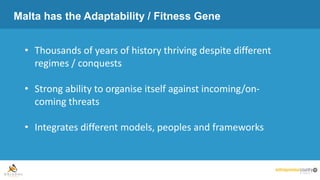

- Malta has the potential to become a leader in digital identity management and combating white collar crime through the use of blockchain technology due to its history of success in attracting business in industries like shipping, gaming, and financial services.

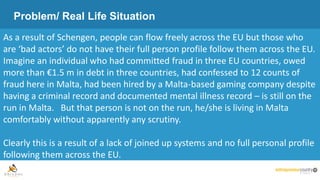

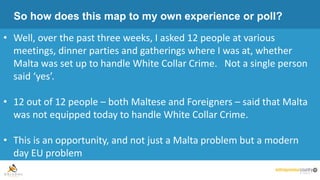

- However, Malta currently lacks the capabilities and resources to properly handle white collar crime, as indicated by interviews where 12 out of 12 people said Malta is not equipped to deal with it.

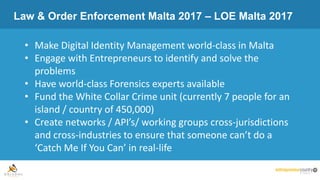

- By inviting entrepreneurs to help solve problems like digital identity management, and increasing funding and staffing for law enforcement, Malta could establish itself as a center of excellence for both financial services and technological solutions in these areas.