GLEIM ONLINE 2017 BUDGETING QUESTIONS

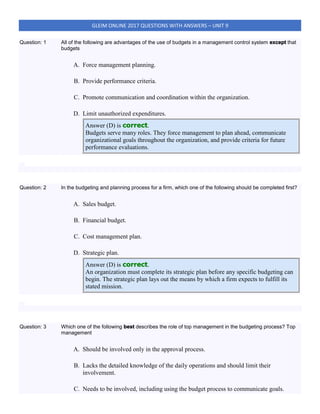

- 1. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Question: 1 All of the following are advantages of the use of budgets in a management control system except that budgets A. Force management planning. B. Provide performance criteria. C. Promote communication and coordination within the organization. D. Limit unauthorized expenditures. Answer (D) is correct. Budgets serve many roles. They force management to plan ahead, communicate organizational goals throughout the organization, and provide criteria for future performance evaluations. Question: 2 In the budgeting and planning process for a firm, which one of the following should be completed first? A. Sales budget. B. Financial budget. C. Cost management plan. D. Strategic plan. Answer (D) is correct. An organization must complete its strategic plan before any specific budgeting can begin. The strategic plan lays out the means by which a firm expects to fulfill its stated mission. Question: 3 Which one of the following best describes the role of top management in the budgeting process? Top management A. Should be involved only in the approval process. B. Lacks the detailed knowledge of the daily operations and should limit their involvement. C. Needs to be involved, including using the budget process to communicate goals.

- 2. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Answer (C) is correct. Among other things, the budget is a tool by which management can communicate goals to lower-level employees. It is also a tool for motivating employees to reach those goals. For the budget to function in these communication and motivating roles, top management must be involved in the process. This involvement does not extend to dictating the exact numerical contents of the budget since top management lacks a detailed knowledge of daily operations. D. Needs to separate the budgeting process and the business planning process into two separate processes. Question: 4 Which one of the following is usually not cited as being an advantage of a formal budgetary process? A. Forces management to evaluate the reasonableness of assumptions used and goals identified in the budgetary process. B. Ensures improved cost control within the organization and prevents inefficiencies. Answer (B) is correct. A budget is a realistic plan for the future expressed in quantitative terms. It is useful for planning, control, motivation, communication, and achieving goal congruence. As a planning tool, a budget forces management to evaluate the reasonableness of assumptions used and goals identified in the budgetary process. As a control tool, the budget provides a formal benchmark to be used for feedback and performance evaluation. As a communication tool, a budget serves to coordinate activities between management and subordinates and provides management with a means of dealing with uncertainty. Despite its advantages, a budget neither ensures improved cost control nor prevents inefficiencies. C. Provides a formal benchmark to be used for feedback and performance evaluation. D. Serves as a coordination and communication device between management and subordinates. Question: 5 The major objectives of any budget system are to A. Define responsibility centers, provide a framework for performance evaluation, and promote communication and coordination among organization segments.

- 3. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 B. Define responsibility centers, facilitate the fixing of blame for missed budget predictions, and ensure goal congruence between superiors and subordinates. C. Foster the planning of operations, provide a framework for performance evaluation, and promote communication and coordination among organization segments. Answer (C) is correct. A budget is a realistic plan for the future expressed in quantitative terms. The process of budgeting forces a company to establish goals, determine the resources necessary to achieve those goals, and anticipate future difficulties in their achievement. A budget is also a control tool because it establishes standards and facilitates comparison of actual and budgeted performance. Because a budget establishes standards and accountability, it motivates good performance by highlighting the work of effective managers. Moreover, the nature of the budgeting process fosters communication of goals to company subunits and coordination of their efforts. Budgeting activities by entities within the company must be coordinated because they are interdependent. Thus, the sales budget is a necessary input to the formulation of the production budget. In turn, production requirements must be known before purchases and expense budgets can be developed, and all other budgets must be completed before preparation of the cash budget. D. Foster the planning of operations, facilitate the fixing of blame for missed budget predictions, and ensure goal congruence between superiors and subordinates. Question: 6 One of the primary advantages of budgeting is that it A. Does not take the place of management and administration. B. Bases the profit plan on estimates. C. Is continually adapted to fit changing circumstances. D. Requires departmental managers to make plans in conjunction with the plans of other interdependent departments. Answer (D) is correct. A budget promotes goal congruence within a company. Departments must coordinate their activities with other interdependent departments in planning and developing the budget.

- 4. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Question: 7 A budget helps a company control costs by setting cost guidelines. However, a budget also performs the function(s) of A. Planning. B. Motivating. C. Communicating. D. All of the answers are correct. Answer (D) is correct. A budget is a realistic plan for the future expressed in quantitative terms. It is a planning tool that establishes goals and permits a company to anticipate problems and to plan for decisions. A budget can be a motivator, especially if it sets reasonable standards, has some flexibility, and was prepared with the participation of those affected. A budget is a communication tool because it informs employees about the goals the company is striving to attain and thus enhances goal congruence. A budget is also a means of coordinating the company’s various activities. The company’s overall budget consists of many smaller budgets. Question: 8 When comparing performance report information for top management with that for lower-level management, A. Top management reports are more detailed. B. Lower-level management reports are typically for longer time periods. C. Top management reports show control over fewer costs. D. Lower-level management reports are likely to contain more quantitative data and less financial data. Answer (D) is correct. Information sent to top management is ordinarily more highly aggregated and less timely than that communicated to managers at operational levels. Top managers are concerned with the organization’s overall financial results and long-term prospects and are responsible for the strategic planning function. Lower-level reports contain more quantitative information of an operational nature, e.g., production data. Question: 9 An improperly executed budget process might have the effect(s) of

- 5. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 A. Disregard of overall company goals. B. Inflated budget requests. C. Meeting short-term but not long-term goals. D. All of the answers are correct. Answer (D) is correct. Lack of goal congruence can result when attaining a subunit’s budgetary goal results in disregard of overall company goals. Subunit managers may inflate their budget requests to provide operating leeway and then engage in unnecessary spending to avoid future budget cuts. A budget may encourage exclusive concentration on meeting short-term standards at the expense of long-term considerations. A manager fearful of not meeting the budget targets may improperly manipulate allocation of expenses. The manager seeking to stay within the budget may disregard employee morale and poor working conditions. Interunit resentment may develop as a result of competition for scarce funds. Question: 10 Ineffective budget control systems are characterized by A. Use of budgets as a planning but not a control tool. B. Use of budgets for harassment of individuals rather than motivation. C. Lack of timely feedback in the use of the budget. D. All of the answers are correct. Answer (D) is correct. Ineffective budget control systems are characterized by each of the items noted. The use of budgets for planning only is a problem that must be resolved through the education process. Management must be educated to use the budget documents for control, not just planning. Management must learn that budgets can motivate and help individuals achieve professional growth as well as the goals of the firm. Ignoring budgets obviously contributes to the ineffectiveness of the budget system. Finally, feedback must be timely or lower management and employees will soon recognize that budget feedback is so late it provides no information, making the budget a worthless device.

