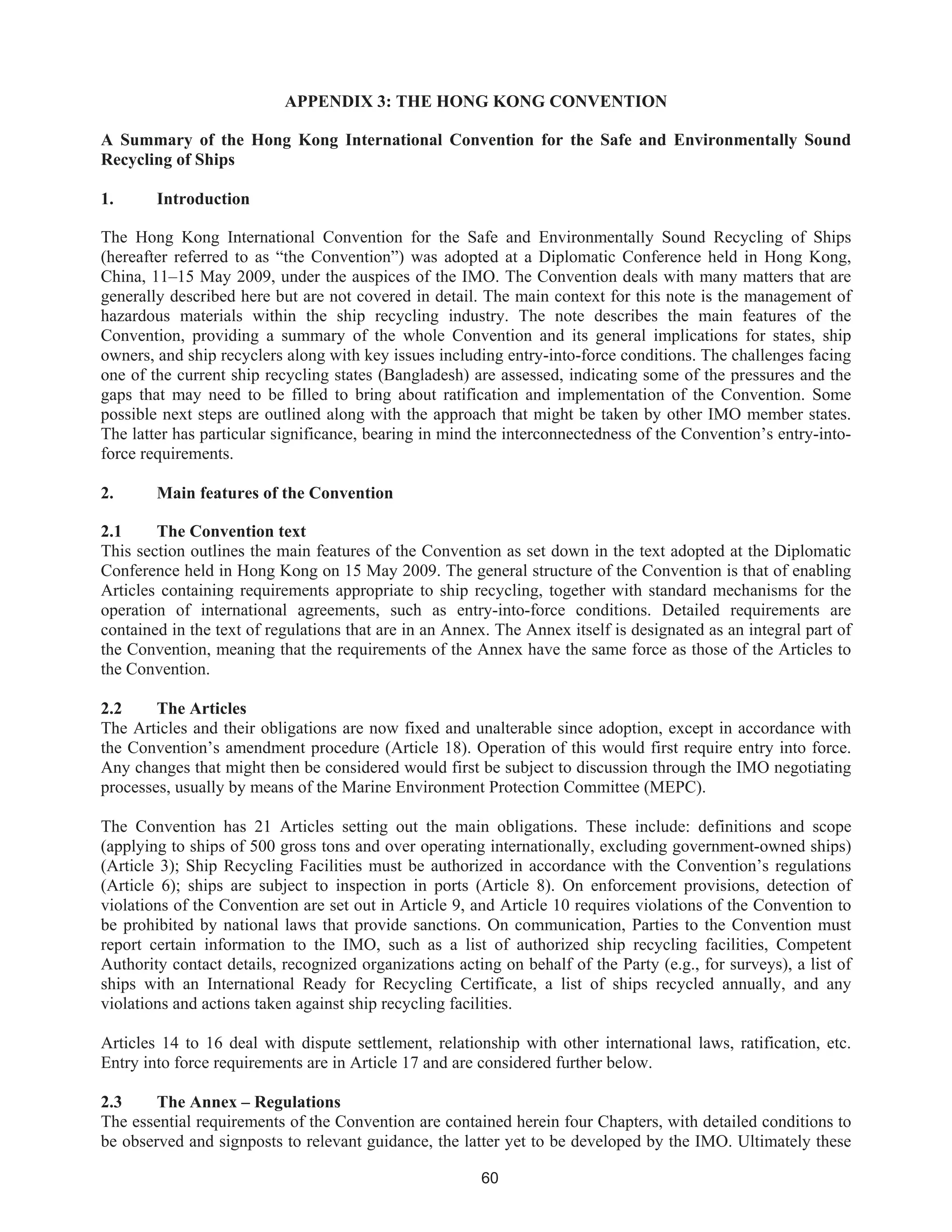

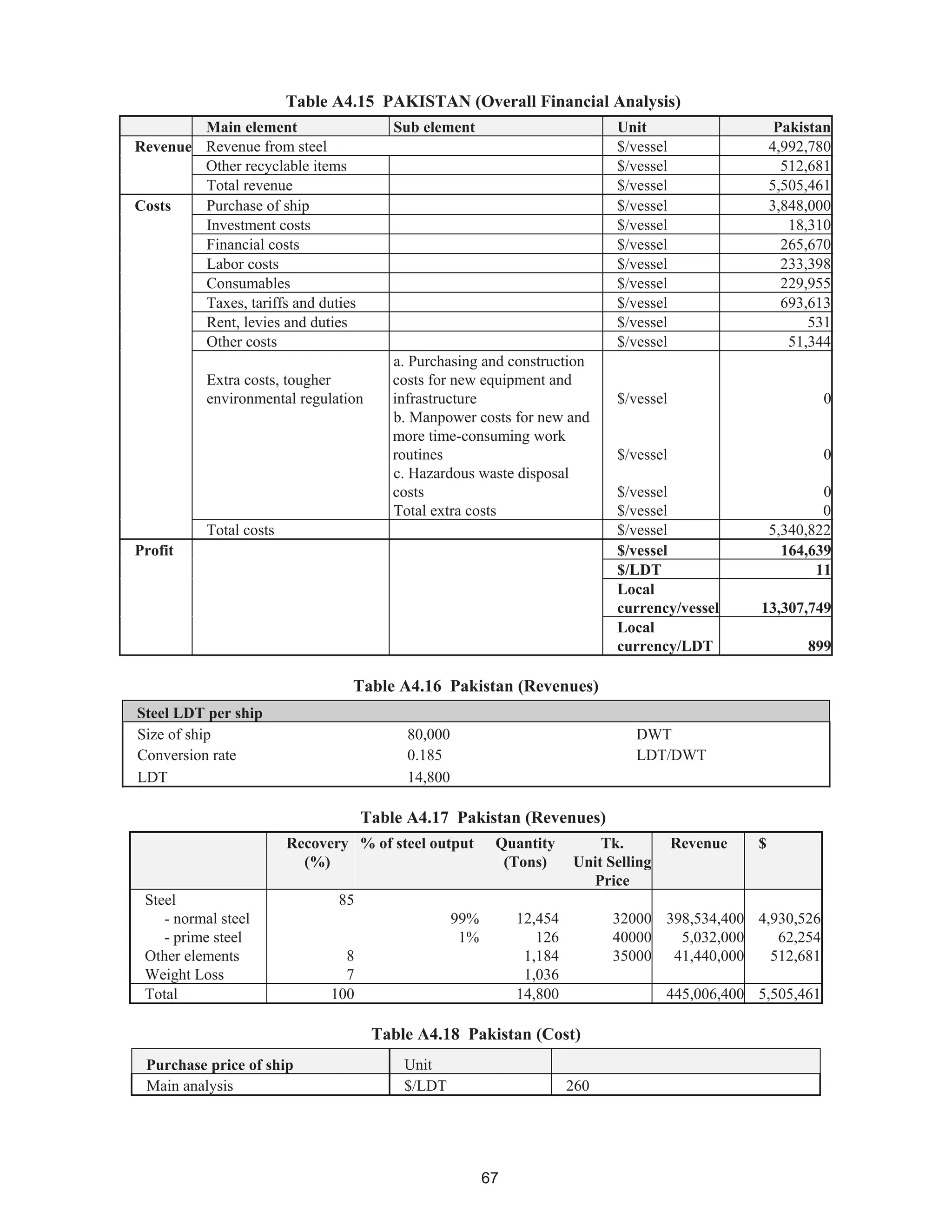

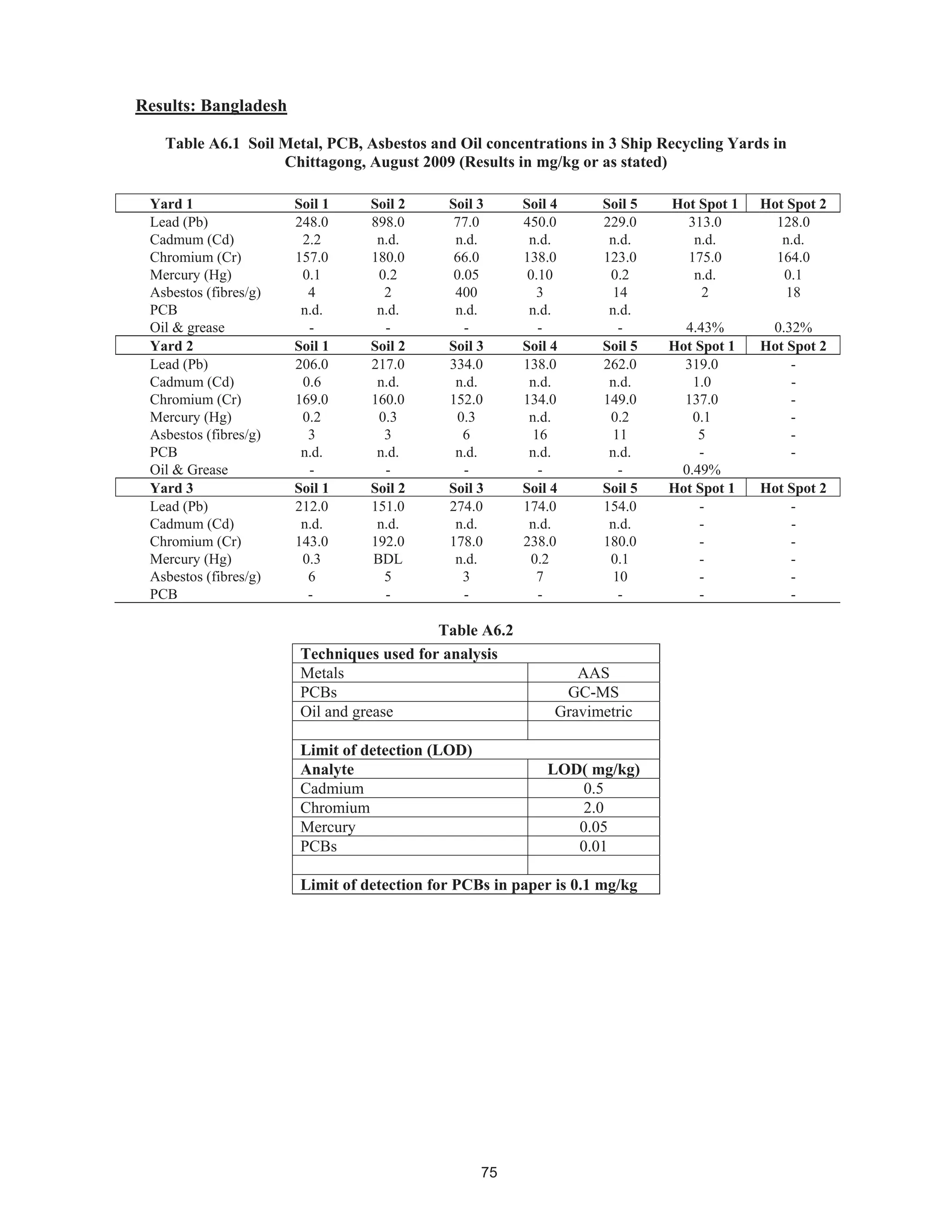

![71

TABLEA5.2NAVALFLEET(calculationsareonthebasisofdeclaredhazardousmaterialsfromthefollowingtypesandnumbersofnavalships:two

aircraftcarriers,foursupply/cargo,twomisc.,oneradar,andfourtankers)

NavalFleet-MeanTotal

HazardousMaterialUnit

Material

Total

1000

LDT

Total

Material

/million

LDT

Rangeof

shipsize

[LDT]

Rangeof

material

Rangeof

material/

millionLDT

No.

observations

Compiledfrom

entryno.

1Asbestoston265515417222

4,700-

26,705

76-7717,088-26,41715/15

