Hhtfa8e ch03 sm

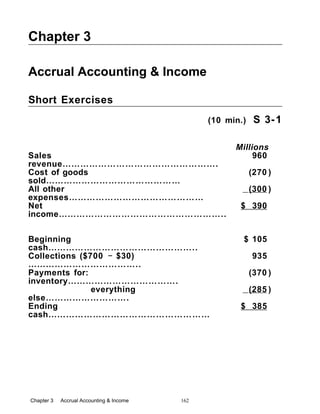

- 1. Chapter 3 Accrual Accounting & Income Short Exercises (10 min.) S 3-1 Millions Sales revenue……………………………………………. 960 Cost of goods sold……………………………………… (270 ) All other expenses……………………………………… (300 ) Net income……………………………………………….. $ 390 Beginning cash………………………………………….. $ 105 Collections ($700 $30)− ……………………………….. 935 Payments for: inventory………………………………. (370 ) everything else………………………. (285 ) Ending cash……………………………………………… $ 385 Chapter 3 Accrual Accounting & Income 162

- 2. (10 min.) S 3-2 Statement Reports (Amounts in millions) Income statement Interest expense………………. $1.8 Balance sheet Notes payable ($3.9 + $2.3 $2.0)− …………. $4.2 Interest payable……………….. 0.1 (10 min.) S 3-3 At the end of each accounting period, the business reports its performance through the preparation of financial statements. In order to be useful to the various users of financial statements they must be up-to-date. Accounts such as cash, Equipment, Accounts Payable, Common Stock and Dividends are up-to date and require no adjustment at the end of the accounting period. Accounts such as Accounts Receivable, Supplies, Salary Expense and Salaries Payable may not be up to date as of the last day of the accounting period. Why? Because certain transactions that took place in the month may not have been recorded. The accrued salaries, which are owed to the employees yet have not been paid, are an expense related to the current period. The salaries that are owed to the employees but are unpaid also represent a liability or debt that is owed by the business. The business must make an adjusting entry to record the accrued salary owed as both an increase in Salary Expense and an increase in Salaries Payable. If the business does not make this adjustment the expenses will be understated and net income will be overstated. In addition, liabilities will be understated. Chapter 3 Accrual Accounting & Income 163

- 3. (10 min.) S 3-4 The large auto manufacturer should record sales revenue when the revenue is earned by delivering automobiles to Acme or Harris. The large auto manufacturer should not record any revenue prior to delivery of the vehicles because the large auto manufacturer hasn’t earned the revenue yet. The revenue principle governs this decision. When the large auto manufacturer records the revenue from the sale, at that time —not before or after — the large auto manufacturer should also record cost of goods sold, the expense. The matching principle tells when to record expenses. Chapter 3 Accrual Accounting & Income 164

- 4. (10 min.) S 3-5 Depreciation is the periodic allocation of the cost of a tangible long-lived asset, less its estimated residual value, over its estimated useful life. All long-lived or plant assets, except for land decline in usefulness during their life and this decline is an expense. Accountants must allocate the cost of each plant asset, except for land, over the asset’s useful life. Depreciation is the process of allocating the cost of a plant asset to expense. Depreciation also decreases the book value of the asset to reflect its usage. (10 min.) S 3-6 a. The Matching Principle b. The Time Period Concept c. The Revenue Principle d. The Revenue Principle e. The Matching Principle Chapter 3 Accrual Accounting & Income 165

- 5. (10 min.) S 3-7 a. Mar. 31 Rent Expense ($4,800 × 1/6) …….. 800 Prepaid Rent…………………….. 800 To record rent expense. Prepaid Rent Rent Expense Mar. 1 4,800 Mar. 31 800 Mar. 31 800 Bal. 4,000 Bal. 800 b. Dec. 31 Supplies Expense ($900 − $700)…. 200 Supplies…………………………… . 200 To record supplies expense. Supplies Supplies Expense Dec. 1 900 Mar. 31 200 Marc. 31 200 Bal. 700 Bal. 200 Chapter 3 Accrual Accounting & Income 166

- 6. (10 min.) S 3-8 Req. 1 (a ) Jan. 1 Computer Equipment……………. ….. 80,00 0 Cash…………………………………. . 80,00 0 Purchased computer equipment. (b ) Dec. 31 Depreciation Expense − Computer Equipment ($80,000 / 4)… 20,00 0 Accumulated Depreciation − Computer Equipment……………... 20,00 0 Req. 2 Computer Equipment Accumulated Depreciatio n − Computer Equipment Depreciation Expense − Computer Equipment Jan. 80,00 0 Dec. 31 20,00 0 Dec. 31 20,00 0 Bal. 80,00 0 Bal. 20,00 0 Bal. 20,00 0 Req. 3 Computer equipment…………………………………. $80,000 Less Accumulated depreciation……………………. (20,000 ) Book $60,000 Chapter 3 Accrual Accounting & Income 167

- 7. value……………………………………………… Chapter 3 Accrual Accounting & Income 168

- 8. (10 min.) S 3-9 (Amounts in millions) Income statement: 2010 Salary expense ($38.3 + $2.8) ….. $41.1 Balance sheet: 2010 Salary payable………………... $ 2.8 Chapter 3 Accrual Accounting & Income 169

- 9. (10 min.) S 3-10 Req. 1 Oct. 31 Interest Expense………………………………. 500 Interest Payable…………………………….. 500 To accrue interest expense for October. Nov. 30 Interest Expense………………………………. 500 Interest Payable…………………………….. 500 To accrue interest expense for November. Dec. 31 Interest Expense………………………………. 500 Interest Payable…………………………….. 500 To accrue interest expense for December. Req. 2 Interest Payable Oct. 31 500 Nov. 30 500 Dec. 31 500 Bal. 1,500 Chapter 3 Accrual Accounting & Income 170

- 10. Req. 3 Dec. 31 Interest Payable……………………………... 1,50 0 Cash……………………………………… … 1,50 0 To pay interest. Chapter 3 Accrual Accounting & Income 171

- 11. (10 min.) S 3-11 Req. 1 Oct. 31 Interest Receivable………………………….. 500 Interest Revenue………………………….. 500 To accrue interest revenue for October. Nov. 30 Interest Receivable………………………….. 500 Interest Revenue……... ………………….. 500 To accrue interest revenue for November. Dec. 31 Interest Receivable………………………….. 500 Interest Revenue……... ……………….….. 500 To accrue interest revenue for December. Req. 2 Interest Receivable Oct. 31 500 Nov. 30 500 Dec. 31 500 Bal. 1,500 Req. 3 Dec. Cash……………………………………… 1,50 Chapter 3 Accrual Accounting & Income 172

- 12. 31 …… 0 Interest Receivable……………………… 1,50 0 To collect interest. Chapter 3 Accrual Accounting & Income 173

- 13. (5- 10 min.) S 3-12 Unearned revenues are liabilities because The Globe and Trail has received cash from subscribers in advance of providing them with newspapers. Receiving the cash in advance creates an obligation (a liability) for The Globe and Trail. As The Globe and Trail delivers newspapers to subscribers, The Globe and Trail earns the revenue, and the dollar amount of the unearned revenue then goes into the revenue account. a. Cash…………………………………… …… 50,000 Unearned Subscription Revenue…... 50,000 Received cash for revenue in advance. b. Unearned Subscription Revenue................ 50,000 Subscription Revenue……………………. 50,000 To record the earning of subscription revenue that was collected in advance. Chapter 3 Accrual Accounting & Income 174

- 14. (5- 10 min.) S 3-13 Prepaid Rent at December 31: a. Unadjusted amount…………………………. $24,00 0 b. Adjusted amount ($24,000 $8,000)− ………. 16,000 Rent Expense at December 31: c. Unadjusted amount…………………………. $ 0 d. Adjusted amount ($24,000 / 3) ………………. 8,000 (10 min.) S 3-14 a. Accounts Receivable……………………. 60,000 Service Revenue………………………. 60,000 Cash…………………………………… …… 45,000 Accounts Receivable………………… 45,000 b. Cash…………………………………… …… 7,500 Unearned Service Revenue…………. 7,500 Unearned Service Revenue……………. 3,500 Service Revenue………………………. 3,500 Chapter 3 Accrual Accounting & Income 175

- 15. (15- 30 min.) S 3-15 Vulture Sporting Goods Company Income Statement Year Ended March 31, 2010 Thousands Net revenues……………………………. $174,000 Cost of goods sold……………………. 136,800 All other expenses…………………….. 26,000 Net income……………………………… $ 11,200 Vulture Sporting Goods Company Statement of Retained Earnings Year Ended March 31, 2010 Thousand s Retained earnings, March 31, 2009…... $2,000 Add: Net income……………………….. 11,200 Retained earnings, March 31, 2010.….. $13,200 Chapter 3 Accrual Accounting & Income 176

- 16. (continued) S 3-15 Vulture Sporting Goods Company Balance Sheet March 31, 2010 Thousands ASSETS Current: Cash……………………………………… $ 1,300 Accounts receivable………………….. 28,200 Inventories……………………………… 37,000 Other current assets………………….. 5,200 Total current assets……………….. 71,700 Property and equipment, net…………… 6,000 Other assets………………………………. 28,0 00 Total assets…………………………………... $105,7 00 LIABILITIES Total current liabilities………………….. $53,00 0 Long-term liabilities…………………. ….. 12,5 00 Total liabilities……………………………….. 65,500 STOCKHOLDERS’ EQUITY Common stock…………………………… 27,000 Retained earnings……………………….. 13,2 00 Total stockholders’ equity…………. …....... 40,2 00 Total liabilities and stockholders’ equity.. $105,7 00 Chapter 3 Accrual Accounting & Income 177

- 17. Chapter 3 Accrual Accounting & Income 178

- 18. (5- 10 min.) S 3-16 CLOSING ENTRIES Thousands Mar. 31 Net Revenues………………………… 174,00 0 Retained Earnings………………... 174,00 0 31 Retained Earnings…………………… 162,80 0 Cost of Goods Sold………………. 136,80 0 All Other Expenses……………….. 26,000 Retained Earnings Mar. 31, 2010 Expenses 162,80 0 Mar. 31, 2009 Bal. 2,000 Mar. 31, 2010 Revenues 174,00 0 Mar. 31, 2010 Bal. 13,200 Retained Earnings’ ending balance agrees with the amount reported on the statement of retained earnings and the balance sheet (in S 3-15). Chapter 3 Accrual Accounting & Income 179

- 19. (5 min.) S 3-17 Req. 1 (Dollars in thousands) Current ratio = Total current assets = $71,70 0 = 1.3 5Total current liabilities $53,00 0 Req. 2 Debt ratio = Total liabilities = $65,50 0 = 0.6 2Total assets $105,7 00 These ratio values are neither strong nor weak. They are middle-of-the-road values. Chapter 3 Accrual Accounting & Income 180

- 20. (10 min.) S 3-18 1 . Earned revenue of $8,000 on account: a . Current ratio = $71,700 + $8,000 = 1.50 $53,000 b . Debit ratio = $65,500 = 0.58$105,700 + $8,000 2 . Paid accounts payable of $8,000: a . Current ratio = $71,700 − $8,000 = 1.42 $53,000 − $8,000 b . Debit ratio = $65,500 − $8,000 = 0.59 $105,700 − $8,000 Chapter 3 Accrual Accounting & Income 181

