8 economics

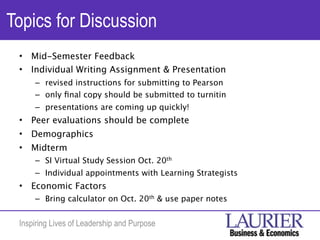

- 1. Topics for Discussion • Mid-Semester Feedback • Individual Writing Assignment & Presentation – revised instructions for submitting to Pearson – only final copy should be submitted to turnitin – presentations are coming up quickly! • Peer evaluations should be complete • Demographics • Midterm – SI Virtual Study Session Oct. 20th – Individual appointments with Learning Strategists • Economic Factors – Bring calculator on Oct. 20th & use paper notes Inspiring Lives of Leadership and Purpose

- 2. Midterm Midterm administrative details – Saturday, October 22nd – 9:00 a.m. to 11:30 a.m. – locations are posted on course website (you must write in the location posted for your lab) – bring student ID and multiple writing instruments – coats, bags, phones, IPods (TURNED OFF) must all be left at front of room – use the washroom before the exam starts – read instructions carefully and read questions carefully – show all your work and all your thinking – don’t second guess marking key and don’t make it hard for your TA to mark! – adhere to academic integrity guidelines!!! Review Study Skills slides for additional tips i.e. cue cards, Inspiring Lives ofcomplete M/C questions, acronyms, sleep, how to Leadership and Purpose etc.

- 3. Economic Factors • Canadian financial system • Investment instruments • Time value of money Inspiring Lives of Leadership and Purpose

- 4. General economic factors • Recall: – Effect of trade balance on domestic economy – Effect of exchange rates on competitive advantage – Effect of GDP on standard of living Inspiring Lives of Leadership and Purpose

- 5. Canadian Financial System Inspiring Lives of Leadership and Purpose

- 6. Canadian Financial System • Financial institutions facilitate flow of money Inspiring Lives of Leadership and Purpose

- 7. Canadian Financial System • Financial institutions facilitate flow of money • Four distinct legal areas /”pillars”: – Chartered banks – Alternate banks – Life insurance companies – Investment dealers Inspiring Lives of Leadership and Purpose

- 8. Canadian Financial System • Financial institutions facilitate flow of money • Four distinct legal areas /”pillars”: – Chartered banks – Alternate banks – Life insurance companies – Investment dealers • Lines between pillars have been blurred due to deregulation Inspiring Lives of Leadership and Purpose

- 9. Pillar #1 – Chartered Banks • Privately owned • Serve individuals, business, and others • Largest and most important institution • Five largest account for 90% of total bank assets • Bank Act limits foreign-controlled banks to <8% of total domestic bank assets Inspiring Lives of Leadership and Purpose

- 10. Banks (continued) Inspiring Lives of Leadership and Purpose

- 11. Banks (continued) • Major source of short loans for business – Secured vs. unsecured loans Inspiring Lives of Leadership and Purpose

- 12. Banks (continued) • Major source of short loans for business – Secured vs. unsecured loans • Expand money supply through deposit expansion Inspiring Lives of Leadership and Purpose

- 13. Banks (continued) • Major source of short loans for business – Secured vs. unsecured loans • Expand money supply through deposit expansion • Changes in banking Inspiring Lives of Leadership and Purpose

- 14. Banks (continued) • Major source of short loans for business – Secured vs. unsecured loans • Expand money supply through deposit expansion • Changes in banking Inspiring Lives of Leadership and Purpose

- 15. Banks (continued) • Major source of short loans for business – Secured vs. unsecured loans • Expand money supply through deposit expansion • Changes in banking • Bank of Canada – Open market operations – Bank rate Inspiring Lives of Leadership and Purpose

- 16. • Pillar #2 – Alternate banks • Pillar #3 – Specialized lending/saving interm. • Pillar #4 – Investment Dealers Inspiring Lives of Leadership and Purpose

- 17. International Banking & Finance Inspiring Lives of Leadership and Purpose

- 18. International Banking & Finance • Governments and corporations frequently borrow in foreign markets Inspiring Lives of Leadership and Purpose

- 19. International Banking & Finance • Governments and corporations frequently borrow in foreign markets • International Bank Structure Inspiring Lives of Leadership and Purpose

- 20. International Banking & Finance • Governments and corporations frequently borrow in foreign markets • International Bank Structure – Stability relies on a loose structure of agreements Inspiring Lives of Leadership and Purpose

- 21. International Banking & Finance • Governments and corporations frequently borrow in foreign markets • International Bank Structure – Stability relies on a loose structure of agreements – World Bank - Inspiring Lives of Leadership and Purpose

- 22. International Banking & Finance • Governments and corporations frequently borrow in foreign markets • International Bank Structure – Stability relies on a loose structure of agreements – World Bank - – International Monetary Fund – Inspiring Lives of Leadership and Purpose

- 23. Securities Markets Inspiring Lives of Leadership and Purpose

- 24. Securities Markets • Where stocks, bonds, and other securities are sold Inspiring Lives of Leadership and Purpose

- 25. Securities Markets • Where stocks, bonds, and other securities are sold • Primary markets – Investment bankers Inspiring Lives of Leadership and Purpose

- 26. Securities Markets • Where stocks, bonds, and other securities are sold • Primary markets – Investment bankers • Secondary markets – Toronto Stock Exchange and other exchanges Inspiring Lives of Leadership and Purpose

- 27. Bonds Inspiring Lives of Leadership and Purpose

- 28. Bonds • Represents debt – Inspiring Lives of Leadership and Purpose

- 29. Bonds • Represents debt – • Characteristics of a Bond – Fixed rate of return – Fixed term – Priority over stockholders Inspiring Lives of Leadership and Purpose

- 30. Bonds • Represents debt – • Characteristics of a Bond – Fixed rate of return – Fixed term – Priority over stockholders • Types – Secured vs. Unsecured (debentures) – Registered vs. Bearer – Callable - Serial, convertible Inspiring Lives of Leadership and Purpose

- 31. Bond value determined by: • Prevailing interest rate • Coupon rate • Credit rating of issuer • Features • Time to maturity Inspiring Lives of Leadership and Purpose

- 32. Concept of Yield • Percentage return on any investment Inspiring Lives of Leadership and Purpose

- 33. Concept of Yield • Percentage return on any investment Inspiring Lives of Leadership and Purpose

- 34. Concept of Yield • Percentage return on any investment Inspiring Lives of Leadership and Purpose

- 35. Calculating Approximate Yield to Maturity (assumes will hold until maturity) Inspiring Lives of Leadership and Purpose

- 36. Calculating Approximate Yield to Maturity (assumes will hold until maturity) Inspiring Lives of Leadership and Purpose

- 37. Calculating Approximate Yield to Maturity (assumes will hold until maturity) Inspiring Lives of Leadership and Purpose

- 38. Calculating Approximate Yield to Maturity (assumes will hold until maturity) Example: Inspiring Lives of Leadership and Purpose

- 39. How are bond prices determined?

- 40. How are bond prices determined?

- 41. How are bond prices determined?

- 42. How are bond prices determined?

- 43. How are bond prices determined?

- 44. How are bond prices determined?

- 45. How are bond prices determined?

- 46. How are bond prices determined?

- 47. • Facts: Example – bond A has risk premium of 2%; issued in 2002, coupon = 5% – 2002 – interest = 3%, – 2003 – interest = 4% – 2004 – interest = 2% Yield = coupon + capital gain/loss 2002 5% = 5% + ? 2003 6% = 5% + ?

- 48. • Facts: Example – bond A has risk premium of 2%; issued in 2002, coupon = 5% – 2002 – interest = 3%, – 2003 – interest = 4% – 2004 – interest = 2% Yield = coupon + capital gain/loss 2002 5% = 5% + ? 2003 6% = 5% + ?