- 6. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Question: 11 Which of the following statements regarding budgets is false? A. Budgets present organizational plans in a formal, logical, and integrated manner. B. Budgets are used only as a planning function. Answer (B) is correct. Budget formulation is a planning function; however, budgets are also useful control devices. Budgets provide a basis for control of performance through comparisons of actual with budgeted data. They permit analysis of variations from plans and signal the need for corrective managerial action. C. Budgets may be developed for cash flows or labor usage. D. A budget is a plan that contains a quantitative statement of expected results. Question: 12 A planning calendar in budgeting is the A. Calendar period covered by the budget. B. Schedule of activities for the development and adoption of the budget. Answer (B) is correct. The budget planning calendar is the schedule of activities for the development and adoption of the budget. It should include a list of dates indicating when specific information is to be provided by each information source to others. The preparation of a master budget usually takes several months. For instance, many firms start the budget for the next calendar year some time in September in hopes of having it completed by December 1. Because all of the individual departmental budgets are based on forecasts prepared by others and the budgets of other departments, it is essential to have a planning calendar to ensure the proper integration of the entire process. C. Calendar period covered by the annual budget and the long-range plan. D. Sales forecast by months in the annual budget period. Question: 13 A budget manual, which enhances the operation of a budget system, is most likely to include A. A chart of accounts.

- 7. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 B. Distribution instructions for budget schedules. Answer (B) is correct. A budget manual describes how a budget is to be prepared. Items usually included in a budget manual are a planning calendar and distribution instructions for all budget schedules. Distribution instructions are important because, once a schedule is prepared, other departments within the organization will use the schedule to prepare their own budgets. Without distribution instructions, someone who needs a particular schedule may be overlooked. C. Employee hiring policies. D. Documentation of the accounting system software. Question: 14 Which one of the following is not an advantage of a participatory budgeting process? A. Coordination between departments. B. Communication between departments. C. Goal congruence. D. Control of uncertainties. Answer (D) is correct. Uncertainties can be prepared for, but they cannot be subjected to human control through any budget process. Question: 15 In developing the budget for the next year, which one of the following approaches would produce the greatest amount of positive motivation and goal congruence? A. Permit the divisional manager to develop the goal for the division that in the manager’s view will generate the greatest amount of profits. B. Have senior management develop the overall goals and permit the divisional manager to determine how these goals will be met. C. Have the divisional and senior management jointly develop goals and objectives while constructing the corporation’s overall plan of operation.

- 8. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 D. Have the divisional and senior management jointly develop goals and the divisional manager develop the implementation plan. Answer (D) is correct. Joint development of goals is more conducive to motivation, as is allowing divisional managers to develop the implementation plan. Goal congruence is enhanced when senior management is involved in the budgeting process along with division managers. Question: 16 Which one of the following statements concerning approaches for the budget development process is correct? A. The top-down approach to budgeting will ensure adherence to strategic organizational goals. B. To prevent ambiguity, once departmental budgeted goals have been developed, they should remain fixed even if the sales forecast upon which they are based proves to be wrong in the middle of the fiscal year. C. With the information technology available, the role of budgets as an organizational communication device has declined. D. Since department managers have the most detailed knowledge about organizational operations, they should use this information as the building blocks of the operating budget. Answer (D) is correct. Since department managers have the most detailed knowledge about organizational operations, they should use this information as the building blocks of the operating budget. Question: 17 In the quest to develop a more achievable budget for the coming year, the chief executive officer has elected to develop the company’s budget by using a decentralized bottom-up budget approach. A production manager’s involvement in the budget process this year will probably A. Be negligible. B. Require development of a production budget that is forwarded to the Budget Department.

- 9. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 C. Require development of a production budget after receiving the division’s projected sales forecast. Answer (C) is correct. Management of the division is responsible for setting the sales forecast. The production manager has the responsibility of ensuring the products are ready on schedule and in the right quantities. D. Require development of a production budget based on the prior year’s manufacturing activity. Question: 18 When developing a budget, an external factor to consider in the planning process is A. A change to a decentralized management system. B. The implementation of a new bonus program. C. New product development. D. The merger of two competitors. Answer (D) is correct. Several planning assumptions should be made at the beginning of the budget process. Some of these assumptions are internal factors; others are external to the company. External factors include general economic conditions and their expected trend, governmental regulatory measures, the labor market in the locale of the company’s facilities, and activities of competitors, including the effects of mergers. Question: 19 An advantage of participative budgeting is that it A. Minimizes the cost of developing budgets. B. Reduces the effect on the budgetary process of employee biases. C. Yields information known to management but not to employees. D. Encourages acceptance of the budget by employees. Answer (D) is correct. Participative (grass-roots) budgeting and standard-setting use input from lower-

- 10. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 level and middle-level employees. Participation encourages employees to have a sense of ownership of the output of the process. The result is an acceptance of and commitment to the goals expressed in the budget. Question: 20 The primary role of the budget director and the budgeting department is to A. Settle disputes among operating executives during the development of the annual operating plan. B. Develop the annual profit plan by selecting the alternatives to be adopted from the suggestions submitted by the various operating segments. C. Justify the budget to the executive committee of the board of directors. D. Compile the budget and manage the budget process. Answer (D) is correct. The budget department is responsible for compiling the budget and managing the budget process. The budget director and department are not responsible for actually developing the estimates on which the budget is based. This role is performed by those to whom the resulting budget will be applicable. The budget director has staff, not line, authority. (S)he has a technical and advisory role. The final decision- making responsibility rests with line management. Question: 21 Which one of the following is not considered to be a benefit of participative budgeting? A. Individuals at all organizational levels are recognized as being part of the team; this results in greater support of the organization. B. The budget estimates are prepared by those in direct contact with various activities. C. Managers are more motivated to reach the budget objectives since they participated in setting them. D. When managers set the final targets for the budget, senior management need not be concerned with the overall profitability of current operations. Answer (D) is correct. One of the behavioral considerations of budgeting is the extent of participation in the process by managers at all levels within the organization. Managers are more

- 11. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 motivated to achieve budgeted goals when they are involved in budget preparation. A broad level of participation usually leads to greater support for the budget and the entity as a whole, as well as a greater understanding of what is to be accomplished. Advantages of a participative budget include greater accuracy of budget estimates. Managers with immediate operational responsibility for activities have a better understanding of what results can be achieved and at what costs. Also, managers cannot blame unrealistic objectives as an excuse for not achieving budget expectations when they have helped to establish those objectives. Despite the involvement of lower level managers, senior management must still participate in the budget process to ensure that the combined objectives of the various departments are consistent with profitability objectives of the company. Question: 22 The budgeting technique that is most likely to motivate managers is A. Top-down budgeting. B. Zero-based budgeting. C. Program budgeting and review technique. D. Bottom-up budgeting. Answer (D) is correct. Bottom-up budgeting is the best way of motivating managers to meet budget estimates because it permits participation in the budget process. Lower level managers who take part in budgeting decisions are more likely to support the result and less likely to feel that the budget has been imposed from above. Question: 23 Which one of the following is most important to a successful budgeting effort? A. Experienced analysts. B. Integrated budget software. C. Reliable forecasts and trend analyses. D. Top management support. Answer (D) is correct. An organizational budget requires a significant commitment of internal resources.

