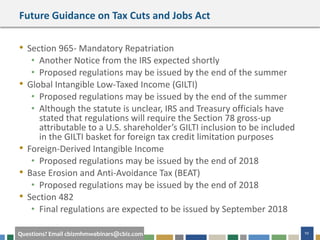

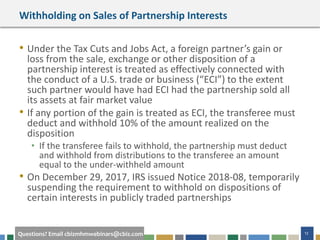

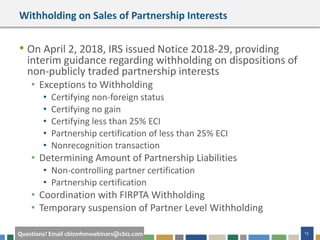

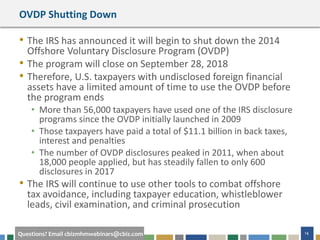

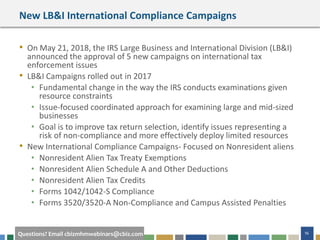

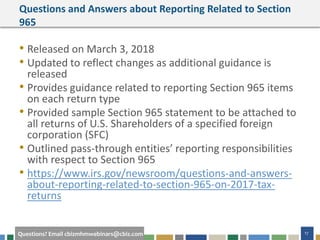

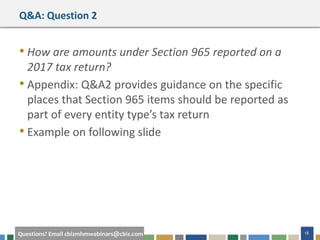

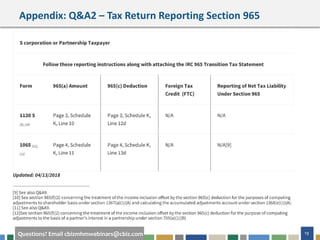

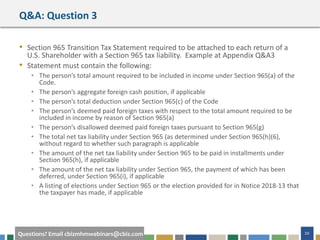

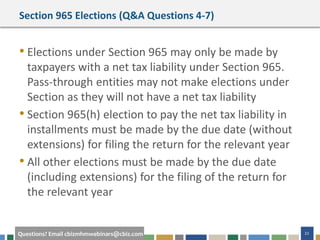

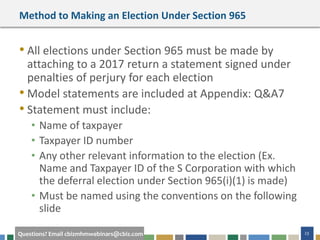

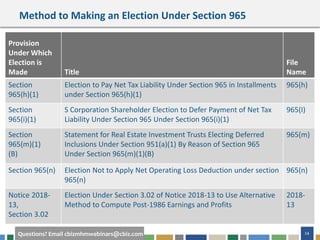

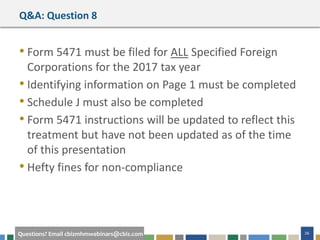

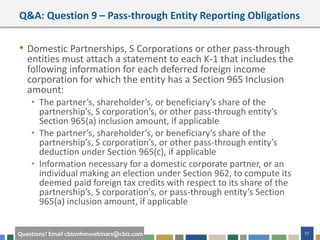

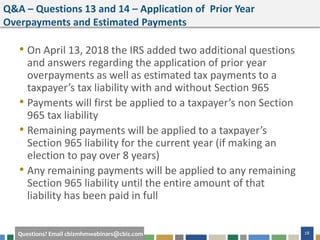

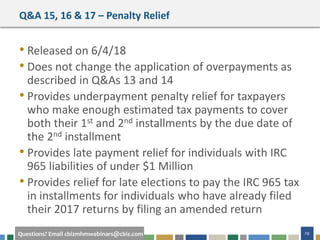

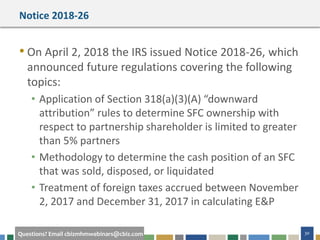

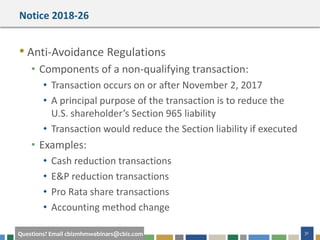

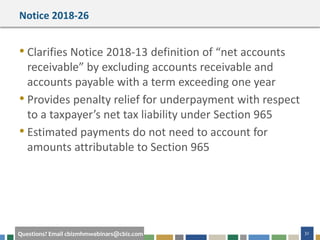

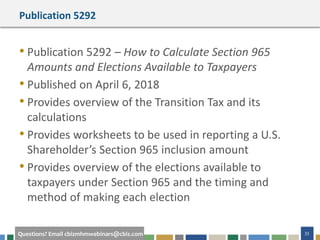

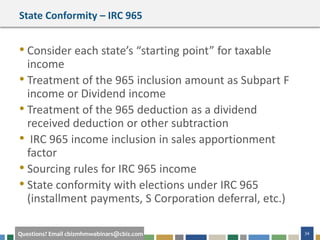

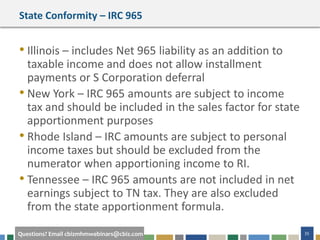

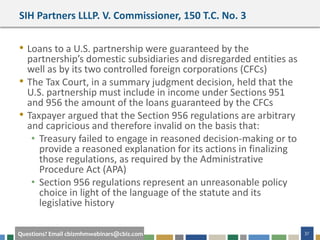

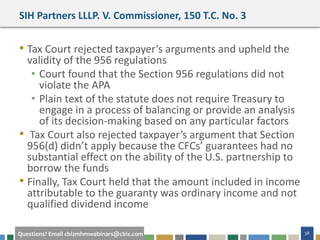

This document contains a webinar presentation by CBIZ and MHM discussing key updates on international tax considerations, including the Tax Cuts and Jobs Act and its implications for withholding on sales of partnership interests and the Offshore Voluntary Disclosure Program. It highlights eligibility for CPE credits, introduces the speakers and their expertise, and outlines the agenda along with various international tax issues facing businesses. Additionally, it provides guidance on compliance and reporting under Section 965, including upcoming regulations and election procedures for taxpayers.