- 49. Bond Price Calculation • Example: What would you pay for a GM 9.5 of 2021, if similar risk bonds issued today have coupon rates of 10.5%? 1991 2011 2021 Inspiring Lives of Leadership and Purpose

- 50. Bond Price Calculation • Example: What would you pay for a GM 9.5 of 2021, if similar risk bonds issued today have coupon rates of 10.5%? 1991 2011 2021 GM 9.5s of 2021 issued at par Inspiring Lives of Leadership and Purpose

- 51. Bond Price Calculation • Example: What would you pay for a GM 9.5 of 2021, if similar risk bonds issued today have coupon rates of 10.5%? 1991 2011 2021 GM 9.5s of 2021 prevailing interest rate 10.5% issued at par pay $1,000 for GM 9.5 of ‘21? Inspiring Lives of Leadership and Purpose

- 52. Reading bond quotations Bonds issued at $1,000 face value and redeemed at $1,000 face value at maturity Issuer Coupon Maturity Price Yield Change Inspiring Lives of Leadership and Purpose

- 53. Types of Investments: STOCKS • What is a stock? • Characteristics of stock – equity – voting rights – no fixed term – variable return – discretionary payment (dividends) – risk Inspiring Lives of Leadership and Purpose

- 54. Types of Stocks Inspiring Lives of Leadership and Purpose

- 55. Factors that affect stock price • demand and supply of stock due to negative or positive perceptions/facts • Primary factors • PRICE OF A SECURITY IS A COLLECTIVE EXPRESSION OF ALL OPINIONS OF THOSE WHO ARE BUYING AND SELLING • Undervalued issue - Inspiring Lives of Leadership and Purpose

- 56. Reading Stock Quotations High Low Stock Dividend High Low Close Change Volume last price of board lot marketability volatility from yesterday’s close •prices <$5 move in 1 cent increments • prices >$5 move in 5 cent increments • if not traded on a particular day… BID ASK Inspiring Lives of Leadership and Purpose

- 57. Other Investment Vehicles • blue chip stocks • small-cap stocks • penny stocks • Canada Savings Bonds - CSBs • Guaranteed Investment Certificates - GICs • Treasury Bills - T-Bills • mutual funds Inspiring Lives of Leadership and Purpose

- 58. Leverage • Engaging in a transaction whose value is greater than the actual dollars you have available • selling short – • buying on margin - Inspiring Lives of Leadership and Purpose

- 59. Buying on Margin Inspiring Lives of Leadership and Purpose

- 60. Buying on Margin • put up only part of purchase price Inspiring Lives of Leadership and Purpose

- 61. Buying on Margin • put up only part of purchase price • broker lends remainder (with interest) Inspiring Lives of Leadership and Purpose

- 62. Buying on Margin • put up only part of purchase price • broker lends remainder (with interest) • allows you to buy more than you could using just your own money... Inspiring Lives of Leadership and Purpose

- 63. Comparison of long and margin Example: XYZ trading @ $45; have $6,300 to invest; minimum margin requirement is 70%; sell at $55 Inspiring Lives of Leadership and Purpose

- 64. Comparison of long and margin Example: XYZ trading @ $45; have $6,300 to invest; minimum margin requirement is 70%; sell at $55 A. go long - Inspiring Lives of Leadership and Purpose

- 65. Comparison of long and margin Example: XYZ trading @ $45; have $6,300 to invest; minimum margin requirement is 70%; sell at $55 A. go long - Sell Bought for Less: 2% IN 2% OUT Capital gain Inspiring Lives of Leadership and Purpose

- 66. Comparison of long and margin Example: XYZ trading @ $45; have $6,300 to invest; minimum margin requirement is 70%; sell at $55 A. go long - Sell Bought for Less: 2% IN 2% OUT Capital gain Inspiring Lives of Leadership and Purpose

- 67. Utilize full margin Inspiring Lives of Leadership and Purpose

- 68. Utilize full margin – let total amount invested be ‘x’ Inspiring Lives of Leadership and Purpose

- 69. Utilize full margin – let total amount invested be ‘x’ 70% x = x= Inspiring Lives of Leadership and Purpose

- 70. Utilize full margin – let total amount invested be ‘x’ 70% x = x= – broker advances Inspiring Lives of Leadership and Purpose

- 71. Utilize full margin – let total amount invested be ‘x’ 70% x = x= – broker advances – Purchase Inspiring Lives of Leadership and Purpose

- 72. Utilize full margin – let total amount invested be ‘x’ 70% x = x= – broker advances – Purchase Inspiring Lives of Leadership and Purpose

- 73. Utilize full margin – let total amount invested be ‘x’ 70% x = x= – broker advances – Purchase Sell Bought for Less: 2% IN 2% OUT Capital gain $ Inspiring Lives of Leadership and Purpose

- 74. Utilize full margin – let total amount invested be ‘x’ 70% x = x= – broker advances – Purchase Sell Bought for Less: 2% IN 2% OUT Capital gain $ Inspiring Lives of Leadership and Purpose

- 75. Margin Buying Rules: Inspiring Lives of Leadership and Purpose

- 76. Margin Buying Rules: • Must sign ‘hypothecation’ agreement (Margin Account Agreement Form) -- pledging of securities as collateral for a loan Inspiring Lives of Leadership and Purpose

- 77. Margin Buying Rules: • Must sign ‘hypothecation’ agreement (Margin Account Agreement Form) -- pledging of securities as collateral for a loan • the investor’s % equity (margin) in the margined stock must always be > the minimum margin requirement Inspiring Lives of Leadership and Purpose

- 78. Margin Buying Rules: • Must sign ‘hypothecation’ agreement (Margin Account Agreement Form) -- pledging of securities as collateral for a loan • the investor’s % equity (margin) in the margined stock must always be > the minimum margin requirement CMV - loan > % margin req’t CMV Inspiring Lives of Leadership and Purpose

- 79. Selling Short Inspiring Lives of Leadership and Purpose

- 80. Selling Short • sell shares you don’t own - borrow from broker Inspiring Lives of Leadership and Purpose

- 81. Selling Short • sell shares you don’t own - borrow from broker Rules Inspiring Lives of Leadership and Purpose

- 82. Selling Short • sell shares you don’t own - borrow from broker Rules • agreement may be terminated by either party at any time - forced to cover / “buy-in” Inspiring Lives of Leadership and Purpose

- 83. Selling Short • sell shares you don’t own - borrow from broker Rules • agreement may be terminated by either party at any time - forced to cover / “buy-in” • short sale price governed by ‘last sale’ rule Inspiring Lives of Leadership and Purpose

- 84. Selling Short • sell shares you don’t own - borrow from broker Rules • agreement may be terminated by either party at any time - forced to cover / “buy-in” • short sale price governed by ‘last sale’ rule • dividends declared are the responsibility of the seller Inspiring Lives of Leadership and Purpose

- 85. Selling Short • sell shares you don’t own - borrow from broker Rules • agreement may be terminated by either party at any time - forced to cover / “buy-in” • short sale price governed by ‘last sale’ rule • dividends declared are the responsibility of the seller • short deposit must be 150% CMV at all times Inspiring Lives of Leadership and Purpose

- 86. Short selling Current market Required Short accounts value (CMV) of total balance investment 150% = 50% 100% (100 shares) (1.5xCMV) Short @ $10/sh. $1000 $1500 = $500 $1000 Proceeds from sale Your investment Inspiring Lives of Leadership and Purpose

- 87. Example: Inspiring Lives of Leadership and Purpose

- 88. Example: • ABC selling at $70/share; expect drop in price, short 100 shares Inspiring Lives of Leadership and Purpose

- 89. Example: • ABC selling at $70/share; expect drop in price, short 100 shares • Broker Inspiring Lives of Leadership and Purpose

- 90. Example: • ABC selling at $70/share; expect drop in price, short 100 shares • Broker $7, 000 Sell @ $70x100 (left as collateral) $3 500 Deposit 50% of CMV as collateral as collateral deposit Total short $10 500 Inspiring Lives of Leadership and Purpose

- 91. Cover short at $55 Inspiring Lives of Leadership and Purpose

- 92. Cover short at $55 • buy 100 shares of ABC @ $55 = $5,500 Inspiring Lives of Leadership and Purpose

- 93. Cover short at $55 • buy 100 shares of ABC @ $55 = $5,500 • shares go back to broker - short seller gets back additional collateral Inspiring Lives of Leadership and Purpose

- 94. Cover short at $55 • buy 100 shares of ABC @ $55 = $5,500 • shares go back to broker - short seller gets back additional collateral Proceeds from sale CA$7,000 Cost of covering - CA$5,500 Gross profit = CA$1,500 110 Less: 2% IN 2% OUT + 140 Capital Gain = CA$1,250 Inspiring Lives of Leadership and Purpose

- 95. Cover short at $55 • buy 100 shares of ABC @ $55 = $5,500 • shares go back to broker - short seller gets back additional collateral Proceeds from sale CA$7,000 Cost of covering - CA$5,500 Gross profit = CA$1,500 110 Less: 2% IN 2% OUT + 140 Capital Gain = CA$1,250 Inspiring Lives of Leadership and Purpose

- 96. Short Sales Inspiring Lives of Leadership and Purpose

- 97. Short Sales • What is maximum profit you can make? Inspiring Lives of Leadership and Purpose

- 98. Short Sales • What is maximum profit you can make? • What is maximum loss? Inspiring Lives of Leadership and Purpose

- 99. Short Sales • What is maximum profit you can make? • What is maximum loss? Inspiring Lives of Leadership and Purpose

- 100. Short Sales • What is maximum profit you can make? • What is maximum loss? Inspiring Lives of Leadership and Purpose

- 101. Short Sales • What is maximum profit you can make? • What is maximum loss? • Risks Inspiring Lives of Leadership and Purpose

- 102. Options ‘call’ -option to buy at a set price ‘put’- option to sell at a set price Inspiring Lives of Leadership and Purpose

- 103. Options • An option is a contract that allows the investor (option ‘holder’/‘buyer’) the right to buy or sell at a specific price in the future regardless of market price. ‘call’ -option to buy at a set price ‘put’- option to sell at a set price Inspiring Lives of Leadership and Purpose

