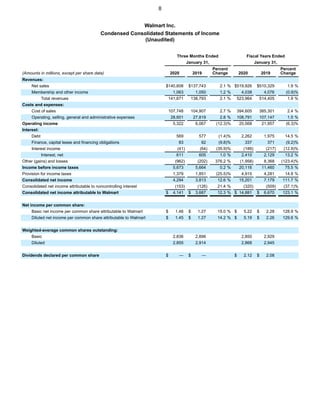

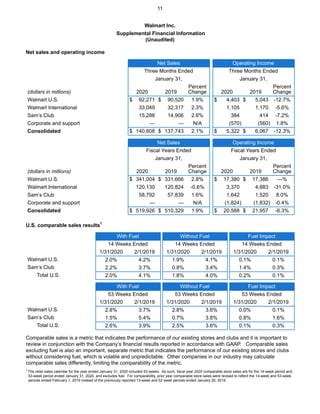

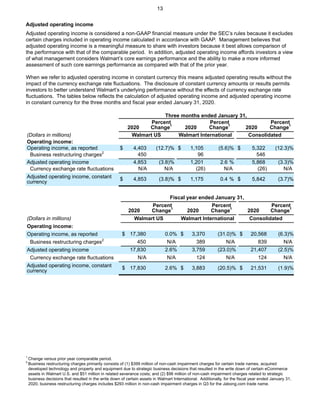

Walmart reported its financial results for the fourth quarter and full fiscal year 2020. For Q4, total revenue increased 2.1% to $141.7 billion while operating income decreased 12.3% to $5.3 billion. Walmart U.S. comp sales grew 1.9% and ecommerce sales increased 35%. For the full fiscal year, total revenue increased 1.9% to $524 billion and operating income decreased 6.3% to $20.6 billion. Walmart also provided guidance for fiscal year 2021, forecasting net sales growth of approximately 3% and EPS growth between 1.5-4.5% to $5.00-$5.15.