2PCB

2.1PCBliquids(transformers,etc)tonNoinformationavailable

2.2

PCBssolids(capacitors,ballasts,

etc)

ton8231495508

5,174-

26,705

13.7-286.02,574-23,83314/15

3Hydraulicoilston49311560

4,700-

26,705

749-6,1702/15

4ODS

4.1ODSliquids(CFC,Halons,etc)tonNoinformationavailable

4.2ODSsolids(e.gPU)tonNoinformationavailable

5Paints

5.1Paintsnoinfoton183538936NorangeNorangeNorange1/15

5.2Paintscont.TBTtonNoinformationavailable

5.3Paintscont.PCBtonNoinformationavailable

5.4Paintscont.Metalston120525532NorangeNorangeNorange1/15

6heavymetals

6.1Leadton0.16534NorangeNorangeNorange1/15

6.4Mercuryton2.002775NorangeNorangeNorange1/15

7RadioactivesubstanceskgNoinformationavailable

8Wasteliquidsorganicm32481321880

4,700-

14,170

0.20-237.1043-22,11115/308.1,8.2

9

Reusableliquidsorganic(HFO,

diesel)

ton347215422522

4,700-

26,705

7.0-813.575-157,22815/15

NavalFleet-MeanTotal–cont’d

HazardousMaterialUnit

Material

Total

1000

LDT

Total

Material

/million

LDT

Rangeof

shipsize

[LDT]

Rangeof

material

Rangeof

material/

millionLDT

No.

observations

Compiledfrom

entryno.](https://image.slidesharecdn.com/shipbreaking-myanmar-2014-140611041422-phpapp02/75/Shipbreaking-myanmar-2014-97-2048.jpg)

