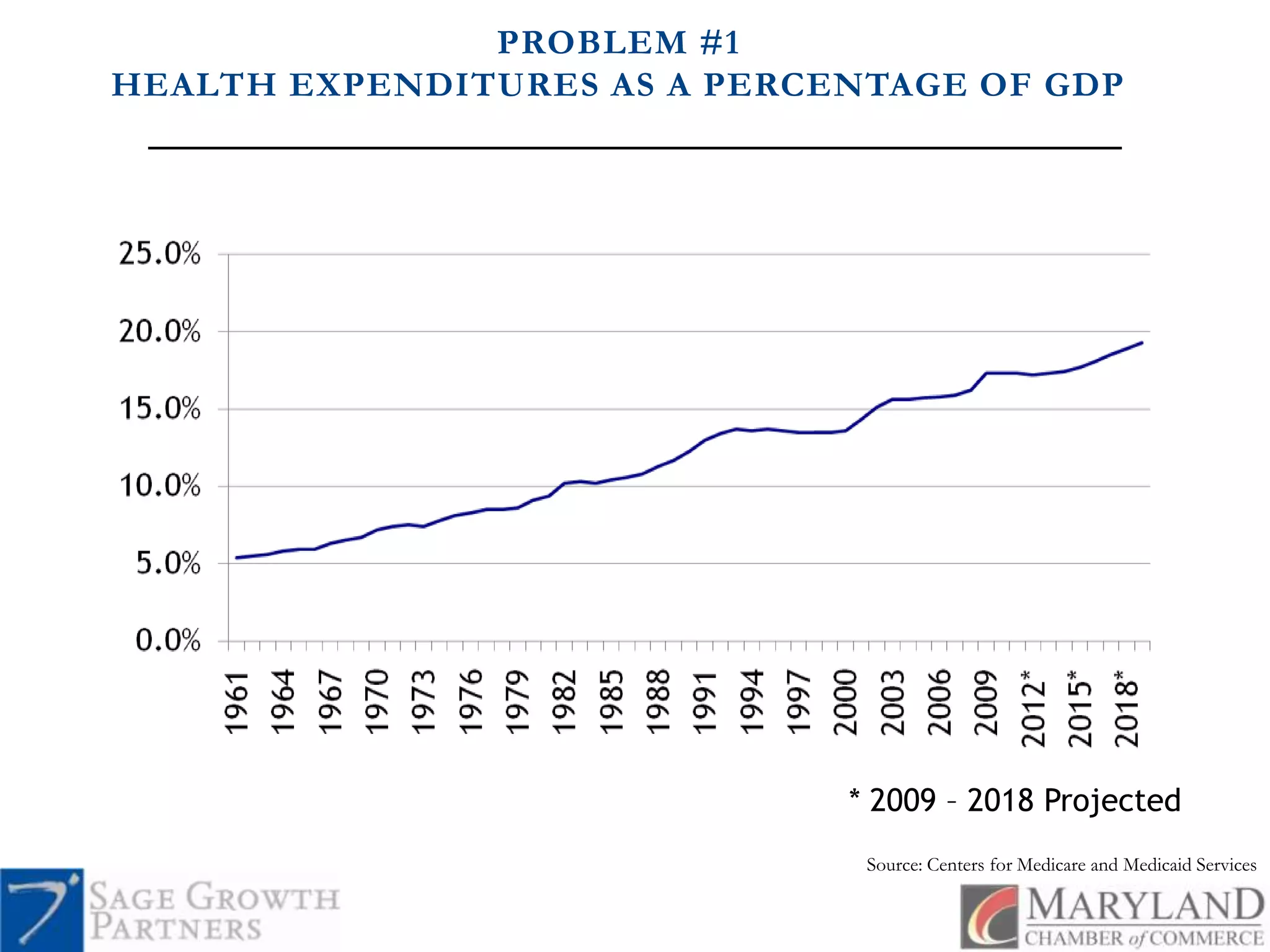

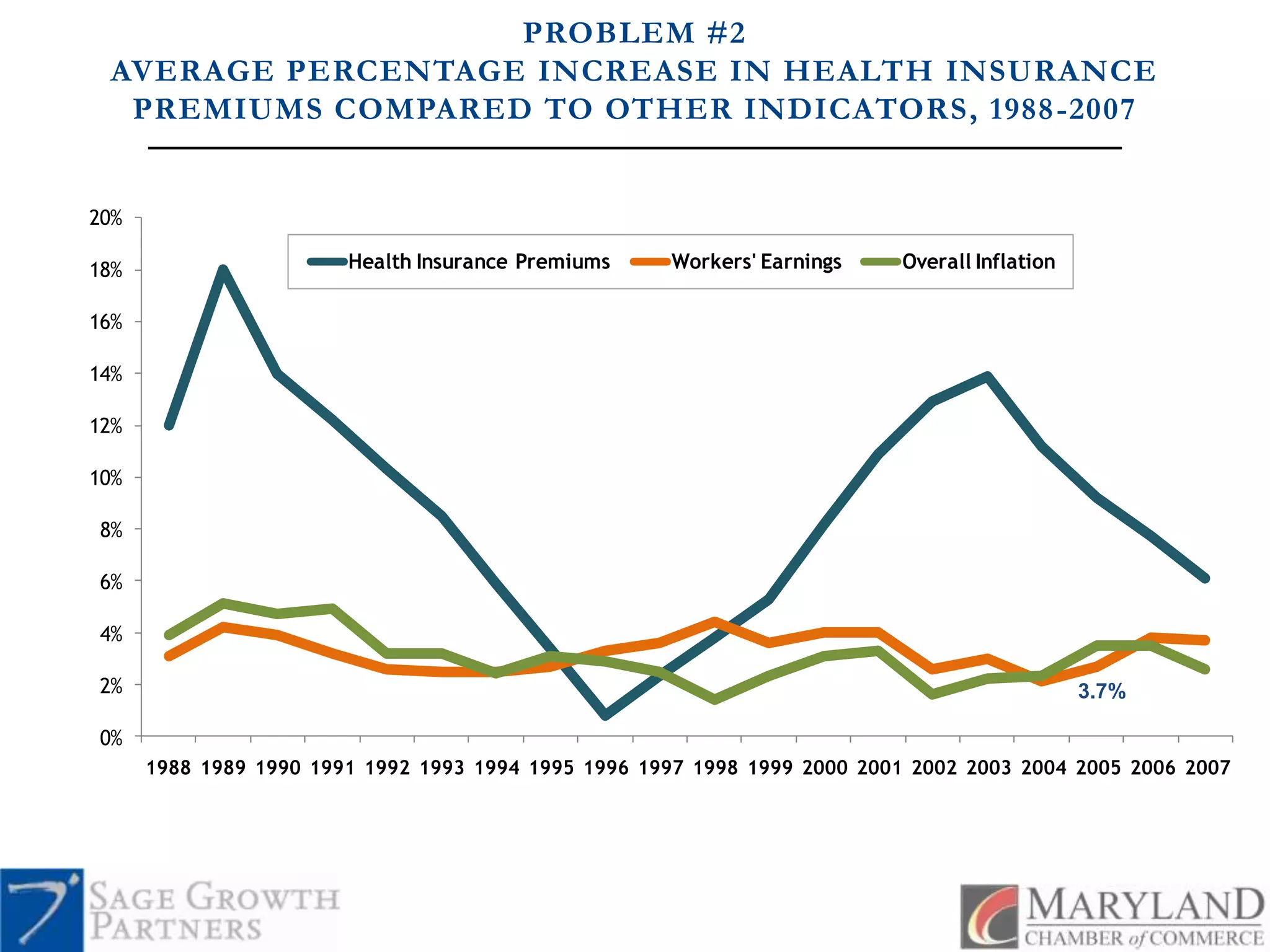

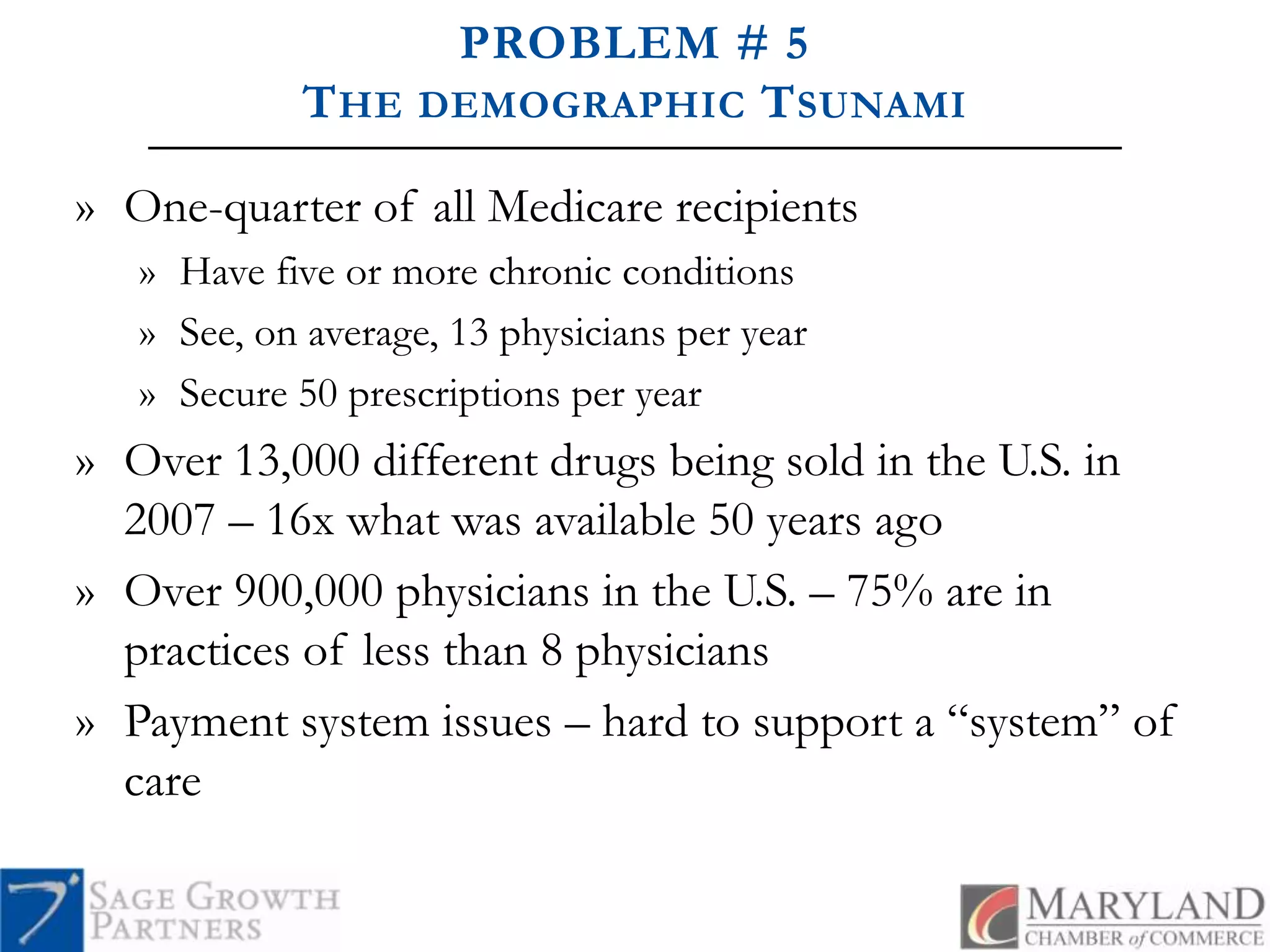

