Grossing up operating_expenses-_a_reasonable_concept_that_gets__lost_in_translation_10-08

•

0 likes•697 views

Report

Share

Report

Share

Download to read offline

Recommended

Call: Viber#09155956080

Sun#09328559227

Landline# 046-450-8284

Single detached House in Cavite/4BR/15% down Lipat In 60 Days/RFO/Foreclosed/...

Single detached House in Cavite/4BR/15% down Lipat In 60 Days/RFO/Foreclosed/...Ma Erica Victoria Sacdalan

Recommended

Call: Viber#09155956080

Sun#09328559227

Landline# 046-450-8284

Single detached House in Cavite/4BR/15% down Lipat In 60 Days/RFO/Foreclosed/...

Single detached House in Cavite/4BR/15% down Lipat In 60 Days/RFO/Foreclosed/...Ma Erica Victoria Sacdalan

More Related Content

More from Chris Fyvie

More from Chris Fyvie (20)

Downtown toronto office survey package august 25 2016

Downtown toronto office survey package august 25 2016

WTF Properties - Toronto Office Space July availability report

WTF Properties - Toronto Office Space July availability report

Plug in to peak productivity - Colliers Spark Report

Plug in to peak productivity - Colliers Spark Report

#Toronto Businesses now demanding their offices be close to accessible, rapid...

#Toronto Businesses now demanding their offices be close to accessible, rapid...

Recently uploaded

Recently uploaded (20)

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Marel Q1 2024 Investor Presentation from May 8, 2024

Marel Q1 2024 Investor Presentation from May 8, 2024

New 2024 Cannabis Edibles Investor Pitch Deck Template

New 2024 Cannabis Edibles Investor Pitch Deck Template

Jual Obat Aborsi ( Asli No.1 ) 085657271886 Obat Penggugur Kandungan Cytotec

Jual Obat Aborsi ( Asli No.1 ) 085657271886 Obat Penggugur Kandungan Cytotec

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Nashik Call Girl Just Call 7091819311 Top Class Call Girl Service Available

Nashik Call Girl Just Call 7091819311 Top Class Call Girl Service Available

Lucknow Housewife Escorts by Sexy Bhabhi Service 8250092165

Lucknow Housewife Escorts by Sexy Bhabhi Service 8250092165

Falcon Invoice Discounting: Empowering Your Business Growth

Falcon Invoice Discounting: Empowering Your Business Growth

PARK STREET 💋 Call Girl 9827461493 Call Girls in Escort service book now

PARK STREET 💋 Call Girl 9827461493 Call Girls in Escort service book now

Getting Real with AI - Columbus DAW - May 2024 - Nick Woo from AlignAI

Getting Real with AI - Columbus DAW - May 2024 - Nick Woo from AlignAI

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

GUWAHATI 💋 Call Girl 9827461493 Call Girls in Escort service book now

GUWAHATI 💋 Call Girl 9827461493 Call Girls in Escort service book now

Kalyan Call Girl 98350*37198 Call Girls in Escort service book now

Kalyan Call Girl 98350*37198 Call Girls in Escort service book now

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

Chennai Call Gril 80022//12248 Only For Sex And High Profile Best Gril Sex Av...

Chennai Call Gril 80022//12248 Only For Sex And High Profile Best Gril Sex Av...

Grossing up operating_expenses-_a_reasonable_concept_that_gets__lost_in_translation_10-08

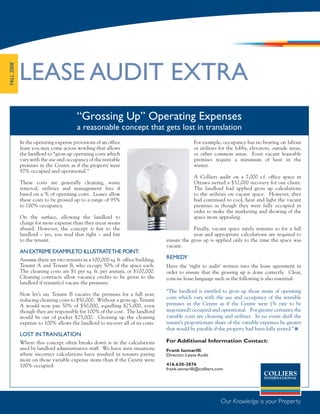

- 1. -ssorG sesnepxE gnitarepO ”pU gni noitalsnart ni tsol steg taht tpecnoc elbanosaer a Lease Audit Extra FALL 2008 “Grossing Up” Operating Expenses a reasonable concept that gets lost in translation In the operating expense provisions of an office For example, occupancy has no bearing on labour lease you may come across wording that allows or utilities for the lobby, elevators, outside areas, the landlord to “gross up operating costs which or other common areas. Even vacant leaseable vary with the use and occupancy of the rentable premises require a minimum of heat in the premises in the Centre as if the property were winter. 97% occupied and operational.” A Colliers audit on a 7,000 s.f. office space in These costs are generally cleaning, waste Ottawa netted a $32,000 recovery for our client. removal, utilities and management fees if The landlord had applied gross up calculations based on a % of operating costs. Leases allow to the utilities on vacant space. However, they these costs to be grossed up to a range of 95% had continued to cool, heat and light the vacant to 100% occupancy. premises as though they were fully occupied in order to make the marketing and showing of the On the surface, allowing the landlord to space more appealing. charge for more expense than they incur seems absurd. However, the concept is fair to the Finally, vacant space rarely remains so for a full landlord – yes, you read that right – and fair year and appropriate calculations are required to to the tenant. ensure the gross up is applied only to the time the space was vacant. An extreme example to illustrate the point: Assume there are two tenants in a 100,000 sq. ft. office building, REMEDY Tenant A and Tenant B, who occupy 50% of the space each. Have the ‘right to audit’ written into the lease agreement in The cleaning costs are $1 per sq. ft. per annum, or $100,000. order to ensure that the grossing up is done correctly. Clear, Cleaning contracts allow vacancy credits to be given to the concise lease language such as the following is also essential: landlord if tenant(s) vacate the premises. “The landlord is entitled to gross up those items of operating Now let’s say Tenant B vacates the premises for a full year, costs which vary with the use and occupancy of the rentable reducing cleaning costs to $50,000. Without a gross up, Tenant A would now pay 50% of $50,000, equalling $25,000, even premises in the Centre as if the Centre were (% rate to be though they are responsible for 100% of the cost. The landlord negotiated) occupied and operational. For greater certainty the would be out of pocket $25,000. Grossing up the cleaning variable costs are cleaning and utilities. In no event shall the expense to 100% allows the landlord to recover all of its costs. tenant’s proportionate share of the variable expenses be greater that would be payable if the property had been fully rented.” Lost in translation Where this concept often breaks down is in the calculations For Additional Information Contact: used by landlord administrative staff. We have seen situations Frank Iannarilli where incorrect calculations have resulted in tenants paying Director, Lease Audit more on those variable expense items than if the Centre were 100% occupied. 416.620-2876 frank.iannarilli@colliers.com