Valuation Rules-GST

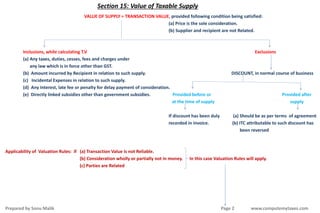

- 1. Section 15: Value of Taxable Supply VALUE OF SUPPLY = TRANSACTION VALUE, provided following condition being satisfied: (a) Price is the sole consideration. (b) Supplier and recipient are not Related. Inclusions, while calculating T.V Exclusions (a) Any taxes, duties, cesses, fees and charges under any law which is in force other than GST. (b) Amount incurred by Recipient in relation to such supply. DISCOUNT, in normal course of business (c) Incidental Expenses in relation to such supply. (d) Any Interest, late fee or penalty for delay payment of consideration. (e) Directly linked subsidies other than government subsidies. Provided before or Provided after at the time of supply supply If discount has been duly (a) Should be as per terms of agreement recorded in invoice. (b) ITC attributable to such discount has been reversed Applicability of Valuation Rules: if (a) Transaction Value is not Reliable. (b) Consideration wholly or partially not in money. In this case Valuation Rules will apply. (c) Parties are Related Prepared by Sonu Malik Page 2 www.computemytaxes.com

- 2. Valuation Rules GST Rule 1 to Rule 8 RULE-1 (Consideration not wholly in money): The value of the supply shall: (A) Open market value (C) (D) of such supply : #### Value of Goods or Services Application of Rule-4 (B) or Both of like Kind & Quality or Rule-5 in that order Consideration in Money : #### Money equivalent to consideration not in money : #### #### If open market value not Available if (A) & (B) both not applicable if value is not determinable under clause (A) or clause (B) or clause (C) Illustration 1: Where a new phone is supplied for Rs.20000 along with the exchange of an old phone and if the price of the new phone without exchange is Rs.24000, the open market value of the new phone is Rs 24000. Illustration 2: Where a laptop is supplied for Rs.40000 along with a barter of printer that is manufactured by the recipient and the value of the printer known at the time of supply is Rs.4000 but the open market value of the laptop is not known, the value of the supply of laptop is Rs.44000 Prepared by Sonu Malik www.computemytaxes.com

- 3. Rule-2 : Supply between distinct or related persons, other than through an agent The Value of Supply Shall: The Open Market Value of such supply. if value is not determinable under clause (a) or (b) Prepared by Sonu Malik www.computemytaxes.com (a) Open Market Value of such supply (b) Value of Supply of Goods & Services of like and quality. If open market value not available as per clause (a) (c) : Value as determined by application of Rule 4 or Rule 5, in that order. Provided that where goods are intended for further supply as such by the recipient, the value shall, at the option of the supplier, be an amount equivalent to ninety percent of the price charged for the supply of goods of like kind and quality by the recipient to his customer not being a related person Provided further that where the recipient is eligible for full input tax credit, the value declared in the invoice shall be deemed to be the open market value of goods or services:

- 4. Rule:3 Value of supply of goods made or received through an agent The value of supply of goods between the principal and his agent shall: Prepared by Sonu Malik www.computemytaxes.com (a): Be the open market value of the goods being supplied, or At the option of the supplier, be 90% of the price charged for the supply of goods of like kind and quality by the recipient to his customer not being a related person, where the goods are intended for further supply by the said recipient; (b): where the value of a supply is not determinable under clause (a), the same shall be determined by application of Rule 4 or Rule 5 in that order. Illustration: Where a principal supplies groundnut to his agent and the agent is supplying groundnuts of like kind and quality in subsequent supplies at a price of Rs.5000 per quintal on the day of supply. Another independent supplier is supplying groundnuts of like kind and quality to the said agent at the price of Rs.4550 per quintal. The value of the supply made by the principal shall be Rs.4550 per quintal or where he exercises the option the value shall be 90% of the Rs.5000 i.e. is Rs.4500 per quintal.

