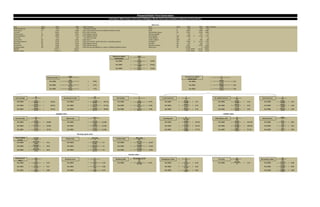

08. financial ratio tree (deb sahoo)

•

0 likes•340 views

Report

Share

Report

Share

Recommended

Current Year Financial Ratios of Reliance Communication.Rahul Mehrotra Presentation on Reliance Financial Ratio

Rahul Mehrotra Presentation on Reliance Financial RatioINSTITUTE of TECHNOLOGY and SCIENCE(ITS) Mohan Nagar, Ghaziabad

More Related Content

What's hot

Current Year Financial Ratios of Reliance Communication.Rahul Mehrotra Presentation on Reliance Financial Ratio

Rahul Mehrotra Presentation on Reliance Financial RatioINSTITUTE of TECHNOLOGY and SCIENCE(ITS) Mohan Nagar, Ghaziabad

What's hot (20)

Financial Ratio Analysis PowerPoint Presentation Slides

Financial Ratio Analysis PowerPoint Presentation Slides

KSB Pumps Q3CY14 Result Update: Weak margin performance - Prabhudas Lilladher

KSB Pumps Q3CY14 Result Update: Weak margin performance - Prabhudas Lilladher

occidental petroleum Core Results and Reported Earnings Release

occidental petroleum Core Results and Reported Earnings Release

Rahul Mehrotra Presentation on Reliance Financial Ratio

Rahul Mehrotra Presentation on Reliance Financial Ratio

Elo Mutual Insurance Company: Pension assets grew at a record pace – return E...

Elo Mutual Insurance Company: Pension assets grew at a record pace – return E...

Viewers also liked

Viewers also liked (6)

Crisis Management through Social Media [FRAMEWORK]![Crisis Management through Social Media [FRAMEWORK]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Crisis Management through Social Media [FRAMEWORK]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Crisis Management through Social Media [FRAMEWORK]

Social Media Governance - how it works in organisations

Social Media Governance - how it works in organisations

Joining the dots from Social Strategy to Social Analytics: And Why you Shou...

Joining the dots from Social Strategy to Social Analytics: And Why you Shou...

Social business intelligence assessing the major Social Media Monitoring tool

Social business intelligence assessing the major Social Media Monitoring tool

Similar to 08. financial ratio tree (deb sahoo)

Similar to 08. financial ratio tree (deb sahoo) (20)

Fixed Capital Analysis PowerPoint Presentation Slides

Fixed Capital Analysis PowerPoint Presentation Slides

Nordnet's report presentation, January-September 2015

Nordnet's report presentation, January-September 2015

Buy Orient Refractories, engineering sector to get boost from infrastructure ...

Buy Orient Refractories, engineering sector to get boost from infrastructure ...

More from Deb Sahoo, MBA(Finance), MS(EE), BTech(EE),

13. deal due diligence and valuation of marshall ilsley bank

13. deal due diligence and valuation of marshall ilsley bankDeb Sahoo, MBA(Finance), MS(EE), BTech(EE),

05. due diligence and leveraged buyout of overhill firms (deb sahoo)

05. due diligence and leveraged buyout of overhill firms (deb sahoo)Deb Sahoo, MBA(Finance), MS(EE), BTech(EE),

More from Deb Sahoo, MBA(Finance), MS(EE), BTech(EE), (20)

21. start up capitalization table analysis (deb sahoo)

21. start up capitalization table analysis (deb sahoo)

19. saa s kp is and profitability analysis (deb sahoo)

19. saa s kp is and profitability analysis (deb sahoo)

13. deal due diligence and valuation of marshall ilsley bank

13. deal due diligence and valuation of marshall ilsley bank

10. eva tree analysis of financial statement (deb sahoo)

10. eva tree analysis of financial statement (deb sahoo)

