Introduction

"Work in progress" (WIP) is a term used across various industries to describe tasks, projects, or creations that are incomplete but actively being developed. Whether in art, construction, software development, manufacturing, or personal projects, WIP represents the dynamic state of ongoing effort. This concept is essential in project management, creative processes, and workflow optimization.

This detailed exploration will cover:

The Definition and Importance of Work in Progress

WIP in Different Industries

Challenges of Managing WIP

Strategies for Effective WIP Management

Psychological and Productivity Aspects

Case Studies and Real-World Examples

Future Trends in WIP Optimization

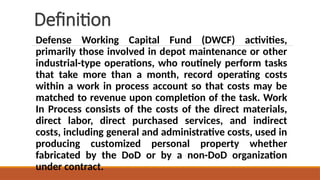

1. The Definition and Importance of Work in Progress

Work in progress refers to any unfinished task or project that is currently being developed. It is a critical concept in:

Project Management – Tracks ongoing tasks to ensure timely completion.

Manufacturing – Partially completed goods awaiting final assembly.

Creative Fields – Unfinished artworks, manuscripts, or designs.

Software Development – Features or code in development but not yet deployed.

Why WIP Matters:

Helps in resource allocation.

Prevents bottlenecks in production.

Ensures continuous workflow without overburdening teams.

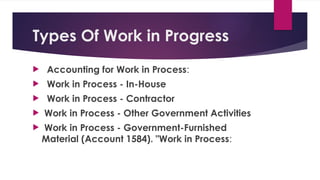

2. WIP in Different Industries

A. Manufacturing & Construction

Just-In-Time (JIT) Manufacturing – Minimizes WIP to reduce storage costs.

Lean Manufacturing – Focuses on reducing excess WIP to improve efficiency.

Construction Projects – Tracks ongoing builds (e.g., unfinished buildings, pending inspections).

B. Software Development & Agile Methodologies

Scrum & Kanban – Use WIP limits to prevent overload.

Continuous Integration (CI) – Code in progress must be tested before merging.

C. Creative Industries (Art, Writing, Film)

Unfinished novels, half-painted canvases, or partially edited films.

Iterative processes where revisions are constant.

D. Personal Productivity & Self-Improvement

Incomplete learning goals (e.g., learning a language).

Half-finished home projects.

3. Challenges of Managing WIP

Excessive WIP can lead to:

Resource Strain – Too many tasks slow down overall progress.

Quality Issues – Rushing to complete multiple tasks reduces attention to detail.

Stress & Burnout – Unfinished work can demotivate teams.

Financial Costs – In manufacturing, excess WIP ties up capital.

4. Strategies for Effective WIP Management

A. Implementing WIP Limits (Kanban Method)

Restricts the number of active tasks to improve focus.

B. Prioritization Techniques

Eisenhower Matrix – Focus on urgent & important tasks first.

MoSCoW Method – Categorizes tasks as Must-have, Should-have, Could-have, Won’t-have.

C. Agile & Scrum Practices

Sprint planning to break work into manageable chunks.

Daily stand-ups to track progress.

D. Automation & Digital Tools

Project management software (Trello, Asana, Jira).

AI-driven task schedulers.