- 12. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 The single most important factor in assuring its success is for upper management to demonstrate that they take the project seriously and consider it vital to the organization’s future. Question: 24 The major disadvantage of a budget produced by means of a top-down process is A. Impairment of goal congruence. Answer (A) is correct. Budgets provide a means for coordinating the plans of all organizational subunits. Thus, budgets are a way to promote goal congruence. Although budgets should be consistent with the strategic plans of top management, they should also be based on input from lower-level managers since the latter have detailed knowledge of operating activities. Successful budgets are therefore a compromise. In a top-down process, however, budgets are imposed on subordinates without their participation. B. Lack of involvement by upper-level management. C. Inconsistency with strategic plans. D. Positive motivational effect. Question: 25 All of the following are criticisms of the traditional budgeting process except that it A. Makes across-the-board cuts when early budget iterations show that planned expenses are too high. B. Incorporates non-financial measures as well as financial measures into its output. Answer (B) is correct. Traditional budgeting focuses strictly on financial measures. C. Overemphasizes a fixed time horizon, such as one year. D. Is not used until the end of the budget period to evaluate performance. Question: 26 The following sequence of steps is employed by a company to develop its annual profit plan:

- 13. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Planning guidelines are disseminated downward by top management after receiving input from all levels of management. A sales budget is prepared by individual sales units reflecting the sales targets of the various segments. This provides the basis for departmental production budgets and other related components by the various operating units. Communication is primarily lateral with some upward communication possible. A profit plan is submitted to top management for coordination and review. Top management’s recommendations and revisions are acted upon by middle management. A revised profit plan is resubmitted for further review to top management. Top management grants final approval and distributes the formal plan downward to the various operating units. This outline of steps best describes which one of the following approaches to budget development? A. Imposed budgeting by top management. B. Bottom-up approach. Answer (B) is correct. A bottom-up approach is characterized by general guidance from the highest levels of management, followed by extensive input from middle and lower management. This sequence of steps aptly describes this process. C. Top-down approach. D. Total justification of all activities by operating units. Question: 27 All of the following are advantages of top-down budgeting as opposed to participatory budgeting, except that it A. Increases coordination of divisional objectives. B. Reduces the time required for budgeting. C. May limit the acceptance of proposed goals and objectives. Answer (C) is correct. Since a top-down budget is imposed by upper management, it has less chance of acceptance (also called buy-in) by those on whom the budget is imposed. D. Facilitates implementation of strategic plans.

- 14. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Question: 28 A corporation’s vice president of planning has seen and heard it all. She has told the corporate controller that she is “....very upset with the degree of slack that veteran managers use when preparing their budgets.” The vice president has considered implementing some of the following activities during the budgeting process. 1. Develop the budgets by top management and issue them to lower-level operating units. 2. Study the actual revenues and expenses of previous periods in detail. 3. Have the budgets developed by operating units and accept them as submitted by a company-wide budget committee. 4. Share the budgets with all employees as a means to reach company goals and objectives. 5. Use an iterative budgeting process that has several “rounds” of changes initiated by operating units and/or senior managers. Which one of these activities should the corporation implement in order to best remedy the vice president’s concerns, help eliminate the problems experienced by the corporation, and motivate personnel? A. 1 only. B. 2 and 3. C. 2 and 4. D. 2, 4, and 5. Answer (D) is correct. Steps 2, 4, and 5 are appropriate for alleviating the corporation’s budget problems. Step 1 should not be performed because a budget imposed from the top is more likely to encounter resistance. Step 3 should not be performed because operating units will tend to consider only their own interests when preparing budgets. Question: 29 Budgeting problems where departmental managers are repeatedly achieving easy goals or failing to achieve demanding goals can be best minimized by establishing A. Preventive controls. B. A policy that allows managers to build slack into the budget. C. Participative budgeting where managers pursue objectives consistent with those set by top management.

- 15. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Answer (C) is correct. Participative budgeting is a practical means of setting realistic, achievable budget goals. D. Better communication whereby managers discuss budget matters daily with their superiors. Question: 30 Which one of the following items would most likely cause the planning and budgeting system to fail? The lack of A. Historical financial data. B. Input from several levels of management. C. Top management support. Answer (C) is correct. Top management’s belief in and support of the planning and budgeting process is the single most important element in its success. D. Adherence to rigid budgets during the year. Question: 31 All of the following are disadvantages of top-down budgeting as opposed to participatory budgeting, exceptthat it A. May result in a budget that is not possible to achieve. B. May limit the acceptance of proposed goals and objectives. C. Reduces the communication between employees and management. D. Reduces the time required for budgeting. Answer (D) is correct. Since a top-down budget is coordinated from above, it is less time-consuming than obtaining lower-level input.

- 16. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Question: 32 Suboptimal decision making is not likely to occur when A. There is little congruence among the overall organization goals, the subunit goals, and the individual goals of decision makers. B. Goals and standards of performance are set by the top management. C. Guidance is given to subunit managers about how standards and goals affect them. Answer (C) is correct. Suboptimal decision making is not likely to occur when guidance is given to subunit managers about how standards and goals affect them. D. The subunits in the organization compete with each other for the same input factors or for the same customers. Question: 33 The budgeting process should be one that motivates managers and employees to work toward organizational goals. Which one of the following is least likely to motivate managers? A. Setting budget targets at attainable levels. B. Participation by subordinates in the budgetary process. C. Use of management by exception. D. Having top management set budget levels. Answer (D) is correct. A budget is potentially a good motivational tool. If lower-level managers have participated in preparing the budget, instead of simply receiving a budget imposed by top management, they are more likely to understand and share the goals of top management and to work to keep costs within the budget. Participation and understanding are also likely to result in budgets that are reasonably attainable and viewed as realistic. However, a budget is also a motivator in the sense that managers are accountable for variances in controllable costs but are rewarded for good performance. Moreover, budgeting coupled with analysis of variances tends to improve motivation by allowing upper-level managers to concentrate on problems (exceptions) rather than engaging in routine supervision of subordinates, which may be viewed as unnecessarily intrusive and unwelcome. Question: 34 The best explanation of how the efficient allocation of organizational resources is planned during the budgeting process is that a budget

- 17. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 A. Demonstrates how important it is to have additional spare resources on hand in case the actual results vary from the budget. B. Demonstrates how a company can pull resources from bottlenecks to apply them to other areas to attain goals. C. Identifies the resources and commitments required to fulfill the organization’s goals for the period identified. Answer (C) is correct. A budget lays out in specific terms an organization’s expectations about the consumption of resources and the resulting outcomes. Therefore, it identifies the resources and commitments required to fulfill the organization’s goals for the period identified. D. Is a process for evaluating projects needed and related external financing required to meet resource requirements. Question: 35 A company’s annual budget provides information that can impact the company’s A. Long-term planning only. B. Long-term planning and operational budgets only. C. Operational budgets and strategy only. D. Long-term planning, operational budgets, and strategy. Answer (D) is correct. Budgeting plays a role in the overall planning and evaluation process of the company. It includes information that can impact the company’s long-term planning, operational budgets, and strategy. The strategic plan is made up of long- term objectives that make clear the priorities of the organization. Awareness of priorities is crucial for the allocation of resources because it affects the operational and financial budgets. Question: 36 Which one of the following is an advantage of using the budgeting process to judge performance? A. Management is able to measure actual performance against predicted performance.