- 104. Options • An option is a contract that allows the investor (option ‘holder’/‘buyer’) the right to buy or sell at a specific price in the future regardless of market price. ‘call’ -option to buy at a set price ‘put’- option to sell at a set price Inspiring Lives of Leadership and Purpose

- 105. Options • An option is a contract that allows the investor (option ‘holder’/‘buyer’) the right to buy or sell at a specific price in the future regardless of market price. ‘call’ -option to buy at a set price ‘put’- option to sell at a set price Inspiring Lives of Leadership and Purpose

- 106. Options • An option is a contract that allows the investor (option ‘holder’/‘buyer’) the right to buy or sell at a specific price in the future regardless of market price. ‘call’ -option to buy at a set price ‘put’- option to sell at a set price • Why? Inspiring Lives of Leadership and Purpose

- 107. Options • An option is a contract that allows the investor (option ‘holder’/‘buyer’) the right to buy or sell at a specific price in the future regardless of market price. ‘call’ -option to buy at a set price ‘put’- option to sell at a set price • Why? • Buy Call - leverage, guarantee cover price Inspiring Lives of Leadership and Purpose

- 108. Options • An option is a contract that allows the investor (option ‘holder’/‘buyer’) the right to buy or sell at a specific price in the future regardless of market price. ‘call’ -option to buy at a set price ‘put’- option to sell at a set price • Why? • Buy Call - leverage, guarantee cover price • Sell Call - income Inspiring Lives of Leadership and Purpose

- 109. Options • An option is a contract that allows the investor (option ‘holder’/‘buyer’) the right to buy or sell at a specific price in the future regardless of market price. ‘call’ -option to buy at a set price ‘put’- option to sell at a set price • Why? • Buy Call - leverage, guarantee cover price • Sell Call - income • Buy Put - leverage, protect profit Inspiring Lives of Leadership and Purpose

- 110. Options • An option is a contract that allows the investor (option ‘holder’/‘buyer’) the right to buy or sell at a specific price in the future regardless of market price. ‘call’ -option to buy at a set price ‘put’- option to sell at a set price • Why? • Buy Call - leverage, guarantee cover price • Sell Call - income • Buy Put - leverage, protect profit • Sell Put - income Inspiring Lives of Leadership and Purpose

- 111. Example: Inspiring Lives of Leadership and Purpose

- 112. Example: Specifically… purchase option to buy/sell Inspiring Lives of Leadership and Purpose

- 113. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) Inspiring Lives of Leadership and Purpose

- 114. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) Inspiring Lives of Leadership and Purpose

- 115. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) Inspiring Lives of Leadership and Purpose

- 116. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ Inspiring Lives of Leadership and Purpose

- 117. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ Inspiring Lives of Leadership and Purpose

- 118. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ Inspiring Lives of Leadership and Purpose

- 119. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ Inspiring Lives of Leadership and Purpose

- 120. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ • One LMN July/85 Call at 5 Inspiring Lives of Leadership and Purpose

- 121. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ • One LMN July/85 Call at 5 Inspiring Lives of Leadership and Purpose

- 122. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ • One LMN July/85 Call at 5 100 shares Inspiring Lives of Leadership and Purpose

- 123. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ • One LMN July/85 Call at 5 100 shares Inspiring Lives of Leadership and Purpose

- 124. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ • One LMN July/85 Call at 5 100 shares underlying interest/security Inspiring Lives of Leadership and Purpose

- 125. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ • One LMN July/85 Call at 5 100 shares underlying interest/security Inspiring Lives of Leadership and Purpose

- 126. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ • One LMN July/85 Call at 5 expiry - 3rd Friday 100 shares of each month underlying interest/security Inspiring Lives of Leadership and Purpose

- 127. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ • One LMN July/85 Call at 5 expiry - 3rd Friday 100 shares of each month underlying interest/security Inspiring Lives of Leadership and Purpose

- 128. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ • One LMN July/85 Call at 5 expiry - 3rd Friday 100 shares strike price of each month underlying interest/security Inspiring Lives of Leadership and Purpose

- 129. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ • One LMN July/85 Call at 5 expiry - 3rd Friday 100 shares strike price of each month underlying interest/security Inspiring Lives of Leadership and Purpose

- 130. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ • One LMN July/85 Call at 5premium/sh expiry - 3rd Friday 100 shares strike price of each month underlying interest/security Inspiring Lives of Leadership and Purpose

- 131. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ • One LMN July/85 Call at 5premium/sh expiry - 3rd Friday 100 shares strike price of each month underlying interest/security Inspiring Lives of Leadership and Purpose

- 132. Example: Specifically… purchase option to buy/sell - prescribed # of shares of ‘underlying interest’ (100) - at prescribed price (‘strike’ price/’exercise’ price) - over a period of time (until expiry) - for a ‘premium’ buy Opti on to • One LMN July/85 Call at 5premium/sh expiry - 3rd Friday 100 shares strike price of each month underlying interest/security Inspiring Lives of Leadership and Purpose

- 133. Derivative – Premium depends on… volatility of stock optioned direction of market length of time contract ;time value difference between strike price and market price -;intrinsic value) Inspiring Lives of Leadership and Purpose

- 134. Derivative – Premium depends on… volatility of stock optioned direction of market length of time contract ;time value difference between strike price and market price -;intrinsic value) Inspiring Lives of Leadership and Purpose

- 135. Derivative – Premium depends on… volatility of stock optioned direction of market length of time contract ;time value difference between strike price and market price -;intrinsic value) Example: Inspiring Lives of Leadership and Purpose

- 136. Derivative – Premium depends on… volatility of stock optioned direction of market length of time contract ;time value difference between strike price and market price -;intrinsic value) Example: • market price of LMN is $40 Inspiring Lives of Leadership and Purpose

- 137. Derivative – Premium depends on… volatility of stock optioned direction of market length of time contract ;time value difference between strike price and market price -;intrinsic value) Example: • market price of LMN is $40 • buy One LMN Nov/35 Call at 7 Inspiring Lives of Leadership and Purpose

- 138. Derivative – Premium depends on… volatility of stock optioned direction of market length of time contract ;time value difference between strike price and market price -;intrinsic value) Example: • market price of LMN is $40 • buy One LMN Nov/35 Call at 7 • premium =$5intrinsic value + $2 time value Inspiring Lives of Leadership and Purpose

- 139. Derivative – Premium depends on… volatility of stock optioned direction of market length of time contract ;time value difference between strike price and market price -;intrinsic value) Strike price on call $20: Example: • market price of LMN is $40 • buy One LMN Nov/35 Call at 7 • premium =$5intrinsic value + $2 time value Inspiring Lives of Leadership and Purpose

- 140. Derivative – Premium depends on… volatility of stock optioned direction of market length of time contract ;time value difference between strike price and market price -;intrinsic value) Strike price on call $20: mkt $20 “at the money” Example: • market price of LMN is $40 • buy One LMN Nov/35 Call at 7 • premium =$5intrinsic value + $2 time value Inspiring Lives of Leadership and Purpose

- 141. Derivative – Premium depends on… volatility of stock optioned direction of market length of time contract ;time value difference between strike price and market price -;intrinsic value) Strike price on call $20: mkt $20 “at the money” mkt.$24 “in the money” Example: • market price of LMN is $40 • buy One LMN Nov/35 Call at 7 • premium =$5intrinsic value + $2 time value Inspiring Lives of Leadership and Purpose

- 142. Derivative – Premium depends on… volatility of stock optioned direction of market length of time contract ;time value difference between strike price and market price -;intrinsic value) Strike price on call $20: mkt $20 “at the money” mkt.$24 “in the money” Example: mkt.$16 “out of the money” • market price of LMN is $40 • buy One LMN Nov/35 Call at 7 • premium =$5intrinsic value + $2 time value Inspiring Lives of Leadership and Purpose

- 143. Exercise a call option Inspiring Lives of Leadership and Purpose

- 144. Exercise a call option • LMN selling @ $50/sh, you think price will rise Inspiring Lives of Leadership and Purpose

- 145. Exercise a call option • LMN selling @ $50/sh, you think price will rise • purchase 1 LMN Dec/50 Call at 5 Inspiring Lives of Leadership and Purpose

- 146. Exercise a call option • LMN selling @ $50/sh, you think price will rise • purchase 1 LMN Dec/50 Call at 5 • price increases to $70/share Inspiring Lives of Leadership and Purpose

- 147. Exercise a call option • LMN selling @ $50/sh, you think price will rise • purchase 1 LMN Dec/50 Call at 5 • price increases to $70/share buy 100 shares at 500 strike price CA$5,000 Sell 100 shares at $70 mkt. price CA$7,000 CA$2,000 equals= 500 Less: Premium 100 2% IN 140 2% OUT 10 2% on premium Capital gain = CA$1,250 Inspiring Lives of Leadership and Purpose

