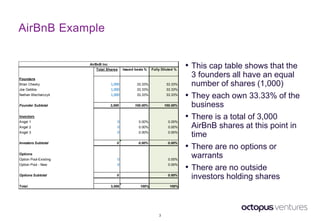

The document describes an example cap table for AirBnB showing:

- The three founders each originally owned 1,000 shares (33.33% each) for a total of 3,000 shares

- An investment round was held where AirBnB raised £1 million, issuing 1,000 new shares to investors

- This reduced the founders' ownership to 25% each but increased the total shares to 4,000