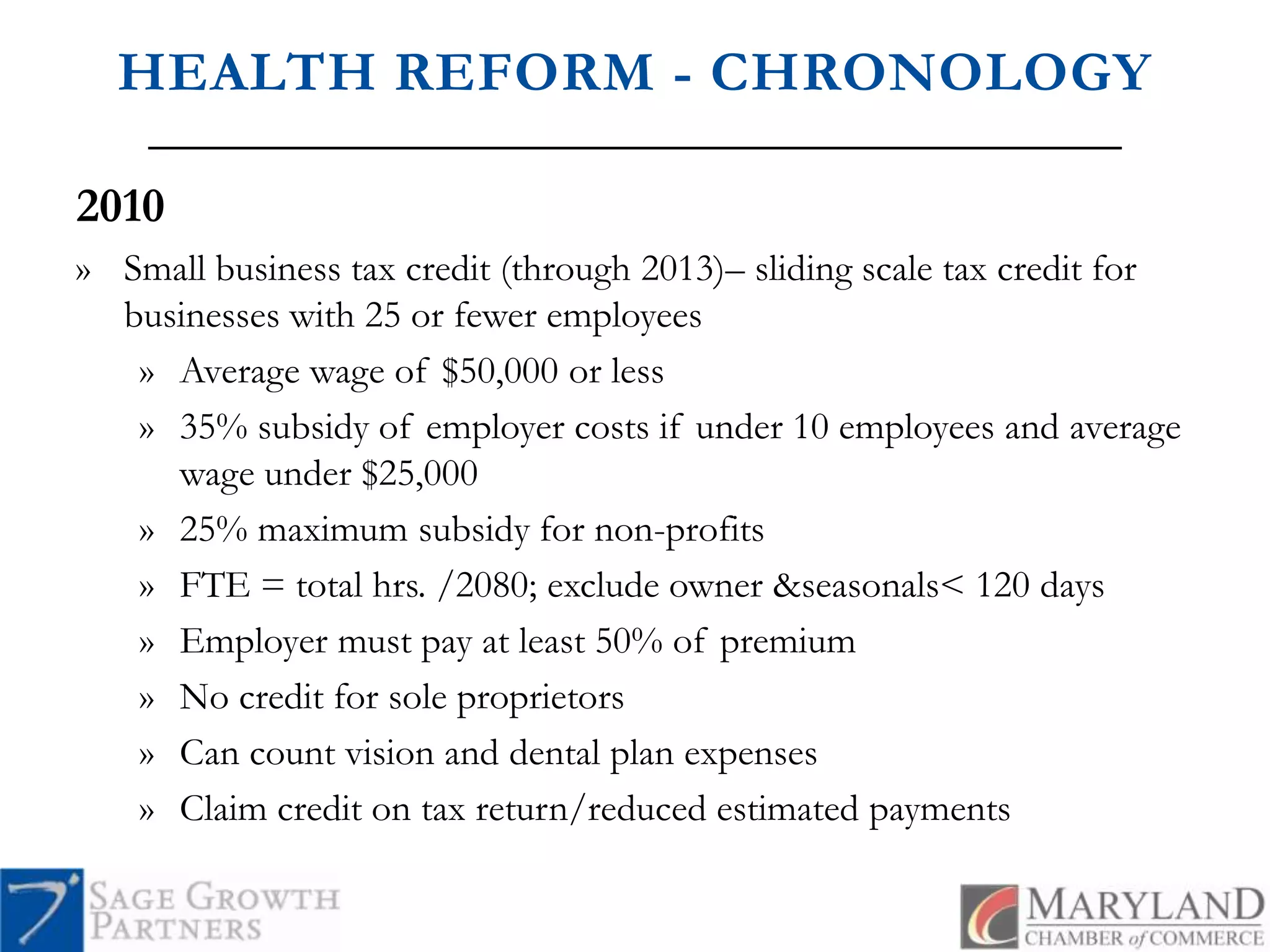

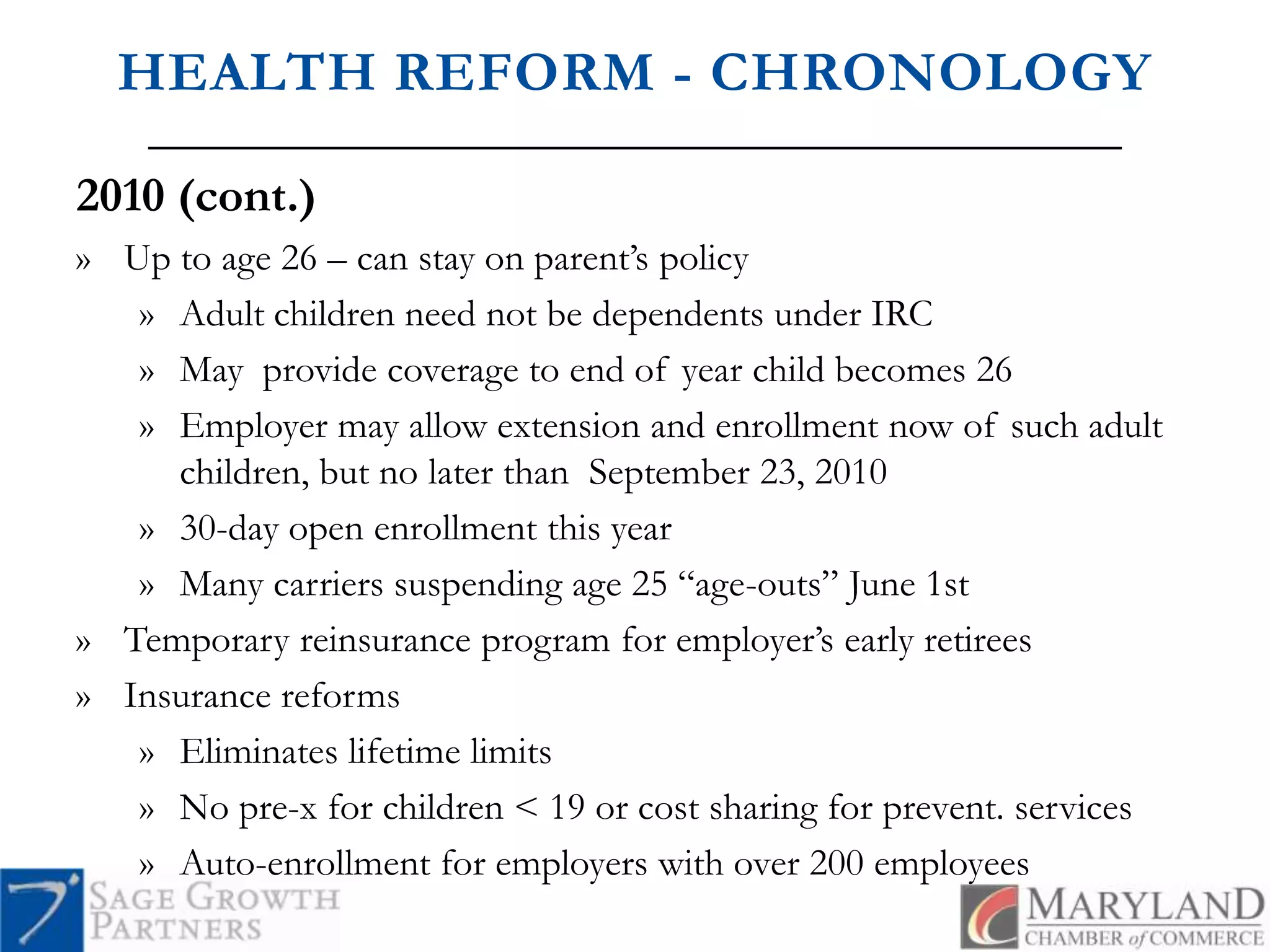

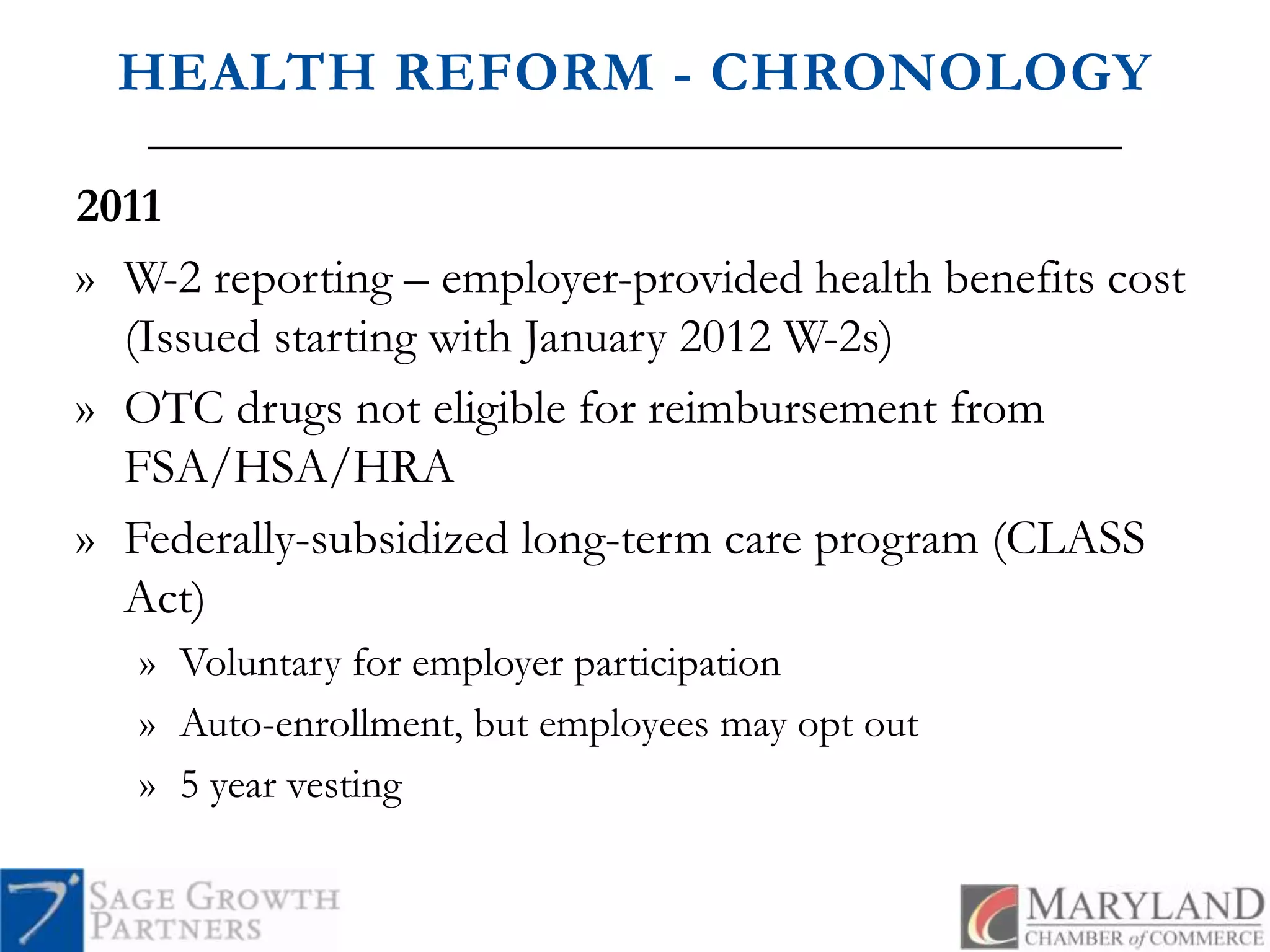