- 148. Exercise a call option • LMN selling @ $50/sh, you think price will rise • purchase 1 LMN Dec/50 Call at 5 • price increases to $70/share buy 100 shares at 500 strike price CA$5,000 Sell 100 shares at $70 mkt. price CA$7,000 CA$2,000 equals= 500 Less: Premium 100 2% IN Yield = 140 2% OUT $1250 2% on premium 10 $500 =250 % Capital gain = CA$1,250 Inspiring Lives of Leadership and Purpose

- 149. PUT Example: Inspiring Lives of Leadership and Purpose

- 150. PUT Example: • LMN selling @ $50/sh, you think price will drop Inspiring Lives of Leadership and Purpose

- 151. PUT Example: • LMN selling @ $50/sh, you think price will drop • purchase 1 LMN Dec/50 Put at 4.50 Inspiring Lives of Leadership and Purpose

- 152. PUT Example: • LMN selling @ $50/sh, you think price will drop • purchase 1 LMN Dec/50 Put at 4.50 • price decreases to $30/sh Inspiring Lives of Leadership and Purpose

- 153. PUT Example: • LMN selling @ $50/sh, you think price will drop • purchase 1 LMN Dec/50 Put at 4.50 • price decreases to $30/sh CA$3,000 Buy CA$5,000 Sell 450 Less: Premium 2% IN(buy commision) 60 2% OUT(sell commision 100 9 2% on premium Capital gain = CA$1,381 Inspiring Lives of Leadership and Purpose

- 154. PUT Example: • LMN selling @ $50/sh, you think price will drop • purchase 1 LMN Dec/50 Put at 4.50 • price decreases to $30/sh CA$3,000 Buy CA$5,000 Sell 450 Less: Premium 2% IN(buy commision) 60 Yield =$1,381 2% OUT(sell commision 100 9 $450 2% on premium =307% Capital gain = CA$1,381 Inspiring Lives of Leadership and Purpose

- 155. Time value of money Inspiring Lives of Leadership and Purpose

- 156. Time value of money • Is $1 one year from today worth the same as $1 today? Inspiring Lives of Leadership and Purpose

- 157. Time value of money • Is $1 one year from today worth the same as $1 today? • we want money today because is depreciates over time Inspiring Lives of Leadership and Purpose

- 158. Time value of money • Is $1 one year from today worth the same as $1 today? • we want money today because is depreciates over time • risk - do we trust you Inspiring Lives of Leadership and Purpose

- 159. Time value of money • Is $1 one year from today worth the same as $1 today? • we want money today because is depreciates over time • risk - do we trust you • things can attack the value of it, we might need it for something today Inspiring Lives of Leadership and Purpose

- 160. Time value of money • Is $1 one year from today worth the same as $1 today? • we want money today because is depreciates over time • risk - do we trust you • things can attack the value of it, we might need it for something today Inspiring Lives of Leadership and Purpose

- 161. Time value of money • Is $1 one year from today worth the same as $1 today? • we want money today because is depreciates over time • risk - do we trust you • things can attack the value of it, we might need it for something today Inspiring Lives of Leadership and Purpose

- 162. Time value of money • Is $1 one year from today worth the same as $1 today? • we want money today because is depreciates over time • risk - do we trust you • things can attack the value of it, we might need it for something today Inspiring Lives of Leadership and Purpose

- 163. Time value of money • Is $1 one year from today worth the same as $1 today? • we want money today because is depreciates over time • risk - do we trust you • things can attack the value of it, we might need it for something today • Concept important to leases, mortgages, bonds, retirement contributions, stock valuation, project selection Inspiring Lives of Leadership and Purpose

- 164. Single amount – FV Single period • What will you have in one year if you deposit $100 into an account today that earns 4% interest compounded annually? r=0.04 (int. or discount rate PMT= $100 (payment 100 ? amount x 1.04 (because we still have our hundred) n=1 number of periods in years Inspiring Lives of Leadership and Purpose

- 165. Single amount – FV Single period • What will you have in one year if you deposit $100 into an account today that earns 4% interest compounded annually? r=0.04 (int. or discount rate PMT= $100 (payment 100 ? amount x 1.04 (because we still have our hundred) n=1 number of periods in years Inspiring Lives of Leadership and Purpose

- 166. Single amount – FV Single period • What will you have in one year if you deposit $100 into an account today that earns 4% interest compounded annually? r=0.04 (int. or discount rate PMT= $100 (payment 100 ? amount x 1.04 (because we still have our hundred) n=1 number of periods in years Inspiring Lives of Leadership and Purpose

- 167. Single amount – FV Single period • What will you have in one year if you deposit $100 into an account today that earns 4% interest compounded annually? r=0.04 (int. or discount rate PMT= $100 (payment 100 ? amount x 1.04 (because we still have our hundred) n=1 number of periods in years Inspiring Lives of Leadership and Purpose

- 168. Single amount – FV Single period • What will you have in one year if you deposit $100 into an account today that earns 4% interest compounded annually? r=0.04 (int. or Today discount rate PMT= $100 (payment 100 ? amount x 1.04 (because we still have our hundred) n=1 number of periods in years Inspiring Lives of Leadership and Purpose

- 169. Single amount – FV Single period • What will you have in one year if you deposit $100 into an account today that earns 4% interest compounded annually? r=0.04 (int. or Today 1 discount rate PMT= $100 (payment 100 ? amount x 1.04 (because we still have our hundred) n=1 number of periods in years Inspiring Lives of Leadership and Purpose

- 170. Single amount – FV Single period • What will you have in one year if you deposit $100 into an account today that earns 4% interest compounded annually? r=0.04 (int. or Today 1 discount rate PMT= $100 (payment 100 ? amount x 1.04 (because we still have our hundred) n=1 number of periods in years Inspiring Lives of Leadership and Purpose

- 171. Single amount – FV Multiple periods • What will you have in three years if you deposit a $100 gift into an account today that earns 4% interest compounded annually? r=.04 Today 1 PMT=$100 3 N=3 100 ? x 1.04=$140 x 1.04=$108.16 x 1.04= $112.49 FVsingle amount =$100 x (1+.04^3)= $112.49 Inspiring Lives of Leadership and Purpose

- 172. Single amount – FV Multiple periods • What will you have in three years if you deposit a $100 gift into an account today that earns 4% interest compounded annually? r=.04 Today 1 PMT=$100 3 N=3 100 ? x 1.04=$140 x 1.04=$108.16 x 1.04= $112.49 FVsingle amount =$100 x (1+.04^3)= $112.49 Inspiring Lives of Leadership and Purpose

- 173. Sample problem • How much money will you have in five years if you deposit $200 into an account that earns 3% compounded annually? • PMT=200 • r= 0.03 • n= 5 • FVsingle=PMTx(1+r)^n =231.85 :Dwoo! Inspiring Lives of Leadership and Purpose

- 174. Single amount – PV Single period • How much do you have to deposit today to have $100 after one year (assuming 4% interest compounded annually?) OR what is the present value of $100 to be received in one year (assume a 4% discount rate). ? 100 100 (1+0.04) = $96.15 Inspiring Lives of Leadership and Purpose

- 175. Single amount – PV Single period • How much do you have to deposit today to have $100 after one year (assuming 4% interest compounded annually?) OR what is the present value of $100 to be received in one year (assume a 4% discount rate). Today ? 100 100 (1+0.04) = $96.15 Inspiring Lives of Leadership and Purpose

- 176. Single amount – PV Single period • How much do you have to deposit today to have $100 after one year (assuming 4% interest compounded annually?) OR what is the present value of $100 to be received in one year (assume a 4% discount rate). Today 1 ? 100 100 (1+0.04) = $96.15 Inspiring Lives of Leadership and Purpose

- 177. Single amount – PV Single period • How much do you have to deposit today to have $100 after one year (assuming 4% interest compounded annually?) OR what is the present value of $100 to be received in one year (assume a 4% discount rate). Today 1 ? 100 100 (1+0.04) = $96.15 Inspiring Lives of Leadership and Purpose

- 178. Single amount – PV Multiple periods • How much do you have to deposit today to have $100 after three years (assuming 4% interest compounded annually?) OR what is the present value of $100 to be received in three years (assume a 4% discount rate). Inspiring Lives of Leadership and Purpose

- 179. Single amount – PV Multiple periods • How much do you have to deposit today to have $100 after three years (assuming 4% interest compounded annually?) OR what is the present value of $100 to be received in three years (assume a 4% discount rate). Today Inspiring Lives of Leadership and Purpose

- 180. Single amount – PV Multiple periods • How much do you have to deposit today to have $100 after three years (assuming 4% interest compounded annually?) OR what is the present value of $100 to be received in three years (assume a 4% discount rate). Today 1 Inspiring Lives of Leadership and Purpose

- 181. Single amount – PV Multiple periods • How much do you have to deposit today to have $100 after three years (assuming 4% interest compounded annually?) OR what is the present value of $100 to be received in three years (assume a 4% discount rate). Today 1 2 Inspiring Lives of Leadership and Purpose

