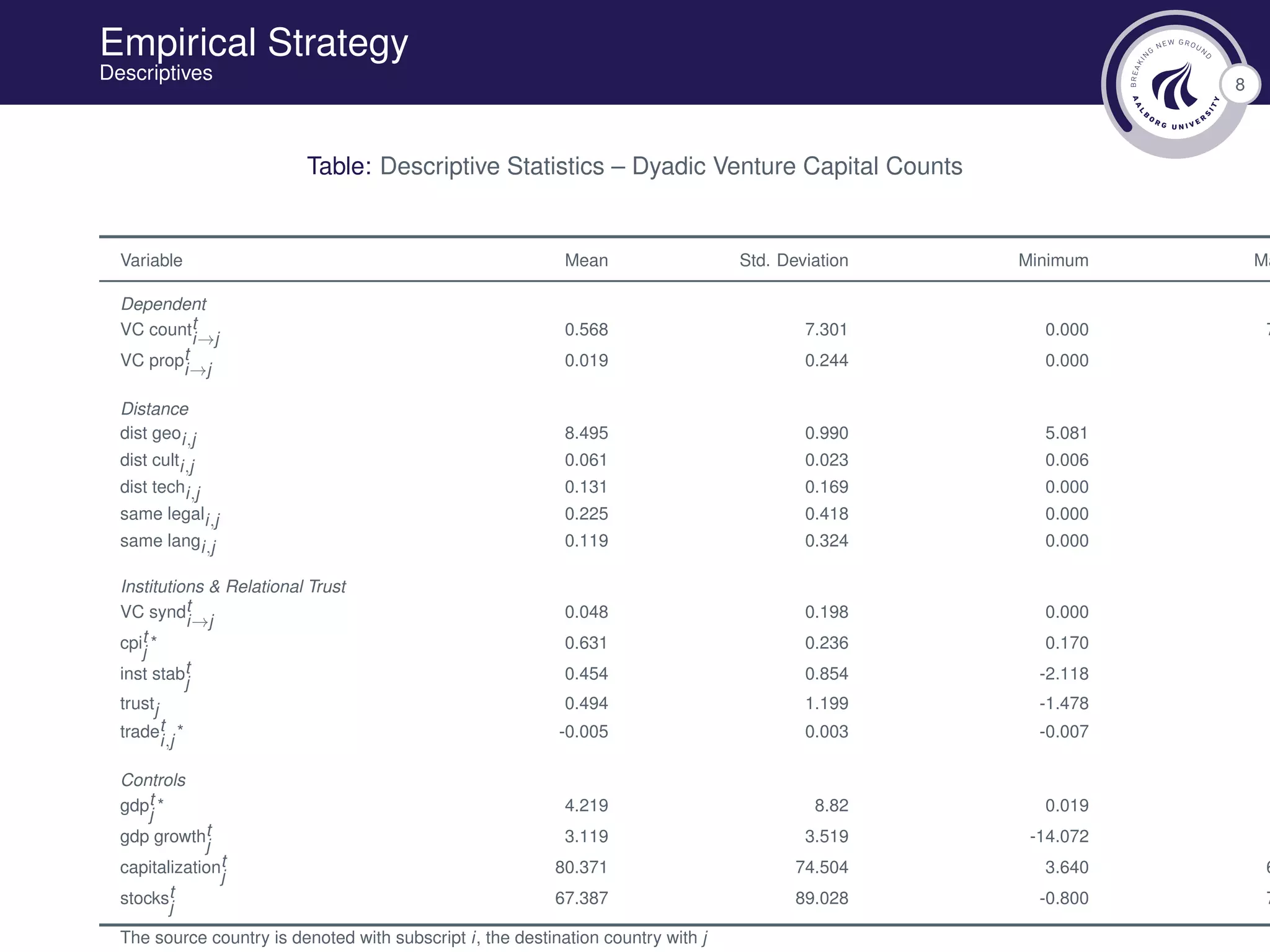

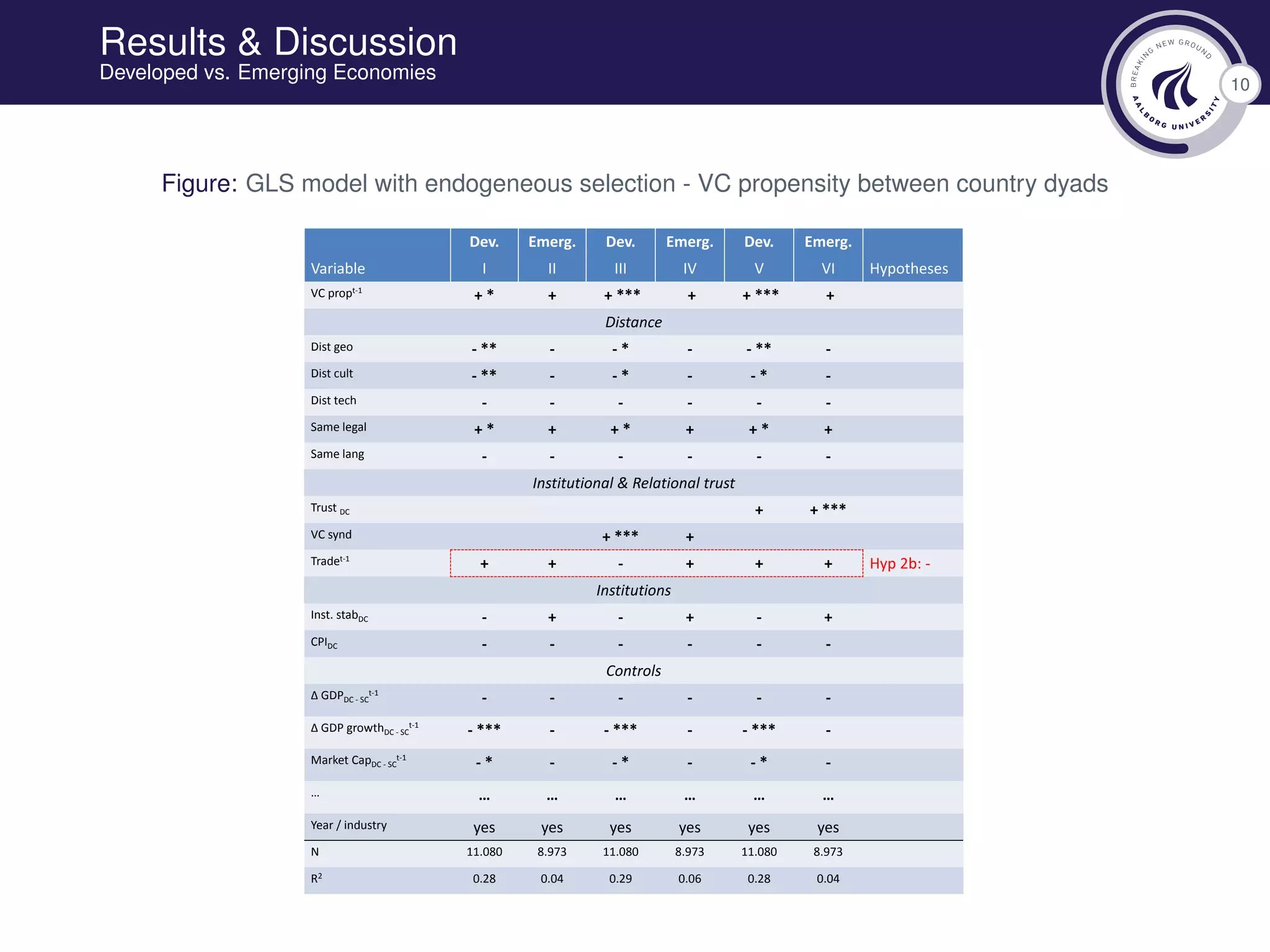