- 21. Exercises Group A (5- 10 min.) E 3-19A Statement Reports 1. Income statement Sales revenue………… $4,10 0 Operating expenses… 1,400 Balance sheet Accounts receivable… $ 700 Accounts payable…… 1,300 2. Cash basis would report only the cash collections of $4,900 from customers and the payment of operating expenses ($1,400). Their balance sheet should have included neither accounts receivable nor accounts payable. (5- 10 min.) E 3-20A a. Cash Basis b. Accrual Basis Revenues……………… …... $590,000 $580,000 Expenses……………… …... 460,000 480,000 Net income………………… $130,000 $ 100,000 The accrual basis measures net income better because its information on revenues and expenses is more complete than the information provided by the cash basis. Chapter 3 Accrual Accounting & Income 182

- 22. Chapter 3 Accrual Accounting & Income 183

- 23. (5- 10 min.) E 3-21A Million a. Revenue………………………………………… ……. $800 The revenue principle says to record revenue when it has been earned, regardless of when cash is collected. Therefore, report the amount of revenue earned, regardless of when the company collects cash. b. Total expense…………………………………….….. $590 The matching principle governs accounting for expenses. c. The income statement reports revenues and expenses. The statement of cash flows reports cash receipts and cash payments. Chapter 3 Accrual Accounting & Income 184

- 24. (15- 20 min.) E 3-22A Req. 1 Adjusting Entries DATE ACCOUNT TITLES DEBIT CREDIT a. Insurance Expense……………………………... 1,000 Prepaid Insurance ($500+$1,500− $1,000).. 1,000 b. Interest Receivable………………………... …… 1,100 Interest Revenue…………………………...... 1,100 c. Unearned Service Revenue ($1,200 − $400).. 800 Service Revenue…………………………… 800 d. Depreciation Expense…………………….. ….. 4,900 Accumulated Depreciation………………... 4,900 e. Salary Expense ($14,000 × 3/5) ……………… 8,400 Salary Payable……………………….….. ….. 8,400 f. Income Tax Expense ($22,000 × .25) ……..… 5,500 Income Tax Payable………………….. ……. 5,500 Chapter 3 Accrual Accounting & Income 185

- 25. (continued) E 3-22A Req. 2 Net income understated by omission of: Interest revenue…………………………….. $ 1,100 Service revenue……………………………... 800 Total understatement………………………. $ 1,900 Net income overstated by omission of: Insurance expense…………………………. $1,000 Depreciation expense……………………… 4,900 Salary expense……………………………… 8,400 Income tax expense………………………… 5,500 Total overstatement………………………… 19,800 Overall effect — net income overstated by.. $17,90 0 Chapter 3 Accrual Accounting & Income 186

- 26. (10- 15 min.) E 3-23A Missing amounts in italics. 1 2 3 4 Beginning Supplies $ 100 $600 $ 1,400 $ 900 Add: Payments for supplies during the year 1,300 600 800 700 Total amount to account for 1,400 1,200 2,200 1,600 Less: Ending Supplies (200 ) (200 ) (1,00 0) (300 ) Supplies Expense $ 1,200 $1,000 $ 1,200 $1,300 Journal entries: Situation 1: Supplies……………………… …… 1,300 Cash…………………………. …. 1,300 Situation 2: Supplies Expense……………….. 1,000 Supplies……………………….. . 1,000 Chapter 3 Accrual Accounting & Income 187

- 27. (10- 20 min.) E 3-24A Adjusting Entries DATE ACCOUNT TITLES DEBIT CREDIT a. Interest Expense……………………………… 9,500 Interest Payable……………………………. 9,500 b. Interest Receivable…………………………… 4,500 Interest Revenue……………………. …….. 4,500 c. Unearned Rent Revenue ($13,600 / 2 × 6/12) 3,400 Rent Revenue………………………………. 3,400 d. Salary Expense ($1,800 × 3) ……………….... 5,400 Salary Payable……………………………… 5,400 e. Supplies Expense…………………………….. 2,100 Supplies ($3,300 1,200)− ……………….…. 2,100 f. Depreciation Expense ($100,000 / 5) ………... 20,00 0 Accumulated Depreciation………………. 20,000 Book value = $80,000 ($100,000 $20,000)− Chapter 3 Accrual Accounting & Income 188

- 28. (10- 20 min.) E 3-25A Accounts Receivable Supplies 1,600 600 (a) 500 (c) 800 Bal. 100 Bal. 2,400 Salary Payable Unearned Service Revenue (b) 300 (d) 200 900 Bal. 300 Bal. 700 Service Revenue Salary Expense 4,800 2,500 (c) 800 (b) 300 (d) 200 Bal. 2800 Bal. 5,800 Supplies Expense (a) 500 Bal. 500 Chapter 3 Accrual Accounting & Income 189

- 29. (20- 30 min.) E 3-26A Delicious Hams, Inc. Income Statement Year Ended December 31, 2010 Thousands Revenues: Sales revenue……………….. . $41,40 0 Expenses: Cost of goods sold………….. $25,10 0 Selling, administrative, and general expense………….. 10,70 0 Total expenses……………. 35,80 0 Income before tax……………… 5,600 Income tax expense……………. 2,30 0 Net income………………………. $ 3,300 Delicious Hams, Inc.. Statement of Retained Earnings Year Ended December 31, 2010 Thousands Retained earnings, December 31, 2009… $4,700 Add: Net income …………………………. 3,300 8,000 Less: Dividends……………………………. (1,500 ) Retained earnings, December 31, 2010… $6,500 Chapter 3 Accrual Accounting & Income 190

- 30. Chapter 3 Accrual Accounting & Income 191

- 31. (continued) E 3-26A Delicious Hams, Inc. Balance Sheet December 31, 2010 Thousands ASSETS LIABILITIES Cash………………………… …. $ 3,800 Accounts payable……… $ 7,600 Accounts receivable………… 1,500 Income tax payable…….. 600 Inventories………………… …. 1,100 Other liabilities………….. 2,20 0 Prepaid expenses……………. 1,700 Total liabilities…………... 10,400 Prop., plant, equip. $ 6,500 STOCKHOLDERS’ Less: Accum. EQUITY deprec…… . (2,300 ) 4,200 Common stock………….. 4,700 Other assets………………….. 9,300 Retained earnings……… 6,50 0 Total stockholders’ equity 11,20 Total liabilities and Total assets…………………… $21,60 0 stockholders’ equity... $21,60 0 Chapter 3 Accrual Accounting & Income 192

- 32. (10- 20 min.) E 3-27A One mechanism for solving this exercise is to prepare the relevant T-accounts, insert the given information, and solve for the unknown amounts, shown in italics. Amounts in millions Receivables Beg. bal. 270 Sales revenue 20,200 Collections 20,08 0 End. bal. 390 Prepaid Insurance Beg. bal. 160 Payment 420 Insurance expense 39 0 End. bal. 190 Accrued Liabilities Payable Beg. bal. 610 Payments 4,100 Other operating expenses 4,220 End. bal. 730 Chapter 3 Accrual Accounting & Income 193

- 33. (10 min.) E 3-28A Req. 1 Mother Meghan’s income statement: Service revenue ($6,000 × 1/2) …………………..... $3,000 Mother Meghan’s balance sheet: Unearned service revenue ($6,000 × 1/2) ……….. $3,000 Req. 2 Boston’s income statement: Medical expense ($6,000 × 1/2) …………………… $3,000 Boston’s balance sheet: Prepaid medical expense ($6,000 × 1/2) ………… $3,000 Chapter 3 Accrual Accounting & Income 194

- 34. (10- 15 min.) E 3-29A Req. 1 Mi llions Income statement Service revenue (£460 £110)− …………………… £350 Balance sheet Unearned service revenue………………………... £110 Req. 2 Income statement Service revenue (£55 + £460 £110)− ……………. £405 Balance sheet Unearned service revenue………………………... £110 Service revenue is greater in (2) because Nanofone began the year owing more phone service to customers. With collections for the year and the amount of the ending liability unchanged, Nanofone must have earned more revenue in situation 2 than in situation 1. Not required but helpful: Unearned Service Revenue Beg. bal. 55 Earned revenue 40 5 Collected cash 460 End. bal. 110 Chapter 3 Accrual Accounting & Income 195

- 35. (10- 20 min.) E 3-30A Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT Closing Entries Dec . 31 Service Revenue………………………… 24,00 0 Other Revenue…………………………… 300 Retained Earnings……………………. 24,30 0 31 Retained Earnings………………………. 23,60 0 Cost of Services Sold………………... 11,30 0 Selling, General, and Administrative Expense……………………………... 6,700 Depreciation Expense……………….. 4,800 Income Tax Expense…………………. 800 31 Retained Earnings………………………. 600 Dividends……………………………. … 600 Net income for 2010 was $700 ($24,300 $23,600).− Retained Earnings Dec. 31, 2009 2,10 0 Dividend s 600 Net income 700 Chapter 3 Accrual Accounting & Income 196

- 36. Dec. 31, 2010 2,20 0 Chapter 3 Accrual Accounting & Income 197

- 37. (15- 25 min.) E 3-31A Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDI T Adjusting Entries Dec. 31 Unearned Service Revenue………………. 6,500 Service Revenue ($20,100 − $13,600)... 6,500 31 Salary Expense ($5,100 $4,600)− ………... 500 Salary Payable………………………. …... 500 31 Rent Expense ($1,300 $1,000)− ………….. 300 Prepaid Rent……………………………… 300 31 Depreciation Expense ($400 $0)− ……….. 400 Accumulated Depreciation…………….. 400 31 Income Tax Expense ($1,000 $0)− ………. 1,000 Income Tax Payable…………………….. 1,000 Closing Entries 31 Service Revenue……………………………. 20,10 0 Retained Earnings………………………. 20,10 0 31 Retained Earnings………………………….. 7,800 Salary Expense…………………………... 5,100 Chapter 3 Accrual Accounting & Income 198

- 38. Rent Expense…………………………….. 1,300 Depreciation Expense…………………... 400 Income Tax Expense……………………. 1,000 31 Retained Earnings………………………….. 1,300 Dividends……………………………. …… 1,300 Chapter 3 Accrual Accounting & Income 199

- 39. (20- 30 min.) E 3-32A Req. 1 Draper Production Company Balance Sheet December 31, 2009 ASSETS Current: Cash…………………………………..…….... $14,800 Prepaid rent ($1,000 $300)……..……….− 700 Total current assets…………..…….….. 15,500 Plant: Equipment…………………………………. .. $44,00 0 Less accumulated depreciation ($3,100 + $400)……………………. …….. (3,500 ) 40,50 0 Total assets……………………………………… $56,000 LIABILITIES Current: Accounts payable………………………….. $ 5,100 Salary payable ($5,100 $4,600)………− 500 Unearned service revenue ($9,300 $6,500)− 2,800 Income tax payable……………………..…. 1,00 0 Total current liabilities……………….... 9,400 Note payable, long-term…………………..… 13,000 Total liabilities……………………………….… 22,400 STOCKHOLDERS’ EQUITY Common stock………………………………… 8,500 Retained earnings ($14,100+$20,100 $5,100 $1,300 $400− − − $1,000 $1,300)…….……………………− − 25,10 0 Total stockholders’ equity………………… 33,600 Total liabilities and stockholders’ equity… $56,000 Chapter 3 Accrual Accounting & Income 200

