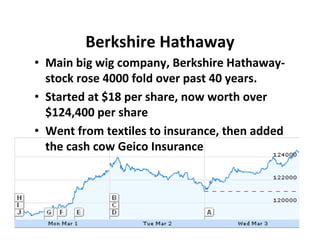

Warren Buffett is a renowned American investor and philanthropist. He started his career young, working odd jobs and investing throughout high school and college. By age 32, he had made his first million dollars from investing. He built his fortune by acquiring companies like Fruit of the Loom, Coca-Cola, and Geico and turning Berkshire Hathaway into a hugely successful conglomerate. Buffett follows a buy-and-hold philosophy, investing for the long term. He also donates much of his wealth to charitable causes, pledging to give away 99% of his fortune.