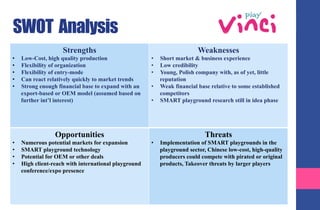

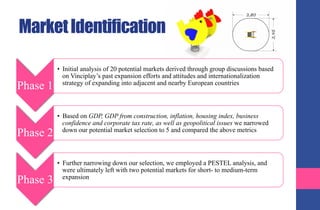

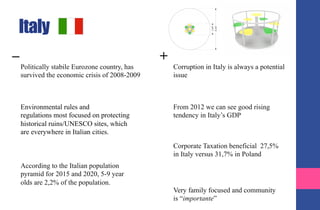

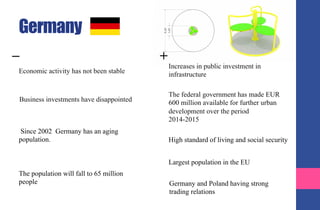

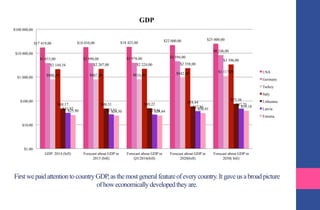

This document discusses Vinciplay, a Polish playground equipment manufacturer, exploring further internationalization opportunities. It provides an overview of Vinciplay and the playground industry, then analyzes potential new markets through phases of identification and selection. Germany and the US are selected for deeper analysis, considering economic indicators and 5 forces analyses. The document recommends partnering with construction companies and municipalities, and explores public-private partnerships and questions for potential partners to support market entry.