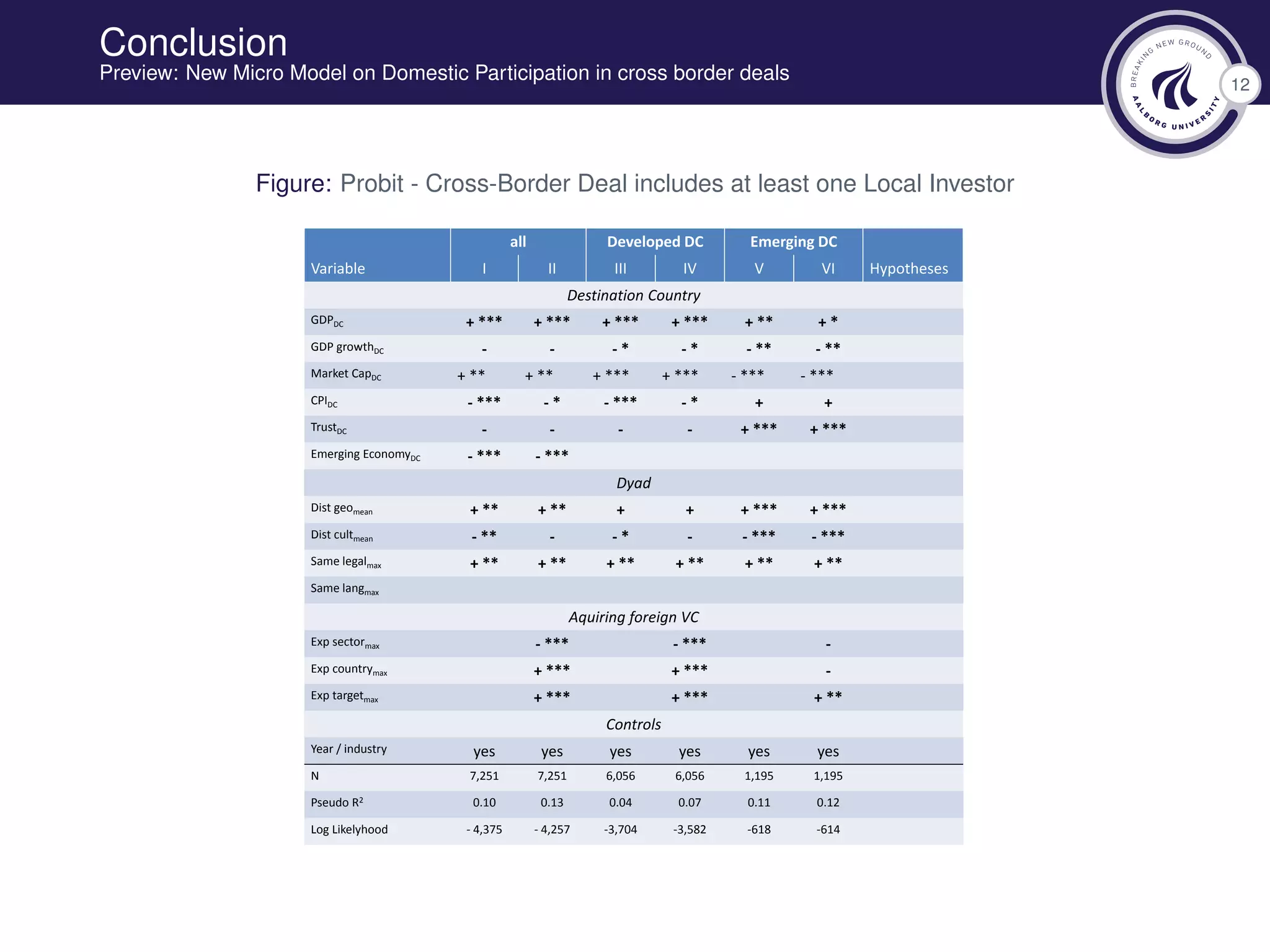

- The document discusses cross-border venture capital syndication between countries.

