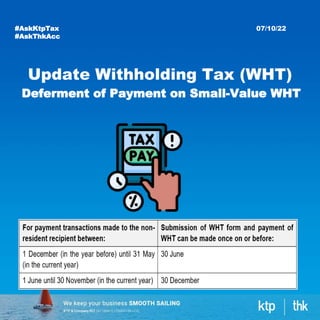

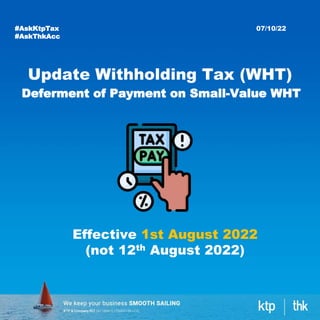

The document outlines the updates on the deferment of payment for small-value withholding tax (WHT) in Malaysia, effective from August 1, 2022. It specifies that individuals or entities must adhere to certain conditions, including that the WHT per transaction does not exceed RM500 and must be paid to the IRB every six months. The relevant forms for remittance are CP37 and CP37D, which require specific date entries corresponding to the transaction period.