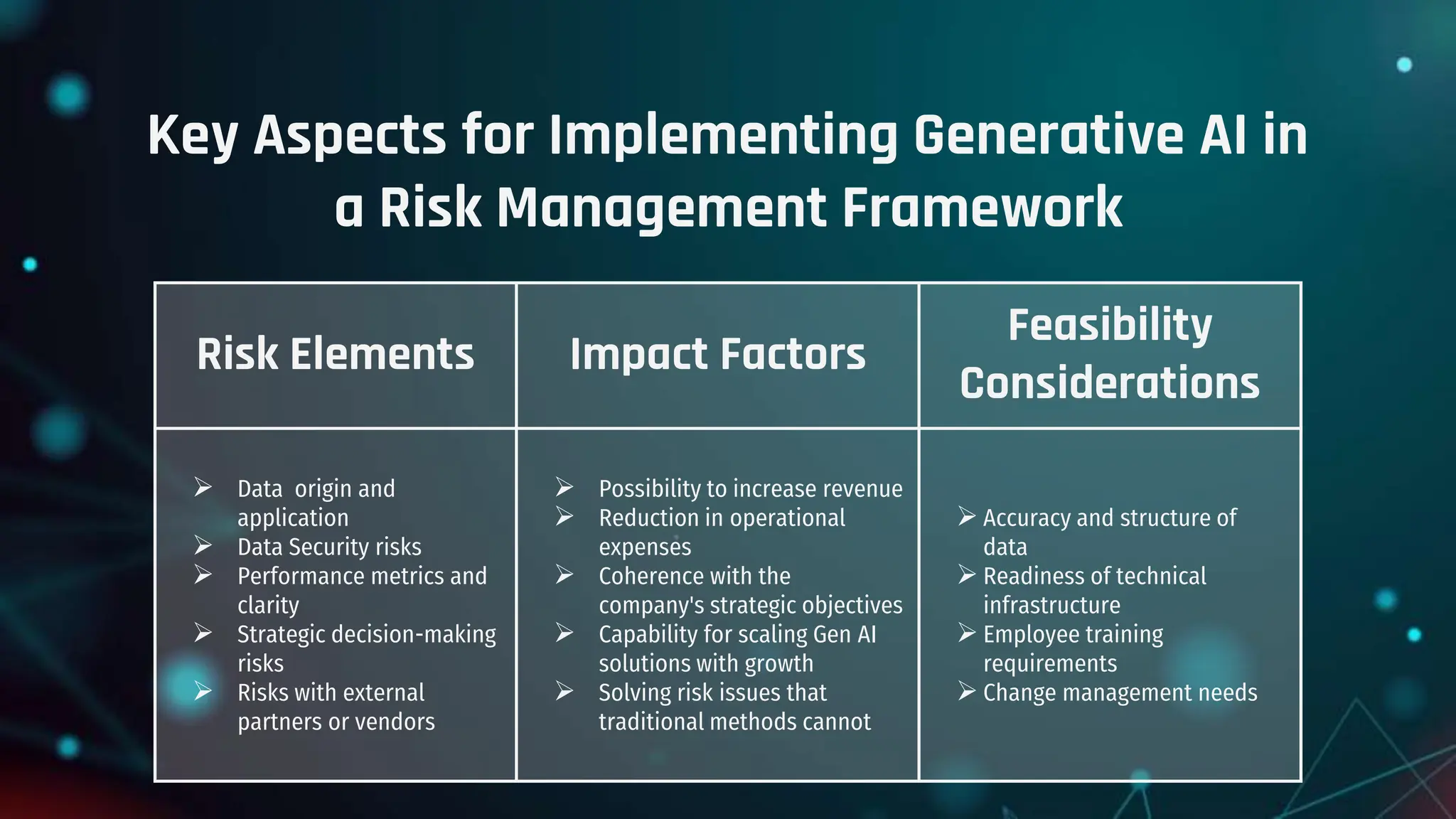

Generative AI (Gen AI) has the potential to significantly enhance efficiency in the financial services industry, particularly in risk management, by improving analytical models and regulatory compliance. Key considerations for implementation include data security, performance metrics, and alignment with strategic goals, while risk executives must ensure that their use of Gen AI adheres to established standards and legal frameworks. The implementation of tools like Predict360 ERM can improve decision-making and institutional resilience in a competitive market.