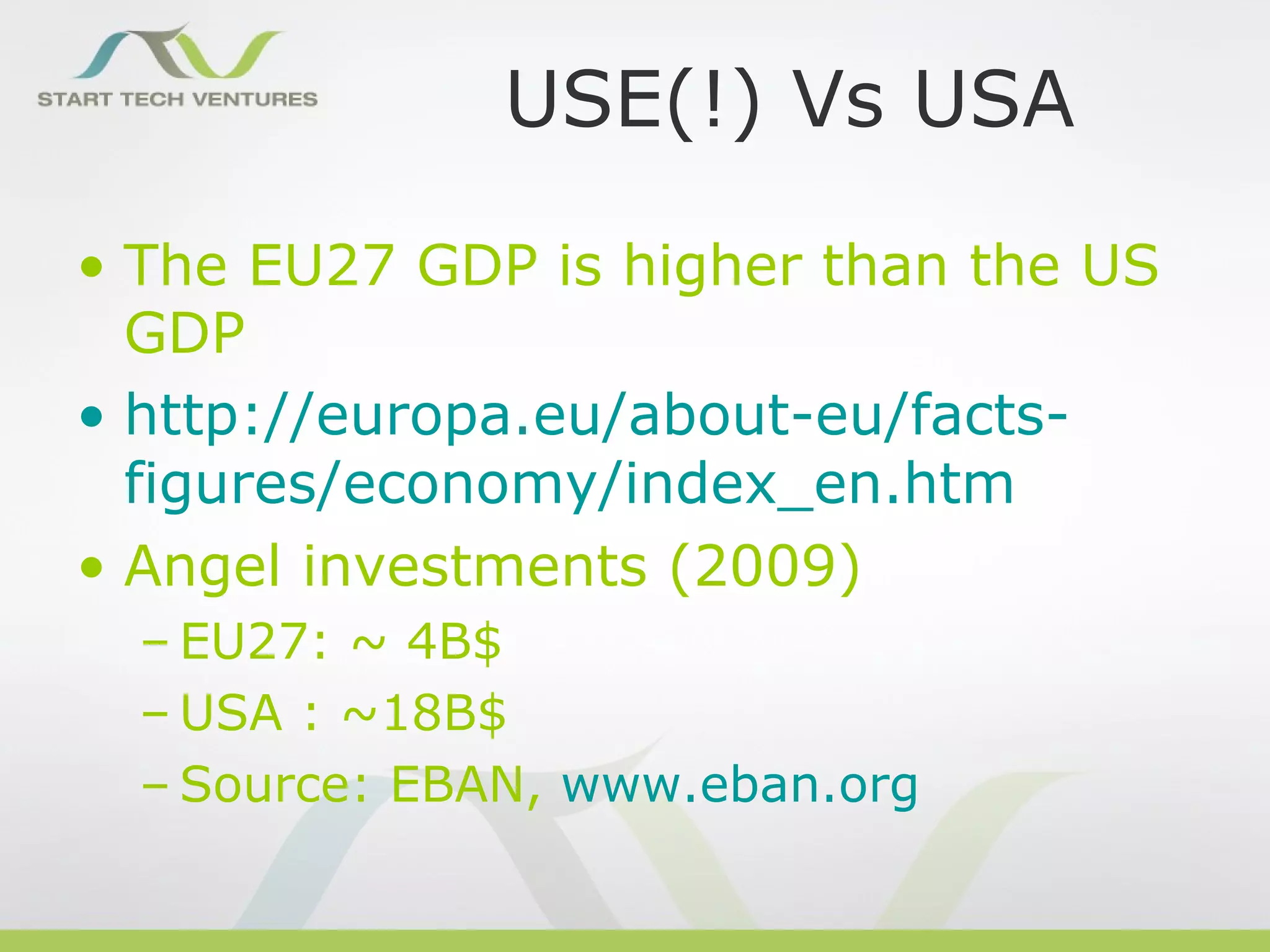

1) Risk financing for entrepreneurship in Europe faces challenges due to Europe being seen as "Old" compared to places like Silicon Valley, with a more conservative culture and slow moving approach.

2) Europe needs to develop a "culture of failure" through education and legislation to turn Europe "Young" again and better support entrepreneurship and risk-taking.

3) The Silicon Valley model of high funding and expectations is not a panacea for Europe, which should develop its own authentic growth models like the "Entrepreneurial Ecosystem" model of supporting startups through access to markets rather than just capital.