- 40. (continued) E 3-32A Req. 2 Current Year Prior Year Current rati o = Total current assets = $15,50 0 = 1.65 1.70 Total current liabilities $9,400 The ability to pay current liabilities with current assets deteriorated. Debt ratio = Total liabilities = $22,40 0 = 0.40 0.30 Total assets $56,00 0 The overall ability to pay total liabilities deteriorated a little. Chapter 3 Accrual Accounting & Income 201

- 41. (30 min.) E 3-33A a. Current ratio = $30 = 1.6 7 Debt ratio = $30 + 8 = 0.56$10 + $8 $60 + $8 The purchase of equipment on account hurts both ratios. b. Current ratio = $30 − $11 = .95 Debt ratio = $30 − $11 = 0.39 $20 $60 − $11 The payment of long-term debit hurts the current ratio and improves the debt ratio. c. Current ratio = $30 + $6 = 1.3 8 Debt ratio = $30 + $6 = 0.55 $20 + $6 $60 + $6 Collecting cash in advance hurts both ratios. d. Current ratio = $30 = 1.3 0 Debt ratio = $30 + $3 = 0.55 $20 + $3 $60 Accruing an expense hurts both ratios. e. Current ratio = $30 + $11 = 2.0 5 Debt ratio = $30 = .42$20 $60 + $11 A cash sale improves both ratios. Chapter 3 Accrual Accounting & Income 202

- 42. Exercises Group B (5- 10 min.) E 3-34B Statement Reports 1. Income statement Sales revenue………… $4,80 0 Operating expenses… 1,100 Balance sheet Accounts receivable… $ 300 Accounts payable…… 500 2. Cash basis would report only the cash collections of $4,900 from customers and the payment of operating expenses ($1,100).The balance sheet would include neither accounts receivable nor accounts payable. (5- 10 min.) E 3-35B a. Cash Basis b. Accrual Basis Revenues……………… …... $580,000 $510,000 Expenses……………… …... 440,000 470,000 Net income………………… $140,000 $ 40,000 The accrual basis measures net income better because its information on revenues and expenses is more complete than the information provided by the cash basis. Chapter 3 Accrual Accounting & Income 203

- 43. (5- 10 min.) E 3-36B Million a. Revenue………………………………………… ……. $740 The revenue principle says to record revenue when it has been earned, regardless of when cash is collected. Therefore, report the amount of revenue earned, regardless of when the company collects cash. b. Total expense…………………………………….….. $560 The matching principle governs accounting for expenses. c. The income statement reports revenues and expenses. The statement of cash flows reports cash receipts and cash payments. Chapter 3 Accrual Accounting & Income 204

- 44. (15- 20 min.) E 3-37B Req. 1 Adjusting Entries DATE ACCOUNT TITLES DEBIT CREDIT a. Insurance Expense……………………………... 1,600 Prepaid Insurance ($800+$2,400- $1,600)… 1,600 b. Interest Receivable………………….. ………… 1,000 Interest Revenue…………………….. ……... 1,000 c. Unearned Service Revenue ($1,500 − $400).. 1,100 Service Revenue…………………….. ……… 1,100 d. Depreciation Expense………………….. …….. 4,600 Accumulated Depreciation………….. ……. 4,600 e. Salary Expense ($16,000 × 3/5) ………….…… 9,600 Salary Payable……………………….….. …... 9,600 f. Income Tax Expense ($21,000 × .25) ………… 5,250 Chapter 3 Accrual Accounting & Income 205

- 45. Income Tax Payable…………………………. 5,250 Chapter 3 Accrual Accounting & Income 206

- 46. (continued) E 3-37B Req. 2 Net income understated by omission of: Interest revenue…………………………….. $ 1,000 Service revenue……………………………... 1,100 Total understatement………………………. $ 2,100 Net income overstated by omission of: Insurance expense…………………………. $1,600 Depreciation expense……………………… 4,600 Salary expense……………………………… 9,600 Income tax expense………………………… 5,250 Total overstatement………………………… 21,050 Overall effect — net income overstated by.. $18,95 0 Chapter 3 Accrual Accounting & Income 207

- 47. (10- 15 min.) E 3-38B Missing amounts in italics. 1 2 3 4 Beginning Supplies $ 100 $400 $ 1,200 $ 800 Add: Payments for supplies during the year 1,400 1,000 800 800 Total amount to account for 1,500 1,400 2,000 1,600 Less: Ending Supplies (400 ) (500 ) (700 ) (500 ) Supplies Expense $ 1,100 $ 900 $ 1,300 $1,100 Journal entries: Situation 1: Supplies……………………… …… 1,400 Cash…………………………. …. 1,400 Situation 2: Supplies Expense……………….. 900 Supplies……………………….. . 900 Chapter 3 Accrual Accounting & Income 208

- 48. Chapter 3 Accrual Accounting & Income 209

- 49. (10- 20 min.) E 3-39B Adjusting Entries DATE ACCOUNT TITLES DEBIT CREDIT a. Interest Expense……………………………… 9,200 Interest Payable……………………………. 9,200 b. Interest Receivable…………………………… 4,200 Interest Revenue……………………. …….. 4,200 c. Unearned Rent Revenue ($12,600 / 2 × 6/12) 3,150 Rent Revenue………………………………. 3,150 d. Salary Expense ($1,900 × 3) ……………….... 5700 Salary Payable……………………………… 5,700 e. Supplies Expense…………………………….. 1,400 Supplies ($2,600 1,200)− ……………….…. 1,400 f. Depreciation Expense ($160,000 / 5) ………... 32,00 0 Accumulated Depreciation………………. 32,000 Book value = $128,000 ($160,000 $32,000)− Chapter 3 Accrual Accounting & Income 210

- 50. Chapter 3 Accrual Accounting & Income 211

- 51. (10- 20 min.) E 3-40B Accounts Receivable Supplies 1,200 300 (a) 100 (c) 800 Bal. 200 Bal. 2,000 Salary Payable Unearned Service Revenue (b) 600 (d) 100 800 Bal. 600 Bal. 700 Service Revenue Salary Expense 4,400 1,900 (c) 800 (b) 600 (d) 100 Bal. 2,500 Bal. 5,300 Supplies Expense (a) 100 Bal. 100 Chapter 3 Accrual Accounting & Income 212

- 52. (20- 30 min.) E 3-41B Holiday Hams, Inc. Income Statement Year Ended December 31, 2010 Thousands Revenues: Sales revenue……………….. . $39,90 0 Expenses: Cost of goods sold………….. $25,40 0 Selling, administrative, and general expense………….. 10,40 0 Total expenses……………. 35,80 0 Income before tax……………… 4,100 Income tax expense……………. 2,40 0 Net income………………………. $ 1,700 Holiday Hams, Inc. Statement of Retained Earnings Year Ended December 31, 2010 Thousands Retained earnings, December 31, 2009… $4,700 Add: Net income …………………………. 1,700 6,400 Less: Dividends……………………………. (1,200 ) Retained earnings, December 31, 2010… $5,200 Chapter 3 Accrual Accounting & Income 213

- 53. Chapter 3 Accrual Accounting & Income 214

- 54. (continued) E 3-41B Holiday Hams, Inc. Balance Sheet December 31, 2010 Thousands ASSETS LIABILITIES Cash………………………… …. $ 3,500 Accounts payable……… $ 7,900 Accounts receivable………… 1,700 Income tax payable…….. 900 Inventories………………… …. 1,200 Other liabilities………….. 2,70 0 Prepaid expenses……………. 1,600 Total liabilities…………... 11,500 Prop., plant, equip. $ 6,700 STOCKHOLDERS’ Less: Accum. EQUITY deprec…… . (2,700 ) 4,000 Common stock………….. 4,800 Other assets………………….. 9,500 Retained earnings……… 5,20 0 Total stockholders’ equity 10,00 Total liabilities and Total assets…………………… $21,50 0 stockholders’ equity... $21,50 0 Chapter 3 Accrual Accounting & Income 215

- 55. (10- 20 min.) E 3-42B One mechanism for solving this exercise is to prepare the relevant T-accounts, insert the given information, and solve for the unknown amounts, shown in italics. Amounts in millions Receivables Beg. bal. 250 Sales revenue 20,68 0 Collections 20,60 0 End. bal. 330 Prepaid Insurance Beg. bal. 130 Payment 450 Insurance expense 44 0 End. bal. 140 Accrued Liabilities Payable Beg. bal. 600 Payments 4,100 Other operating expenses 4,260 End. bal. 760 Chapter 3 Accrual Accounting & Income 216

- 56. (10 min.) E 3-43B Req. 1 Mother Elizabeth’s income statement: Service revenue ($9,600 × 1/2) …………………..... $4,800 Mother Elizabeth’s balance sheet: Unearned service revenue ($9,600 × 1/2) ……….. $4,800 Req. 2 Portland’s income statement: Medical expense ($9,600 × 1/2) …………………… $4,800 Boston’s balance sheet: Prepaid medical expense ($9,600 × 1/2) ………… $4,800 Chapter 3 Accrual Accounting & Income 217

- 57. (10 min.) E 3-44B Req. 1 Mi llions Income statement Service revenue (£400 £105)− …………………… £295 Balance sheet Unearned service revenue………………………... £105 Req. 2 Income statement Service revenue (£95 + £400 £105)− ……………. £390 Balance sheet Unearned service revenue………………………... £105 Service revenue is greater in (2) because Direct began the year owing more phone service to customers. With collections for the year and the amount of the ending liability unchanged, Direct must have earned more revenue in situation 2 than in situation 1. Not required but helpful: Unearned Service Revenue Beg. bal. 95 Earned revenue 39 0 Collected cash 400 End. bal. 105 Chapter 3 Accrual Accounting & Income 218

- 58. (10- 20 min.) E 3-45B Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT Closing Entries Dec . 31 Service Revenue………………………… 24,10 0 Other Revenue…………………………… 500 Retained Earnings……………………. 24,60 0 31 Retained Earnings………………………. 22,50 0 Cost of Services Sold………………... 11,20 0 Selling, General, and Administrative Expense……………………………... 6,100 Depreciation Expense……………….. 4,800 Income Tax Expense…………………. 400 31 Retained Earnings………………………. 900 Dividends……………………………. … 900 Net income for 2010 was $2,100 ($24,600 $22,500).− Retained Earnings Dec. 31, 2009 2,400 Dividend s 900 Net income 2,100 Dec. 31, 2010 3,600 Chapter 3 Accrual Accounting & Income 219

- 59. Chapter 3 Accrual Accounting & Income 220

- 60. (15- 25 min.) E 3-46B Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT Adjusting Entries Dec. 31 Unearned Service Revenue………………. 6,500 Service Revenue ($19,900 − $13,400)... 6,500 31 Salary Expense ($4,900 $4,500)− ………... 400 Salary Payable………………………. …... 400 31 Rent Expense ($1,400 $900)− ………….. 500 Prepaid Rent……………………………… 500 31 Depreciation Expense ($600 $0)− ……….. 600 Accumulated Depreciation…………….. 600 31 Income Tax Expense ($1,700 $0)− ………. 1,700 Income Tax Payable…………………….. 1,700 Closing Entries 31 Service Revenue……………………………. 19,90 0 Retained Earnings………………………. 19,90 0 31 Retained Earnings………………………….. 8,600 Salary Expense…………………………... 4,900 Rent 1,400 Chapter 3 Accrual Accounting & Income 221