- 18. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Answer (A) is correct. This is an advantage of using the budgeting process to judge performance. Comparing actual results to the budget allows the organization as a whole to evaluate performance and allows managers to do the same on an individual level. B. Past performance can be used to evaluate performance improvements. C. Management believes that past conditions are an indicator of future conditions. D. Company performance can be measured against the performance of others in the same industry. Question: 37 Which one of the following is not a characteristic of a successful budget process? A. Setting specific expectations to compare to actual results. B. Gaining top management’s support. C. Using market feedback to assist in setting expectations. D. Implementing the budget as the only benchmark for performance evaluation. Answer (D) is correct. Implementing the budget as the only benchmark for performance evaluation is not a characteristic of a successful budget process. Decisions about a firm’s strategy, and in turn about its budget, are dependent upon general economic conditions and their expected trends as well as the availability of financial resources. Industry information is also a crucial aspect of benchmarking performance. Question: 38 Which one of the following statements best describes budgetary slack? A. The practice of management assigning relaxed budgetary goals after the company achieves the first several months of the annual budget. B. The total amount that actual expenses are below budgeted expenses and actual revenues exceed budgeted revenues. C. The practice of understating budgeted revenues or overestimating budgeted costs to make budgeted targets more achievable.

- 19. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Answer (C) is correct. Budgetary slack is the practice of understating budgeted revenues or overestimating budgeted costs to make budgeted targets more achievable. The natural tendency of a manager is to negotiate for a less stringent measure of performance to avoid unfavorable variances from expectations. D. The margin of error assigned to each cost center to encourage the manager to budget accurately and consistently. Question: 39 The finance department of a large company has prepared a master budget with very limited expense budgets for each department. The department managers are worried about being held accountable for these assigned targets, but senior management wants to keep spending reduced to allow for contingencies and strategic adjustments to the company-wide master budget. Based on this information, this budget process is A. A successful budgeting process because it will be a very useful tool to hold people accountable for overspending. B. A successful budgeting process because it will encourage the associates to work their hardest to meet the goals. C. Not a successful budgeting process because management has left too much room for strategic unknowns. D. Not a successful budgeting process because it has not been widely accepted by the employees. Answer (D) is correct. This budget process represents a top-down budgeting approach. It is imposed by upper management and therefore has less of a chance of acceptance by those on whom the budget is imposed. It is not a successful budgeting process since there is not a buy-in at all levels. Participative budgeting has a much greater chance of acceptance by those affected and thus of achieving ultimate success than does a budget that is imposed from above. Question: 40 A ceramics manufacturer is facing several challenges in its operations due to economic and industry conditions. The company is currently preparing its annual plan and budget. Which one of the following is subject to the least control by management in the current fiscal year? A. A new machine that was purchased this year has not helped reduce the company’s unfavorable labor efficiency variances.

- 20. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 B. A competitor has achieved an unexpected technological breakthrough that has given them a significant quality advantage, and has caused the company to lose market share. Answer (B) is correct. The company has no control over the actions of its competitors; it can only respond to these actions, e.g., increase the company’s research and development efforts. The company has some control over the other alternatives presented. C. Vendors have asked that the contract price for the goods they supply to the company be renegotiated and adjusted for inflation. D. Experienced employees have decided to terminate their employment with the company and go to work for the competition. Question: 41 A company uses participative budgeting. In order to more easily meet budgetary goals, the controller underestimates the amount of revenue and overestimates fixed selling and administrative expenses. This is an example of A. Flexible budgeting. B. Budgetary slack. Answer (B) is correct. Budgetary slack is the excess of resources budgeted over the resources necessary to achieve organizational goals. Management may create slack by overestimating costs and underestimating revenues. C. Zero-based budgeting. D. Budgetary variance. Question: 42 All of the following are advantages of the budgeting process except that the budget A. Forces management to assess the future objectives of the company. B. Establishes benchmarks to identify unsatisfactory organizational performance. C. Facilitates communication among organizational units.

- 21. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 D. Allocates resources on an as-needed basis. Answer (D) is correct. Allocating resources on an as-needed basis is not an advantage of the budgeting process. The budget is usually determined before the period begins, and an as- needed basis would be decided during the period, not before. Question: 43 A corporation is developing standards for the next year. Currently, one of the material components is being purchased for $36.45 per unit. It is expected that the component’s cost will increase by approximately 10% next year and that the price could range from $38.75 to $44.18 per unit, depending on the quantity purchased. The appropriate standard for the material component for next year should be set at the A. Current actual cost plus the forecasted 10% price increase. B. Lowest purchase price in the anticipated range to keep pressure on purchasing to always buy in the lowest price range. C. Highest price in the anticipated range to ensure that there are only favorable purchase price variances. D. Price agreed upon by the purchasing manager and the appropriate level of company management. Answer (D) is correct. Standard prices are designed for internal performance measurement. Standards should be attainable, but not so easily as to not provide motivation. Management should decide its objectives and set a standard that will achieve that objective when the standard is met. For example, the lowest price might not be selected if the company is using a JIT system, for which the primary objective is the minimization of inventories. Question: 44 After performing a thorough study of a firm’s operations, an independent consultant determined that the firm’s labor standards were probably too tight. Which one of the following facts would be inconsistent with the consultant’s conclusion? A. A review of performance reports revealed the presence of many unfavorable efficiency variances. B. The firm’s budgeting process was well-defined and based on a bottom-up philosophy.

- 22. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Answer (B) is correct. It is highly unlikely that workers familiar with their own processes would set too- tight standards. C. Management noted that minimal incentive bonuses have been paid in recent periods. D. Production supervisors found several significant fluctuations in manufacturing volume, with short-term increases on output being followed by rapid, sustained declines. Question: 45 When compared with ideal standards, practical standards A. Produce lower per-unit product costs. B. Result in a less desirable basis for the development of budgets. C. Incorporate very generous allowance for spoilage and worker inefficiencies. D. Serve as a better motivating target for manufacturing personnel. Answer (D) is correct. Practical standards, also called attainable standards, are more likely to meet with worker acceptance than standards based on an unachievable ideal. Question: 46 A manufacturer’s factory manager had lost her patience. Six months ago, she appointed a team from the production and service departments to finalize the allocation of costs and setting of standard costs. They were still feuding, so she hired a large consulting firm to resolve the matter. All of the following are potential consequences of having the standards set by the consulting firm exceptthat A. The consulting firm may not fully understand the manufacturer’s manufacturing process, resulting in suboptimal performance. B. Employees could react negatively since they did not participate in setting the standards. C. There could be dissatisfaction if the standards contain costs that are not controllable by the unit held responsible. D. The standards may appear to lack management support.

- 23. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Answer (D) is correct. Of the choices listed, this one is not a potential consequence of having an outside consultant set standards. Since management did the hiring, the consultant’s work product would naturally appear to have management support. Question: 47 All of the following statements concerning standard costs are correct except that A. Time and motion studies are often used to determine standard costs. B. Standard costs are usually set for one year. C. Standard costs can be used in costing inventory accounts. D. Standard costs are usually stated in total, while budgeted costs are usually stated on a per-unit basis. Answer (D) is correct. Standard costs can be used at the per-unit level and any level of aggregation above. Question: 48 One approach for developing standard costs incorporates communication, bargaining, and interaction among product line managers; the immediate supervisors for whom the standards are being developed; and the accountants and engineers before the standards are accepted by top management. This approach would best be characterized as a(n) A. Imposed approach. B. Centralized top-down approach. C. Engineering approach. D. Team development approach. Answer (D) is correct. A team development approach to standard setting involves interaction among various groups or individuals, including product line managers, the departments for which the standards are being developed, accountants, and industrial engineers.