- 182. Single amount – PV Multiple periods • How much do you have to deposit today to have $100 after three years (assuming 4% interest compounded annually?) OR what is the present value of $100 to be received in three years (assume a 4% discount rate). Today 1 2 3 Inspiring Lives of Leadership and Purpose

- 183. Single amount – PV Multiple periods • How much do you have to deposit today to have $100 after three years (assuming 4% interest compounded annually?) OR what is the present value of $100 to be received in three years (assume a 4% discount rate). Today 1 2 3 Inspiring Lives of Leadership and Purpose

- 184. Single amount – PV Multiple periods • How much do you have to deposit today to have $100 after three years (assuming 4% interest compounded annually?) OR what is the present value of $100 to be received in three years (assume a 4% discount rate). Today 1 2 3 Inspiring Lives of Leadership and Purpose

- 185. Single amount – PV Multiple periods • How much do you have to deposit today to have $100 after three years (assuming 4% interest compounded annually?) OR what is the present value of $100 to be received in three years (assume a 4% discount rate). Today 1 2 3 Inspiring Lives of Leadership and Purpose

- 186. Single amount – PV Multiple periods • How much do you have to deposit today to have $100 after three years (assuming 4% interest compounded annually?) OR what is the present value of $100 to be received in three years (assume a 4% discount rate). Today 1 2 3 Inspiring Lives of Leadership and Purpose

- 187. Single amount – PV Multiple periods • How much do you have to deposit today to have $100 after three years (assuming 4% interest compounded annually?) OR what is the present value of $100 to be received in three years (assume a 4% discount rate). Today 1 2 3 Inspiring Lives of Leadership and Purpose

- 188. Sample problem: • How much do you have to deposit today to have $3,000 four years from now (assume a 5% discount rate)? PMT=3000 r=0.05 n=4 PV= 3000/(1.05)^4 =$2468.11 Inspiring Lives of Leadership and Purpose

- 189. FV - Multiple payments & periods • What will you have after three years if you deposit $100 each year for three years (beginning at the end of this year) into an account that earns 4% interest compounded annually? Today 1 2 3 PMT= 100 r=0.04 100 100 100 n=3 FVordinaryannuity=100[(1+0.04)^3-1 0.04] Inspiring Lives of Leadership and Purpose

- 190. FV - Multiple payments & periods • What will you have after three years if you deposit $100 each year for three years (beginning at the end of this year) into an account that earns 4% interest compounded annually? Today 1 2 3 PMT= 100 r=0.04 100 100 100 n=3 FVordinaryannuity=100[(1+0.04)^3-1 0.04] Inspiring Lives of Leadership and Purpose

- 191. FV - Multiple payments & periods • What will you have after three years if you deposit $100 each year for three years STARTING TODAY into an account today that earns 4% interest compounded annually? Today 1 2 3 $100(1.04)^3 $100 (1.04)^2 $100 (1.04) = $104 $108.16 FV Annuity Due: $112.4868+108.16+104= $112.4864 Inspiring Lives of Leadership and Purpose

- 192. FV - Multiple payments & periods • What will you have after three years if you deposit $100 each year for three years STARTING TODAY into an account today that earns 4% interest compounded annually? Today 1 2 3 $100(1.04)^3 $100 (1.04)^2 $100 (1.04) = $104 $108.16 FV Annuity Due: $112.4868+108.16+104= $112.4864 Inspiring Lives of Leadership and Purpose

- 193. Sample problem: • How much will you have in your retirement account in 10 years if you deposit $500 per year starting at the end of this year (assume 3% r=0.03 compounded annually). PMT=500 PMT [(1+r)^n-1 n=10 r] =500[(1+0.03)^10-1 0.03] 0 1 2 3 ... 10 5731.94 500 500 500 ..? Inspiring Lives of Leadership and Purpose

- 194. Sample problem: • What if we began saving immediately? if we start saving today (use the annuity due INSTEAD of x 1+r for annuity ordinary annuity so =500[(1+0.03)^10-1 annuity due you multiply final answer 0.03] (1+r) (from previously slide) and 5731.94 x 1.03 multiply it by 0.03 =5,903.90 -on our timeline we start at TODAY not 0! Inspiring Lives of Leadership and Purpose

- 195. Sample problem: • How much must we put in an account each year earning 4% if we want to have $20,000 at the end of 10 years? r=0.04 use FV formula but solve for PMT PMT=? not FV n=10 FV = PMT [(1+ r)^n-1 FV= 20,000 r] 20,000= PMT [(1+0.04)^10-1 0.04] =166582 (solve for PMT) Inspiring Lives of Leadership and Purpose

- 196. PV - Multiple payments & periods How big must your trust fund be today if you want to receive a payment of $500 each year for the next three years? Assume an interest/discount rate of 4%. Today 1 2 3 *Today!* =present value ? 500/1.04 500/1,04^2 500/1.04^3 NOT future r=.04 PMT=$500 value n=3 =500 [1 - 1 .04 .04(1+0.04)^3] = Inspiring Lives of Leadership and Purpose

- 197. PV - Multiple payments & periods How big must your trust fund be today if you want to receive a payment of $500 each year for the next three years? Assume an interest/discount rate of 4%. Today 1 2 3 *Today!* =present value ? 500/1.04 500/1,04^2 500/1.04^3 NOT future r=.04 PMT=$500 value n=3 =500 [1 - 1 .04 .04(1+0.04)^3] = Inspiring Lives of Leadership and Purpose

- 198. PV - Multiple payments & periods How big must your trust fund be today if you want to receive a payment of $500 each year for the next three years starting today? Assume an interest/ discount rate of 4%. Today 1 2 3 r=0.04 PMT=500 n=3 use present value annuity due formula =$1,443.05 Inspiring Lives of Leadership and Purpose

- 199. PV - Multiple payments & periods How big must your trust fund be today if you want to receive a payment of $500 each year for the next three years starting today? Assume an interest/ discount rate of 4%. Today 1 2 3 r=0.04 PMT=500 n=3 use present value annuity due formula =$1,443.05 Inspiring Lives of Leadership and Purpose

- 200. Sample Problem: You borrowed $20,000 to fund your education. How big will your educational loan payments be if you want to have the loan paid off in four years, you make the first payment at the end of this year, and the discount rate is 3%? r=.03 Today 1 2 3 4 PMT=? n=4 PV=20, 000 PVord. annuity=P MT[1 - 1 r r(1+r)^n ordinary annuity and discount rate ...discount rate= present value annuity! 5,380.54 so ordinary present value formula Inspiring Lives of Leadership and Purpose

- 201. Sample Problem: How much would you pay for an investment that will given you $1,000 after four years and a payment of $50 each year as well. Assume 3% interest compounded annually. Today 1 2 3 4 r=.03 n=4 ? 50 50 50 1000 this must be a bond because we know there is a set maturity date use PVordinary annuity + PVsingle amount = FV (1+r)^n price we pay for this investment TODAY=$1,074.34 (selling at premium) Inspiring Lives of Leadership and Purpose

- 202. Perpetuity r=0.03 PMT=. PV perpetuity= .05x12 05(12)=60 .03 =20 Inspiring Lives of Leadership and Purpose

- 203. Perpetuity • Annuity that goes on forever, e.g. dividend on a preferred share r=0.03 PMT=. PV perpetuity= .05x12 05(12)=60 .03 =20 Inspiring Lives of Leadership and Purpose

- 204. Perpetuity • Annuity that goes on forever, e.g. dividend on a preferred share r=0.03 PMT=. PV perpetuity= .05x12 05(12)=60 .03 =20 Inspiring Lives of Leadership and Purpose

- 205. Perpetuity • Annuity that goes on forever, e.g. dividend on a preferred share r=rate PMT=amount received r=0.03 PMT=. PV perpetuity= .05x12 05(12)=60 .03 =20 Inspiring Lives of Leadership and Purpose

- 206. Perpetuity • Annuity that goes on forever, e.g. dividend on a preferred share r=rate PMT=amount received • What is the value of an investment in a 5% preferred with a par value of $12 if interest rates are 3%? r=0.03 PMT=. PV perpetuity= .05x12 05(12)=60 .03 =20 Inspiring Lives of Leadership and Purpose

- 207. Payment & compounding periods • Payment and interest periods must be the same • Adjust compounding rate to match payment frequency (this is your new “r”) • Always multiply “n” by number of payments per year Inspiring Lives of Leadership and Purpose

- 208. Interest and payment periods same but more than once per year (or single payment but compounding >once per year) -multiply “n” by number of payments per year -divide “r” by number of payments per year • What is the present value of four years of $50 payments received every six months and compounded semi- annually at 3%? r= .03/2 =0.015 since it does not start today it is PMT= $50 n=4x2=8 an ordinary annuity! use PVord.annuity Inspiring Lives of Leadership and Purpose

