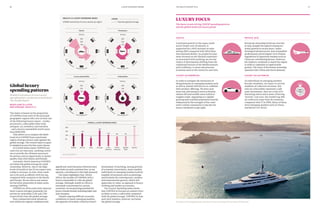

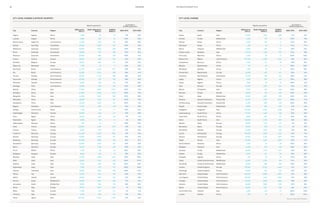

This document provides an overview of the 10th edition of The Wealth Report by Knight Frank. It includes sections on the decade in review highlighting predictions from past reports, results from the latest UHNWI attitudes survey, interviews on topics like inclusive capitalism and philanthropy, analysis of global wealth and property market trends, and data on UHNWI populations and luxury spending. The report aims to help clients make more informed decisions by documenting trends in prime property and wealth.