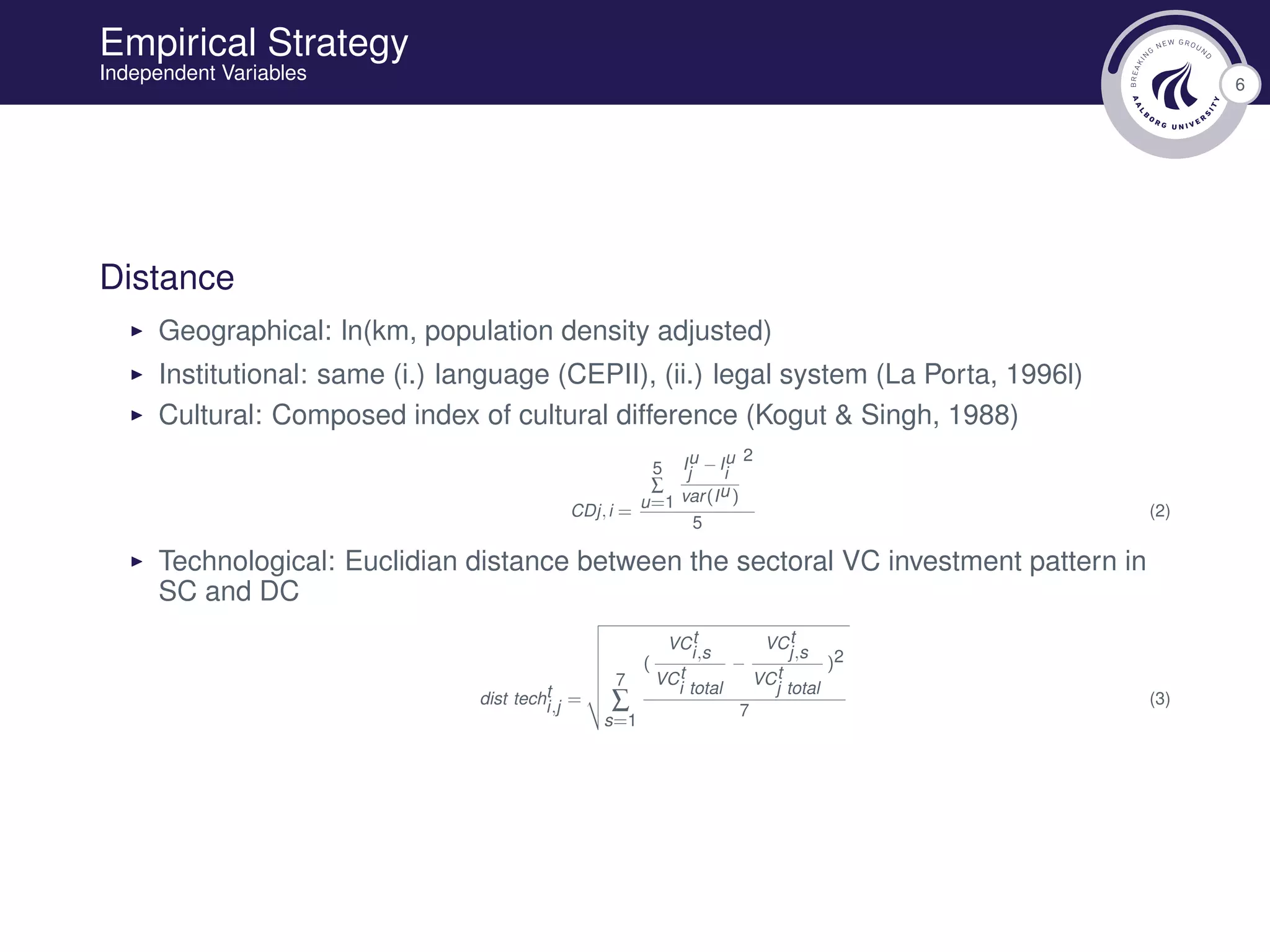

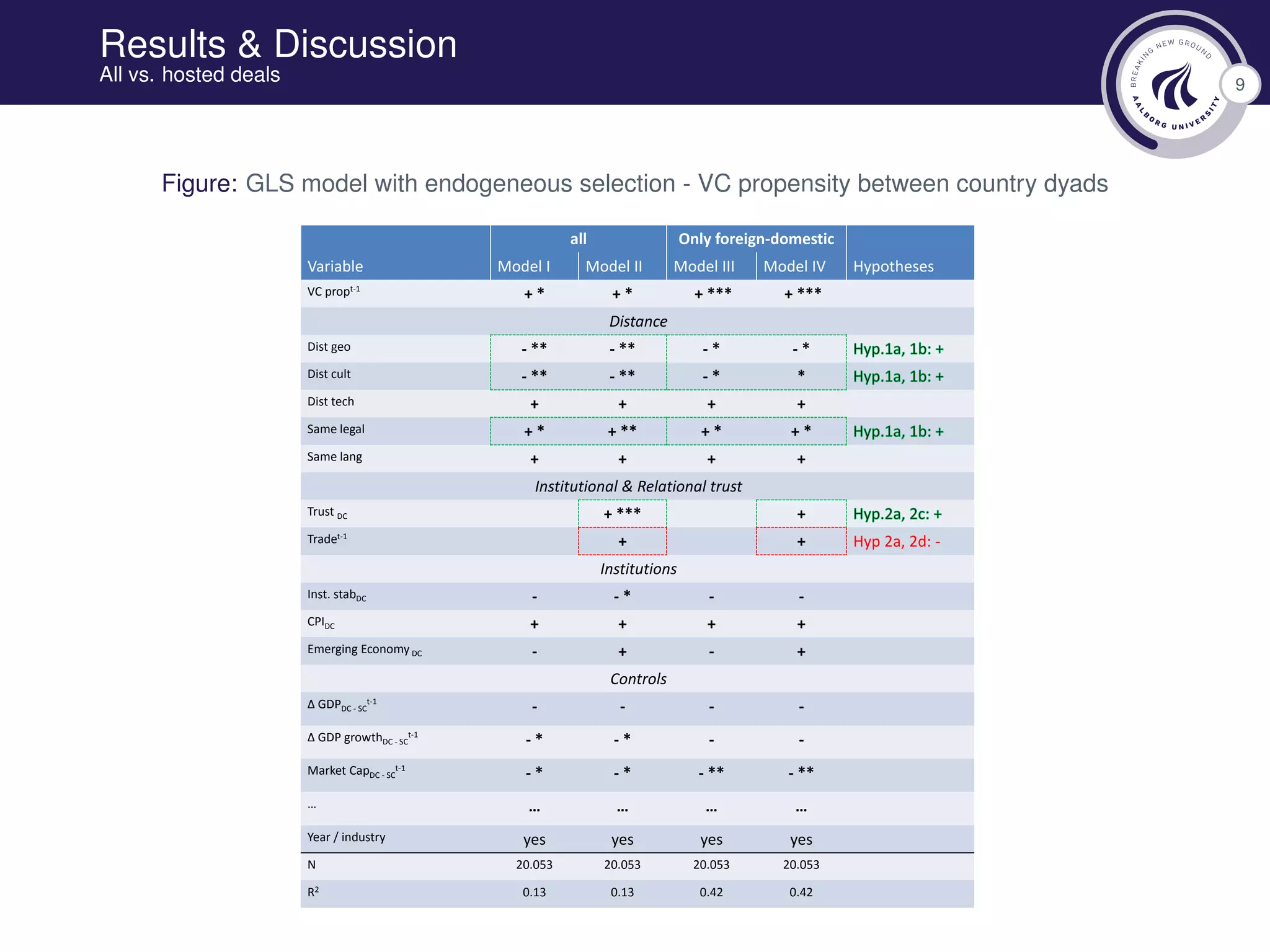

- It presents hypotheses that geographical, cultural, and institutional distance negatively impact cross-border investments, but this effect is lessened when investments are syndicated with a domestic venture capitalist.