- 209. Interest & payment periods don’t match this means r rnom = rate given m = # of compounding periods per year P= • What is the FV of $100 received monthly for three years and compounded at 5% semi- annually? we are describing an ordinary annuity effective monthly rate = (1 + 0.5/2) ^2*1/12 -1 = 0.0041 plug r into FV ordinary annuity formula = 3,870.72 Inspiring Lives of Leadership and Purpose

- 210. Interest & payment periods don’t match rnom = .05 (rate given m = 2 (# of compounding periods per year) p= 1 (payment period measured in fractions of a year effective annual rate = (1+.05/2)^2/1 - 1 = 0.0506 Inspiring Lives of Leadership and Purpose

- 211. Interest & payment periods don’t match • What is the effective rate if you are calculating the PV of a three year annuity of $1,000 compounded at 5% semi-annually? rnom = .05 (rate given m = 2 (# of compounding periods per year) p= 1 (payment period measured in fractions of a year effective annual rate = (1+.05/2)^2/1 - 1 = 0.0506 Inspiring Lives of Leadership and Purpose

- 212. Summary Interest > Payments Matchin r & n adjustments one per > once per g year year schedul es Yes Yes yes New r=r÷payment frequency New n=n x payment frequency Yes or No Yes No r=Effective rate for payment period New n=n x payment frequency Interest Yes r=APR÷payment frequency stated as New n=n x payment APR frequency Inspiring Lives of Leadership and Purpose

- 213. Bond What would you pay for a GM 9.5 of 2021, if the yield (prevailing rate) on similar risk bonds issued today is 10.5%? 1. Draw timeline. -------------------------------------------------- today 1 2 10 47.50 47.50 47.50 47.50 47.50 2. What are we calculating? $1,000 the present value of ten years of semi- annual annuity payments $47.50. Add to this the present value of a single amount of $1000 to be received in ten years. the discount rate is 10.5% 3. What is my “r” and “n”? -interest and payments happen at the same frequency (2 times per year) r=.105/2=.0525 n=10x2=20 Inspiring Lives of Leadership and Purpose

- 214. Bond example 4. Plug numbers into formulas PV ordinary annuity= $579.61 PVsingle amount = $359.3833 price of bond= 359.3833+579.61= $938.99 (discount rate!) Inspiring Lives of Leadership and Purpose

- 215. Bond example 4. Plug numbers into formulas PV ordinary annuity= $579.61 PVsingle amount = $359.3833 price of bond= 359.3833+579.61= $938.99 (discount rate!) Inspiring Lives of Leadership and Purpose

- 216. Bond example 4. Plug numbers into formulas PMT (annuity) =$95-2 PMT(single)=1,000 r=.0525 n=20 PV ordinary annuity= $579.61 PVsingle amount = $359.3833 price of bond= 359.3833+579.61= $938.99 (discount rate!) Inspiring Lives of Leadership and Purpose

- 217. Bond example 4. Plug numbers into formulas PMT (annuity) =$95-2 PMT(single)=1,000 r=.0525 n=20 PV ordinary annuity= $579.61 PVsingle amount = $359.3833 price of bond= 359.3833+579.61= $938.99 (discount rate!) Inspiring Lives of Leadership and Purpose

- 218. Bond example 4. Plug numbers into formulas PMT (annuity) =$95-2 PMT(single)=1,000 r=.0525 n=20 PV ordinary annuity= $579.61 PVsingle amount = $359.3833 price of bond= 359.3833+579.61= $938.99 (discount rate!) Inspiring Lives of Leadership and Purpose

- 219. Mortgage question Inspiring Lives of Leadership and Purpose

- 220. Mortgage question • Calculate your mortgage payments if you buy a house for $300,000, make a down payment of $50,000, pay 6% interest compounded semi-annually, and make monthly payments. Inspiring Lives of Leadership and Purpose

- 221. Mortgage question • Calculate your mortgage payments if you buy a house for $300,000, make a down payment of $50,000, pay 6% interest compounded semi-annually, and make monthly payments. • Note: – Mortgages are calculated over 25 years but we actually only sign for 5 years or less – At end of five years we redo calculation Inspiringon remaining Purpose Lives of Leadership and balance for remainder of years

- 222. Mortgage Amount owing today = $300,000-$50,000= $250,000 1. What are we calculating? 2. What is the “r” and “n”? • Uneven payment & compounding periods – calculate new “r” effective monthly rate = (1+.06/2)^2/1/12 -1 =.0049 New n=25 years x 12 payments per year =300 Inspiring Lives of Leadership and Purpose

- 223. Mortgage 3. Plug numbers into formula r=0.0049 n=300 PVordinary annuity=$250,000 $250,000=PMT [ 1 - 1 ] .0049 .0049(1.0049)^300 PMT=$1,592.47 Inspiring Lives of Leadership and Purpose

- 224. Mortgage 3. Plug numbers into formula r=0.0049 n=300 PVordinary annuity=$250,000 $250,000=PMT [ 1 - 1 ] .0049 .0049(1.0049)^300 PMT=$1,592.47 Inspiring Lives of Leadership and Purpose

- 225. How much do you still owe when the mortgage is renewed the end of five years? PVordinary annuity=224,441.56 250,000-224,441.56=25,558.44 1,592.47x5x12-25,558.44= 69,989.76 Inspiring Lives of Leadership and Purpose

- 226. How much do you still owe when the mortgage is renewed the end of five years? PVordinary annuity=224,441.56 Principal repaid = 250,000-224,441.56=25,558.44 1,592.47x5x12-25,558.44= 69,989.76 Inspiring Lives of Leadership and Purpose

- 227. How much do you still owe when the mortgage is renewed the end of five years? PVordinary annuity=224,441.56 Principal repaid = 250,000-224,441.56=25,558.44 Interest paid = 1,592.47x5x12-25,558.44= 69,989.76 Inspiring Lives of Leadership and Purpose

- 228. How much do you still owe when the mortgage is renewed the end of five years? PVordinary annuity=224,441.56 Principal repaid = 250,000-224,441.56=25,558.44 Interest paid = 1,592.47x5x12-25,558.44= 69,989.76 Inspiring Lives of Leadership and Purpose

- 229. Lease 0 1 2 3 4 ? ???? ? ? $7000 PV=23,000 Inspiring Lives of Leadership and Purpose

- 230. Lease Leased a $25,000 car at 4% APR with $2,000 down payment and residual of $7,000. What are the monthly lease payments? 0 1 2 3 4 ? ???? ? ? $7000 PV=23,000 Inspiring Lives of Leadership and Purpose

- 231. Lease Leased a $25,000 car at 4% APR with $2,000 down payment and residual of $7,000. What are the monthly lease payments? Amount owing today:25,000-2,000=23,000 0 1 2 3 4 ? ???? ? ? $7000 PV=23,000 Inspiring Lives of Leadership and Purpose

- 232. Lease Leased a $25,000 car at 4% APR with $2,000 down payment and residual of $7,000. What are the monthly lease payments? Amount owing today:25,000-2,000=23,000 0 1 2 3 4 ? ???? ? ? $7000 PV=23,000 1. What are we calculating? The payments that will allow us to pay off our lease/loan Inspiring Lives of Leadership and Purpose

- 233. Lease a single payment of 7,000 and monthly payments over 4 years starting today PVlease= PVsingle amount+PVannuity due using APR therefore r=APR/12 (monthly payments)=. 04/12=0.0033 -new n=4 years x 12 payments per yr = 48 Inspiring Lives of Leadership and Purpose

- 234. Lease 1a. How are we paying this loan off? a single payment of 7,000 and monthly payments over 4 years starting today PVlease= PVsingle amount+PVannuity due using APR therefore r=APR/12 (monthly payments)=. 04/12=0.0033 -new n=4 years x 12 payments per yr = 48 Inspiring Lives of Leadership and Purpose

- 235. Lease 1a. How are we paying this loan off? a single payment of 7,000 and monthly payments over 4 years starting today PVlease= PVsingle amount+PVannuity due 2. What is our “r” and “n”? using APR therefore r=APR/12 (monthly payments)=. 04/12=0.0033 -new n=4 years x 12 payments per yr = 48 Inspiring Lives of Leadership and Purpose

- 236. Lease =5,976.1165 PMT=382.82 Inspiring Lives of Leadership and Purpose

- 237. Lease 3. Plug numbers into formulas. =5,976.1165 PMT=382.82 Inspiring Lives of Leadership and Purpose

- 238. Lease 3. Plug numbers into formulas. =5,976.1165 PMT=382.82 Inspiring Lives of Leadership and Purpose

- 239. Lease Single amount =7,000 3. Plug numbers into formulas. Annuity payment =? r=.0033 n=48 =5,976.1165 PMT=382.82 Inspiring Lives of Leadership and Purpose

- 240. Lease Single amount =7,000 3. Plug numbers into formulas. Annuity payment =? r=.0033 n=48 =5,976.1165 PMT=382.82 Inspiring Lives of Leadership and Purpose

