Financial Management Question Bank Chapter Summary

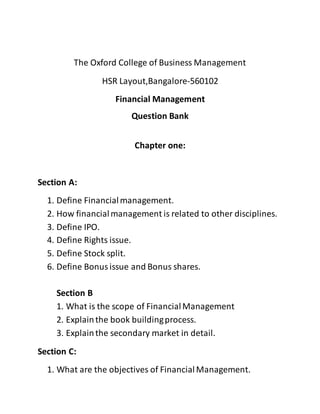

- 1. The Oxford College of Business Management HSR Layout,Bangalore-560102 Financial Management Question Bank Chapter one: Section A: 1. Define Financialmanagement. 2. How financialmanagement is related to other disciplines. 3. Define IPO. 4. Define Rights issue. 5. Define Stock split. 6. Define Bonusissue and Bonus shares. Section B 1. What is the scope of FinancialManagement 2. Explainthe book buildingprocess. 3. Explainthe secondary market in detail. Section C: 1. What are the objectives of FinancialManagement.

- 2. 2. Explainthe difference between Primary market and Secondary market. 3. Explainthe Difference between Capitalmarket and money market. Chapter two: Section A: 1. Define Risk. 2. Define SML. 3. Define CML. 4. What are the assumptions of CAPM. 5. Define Discounting. 6. Define Compounding. 7. Define Time value of money. 8. Define Systematic risk. 9. Define Unsystematic risk. 10. Define Beta. 11. ExplainBonds . 12. ExplainDebentures. 13. ExplainPreference shares. 14. ExplainEquity shares. Section B 1. Define risk and explain the types of risk.

- 3. 2. Explainthe valuationod Bonds. How to know whether the bondsare overvaluedor undervalued. 3. A 5% Rs 1000 face value bonds are sold at a premium of 10%.It has a maturity of 5 years. If the minimum expected rate of return is 12%, calculate the present value of the bond. 4. A 5% Rs 100 face value bondsare sold at a discount of 10%.It has a maturity of 8 years. If the minimum expected rate of return is 7%, calculate the present value of the bond. Is the bond overvaluedor undervalued. 5. A 8.5% Rs 1000 face valuebonds are sold at a discount of 5%.It has a maturity of 7 years. If the minimum expected rate of return is 9%, Calculatethe present valueof the bond 6. A 5% Rs 1000 face value preference shares are sold at a premium of 10%.It has a maturity of 5 years. If the minimum expected rate of return is 12%, Calculatethe present value of the preference shares.

- 4. 7. A 4.5% Rs 100 face value bonds hasa maturity of 5 years. If the minimum expected rate of return is 12%, Calculate the present value of the bond. 8. The ABC corporationsexpected return and growth s said to grow at a rate of 10% indefinitely.The last year dividend is Rs 2/-. If the expected rate of return is14% .Calculatethe present value of equity shares. 9. Calculatebeta from the following. Return of market index(%) return of security ‘x’(%) 10 12 12 23 -10 4 8 6 7 2 13 12 4 6 -7 3 1 -6

- 5. 7 8 10. Explain CAPM. Its assumptions. Its Implications. Define SML. Section C 1. Why Investing in preference shares is better than equity shares. Explain. 2. The evergreen investment company manages a stock fund consisting of four stocks with the following market values and beta Stock Market value(Rs) Beta Bell 2,00,000 1.16 Sell 1,00,000 1.20 Grill 1,50,000 0.80 Shrill 50,000 0.50 If the risk free rate of interest is 19% and the market return is 15% What is portfolio’sexpected return.

- 6. Chapter three: Section A: 1. Define CapitalBudgeting. 2. ExplainCapitalrationing. 3. ExplainIRR. 4. ExplainNPV and its advantages. 5. ExplainBenefit –cost ratio. 6. What do you mean by capitalrationing? 7. Explainthe importance of Debt –Equityratio. 8. Explainthe relevance of the financing decision? 9. What do you mean by cut- off rate? 10. What do you mean by mutuallyexclusive projects? Section B: 1. Explainthe different techniques used in capitalbudgeting methods. Explainits advantagesand disadvantages. Section C 1. Explainthe various risk management techniquesin capital budgeting. 2. Explainthe Scenario methodsand Sensitivityanalysisin Capital Budgeting. 3. XYZ company has the following cash flows as follows Year earnings before depreciationand tax

- 7. 1 20,000 2 40,000 3 60,000 4 70,000 5 80,000 The initialinvestment is Rs 50,000.Tax is 40%. Depreciationis on straight line basis. Calculate 1. Pay back period 2. NPV at 12% discount rate 3. PI at 10% discount rate 4. XYZ company has the following cash flows as follows Year earnings before depreciationand tax 1 1,20,000 2 1,40,000 3 1, 60,000 4 1,80,000 5 1,90,000 The initialinvestment is Rs 1,00,000.Tax is 40%. Depreciation is on straight line basis. Calculate

- 8. 5 Pay back period 6 NPV at 14% discount rate 7 PI at 12% discount rate 5. ABC Companyis excepting a fine rate of EBIT. The firm is under tax bracket of 35%. Selling price per unit – Rs 700 Variablecost per unit Rs 200 Fixed cost - Rs 90,000 Total number of units are- 800 ABC Company is having total capital of Rs 10, 00,000. 50% of the capital is of equity .Remaining capitalis of debt and 10 % preference capitalequally. The company is having debentures at 6% and they are paying regular interest. Followingare variables Variables Situation 1 Situation 2 Situation 3 Variable cost 100 200 300 Tax Rate 20% 35% 50% Interest rate 3% 6% 12% Selling price 800 700 500