- 61. Expense…………………………….. Depreciation Expense…………………... 600 Income Tax Expense……………………. 1,700 31 Retained Earnings………………………….. 1,000 Dividends……………………………. …… 1,000 Chapter 3 Accrual Accounting & Income 222

- 62. (20- 30 min.) E 3-47B Req. 1 Wallace Production Company Balance Sheet December 31, 2009 ASSETS Current: Cash………………………………………………….. …. $13,600 Prepaid rent ($1,100 $500)− ……………………….... 600 Total current assets……………………………….. 14,200 Plant: Equipment…………………………………. . $48,00 0 Less accumulated depreciation ($3,800 + $300)……………………. ….. (4,200 ) 43,80 0 Total assets…………………………………………………. $58,000 LIABILITIES Current: Accounts payable………………………………………. $ 4,400 Salary payable ($4,900 $4,500)− …………………..… 400 Unearned service revenue ($8,500 $6,500)− ……………………………………... 2,000 Income tax payable…………………………………..… 1,70 0 Total current liabilities……………………………… 8,500 Chapter 3 Accrual Accounting & Income 223

- 63. Note payable, long- term………………………………….. 10,000 Total liabilities…………………………………… ………… 18,500 STOCKHOLDERS’ EQUITY Common stock……………………………………………... 8,400 Retained earnings ($20,800 + $19,900 $4,900 $1,400− − − $600 $1,700 $1,000)…….− − ………………………………… 31,10 0 Total stockholders’ equity…………………………….…. 39,50 0 Total liabilities and stockholders’ equity……………… $58,000 Chapter 3 Accrual Accounting & Income 224

- 64. (continued) E 3-47B Req. 2 Current Year Prior Year Current rati o = Total current assets = $14,20 0 = 1.67 1.45 Total current liabilities $8,500 The ability to pay current liabilities with current assets improved. Debt ratio = Total liabilities = $18,50 0 = 0.32 0.35 Total assets $58,00 0 The overall ability to pay total liabilities improved a little. Chapter 3 Accrual Accounting & Income 225

- 65. (30 min.) E 3-48B a. Current ratio = $40 = 1.11 Debt ratio = $30 + 6 = 0.55 $30 + $6 $60 + $6 The purchase of equipment on account hurts both ratios. b. Current ratio = $40 − $11 = .97 Debt ratio = $30 − $11 = 0.39 $30 $60 − $11 The payment of long-term debit hurts the current ratio and improves the debt ratio. c. Current ratio = $40 + $8 = 1.26 Debt ratio = $30 + $8 = 0.56 $30 + $8 $60 + $8 Collecting cash in advance hurts both ratios. d. Current ratio = $40 = 1.08 Debt ratio = $30 + $7 = 0.62 $30 + $7 $60 Accruing an expense hurts both ratios. e. Current ratio = $40 + $11 = 1.7 Debt ratio = $30 = 0.42 $30 $60 + $11 A cash sale improves both ratios. Chapter 3 Accrual Accounting & Income 226

- 66. Serial Exercises (3 hours) E 3- 49 Reqs. 1, 3, 6, and 8 Cash Accounts Receivable Mar. 2 7,000 Mar. 2 600 Mar. 18 2,100 Jan. 28 2,100 9 1,200 3 2,400 Bal. 0 21 1,800 12 300 Adj. 1,600 28 2,100 26 500 Bal. 1,600 31 1,400 Bal. 6,900 Supplies Equipment Mar. 5 500 Adj. 400 Mar. 3 2,400 Bal. 100 Accumulated Depreciation – Equipment Furniture Adj. 40 Mar. 4 7,500 Accumulated Depreciation – Furniture Accounts Payable Adj. 125 Mar. 26 500 Mar. 4 7,500 5 500 Bal. 7,500 Chapter 3 Accrual Accounting & Income 227

- 67. (continued) E 3-49 Reqs. 1, 3, 6, and 8 Salary Payable Unearned Service Revenue Adj. 600 Adj. 600 Mar. 21 1,800 Bal. 1,200 Common Stock Retained Earnings Mar. 2 7,000 Clo. 2,065 Clo. 5,50 0 Clo. 1,400 Bal. 2,03 5 Dividends Service Revenue Mar. 31 1,400 Clo. 1,400 Mar. 9 1,20 0 18 2,10 0 Bal. 3,30 0 Adj. 1,60 0 Adj. 600 Clo. 3,800 Bal. 5,50 0 Rent Expense Utilities Expense Mar. 2 600 Clo. 600 Mar. 12 300 Clo. 300 Salary Expense Depreciation Expense – Equipment Adj. 600 Clo. 600 Adj. 40 Clo. 40 Depreciation Expense – Furniture Supplies Expense Adj. 125 Clo. 125 Adj. 400 Clo. 400 Chapter 3 Accrual Accounting & Income 228

- 68. Chapter 3 Accrual Accounting & Income 229

- 69. (continued) E 3-49 Req. 2 March 2 through 18 entries are repeated from Solution to Exercise 2-36. Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT Mar. 2 Cash………………………………… ….. 7,000 Common Stock…………………….. 7,000 2 Rent Expense………………………….. 600 Cash…………………………………. . 600 3 Equipment………………………… …… 2,400 Cash…………………………………. . 2,400 4 Furniture…………………………… ….. 7,500 Accounts Payable…………………. 7,500 5 Supplies…………………………… …… 500 Accounts Payable…………………. 500 9 Cash………………………………… ….. 1,200 Service Revenue…………………… 1,200 Chapter 3 Accrual Accounting & Income 230

- 70. 12 Utilities Expense……………………… 300 Cash…………………………………. . 300 18 Accounts Receivable………………… 2,100 Service Revenue…………………… 2,100 Chapter 3 Accrual Accounting & Income 231

- 71. (continued) E 3-49 Req. 2 Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT Mar . 21 Cash………………………………… ….. 1,800 Unearned Service Revenue……… 1,800 21 No entry; no transaction yet 26 Accounts Payable……………………. 500 Cash………………………………… . 500 28 Cash………………………………… ….. 2,100 Accounts Receivable…………… 2,100 31 Dividends………………………… …… 1,400 Cash………………………………… . 1,400 Chapter 3 Accrual Accounting & Income 232

- 72. (continued) E 3-49 Reqs. 4 and 5 Jerome Smith, Certified Public Accountant, P.C. Adjusted Trial Balance March 31, 2009 TRIAL BALANCE ADJUSTMENTS ADJUSTED TRIAL BALANCE ACCOUNT TITLE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT Cash 6,900 6,900 Accounts receivable 0 (a) 1,600 1,600 Supplies 500 (c) 400 100 Equipment 2,400 2,400 Accumulated depr. – equip. — (d1) 40 40 Furniture 7,500 7,500 Accumulated depr. – furn. — ( d2) 125 125 Accounts payable 7,500 7,500 Salary payable — (e) 600 600 Unearned service revenue 1,800 (b) 600 1,200 Common stock 7,000 7,000 Retained earnings — — Dividends 1,400 1,400 Service revenue 3,300 (a)1,600 5,500 (b) 600 Rent expense 600 600 Utilities expense 300 300 Salary expense (e) 600 600 Depreciation expense – equip. (d1) 40 40 Depreciation expense – furn. (d2) 125 125 Supplies expense (c) 400 400 19,600 19,600 3,365 3,365 21,965 21,965 Chapter 3 Accrual Accounting & Income 233

- 73. (continued) E 3-49 Req. 6 Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDI T Adjusting Entries (a) Mar. 31 Accounts Receivable………………….. 1,60 0 Service Revenue…………………….. 1,60 0 (b) 31 Unearned Service Revenue………… 600 Service Revenue…………………….. 600 (c) 31 Supplies Expense ($500 $100)− …….. 400 Supplies………………………………. . 400 (d1) 31 Depreciation Expense – Equipment… 40 Accumulated Depreciation – Equip 40 (d2) 31 Depreciation Expense – Furniture… 125 Accumulated Depreciation – Furn.. 125 (e) 31 Salary Expense…………………………. 600 Salary Payable……………………….. 600 Chapter 3 Accrual Accounting & Income 234

- 74. (continued) E 3-49 Req. 7 Jerome Smith, Certified Public Accountant, P.C. Income Statement Month Ended March 31, 2009 Revenues: Service revenue $5,50 0 Expenses: Salary expense $600 Supplies expense 400 Rent expense 600 Utilities expense 300 Depreciation expense – furniture 40 Depreciation expense – equipment 12 5 Total expenses 2,06 5 Net income $3,43 5 Jerome Smith, Certified Public Accountant, P.C. Statement of Retained Earnings Month Ended March 31, 2009 Retained earnings, March 1, 2010 $ 0 Add: Net income 3,435 3,435 Less: Dividends (1,400 ) Retained earnings, March 31, 2010 $ 2,035 Chapter 3 Accrual Accounting & Income 235

- 75. (continued) E 3-49 Req. 7 Jerome Smith, Certified Public Accountant, P.C. Balance Sheet March 31, 2009 ASSETS LIABILITIES Current assets: Current liabilities: Cash $ 6,900 Accounts payable $ 7,500 Accounts receivable 1,600 Salary payable 600 Supplies 10 0 Unearned service Total current assets 8,600 revenue 1,200 Plant assets: Total current liabilities 9,300 Equipment $2,400 Less accum. STOCKHOLDERS’ EQUITY depr. (40 ) 2,360 Common stock 7,000 Furniture $7,500 Retained earnings 2,035 Less accum. Total stockholders’ equity 9,035 depr. (125) 7,37 5 Total liabilities and _____ _ Total assets $18,33 5 stockholders' equity $18,33 5 Chapter 3 Accrual Accounting & Income 236

- 76. (continued) E 3-49 Req. 8 Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT Closing Entries Mar . 31 Service Revenue………………………….. 5,500 Retained Earnings…………………….. 5,500 31 Retained Earnings……………………….. 2,065 Rent Expense………………………….. 600 Utilities Expense………………………. 300 Salary Expense………………………… 600 Depreciation Expense – Equipment.. 40 Depreciation Expense – Furniture…. 125 Supplies Expense……………………... 400 31 Retained Earnings……………………….. 1,400 Dividends………………………………. . 1,400 Chapter 3 Accrual Accounting & Income 237

- 77. (continued) E 3-49 Req. 9 Current ratio = Total current assets = $8,60 0 = 0.92 Total current liabilities $9,30 0 Debt ratio = Total liabilities = $9,300 = 0.5 1Total assets $18,33 5 These ratios indicate a weak financial position. The business has only $0.92 in current assets for every $1.00 of current liabilities. It could face serious trouble in paying current liabilities with current assets. The debt ratio of 51% is not too high, which suggests that, overall, the business should be able to pay its debts — if it can generate enough cash to get its current ratio higher. Chapter 3 Accrual Accounting & Income 238