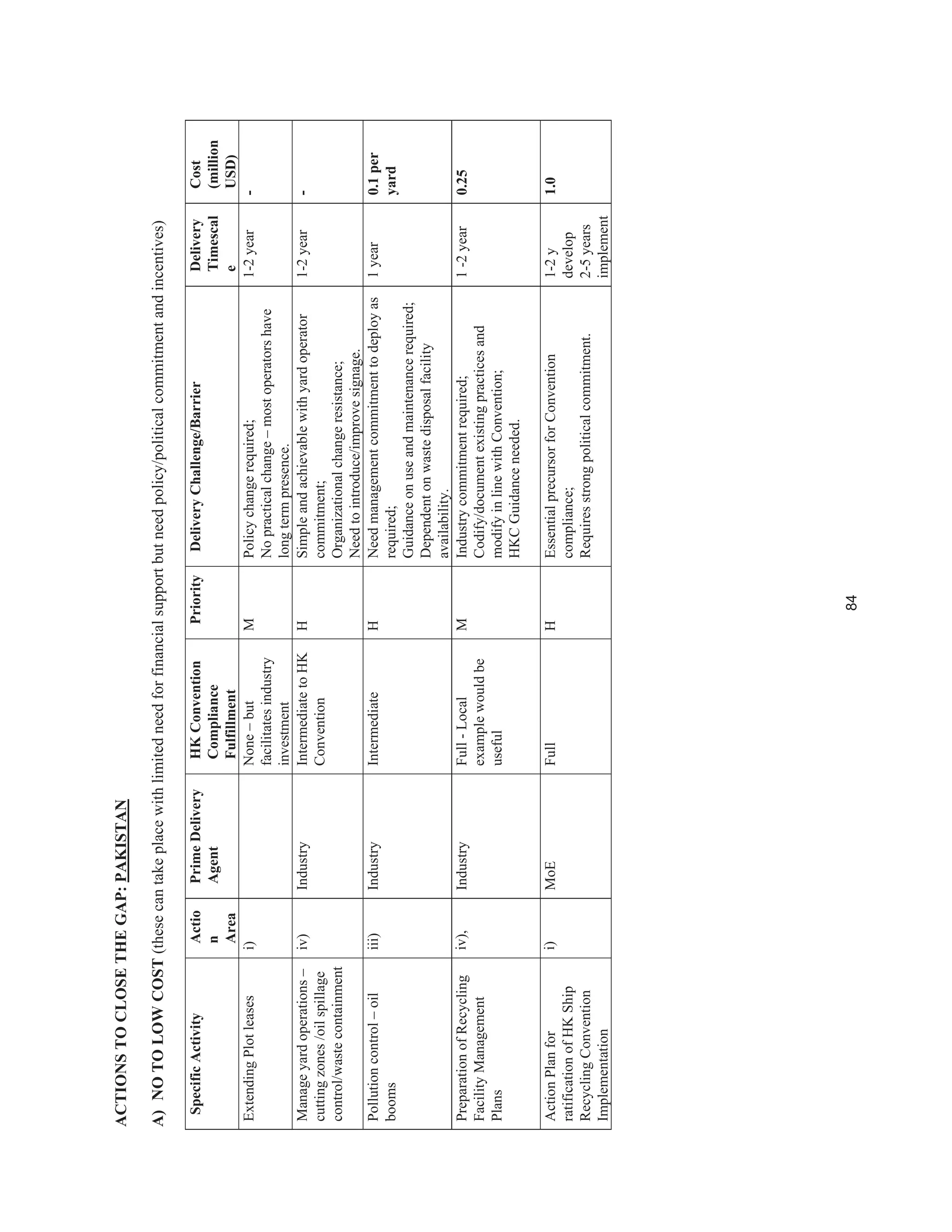

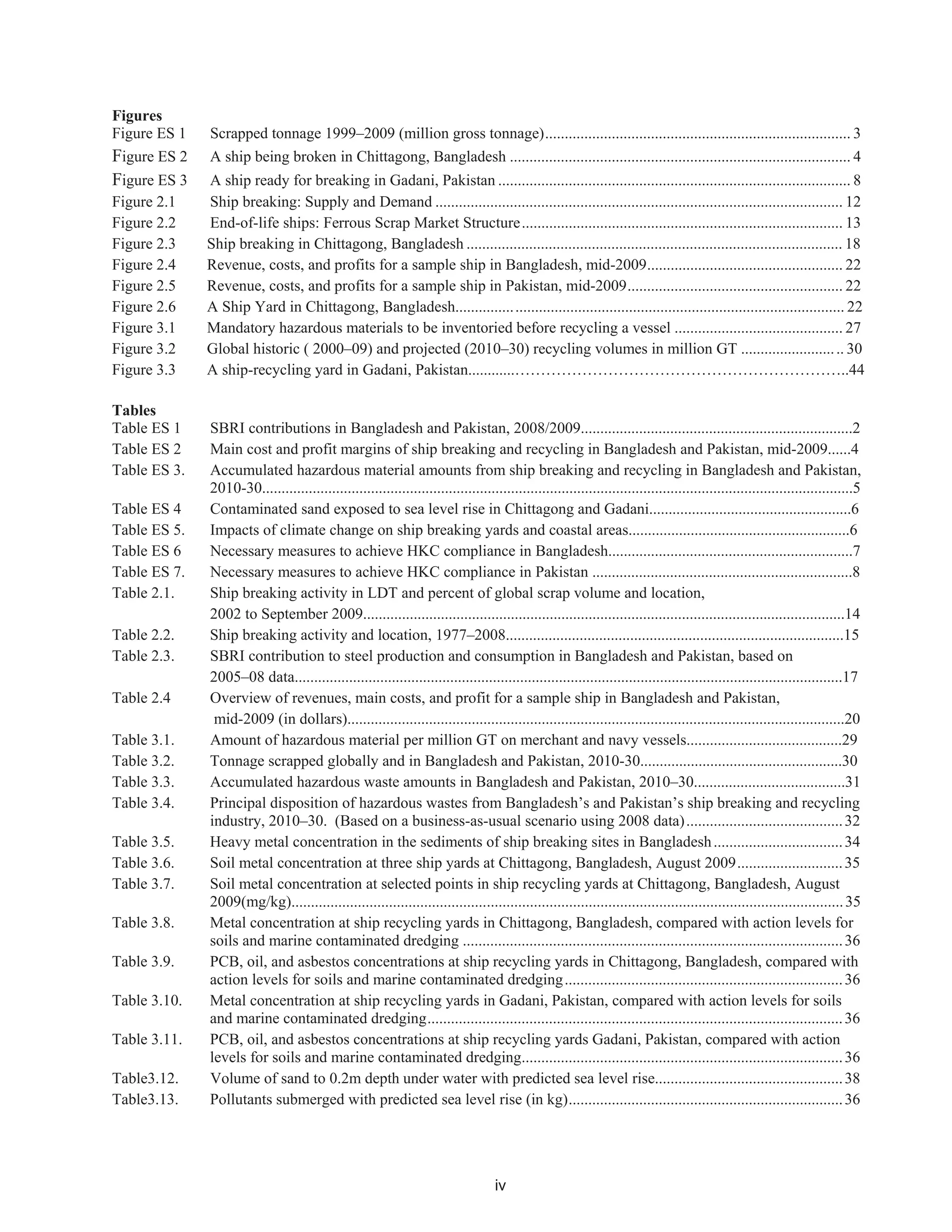

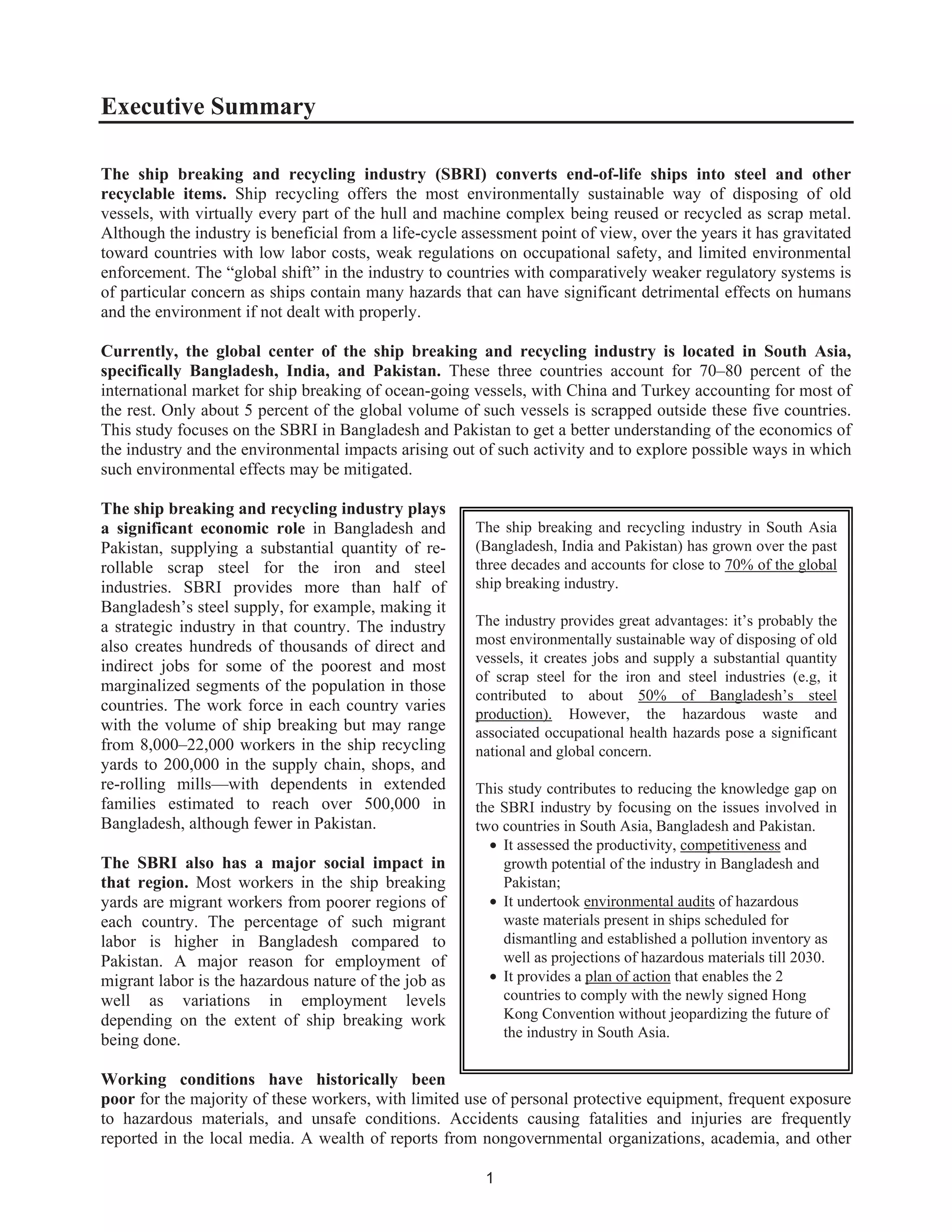

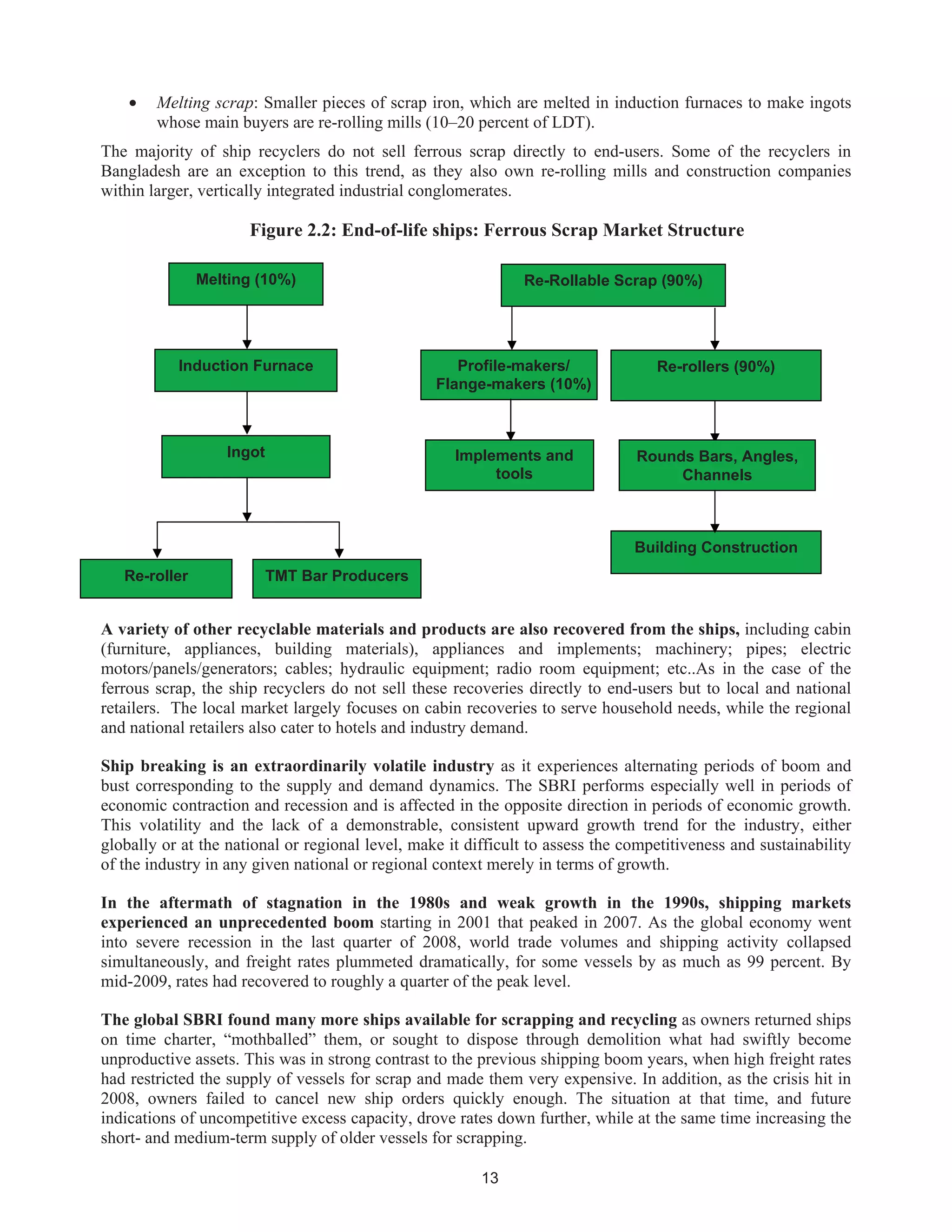

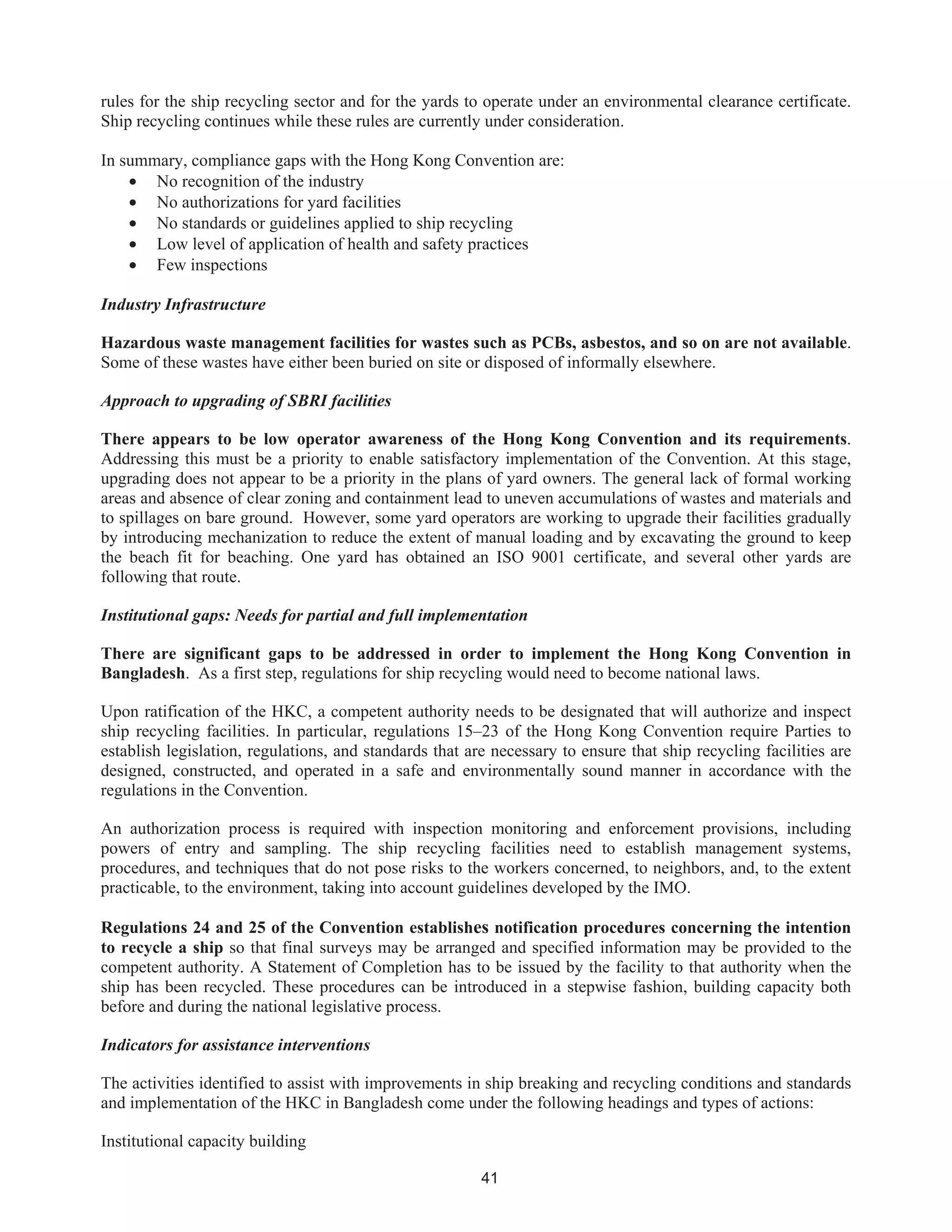

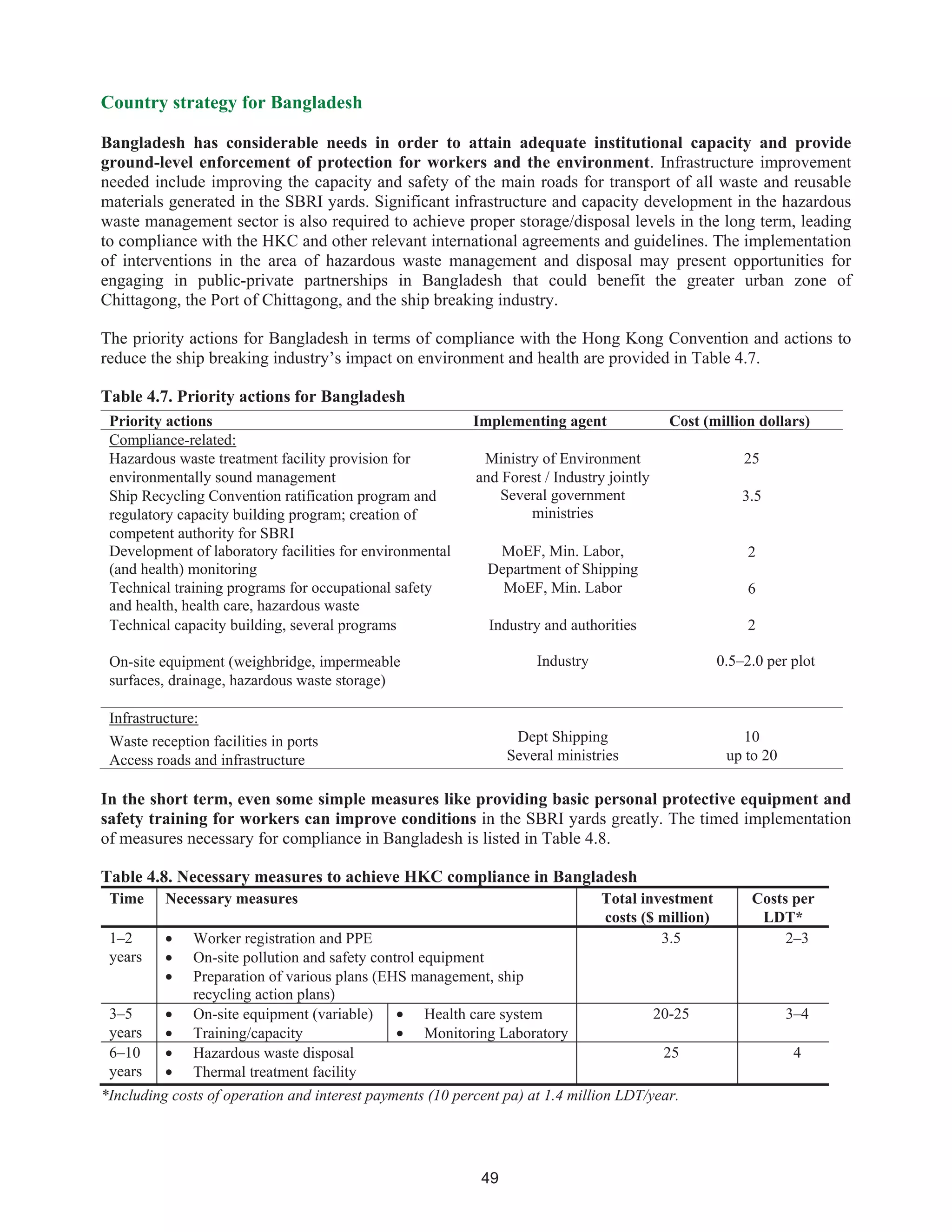

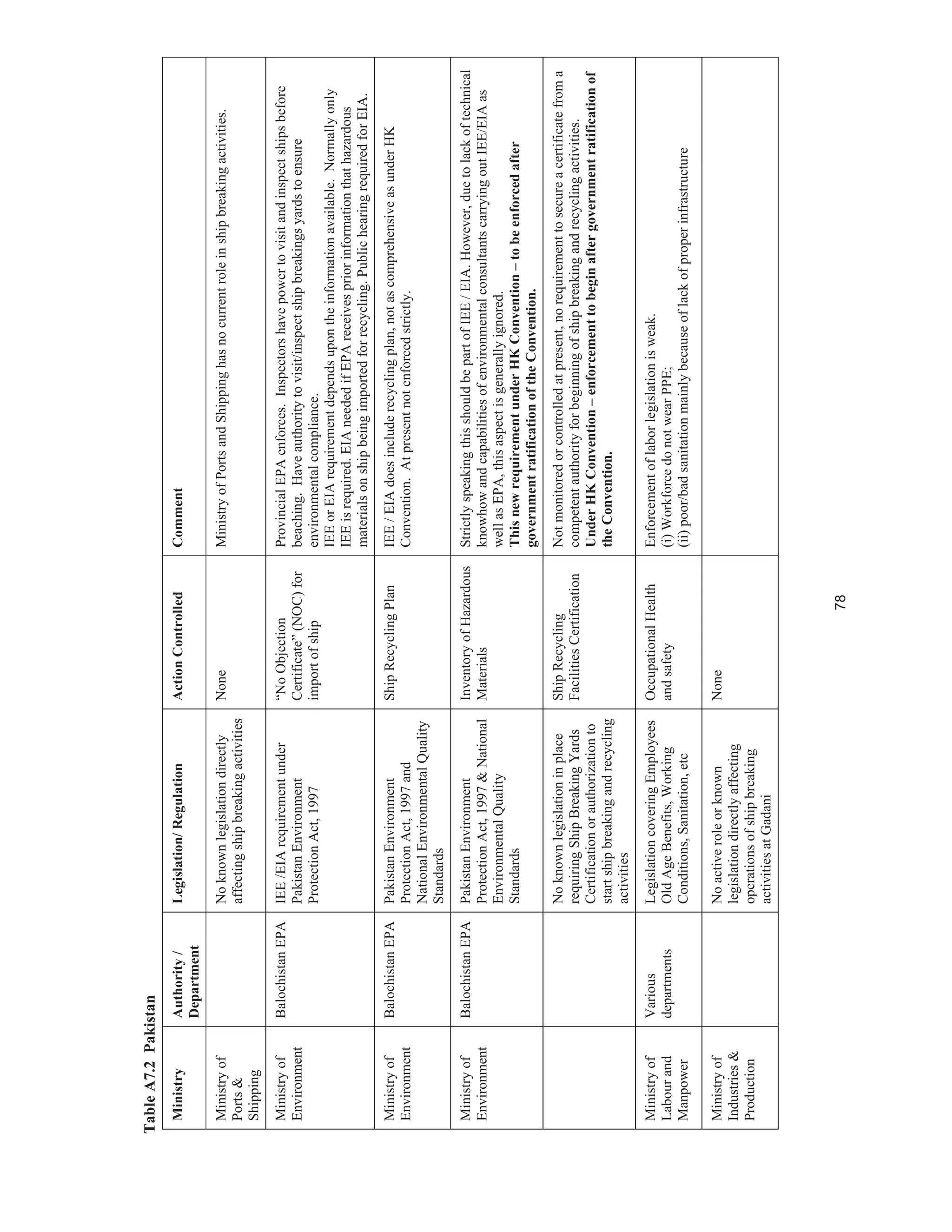

![79

Ministryof

Petroleum&

Natural

Resources

Noactiveroleorknown

legislationdirectlyaffecting

operationsofshipbreaking

activitiesatGadani

