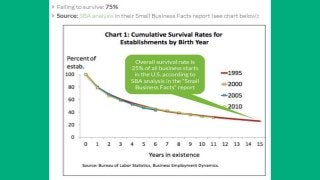

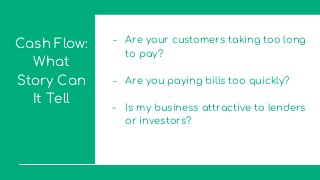

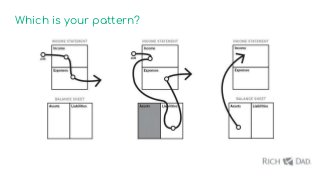

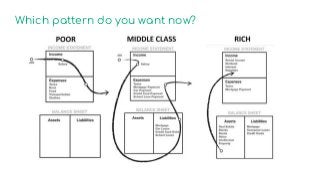

Most of us are happy in our small businesses but 3/4 of us are likely to fail and the main reason is due to cash flow problems.

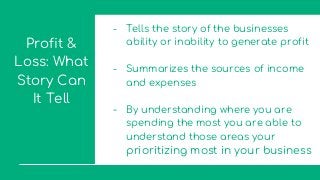

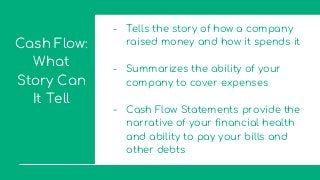

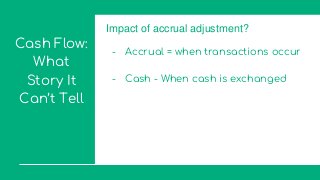

Knowing how to tell the right story from your business numbers can help you tell a better story. With a happier ending.

Want help to understand your numbers and tell a better story? Visit www.beanninjas.com