- 78. Challenge Exercises (20- 25 min.) E 3-50 (Dollar amounts in thousands) December 31, 2010 Current = $1,800 + $5,300 + $2,300 + $1,100 = $10,500 = 1.78 ratio $2,800 + $1,100 + $2,000 $5,900 December 31, 2011 Current = $400 1 + $6,500 2 + $2,300 3 + $700 4 = $9,900 = 2.11 ratio $1,300 5 + $1,100 6 + $2,300 7 $4,700 _____ Computations of December 31, 2010 balances: 1 Cash = $1,800 $7,400 + $7,500 $1,500 = $400− − 2 Receivables = $5,300 + $8,700 $7,500 = $6,500− 3 No change in the Inventory balance. 4 Prepaid expenses = $1,100 $400 = $700− 5 Accounts payable = $2,800 $1,500 = $1,300− 6 No change in the Unearned Revenues balance. 7 Accrued expenses payable = $2,000 + $300 = $2,300 Conclusion: Worthy Hill’s current ratio improved during 2010. The company’s current ratio is very strong. Chapter 3 Accrual Accounting & Income 239

- 79. (60 min.) E 3-51 a. Net income: Service revenue: ($160,000 + $1,620 + $32,000). $193,620 Expenses: Salary ($34,000 + $3,200) ……… $ 37,200 Depreciation – building……….. 2,500 Supplies………………………….. 3,600 Insurance………………………… 1,200 Advertising………………………. 7,600 Utilities…………………………… 2,100 54,20 0 Net income………………………….. $139,420 b. Total assets: Cash……………………………… ….. 16,600 Accounts receivable ($7,000 + $32,000) …………..... 39,000 Supplies ($4,200 $3,600)− ……….. 600 Prepaid insurance ($3,400 $1,200)− ………………... 2,200 Building…………………………… … $107,00 0 Less: Accum. Depr. ($15,000 + $2,500)…………. …… (17,500 ) 89,500 Land……………………………… ….. 52,00 0 Total assets…………………. ….. $199,900 Chapter 3 Accrual Accounting & Income 240

- 80. (continued) E 3-51 c. Total liabilities: Accounts payable……………………. $ 6,500 Salary payable………………………… 3,200 Unearned service revenue ($5,400 $1,620)− …………………... 3,780 Total liabilities………………………… $ 13,480 d. Total stock- holders’ equity: Common stock………………………... $ 14,000 Retained earnings, beginning…. …... 45,000 Add: Net income…. …………………... 139,420 198,420 Less: Dividends.............................. (12,00 0) Total stockholders’ equity………….. $186,420 e. Total assets = Total liabilities + Total stockholders’ equity $199,900 = $13,480 + $186,420 Chapter 3 Accrual Accounting & Income 241

- 81. Quiz Q3- 52 b Q3- 53 b Q3- 54 d Q3- 55 b Q3- 56 b Q3- 57 a Q3- 58 b Q3- 59 b Q3- 60 b ($2,700 × 9/12 = $2,025) Q3- 61 a $2,000 + $26,000 $17,000− = revenue of $11,000 Q3- 62 c Q3- 63 d Q3- 64 b Q3- 65 d Q3- 66 c Current ratio = $29,333 / $24,800 = 1.183 to 1 Debt ratio = $24,800 + $112,738 = .635 to 1 $29,333 + $187,430 Q3- $7,39 ($7,500 $660 $100 + $950 $300)− − − Chapter 3 Accrual Accounting & Income 242

- 82. 67 0 Q3- 68 b Salary Payable Beg. bal. 28,000 Payment 139,00 0 Salary exp. 126,00 0 End. bal. 15,000 Chapter 3 Accrual Accounting & Income 243

- 83. Problems Group A (15- 20 min.) P 3-69A (All amounts in millions) 1. $41 – x = $5 ; x = $36 2. Revenues………… ….. $41 Expenses………… ….. 36 Net income…………... $ 5 3. Beginning receivables……… $ 4 Add: Sales………………….. 41 Less: Collections…………... (23 ) Ending receivables…………. $18 Balance sheet ASSETS Current assets: Receivables…………. $ 18 4. Beginning accounts payable………. $ 8 Add: Expenses……………………… 36 Less: Payments……………………... (41 ) Ending accounts payable…………… $ 3 Chapter 3 Accrual Accounting & Income 244

- 84. Balance sheet LIABILITIES Current liabilities: Accounts payable…………… $ 3 Chapter 3 Accrual Accounting & Income 245

- 85. (20- 30 min.) P 3-70A Req. 1 Elders Consulting Amount of Revenue (Expense) for August Date Cash Basis Accrual Basis Aug. 1 Expense $(500 ) $ 0 4 Expense (800 ) 0 5 Revenue 700 700 8 Expense (500 ) (500 ) 11 Revenue 0 3,500 19 0 0 24 Revenue 3,500 0 26 Expense (1,700 ) 0 29 Expense (800 ) (800 ) 31 Expense 0 $500 ÷ 5 = (100) 31 Revenue 0 600 Req. 2 Income (loss) before tax $ (100 ) $3,400 Chapter 3 Accrual Accounting & Income 246

- 86. (continued) P 3-70A Req. 3 The accrual-basis measure of net income is preferable because it accounts for revenues and expenses when they occur, not when they are received or paid in cash. For example, on August 11, the company earned $3,500 of revenue and increased its wealth as a result. The accrual basis records this revenue, but the cash basis ignores it. On August 24, the business collected the receivable that was created by the revenue earned on account at August 11. The accrual basis records no revenue on August 24 because the company’s increase in wealth occurred back on August 11. The cash basis waits until cash is received, on August 24, to record the revenue. This is too late. Chapter 3 Accrual Accounting & Income 247

- 87. (10- 20 min.) P 3-71A Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT Dec . 31 a. Insurance Expense………………….. 3,200 * Prepaid Insurance……………...... 3,200 To record insurance expense. 31 b. Salary Expense ($6,100 × 2/5) …….. 2,440 Salary Payable……………………. 2,440 To accrue salary expense. 31 c. Interest Receivable…………………. 400 Interest Revenue…………………. 400 To accrue interest revenue. 31 d. Supplies Expense…………………… 6,900 ** Supplies……………………………. 6,900 To record supplies expense. 31 e. Unearned Service Revenue ($12,000 × 7/12) ……………………... 8,400 Service Revenue……………. …… 8,400 To record revenue that was collected in advance. 31 f. Depreciation – Office Furniture…… 3,000 Depreciation Expense – Equipment 5,400 Accumulated Depreciation – Office Furniture………………... 3,000 Chapter 3 Accrual Accounting & Income 248

- 88. Accumulated Depreciation – Equipment………………………. 5,400 To record depreciation expense. _____ * $ 900 + $3,600 $1,300= $3,200− ** $2,700 + $6,400 $2,200 = $6,900− Chapter 3 Accrual Accounting & Income 249

- 89. (45- 60 min.) P 3-72A Req. 1 London, Inc. Adjusted Trial Balance December 31, 2010 TRIAL BALANCE ADJUSTMENTS ADJUSTED TRIAL BALANCE ACCOUNT TITLE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT Cash 8,900 8,900 Accounts receivable 1,200 (a) 2,100 3,300 Prepaid rent 2,400 (b) 800* 1,600 Supplies 2,500 (c) 2,170 330 Furniture 72,000 72,000 Accumulated depreciation 3,900 (d) 2,000** 5,900 Accounts payable 3,300 3,300 Salary payable (e) 2,880*** 2,880 Common stock 12,000 12,000 Retained earnings 63,110 63,110 Dividends 3,500 3,500 Service revenue 11,000 (a) 2,100 13,100 Salary expense 2,300 (e) 2,880*** 5,180 Rent expense (b) 800* 800 Utilities expense 510 510 Depreciation expense (d) 2,000** 2,000 Supplies expense (c) 2,170 _____ 2,170 93,310 93,310 9,950 9,950 100,290 100,290 _____ * $2,400 ÷ 3 = $800 ** $72,000 ÷ 3 = $24,000 ÷ 12 = $2,000 Chapter 3 Accrual Accounting & Income 250

- 90. *** $4,800 × 3/5 = $2,880 Chapter 3 Accrual Accounting & Income 251

- 91. (continued) P 3-72A Req. 2 London, Inc. Income Statement Month Ended December 31, 2010 Revenues: Service revenue $13,10 0 Expenses: Salary expense $5,180 Supplies expense 2,170 Rent expense 800 Depreciation expense 2,000 Utilities expense 510 Total expenses 10,660 Net income $ 2,440 London, Inc. Statement of Retained Earnings Month Ended December 31, 2010 Retained earnings, December 1, 2010 $63,110 Add: Net income 2,440 65,550 Less: Dividends (3,500 ) Retained earnings, December 31, 2010 $62,050 Chapter 3 Accrual Accounting & Income 252

- 92. (continued) P 3-72A Req. 2 (continued) London, Inc. Balance Sheet December 31, 2010 ASSETS LIABILITIES Current assets: Current liabilities: Cash $ 8,900 Accounts payable $3,300 Accounts receivable 3,300 Salary payable 2,88 0 Prepaid rent 1,600 Total current liabilities 6,180 Supplies 330 Total current assets 14,130 Furniture $72,000 STOCKHOLDERS’ EQUITY Less: Accum. Common stock 12,000 deprec. (5,900 ) 66,100 Retained earnings 62,05 0 Total stockholders’ equity 74,050 Total liabilities and Total assets $80,23 0 stockholders’ equity $80,23 0 Chapter 3 Accrual Accounting & Income 253

- 93. (10- 20 min.) P 3-73A Req. 1 Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDI T Apr. 30 Accounts Receivable ($6,810 − $5,900)... 910 Rental Revenue…………………………. 910 To accrue rental revenue. 30 Interest Receivable ($200 $0)− ………….. 200 Interest Revenue ($600 $400)− …….… 200 To accrue interest revenue. 30 Supplies Expense ($1,200 $0)− ………… 1,20 0 Supplies ($1,800 $600)− ………………. 1,20 0 To record supplies expense. 30 Insurance Expense ($1,700 $0)− ……….. 1,70 0 Prepaid Insurance ($2,300 − $600)…... 1,70 0 To record insurance expense. 30 Depreciation Expense ($1,400 $0)− ……. 1,40 0 Accumulated Depreciation ($8,800 $7,400)− ……………………... 1,40 0 To record depreciation expense. 30 Wage Expense ($2,300 $1,300)− ………... 1,00 0 Wages Payable ($1,000 $0)− 1,00 Chapter 3 Accrual Accounting & Income 254

- 94. ……….… 0 To accrue wage expense. 30 Unearned Rental Revenue ($2,100 − 1,600) 500 Rental Revenue…………………………. 500 To record revenue that was collected in advance. Chapter 3 Accrual Accounting & Income 255

- 95. (continued) P 3-73A Req. 2 Total assets = $82,710 ($8,900 + $6,810 + $200 + $4,400 + $600 + $600 + $70,000 − $8,800) Total liabilities = $ 9,300 ($6,700 + $1,000 + $1,600) Total equity = $73,410 ($82,710 $9,300)− Net income = $ 19,710 ($26,510 + $600 $1,400− − $1,200 $400 $2,300 $400− − − − $1,700) Chapter 3 Accrual Accounting & Income 256