- 24. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Question: 49 A company is reviewing its standard machine hours per unit to use in its budget for the upcoming year. The machine manufacturer’s specifications indicated a unit could be made in 0.75 hours, and a benchmarking study showed a competitor produced at a speed of 0.78 machine hours per unit. The company’s actual results from last year averaged 0.83 machine hours per unit even though a standard of 0.80 machine hours per unit had been established using engineering studies. The standard the company should use in its upcoming budget is A. 0.75 machine hours per unit. B. 0.78 machine hours per unit. C. 0.80 machine hours per unit. Answer (C) is correct. Standard costs are predetermined expectations about how much a given activity should cost. Standards should be based on accounting, engineering, or statistical control studies. D. 0.83 machine hours per unit. Question: 50 A manufacturer makes picture frames that require one sheet of glass each. Each sheet of glass comes from one larger sheet that is cut into four pieces. Normally, the company is able to produce 400 frames using 110 large sheets of glass, as there is typically some breakage during the process. To improve its operation, the company has set its standard for glass material usage at 100 sheets of large glass to manufacture 400 frames. Which one of the following statements best describes the type of standard the company has set? A. It is an ideal standard because it would normally be attainable with some deviations. B. It is a currently attainable standard because it demands perfect implementation. C. It is a theoretical standard because it assumes that all equipment is in order and employees work as expected. Answer (C) is correct. Theoretical standards are standard costs that are set for production under optimal conditions. Setting the company’s standard for glass material usage at 100 sheets of large glass to manufacture 400 frames is a theoretical standard because it leaves no room for waste, spoilage, machine breakdowns, or any other downtime. D. It is a practical standard because it assumes all operating factors occur as expected. Question: 51 A manufacturer is able to sell up to 50,000 units of product X each month. Engineers are currently in the process of studying labor movement to determine the labor hours standard for product X. Engineers

- 25. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 have found that the fastest workers who take no breaks can complete a unit of product X within 30 minutes. The average worker can complete one unit of product X within 45 minutes, including time for company-mandated breaks. The 0.75 hours per unit is known as the A. Theoretical standard. B. Average standard. C. Practical standard. Answer (C) is correct. The practical standard involves the average worker (includes time for company- mandated breaks). This standard would yield a rate of 0.75 (45 minutes ÷ 60 minutes). D. Variance standard. Question: 52 Which one of the following statements best describes the concept of continuous improvement when developing standard costs? A. Standards become more challenging as time passes. Answer (A) is correct. A standard costing system assumes costs do not greatly change in the short term. However, in an environment where continuous improvement is reducing standard costs over a series of succeeding periods, a standard cost may become out-of-date. B. Standards are developed with zero slack or downtime factored into the calculation. C. Standards remain unattainable to encourage employees to strive harder. D. Standards are established at an easily attainable level to increase employee morale. Question: 53 In an organization that plans by using comprehensive budgeting, the master budget is A. A compilation of all the separate operational and financial budget schedules of the organization. Answer (A) is correct. A company’s overall budget, often called the master or comprehensive budget, encompasses the organization’s operating and financial plans for a specified period, ordinarily a year. Thus, all other budgets are subsets of the master budget. In the operating budget, the emphasis is on obtaining and using current resources. In the

- 26. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 financial budget, the emphasis is on obtaining the funds needed to purchase operating assets. B. The booklet containing budget guidelines, policies, and forms to use in the budgeting process. C. The current budget updated for operations for part of the current year. D. A budget of a not-for-profit organization after it is approved by the appropriate authoritative body. Question: 54 While an operating budget is a key element in planning and control, it is not likely to A. Establish a commitment of company resources. B. Set out long-range, strategic concepts. Answer (B) is correct. Operating budgets seldom set out long-range strategic concepts because they usually deal with the quantitative allocation of people and resources. Strategic concepts are overall goals for the organization and are almost always stated in words. C. Integrate organizational activities. D. Provide subsidiary planning information. Question: 55 In preparing a corporate master budget, which one of the following is most likely to be prepared last? A. Sales budget. B. Cash budget. Answer (B) is correct. The cash budget is the lynchpin of the financial budget. It combines the results of the operating budget with the cash collection and disbursement schedules to

- 27. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 produce a comprehensive picture of where the company’s cash flows are expected to come from and where they are expected to go. All the other budgets listed feed the cash budget in one way or another. C. Production budget. D. Cost of goods sold budget. Question: 56 The master budget process usually begins with the A. Production budget. B. Operating budget. C. Financial budget. D. Sales budget. Answer (D) is correct. The starting point for the annual budget is the sales forecast. All other aspects of the budget, including production, costs, and inventory levels, rely on projected sales figures. Question: 57 All of the following are considered operating budgets except the A. Sales budget. B. Materials budget. C. Production budget. D. Capital budget. Answer (D) is correct. The operating budget consists of all budgets that concern normal operating activities, including the sales budget, production budget, materials budget, direct labor budget, and factory overhead budget. The capital expenditures budget, which

- 28. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 outlines needs for new capital investment, is not a part of normal operations. The capital expenditures budget is sometimes prepared more than a year in advance to allow sufficient time to secure financing for these major expenditures. Question: 58 Which one of the following items is the last schedule to be prepared in the normal budget preparation process? A. Cash budget. Answer (A) is correct. The last schedule prepared before the financial statements is the cash budget. The cash budget is a schedule of estimated cash collections and payments. The various operating budgets and the capital budget are inputs to the cash budgeting process. B. Cost of goods sold budget. C. Manufacturing overhead budget. D. Selling expense budget. Question: 59 The master budget A. Shows forecasted and actual results. B. Reflects controllable costs only. C. Can be used to determine manufacturing cost variances. D. Contains the operating budget. Answer (D) is correct. All other budgets are subsets of the master budget. Thus, quantified estimates by management from all functional areas are contained in the master budget. These results are then combined in a formal quantitative model recognizing the organization’s objectives, inputs, and outputs.

- 29. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Question: 60 The preparation of a comprehensive master budget culminates with the preparation of the A. Production budget. B. Capital investment budget. C. Cash management and working capital budget. Answer (C) is correct. The creation of a comprehensive master budget begins with the preparation of the sales budget and ends with the preparation of the cash management and working capital budget. D. Strategic budget. Question: 61 A company uses a comprehensive planning and budgeting system. The proper order for the company to prepare certain budget schedules would be A. Cost of goods sold, balance sheet, income statement, and statement of cash flows. B. Income statement, balance sheet, statement of cash flows, and cost of goods sold. C. Statement of cash flows, cost of goods sold, income statement, and balance sheet. D. Cost of goods sold, income statement, balance sheet, and statement of cash flows. Answer (D) is correct. The pro forma cost of goods sold must be prepared before the pro forma income statement because it is a component of the income statement. Also, the income statement must be prepared before the pro forma balance sheet because net income is a necessary part of preparing the stockholders’ equity section of the balance sheet. In turn, the income statement and the balance sheet are necessary for estimating cash flows. If the statement of cash flows is prepared using the indirect method, balance sheet data, e.g., the changes in accounts receivable, inventory, and accounts payable, must be available to determine the adjustments needed to reconcile net income to net cash flow.

