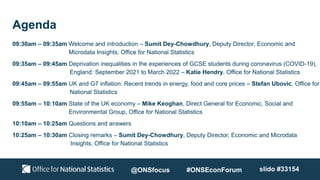

The document outlines the agenda and key findings from the Office for National Statistics Economic Forum, focusing on issues such as deprivation inequalities among GCSE students during COVID-19, inflation trends in the UK and G7, and the current state of the UK economy. Notable findings include marked disparities in educational access and outcomes for students from deprived areas, and ongoing high inflation particularly in core prices despite improvements in energy inflation. The forum also emphasizes the uncertain economic outlook and opens opportunities for public consultation and engagement in statistical development.