06. equity valuation of lsi semiconductor (deb sahoo)

06. equity valuation of lsi semiconductor (deb sahoo)

05. due diligence and leveraged buyout of overhill firms (deb sahoo)

05. due diligence and leveraged buyout of overhill firms (deb sahoo)

Recently uploaded

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday With Jareena * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...dipikadinghjn ( Why You Choose Us? ) Escorts

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangements Near You

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9352852248

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 🌐 beautieservice.com 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9352852248

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S020524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9352852248

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...From Luxury Escort : 9352852248 Make on-demand Arrangements Near yOU

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Satisfaction and Quality Time

Booking Contact Details

WhatsApp Chat: +91-7001035870

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

29-april-2024(v.n)

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...Call Girls in Nagpur High Profile

Booking open Available Pune Call Girls Wadgaon Sheri 6297143586 Call Hot Indian Girls Waiting For You To Fuck

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Booking open Available Pune Call Girls Wadgaon Sheri 6297143586 Call Hot Ind...

Booking open Available Pune Call Girls Wadgaon Sheri 6297143586 Call Hot Ind...Call Girls in Nagpur High Profile

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S030524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...dipikadinghjn ( Why You Choose Us? ) Escorts

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...Call Girls in Nagpur High Profile

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-992072523VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...dipikadinghjn ( Why You Choose Us? ) Escorts

Recently uploaded (20)

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

20240429 Calibre April 2024 Investor Presentation.pdf

20240429 Calibre April 2024 Investor Presentation.pdf

06_Joeri Van Speybroek_Dell_MeetupDora&Cybersecurity.pdf

06_Joeri Van Speybroek_Dell_MeetupDora&Cybersecurity.pdf

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Booking open Available Pune Call Girls Wadgaon Sheri 6297143586 Call Hot Ind...

Booking open Available Pune Call Girls Wadgaon Sheri 6297143586 Call Hot Ind...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

Mira Road Memorable Call Grls Number-9833754194-Bhayandar Speciallty Call Gir...

Mira Road Memorable Call Grls Number-9833754194-Bhayandar Speciallty Call Gir...

08. financial ratio tree (deb sahoo)

