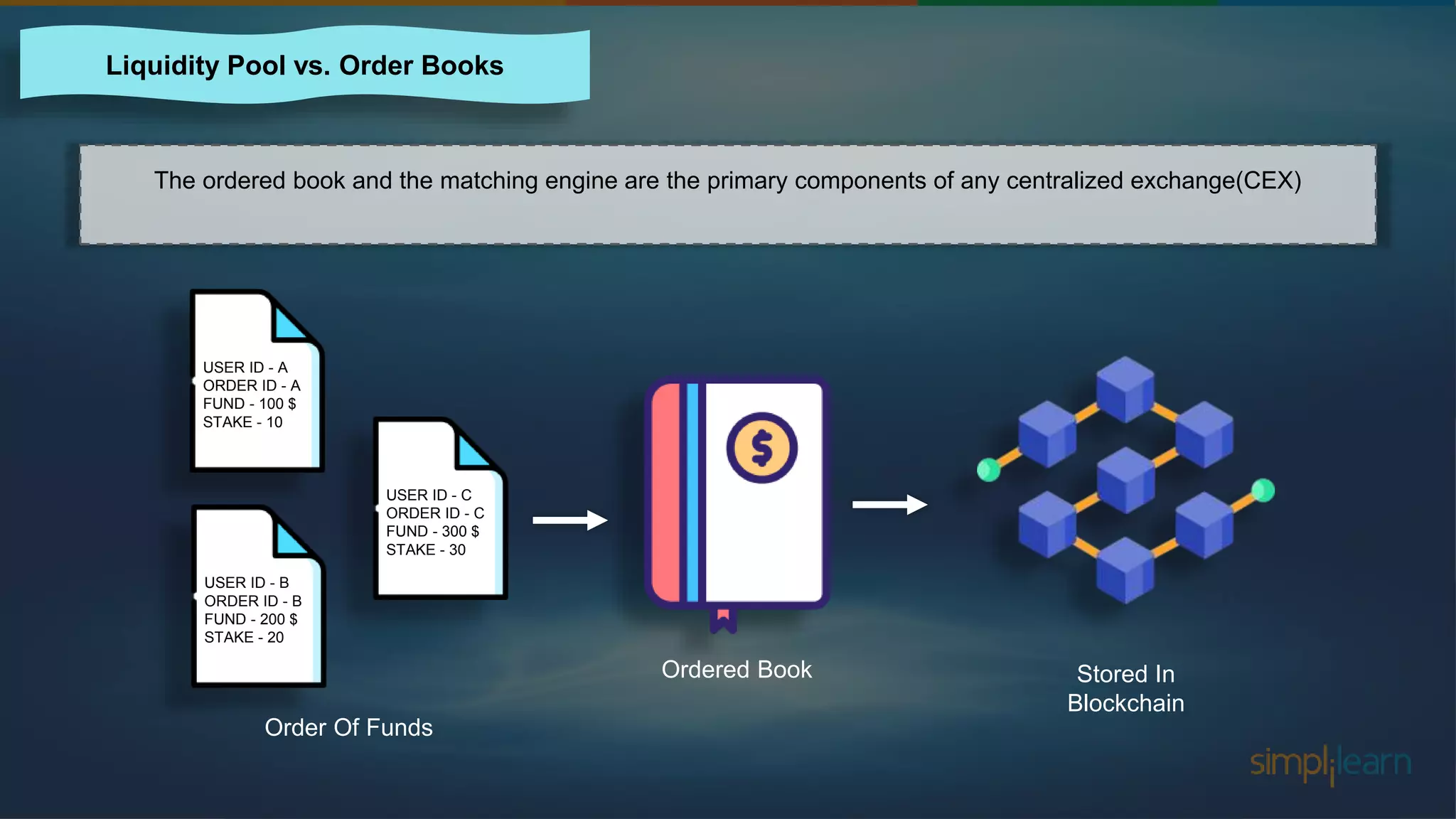

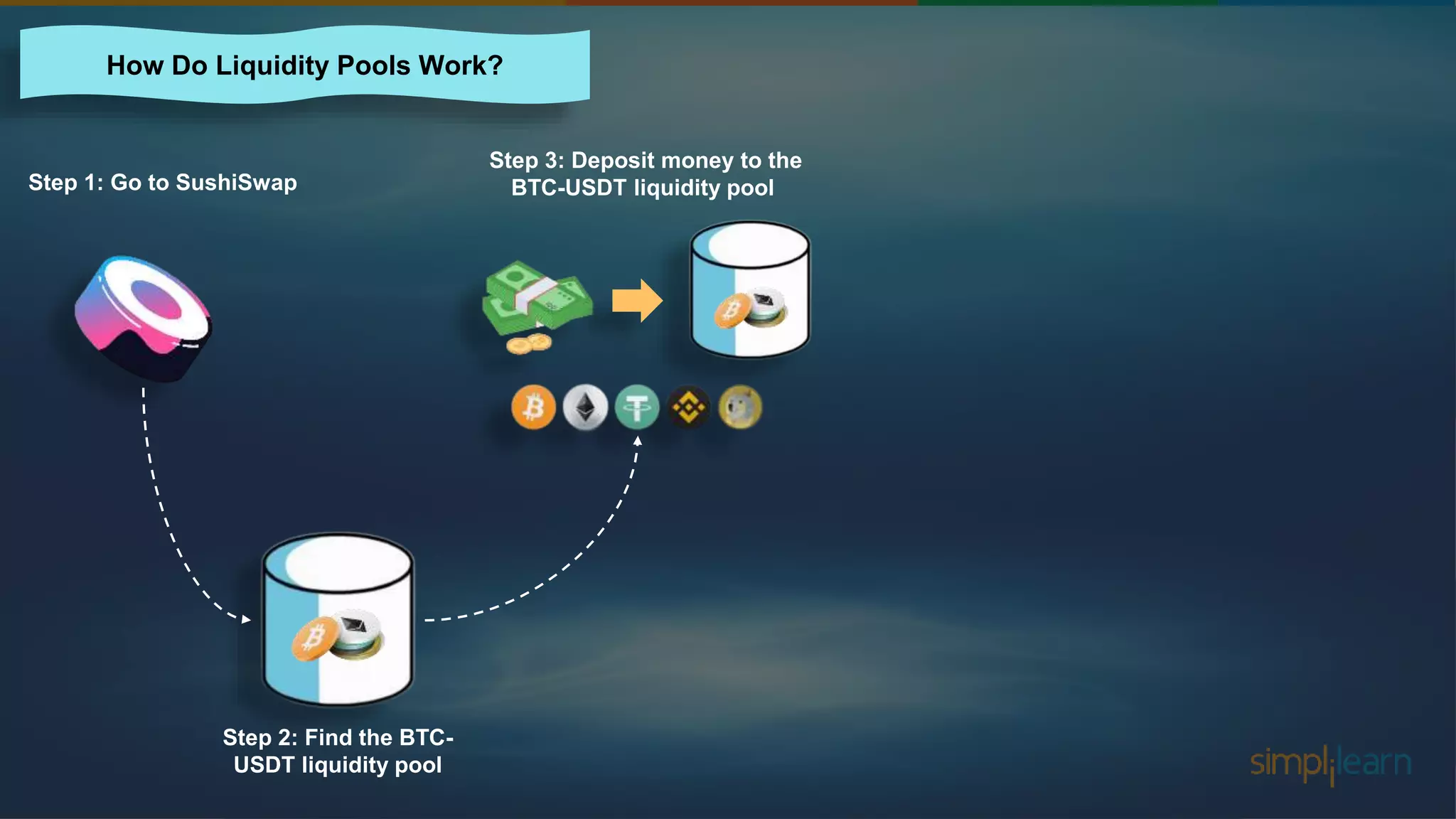

The document explores decentralized finance (DeFi) and liquidity pools, explaining that DeFi enables direct financial transactions without intermediaries. It discusses how liquidity pools allow users to pool their assets in decentralized exchanges, rewarding them for staking while contrasting this mechanism with traditional order books. Additionally, it outlines the pros and cons of liquidity pools, including the potential for fraud and benefits such as current market price transactions and decentralization.