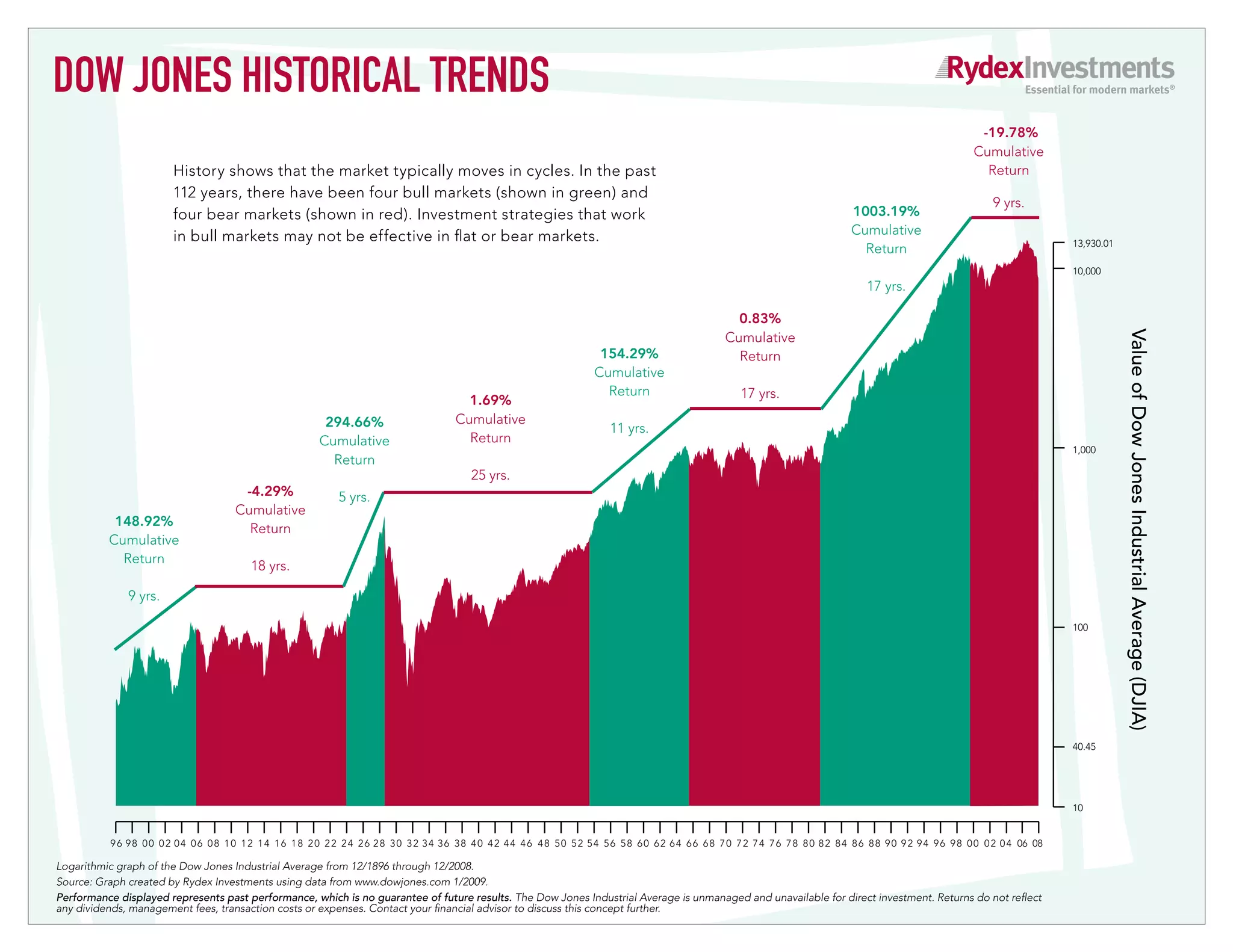

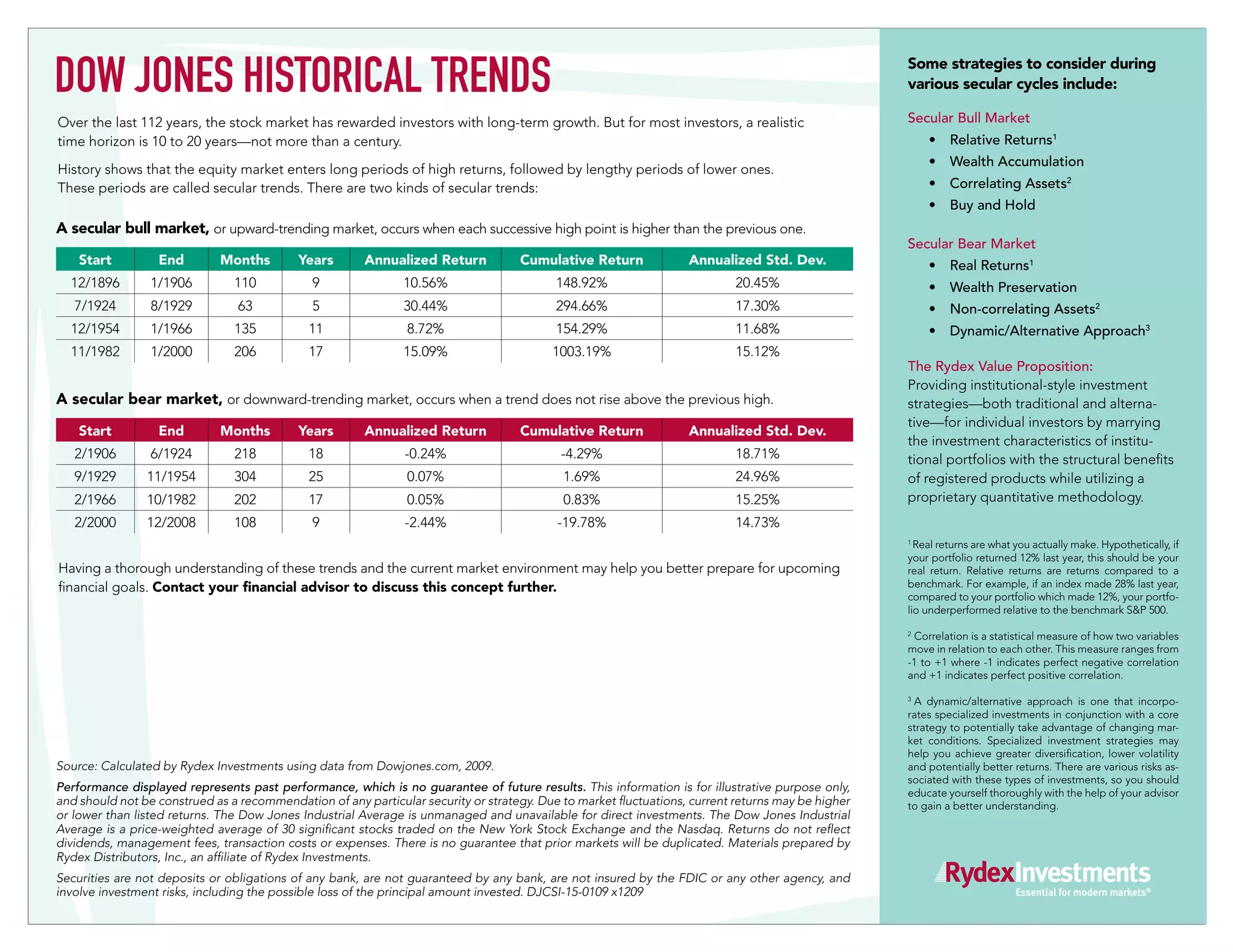

The document outlines historical trends of the Dow Jones Industrial Average, highlighting cycles of bull and bear markets over the past 112 years. It discusses various investment strategies, emphasizing the need for adjustments in approaches based on market conditions and the importance of understanding secular trends in wealth accumulation. It concludes with a note on the potential risks associated with different investment strategies and the importance of consulting financial advisors.