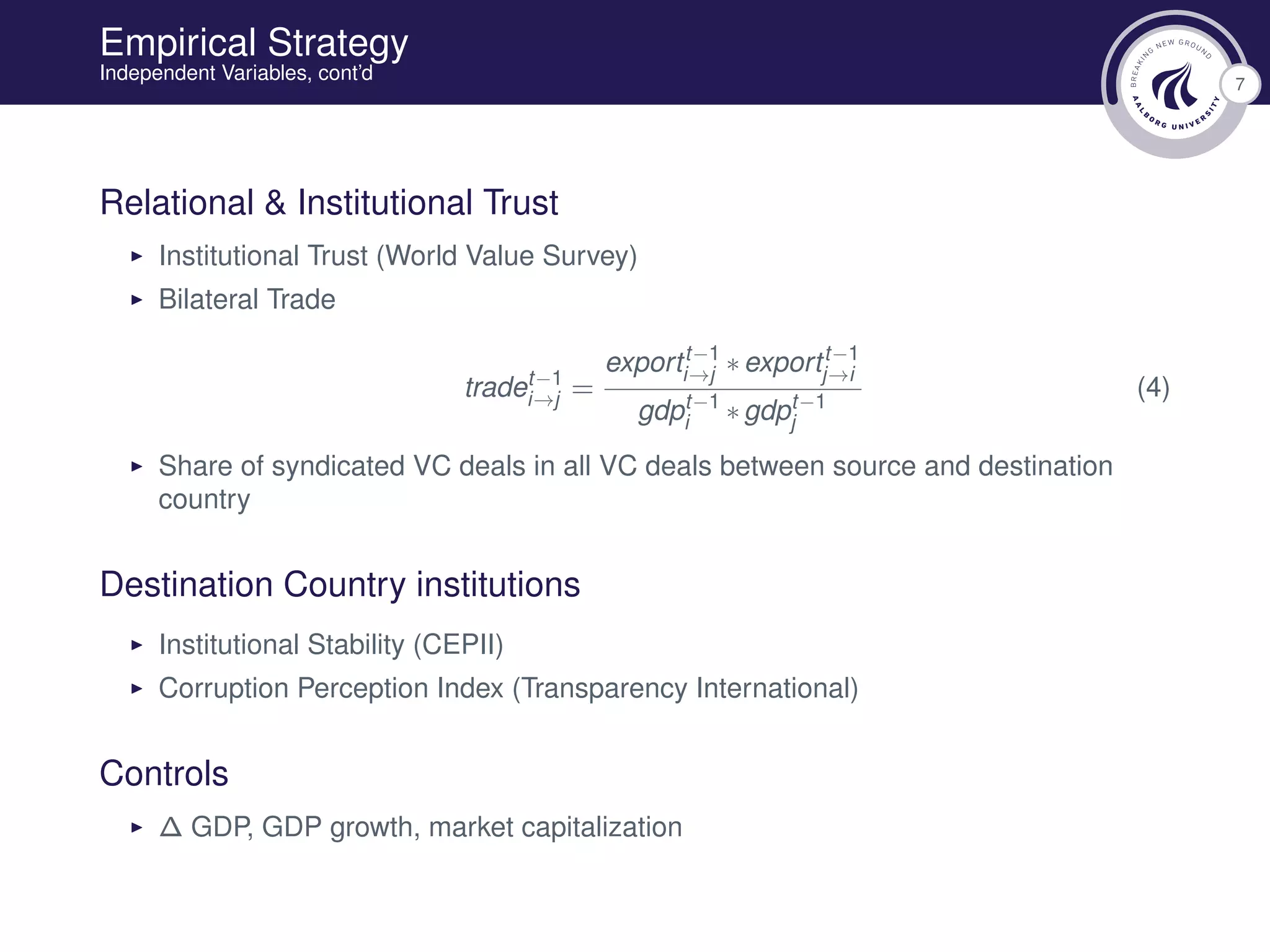

- Institutional and relational trust are hypothesized to positively influence investments by diminishing the negative effects of distance, especially for emerging economies.