- 30. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Question: 62 Which one of the following may be considered an independent item in the preparation of the master budget? A. Ending inventory budget. B. Capital investment budget. Answer (B) is correct. The capital investment budget may be prepared more than a year in advance, unlike the other elements of the master budget. Because of the long-term commitments that must be made for some types of capital investments, planning must be done far in advance and is based on needs in future years as opposed to the current year’s needs. C. Pro forma income statement. D. Pro forma statement of financial position. Question: 63 A company is anticipating that a major supplier might experience a strike this year. Because of the nature of the product and emphasis on quality, extra production cannot be stored as finished goods inventory. When developing a contingency budget that would anticipate a direct materials buildup, the two most significant items that will be affected are A. Production volume and direct material. B. Sales and ending inventory. C. Production and cash flow. D. Direct materials and cash flow. Answer (D) is correct. The most significant items are those that will vary between the contingency budget and the regular budget. The company cannot increase its finished goods inventory, but it can increase its inventory of the direct materials provided by the supplier. Thus, the items most affected will be direct materials and cash. The cash budget will be affected because of the need to pay for direct materials prior to their usage.

- 31. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Question: 64 Many companies use comprehensive budgeting in planning for the next year’s activities. When both an operating budget and a financial budget are prepared, which one of the following is correct concerning the financial budget? Included in the Financial Budget Capital Pro-forma Cash Budget Balance Sheet Budget A. YesNoYes B. NoYesNo C. YesYesYes Answer (C) is correct. In the financial budget, the emphasis is on obtaining the funds needed to purchase operating assets. It contains the capital budget, projected cash disbursement schedule, projected cash collection schedule, cash budget, pro forma balance sheet, and pro forma statement of cash flows. D. NoNoNo Question: 65 The starting point for creating a master budget for a proprietary secretarial school would be A. Estimating salaries of the instructors. B. Forecasting enrollment. Answer (B) is correct. The sales forecast drives all the other components of the operating budget. How much revenue the firm expects to bring in affects every other decision. C. Preparing a capital expenditure budget. D. Preparing the student recruiting budget. Question: 66 Which of the following is normally included in the financial budget of a firm? A. Direct materials budget. B. Selling expense budget.

- 32. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 C. Budgeted balance sheet. Answer (C) is correct. The financial budget normally includes the capital budget, the cash budget, the budgeted balance sheet, and the budgeted statement of cash flows. D. Sales budget. Question: 67 The financial budget process includes A. The cash budget. B. The capital budget. C. The budgeted statement of cash flows. D. All of the answers are correct. Answer (D) is correct. The financial budget normally includes the capital budget, the cash budget, the budgeted balance sheet, and the budgeted statement of cash flows. Question: 68 The foundation of a profit plan is the A. Capital budget. B. Sales forecast. Answer (B) is correct. The starting point for the annual budget is the sales forecast. All other aspects of the budget, including production, costs, and inventory levels, rely on projected sales figures. C. Cost and expense budget. D. Production plan. Question: 69 The operating budget process usually begins with the

- 33. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 A. Financial budget. B. Balance sheet. C. Income statement. D. Sales budget. Answer (D) is correct. The starting point for the annual budget is the sales forecast. All other aspects of the budget, including production, costs, and inventory levels, rely on projected sales figures. Question: 70 A company produces farm tractors. The details of its budgeted cost of goods manufactured schedule should come from which of the following schedules? A. Cost of goods sold plus or minus the change planned in finished goods. B. Direct materials used, direct labor, manufacturing overhead, and work-in-process. Answer (B) is correct. Cost of goods manufactured equals all manufacturing costs incurred during the period, plus beginning work-in-process inventory, minus ending work-in-process inventory. The cost of goods manufactured schedule therefore includes direct materials, direct labor, factory overhead, and changes in work-in-process inventories. C. Purchases, direct labor, manufacturing overhead, finished goods, and work-in- process. D. Purchases, raw material, work-in-process, and finished goods. Question: 71 In developing a comprehensive budget for a manufacturing company, which one of the following items should be done first? A. Development of a sales plan. Answer (A) is correct. The starting point for the annual budget is the sales forecast. All other aspects of the budget, including production, costs, and inventory levels, rely on projected sales figures.

- 34. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 B. Determination of manufacturing capacity. C. Development of the capital budget. D. Determination of the advertising budget. Question: 72 When budgeting, the items to be considered by a manufacturing firm in going from a sales quantity budget to a production budget would be the A. Expected change in the quantity of work-in-process inventories. B. Expected change in the quantity of finished goods and work-in-process inventories. Answer (B) is correct. Production quantities are not identical to sales because of changes in inventory levels. Both finished goods and work-in-process inventories may change during a period, thus necessitating an analysis of both inventory levels before the production budget can be set. C. Expected change in the quantity of finished goods and raw material inventories. D. Expected change in the availability of raw material without regard to inventory levels. Question: 73 Which one of the following schedules would be the last item to be prepared in the normal budget preparation process? A. Direct labor budget. B. Cash budget. Answer (B) is correct. The budget process begins with the sales budget, proceeds to the production and expense budgets, and eventually the cash budget. The cash budget cannot be prepared until the end of the process because all other budgets provide inputs to the cash budget. C. Cost of goods sold budget. D. Manufacturing overhead budget.

- 35. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Question: 74 After the goals of the company have been established and communicated, the next step in the planning process is development of the A. Production budget. B. Direct materials budget. C. Selling and administrative budget. D. Sales budget. Answer (D) is correct. The sales budget is the first step in the operating budget process because it is needed to prepare all of the other budgets. For example, the production budget cannot be prepared until the sales department has determined how many units are needed. Question: 75 The production budget process usually begins with the A. Direct labor budget. B. Direct materials budget. C. Manufacturing overhead budget. D. Sales budget. Answer (D) is correct. Neither a master budget nor a production budget can be prepared until after the sales budget has been completed. Once a firm knows its expected sales, production can be estimated. The production budget is based on assumptions appearing in the sales budget; thus, the sales budget is the first step in the preparation of a production budget. Question: 76 Individual budget schedules are prepared to develop an annual comprehensive or master budget. The budget schedule that would provide the necessary input data for the direct labor budget would be the A. Sales forecast. B. Raw materials purchases budget. C. Schedule of cash receipts and disbursements.

