Stock Research Report for RIMM as of 6/23/11 - Chaikin Power Tools

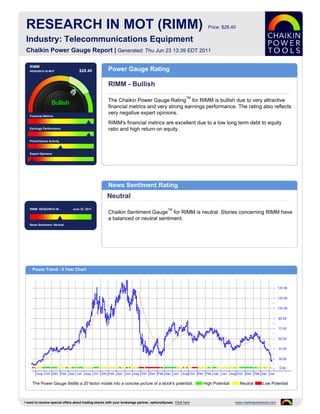

- 1. RESEARCH IN MOT (RIMM) Price: $28.40 Industry: Telecommunications Equipment Chaikin Power Gauge Report | Generated: Thu Jun 23 13:39 EDT 2011 RIMM RESEARCH IN MOT $28.40 Power Gauge Rating RIMM - Bullish TM The Chaikin Power Gauge Rating for RIMM is bullish due to very attractive financial metrics and very strong earnings performance. The rating also reflects very negative expert opinions. Financial Metrics RIMM's financial metrics are excellent due to a low long term debt to equity Earnings Performance ratio and high return on equity. Price/Volume Activity Expert Opinions News Sentiment Rating Neutral RIMM RESEARCH IN .. June 23, 2011 TM Chaikin Sentiment Gauge for RIMM is neutral. Stories concerning RIMM have a balanced or neutral sentiment. News Sentiment :Neutral Power Trend - 5 Year Chart The Power Gauge distills a 20 factor model into a concise picture of a stock's potential. High Potential Neutral Low Potential I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here www.chaikinpowertools.com

- 2. Financials & Earnings Financial Metrics Financial Metrics Rating LT Debt/Equity Ratio Very Bullish Price to Book Value RIMM's financial metrics are excellent. The company does not hold much long term debt and yields a high return on shareholder's equity. Return on Equity The rank is based on a low long term debt to equity ratio, low price to book value, high return on equity, low price to sales ratio and relatively high cash flow. Price to Sales Ratio Business Value Assets and Liabilities Valuation Returns Ratio TTM Ratio TTM Ratio TTM Current Ratio 2.04 Price/Book 1.55 Return on Invest 39.6% LT Debt/Equity 0.00 Price/Sales 0.75 Return on Equity 39.6% Earnings Performance Earnings Performance Rating Earnings Growth Very Bullish Earnings Surprise RIMM's earnings performance has been very strong. The company has a history of strong earnings growth and is priced relatively low compared to next year's projected EPS. Earnings Trend The rank is based on high earnings growth over the past 3-5 years, worse than Projected P/E Ratio expected earnings in recent quarters, an upward trend in earnings this year, a relatively low projected P/E ratio and consistent earnings over the past 5 years. Earnings Consistency 5 Year Revenue and Earnings Growth EPS Estimates 02/07 02/08 02/09 02/10 02/11 Factor Actual EPS Prev EST EPS Current Change Revenue(M) 3,037.10 6,009.40 11,065.19 14,953.22 19,907.00 Quarterly EPS $1.46 $0.89 -0.57 Rev % Growth 47.02% 97.87% 84.13% 35.14% 33.13% Yearly EPS $6.36 $5.24 -1.12 EPS $1.14 $2.31 $3.35 $4.35 $6.36 Factor Actual EPS Growth Est EPS Growth Change EPS % Growth 69.39% 102.63% 45.02% 29.85% 46.21% 3-5 year EPS 59.46% 12.88% -46.58 EPS Surprise EPS Quarterly Results Estimate Actual Difference % Difference FY Qtr 1 Qtr 2 Qtr 3 Qtr 4 Total Latest Qtr $1.32 $1.33 $0.01 0.76 02/09 $1.13 $0.84 $1.11 $1.27 $4.35 1 Qtr Ago $1.75 $1.78 $0.03 1.71 02/10 $1.39 $1.46 $1.74 $1.79 $6.38 2 Qtr Ago $1.64 $1.74 $0.10 6.10 02/11 $1.33 - - - - 3 Qtr Ago $1.35 $1.46 $0.11 8.15 Fiscal Year End Month is February. I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here www.chaikinpowertools.com