- 241. Lease Single amount =7,000 3. Plug numbers into formulas. Annuity payment =? r=.0033 n=48 =5,976.1165 PMT=382.82 Inspiring Lives of Leadership and Purpose

- 242. Tackling TVM problems Inspiring Lives of Leadership and Purpose

- 243. Tackling TVM problems 1. Draw timeline and note other variables Inspiring Lives of Leadership and Purpose

- 244. Tackling TVM problems 1. Draw timeline and note other variables 2. Figure out which formula(s) to use Are you calculating PV or FV? Hint: Look for the question mark or where your final total falls on your time line! Is it an annuity, a single payment, or both? Hint: Count the number of payments on your time line! Inspiring Lives of Leadership and Purpose

- 245. Tackling TVM problems 1. Draw timeline and note other variables 2. Figure out which formula(s) to use Are you calculating PV or FV? Hint: Look for the question mark or where your final total falls on your time line! Is it an annuity, a single payment, or both? Hint: Count the number of payments on your time line! 3. Calculate the “r” and “n” you will use Calculate “r” to match payment frequency (# of payments per year) Multiply “n” by number of payments per year Inspiring Lives of Leadership and Purpose

- 246. Tackling TVM problems 1. Draw timeline and note other variables 2. Figure out which formula(s) to use Are you calculating PV or FV? Hint: Look for the question mark or where your final total falls on your time line! Is it an annuity, a single payment, or both? Hint: Count the number of payments on your time line! 3. Calculate the “r” and “n” you will use Calculate “r” to match payment frequency (# of payments per year) Multiply “n” by number of payments per year 4. Plug new “r” and “n” into formulas Inspiring Lives of Leadership and Purpose

- 247. Requirements • Must show formula and calculation steps on final exam • Take number to four decimals while executing calculation steps • Round final answer to nearest penny • Formulas will be provided on exam Inspiring Lives of Leadership and Purpose

Editor's Notes

- Remember that your writing assignment should be an informal report which means memo style, recommendation at beginning &#x2013; but not like a case in that it has an implementation and contingency plan.\n

- \n

- \n

- \n

- Material on pillars taken from text chapter 5\n- \n

- Material on pillars taken from text chapter 5\n- \n

- Material on pillars taken from text chapter 5\n- \n

- -federal banks only grant a charter to a hand full of companies- charter= able to own a bank\n-public companies not owned by the government- anyone can buy a share \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- Pillar 2\n-trust companies and credit unions\nPillar 3\n-insurance co., venture capital firms, pension funds\nPillar 4\n-facilitate trade of securities \n

- world bank- provides limited services; typically funds national improvements through loans for roads, etc\ninternational monetary fund- promotes stability of exchange rates, short-term loans to members, encourages member cooperation on international monetary issues, encourages development of a system for international payments \n

- world bank- provides limited services; typically funds national improvements through loans for roads, etc\ninternational monetary fund- promotes stability of exchange rates, short-term loans to members, encourages member cooperation on international monetary issues, encourages development of a system for international payments \n

- world bank- provides limited services; typically funds national improvements through loans for roads, etc\ninternational monetary fund- promotes stability of exchange rates, short-term loans to members, encourages member cooperation on international monetary issues, encourages development of a system for international payments \n

- world bank- provides limited services; typically funds national improvements through loans for roads, etc\ninternational monetary fund- promotes stability of exchange rates, short-term loans to members, encourages member cooperation on international monetary issues, encourages development of a system for international payments \n

- world bank- provides limited services; typically funds national improvements through loans for roads, etc\ninternational monetary fund- promotes stability of exchange rates, short-term loans to members, encourages member cooperation on international monetary issues, encourages development of a system for international payments \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- Will teach you how to calculate bond price during the TMV material\n

- Will teach you how to calculate bond price during the TMV material\n

- \n

- \n

- \n

- \n

- \n

- \n

- i.e. have $50,000 but buy a $200,000 house by using debt or buying $75,000 in stock by borrowing rest\n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- cmv= current market value \n-if the stock goes down in price...say it drops to 40\nCMV=40\n($40 x 200) -2700\n$40 x 280 =66.25 ...below 70, not good! (below margin requirement) \n

- cmv= current market value \n-if the stock goes down in price...say it drops to 40\nCMV=40\n($40 x 200) -2700\n$40 x 280 =66.25 ...below 70, not good! (below margin requirement) \n

- cmv= current market value \n-if the stock goes down in price...say it drops to 40\nCMV=40\n($40 x 200) -2700\n$40 x 280 =66.25 ...below 70, not good! (below margin requirement) \n

- \n

- \n

- \n

- \n

- \n

- \n

- 150 % rule = sell short at 10 $, 1000$ are generated from who is buying the shares, short seller asks for colateral of 500 dollars\n\n

- \n

- \n

- \n

- yield= what you made ...1 250\ndivided by deposit ...3500\n

- yield= what you made ...1 250\ndivided by deposit ...3500\n

- yield= what you made ...1 250\ndivided by deposit ...3500\n

- yield= what you made ...1 250\ndivided by deposit ...3500\n

- max profit:price of short\nmax loss:price goes up to infinity \nrisks= unlimited losses, forced to cover at a disadvantageous price, dividends may be declared that you must cover, short calls \n\n-similarities and differences between short selling and margin buying -both use leverage, both subject to calls -short selling we want markets to drop, margin buying we want to rise \n

- max profit:price of short\nmax loss:price goes up to infinity \nrisks= unlimited losses, forced to cover at a disadvantageous price, dividends may be declared that you must cover, short calls \n\n-similarities and differences between short selling and margin buying -both use leverage, both subject to calls -short selling we want markets to drop, margin buying we want to rise \n

- max profit:price of short\nmax loss:price goes up to infinity \nrisks= unlimited losses, forced to cover at a disadvantageous price, dividends may be declared that you must cover, short calls \n\n-similarities and differences between short selling and margin buying -both use leverage, both subject to calls -short selling we want markets to drop, margin buying we want to rise \n

- max profit:price of short\nmax loss:price goes up to infinity \nrisks= unlimited losses, forced to cover at a disadvantageous price, dividends may be declared that you must cover, short calls \n\n-similarities and differences between short selling and margin buying -both use leverage, both subject to calls -short selling we want markets to drop, margin buying we want to rise \n

- max profit:price of short\nmax loss:price goes up to infinity \nrisks= unlimited losses, forced to cover at a disadvantageous price, dividends may be declared that you must cover, short calls \n\n-similarities and differences between short selling and margin buying -both use leverage, both subject to calls -short selling we want markets to drop, margin buying we want to rise \n

- option contact is almost like a coupon -difference: you dont pay for most coupons \n

- option contact is almost like a coupon -difference: you dont pay for most coupons \n

- option contact is almost like a coupon -difference: you dont pay for most coupons \n

- option contact is almost like a coupon -difference: you dont pay for most coupons \n

- option contact is almost like a coupon -difference: you dont pay for most coupons \n

- option contact is almost like a coupon -difference: you dont pay for most coupons \n

- option contact is almost like a coupon -difference: you dont pay for most coupons \n

- option contact is almost like a coupon -difference: you dont pay for most coupons \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- -premium-reflects whether it is a valuable option for you or not; potential \n\nif this was a PUT option you would want your market price to be lower then your strike price \n

- -premium-reflects whether it is a valuable option for you or not; potential \n\nif this was a PUT option you would want your market price to be lower then your strike price \n

- -premium-reflects whether it is a valuable option for you or not; potential \n\nif this was a PUT option you would want your market price to be lower then your strike price \n

- -premium-reflects whether it is a valuable option for you or not; potential \n\nif this was a PUT option you would want your market price to be lower then your strike price \n

- -premium-reflects whether it is a valuable option for you or not; potential \n\nif this was a PUT option you would want your market price to be lower then your strike price \n

- -premium-reflects whether it is a valuable option for you or not; potential \n\nif this was a PUT option you would want your market price to be lower then your strike price \n

- -premium-reflects whether it is a valuable option for you or not; potential \n\nif this was a PUT option you would want your market price to be lower then your strike price \n

- -premium-reflects whether it is a valuable option for you or not; potential \n\nif this was a PUT option you would want your market price to be lower then your strike price \n

- -premium-reflects whether it is a valuable option for you or not; potential \n\nif this was a PUT option you would want your market price to be lower then your strike price \n

- high degree of leverage! (yield)\n\nwhenever we buy or sell shares we need to pay brokers commision \n

- high degree of leverage! (yield)\n\nwhenever we buy or sell shares we need to pay brokers commision \n

- high degree of leverage! (yield)\n\nwhenever we buy or sell shares we need to pay brokers commision \n

- high degree of leverage! (yield)\n\nwhenever we buy or sell shares we need to pay brokers commision \n

- high degree of leverage! (yield)\n\nwhenever we buy or sell shares we need to pay brokers commision \n