- 36. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 D. Production budget. Answer (D) is correct. Once the production budget has been completed, the next step is to prepare the direct labor, raw material, and overhead budgets. Thus, the production budget provides the data for the completion of the direct labor budget. Question: 77 Which one of the following items should be done first when developing a comprehensive budget for a manufacturing company? A. Determination of the advertising budget. B. Development of a sales budget. Answer (B) is correct. The sales budget is the first to be prepared because all other elements of a comprehensive budget depend on projected sales. For example, the production budget is based on an estimate of unit sales and desired inventory levels. Thus, sales volume affects purchasing levels, operating expenses, and cash flow. C. Development of the capital budget. D. Preparation of a pro forma income statement. Question: 78 There are various budgets within the master budget cycle. One of these budgets is the production budget. Which one of the following best describes the production budget? A. It summarizes all discretionary costs. B. It includes required direct labor hours. C. It includes required material purchases. D. It is calculated from the desired ending inventory and the sales forecast. Answer (D) is correct. A production budget is based on sales forecasts, in units, with adjustments for beginning and ending inventories. It is used to plan when items will be produced. After the production budget has been completed, it is used to prepare materials purchases, direct labor, and factory overhead budgets.

- 37. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Question: 79 The budget that is usually the most difficult to forecast is the A. Production budget. B. Expense budget. C. Sales budget. Answer (C) is correct. Following the preparation of the sales budget, all other budgets are prepared based on the assumptions used in the sales budget. For this reason, the sales budget is the most difficult to prepare because there are no internal figures to use as a guide. Sales are based on the desires of consumers and the current business climate. D. Manufacturing overhead budget. Question: 80 When sales volume is seasonal in nature, certain items in the budget must be coordinated. The three mostsignificant items to coordinate in budgeting seasonal sales volume are A. Direct labor hours, work-in-process inventory, and sales volume. B. Production volume, finished goods inventory, and sales volume. Answer (B) is correct. The most important items that need to be coordinated in a seasonal business are sales volume and production. The sales budget is the basis for other budgets. The sales projection determines how much needs to be purchased and produced. In turn, projected sales and production (or purchases) must be coordinated with existing quantities on hand (inventory) and with amounts to be held in the future. If a manufacturer faces sharp variations in demand, this coordination becomes especially crucial. C. Raw material inventory, direct labor hours, and manufacturing overhead costs. D. Raw material inventory, work-in-process inventory, and production volume. Question: 81 A company uses a comprehensive budgeting system in planning its annual operations. Which of the following best describes the information needed to determine the budgeted cost of circuit boards to be purchased for use in building its laptop computer? Assume one circuit board is used in each laptop.

- 38. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 A. Begin with budgeted laptop sales in units, add the desired ending inventory of circuit boards, deduct the expected beginning inventory of circuit boards, and multiply the resulting amount by the budgeted purchase cost per circuit board. B. Begin with budgeted laptop sales in units, deduct the desired ending inventory of circuit boards, add the expected beginning inventory of circuit boards, and multiply the resulting amount by the purchase cost per circuit board. C. Begin with budgeted laptop production in units, deduct the desired ending inventory of circuit boards, add the expected beginning inventory of circuit boards, and multiply the resulting amount by the purchase cost per circuit board. D. Begin with budgeted laptop production in units, add the desired ending inventory of circuit boards, deduct the expected beginning inventory of circuit boards, and multiply the resulting amount by the budgeted purchase cost per circuit board. Answer (D) is correct. Since each laptop requires exactly one circuit board, the beginning figure of the calculation equals the number of finished products to be produced: Units needed for production X,XXX Add: desired ending inventory XXX Less: beginning inventory (XXX) Raw materials to be purchased X,XXX Times: per-unit purchase price × $ X.XX Total raw materials cost $X,XXX Question: 82 Which one of the combinations listed correctly depicts the chronological order of preparation for the following budgets? I. Cost of goods sold budget II. Production budget III. Purchases budget IV. Administrative budget V. A. I, II, III, IV. B. III, II, IV, I.

- 39. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 C. IV, II, III, I. D. II, III, I, IV. Answer (D) is correct. The components of the operating budget are prepared in the following order: sales budget, production budget, direct materials budget, direct labor budget, manufacturing overhead budget, ending finished goods inventory budget, cost of goods sold budget, and nonmanufacturing budget. This last budget consists of the research and development budget, design budget, marketing budget, distribution budget, customer service budget, and administrative budget. Question: 83 Which one of the following best describes the order in which budgets should be prepared when developing the annual master operating budget? A. Production budget, direct material budget, revenue budget. B. Production budget, revenue budget, direct material budget. C. Revenue budget, production budget, direct material budget. Answer (C) is correct. The components of the operating budget are prepared in the following order: sales (revenue) budget, production budget, direct materials budget, direct labor budget, manufacturing overhead budget, ending finished goods inventory budget, cost of goods sold budget, and nonmanufacturing budget. D. Revenue budget, direct material budget, production budget. Question: 84 When preparing the series of annual operating budgets, management usually starts the process with the A. Cash budget. B. Balance sheet. C. Capital budget. D. Sales budget. Answer (D) is correct. The budgeting process begins with the sales budget and then proceeds to the

- 40. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 production budget. Once the production budget is complete, then the raw materials, direct labor, overhead, and cash budgets can be prepared. The capital budget is prepared outside the operating budget process, followed by a cash budget. Question: 85 Which of the following is normally included in the operating budget? A. Capital budget. B. Cash budget. C. Selling expense budget. Answer (C) is correct. An operating budget normally includes sales, production, selling and administrative, and budgeted income statement components. D. Budgeted balance sheet. Question: 86 Which budget is prepared after the creation of the cash budget? A. Sales budget. B. Capital expenditures budget. C. Production budget. D. Budgeted balance sheet. Answer (D) is correct. Budgeted financial statements, more specifically the budgeted balance sheet, are prepared after the creation of the cash budget. Question: 87 Which one of the following would cause a company’s production budget to decrease? A. An increase in direct labor costs per unit. B. A decrease in units produced per direct labor hour. C. A decrease in required ending inventory.

- 41. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Answer (C) is correct. Production budgets are based on sales in units plus or minus desired inventory buildup or reduction. Products to be manufactured = desired ending inventory + budgeted sales units – beginning inventory. Therefore, a decrease in required ending inventory will cause the production budget to decrease. D. An increase in beginning direct labor inventory. Question: 88 Which one of following budgets is regarded as the foundation of the master budget? A. Production. B. Sales. Answer (B) is correct. The sales budget is the first budget prepared because sales volume affects production and purchasing levels, operating expenses, and cash flows. C. Operating. D. Cash. Question: 89 The budget that describes the long-term position and objectives of an entity within its environment is the A. Capital budget. B. Operating budget. C. Cash management budget. D. Strategic budget. Answer (D) is correct. Strategic budgeting is a form of long-range planning based on identifying and specifying organizational objectives. The strengths and weaknesses of the organization are evaluated and risk levels are assessed. The influences of environmental factors are forecast to derive the best strategy for reaching the organization’s objectives.

- 42. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Question: 90 Which one of the following is not an advantage of activity-based budgeting? A. Better identification of resource needs. B. Linking of costs to outputs. C. Identification of budgetary slack. D. Reduction of planning uncertainty. Answer (D) is correct. Although activity-based budgeting provides greater detail than other budgeting methods, it does not necessarily reduce planning uncertainty. Question: 91 An advantage of incremental budgeting when compared with zero-based budgeting is that incremental budgeting A. Encourages adopting new projects quickly. B. Accepts the existing base as being satisfactory. Answer (B) is correct. Incremental budgeting simply adjusts the current year’s budget to allow for changes planned for the coming year; a manager is not asked to justify the base portion of the budget. ZBB, however, requires a manager to justify the entire budget for each year. Incremental budgeting offers to managers the advantage of requiring less managerial effort to justify changes in the budget. C. Eliminates functions and duties that have outlived their usefulness. D. Eliminates the need to review all functions periodically to obtain optimum use of resources. Question: 92 The major appeal of zero-based budgeting is that it A. Solves the problem of measuring program effectiveness. B. Relates performance to resource inputs by an integrated planning and resource- allocation process. C. Reduces significantly the time required to review a budget.

