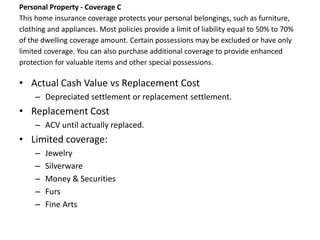

The document outlines the various standard coverages included in homeowners insurance policies, such as dwelling protection, personal property coverage, liability, and medical payments. It emphasizes the importance of adequate coverage limits and explains specific details on each type of coverage, including optional enhancements and restrictions. Additionally, it briefly mentions flood insurance and its limitations under the National Flood Insurance Program (NFIP).