- 96. (20- 30 min.) P 3-74A Req. 1 Schneider Corporation Income Statement Year Ended July 31, 2010 Revenues: Service revenue $102,1 00 Expenses: Salary expense $39,80 0 Rent expense 10,300 Insurance expense 3,500 Interest expense 3,300 Supplies expense 2,800 Depreciation expense 1,70 0 61,4 00 Income before tax 40,700 Income tax expense 6,5 00 Net income $ 34,200 Schneider Corporation Statement of Retained Earnings Year Ended July 31, 2010 Retained earnings, July 31, 2009 $ 5,000 Add: Net income 34,200 39,200 Less: Dividends (21,000 ) Retained earnings, July 31, 2010 $18,200 Chapter 3 Accrual Accounting & Income 257

- 97. continued) P 3-74A Req. 1 (continued) Schneider Corporation Balance Sheet July 31, 2010 ASSETS LIABILITIES Cash $ 2,000 Accounts payable $ 3,400 Accounts receivable 9,400 Interest payable 200 Supplies 2,400 Unearned service revenue 700 Prepaid rent 1,200 Income tax payable 2,000 Note payable 18,900 Equipment $36,600 Total liabilities 25,200 Less: Accum. deprec. (4,20 0) 32,400 STOCKHOLDERS’ EQUITY Common stock 4,000 Retained earnings 18,200 Total stockholders’ equity 22,200 Total liabilities and Total assets $47,40 0 stockholders’ equity $47,400 Req. 2 Debt ratio: $25,20 0 = 0.53 $47,40 0 Snead is in compliance of its debt agreement, which requires the company to maintain a debt ratio no higher than 0.60. Chapter 3 Accrual Accounting & Income 258

- 98. (20 min.) P 3-75A Req. 1 Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT Closing Entries Mar. 31 Service Revenue…………………….. 95,000 Retained Earnings………………... 95,000 31 Retained Earnings…………………… 35,700 Advertising Expense…………….. 10,900 Depreciation Expense…………… 1,700 Interest Expense……….. ………… 900 Salary Expense…………………… 17,800 Supplies Expense………………… 4,400 31 Retained Earnings…………………… 31,200 Dividends………………………….. . 31,200 Req. 2 Retained Earnings Mar. 31, 2010 Expenses 35,70 0 Mar. 31, 2009 Bal. 22,00 0 Mar. 31, 2010 Dividends 31,20 0 Mar. 31, 2010 Revenues 95,00 0 Mar. 31, 2010 Bal. 50,10 0 Chapter 3 Accrual Accounting & Income 259

- 99. Net income = $59,300 (revenues of $95,000 minus expenses of $35,700. Req. 3 Retained Earnings increased during the year because net income of $59,300 exceeded dividends of $31,200. Chapter 3 Accrual Accounting & Income 260

- 100. (25- 40 min.) P 3-76A Req. 1 Spa View Service, Inc. Balance Sheet March 31, 2010 ASSETS Current assets: Cash $ 7,900 Accounts receivable 16,1 00 Prepaid expenses 6,00 0 Supplies 3,6 00 Total current assets 33,6 00 Plant assets: Equipment $41,700 Less: Accumulated depreciation (6,900 ) 34,800 Other assets 14,400 Total assets $82,800 LIABILITIES Current liabilities: Current portion of note payable $ 1,000 Accounts payable 14,400 Salary payable 2,900 Unearned service revenue 2,700 Total current liabilities 21,000 Note payable, long-term 6,100 Total liabilities 27,100 STOCKHOLDERS’ EQUITY Common stock 5,600 Retained earnings 50,100 * Total stockholders’ equity 55,700 Total liabilities and stockholders’ equity $82,800 Chapter 3 Accrual Accounting & Income 261

- 101. _____ *See next page. Chapter 3 Accrual Accounting & Income 262

- 102. (continued) P 3-76A Req. 1 (continued) *Retained earnings, March 31, 2009…………….. $22,000 Add: Net income ($95,000 $10,900− − $1,700 $900 $17,800 $4,400)− − − ………………... 59,300 81,300 Less: Dividends………………………………........ (31,200 ) Retained earnings, March 31, 2010…………….. $50,100 Req. 2 201 0 200 9 Current ratio = Total current assets = $33,60 0 = 1.60 1.25 Total current liabilities $21,00 0 The ability to pay current liabilities with current assets improved during 2010. Debt ratio = Total liabilities = $27,100 = 0.3 3 0.20 Total assets $82,800 The overall debt position deteriorated a little during 2010. The improvement in the current ratio is greater than the deterioration in the debt ratio. However, Spa Brook’s overall debt position is strong because a debt ratio of .33 is not troublesome. Chapter 3 Accrual Accounting & Income 263

- 103. (45- 60 min.) P 3-77A Req. 1 (All amounts in millions) Current ratio = Total current assets = $15. 6 = 1.63 Total current liabilities $ 9.6 $15.1 Debt ratio = Total liabilities = $9.6 + $5.5 = 0.4 9 Total assets $31.7 Req. 2 Current Ratio Debt Ratio a. $15.6 ($9.6− × 1/2) = 2.25 $15.1 ($9.6 × 1/2)− = 0.38 ($9.6 × 1/2) $31.7 ($9.6 × 1/2)− b. $15.6 + $6.0 = 2.25 $15,1+ $6.0 = 0.56 $9.6 $31.7 + $6.0 c. $15.6 + $2.5 = 1.89 $15.1 = 0.44 $9.6 $31.7 + $2.5 d. $15.6 $.6− = 1.56 $15.1 = 0.48 $9.6 $31.7 $.6− e. $15.6 = 1.51 $15.1 + $0.7 = 0.50 $9.6 + $0.7 $31.7 f. $15.6 $1.5− = 1.47 $15.1 + $2.7 = 0.52 $9.6 $31.7 + $4.2 $1.5− g. $15.6 = 1.63 $15,1 = 0.49 $9.6 $31.7 $0.8− (continued) P 3-77A Chapter 3 Accrual Accounting & Income 264

- 104. Req. 3 a. Revenues usually increase the current ratio. b. Revenues usually decrease the debt ratio. c. Expenses usually decrease the current ratio. Note: Depreciation is an exception to this rule. d. Expenses usually increase the debt ratio. e. If a company’s current ratio is greater than 1.0, as it is for Hartford, paying off a current liability will always increase the current ratio. f. Borrowing money on long-term debt will always increase the current ratio and increase the debt ratio. Chapter 3 Accrual Accounting & Income 265

- 105. Problems Group B (15- 20 min.) P 3-78B (All amounts in millions) 1. $33 – x = $27; x = $6 2. Revenues………… ….. $33 Expenses………… ….. 27 Net income…………... $ 6 3. Beginning receivables……... $ 9 Add: Revenues……………. 33 Less: Collections………….. (24 ) Ending receivables…………. $ 18 Balance sheet ASSETS Current assets: Receivables…………. $ 18 4. Beginning accounts payable……….. $ 11 Add: Expenses………………………. 27 Less: Payments…………………….... (28 ) Ending accounts payable……………. $ 10 Chapter 3 Accrual Accounting & Income 266

- 106. Balance sheet LIABILITIES Current liabilities: Accounts payable……………. $ 10 Chapter 3 Accrual Accounting & Income 267

- 107. (20- 30 min.) P 3-79B Req. 1 Kings Consulting Amount of Revenue (Expense) for May Date Cash Basis Accrual Basis May 1 Expense $ (500 ) Expense 0 4 Expense $(600 ) Expense 0 5 Revenue $1,000 Revenue $1,000 8 Expense $(400 ) Expense $(400 ) 1 1 Revenue Revenue $3,100 1 9 Expense 0 Expense 0 2 4 Revenue $3,100 Revenue 0 2 6 Expense $(2,000 ) Expense 0 2 9 Expense $(1,500 ) Expense $(1,50 0) 3 1 Expense 0 Expense $ (100) 3 1 Revenue 0 Revenue $500 Req. 2 Income (loss) before tax $(900 ) Income before tax $2,60 0 Req. 3 The accrual basis better measures net income. For example, the accrual basis accounts for the prepayment of insurance on May 1 as an asset because prepaid insurance gives the business insurance coverage of the Chapter 3 Accrual Accounting & Income 268

- 108. business’ assets for the next five months. The cash basis ignores the future benefit (asset nature) of the prepayment and accounts for the prepayment as an expense. (10- 20 min.) P 3- 80B Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT Mar 31 a. Insurance Expense 3,400 * Prepaid Insurance 3,400 To record insurance expense 31 b. Salary Expense ($5,800 × 3/5) ……... 3,480 Salary Payable…………………….. 3,480 To accrue salary expense. 31 c. Interest Receivable………………….. 700 Interest Revenue………………….. 700 To accrue interest revenue. 31 d. Supplies Expense……………………. 6,600 * * Supplies…………………………….. 6,600 To record supplies expense. 31 e. Unearned Service Revenue ($12,100 × 60%) ……………………… 7,260 Service Revenue………………….. 7,260 Chapter 3 Accrual Accounting & Income 269

- 109. To record revenue that was collected in advance. 31 Depreciation Expense …………...…. 8,900 Accumulated Depreciation – Office Furniture…………… 3,500 Accumulated Depreciation – Equipment…………….. …… 5,400 To record depreciation expense. _____ * $500 + 3,800 $900 = $3,400− ** $2,700 + $6,100 $2,200 = $ 6,600− Chapter 3 Accrual Accounting & Income 270

- 110. (45- 60 min.) P 3-81B Req. 1 Kings, Inc. Adjusted Trial Balance August 31, 2010 TRIAL BALANCE ADJUSTMENTS ADJUSTED TRIAL BALANCE ACCOUNT TITLE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT Cash 9,200 9,200 Accounts receivable 1,500 (a) 2,000 3,500 Prepaid rent 2,400 (b) 800* 1,600 Supplies 2,200 (c) 1,820 380 Furniture 81,000 81,000 Accumulated depreciation 3,900 (d) 1,350** 5,250 Accounts payable 3,500 3,500 Salary payable (e) 3,120*** 3,120 Common stock 15,000 15,000 Retained earnings 71,020 71,020 Dividends 3,600 3,600 Advertising revenue 10,000 (a) 2,000 12,000 Salary expense 3,000 (e) 3,120*** 6,120 Rent expense (b) 800 * 800 Utilities expense 520 520 Depreciation expense (d) 1,350** 1,350 Supplies expense (c) 1,820 _____ 1,820 103,42 0 103,42 0 9,090 9,090 109,890 109,890 ___ Chapter 3 Accrual Accounting & Income 271

- 111. * $2,400 ÷ 3 = $800 ** $81,000 ÷ 5 = $16,200 ÷ 12 = $1,350 *** $5,200 × 3/5 = $3,120 Chapter 3 Accrual Accounting & Income 272

- 112. (continued) P 3-81B Req. 2 (continued) Kings, Inc. Income Statement Month Ended August 31, 2010 Revenues: Advertising revenue $12,00 0 Expenses: Salary expense $6,120 Rent expense 800 Depreciation expense 1,350 Utilities expense 520 Supplies expense 1,82 0 Total expenses 10,610 Net income $1,390 Kings, Inc. Statement of Retained Earnings Month Ended August 31, 2010 Retained earnings, August 1, 2010 $71,020 Add: Net income 1,390 72,410 Less: Dividends (3,600 ) Retained earnings, Aug 31, 2010 $68,810 Chapter 3 Accrual Accounting & Income 273

