Report

Share

Download to read offline

Recommended

A comprehensive overview of key industry trends driving innovation in the wealth management space and how the industry is reacting to the emergence of Robo Advisors and other Digital Wealth Management providersFT Partners Research: Are the Robots Taking Over? The Emergence of Digital W...

FT Partners Research: Are the Robots Taking Over? The Emergence of Digital W...FT Partners / Financial Technology Partners

Recommended

A comprehensive overview of key industry trends driving innovation in the wealth management space and how the industry is reacting to the emergence of Robo Advisors and other Digital Wealth Management providersFT Partners Research: Are the Robots Taking Over? The Emergence of Digital W...

FT Partners Research: Are the Robots Taking Over? The Emergence of Digital W...FT Partners / Financial Technology Partners

More Related Content

Similar to Value Stack (29 March 2016)

Similar to Value Stack (29 March 2016) (20)

Bring the Customer Journey to Life with Salesforce Marketing Cloud

Bring the Customer Journey to Life with Salesforce Marketing Cloud

Business Risk Management Outline PowerPoint Presentation Slides

Business Risk Management Outline PowerPoint Presentation Slides

Investor and analyst day presentation website post 5 22_18

Investor and analyst day presentation website post 5 22_18

Risk Management Tools And Techniques PowerPoint Presentation Slides

Risk Management Tools And Techniques PowerPoint Presentation Slides

Procurement Risk Management PowerPoint Presentation Slides

Procurement Risk Management PowerPoint Presentation Slides

Tricumen / FY14 Capital Markets: Regions_open 250315

Tricumen / FY14 Capital Markets: Regions_open 250315

MDM comparatively less mature; plans seem to be in place to transform further...

MDM comparatively less mature; plans seem to be in place to transform further...

Project Risk Management Overview PowerPoint Presentation Slides

Project Risk Management Overview PowerPoint Presentation Slides

Tricumen / Capital Markets Regions 6m15_open 230815

Tricumen / Capital Markets Regions 6m15_open 230815

Revenue Assurance Industry Update - Webinar by Dr. Gadi Solotorevsky, cVidya'...

Revenue Assurance Industry Update - Webinar by Dr. Gadi Solotorevsky, cVidya'...

Value Stack (29 March 2016)

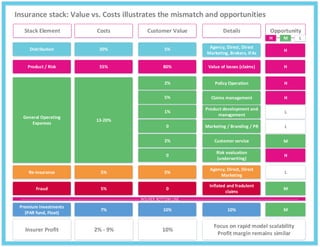

- 1. Distribution 20% Agency, Direct, Direct Marketing, Brokers, IFAs Product / Risk 55% Value of losses (claims) General Operating Expenses 13-20% Policy Operation Re-insurance 5% Agency, Direct, Direct Marketing Fraud 5% Inflated and fradulent claims Claims management Risk evaluation (underwriting) Product development and management Marketing / Branding / PR Premium Investments (PAR fund, Float) 7% Customer service Costs Customer ValueStack Element Details 10% Opportunity H Insurance stack: Value vs. Costs illustrates the mismatch and opportunities 5% 80% 5% 0 10% 2% 5% 0 1% 0 2% Insurer Profit 2% - 9% Focus on rapid model scalability Profit margin remains similar 10% ------------------------------------------------------------------------------------------------ INSURER BOTTOM LINE ----------------------------------------------------------------------------------------------- M L H H H L M H H L L M M