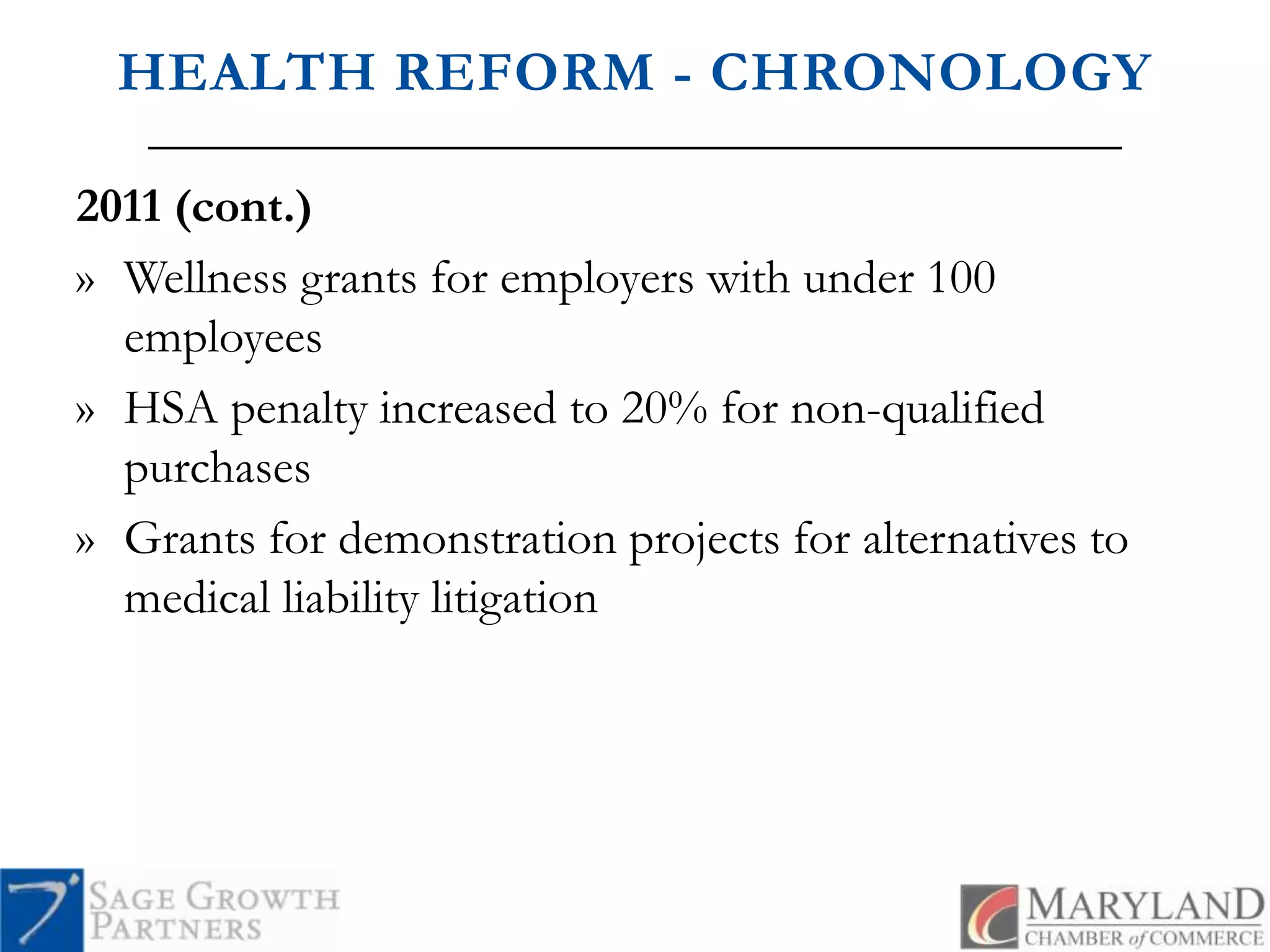

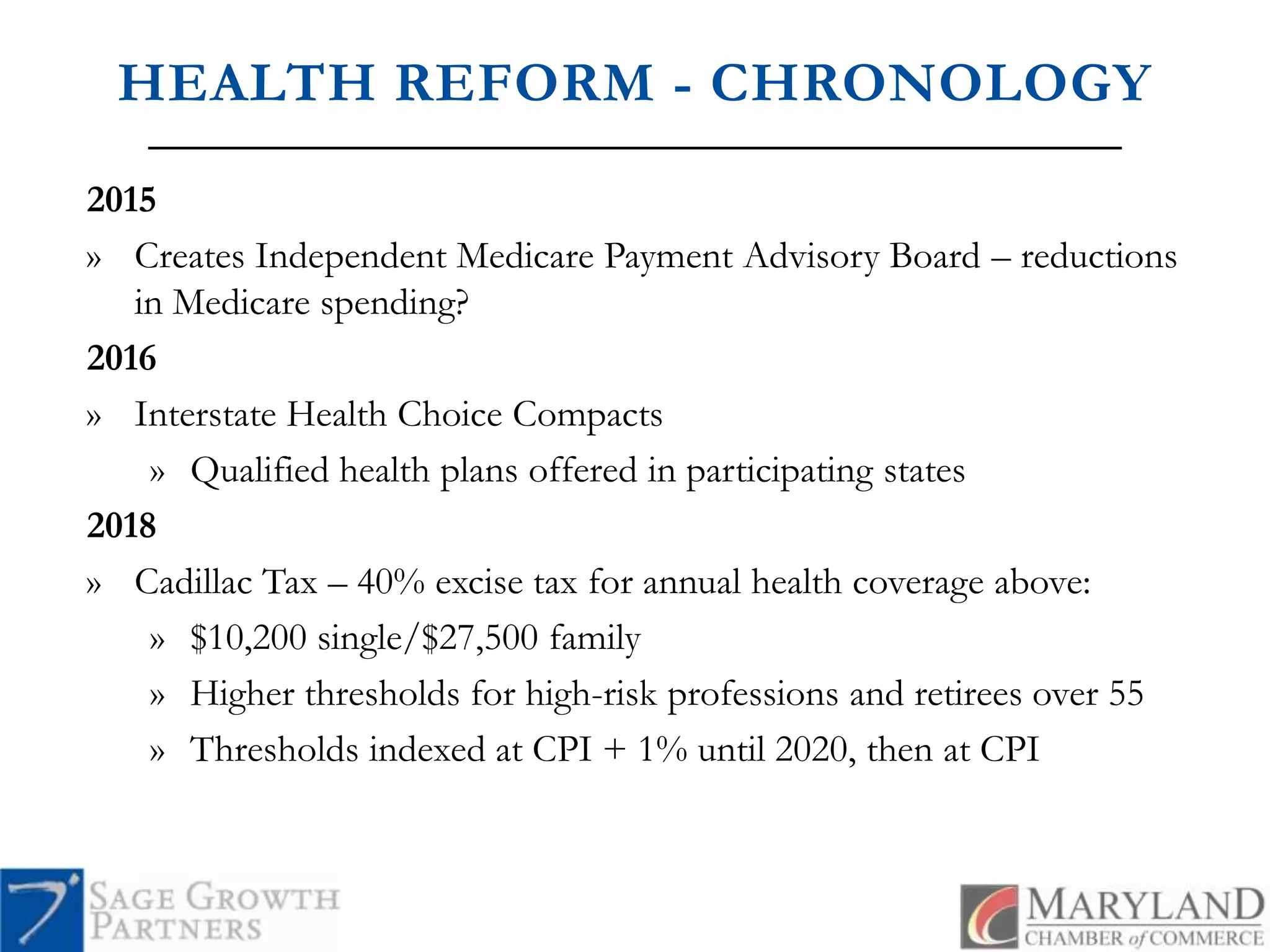