- 113. (continued) P 3-81B Req. 2 (continued) Kings, Inc. Balance Sheet August 31, 2010 ASSETS LIABILITIES Current assets: Current liabilities: Cash $9,200 Accounts payable $ 3,500 Accounts receivable 3,500 Salary payable 3,12 0 Prepaid rent 1,600 Total current liabilities 6,620 Supplies 3 80 Total current assets 14,680 Furniture $81,000 STOCKHOLDERS’ EQUITY Less: Accum. Common stock 15,000 deprec. (5,250 ) 75,750 Retained earnings 68,810 Total stockholders’ equity 83,810 _____ _ Total liabilities and _____ _ Total assets $90,43 0 stockholders’ equity $90,43 0 Chapter 3 Accrual Accounting & Income 274

- 114. (10- 20 min.) P 3-82B Req. 1 Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDI T Dec. 31 Accounts Receivable ($6,880 − $6,000) 880 Rental Revenue…………………………… . 880 To accrue rental revenue. 31 Supplies Expense ($900 $0)− ……………... 900 Supplies ($1,500 $600)− …………………. 900 To record supplies expense. 31 Insurance Expense ($1,700 $0)− ………….. 1,700 Prepaid Insurance ($2,500 $800)− …….. 1,700 To record insurance expense. 31 Depreciation Expense ($1,500 $0)− ……… 1,500 Accumulated Depreciation ($10,300 $8,800)− …………………………. 1,500 To record depreciation expense. 31 Wage Expense ($2,700 $1,900)− …………. 800 Wages Payable ($800 $0)− …………..…. 800 To accrue salary expense. 31 Interest Receivable ($500 0)……….− ……. 500 Interest Income ($500 $0)− 500 Chapter 3 Accrual Accounting & Income 275

- 115. …………….. To accrue interest expense. 31 Unearned Rental Revenue ($1,500 $1,200)− …………………………… 300 Rental Revenue…………………………. 300 To record revenue that was collected in advance. Chapter 3 Accrual Accounting & Income 276

- 116. (continued) P 3-82B Req. 2 Total assets = $78,380 ($7,900 + $6,880 + $500 + $5,000 + $600 + $800 + $67,000 $10,300)− Total liabilities = $8,500 ($6,500 + $800 + $1,200) Total equity = $69,880 ($78,380 $8,500)− Net income = $12,780 ($19,480 + $700 $1,500− − $900 $300 $2,700 $300− − − − $1,700) Chapter 3 Accrual Accounting & Income 277

- 117. (20- 30 min.) P 3-83B Req. 1 Sneed Corporation Income Statement Year Ended October 31, 2010 Revenues: Service revenue $101,7 00 Expenses: Salary expense $40,50 0 Rent expense 10,200 Insurance expense 3,600 Interest expense 3,200 Supplies expense 2,900 Depreciation expense 1,20 0 61,600 Income before tax 40,100 Income tax expense 7,50 0 Net income $ 32,600 Sneed Corporation Statement of Retained Earnings Year Ended October 31, 2010 Retained earnings, October 31, 2009 $ 4,000 Add: Net income 32,600 36,600 Less: Dividends (25,000 ) Retained earnings, October 31, 2010 $ 11,600 Chapter 3 Accrual Accounting & Income 278

- 118. (continued) P 3-83B Req. 1 (continued) Sneed Corporation. Balance Sheet October 31, 2010 ASSETS LIABILITIES Cash $ 1,600 Accounts payable $ 3,800 Accounts receivable 8,800 Unearned service Supplies 2,100 revenue 900 Prepaid rent 1,000 Interest payable 4 00 Income tax payable 2,500 Equipment $36,700 Note payable 18,60 0 Less: Accum. Total liabilities 26,200 deprec. (4,400 ) 32,300 STOCKHOLDERS’ EQUITY Common stock 8,0 00 Retained earnings 11,60 0 Total stockholders’ equity 19,60 0 Total liabilities and Total assets $45,800 stockholders’ equity $45,800 Req. 2 Debt ratio: $26,200 = 0.57 $45,800 Sneed Corporation’s debt ratio of 0.57 is in compliance with the lenders’ debt restriction. Chapter 3 Accrual Accounting & Income 279

- 119. Chapter 3 Accrual Accounting & Income 280

- 120. (20 min.) P 3-84B Req. 1 Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT Closing Entries Mar . 31 Service Revenue……………………… 94,100 Retained Earnings………………… 94,100 31 Retained Earnings……………………. 36,300 Salary Expense…………………….. 18,100 Supplies Expense…………………. 4,300 Advertising Expense……………… 11,100 Depreciation Expense……………. 2,000 Interest Expense…………………... 800 31 Retained Earnings……………………. 30,000 Dividends…………………………… 30,000 Req. 2 Retained Earnings Mar. 31, 2010 Expenses 36,30 0 Mar. 31, 2009 Bal. 22,00 0 Mar. 31, 2010 Dividends 30,00 0 Mar. 31, 2010 Revenues 94,10 0 Mar. 31, 2010 Bal. 49,80 0 Chapter 3 Accrual Accounting & Income 281

- 121. Net income = $57,800 (revenues of $94,100 minus expenses of $36,300) Req. 3 Retained Earnings increased during the year because net income of $57,800 exceeded dividends of $30,000. Chapter 3 Accrual Accounting & Income 282

- 122. (30- 40 min.) P 3-85B Req. 1 Sunny Stream Service, Inc. Balance Sheet March 31, 2010 ASSETS Current assets: Cash…………………………………………………… . $ 7,300 Accounts receivable………………………………… 16,400 Supplies………………………………………… …….. 3,30 0 Prepaid expenses 5,70 0 Total current assets……………………………... $32,700 Plant assets: Equipment……………………………… … $42,500 Less accumulated depreciation…. (7,300 ) 35,200 Other assets…………………………………………… .. 14,500 Total assets……………………………………………… $82,400 LIABILITIES Current liabilities: Accounts payable…………………………………… 14,300 Current portion of note payable 50 0 Salary payable……………………………………….. 2,600 Chapter 3 Accrual Accounting & Income 283

- 123. Unearned service revenue……………………… 2,600 Total current liabilities…………………………... 20,000 Note payable, long- term………………………………. 5,900 Total liabilities…………………………………………... 25,900 STOCKHOLDERS’ EQUITY Common stock………………………………………….. 6,700 Retained earnings ……………………………………... 49,800 * Total stockholders’ equity……………………………. 56,500 Total liabilities and stockholders’ equity…………... $82,400 _____ *See next page. Chapter 3 Accrual Accounting & Income 284

- 124. (continued) P 3-85B Req. 1 (continued) _____ *Computation: Retained earnings, March 31, 2009……… $ 22,000 Add: Net income ($94,100 $18,100− − $4,300 $11,100 $2,000 $800)− − − ……………... 57,800 79,800 Less: Dividends…………………………………. (30,000 ) Retained earnings, March 31, 2010……… $49,800 Req. 2 2010 200 9 Current ratio = Total current assets = $32,700 = 1.64 1.40Total current liabilities $20,000 The ability to pay current liabilities with current assets improved during 2010. Debt ratio = Total liabilities = $25,90 0 = 0.3 1 0.2 5Total assets $82,40 0 Sunny Stream Services’ overall debt position deteriorated a bit from 2009 to 2010. However, the company’s debit position is still very strong. Chapter 3 Accrual Accounting & Income 285

- 125. Chapter 3 Accrual Accounting & Income 286

- 126. (45- 60 min.) P 3-86B Req. 1 (All amounts in millions) Current ratio = Total current assets = $15. 3 = 1.7 8Total current liabilities $8.6 $14.0 Debt ratio = Total liabilities = $8.6 + $5.4 = 0.4 4 Total assets $31.7 Req. 2 Current Ratio Debt Ratio a . $15.3 ($8.6 × 1/2)− = 2.5 6 $14.0 ($8.6 ×− 1/2) = 0.3 5($8.6 × 1/2) $31.7 ($8.6 ×− 1/2) b . $15.3 + $7.0 = 2.5 9 $14.0 + $7.0 = 0.5 4$8.6 $31.7 + $7.0 c . $15.3 + $2.5 = 2.0 7 $14.0 = 0.4 1$8.6 $31.7 + $2.5 d . $15.3 $3.0− = 1.4 3 $14.0 = 0.4 9$8.6 $31.7 $3.0− e . $15.3 = 1.6 5 $14.0 + $0.7 = 0.4 6$8.6 + $0.7 $31.7 f. $15.3 $1.9− = 1.5 6 $14.0 + $2.8 = 0.4 9 $8.6 $31.7 + $4.7 − $1.9 g . $15.3 = 1.7 8 $14.0 = 0.4 5$8.6 $31.7 $0.6− Chapter 3 Accrual Accounting & Income 287

- 127. (continued) P 3-86B Req. 3 a. Revenues usually increase the current ratio. b. Revenues usually decrease the debt ratio. c. Expenses usually decrease the current ratio. Note: Depreciation is an exception to this rule. d. Expenses usually increase the debt ratio. e. If a company’s current ratio is greater than 1.0, as for Hillsboro, paying off a current liability will always increase the current ratio. f. Borrowing money on long-term debt will always increase the current ratio and increase the debt ratio. Chapter 3 Accrual Accounting & Income 288

- 128. Decision Cases (25 min.) Decision Case 1 Req. 1 Unadjusted trial balance: Cash………………………………… ….. $8,000 Accounts receivable…………………. 4,200 Supplies…………………………… …... 800 Prepaid rent…………………………… 1,200 Land………………………………… ….. 43,000 Accounts payable……………………. $12,000 Salary payable………………………… –0– Unearned service revenue………….. 700 Note payable, due in 3 years……….. 23,400 Common stock………………………... 5,000 Retained earnings……………………. 9,300 Service revenue………………………. 9,100 Salary expense……………………….. 3,400 Rent expense………………………….. –0– Advertising expense…………………. 900 Supplies expense…………………….. – 0– Totals……………………………… …… $61,500 $59,500 Chapter 3 Accrual Accounting & Income 289

- 129. Out of balance $2,000 Chapter 3 Accrual Accounting & Income 290

- 130. (continued) Decision Case 1 Req. 2 Adjusted trial balance: Cash………………………………………… …... $8,000 Accounts receivable………………………….. 4,200 Supplies ($800 -400).. …………………………. 400 Prepaid rent ($1,200 x 11/12) ………………… 1,100 Land ($41,000 + $2,000) ………………………. 43,000 Accounts payable……………………………... 12,000 Salary payable…………………………………. 1,000 Unearned service revenue ($700 - $500)…. 200 Note payable, due in 3 years………………... 25,400 Common stock………………………………… 5,000 Retained earnings…………………………….. 9,300 Service revenue ($9,100 + $500) ……………. 9,600 Salary expense ($3,400 + $1,000) ………….. 4,400 Rent expense ($1,200 x 1/12) ……………….. 100 Advertising expense………………………….. 900 Supplies expense……………………………... 40 0 Total………………………………………… …… $62,50 0 $62,50 0 Req. 3 Chapter 3 Accrual Accounting & Income 291

