- WHV is an asset management firm with $14.3 billion assets under management and 71 employees as of March 31, 2013.

- Developed international equities posted strong returns in the first quarter of 2013, though these returns were reduced for US investors due to a stronger dollar. US equities outperformed, with smaller market caps performing particularly well.

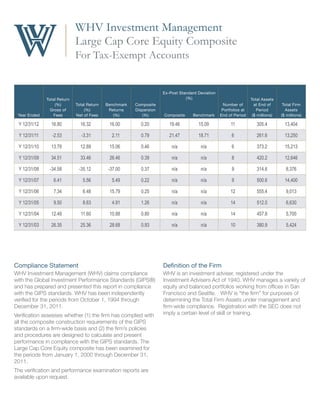

- WHV believes emerging markets equities present an attractive investment opportunity given their faster expected GDP growth, cheaper valuations, and exposure to expanding global consumers classes. WHV aims to provide broad emerging markets exposure through a diversified portfolio.