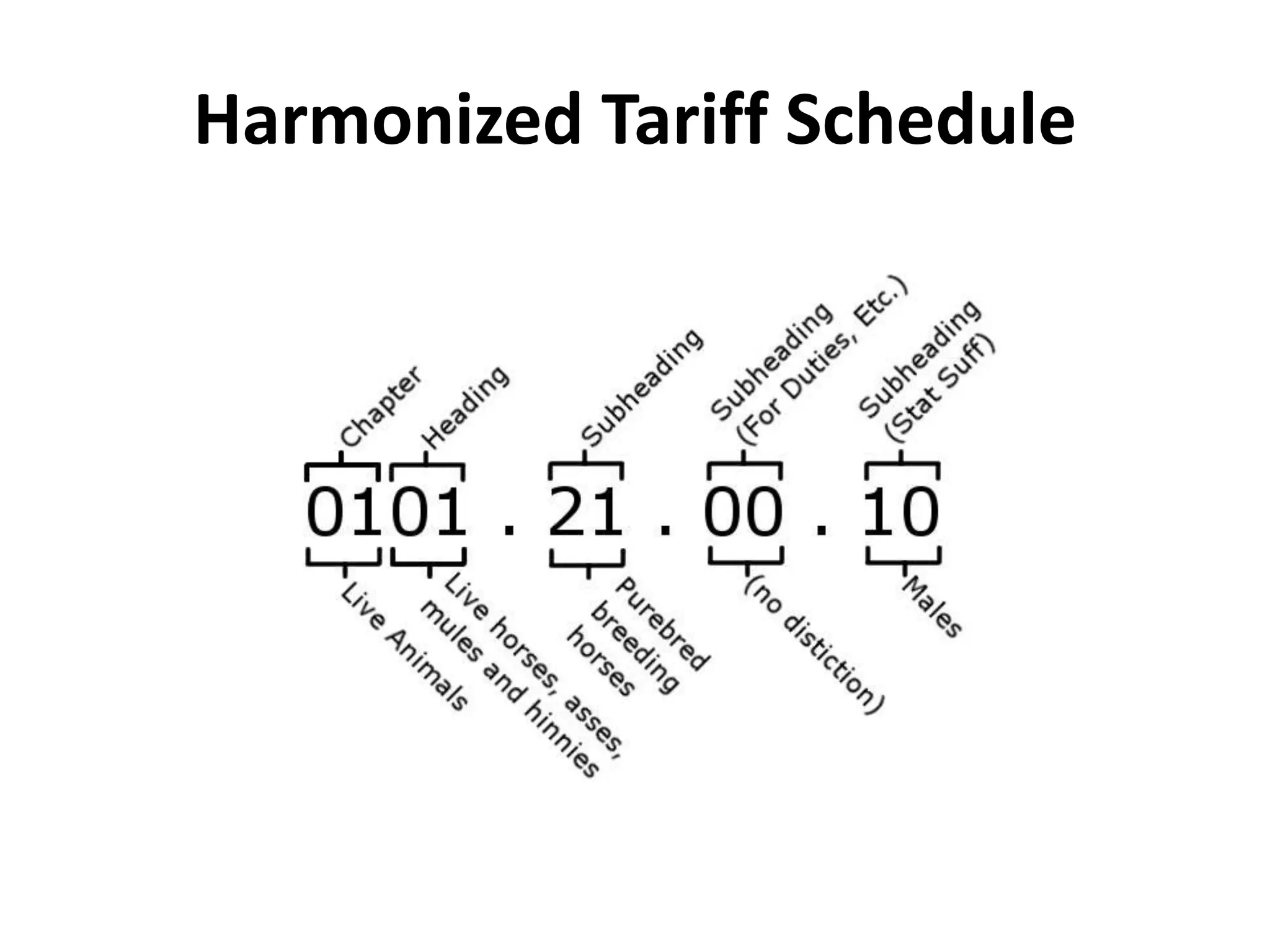

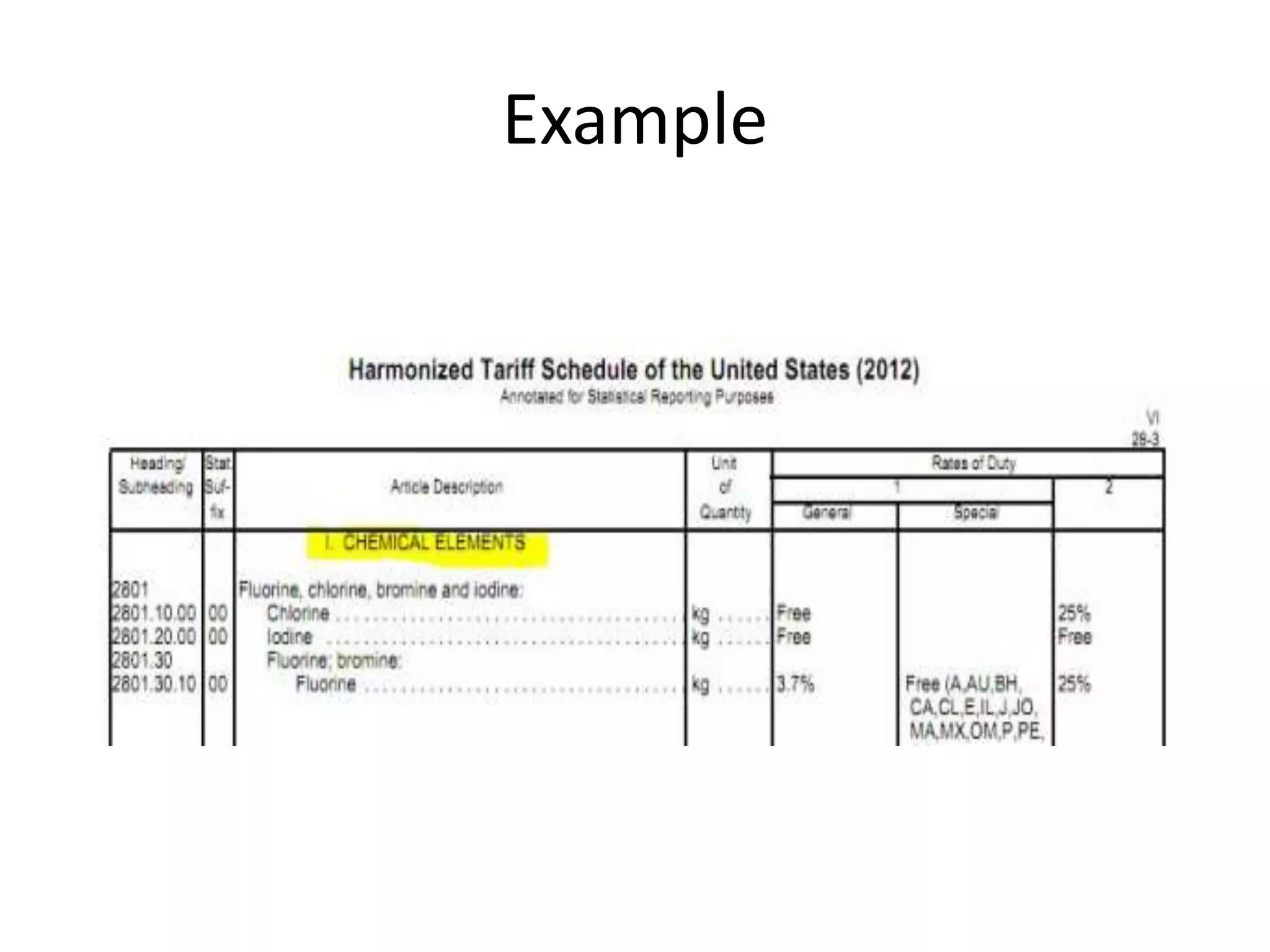

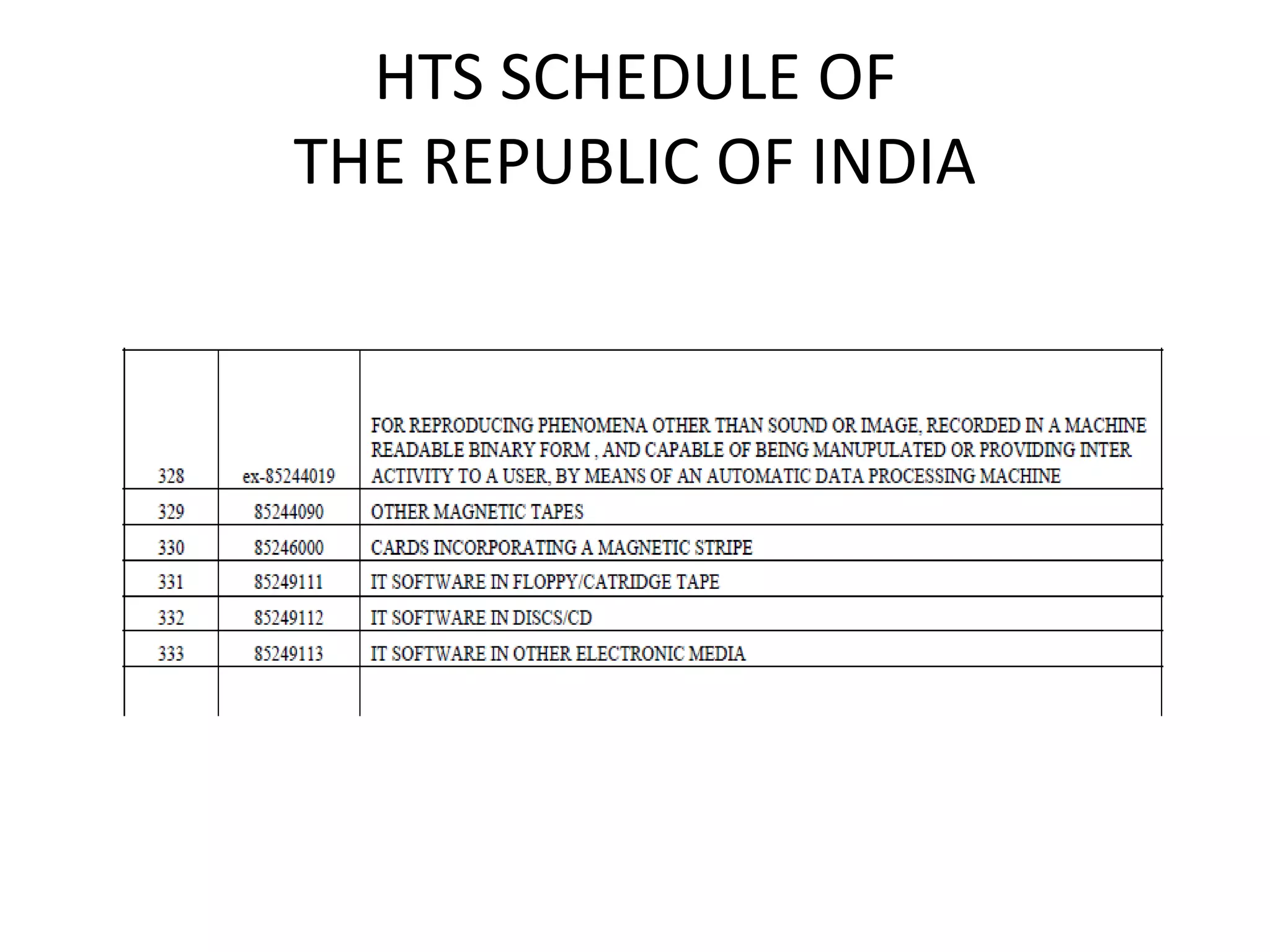

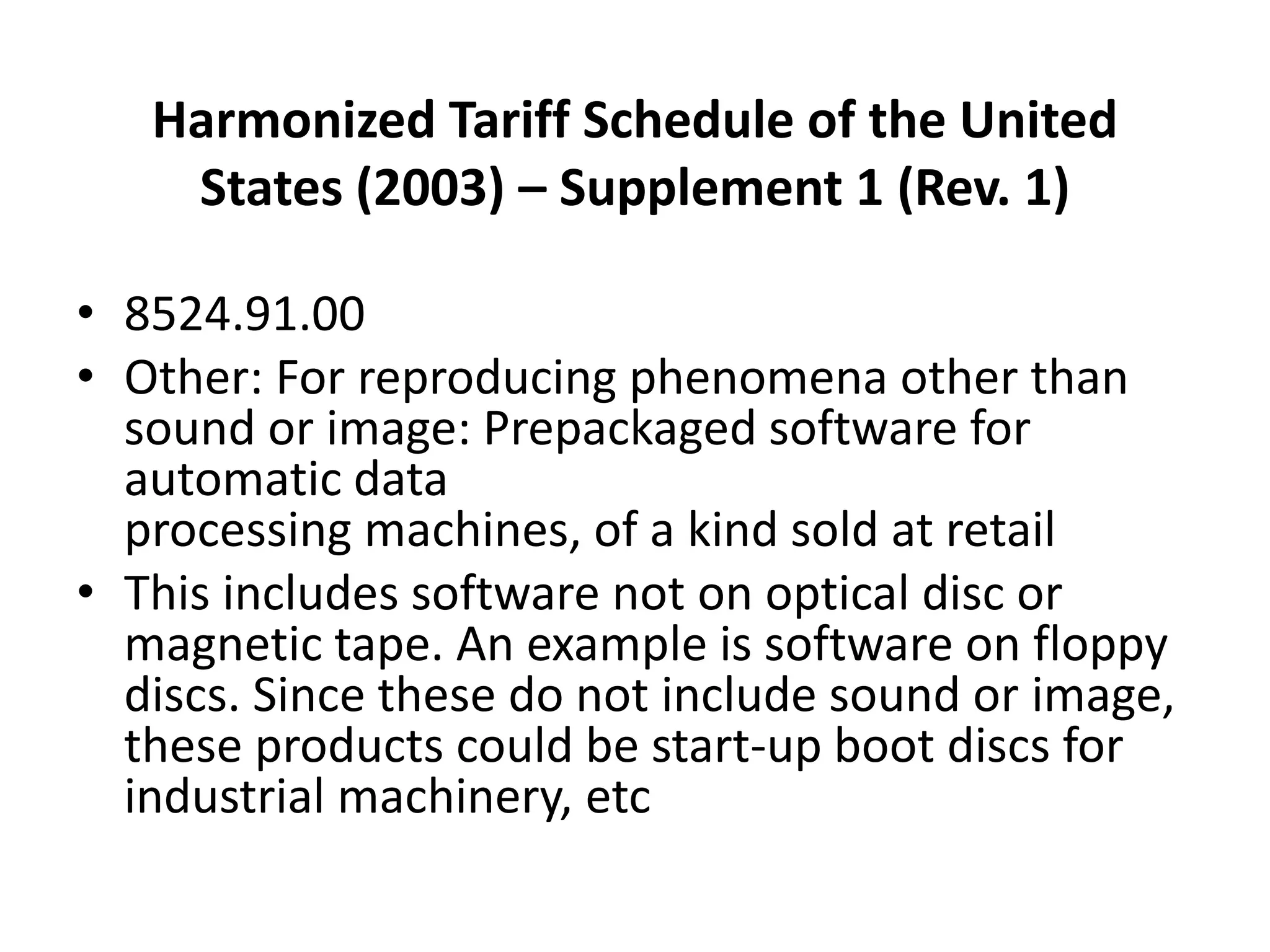

The document discusses Harmonized Tariff Schedule (HTS) and Schedule B codes for classifying computer software for import and export. It notes that proper classification depends on many trade laws and can be complex. Software is generally classified based on the underlying medium it is reproduced on, such as optical disks, magnetic tapes, or floppy disks. An example HTS code provided is 8524.91.00 for prepackaged software sold at retail that is not on optical discs or magnetic tapes, such as software on floppy disks.