- 5. Rule 4 & Rule 5 Rule 4 Rule 5 Prepared by Sonu Malik www.computemytaxes.com Where the value of a supply of goods or services or both is not determinable by any of the preceding rules, the value shall be 110% of the cost of production or manufacture or cost of acquisition of such goods or cost of provision of such services. Where the value of supply of goods or services or both cannot be determined under rules 1 to 4, the same shall be determined using reasonable means consistent with the principles and general provisions of section 15 and these rules Provided that in case of supply of services, the supplier may opt for this rule, disregarding rule 4

- 6. Rule 6: Determination of value in respect of certain supplies Rule 6(2): The value of supply of services in relation to purchase or sale of foreign currency, including money changing Option 1 Option 2 When exchanged from, or to, Indian Rupees (INR) Where neither of the currencies exchanged is Indian Rupee (INR) The value shall be equal to 1% of the lesser of the two amounts the person changing the money would have received by converting any of the two currencies into Indian Rupee on that day at the reference rate provided by RBI. The value shall be equal to the difference in the buying rate or the selling rate, as the case may be, and the Reserve Bank of India (RBI) reference rate for that currency at that time, multiplied by the total units of currency. Provided that in case where the RBI reference rate for a currency is not available, the value shall be 1% of the gross amount of Indian Rupees provided or received by the person changing the money. Amount of currency exchanged up to Rs.1 lac 1% of the gross amount of currency exchanged or Rs.250/- , whichever is higher Amount of currency exchanged exceeding Rs.1 lac and up to Rs.10 lacs Rs.1,000/-plus 0.5% of the gross amount of currency exchanged above Rs.100,000/- Amount of currency exchanged exceeding Rs.10 lacs Amount of currency exchanged exceeding Rs.10 lacs

- 7. Rule 6(3)-Air Travel Agent Rule 6(4)-Life Insurance Business • Domestic bookings : 5% of Basic Fare • International bookings : 10% of Basic Fare “Basic fare” means that part of the air fare on which commission is normally paid to the air travel agent by the airline. a) Gross premium charged from a policyholder reduced by the amount allocated for investment, or savings on behalf of the policyholder, if such amount is intimated to the policyholder at the time of supply of service; b)In case of single premium annuity policies other than(a) - 10% of single premium charged from the policyholder ; or c) In all other cases ,25% of the premium charged from the policy holder in the first year and 12.5% of the premium charged from policyholder in subsequent years This shall not apply where the entire premium paid by the policy holder is only towards the risk cover in life insurance.

- 8. Rule 6(5): Buying and selling of second hand Goods Rule 6(6): Token, Voucher, Coupon or Stamp Rule 6(7): Notified supplies between Distinct Persons • Supply of used goods as such or after such minor processing which does not change the nature of the goods and • where no ITC has been availed on purchase of such goods, • the value of supply shall be the difference between the selling price and purchase price and •where the value of such supply is negative it shall be ignored. • The value of a token, or a voucher, or a coupon, or a stamp (other than postage stamp) • which is redeemable against a supply shall be • money value of the goods or services redeemable against such token, voucher, coupon, or stamp. • The value of taxable services provided by such class of service providers •as may be notified by the Government between distinct persons, (Entry-2 of Schedule I ) •other than those where ITC is not available under S.17(5), •shall be deemed to be NIL Prepared by Sonu Malik www.computemytaxes.com

- 9. Rule 7: Value of supply of services in case of PURE AGENT The expenditure or costs incurred by the pure agent (CA) shall be excluded from the value of supply, if all the following conditions are satisfied, namely- a) Pure agent (CA) makes payment to the third party (ROC) on behalf of recipient (Company R) as the contract is between third party (ROC) and recipient (Company R), b) Recipient (Company R) uses the services procured by pure agent (CA). c) Recipient (Company R) is liable to make payment to third party (ROC). d) Recipient (Company R) authorizes pure agent (CA) to make payment on his behalf. e) Recipient (Company R) knows that the services for which payment has been made by pure agent (CA) shall be provided by third party (ROC). f) Payment made by pure agent (CA) on behalf of recipient (Company R) has been separately indicate din invoice issued by pure agent (CA) to recipient ( Company R) g) Pure agent (CA) recovers from recipient (Company R) only such amount as has been paid by him to third party (ROC). h) Services procured by pure agent (CA) from third party (ROC) are in addition to supply he provides on his own account. Prepared by Sonu Malik www.computemytaxes.com

- 10. Rule 8:Rate of exchange of currency, other than INR, for determination of value • Rate of exchange shall be applicable reference rate for that currency as determined by RBI on the date when point of taxation arises as per S.12 and S.13. www.computemytaxes.com