- 131. Current ratio = $8,000 + $4,200 + $400 + $1,100 $12,000 + $1,000 + $200 = $13,70 0 = 1.04 $13,20 0 We might have trouble sleeping at night with a current ratio of 1.04. To be safe, the current ratio should be around 1.40 or higher. Chapter 3 Accrual Accounting & Income 292

- 132. (20- 30 min.) Decision Case 2 Eagle Restaurant, Inc. Income Statement Month Ended October 31, 2011 Sales revenue $32,000 Cost of goods sold $12,000 Wages expense 5,000 Rent expense 4,000 Insurance expense 1,000 Depreciation expense 1,00 0 23,00 0 Net income $ 9,000 Eagle Restaurant, Inc. Statement of Retained Earnings Month Ended October 31, 2011 Retained earnings, beginning $ 0 + Net income 9,000 - Dividends (3,000 ) Retained earnings, October 31, 2011 $6,000 Chapter 3 Accrual Accounting & Income 293

- 133. (continued) Decision Case 2 Eagle Restaurant, Inc. Balance Sheet October 31, 2011 ASSETS LIABILITIES Cash $ 8,000 Accounts payable $ 7,000 Food inventory 5,000 Unearned revenue 3,000 Prepaid insurance 1,000 10,000 Dishes, silver 4,000 Fixtures $24,000 OWNERS’ EQUITY Less: Accum. Common stock $25,00 0 deprec. (1,000 ) 23,00 0 Retained earnings 6,00 0 31,00 0 Total assets $41,00 0 Total liabilities and equity $41,00 0 Recommendation: Do not expand the business. It is not meeting Marks’ goals for net income or for total assets. Chapter 3 Accrual Accounting & Income 294

- 134. (30- 40 min.) Decision Case 3 Req. 1 (your highest price) Advertising revenue ($22,000 + $4,000) $26,000 Expenses: Salary $4,000 Utilities 900 Other (unrecorded) 1,100 Salary of your manager 5,000 11,00 0 Your expected monthly net income $15,000 Multiplier to compute price X 16 Your highest price $240,00 0 Req. 2 (Williams’ asking price) SW Advertising, Inc. Statement of Retained Earnings and Common Stock June 30, 2010 Beginning retained earnings $ 93,000 Add: Net income Revenue ($22,000 + $4,000) $26,000 Less: Expenses ($4,000 + $900 + $1,100) (6,000) 20,000 113,000 Less: Dividends (9,000 ) Ending retained earnings $104,00 0 Common stock 50,000 Stockholders’ equity, June 30, 2010 $154,00 0 Multiplier to compute price X Chapter 3 Accrual Accounting & Income 295

- 135. 2__ Williams’ asking price $308,00 0 Chapter 3 Accrual Accounting & Income 296

- 136. (continued) Decision Case 3 Req. 3 You may start by offering Williams approximately $225,000 for the business. His asking price is $308,000 so you are starting out quite far apart. If Williams appears especially eager to sell out, you may be able to buy the firm for closer to your highest price of $240,000. However, if he is not so eager to sell and if you want the business badly enough, you may have to pay somewhere between $240,000 and $308,000. It might pay to hire an expert to value the business’s assets. You may find that Williams’ price is inflated based on the value of its assets. You can always raise your offer, but you cannot decrease it, so start the negotiating process with an offer around $225,000. Chapter 3 Accrual Accounting & Income 297

- 137. Ethical Issues Ethical Issue 1 1. The journal entry to record the revenue is: Dec. Accounts Receivable………... XXX Sales Revenue…………….. XXX The debit to Accounts Receivable will increase total current assets and, as a result, increase (improve) the current ratio. The credit to Sales Revenue will increase total owner equity and, as a result, decrease (improve) the debt ratio. 2. a. – c. The issue is whether it is ethical to record the revenue in the current year. The contract has been signed, but the implication is that the company will not have done everything it needs to do in order to earn the revenue in the current year. The stakeholders are the company, the bank, the stockholders, and the company’s other creditors. From an economic standpoint, the entry would obviously improve the company’s short term financial position. However, the advantage would probably be short-lived. When the bank finds out about this entry, they will likely protest, and demand immediate payment, so the longer-term economic impact will likely be negative. From a “legal” standpoint, to record this transaction in December violates GAAP by violating the revenue principle. In this case Cross Timbers has not made the sale (has not delivered the merchandise) to the customer and, therefore, has not earned the revenue prior to December 31 of the current year. From an ethical standpoint, recording this revenue violates the bank’s rights for proper disclosure of the company’s income and assets. Revenue should be recorded no earlier than when it is earned. Cross Timbers expects to earn Chapter 3 Accrual Accounting & Income 298

- 138. the revenue in January of next year. Cross Timbers clearly cannot record this revenue until it is earned. To do so is not in their best economic, legal (GAAP) or ethical best interests. 3. The authors would suggest either of two actions. Cross Timbers can either: a. Report the current ratio of 1.47 and the debt ratio of . 51 because these are the true values. Then tell the bank of the signed contract for additional work and the hope for a better set of ratio values next year. In some cases, banks will agree to sign a waiver of the terms of loan covenants, meaning that, although the company is in violation, the bank will not move to enforce the covenant. They may give Cross Timbers a “grace period” to cure the violation in the covenant. b. Pay off some current liabilities before year end. This will improve both the current ratio and the debt ratio. This may enable Cross Timbers to bring its ratio values into compliance with the bank’s requirements. Chapter 3 Accrual Accounting & Income 299

- 139. Ethical Issue 2 1. These transactions — recorded as directed by Almond — overstate the reported income of the company by $21,000 ($10,000 + $10,000 + $1,000). 2. It appears that Almond wants to improve the company’s reported income in order to borrow on favorable terms. Her action is unethical and probably illegal as well because she is deliberately overstating the company’s reported income. Almond appears to be letting the potential short term economic advantage of these deliberate misstatements take precedence. She needs to remember that these misstatements violate GAAP, and that, depending on what use is made of the financial statements, could subject the company to civil or criminal legal proceedings. If this happens, the short term economic gains ($21,000) would not even come close to the long- term economic costs associated with the legal actions, not to mention the negative publicity. The business will need a bank loan, and perhaps the money would be used to pay bills, expand the business, and so on. However, based on Almond’s lack of integrity, the money may be destined for her own use. Regardless of its use, the money is obtained under false pretenses and cannot be headed for a good outcome. The bank is harmed by Almond’s and Lail’s actions. Lending money to Almond under false pretenses may Chapter 3 Accrual Accounting & Income 300

- 140. lead the bank to charge an unrealistically low interest rate that robs the bank’s owners of interest revenue. In the extreme, the public is robbed if taxpayers wind up financing the bailout of a failed institution. 3. Personal advice will vary from student to student. The purpose of asking this question is to challenge students to take the high road of ethical conduct by having nothing to do with Almond’s scheme. The authors would advise Lail, the accountant, to take these actions, in order: a. Refuse to take any part in Almond’s scheme, explaining that the result is overstatement of reported income. This is both illegal and unethical, and will ultimately have a negative economic impact on the company, as well. Accountants are bound to standards of ethical conduct that these actions violate. The can go to prison when caught falsifying financial statements. b. To remain ethical, the accountant must be willing to lose his/her job. It is better to protect one’s reputation even if that causes a short-term hardship. Chapter 3 Accrual Accounting & Income 301

- 141. Focus on Financials: Amazon.com, Inc. (15- 20 min.) Req. 1 Accrued expenses are expenses that have been incurred but that have not yet been paid as of the balance sheet date. The accrual and matching concepts require that all expenses be recognized during the period in which they are incurred in order to earn revenue, regardless of when they are paid. Req. 2 and Req. 4 (balances in millions at December 31, 2008) Accrued expenses and other Cash Beg. Bal. $902 (a) 90 2 (a) 902 (b) 1,093 (b) 2,335 End. Bal. $1,093 Operating expenses (b) 3,42 8 Chapter 3 Accrual Accounting & Income 302

- 142. (continued) Focus on Financials: Amazon.com, Inc. Req. 3 (amounts in millions) Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT a. Accrued expenses and other……. … 902 Cash………………….. 902 b. Operating expenses…. ………………. 3,428 Cash……………………..………... 2,335 Accrued expenses and other… 1,093 The balance of accrued expenses and other agrees with the financial statements at December 31, 2008. Chapter 3 Accrual Accounting & Income 303

- 143. (continued) Focus on Financials: Amazon.com, Inc. Req. 5 Current ratio: 2008 2007 (Dollar amounts in millions) Total current assets = $6,157 = 1.3 0 $5,164 = 1.3 9Total current liabilities $4,746 $3,714 Debt ratio: Total liabilities = $5,642* = 0.68 $5,288** = 0.82 Total assets $8,314 $6,485 *4,746 + $409 + $487 **3,714 + $1,282 + $292 The current ratio deteriorated slightly, but the debt ratio improved significantly during 2008. The company used cash to pay down long-term liabilities. This reveals strengthening leverage at the expense of only slightly weaker (but still respectable) liquidity. Chapter 3 Accrual Accounting & Income 304

- 144. Focus on Analysis: Foot Locker, Inc. (15- 20 min.) Req. 1 In fiscal 2006, Foot Locker earned the $59 million. In fiscal 2007, Foot Locker earned the $50 million, and $50 million is included in net income for fiscal 2007. Req. 2 $62 million impacted rent expense in 2007 net income computation. $65 million impacted rent expense in 2008 net income. This amount was still prepaid as of December 31, 2007. Req. 3 During 2008, Foot Locker, Inc. sold plant assets (property, plant, and equipment). They must have removed $67 million from accumulated depreciation for the plant assets that it sold ($870 + $100 - $903). Chapter 3 Accrual Accounting & Income 305

- 145. Req. 4 Customer deposits represent unearned income. When received, these amounts are credited to a current liability account. When customers redeem the gift cards, these amounts are debited to customer deposits and credited to sales revenue. The entry to record the increase in this account is (in millions): Cash………………………………………… …… 1 Customer deposits……………………… 1 During 2007, Foot Locker, Inc. collected $1 million from customers who were buying gift certificates. This transaction created a liability for Foot Locker, Inc. Chapter 3 Accrual Accounting & Income 306

- 146. Group Project (45 min.) Req. 1 Davis Lawn Service, Inc. Income Statement Four Months Ended August 31, 2010 Service revenue ($5,600 + $600) $6,200 Expenses: Wage expense ($1,900 + $200) $2,100 Rent expense ($600 × 4/6) 400 Supplies expense ($400 − $50) 350 Repair expense 300 Depreciation expense ($300× 1/3) 10 0 Total expenses 3,250 Net income $2,950 Chapter 3 Accrual Accounting & Income 307

- 147. (continued) Group Project Req. 2 Davis Lawn Service, Inc. Balance Sheet August 31, 2010 ASSETS LIABILITIES Current: Current: Cash $2,040 Wages payable $ 200 Accounts receivable 600 Total current liabilities 200 Receivable from Ludwig (or Prepaid rent) 200 Supplies 50 STOCKHOLDERS’ Total current assets 2,890 EQUITY Long-term: Common stock 400 Trailer $300 Retained earnings Less accum. ($2,950 $460)− 2,490 deprec. (100 ) 200 Total stockholders’ equity 2,890 Total liabilities and Total assets $3,090 stockholders’ equity $3,090 Chapter 3 Accrual Accounting & Income 308