- -expiry date: 3rd friday of the month (dec) \n-PUT option means we are guaranteeing the price we can sell stocks at \nexercise the option with 2 % on premium \n-right at the very beginning were out 450 \nand 9 -the premiums \n\n-always ask where am I at excersicing it to where I am if i dont\n\n

- -expiry date: 3rd friday of the month (dec) \n-PUT option means we are guaranteeing the price we can sell stocks at \nexercise the option with 2 % on premium \n-right at the very beginning were out 450 \nand 9 -the premiums \n\n-always ask where am I at excersicing it to where I am if i dont\n\n

- -expiry date: 3rd friday of the month (dec) \n-PUT option means we are guaranteeing the price we can sell stocks at \nexercise the option with 2 % on premium \n-right at the very beginning were out 450 \nand 9 -the premiums \n\n-always ask where am I at excersicing it to where I am if i dont\n\n

- -expiry date: 3rd friday of the month (dec) \n-PUT option means we are guaranteeing the price we can sell stocks at \nexercise the option with 2 % on premium \n-right at the very beginning were out 450 \nand 9 -the premiums \n\n-always ask where am I at excersicing it to where I am if i dont\n\n

- -expiry date: 3rd friday of the month (dec) \n-PUT option means we are guaranteeing the price we can sell stocks at \nexercise the option with 2 % on premium \n-right at the very beginning were out 450 \nand 9 -the premiums \n\n-always ask where am I at excersicing it to where I am if i dont\n\n

- reasons: risk, real interest=interest rate thats adjusted from inflation, inflation \n

- reasons: risk, real interest=interest rate thats adjusted from inflation, inflation \n

- reasons: risk, real interest=interest rate thats adjusted from inflation, inflation \n

- reasons: risk, real interest=interest rate thats adjusted from inflation, inflation \n

- reasons: risk, real interest=interest rate thats adjusted from inflation, inflation \n

- reasons: risk, real interest=interest rate thats adjusted from inflation, inflation \n

- reasons: risk, real interest=interest rate thats adjusted from inflation, inflation \n

- reasons: risk, real interest=interest rate thats adjusted from inflation, inflation \n

- compounded annually - interest earned then earns interest on top of it (not just a base amount) \n-simple timeline \n\nFVsingle amount= $100 x (1+0.04)=$104\nFVsingle amount= PMT x (1+r) \n

- compounded annually - interest earned then earns interest on top of it (not just a base amount) \n-simple timeline \n\nFVsingle amount= $100 x (1+0.04)=$104\nFVsingle amount= PMT x (1+r) \n

- compounded annually - interest earned then earns interest on top of it (not just a base amount) \n-simple timeline \n\nFVsingle amount= $100 x (1+0.04)=$104\nFVsingle amount= PMT x (1+r) \n

- compounded annually - interest earned then earns interest on top of it (not just a base amount) \n-simple timeline \n\nFVsingle amount= $100 x (1+0.04)=$104\nFVsingle amount= PMT x (1+r) \n

- compounded annually - interest earned then earns interest on top of it (not just a base amount) \n-simple timeline \n\nFVsingle amount= $100 x (1+0.04)=$104\nFVsingle amount= PMT x (1+r) \n

- compounded annually - interest earned then earns interest on top of it (not just a base amount) \n-simple timeline \n\nFVsingle amount= $100 x (1+0.04)=$104\nFVsingle amount= PMT x (1+r) \n

- \n

- \n

- so the present value of a single amount is the payment you want to receive divided by 1+ interest rate as a decimal not percent\n\nsoo..question mark under today = 96.15\n

- so the present value of a single amount is the payment you want to receive divided by 1+ interest rate as a decimal not percent\n\nsoo..question mark under today = 96.15\n

- so the present value of a single amount is the payment you want to receive divided by 1+ interest rate as a decimal not percent\n\nsoo..question mark under today = 96.15\n

- 100 /(1+0.04)^3\n=88.90\nso you would need to deposit $88.90 today to receive $100 in three years \n

- 100 /(1+0.04)^3\n=88.90\nso you would need to deposit $88.90 today to receive $100 in three years \n

- 100 /(1+0.04)^3\n=88.90\nso you would need to deposit $88.90 today to receive $100 in three years \n

- 100 /(1+0.04)^3\n=88.90\nso you would need to deposit $88.90 today to receive $100 in three years \n

- 100 /(1+0.04)^3\n=88.90\nso you would need to deposit $88.90 today to receive $100 in three years \n

- 100 /(1+0.04)^3\n=88.90\nso you would need to deposit $88.90 today to receive $100 in three years \n

- 100 /(1+0.04)^3\n=88.90\nso you would need to deposit $88.90 today to receive $100 in three years \n

- 100 /(1+0.04)^3\n=88.90\nso you would need to deposit $88.90 today to receive $100 in three years \n

- 100 /(1+0.04)^3\n=88.90\nso you would need to deposit $88.90 today to receive $100 in three years \n

- Draw timeline showing how problem maps on there\n time line 01234\n ? 3000\n

- PMT stays do not add it up \n\n\n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- \n

- -\n

- Note that &#x201C;n&#x201D; should always represent the number of payments you give/receive over the time of the investment period\n

- -we don&#x2019;t have a match, there are payments happening 12 times a year, but they are compounded twice or once a year, we need to readjust the r (see formula above) \n-m= number of compounding periods\n-p= payment period as a fraction of a year \n-instead, say p=# of payments a year...formula changes to (1+ rnom) ^m/p -1 \n m\n\n

- -if the interest wasn&#x2019;t compounded semi-annually, i.e. Was compounded annually, the PV would have been $2,723.25\n

- Notice that the &#x201C;n&#x201D; is always multiplied by the number of payment per year if there is more than one payment per year\n\nAPR stands for Annual Percentage Rate -if your given an APR rate, handle it as you see it in the column above, divide by payment frequency! \n

- Remember that bonds pay coupons semi-annually (twice a year) and interest is compounded on them semi-annually\n

- \n

- \n

- \n

- \n

- -typically when we are talking about a lone we are referring to a present value formula, because we know the amount today- we don&#x2019;t know what payments we need to pay it off \n

- -typically when we are talking about a lone we are referring to a present value formula, because we know the amount today- we don&#x2019;t know what payments we need to pay it off \n

- 0 1234520\npresent value\n=250,000 \n\n

- \n

- Draw a time line with points 0, 5, 10, 25 (put dotted lines on line between numbers)\nPoint out that our mortgage payment calculation assumed repayment over 25 years\nPut payments on top of each point ($1592.47)\n\nAt five years we can figure out how much we owe by taking the present value of all of the payments from 5 yrs to 25 yrs\nThat is the amount that we would negotiate the next mortgage on\n\nHow much principal did we repay during the first five years? What we started with owing minus what is still owing at year 5.\n\nHow much interest did we pay during the first five years? Whatever our total payments were minus the portion that was principal.\n

- Draw a time line with points 0, 5, 10, 25 (put dotted lines on line between numbers)\nPoint out that our mortgage payment calculation assumed repayment over 25 years\nPut payments on top of each point ($1592.47)\n\nAt five years we can figure out how much we owe by taking the present value of all of the payments from 5 yrs to 25 yrs\nThat is the amount that we would negotiate the next mortgage on\n\nHow much principal did we repay during the first five years? What we started with owing minus what is still owing at year 5.\n\nHow much interest did we pay during the first five years? Whatever our total payments were minus the portion that was principal.\n

- Draw a time line with points 0, 5, 10, 25 (put dotted lines on line between numbers)\nPoint out that our mortgage payment calculation assumed repayment over 25 years\nPut payments on top of each point ($1592.47)\n\nAt five years we can figure out how much we owe by taking the present value of all of the payments from 5 yrs to 25 yrs\nThat is the amount that we would negotiate the next mortgage on\n\nHow much principal did we repay during the first five years? What we started with owing minus what is still owing at year 5.\n\nHow much interest did we pay during the first five years? Whatever our total payments were minus the portion that was principal.\n

- payments starting today= annuities due \n

- payments starting today= annuities due \n

- payments starting today= annuities due \n

- I could also ask how much would a car cost if you leased it at 4% APR with a $7,000 residual and monthly payments of $400.\n\nSolution: Take the present value of the $7,000 and the annuity due of $400.\n

- I could also ask how much would a car cost if you leased it at 4% APR with a $7,000 residual and monthly payments of $400.\n\nSolution: Take the present value of the $7,000 and the annuity due of $400.\n

- I could also ask how much would a car cost if you leased it at 4% APR with a $7,000 residual and monthly payments of $400.\n\nSolution: Take the present value of the $7,000 and the annuity due of $400.\n

- I could also ask how much would a car cost if you leased it at 4% APR with a $7,000 residual and monthly payments of $400.\n\nSolution: Take the present value of the $7,000 and the annuity due of $400.\n

- I could also ask how much would a car cost if you leased it at 4% APR with a $7,000 residual and monthly payments of $400.\n\nSolution: Take the present value of the $7,000 and the annuity due of $400.\n