NoneGasforcuttingisprocuredfromtwomultinationalcompaniesandsogasutility

companyorgovernmentdepartmenthasnorole.

ThereisnoroutineinspectionbyGovernmentregulatoryauthorityordepartmenton

gaspipinginstalledatyards.

Oil&Gas

Regulatory

Authority

(OGRA).Or

BalochistanEPA

Noknownlegislationinplace

thatwouldrequireNOCorany

kindofapprovaltobegincutting

NOCforGasFreefor

HotWorks

Notmonitoredorcontrolledatthepresentstate.

ThisisanewrequirementunderHKConvention–Notcontrolledatthe

present.(Notyetclearwhichdepartment/authoritywouldbeinvolved)

Noknownlegislationinplace

thatwouldrequireanykindof

approvalforstartingship

breakingandrecycling

activities.

BallastWaterdisposalNotmonitoredorcontrolledatthepresentstate.

Planning&

Development

Department,

Balochistan

Government

Balochistan

Development

Authority

Balochistandevelopmentlevy/

charges

Renewalofleaseforyards

ownedbyBDA

“NoObjection

Certificate”(NOC)for

startingshipbreaking

activities

NOCisrequiredbeforeshipbreakingactivitiescanbestarted.Itisstrictly

enforced.

NOCnotissuedifdevelopmentlevy/chargesareoutstanding.

Ministryof

Finance,

Economic

Affairs,

Statistics&

Revenue

Revenue

Division-

Customs

SalesTax

[SalesTaxNotificationSRO

678(1)/2007]

WithholdingTax

“NoObjection

Certificate”(NOC)for

startingshipbreaking

operations

NOCisrequiredbeforeshipbreakingactivitiescanbestarted.Itisstrictly

enforced.

SalesTaxpaymentscheduleandwithholdingtaxpaymentisnecessaryforissuance

ofNOCbyCustoms.

Withholdingtaxisafixedratetax(1%ofthevalue)chargedregardlessof

profitabilityoftheyards.Itisstrictlyenforced.](https://image.slidesharecdn.com/shipbreaking-myanmar-2014-140611041422-phpapp02/75/Shipbreaking-myanmar-2014-105-2048.jpg)