- 3. Price Trend & Expert Opinions Price/Volume Activity Price/Volume Activity Rating Relative Strength vs Market Neutral Chaikin Money Flow Price and volume activity for RIMM is neutral. RIMM is in an accelerating price trend compared to 4 months ago and has underperformed the S&P 500 over 26 Price Trend weeks. Price Trend ROC The rank for RIMM is based on its relative weakness versus the market, negative Chaikin money flow, a negative Chaikin price trend, a positive Chaikin price trend ROC and an increasing volume trend. Volume Trend Relative Strength vs S&P500 Index Chaikin Money Flow Chart shows whether RIMM is performing better or worse than the market. Chaikin Money Flow analyzes supply and demand for a company's stock. Price Activity Price Activity Volume Activity Factor Value Factor Value Factor Value 52 Week High 69.86 % Change Price - 4 Weeks -34.17% Average Volume 20 Days 28,093,126 52 Week Low 25.89 % Change Price - 24 Weeks -54.13% Average Volume 90 Days 16,092,250 % Change YTD Rel S&P 500 -52.78% % Change Price - 4 Wks Rel to S&P -32.46% Chaikin Money Flow Persistency 12% % Change Price - 24 Wks Rel to S&P -54.51% Expert Opinions Expert Opinions Earnings Estimate Revisions Very Bearish Short Interest Expert opinions about RIMM are very negative. Analysts are lowering their EPS estimates for RIMM and analysts's opinions on RIMM have been more negative Insider Activity recently. The rank for RIMM is based on analysts revising earnings estimates downward, a Analyst Opinions high short interest ratio, pessimistic analyst opinions and relative weakness of the stock versus the Telecommunications Equipment industry group. Relative Strength vs Industry Earnings Estimate Revisions Analyst Recommendations EPS Estimates Revision Summary Current 7 Days Ago % Change Factor Value Last Week Last 4 Weeks Current Qtr 0.88 1.40 -37.14% Mean this Week Hold Up Down Up Down Next Qtr 1.42 1.71 -16.96% Mean Last Week Hold Curr Qtr 0 40 0 39 Curr Yr 0 45 0 44 Current 30 Days Ago % Change Change +0.14 Next Qtr 2 38 2 37 Current FY 5.21 6.41 -1.20 Mean 5 Weeks Ago Hold Next Yr 1 31 0 31 I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here www.chaikinpowertools.com

- 4. The Company & Its Competitors RIMM's Competitors in Telecommunications Equipment News Headlines for RIMM Company Power Historic EPS Projected EPS Profit Margin PEG PE Revenue(M) Nokia to launch Microsoft platform phones in Gauge growth growth 2011 - Jun 21, 2011 RIMM 59.46% 12.88% 16.21% 0.42 4.50 19,907 Analyst upgrades chip designer Marvell to 'buy' - MSI -11.06% 7.00% 5.94% 3.15 16.81 19,282 Jun 20, 2011 RIM Shares Tumble as Forecast Slashed Again NOK 9.39% 7.67% 4.02% 2.58 7.55 58,086 - Jun 16, 2011 ERIC 9.16% 9.00% 6.73% 1.62 15.22 30,844 RIM Acquires Social Gaming Company Scoreloop - Jun 7, 2011 MMI 3.71% 13.33% - 5.93 - 11,460 Research in Motion's BlackBerry Messenger has QCOM 15.03% 15.33% 29.51% 1.28 21.68 10,991 big competitor in Apple's iMessage - Jun 6, 2011 Company Details Company Profile RESEARCH IN MOT RESEARCH IN MOTION is a world leader in the mobile communications market and has 295 PHILLIP ST a history of developing breakthrough wireless solutions. RIM's portfolio of award-winning ONTARIO CANADA, A6 N2L 3W8 products, services and embedded technologies are used by thousands of organizations USA around the world and include the BlackBerry wireless platform, the RIM Wireless Phone: 5198887465 Handheld product line, software development tools, radio-modems and Website: http://www.rim.com software/hardware licensing agreements. Full Time Employees: 13,873 Sector: Computer and Technology Power Gauge Ratings are created using a relative ranking system that assigns a rank of 0 to 100 (100 being the highest) to each stock in the universe. Rank is calculated by evaluating each of the stocks factors and combining them into a single number using a weighting formula. A stock's rank ranges from 100-0, where 100 is the strongest, and a rank of 95 indicates the stock is better than 95% of the stocks in the universe. Chaikin Stock Research(CSR) is not registered as a securities broker dealer or investment advisor with either the U.S. Securities and Exchange Commission or with any state securities regulatory authority. CSR is not responsible for trades executed by users of this research report, our web site or mobile app based on the information included herein. The information presented in this report does not represent a recommendation to buy or sell stocks or any financial instrument nor is it intended as an endorsement of any security or investment. The information in this report is generic by nature and is not personalized to the specific financial situation of any individual. The user bears complete responsibility for their own investment research and should seek the advice of a qualified investment professional before making any investment decisions. Copyright (c) 1978-(Present) by ZACKS Investment Research, Inc ("ZACKS"). The information, data, analyses and opinions contained herein (1) includes the confidential and proprietary information of ZACKS, (2) may not be copied or redistributed, for any purpose, (3) does not constitute investment advice offered by ZACKS, (4) are provided solely for informational purposes, and (5) are not warranted or represented to be correct, complete, accurate or timely. ZACKS shall not be responsible for investment decisions, damages or other losses resulting from, or related to, use of this information, data, analyses or opinions. Past performance is no guarantee of future performance. ZACKS is not affiliated with Chaikin Power Tools. This report from Chaikin Power Tools is for informational purposes only and is not a recommendation to buy or sell securities. LM 2.3 DS 3.0 LS 2.1 Data Provided by ZACKS Investment Research, Inc., www.zacks.com Special offers to trade stocks from optionsXpress: www.chaikinpowertools.com