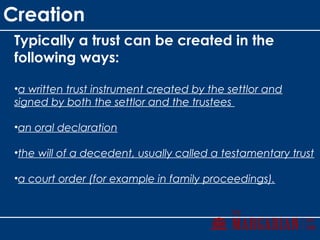

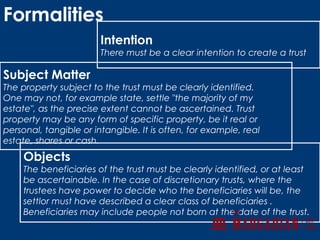

Trusts originated as a legal mechanism called a "use" to avoid feudal obligations and hold land for those away from battle. A modern trust involves a settlor transferring legal title of property to a trustee to hold for the benefit of beneficiaries. The trustee holds legal title and owes fiduciary duties to beneficiaries, who hold equitable title. Trusts are created through a written instrument or will and require clear identification of property, beneficiaries, and intent to create a trust. United States trust law is governed at the state level, with many states adopting uniform codes, and is also subject to federal tax law.