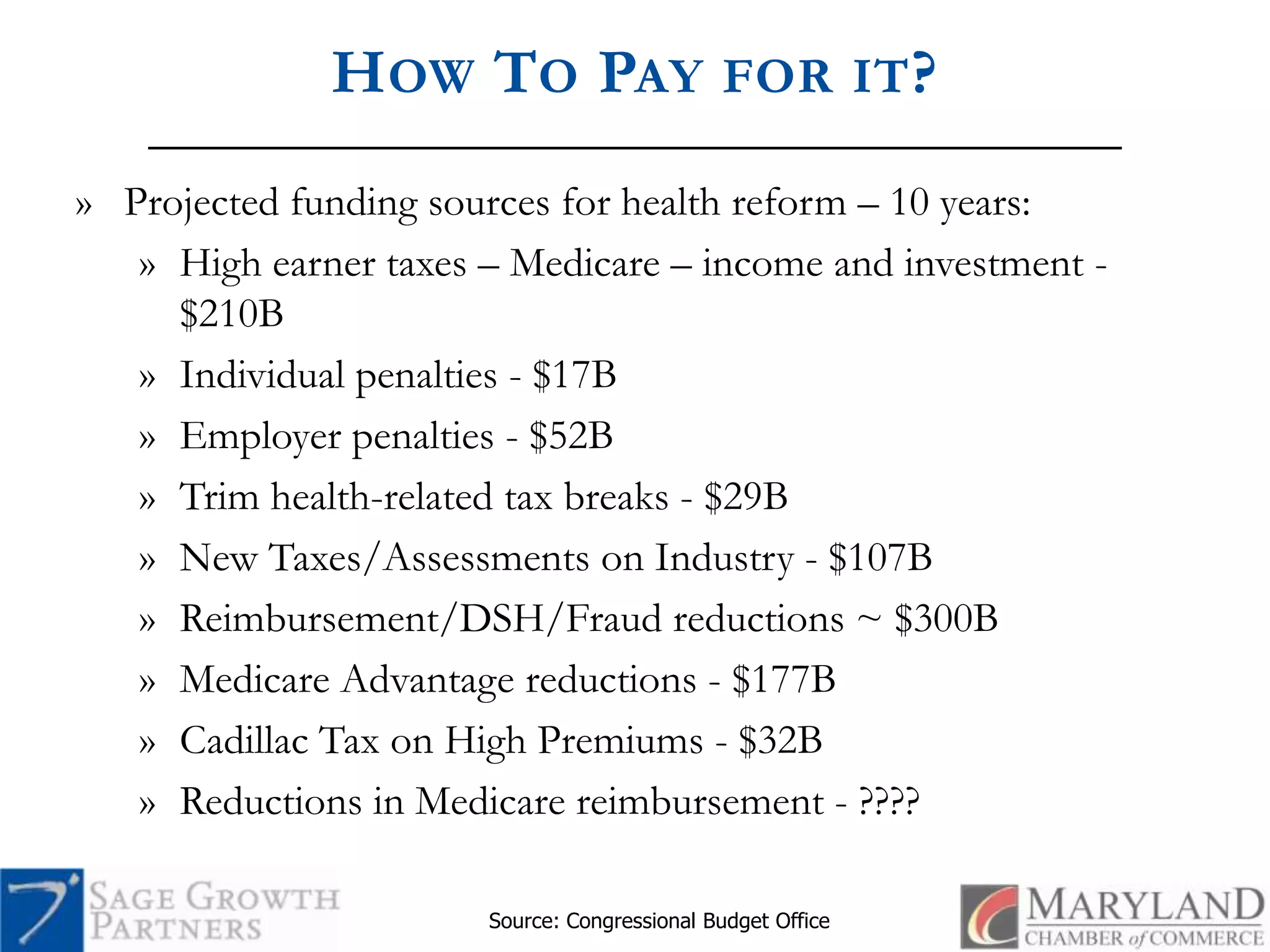

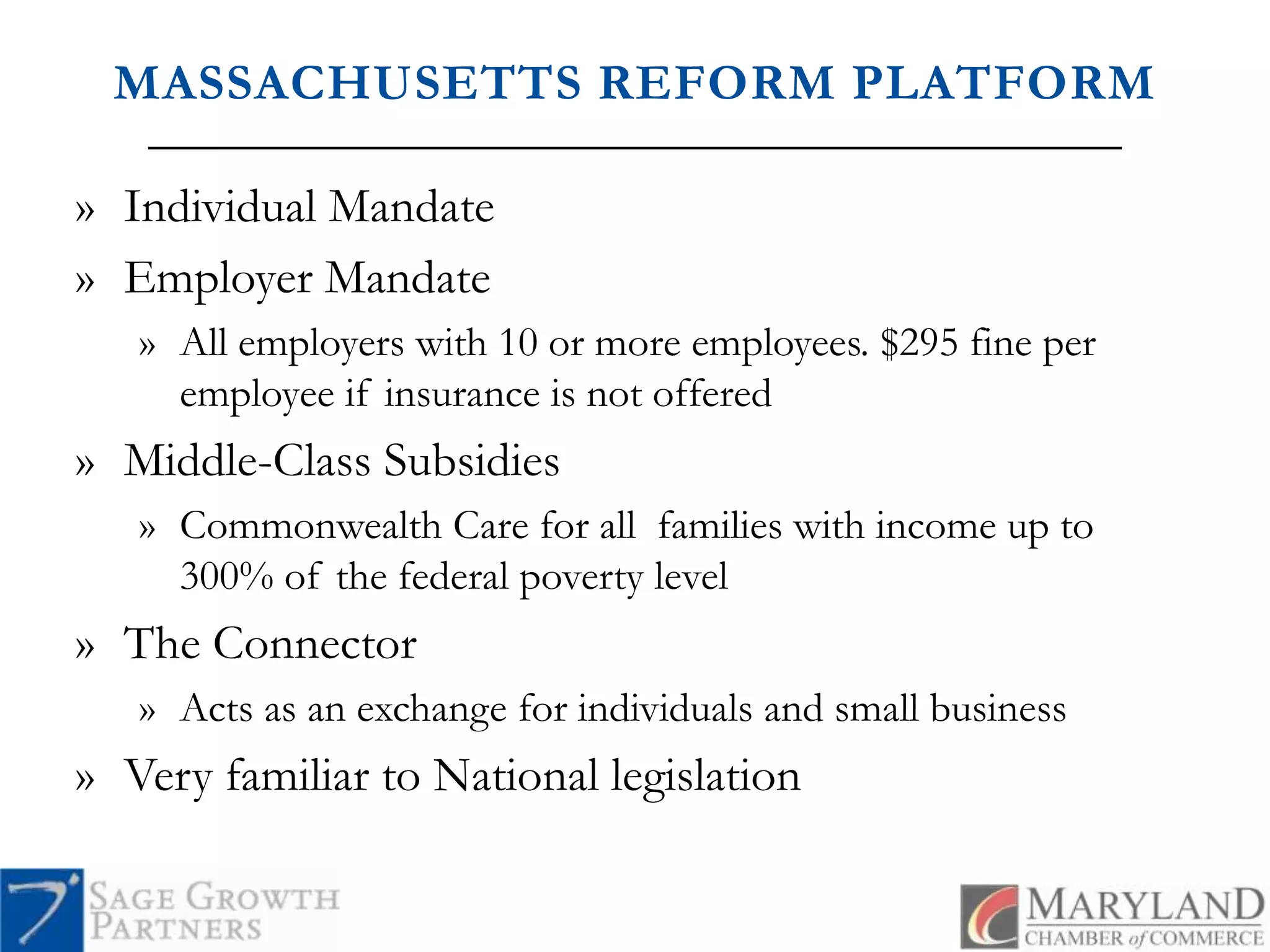

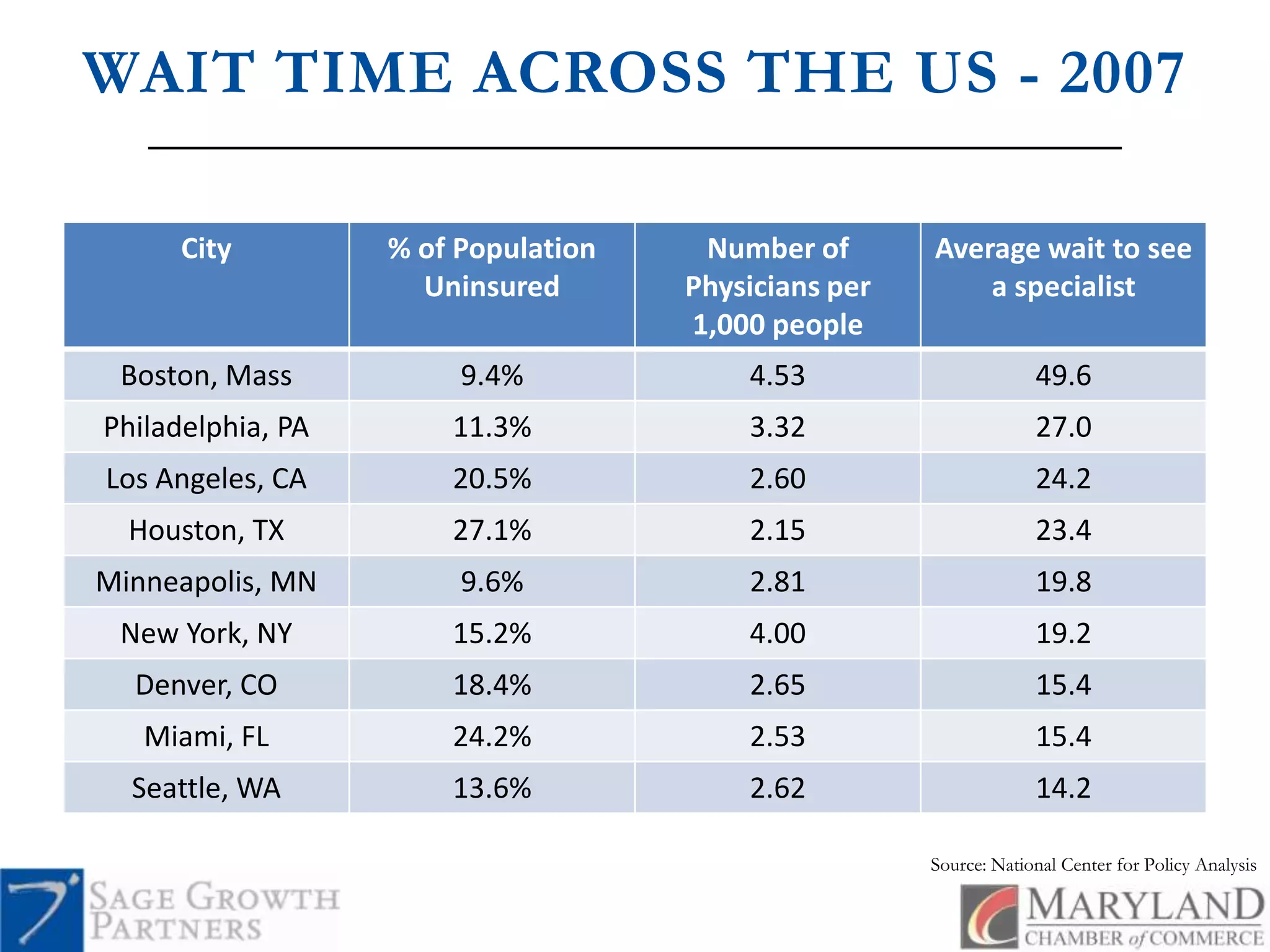

The document discusses the key issues surrounding health care reform, specifically the challenges faced by employers due to the Patient Protection and Affordable Care Act and related legislation. It outlines problems including rising health care costs, insurance premiums, and the projected impact on employer responsibilities and subsidies. Additionally, it highlights the implications for small businesses and the evolving nature of health coverage over the next decade.