- 43. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 D. Deals with some of the problems of the incremental approach to budgeting. Answer (D) is correct. The traditional approach to budgeting is to merely adjust last year’s figures by a given percentage or increment. Zero-based budgeting divides programs into packages of goals, activities, and required resources. The cost of each package is then calculated afresh, without regard to previous performance. Question: 93 A systemized approach known as zero-based budgeting (ZBB) A. Presents the plan for only one level of activity and does not adjust to changes in the level of activity. B. Presents a statement of expectations for a period of time but does not present a firm commitment. C. Divides the activities of individual responsibility centers into a series of packages that are prioritized. Answer (C) is correct. Zero-based budgeting is a planning process in which each manager must justify a department’s entire budget every year (or period). Different levels of service (work effort) are evaluated for each activity, measures of work and performance are established, and activities are ranked (prioritized) according to their importance to the entity. For each budgetary unit, decision packages are prepared that describe various levels of service that may be provided, including at least one level lower than the current one. D. Classifies budget requests by activity and estimates the benefits arising from each activity. Question: 94 A continuous profit plan A. Is a plan that is revised monthly or quarterly. Answer (A) is correct. A continuous, or rolling, budget (profit plan) is one that is revised on a regular or continuous basis. Typically, a company that uses continuous budgeting extends the budget for another month or quarter in accordance with new data as the current month or quarter ends. For example, if the budget is for 12 months, a budget for the next year will always be available at the end of each interim period. Continuous

- 44. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 budgeting encourages a longer-term perspective regardless of how little time remains in the company’s current fiscal year. B. Is an annual plan that is part of a 5-year plan. C. Is a plan devised by a full-time planning staff. D. Works best for a company that can reliably forecast events a year or more into the future. Question: 95 A continuous (rolling) budget A. Presents the plan for only one level of activity and does not adjust to changes in the level of activity. B. Presents the plan for a range of activity so the plan can be adjusted for changes in activity. C. Is a plan that is revised monthly or quarterly, dropping one period and adding another. Answer (C) is correct. A continuous, or rolling, budget is one that is revised monthly or quarterly by dropping one period and adding a new one. Thus, a company desiring a 1-year budget cycle will always have a budget for the next 12 months, regardless of the time of year. D. Is one of the budgets that is part of a long-range strategic plan, unchanged unless the strategy of the company changes. Question: 96 Zero-based budgeting forces managers to A. Estimate a product’s revenues and expenses over its expected life cycle. B. Prepare a budget based on historical costs. C. Formulate a budget by objective rather than function. D. Justify all expenditures at the beginning of every budget period. Answer (D) is correct. Zero-based budgeting is a planning process in which each manager must justify

- 45. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 his/her department’s full budget for each period. The purpose is to encourage periodic reexamination of all costs in the hope that some can be reduced or eliminated. Question: 97 A company uses a type of budgeting that focuses on the cost of the processes required to produce and sell products and services. This type of budgeting is known as A. Process budgeting. B. Activity-based budgeting. Answer (B) is correct. Activity-based budgeting applies activity-based costing principles to budgeting. Its greatest effect is on the application of indirect costs. A traditional budgeting system involves lumping all indirect costs into a single pool and allocating them to products based on a (usually arbitrary) driver such as volume or machine hours. C. Master activity budgeting. D. Controllability budgeting. Question: 98 The goal is to reduce wastefulness and develop a tight, efficient budget. The management team knows that this will take time, so they plan to allow more time and additional resources in the budget process. For the next budget year, a complete review of all activities and functions will be undertaken. The controller has elected to use this year’s master budget as the starting point for next year’s budget process. Considering management’s goals, did the controller make the most appropriate choice of budgeting methodologies? A. Yes, he should take the current budget and make incremental changes to reduce waste. B. No, he should implement a continuous budget to provide more current information. C. No, he should select zero-based budgeting to allow no costs unless they are justified. Answer (C) is correct. Under zero-based budgeting, managers must build the budget every year from a base of zero. All expenditures must be justified regardless of variance from previous years. The objective is to encourage periodic reexamination of all costs in the hope that some can be reduced or eliminated. D. No, he should select activity-based budgeting to focus on the historical cost patterns.

- 46. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 Question: 99 A firm has found that its annual budgets are quickly outdated once actual data is recorded. Sometimes actual preparations have already begun for the period being budgeted by the time the annual budget is finished, which leaves no time to react to changing factors. The firm wants the budget to be as up-to- date as possible, and management is willing to revise budgets as needed. Which budgeting solution would be mostappropriate for the firm? A. Flexible budgeting. B. Activity-based budgeting. C. Zero-based budgeting. D. Continuous budgeting. Answer (D) is correct. A continuous (rolling) budget is one that is revised monthly or quarterly by dropping one period and adding a new one. Thus, a company desiring a budget that is always as up-to-date as possible will benefit from using this type of budget. Question: 100 The type of budget that is available on a continuous basis for a specified future period -- by adding a month, quarter, or year in the future as the month, quarter, or year just ended is dropped -- is called a(n) A. Rolling budget. Answer (A) is correct. A continuous (rolling) budget is one that is revised on a regular (continuous) basis. Typically, a company continuously extends such a budget for an additional month or quarter in accordance with new data as the current month or quarter ends. For example, if the budget cycle is 1 year, a budget for the next 12 months will be available continuously as each month ends. The principal advantage of a rolling budget is that it requires managers always to be thinking ahead. B. Kaizen budget. C. Activity-based budget. D. Flexible budget. Question: 101 The use of the master budget throughout the year as a constant comparison with actual results signifies that the master budget is also a

- 47. GLEIM ONLINE 2017 QUESTIONS WITH ANSWERS – UNIT 9 A. Flexible budget. B. Capital budget. C. Zero-base budget. D. Static budget. Answer (D) is correct. If an unchanged master budget is used continuously throughout the year for comparison with actual results, it must be a static budget, that is, one prepared for just one level of activity. Question: 102 Which one of the following budgeting methodologies would be most appropriate for a firm facing a significant level of uncertainty in unit sales volumes for next year? A. Top-down budgeting. B. Life-cycle budgeting. C. Static budgeting. D. Flexible budgeting. Answer (D) is correct. With flexible budgeting, the firm prepares a series of budgets for many levels of sales and production. At the end of the period, management can compare actual sales performance with the appropriate budgeted level in the flexible budget. Question: 103 A budgeting approach that requires a manager to justify the entire budget for each budget period is known as A. Performance budgeting. B. Program budgeting. C. Zero-based budgeting. Answer (C) is correct. Zero-based budgeting (ZBB) is a budget and planning process in which each manager must justify his/her department’s entire budget every budget cycle. ZBB