- 9. ABC company would like to find the sensitivity analysis(Show any two variables that are sensitive to cash flows) Show the calculationof cost of capitaland calculateNPV in all cases. Chapter four: Section A 1. ExplainCost of Capital. 2. Explainexplicit cost of capital. 3. Explainimplicit cost of capital. 4. Explaincost of debt. 5. Explaincost of preference shares. 6. Explaincost of equity. 7. ExplainWACC. Section B:

- 10. 1. A 7% Rs 1000 face value bonds are sold at a premium of 10%.It hasa maturity of 5 years. The cost of issuing the bondsis 5%. Calculatethe cost of debt. 2. A 11% Rs 1000 face valuepreference shares are sold at a discount of 5%.It has a maturity of 7 years. The cost of issuing the preference shares is 5%. Calculatethe cost of preference shares. 3. A 13% Rs 100 face value bonds are sold at a premium of 20%.It has a maturity of 10 years. The cost of issuing the bondsis 7%. Calculatethe cost of debt. 4. A 12% Rs 1000 face valuepreference shares are sold at a premium of 12%.It has a maturity of 4 years. The cost of issuing the preference shares is 10%. Calculatethe cost of preference shares. Section C:

- 11. 1. Based on the followinginformation calculatethe WACC. a. A 7.5% Rs 1000 face valuebonds are sold at a premium of 10%.It has a maturity of 8 years. The cost of issuing the bondsis 5%. b. A 13% Rs 100 face value preference shares are sold at a discount of 5%.It has a maturity of 7 years. The cost of issuing the preference shares is 5%. c. The risk free rate is 7%. The market risk premium is 10% and equity beta is 1.2 Sources Amount Debt 10,00,000 Preference shares 15,00,000 Equity Shares 10,00,000(face value is Rs 10) 2. As a financialanalystof a large electronicscompany, you are required to determine the weighted average cost of capitalof the company using book value weights and market value weights Debentures (Rs 100 per debenture) Rs 8,00,000 Preference shares (Rs 100 per share) Rs 2,00,000 Equity Shares (Rs 10 per share) Rs 10,00,000

- 12. All these securities are traded in the capital markets. Recent0 prices are Debentures, Rs 110 per debenture, Preference shares,Rs 120 per share and Equity Shares,Rs 22 per share Anticipatedexternal financingopportunitiesare: (i) Rs 100 per debenture redeemable at par ,10 year maturity,11 percent coupon rate,4% flotation cost, Sale price Rs 100/- (ii) Rs 100 preference shares redeemable at par,10 year maturity,12% dividendrate,5% flotation cost, sales price Rs100/- (iii) Equity shares: Rs 2/-per share flotationcost, sale price Rs 22/- In additionthe dividendexpected on the equity share at the end of the year is Rs 2/per share, the anticipated growth rate is 7%,The corporate tax rate is 35%. Chapter five:

- 13. Section A: 1. ExplainOptimum capitalstructure. 2. Explain the various assumptions in capital structure theories. 3. Explain why debt is more important than equity in the capitalstructure . Section B: 1. ExplainNet Income Approach. 2. ExplainNet Operating Income approach. 3. ExplainWhy Net operating Income approachis not ideal. Section C: 1. Explain Modigliani and Miller approach under Capital Structure theories. 2. ExplainNet income and Net operating Income approach. Chapter six: Section A: 1. Explainleverage. 2. ExplainFinancialLeverage. 3. ExplainOperating Leverage.

- 14. 4. Explainindifference point. 5. Explainthe Break-even point in the Leverage concept,. 6. Explainthe EBIT-EPS break even point. Section B: 1. Explainthe Financial,operatingandCombined leverage. 2. Consider the following: Sales(1,00,000 units at Rs 8/-) Variablecost Rs 4/- Fixed cost 2,80,000 CalculateEBIT,Operating Leverage 3. Consider the following: Sales(15,00,000 units at Rs 6/-) Variablecost Rs 3/- Fixed cost 4,00,000 Interest 56,250 Taxes: 50% CalculateEBIT,Operating Leverage,FinancialLeverage.

- 15. 4. What are the implications of operating,financial and combined leverage for risk. Section C: 1. From the followinginformation calculatethe market price of share as per Walter model. Earnings 5,00,000 Dividends 2,00,000 No. of O/s shares 1,00,000 P/E ratio 8 r=0.15 Chapter Seven: Section A: 1. Explainthe dividendpolicy of the firms. Section B: 1. What are the various factors affecting the dividend policy of the firms. 2. ExplainGordon model.

- 16. 3. Explain Walter model with reference to relevance of dividendmodel. Section C: 1. Explain the Modigliani –Miller approach of Irrelevance model. 2. Explain different dividend policy adopted by various firms in India. 3. Explain the relevance and irrelevance model of dividend policies. Chapter eight: Section A: 1. ExplainCash cycle. 2. ExplainOperating Cycle. 3. ExplainNet Working Capital. 4. ExplainGross Working capital. 5. Explainthe objectives of ReceivableManagement. 6. Define the objectives of Inventory management. 7. Explainthe motives of holdingcash.

- 17. 8. What are the objectives of Cash Management 9. Define Loan Syndication. 10. Explaincredit policy. 11. ExplainNet discount 10/30 12. Explaincredit terms Section B: 1. Explain the factors affecting the working capital management. 2. Explainstrict credit policy and liberal credit policy. 3. How to determine the working capital requirements of the firm. Work out in detail.