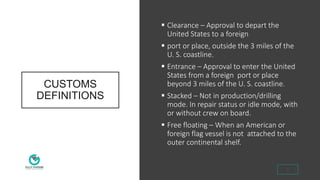

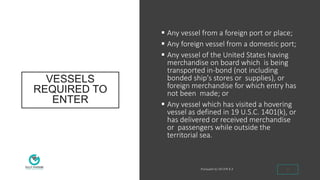

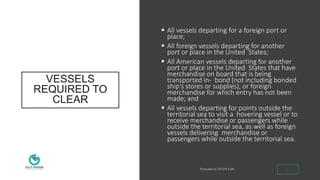

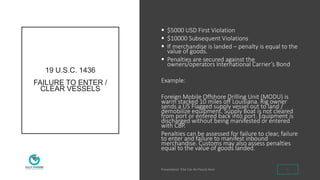

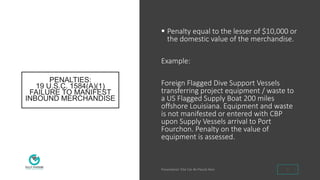

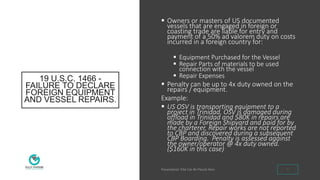

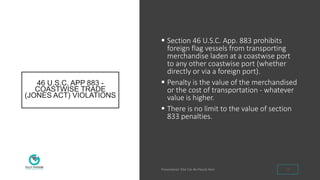

The document outlines the U.S. vessel entry and clearance requirements, highlighting the approval needed for vessels departing or entering U.S. waters and the associated penalties for non-compliance. Key definitions, criteria for vessel entry and clearance, and potential penalties for violations including failure to manifest or declare equipment repairs are discussed. It emphasizes the importance of adhering to customs regulations and consulting legal advice for comprehensive understanding.