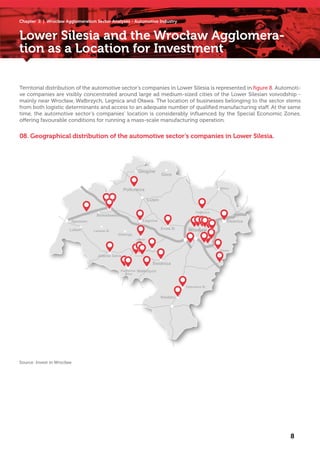

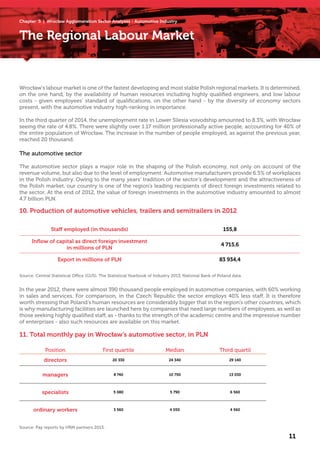

The document analyzes the automotive industry in the Wrocław agglomeration and Lower Silesia as key investment locations in Poland, highlighting the sector's growth potential and existing workforce capabilities. It emphasizes the impact of foreign investments and local companies, underscoring the region's favorable economic conditions and investment incentives. Additionally, it details the structural dynamics of the automotive sector, including production statistics and the importance of collaboration between academia and industry for future development.