- 1. Item Short 2004 2003 2002 Comment Item Short 2004 2003 2002 Comment Profit bf. Int & tax PBIT 824 729 629 (PnL account) Stock S 398 362 325 Total capital TC 5,492 5,000 5,441 Total assets less current liabilities (Balance sheet) Debt D 2,865 2,308 2,807 Turnover T 8,302 8,019 8,135 (PnL account) Shareholders Equity SE 2,454 2,108 3,081 Current assets CA 3,870 3,246 3,761 (Balance sheet) Interest payable I 136 137 117 Current liabilities CL -1,885 -1,711 -1,751 (Balance sheet) Cost of goods CoG 5,260 0 5,118 5,191 Net Profit P 552 507 153 (PnL account) Trade debtors TD 31 32 22 Gross profit GP 3,042 2,901 2,944 Note 2 Trade creditors TRC 210 202 200 Operating expences OE -2,218 -2,172 -2,343 Gross profit - profit of the year = operating expences Purchases PU 5,260 0 5,118 5,191 Net assets NA 2,454 2,108 3,081 (Balance sheet) Divident Div 263 246 239 Fixed assets FA 3,498 3,435 3,381 (Balance sheet) Number of shares SH 2,267 2,294 2,842 Working capital WC 1,985 1,535 2,010 Net current liabilities (c. assets-c. liabilities) (Balance sheet) Share price SP 0.2780 0 0.3850 EBITDA 1107.9 1007.9 4.79% #### 4.51% 4.00% EBITDA margin 13.35% # 12.57% 2.53% #### 2.51% 2.45% PBIT TC 824 5,492 729 5,000 629 5,441 PBIT T T TC 824 8,302 8,302 5,492 729 8,019 8,019 5,000 629 8,135 8,135 5,441 GP OE P T T T T T T FA WC TC 3,042 -2,218 552 8,302 8,302 8,302 8,302 8,302 8,302 3,498 1,985 5,492 2,901 -2,172 507 8,019 8,019 8,019 8,019 8,019 8,019 3,435 1,535 5,000 2,944 -2,343 153 8,135 8,135 8,135 8,135 8,135 8,135 3,381 2,010 5,441 CA CA-S D D PBIT CL CL D+CnR SE I 3,870 3,472 2,865 2,865 824 -1,885 -1,885 5,319 2,454 136 3,246 2,885 2,308 2,308 729 -1,711 -1,711 4,416 2,108 137 3,761 3,435 2,807 2,807 629 -1,751 -1,751 5,888 3,081 117 S x365 TD x365 TRC x365 CoG T PU 145,270 11,133 76,723 5,260 8,302 5,260 132,057 11,717 73,584 5,118 8,019 5,118 118,735 7,994 72,854 5,191 8,135 5,191 Div P Div p share /(1-t) P SP NA SH Div SP SH EPS SH 263 552 0.13 552 0.2780 2,454 2,267 263 0.2780 2,267 0 2,267 246 507 507 2,108 2,294 246 2,294 2,294 239 153 153 3,081 2,842 239 2,842 2,842 Financial Ratio Tree Generation | Deb Sahoo | MBA, Finance, University of Michigan | MS, EE, University of Southern California | B-Tech, EE, IIT | Ratio Tree Return on capital employment = For 2004 = = 15.0% For 2003 = = 14.6% For 2002 = = 11.6% Return on sales = Turnover on capital emplayment = For 2004 = = 9.9% For 2004 = = 1.51 For 2002 = = 9.1% For 2003 = = 1.60 For 2002 = = 7.7% For 2002 = = 1.50 Gross margin = Overheads to sales = Net margin = F. asset turnover = W. Capital turnover = Asset turnover = For 2004 = = 36.6% For 2004 = = -26.7% For 2004 = = 6.7% For 2004 = = 2.37 For 2004 = = 4.18 For 2004 = = 1.51 For 2003 = = 36.2% For 2003 = = -27.1% For 2003 = = 6.3% For 2003 = = 2.33 For 2003 = = 5.22 For 2003 = = 1.60 For 2002 = = 36.2% For 2002 = = -28.8% For 2002 = = 1.9% For 2002 = = 2.41 For 2002 = = 4.05 For 2002 = = 1.50 Liquidity ratios Stability ratios Current ratio = Quick ratio = Gearing ratio = Debt/Equity ratio = Interest cover = For 2004 = = (2.05) For 2004 = = (1.84) For 2004 = = 53.9% For 2004 = = 116.7% For 2004 = = 6.05 For 2003 = = (1.90) For 2003 = = (1.69) For 2003 = = 52.3% For 2003 = = 109.4% For 2003 = = 5.32 For 2002 = = (2.15) For 2002 = = (1.96) For 2002 = = 47.7% For 2002 = = 91.1% For 2002 = = 5.38 Working capital ratios Stock holding period = Debtor days = Creditor days = For 2004 = = 27.6 For 2004 = = 1.3 For 2004 = = 14.59 For 2003 = = 25.8 For 2003 = = 1.5 For 2003 = = 14.38 For 2002 = = 22.9 For 2002 = = 1.0 For 2002 = = 14.03 Investor ratios Dividents per share = Divident cover = Divident yield = Earnings per share = P/E ratio = Net assets p. share = For 2004 = = 0.12 For 2004 = = 2.10 For 2004 = = 0.46 For 2004 = = 0.24 For 2004 = = 1.14 For 2004 = = 1.08 For 2003 = = 0.11 For 2003 = = 2.06 For 2003 = = 0.22 For 2003 = = 0.92 For 2002 = = 0.08 For 2002 = = 0.64 For 2002 = = = = 1.080.05 For 2002