QVP Performance

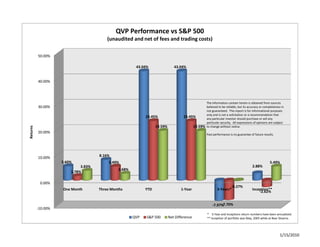

- 1. QVP Performance vs S&P 500 (unaudited and net of fees and trading costs) 50.00% 43.04% 43.04% 40.00% The information contain herein is obtained from sources 30.00% believed to be reliable, but its accuracy or completeness in not guaranteed. This report is for informational purposes only and is not a solicitation or a recommendation that 23.45% 23.45% any particular investor should purchase or sell any particular security. All expressions of opinions are subject 19.59% 19.59% to change without notice. Returns 20.00% Past performance is no guarantee of future results. R 8.16% 10.00% 5.60% 5.49% 5.49% 3.83% 2.88% 2.68% 1.78% 0.00% ‐0.27% One Month Three Months YTD 1‐Year 3‐Years* Inception** ‐2.62% ‐7.70% ‐7.97% ‐10.00% * 3‐Year and Inceptions return numbers have been annualized. QVP S&P 500 Net Difference ** Inception of portfolio was May, 2005 while at Bear Stearns. 1/15/2010